POSITIONING FOR THE END: Banks No Longer Required to Reserve Your Funds…by LYNETTE ZANG

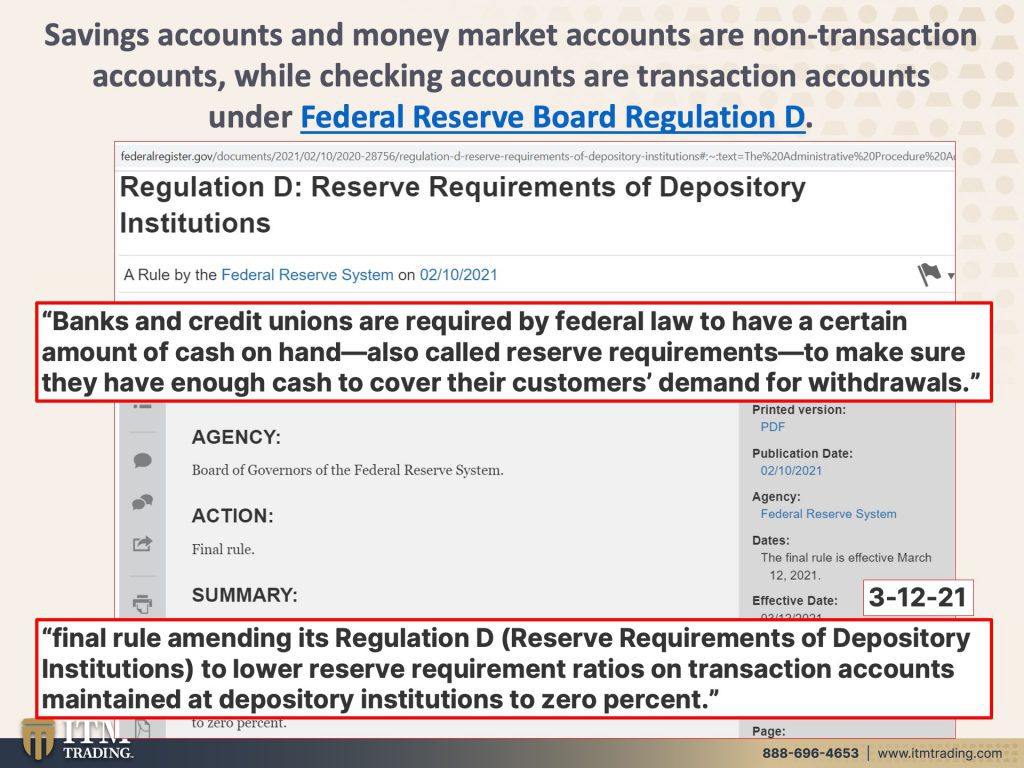

In another change the rules not the behavior, the Federal Reserve has changed Reg D by reclassifying savings account into transaction accounts and eliminated banks requirement to hold reserves for withdrawals.

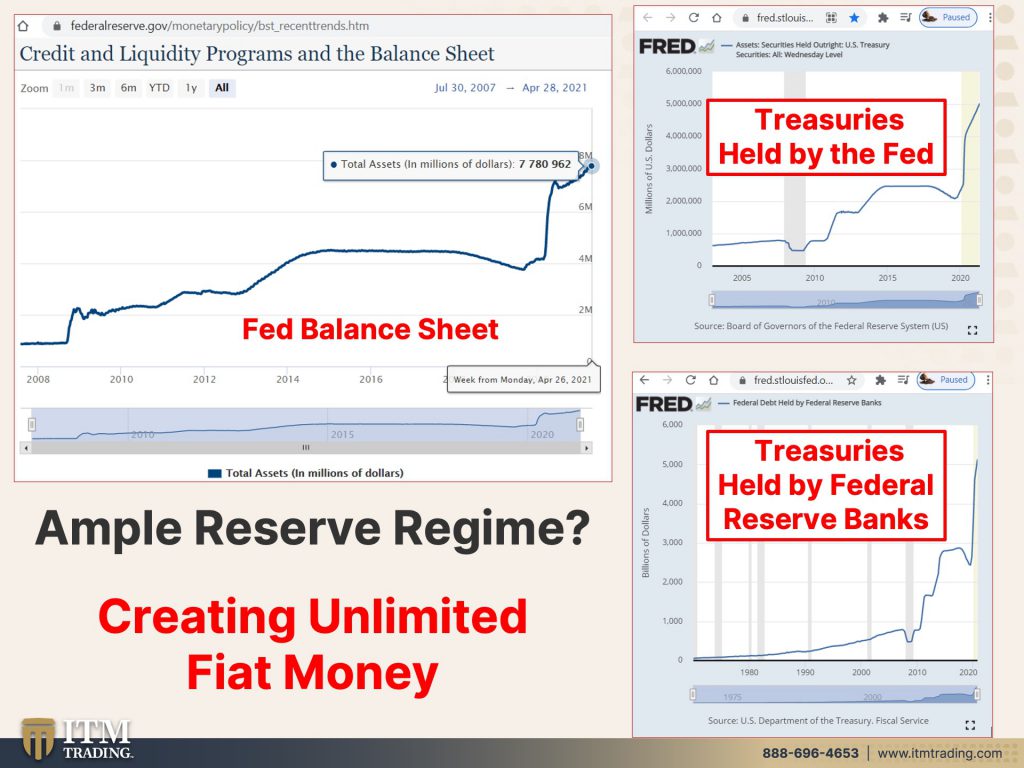

It makes one wonder if this is setting up the next wealth transfer from depositors to banks. The reason they give is their change in policy back in January 2019 to an “Ample Reserve Regimeâ€. Meaning that the Fed will create all the money banks need for withdrawals. Of course, we saw this tested in March 2020 when a run on the banks began and was calmed by a number of central bankers making public announcements about the Fed’s ability to create as much new money as they wanted. One look at the Fed Balance sheet shows that they continue to take new money printing to extreme highs.

But there may be something much bigger ahead, so perhaps this is a heads up.

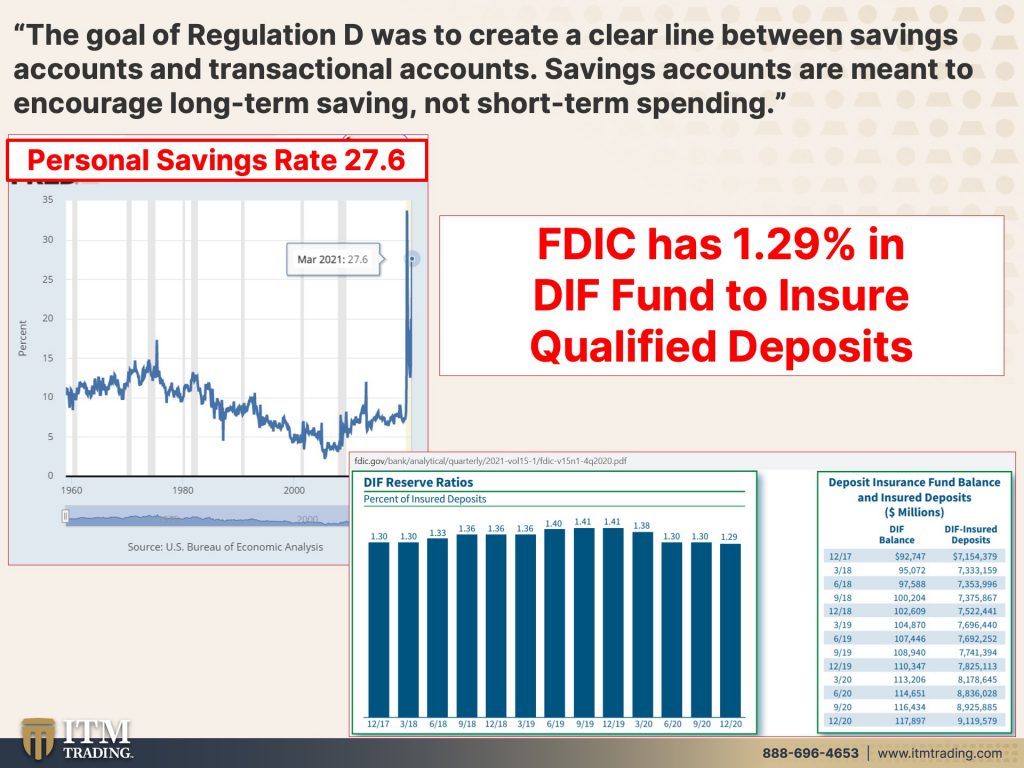

This time around, individuals were included in the Fed’s “stimulus†plans, with multiple rounds of direct stimulus payments, enhanced unemployment benefits and direct payment tax credits. As a result of this and fear of the future, savings rates have exploded. And while they’ve pulled back a bit, they still sit at 27.6% personal savings rate as of March 2021. Additionally, the percentage held in the FDIC’s fund to insure deposits under $250,000 has been declining since December 2019 and currently sits at a paltry 1.29%, which means they only have $0.0129 for every $1.00. Does this make you feel safe?

Personally, it makes me nervous, particularly since, at the same time, this change in Reg D potentially unleashes even more leverage and risk in the FDIC insured banks.

In 2008, for the first time, paid interest on excess reserves. As the Fed attempted to raise interest rates, those excess reserves in the banks declined leading to the Repo market crisis in September 2019. The Fed “fixed†this issue by more free money to banks which was then further expanded as the Corona Virus pandemic took hold of the economy. This sent those excess reserves to new highs. Though I cannot tell you where they are now, since the Fed discontinued reporting in August 2020 when banks held almost $2.8 trillion in excess reserves.

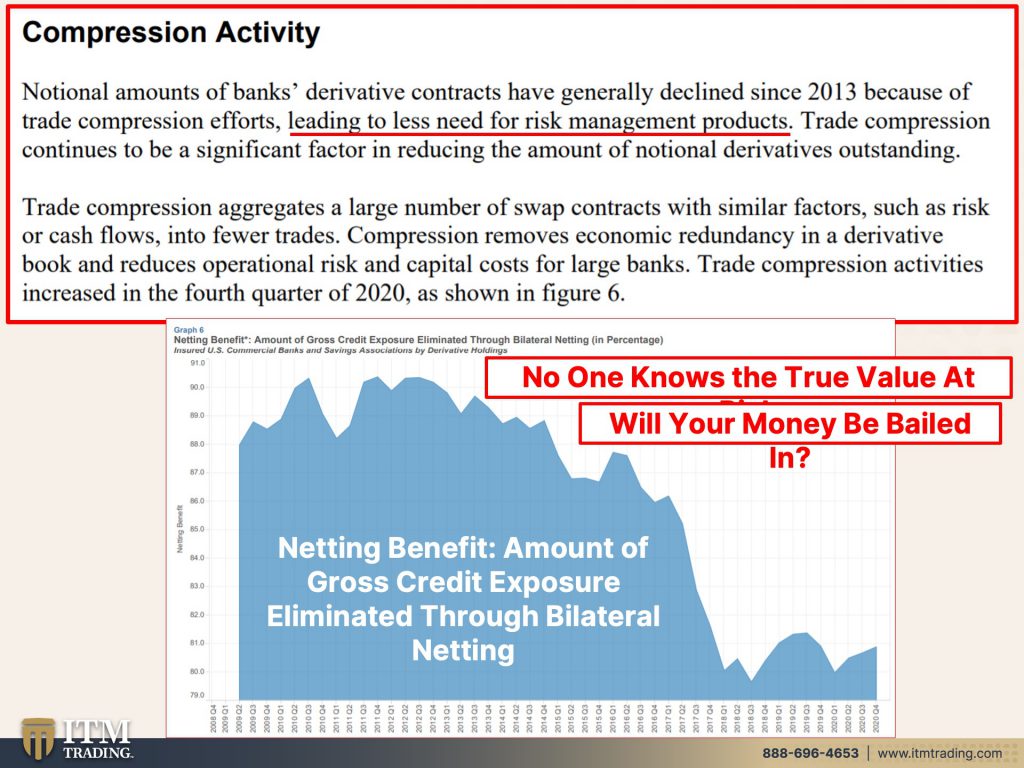

Now, since banks no longer have to hold reserves, those reserves can be used to generate trading revenue! In my opinion, this raises risk to depositors and the entire financial system. But we can’t really tell the true risk because of the financial instruments called derivatives, (big leveraged bets) whose nominal price is just an agreed price and, admittedly, does not reflect the true value at risk. Further, accounting tools created in 2013 further hide the nominal amount of derivatives in the system. YIKES! So this is the blind leading the blind. Do you really think this can end well?

So what about gold and silver? Well, we know that a rising gold price is an indication of a failing currency and one quick look at the precious metals derivatives in the FDIC insured banks was at the highest levels ever in 2020. But here is one irrefutable fact, at some point, all assets and instruments go to their true fundamental value. And the truth is that gold and silver’s true value is much, much higher than what wall street wants you to think.

Sources:

https://www.federalreserve.gov/supervisionreg/savings-deposits-frequently-asked-questions.htm

https://www.federalreserve.gov/supervisionreg/savings-deposits-frequently-asked-questions.htm

https://fred.stlouisfed.org/series/WM1NS

https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

https://fred.stlouisfed.org/series/FDHBFRBNhttps://fred.stlouisfed.org/series/TREAST

https://fred.stlouisfed.org/series/EXCSRESNS

https://www.fdic.gov/bank/analytical/quarterly/2021-vol15-1/fdic-v15n1-4q2020.pdf