YOU HAVE BEEN WARNED: Facts, Historic Cycles and Future Clues of What’s Likely to Come Next… by Lynette Zang

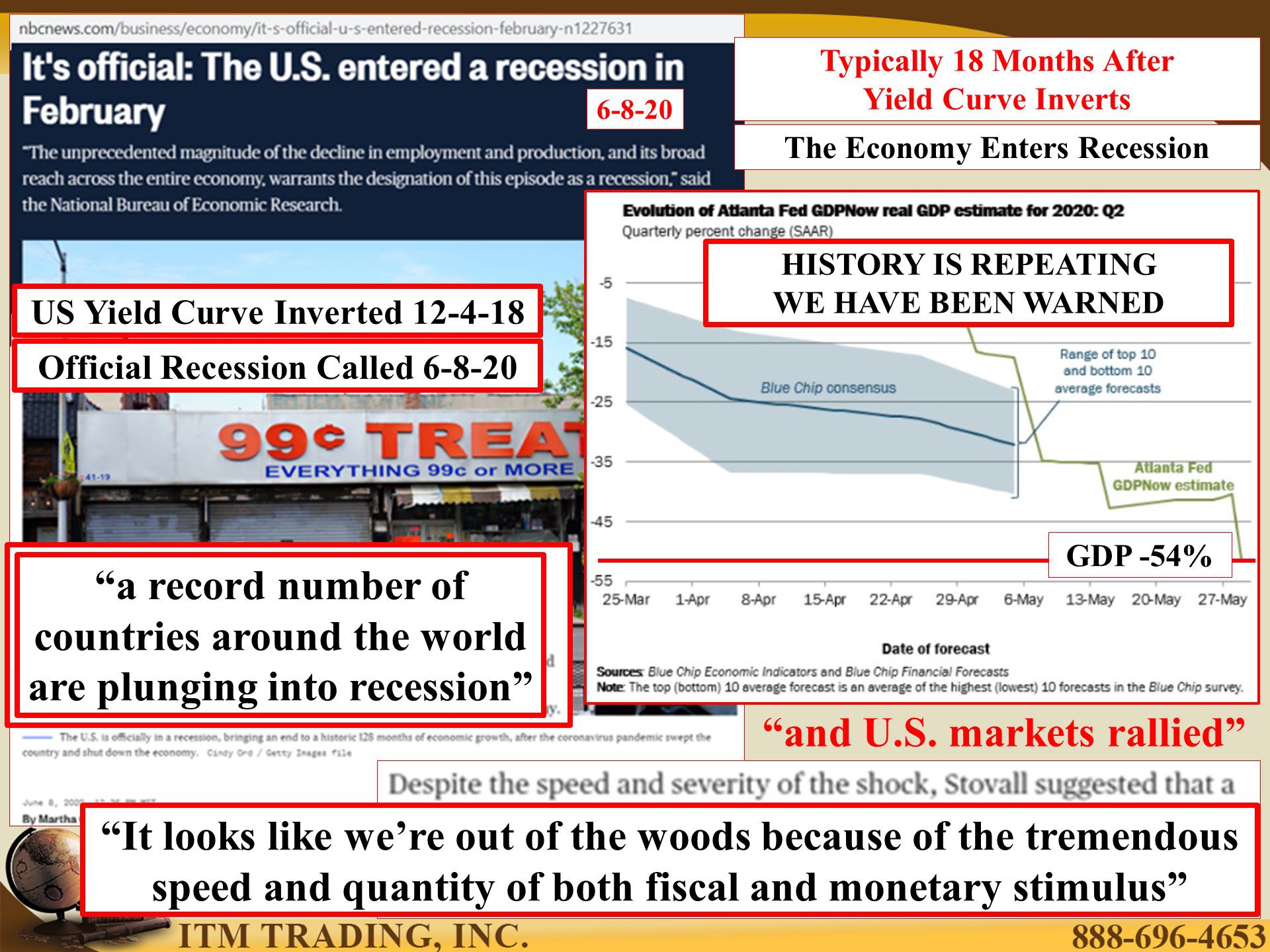

On December 4, 2018 the US yield curve inverted for the first time since 2005. According to data from the New York Fed, typically 18 months after a yield curve inversion there is a recession. Of course, we were told that this time is different, yet on June 8, 2020, NBER (National Bureau of Economic Research) declared an official recession that began in February. Looks like this time is not different after all!

Have more questions that need to get answered? Call: 844-495-6042

Now we are being told that this will be the shortest recession in history because of all the new money flooding into the system from both the government ($3 trillion so far) and the Fed (at least $6 trillion and growing), but if flooding the system with a tsunami of cheap money actually stimulating the real economy, why was the global economy failing before Covid-19 hit?

Because debt accumulation only provides the appearance of prosperity and at some point, debt must be serviced; paid, rolled over or defaulted on. ZIRP (zero interest rate policy) was supposed to enable corporations to roll that debt over at cheaper levels and then pay it off faster using the same level of payments, but that is not what happened. Rather, governments, corporations and individuals simply accumulated more debt. Simply put, you cannot fix a too much debt problem with even more debt. But you can create a whole bunch of new money, since that is how money is created in this fiat money system.

Why are they doing that if they know it doesn’t really work? Because that is the only tool in their toolbox AND it moves the stock market up (that money must go somewhere) which we the people have been trained to equate with: ALL IS WELL.

But there is another historic pattern setting up too and this one foretells a stock market crash.

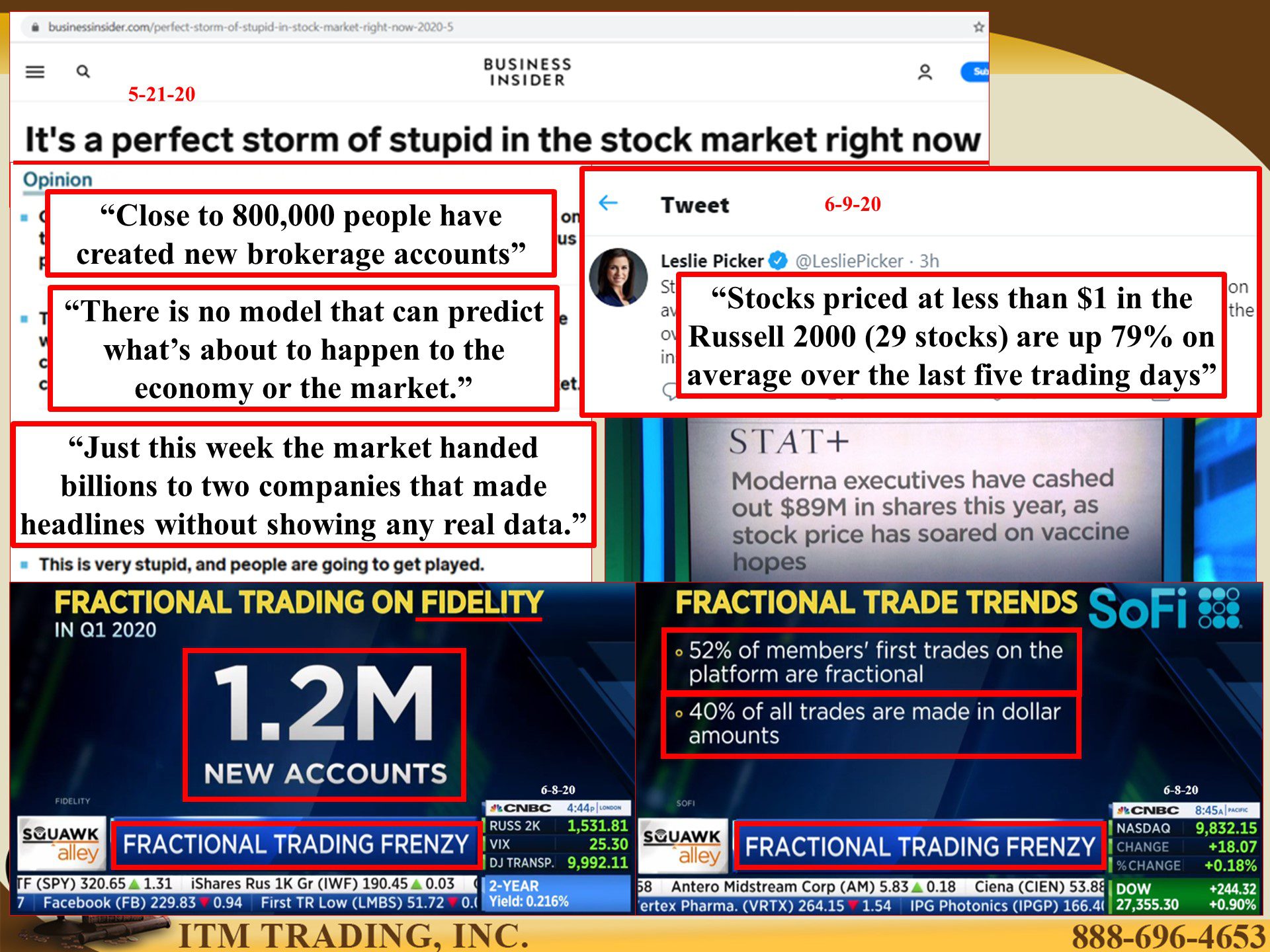

The roaring twenties was the result of a flood of new money and credit into the US economy as we transitioned into a consumer driven economy. In 1928, for the first time ever, the public started buying in to a rising stock market as wall street insiders were selling out. Credit dried up in 1929 and the US plunged into depression. Today’s economic numbers are worse, yet the stock market tears higher.

In addition to new central bank money, what is pushing the market higher? Naïve market newbies.

According to the Financial Times, 780,000 new accounts have been opened at Charles Schwab, E-Trade and Interactive Brokers. All offering zero trading fees and fractional share purchases (you can now buy part of share). Additionally, Fidelity reports 1.2 million new accounts in the first quarter of this year. Further, 52% of first trades are fractional and 40% of all trades are made in dollar amounts rather than number of shares.

Looks like a sucker’s rally and a repeat of 1928 to me.

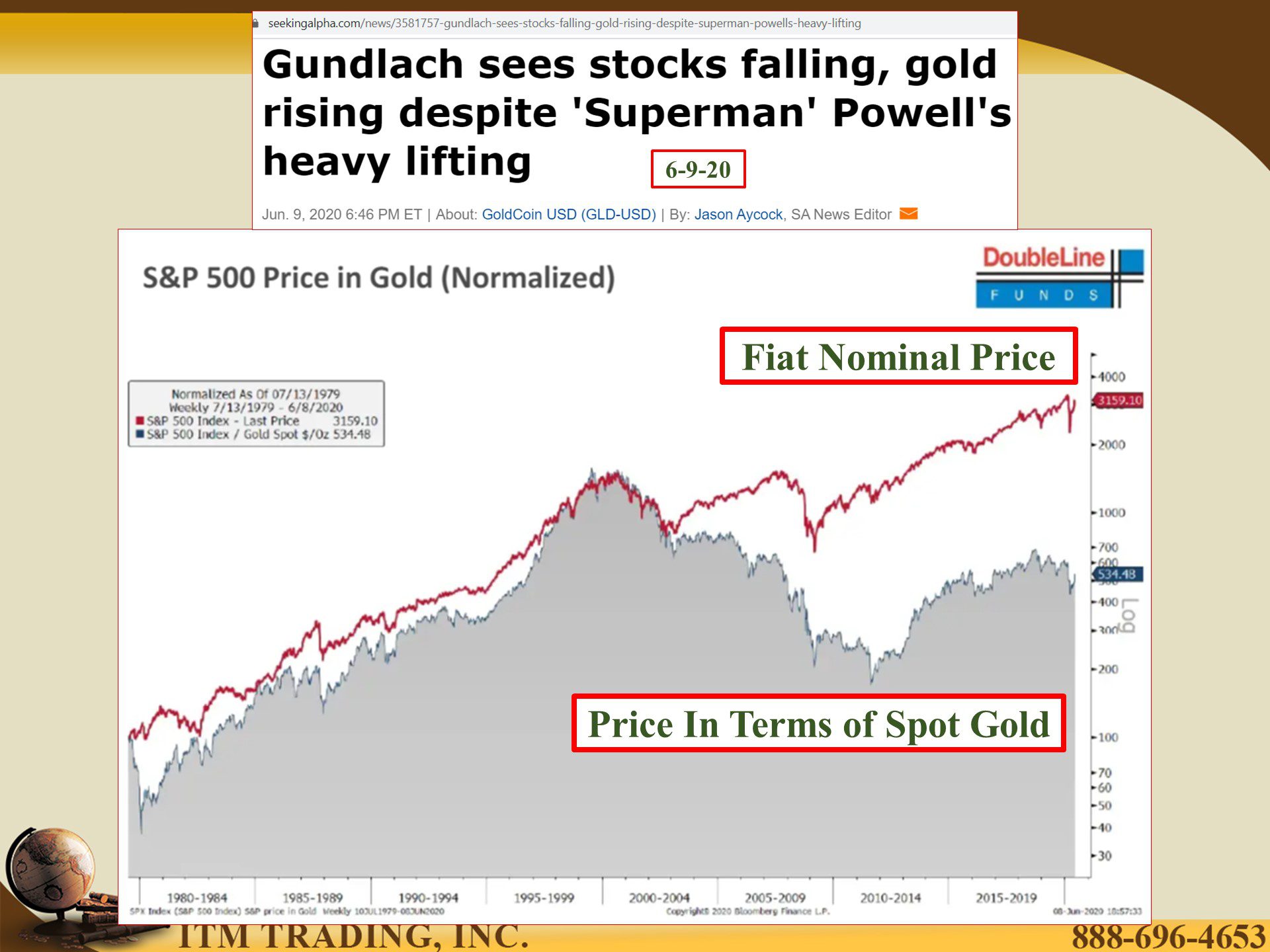

In the meantime, spot gold quietly outperforms all, even in this manipulated market. Remembering that fiat money inflation causes nominal confusion, it is easy to understand how a rising stock market can blind people to value destruction. DON’T BE FOOLED. Though markets can remain insane longer than you think they can, they do not remain insane forever.

It took twenty-five years for the stock markets to recover from 1929 and during that time the purchasing power value of the US declined. That was the kick-off to the new fiat money system. Now too, we are transitioning into a new fiat money system.

It is time to decide what kind of money you want to hold as we make this transition. Fiat, whose value is easily eroded or real money physical gold and silver, that has survived, purchasing power value intact, over 6,000 years. To me, the choice is clear.

Slides and Links:

https://www.nbcnews.com/business/economy/it-s-official-u-s-entered-recession-february-n1227631

https://www.nber.org/cycles/june2020.html

- https://fred.stlouisfed.org/series/DFF

- n/a

- https://www.businessinsider.com/perfect-storm-of-stupid-in-stock-market-right-now-2020-5

- https://stockcharts.com/

- https://seekingalpha.com/news/3581757-gundlach-sees-stocks-falling-gold-rising-despite-superman-powells-heavy-lifting

https://www.zerohedge.com/markets/superman-jeffrey-gundlach-live-webcast

Â