NEW RISK LOOP OPENS: Fannie Mae and the Frankenstein Experiment by Lynette Zang

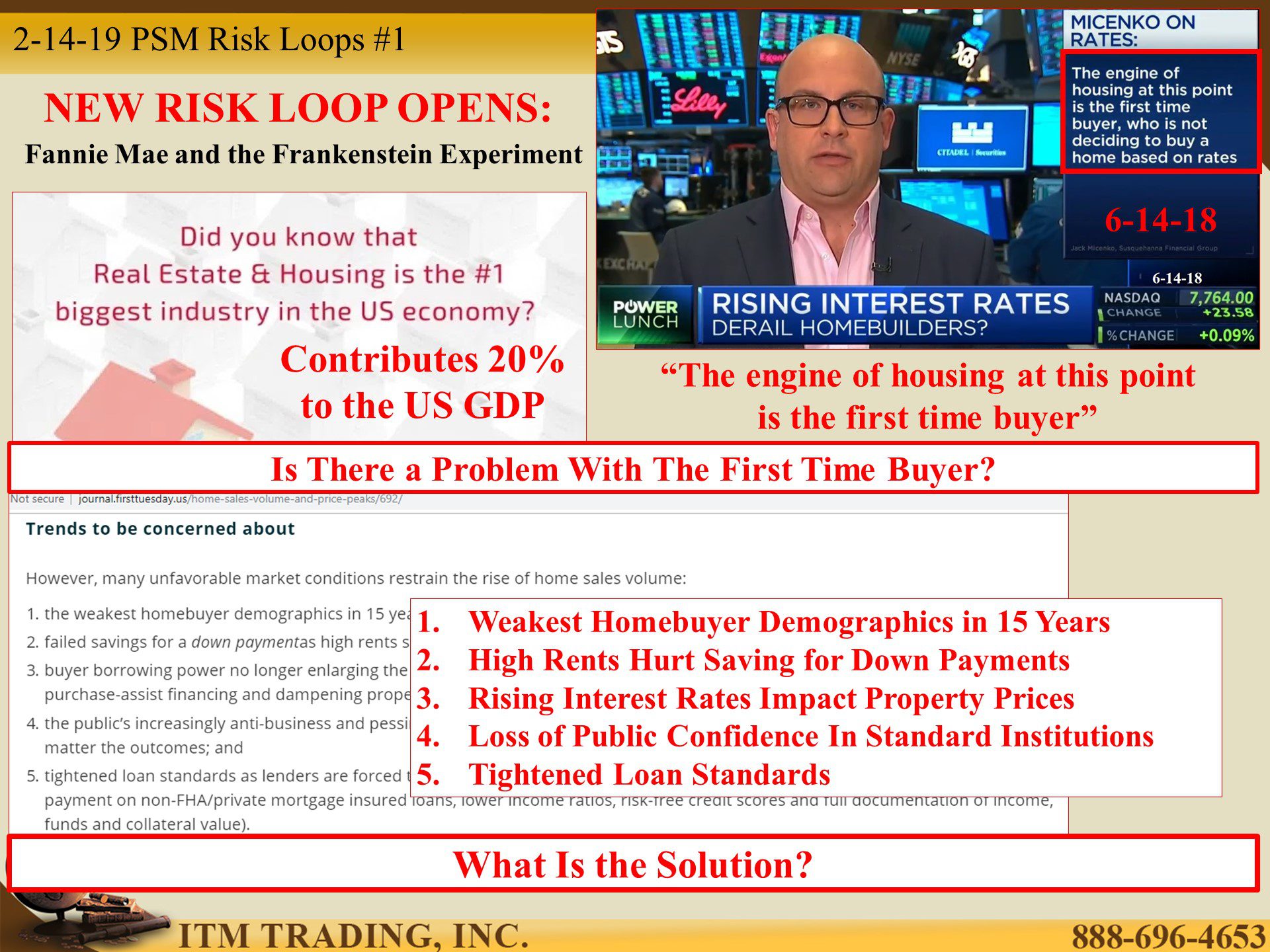

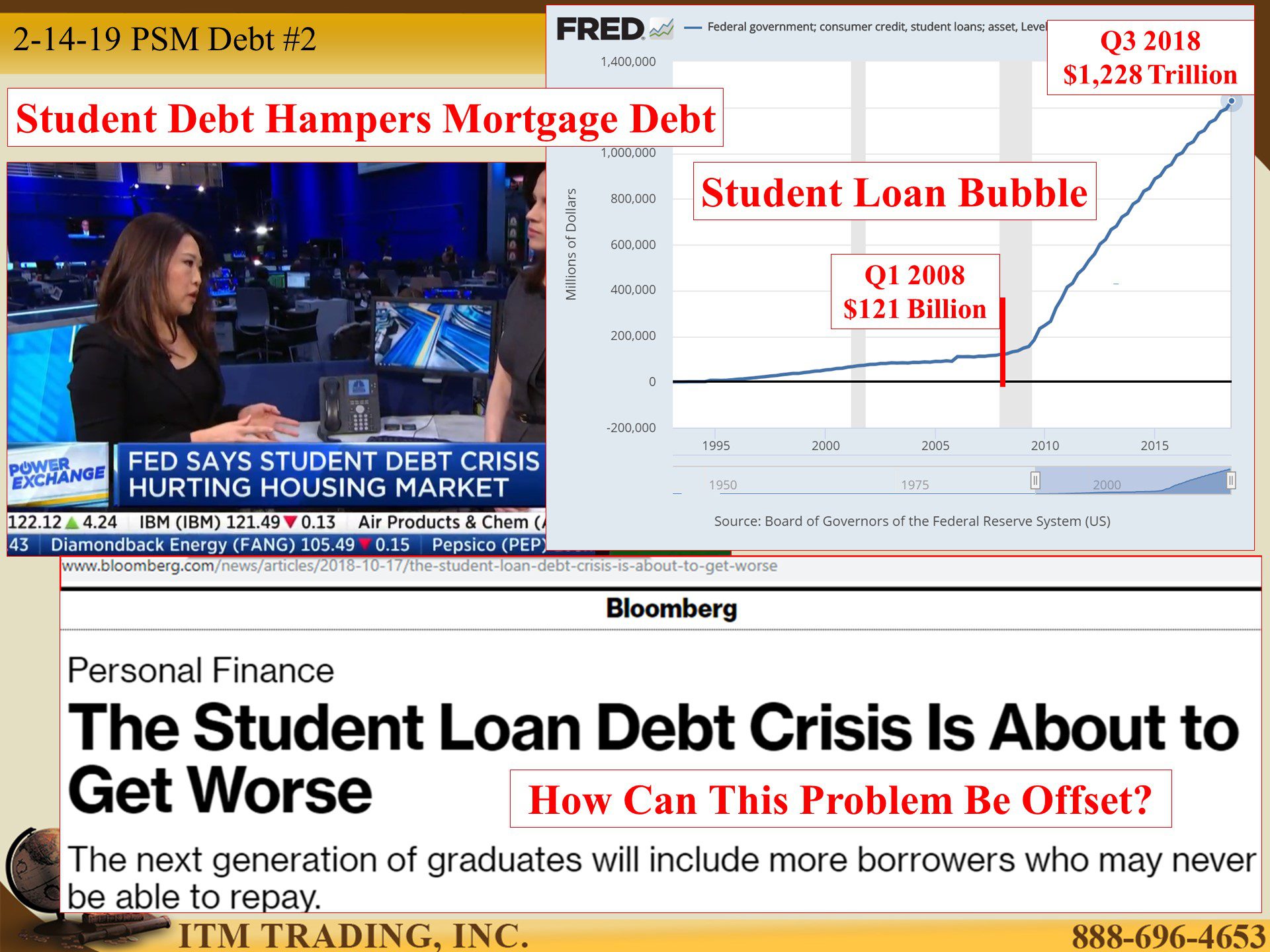

The real estate market is crumbling fast. Real estate is the biggest industry in the US economy, contributing 20% to the GDP. Additionally, real estate derivative products are a large and growing sector held in pension plans. Importantly, there is $6 trillion in “tapable†wealth held in home equity, if homeowners are inspired to spend it. A falling real estate market threatens everything, and we now have the weakest home buyer demographics in 15 years, according to Firsttuesday, a real estate journal.

We’re told that support is coming from first time home buyers who are less sensitive to rising rates. I understand that, being just married, young and ignorant about debt, I remember getting a 12% interest rate on my first mortgage in 1978. That was during the currency reset from the gold to the debt standard, as Nixon handed control of inflation over to the central banks and the beginning of the current fiat cycle.

Now we are at the end and the central banks know a crisis is near. How do YOU know that? Look at what they do. In 2018, global central banks bought the highest level of physical gold since 1971, when the currency reset was announced, the second highest in history. The highest was in the 1940s as global powers handed control over inflation to the US.

I would call that an historic pattern that indicates a major currency shift is near…very near, in my opinion.

Another typical pattern is bubble management, as wealth flows from bubble to bubble, benefiting the smart money elites who have the contacts, tools and means to privatize the gains and socialize the losses, as we saw in 2008, when the old IBOR system died and went on central bank easy money life support with end of life planned for the end of 2021. Global central banks have created a new benchmark out of thin air, now they’re attempting to create a new market.

In the US, the Federal Reserve has created the SOFR (Secured Overnight Financing Rate) and are using trusted SOEs (State Owned Enterprises) to create the market for SOFR. But you need to understand that this has NEVER been done before and is a huge experiment. So how are they doing this and why should I care?

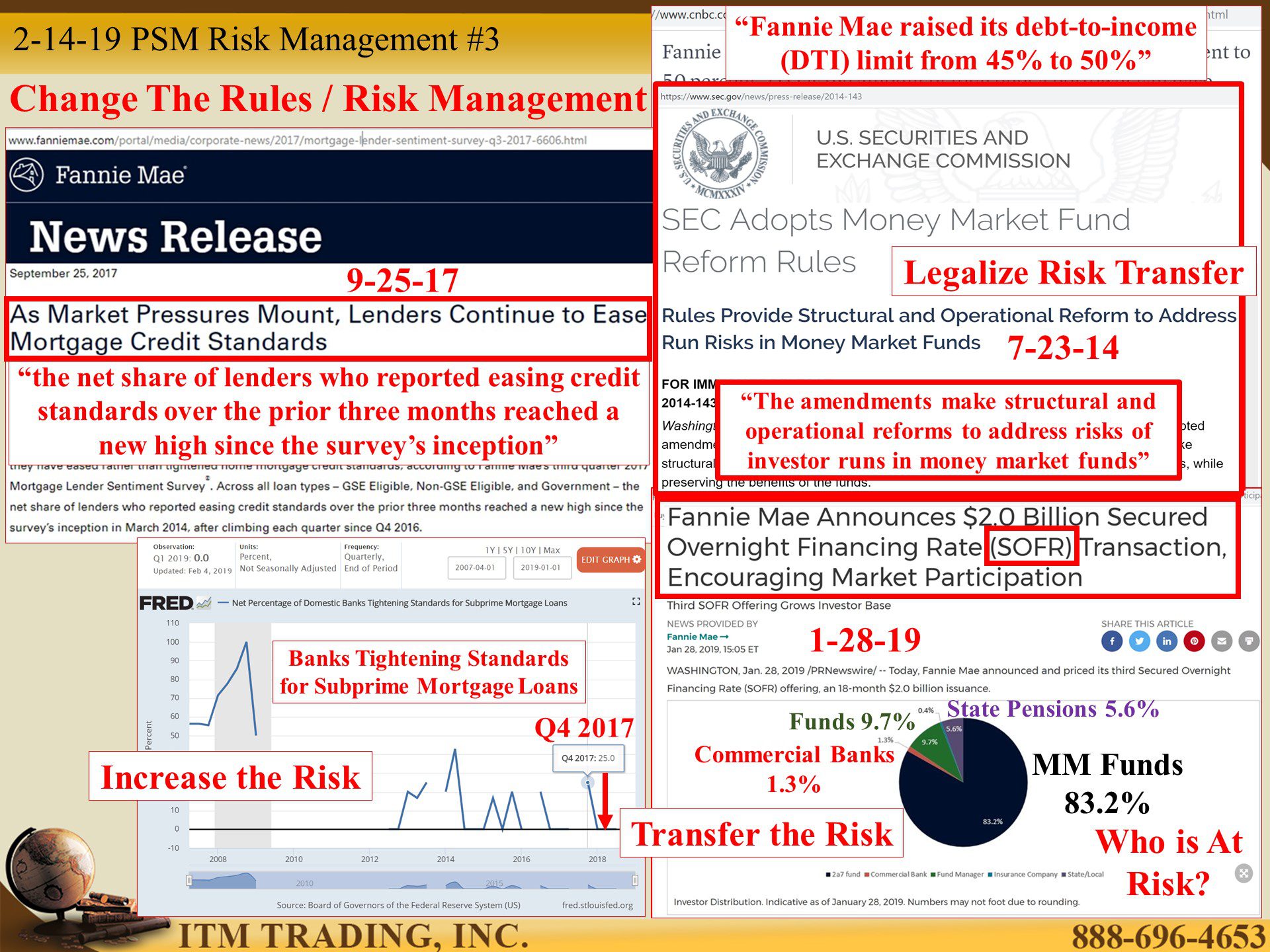

In 2008 the first money market fund fell below $1 as investors ran to liquid positions. This run was contagious, so the government insured the funds to create confidence and keep the public in the system, as they rushed to change the rules.

In 2014 the SEC adopted new Money Market Fund Reform Rules that “The amendments make structural and operational reforms to address risks of investor runs in money market fundsâ€, essentially transferring new risks to what most think of as “safeâ€, money market funds.

In 2017 Fannie Mae encouraged lenders to ease credit standards for sub prime borrowers as they raised their debt to income ratio up to 50%. I remember when that ratio was 30%, but then, it was not normal for first time buyers to be saddled with student debt, one of the new bubbles created out the 2008 crisis.

Starting in July 2017, Fannie Mae began buying up those mortgages exceeding all expectations. But that’s OK because in 2018, they funded these purchases with SOFR bonds! In fact, their third issuance was January 2019. Know who bought those bonds? Commercial banks bought 1.3% and those that use OPM (Other People’s Money) bought the rest; Fund managers bought 9.7%, State and Local Pensions bought 5.6% but the biggest buyer, a whopping 83.2%, was money market funds.

At the same time, global central bankers have been loading up on gold, up 74% YOY for 2018 and the second highest in history. What do you think they’re preparing for?

Slides and Links:

https://fred.stlouisfed.org/series/FGCCSAQ027S

https://www.bls.gov/cpi/factsheets/owners-equivalent-rent-and-rent.pdf

https://tv.youtube.com/watch/TlusSdRQ5lU

https://www.cnbc.com/2018/04/12/sub-prime-mortgages-morph-into-non-prime-loans-and-demand-soars.html

www.journal.firsttuesday.us/home-sales-volume-and-price-peaks/692/

https://fred.stlouisfed.org/series/FGCCSAQ027S

https://www.bls.gov/cpi/factsheets/owners-equivalent-rent-and-rent.pdf

http://journal.firsttuesday.us/home-sales-volume-and-price-peaks/692/

https://www.car.org/aboutus/mediacenter/newsreleases/2018releases/2019housingforecast

https://www.sec.gov/news/press-release/2014-143

https://www.cnbc.com/2018/04/12/sub-prime-mortgages-morph-into-non-prime-loans-and-demand-soars.html

YouTube Short Description:

Starting in July 2017, Fannie Mae began buying up mortgages funding these purchases with SOFR bonds, the new Federal Reserve experimental benchmark. Know who bought those bonds? Commercial banks bought 1.3% and those that use OPM (Other People’s Money) bought the rest; Fund managers bought 9.7%, State and Local Pensions bought 5.6% but the biggest buyer, a whopping 83.2%, was money market funds.

At the same time, global central bankers have been loading up on gold, up 74% YOY for 2018 and the second highest in history. What do you think they’re preparing for?