MARKETS UP, STOCKS DOWN. Confused? Lynette Reveals 3 Hidden Truth’s

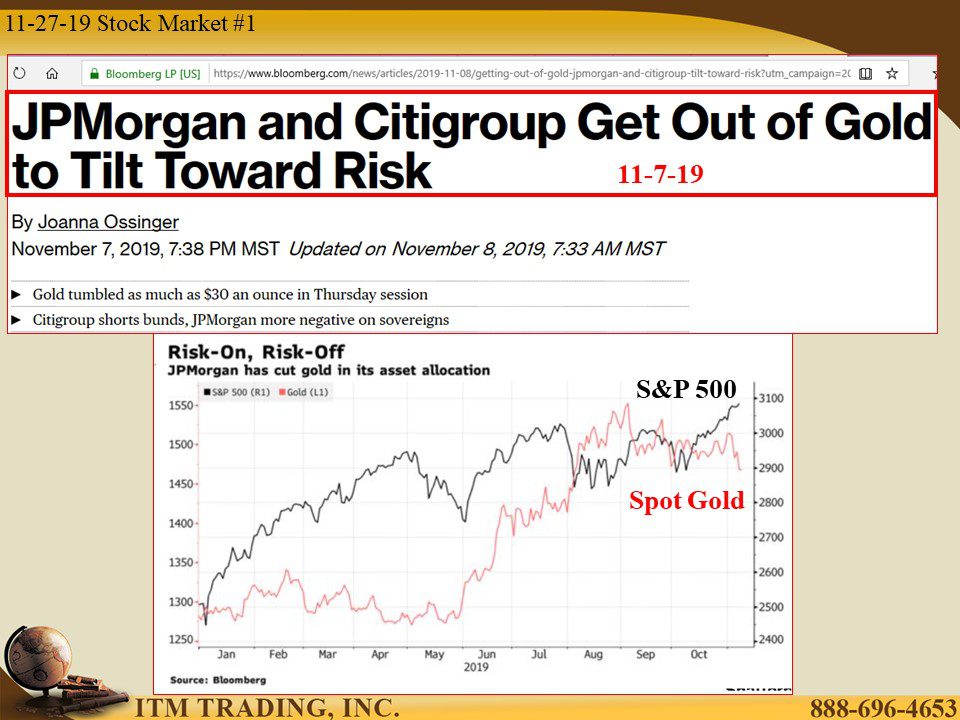

Stocks up, spot gold down, seems like the same old story, but is it? People ask me if they keep this going forever but perhaps we should be asking what lurks beneath the headlines?

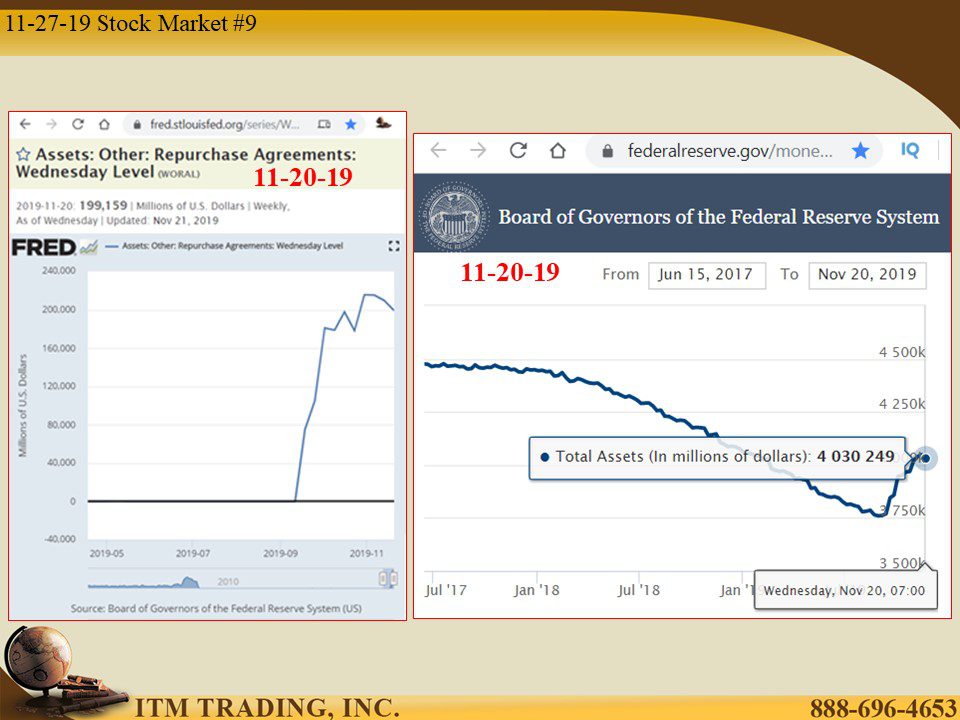

For one thing, large players like JPMorgan and Citi selling lots of gold derivatives and buying stock derivatives. It’s easy to make any market appear weak or strong when you have access to “abundant reserves†and leverage. Thank you Federal Reserve.

Have more questions that need to get answered? Call: 844-495-6042

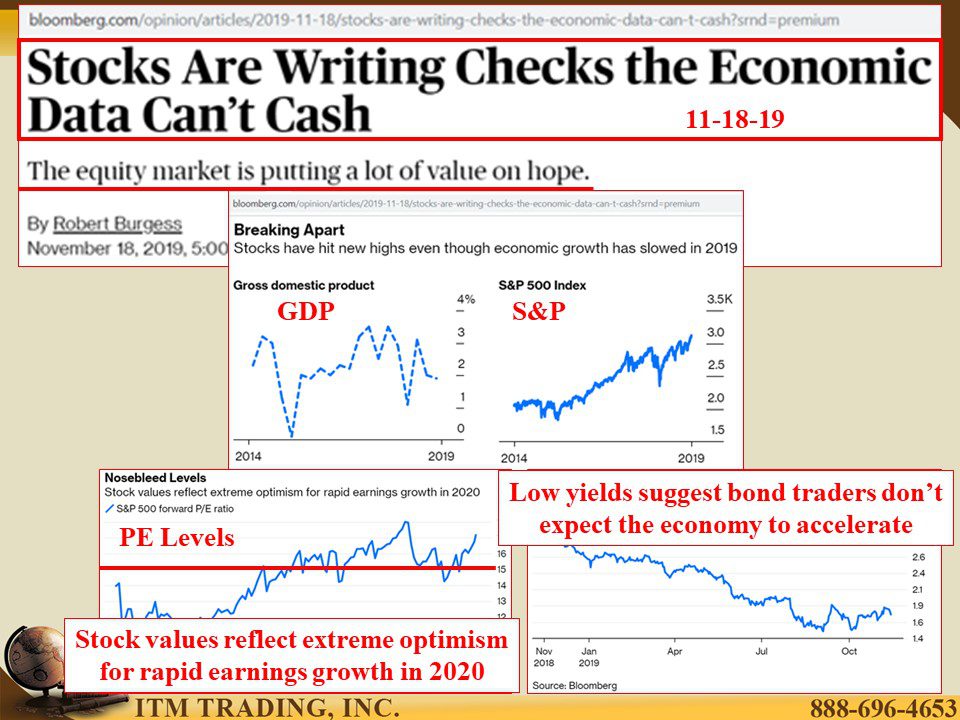

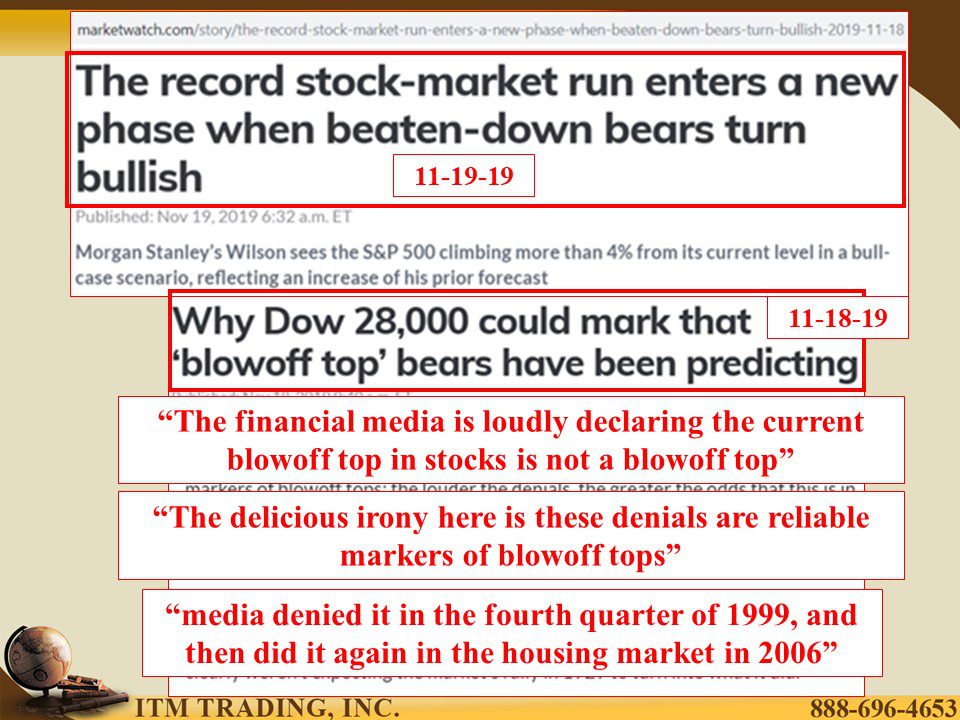

This newly created money, in the right banking hands, can move the markets up, even as market internals are falling apart. This is when it becomes critical to peak beneath the surface to see what’s really happening.

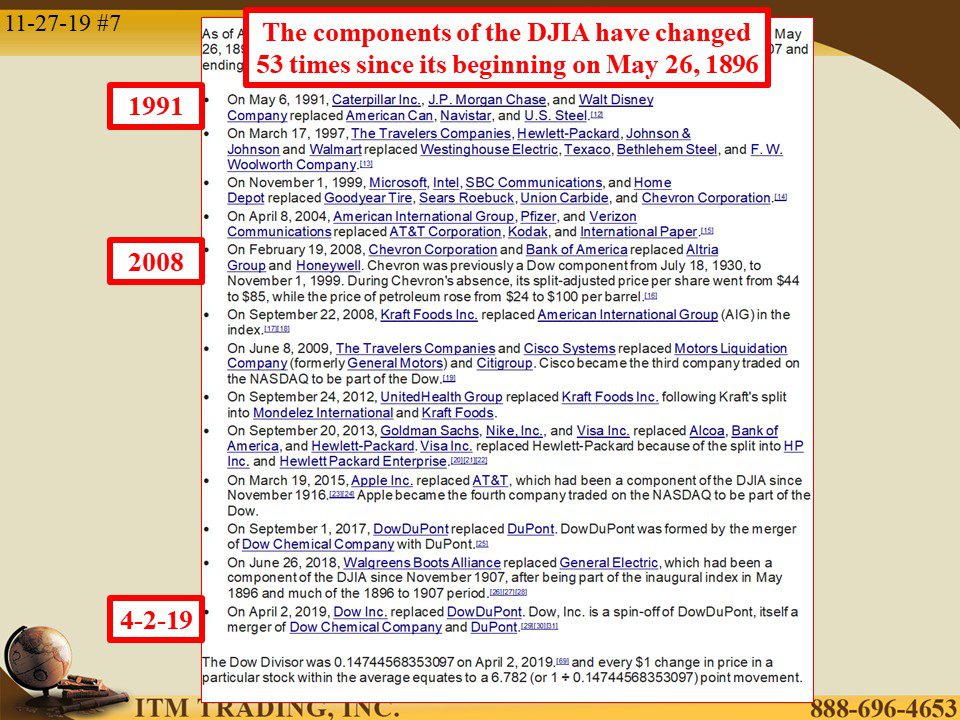

First it’s important to know that the components of any stock market index can and does change when a stock falls below certain levels it is replaced with other stocks, so even though it looks continuous, the stocks that make up the index change over time, particularly after a stock market rout.

Today, it’s the internal technicals that are breaking down. Aside from the extreme overvalued level of these markets, not all stocks are participating. The advance/decline line show stock prices moving up vs stock prices moving down. Recently, the A/D line has been moving down even as markets make new highs. Additionally, the number of stocks whose price is above their 50-day moving average (a positive sign) has been declining.

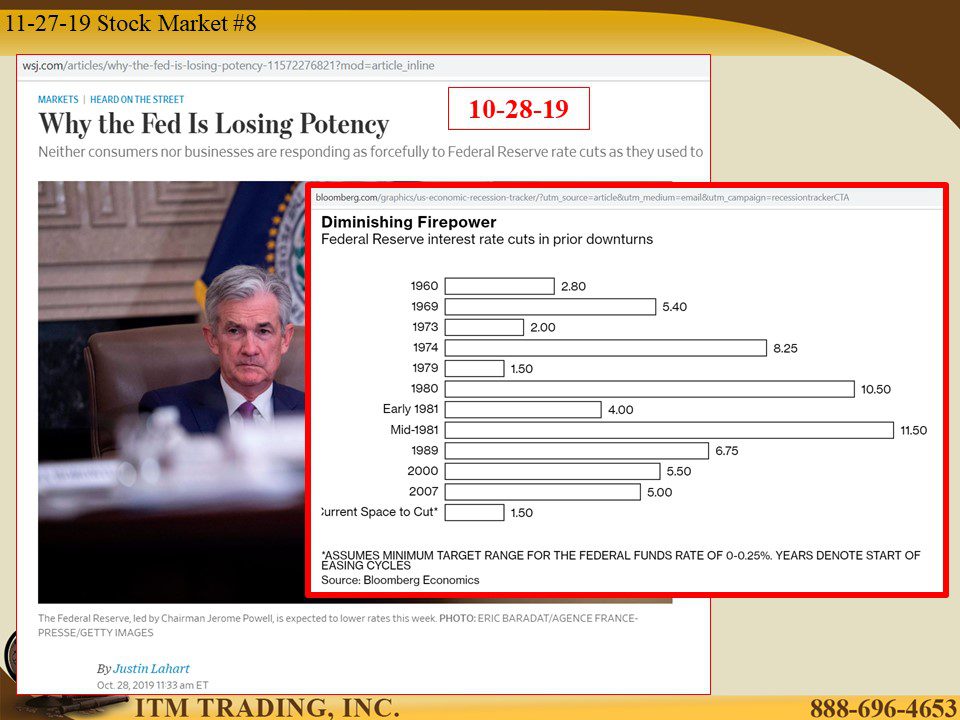

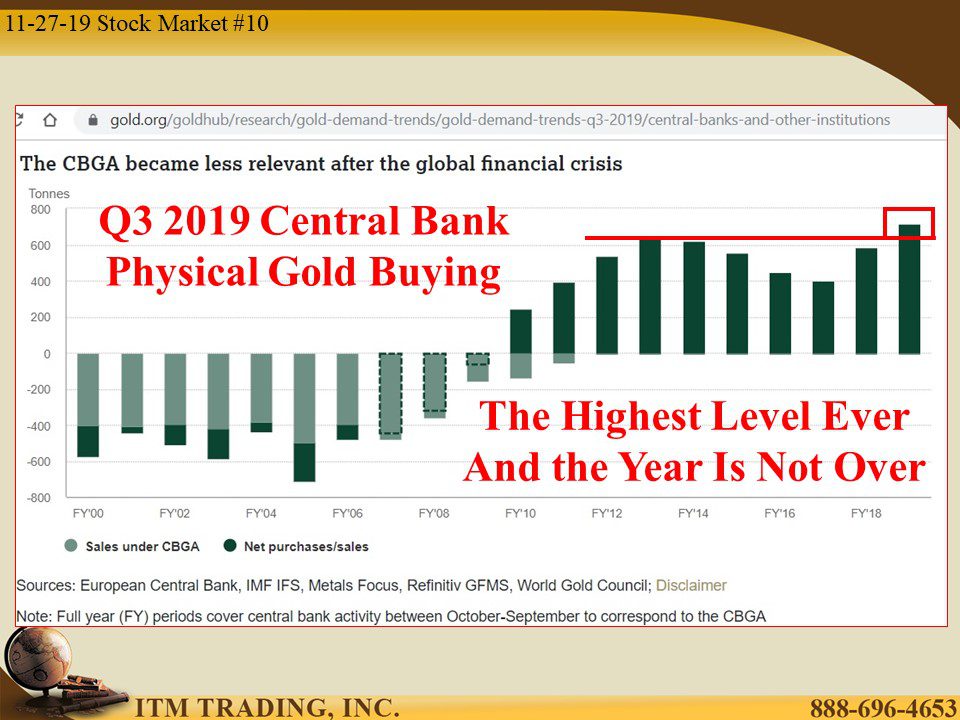

But, admittedly, central bankers know that doing the same thing, low rates and high debt, is having less and less impact and creating more and more instability. Their massive physical gold buying, more than ever before, tells you they are preparing for a major collapse.

Slides and Links:

https://finance.yahoo.com/news/retailers-broadly-lower-kohl-home-145551654.html

https://www.marketwatch.com/story/as-the-market-hits-new-highs-most-stocks-are-sinking-2019-11-18

https://en.wikipedia.org/wiki/Dow_Jones_Industrial_Average

https://www.wsj.com/articles/why-the-fed-is-losing-potency-11572276821?mod=article_inline

https://fred.stlouisfed.org/series/WORAL

https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

YouTube Short Description:

Stocks up, spot gold down, seems like the same old story, but is it? People ask me if they keep this going forever but perhaps, we should be asking what lurks beneath the headlines?

For one thing, large players like JPMorgan and Citi selling lots of gold derivatives and buying stock derivatives. It’s easy to make any market appear weak or strong when you have access to “abundant reserves†and leverage. Thank you Federal Reserve.

This newly created money, in the right banking hands, can move the markets up, even as market internals are falling apart. This is what we’re going to look at today.

Admittedly, central bankers know that doing the same thing, low rates and high debt, is having less and less impact and creating more and more instability. Their massive physical gold buying, more than ever before, tells you they are preparing for a major collapse. Are you?