MARKETS FLASH BIG WARNING SIGNS: When is it Time to Prepare for a Recession or Depression?

CHAPTERS:

3:28 Yield Curve Inversion

8:16 Seven Rate Hikes in 2022 & Stagflation Risk

13:40 Rout in Treasuries Deepens

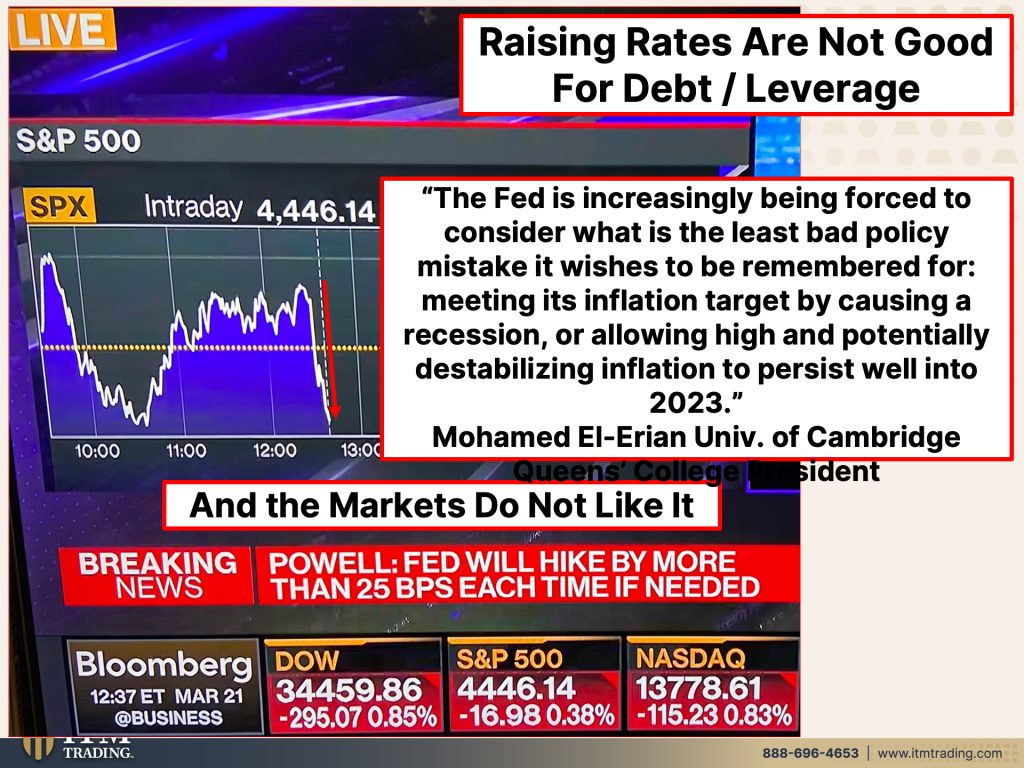

16:51 Raising Rates Are Not Good for Debt/Leverage

20:06 What Will Break the Housing Market?

27:24 Why is Russia Buying Gold?

December 2018: EMERGENCY PATTERN SHIFT: Yield Curve Just Inverted

January 2022: This Pattern Shift Always Leads to a Recession…HEADLINE NEWS with LYNETTE ZANG

TRANSCRIPT FROM VIDEO:

December 2018: I definitely consider today a significant day because the pattern shift, I’m getting goosebumps. The pattern shift that we’ve been talking about waiting for an inverted yield curve actually occurred today. And what happened was that the three year yield was now higher than the five year yield. And the five year yield is at the same level as the two year yield. Now, look, we talked about this in the beginning of October 2018, when I came across that critical report from the San Francisco fed that said every single time, this level has been breached. And it’s a combination of valuations and yields. Every single time that level has been breached. It indicated that we were going to have an averted yield curve, which voila we got it today, which indicates that a recession is going to be following soon. So you need to really consider yourself warned that this has now happened, but I’m telling you right now, this is not good people, technical neck on the line. We have an official, in the U.S. We have an official interest rate, inversion warning, warning, warning.

January 2022: It’s so critically important that you understand what I’m trying to show you here, this right here, you’re looking at it. It is an early warning sign because eventually what’s going to happen, and I don’t mean long term eventually. I mean, short term eventually, when the Fed actually starts to raise the short term rate, though, this could happen before that because the markets could make this happen with or without the Fed, right? But they will start to push up short term rates faster. And then the inversion will go down the food chain to shorter and shorter and shorter maturities when the two and the 10 invert. I mean, those that have been watching me for a while, watch that whole thing play out. I think it was December, 2018 and darned if we didn’t have a recession, 18 months later almost to the flipping day. So you have been warned. This is a leading indicator. Take heed. I’ve been telling you to get ready. I’ve been telling you.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading, a full service, physical gold and silver dealer, specializing in custom strategies to help you survive and even thrive through the reset that boy, I don’t know. You’ve gotta know that it’s going on because today we are getting a huge warning.

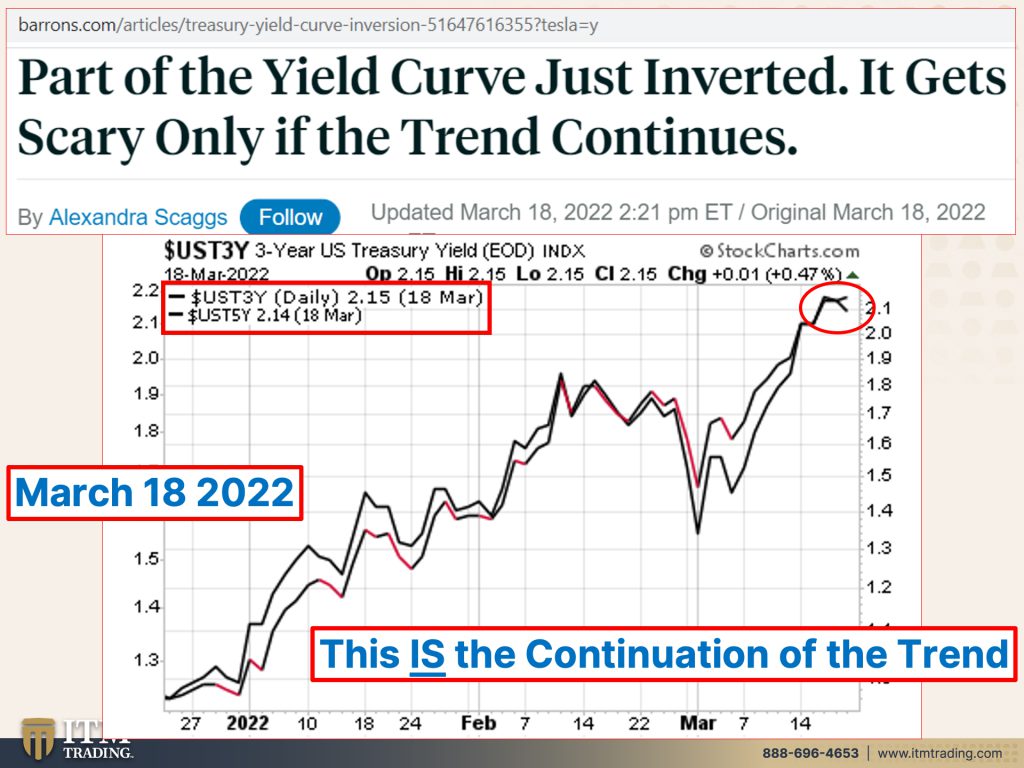

Although it’s quite interesting when I’m listening to the talking heads on CNBC or Bloomberg, what they keep saying is, well, if the yield curve invert. Like it’s something that might happen in the future. And even if you look at this from January, it says by the third quarter, as it delivers rate hikes, and guess what? It already started inverting in January when the 20 year yield. So what a bond a 20 year bond would pay you when above what a 30 year bond would pay. You, you have the links to that video. And also the one I did on yield curve inversions in 2018, but it’s already taken place. So it’s ridiculous that they say that it might be taking place because that was the, the start. And how about if all of this is ending by the end of, I don’t know this month? In other words, let me show you what I’m talking about because another part of the yield curve just inverted on Friday and it says it gets scary only if the trend continues. This is the continuation of that trend people! If you are paying attention, well, I’m talking to them. I’m not talking to you right now, but if they are paying attention or what is it that they’re really trying to hide? Like this is the first one. So on Friday you had the three year yield go higher than the five year yield. Now, why would you pay more or accept less? That’s a better way to say it. Why would you accept less to loan somebody money for five years? Are you not watching what’s happening with inflation? Do you real really think you’re gonna have anything left by the time presuming you get those dollars back? Did you actually get those dollars back? I don’t know, but that’s not the only one. My goodness.

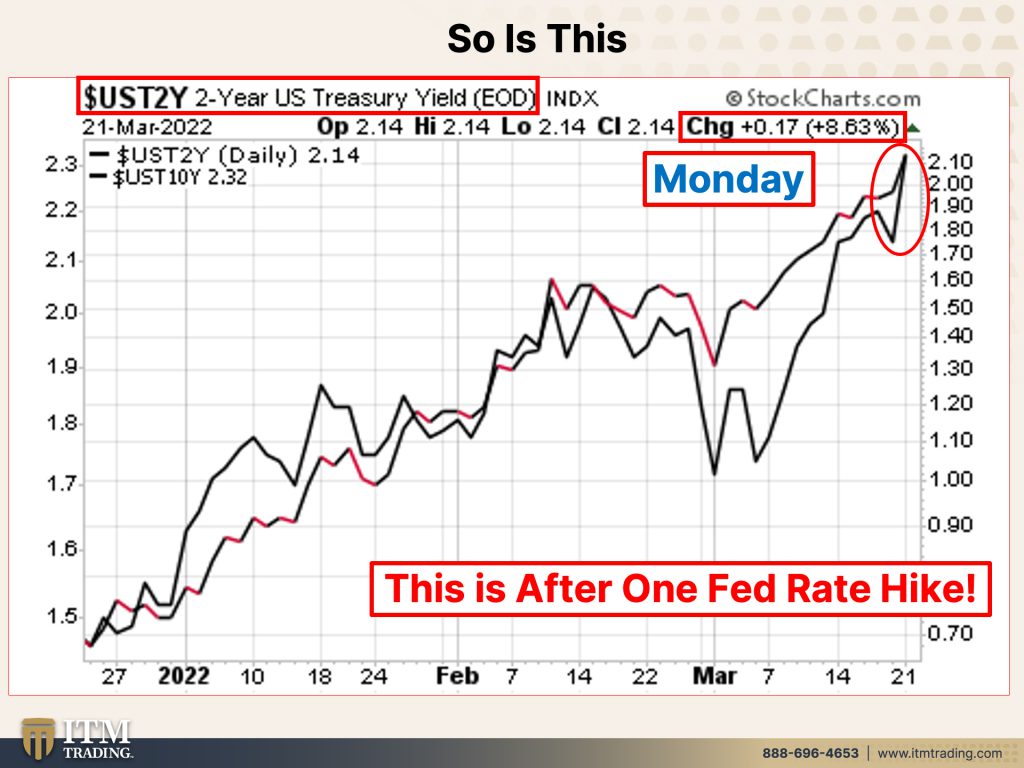

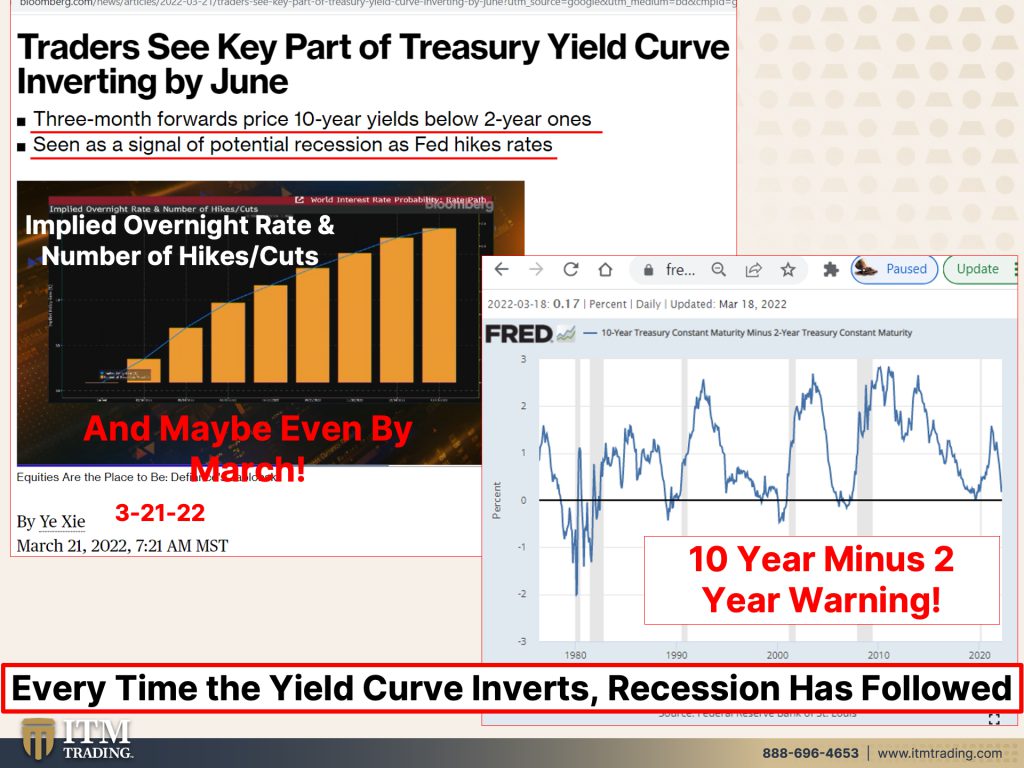

It’s also the five year and the 10 year yield has just inverted on the 21st. Right? So that was Monday where you have the five year yield paying you more than the 10 year yield. The inversions are happening pretty much daily right now. Oh, this is the one that we’re really paying attention to because it’s close, close, close. Now I want you to notice that this is from Friday, March 18th, and you can see right here that the yield on the five year or on the two year rather was at 1.97 versus the 10 year at 2.14 at that time. So the two year yield had just gone up almost 2%, which is actually quite a move. This is what they’ve been talking about and the talking heads freaking out about, but on Monday, my goodness, it had, let me show you this. There’s the issue. It surged the two year yield surged almost 9%. So now you have them very, very close. This is the big one. This is the one that the talking heads think matter the most, but it always starts on the long end or it typically starts on the long end. And then it works its way down to the short end. Now, why do you even care about that? Well, because when we have a yield curve inversion, it has always led to a recession. This isn’t gonna be just a recession. This is going to be the final death now because they have no tools. They’re anchored at zero. Yes. They went up a quarter of a percent and maybe, maybe, and they probably will. Well, they’ll, they’ll try to anyway, raise it a half a percent at their next meeting. And maybe even the following meeting, honestly, they can’t do it. They can’t do it, period, because it’s gonna crash the economy that is built on this mountain of debt. And I’m gonna show you more about that.

But this is the overnight rate and the number of hikes they’re counting on seven rate hikes this year, maybe I’m wrong because Powell has clearly been smoking. That hopeium a lot where they’re gonna raise all these rates in a system that’s based upon debt. Meaning everything will cost more to borrow money, whether it’s on the credit cards or a mortgage or an auto loan or anything like that. So they want people to keep shopping and paying these high inflated prices. And then if he raises rates on top of that, it won’t crash the economy? I don’t even wanna smoke his hopeium because I need to have a clear head to get through this mess. But frankly, any of that talk other than that is a joke. This is the 10 year minus the two year. And the Fred, you know, is the federal reserve education department, right? And look at how close it is. And this is a little bit lagging behind these gray bars represent official recessions. Of course, you see how quickly we got out of the one after the, what we had to deal with 2020, but you can see every time they raise rates, it causes a recession. And this time is not going to be different. Except that this time all they have left is this. They will use it. They’ll take us to negative rates. They will absolutely use it. And we will have our hyperinflation. And that’s more because of the loss of confidence.

But what I also find so interesting Goldman now sees the fed hiking by a half point at the next two meetings. Okay, this is was on the 22nd so Tuesday, and this is the fed dot pot. And you can see that they already plan on leveling that off. And they’re already talking about reducing rates. Again, they will be reducing rates. Let’s see it’s March. I could totally be wrong about this, but I’ll betcha that they start to reduce rates before the end of this year because economy can’t handle it and neither can the markets and neither can the housing market. So the stock market, the bond market, the housing market, I love that. They’re already anticipating when they’re gonna cut rates, is the economy so strong? Why do you need to cut rates? Because they’re added tools and the economy isn’t strong.

These things came out as I was working. So, you know, we talked about stagflation before, and maybe you pull, I did a piece on that, not that long ago. So maybe we could pull that, put that link in there. But this is, is really the key. The fed dot plot eroded decades of credibility, cuz it was a joke. I mean it wasn’t literally a joke, but quite honestly it was a joke. You’re gonna raise rates. You’re gonna level off next year. And then you’re gonna decline rates in 20…How, how in the world can you even anticipate what the economy is gonna look like in 2024? Because you guys at the fed already think there won’t be any inflation, inflation’s gonna not there won’t be any, but then inflation is gonna calm down the second half of this year because of supply chain issues are gonna get better? Boy, I’m telling you right now, I bet any amount of money on that it is wrong. And what I’ve done because of that is I’ve been buying more gold and more silver because this is what fights inflation. Nothing else fights inflation other than having your own gardens. Because remember food is the single biggest issue. Water, Food, Water, Energy, Security, Barterability, Wealth Preservation, Community, and Shelter. If you haven’t put those in place, get them done, get them done as quickly as you possibly can. Stagflation for those that want a definition is declining growth and increasing prices. Guess what? We’re already in stagflation, but Hey, that may happen in the future. Well, let’s see blink your eyes. Oh, it’s happening. It’s ridiculous. When they talk about all of these things that is gonna happen in the future, maybe when you are living through it right now. So don’t be fooled by their misinformation. That’s their job. I get it. But it’s a rotten job. It really is, not one that I would want. Because oh, real consumption has stalled. Yes, it has, any of the price gains. Most of that is because of inflation and people are starting to balk about paying these higher and higher prices.

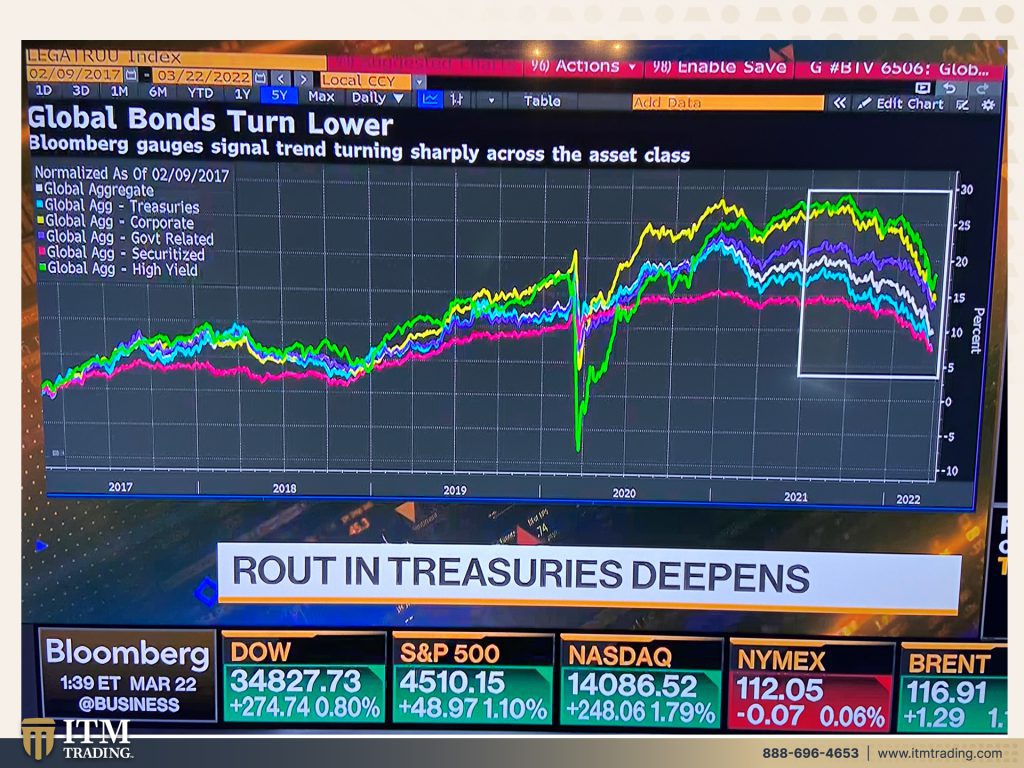

And oh, the route in treasuries deepen? Because remember bond yields, bond prices, oh, maybe I’ll do it the other way. Bond yield, bond prices. When interest rates go up, the price of the bonds go down. The longer the bond is the greater that movement. So we’ve just been coming out of a what? 40 year bubble and bond where, where Paul Volker gave us broom pushed all those short term interest rates up to intraday over 21%. Well, yeah. Then you get into a recession and what do you do? You drop interest rates five and a half, five and three quarters percent. That’s a substantial amount. And you encourage more borrowing and more spending. Pulls us out of a recession. Economy’s doing great. I love it. When they say economy’s doing great. Well, yeah, those at the top. I love these reports that talk about how the wealthy are. Yeah. Well inflation is an inconvenience, but you know, it doesn’t hurt the wealthy that much. No, because because the wealthy don’t have to decide between buying food for your family or putting gas in your car. They don’t have to make those choices. But most of the public do have to make those choices. And there are hard choices, but these guys haven’t worked a day in their lives. They sit around the table and they make all these theories and they try all of these experiments. And we’re the big Guinea pigs, because this is really about well transfer. We get these, the dollar bills when they have less and less value. So yes. Is that going to deepen? And one thing I wanna point out on this graph is that the green line, this bright green line are high yield bonds. So as they’ve been robbing us as this central banks have been removing the interest from everything that you buy to generate income with, people have been forced out on the risk spectrum. They’ve taken more risk and you can see this huge drop off. So if you are in high yield, anything, this would be a really good time to make sure you’re out of it. You do whatever you want, but I don’t own any, any Fiat money garbage. I have some cash because that’s still our tool of barter. Other than that, no, because I understand this stuff. Why in the world would I hold this? And you’ve got oil, that’s getting cheaper? No, I mean, I got a little bit of route because it went up so fast and nothing goes straight up, nothing goes straight down. You gotta have some bouncing along the way. So I hope you’re not even thinking about buying this dip because that’s insane.

When Powell came out and said that the could do more than 25 basis points, if he needed to that he is committed to fighting inflation above all else. Well, the markets went, no, I don’t like this. Now, today, you know the volatility in these markets, the banks and the traders are making a lot of money. Are you? No, you’re just watching your prices go up and up and up because the reality is, is the entities that are really controlling all of these markets, whether it’s it’s wheat or it’s oil or it’s, anything else are wall street traders, and they don’t get the crap about your standard of living or whether or not you live or die. To be perfectly honest with you. They only care about making a little bit of money. They love this volatility. And if you have your wealth invested in this kind of any kind of Fiat money product, the real trend is what’s happening to the purchasing power. And even if you don’t go on the purchasing power charts at the federal reserve, you’re feeling the inflation. Aren’t you. Every time you go to the grocery store, every time you go to the gas pump, every time you do anything, prices are going up substantially. That’s really the loss of value in the purchasing power. Is that gonna change? No, it’s not gonna change. It’s gonna get worse because we’re at the end of this grand experiment. And so whenever you have an experiment, we’ll talk about this a little bit more later, but you wanna have diversification so that you’re properly balanced. I do like Mohamed El-Erian, I think he’s a very, very bright guy. I’ve watched his work for a number of years. And he talked about out that just the other day, the fed is increasingly being forced to consider what is the least bad policy mistake. So in other words, there’s gonna be a policy mistake, guess what? They’re already making them and they’ve been already making them so what does the least bad policy mistake it wishes to be remembered for meeting its inflation target by causing a recession. Even if they do cause a recession, I got news for you. It’s not gonna stop this inflation. It’s too late. It’s too late or allowing high and potentially destabilizing inflation to persist well into 2023. So no matter what they do, I’ve been telling you this for a while. They’re between a rock and a hard place, and they’re outta tools. They can’t really fight this inflation because it’s not demand side. In fact consumption is going down. So even when we’re showing, look at how strong this economy is, it’s built on inflation numbers. That’s what it’s built on. That doesn’t really make for a very strong economy.

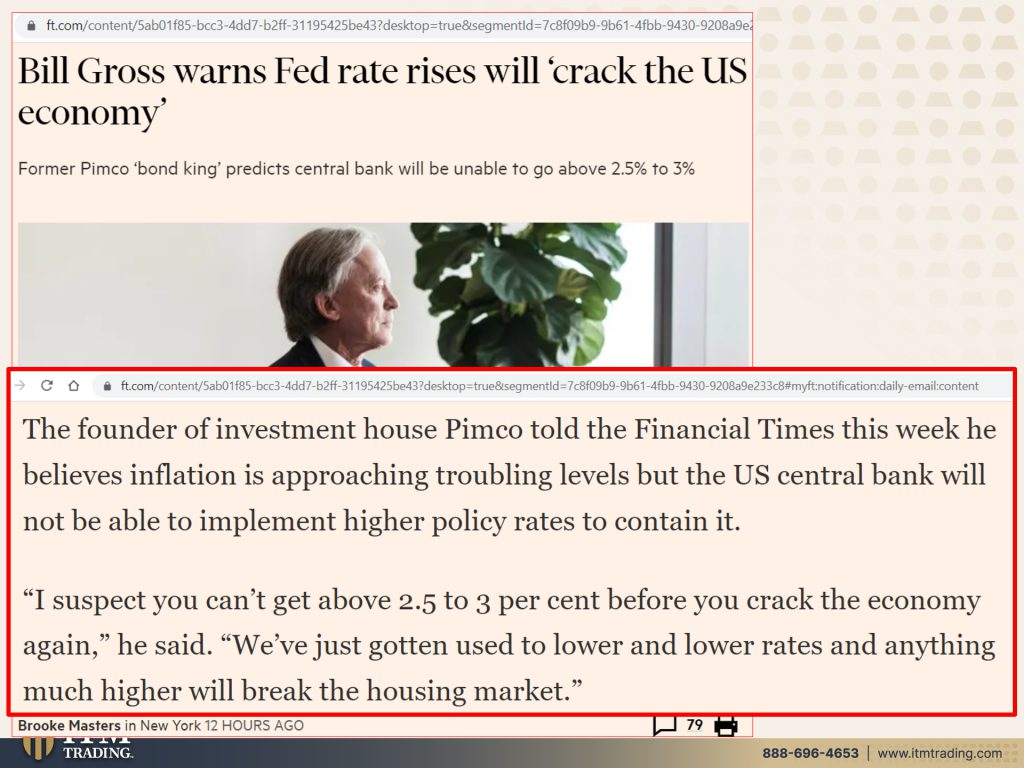

But another person that I admire a lot is bill gross, who founded Pimco and was known as the bond king. So I follow him for years and years. He is subsequently retired, but even so you don’t take away your knowledge. And he is saying the founder of investment house Pimco told the financial times that he believes inflation is approaching troubling levels. I agree, but the us central bank will not be able to higher policy rates to contain it. And frankly, it wouldn’t really contain it anyway, because again, it, this is a supply side issue, not a demand side issue, but I suspect you can’t get above 2.5 to 3% before you crack the economy. Again, we’ve just gotten used to lower and lower rates in anything much higher will break the housing market, which is a huge part in many places, 30% of the global global GDP or of the GDP of different countries is based on housing and everything around that supports housing. Are we in a housing bubble? Hmm. You think this can last? Hmm. You think if it takes, if it costs more on a mortgage, how many people really have cash to pay for a house? Not many. And that means they have to take out mortgages and the higher the interest, the bigger the mortgage payment, but the prices of the houses are ridiculous. Now. So the affordability level for most people has gone away and availability has gone away. Maybe that’s why they’re building all these high rises all over the place that you see, because there’s gonna need to be housing somewhere.

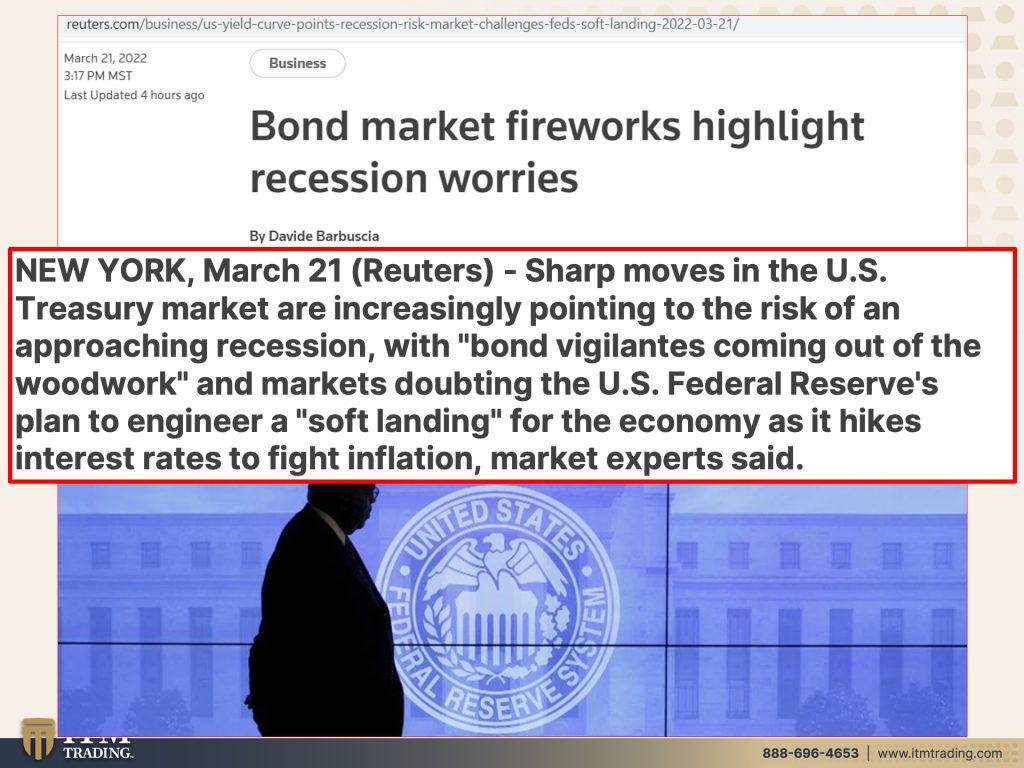

And this is a big, huge warning highlights, recession worries. What are they gonna do when this next recession hits? And it will. I promise you, I mean, I’ll give you a hundred percent guarantee on that puppy a hundred percent. And I can’t usually give you many guarantees, but I don’t think we’ve left one yet personally. It’s like, let’s just change the way we account for things. And then people don’t know what’s really happening, except you know, every time you have to open your purse or your wallet, you know, that thing is costing more and more and more. And if your income does not keep pace with that, you are SOL. Sharp moves in the U.S. Treasury market are increasingly pointing to the risk of an approaching recession with bond vigilantes coming outta the woodwork. They were hand this market in 2013, I should have pulled the VIX chart, but I didn’t, but I’ve shown you that about a gazillion times. And maybe we’ll put it in. We’ll put it in the blog just as a reminder and markets doubting the U.S. Federal reserves plan to engineer, a soft landing for the economy, as it hikes interest rates to fight inflations. Now here’s the thing. This is in two different pieces. We’re now hearing about the loss of credibility and the loss of confidence in the federal Reserve’s abilities to fight this inflation, to engineer this soft land. I mean, he’s on hopeium, but that’s all he’s on because history tells a very different story every time. And with inflation running as hot as it is, and they’ve started, they have not started to run off any of their balance sheet yet. And I’ll be paying attention to that. And we’ll take a look at the balance sheet because presumably they’ve stopped buying, but they might have stopped buying in one place and started by in another place, sneaky moves. But they do that all the time. They’re experts, anything to keep things hidden from the public because they require public confidence. The markets already saying, nah, we’re losing confidence in yal. I lost confidence in the system time ago. I’m so grateful that I got to work in the belly of the beast.

Because that takes us to gold and it takes us to silver and it takes us to real money that’s out of the system. So a little technical lesson here because interesting things are happening. And I remember back in 2011, when we hit a peak for gold, and then it created that cup formation well on a much shorter term basis, because if you’re a trader, then you just look since they all apply, but you kind of go shorter and shorter with it. So my goodness, there’s a second cup and it’s about to break out spot gold is concluding a second cup and it’s positioned to go a lot, lot higher. So you wanna do yourself a favor. I mean, seriously, you wanna buy more? You wanna do it now at these price levels because it will get more expensive and availability will get tighter and tighter and tighter. And we’re seeing something similar or similar kind of day to day behavior in silver that has not yet concluded its cup formation. But what it has concluded is filling this gap, see that gap, right? And remember I told you this a long time ago, it just is what it is at some point sooner or later, all gaps get filled. And that is what’s happening with silver right now. So you can see that gap and you can see how it’s gotten filled over here. This is strong foundational stuff, this is in indicating somewhere around a price bottom and substantially higher prices moving forward. And you know, it’s not really the prices that worry me too much because they’re still both so severely undervalued that I frankly don’t really care about the prices. But what I do care about is the availability of all these different things. Because once in the physical world, there’s a finite amount. And once these things come off, the market, they’re not coming back on. So I’m grateful that I was able to build my barterable and a lot of my positions over many, many years when I still had access to absolutely everything. But you wanna do this sooner than later, so that you can get the best alternatives before they’re going away. I can’t tell you what they are because I don’t work in that area. I’m constantly researching, but our consultants can because that’s what they do every day. And they have a much better handle on exactly what’s available than I do. But I have a, a handle on what’s going on in these markets.

And one thing that I definitely wanted to point out to you, because I think this is so significant is that Russians are buying so much more gold amid the rubles collapse, right? That is a Fiat money collapse. I, I have one lots of these bills in here, here. That’s the first one that I grabbed 10 trillion dollar Zimbabwe note. But how much is this piece of gold worth? A lot more than this cause this has absolutely zero purchasing power value. This maintains it. So, you know, part of what we’re looking at here, and I think it’s actually kind of nice that the central bank has halted its own purchases, but that’s because the demand from the citizens has gone through the roof. Now gold has become one of Russia’s last safe havens to preserve their wealth. Russia’s Central Bank is suspending purchases of gold from banks amid increased consumer demand and Russians have sought gold as a way to preserve wealth as the ruble tumbles to historic lows. And what you have to ask yourself is when do you want to be prepared? You don’t wanna be forced to buy it into a crisis because I guarantee you it’s taking an awful lot more rubles and I should have pulled that up. I’m sorry, I didn’t. But I guarantee you it’s taking an awful lot more rubles to buy one ounce of gold today than it did last year than it did the year before than it did five years ago, etcetera, etcetera, because Fiat money is government based money and, and it’s easy for them to manipulate its value. It’s purchasing power value through inflation. It’s baked into the system. And any currency that a government can say, oh, this is money. Guess what? They can also say boop, not money anymore. So there are so many different ways to destroy it, but it always starts and ends with inflation. And that’s where we are.

I’ve been telling you this for a little while now that in my opinion, that we’ve already started the early phases of hyperinflation. And every day that goes by I’m more and more and more certain of it more and more. And I don’t think I need to wait until it hits 50% to say, oh, we’re in hyperinflation because those numbers get massaged as well. Please take heed. Please take heed. Because once we get a full inversion and we have gotten the inversion, this is not something that we’re waiting for. I mean the two and 10 year are so close, maybe by the end of this week, maybe by the end of in a month? Maybe at the next FOMC meeting minutes. And they raise it another 50 basis points, but it will invert. And all the other ones have already inverted. What are you waiting for? The time to get prepared is now Food, Water, Energy, Security, Barterability, Wealth Preservation, Community, and Shelter. The time to get prepared is now. And that’s why we started our new YouTube channel Beyond Gold and Silver, where we talk about all the other parts of the mantra. And in case you missed it, you totally wanna watch the Coffee with Lynette interview with Judge Andrew Napolitano, a man that I admire greatly. I mean, brilliant man knows Jay Powell personally, as well as many others. But if you didn’t see that interview, you absolutely need to. And then also do not miss the interview I did with security experts, Sean Connelly, and Curtis Teets on our new channel. And the link for that is in the description. And by the way, I had them over just the other day. So they analyzed my house. They took a look at it anyway and they’ll be doing the same thing for my bug out house. And I’m like so excited because I feel like, you know, sometimes we just don’t know what we don’t know. And these is people know a lot of things that I don’t know about security with their background. So I’m really excited to be working with them. And we’ll keep you in the loop on that, cause we’re gonna record everything and give you, we’re gonna try anyway to give you every single tool that you need to create your own self-sufficient Community, Food, Water, Energy, Security, Barterability, Wealth Preservation, Community, Shelter, please get it done and go visit our new channel. So if you like this, please give us a thumbs up. Make sure you leave a comment because it helps more people see this information and even share it with the people that you love and care about because ignorance does not make anyone immune. It just leaves them vulnerable. And this is not a good time to be vulnerable. So until next we meet, you know, it is time to cover your assets. Every single one, every single one, get them covered. And until next we meet, please take care. Bye-Bye be careful out there.

SOURCES:

https://stockcharts.com/h-sc/ui

https://www.barrons.com/articles/treasury-yield-curve-inversion-51647616355?tesla=y

https://stockcharts.com/h-sc/ui

https://fred.stlouisfed.org/series/T10Y2Y

https://uk.finance.yahoo.com/news/russians-buying-much-gold-amid-135710312.html