MARKETS DROP & GOLD SETS GLOBAL RECORDS: As Currency War becomes official By Lynette Zang

Markets had hoped the US and China’s trade talks would come to a positive conclusion, instead as negotiations continued, President Trump surprised everyone with a new 10% tariff scheduled to go into effect on September 1st.

In retaliation, Beijing asked state-owned firms to suspend US crop purchases and allowed their currency to fall below a key psychological level not seen since 2008. Global market reaction to these surprises were hard and swift. Crop futures, like soy and wheat, dropped in some cases almost 10%, and global stock markets fell dramatically. In fact, according to CNBC, the Dow’s 767-point decline was the 6th biggest decline in its history.

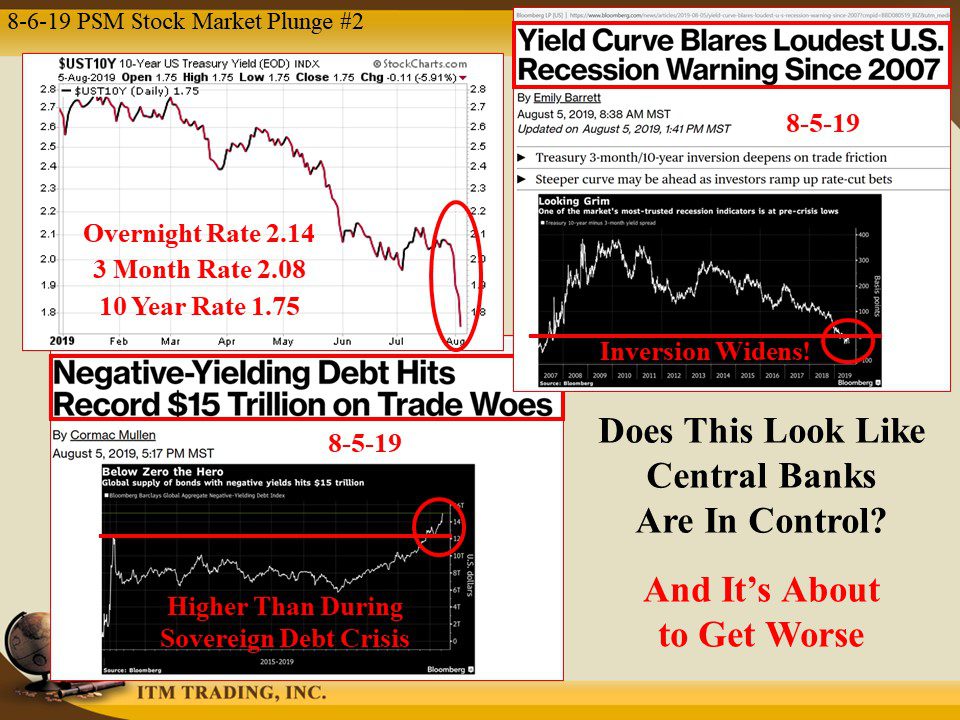

What didn’t decline on Monday? The bizarro world of bonds with expanding yield curve inversions (short-term rates higher than longer-term rates) as well as the negative yielding bond universe hitting over $15 trillion, a jump of almost $2 trillion in roughly a week, and real money gold and silver.

What are these markets telling us? An inverted yield curve screams recession and a raising gold price indicates a failing currency. The two together are very ominous signals. And frankly, it appears that things are about to get a lot worse.

You might remember that on June 26th I did a video on “What Scares Me,†where I told you that an escalation of the trade wars into a full-blown currency war, with all sides weaponizing their own currencies. The public is caught in the line of fire as hyperinflation eats any purchasing power value left in the fiat currencies. Unfortunately, this is officially coming to pass.

On August 5, 2019 the US Treasury Officially labelled China as a currency manipulator. Of course, ALL fiat currencies are admittedly manipulated, and China’s policy is to “fix†(set) the rate of their Yuan, but not since the 1990’s, has the US made the label official. Of course, wall street will justify, and try to nullify the implications of this, but know this, the trade war has now OFFICIALLY become a currency war.

Is this the black swan event we’ve been waiting for? Probably not since we talked about it a couple of months ago, which means it was anticipated. But with both China and the US digging in their heals in negotiations, it seems the potential for compromise has passed. This could easily lead to “unintended consequences†of the black swan kind. Governments and central bankers know this and so do the markets.

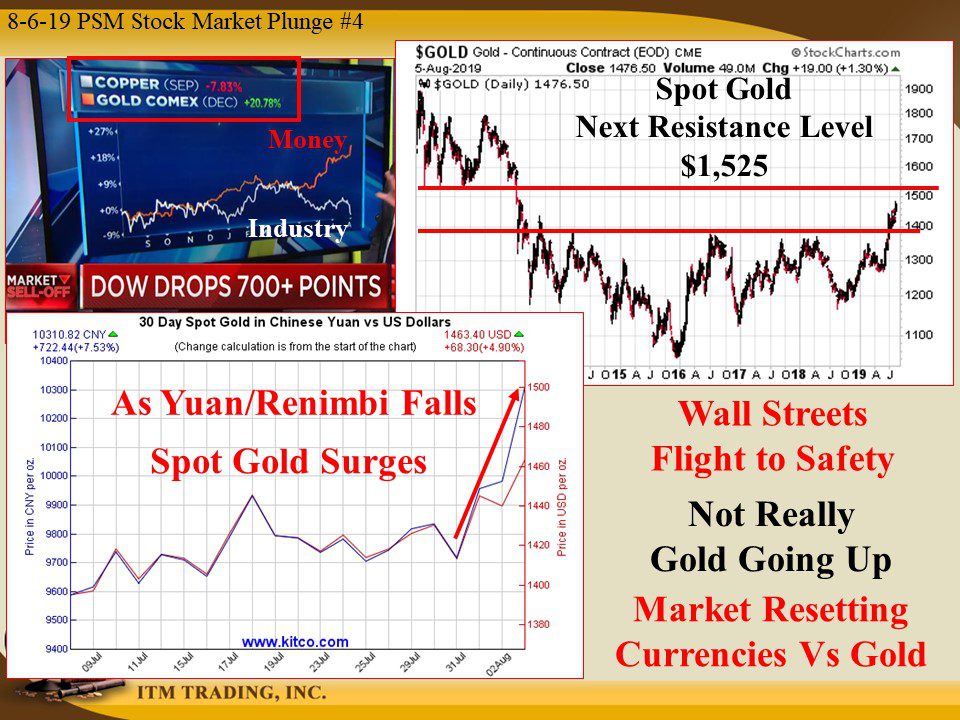

Of course, spot gold spiked in terms of both the Yuan and the US Dollar but on August 5, 2019, after more massive central bank buying, gold now sits at all-time highs in at least six currencies: Indian rupee, Japanese Yen, British Pound, South African Rand, Australian Dollar and Canadian Dollar.

What is this really telling us? In my opinion, wall street has now begun the fiat money to gold reset. Down the road, the government will finish the reset, but I do believe the gold reset has begun. Are you ready?

Slides and Links:

https://www.kitco.com/news/2019-08-05/Gold-Prices-Hit-All-Time-Highs-Monday-In-These-Currencies.html

https://www.kitco.com/gold_currency/index.html?currency=cny&timePeriod=30d&flag=gold&otherChart=no

https://www.kitco.com/news/2019-08-05/Gold-Prices-Hit-All-Time-Highs-Monday-In-These-Currencies.html

YouTube Short Description:

You might remember that on June 26th I did a video on “What Scares Me†where I told you that an escalation of the trade wars into a full-blown currency war with all sides weaponizing their own currencies. Unfortunately, this is now officially coming to pass.

On August 5, 2019 the US Treasury Officially labelled China as a currency manipulator.

Of course, spot gold spiked in terms of both the Yuan and the US Dollar but on August 5, 2019, after more massive central bank buying, gold now sits at all-time highs in at least six currencies: Indian rupee, Japanese Yen, British Pound, South African Rand, Australian Dollar and Canadian Dollar.

What is this really telling us? In my opinion, wall street has now begun the fiat money to gold reset. Down the road, the government will finish the reset, but I do believe the gold reset has begun. Are you ready?