Introducing the Official One-World Currency

Imagine your future and life choices being controlled by an external entity, sidestepping the Constitution and your voice as a citizen. Can an international organization reshape our nation’s history, culture, and identity? Will the next generation lose touch with the values and traditions that defined this country?

If the IMF’s push for a One World Currency concerns you, brace yourself—it’s already in progress. Discover what’s unfolding and how to safeguard your freedom during this transition, coming up!

CHAPTERS:

0:00 Your Future Controlled

1:58 One World Currency

4:25 G20 Roadmap

6:18 Cross Boarder Payments

7:42 Rise of Payments

10:56 Ruled by the IMF

19:24 IMF & Greece

21:57 The Thrivers Community

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

How would you feel if the rest of your future and life choices were dictated by an entity that was completely removed from your day-to-day life, completely bypassing the constitution and your voice as a citizen? Do you believe that our nation’s history, culture, and identity would remain intact if dictated by an international organization? Or could this lead to a future where the next generation doesn’t even recognize the values and traditions that wants to find this country? If the idea of the IMF forcing us into a one world currency makes you uncomfortable, I have bad news for you. It’s already unfolding. The key is what you can do about it. Now I’ll show you what’s happening and how to maintain your freedom in this transition. Coming up.

I am Lynette Zang, Chief Market Analyst here at ITM Trading, a full service physical, gold and silver dealer specializing in custom strategies and never has that been more important than it is today. Hit that Calendly link below if you don’t have your strategy set up and talk to us. ASAP. Now, recently I did a video on a one world currency and I told you how they were most likely gonna set it up, but that I didn’t think that would be the one because it’s a private entity and it’s just hard for me to imagine that after hundreds and thousands of years of control, central bankers and governments would go, ah, yeah, well we’ve had enough. It’s your turn now.

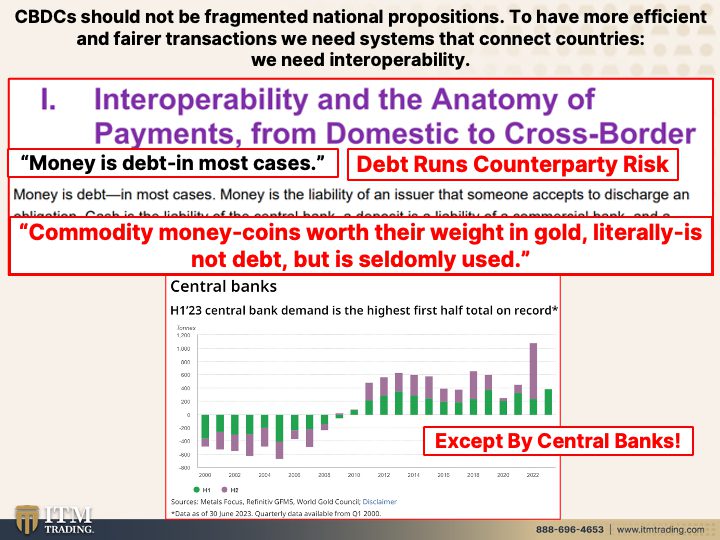

Let me show you what I think is most likely to be the one world currency. First of all, from a report from the IMF. CBDC should not be fragmented national position to have more efficient and fairer transactions. We need systems that connect countries. We need interoperability. One world, what is interoperability and the anatomy of payments from domestic to cross border. Because after all, it really is all about payments. It’s all about moving money around the world, not for you and me, other than our ability to move our equity to somebody distant in any other country Yeah, that they want us to do. But I love that they started out talking about money. Money is debt. In most cases, money is the liability of an issuer that someone accepts to discharge an obligation. Now debt always runs counterparty risk. This is the only according to the Bank for International Settlements and me, it’s true. Gold is the only financial asset that runs no counterparty risk. You hold it, you own it outright. Everything else runs counterparty risk. Cash is the liability of the central bank. A deposit is a liability of a commercial bank. And a check drawn on a money market account is a liability of the issuing fund. However, commodity money coins worth their weight in gold literally is not debt, but is seldomly used. Well, is that really true? Maybe except by central banks who have bought more gold in the first half of 2023 than they have since they started recording how much gold central bankers were buying. So don’t you have to ask why If, if it’s just all this money is debt and they’re controlling everything, why are they accumulating so much gold? Could it be because they know that the transition is upon us and they want to retain their freedom and their control and their choices? Same exact reasons why you and I should do so too. The G20. So that’s the top 20 global economies roadmap to enhance those cross-border payments, which are far more important than your privacy or your freedom.

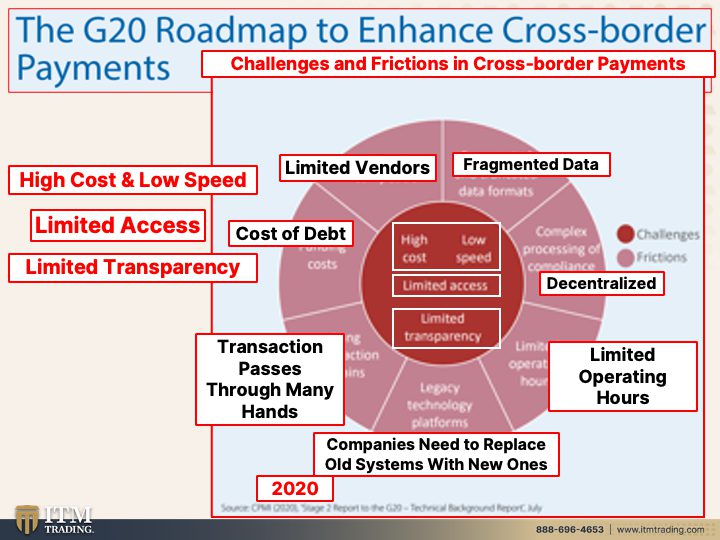

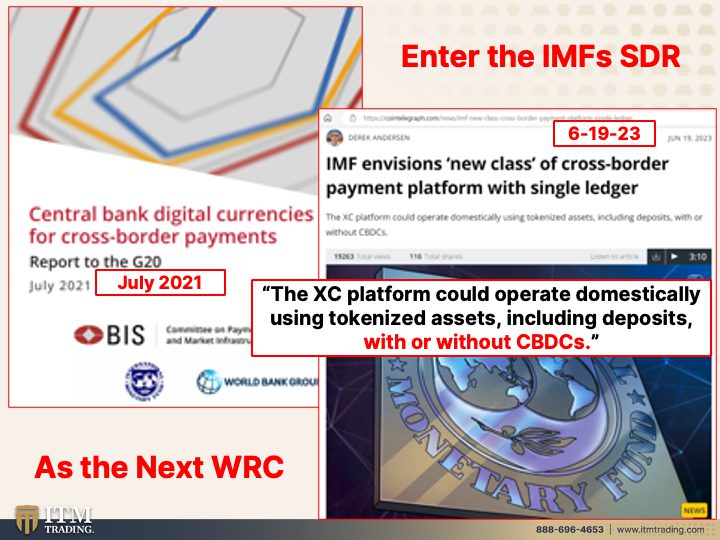

Let’s take a look at this little roadmap that they have. This darker area, here are the challenges and then the the outer ring is their challenges to accomplishing this. And let’s look at, first of all, it is the cost of the debt, right? So those interest rates make that debt cost, especially in this higher interest rate environment, go up a lot. And there’s limited vendors. So there’s limited people that you can pass this debt through that issues it, etcetera. And because you have different countries, the data is fragmented. So let’s bring it together maybe in one place, much easier to control. Ah, decentralized, right now it is. You’ve got the EU doing their thing, you’ve got the US doing their thing, you’ve got China doing their thing. So it is decentralized, limited operating hours, right? Okay. You can only send money from this time to this time. Companies need to replace old systems with new systems because the technology is old and therefore it’s inefficient and they can’t do what they want. And the transaction passes through many hands and every time it passes through a hands costs are involved. So you have a lot of peace in here that create that high cost, low speed, limited access, and limited transparency. Hmm. How can they fix that? Hmm. Well enter the IMFs SDR. Now we’ve talked about the SDR, which has been around since 69, so they don’t have to reinforce the wheel. And might I remind you that all the members of the IMF are 190 countries. There’s 196 countries. So almost every single country in the world is a member of the IMF, their treasury secretary, their central bank head, both unelected officials, central bank digital currencies for cross border payments. Very convenient. This is from the Bank for International Settlements. The IMF envisions a new class of cross-border payment platform with a single ledger, one place. It’s called the XC platform, which could operate domestically using tokenized assets, including deposits with or without CBDCs. So maybe we aren’t gonna go to CBDCs if people won’t adopt them, whatever. But don’t worry because we’re still taking you to a one world currency controlled by a single entity. How’s that make you feel? Because frankly, it scares the crap outta me as the next world reserve currency unfolds.

Because remember too, when I look for how they’re going to justify creating the CBDCs, creating this new monetary form, this new fiat money, what they said in some of them though, they might do it based on debt. So they gotta burn off this debt in order to do that next debt. Or they would do it on transactions, what people are going to buy. So the rise of the payment and the contracting platforms is critical. Technology presents an opportunity for money to evolve. How nice. Today, technology presents another opportunity for money to evolve. Cryptography, tokenization and programability are being explored around the world as a basis for innovation. Banks are exploring deposit tokenization. Central banks experiment with their own digital currencies and FinTech companies innovate around all dimensions of money and payments. Fintech is financial technology. By the way. This note explores the design and governance of platforms to enhance that cross-border payments in line with public policy goals. Now, right now we have SWIFT, the US system is the most widely used system for moving money around the world, but we weaponized it and everybody saw that. And so you have the rise of the BRICS nations though they’ve been working on this for a while as well, to create their own cross border transactions. But while much innovation in recent years has more narrowly targeted end user frictions, public frictions, the vision of this paper is based on the mandate of the IMF governed by the central banks and finance member ministries of 190 member countries. Cross-Border payments presented the foundation of the global financial system and its functioning is overseen by the IMF. Might wanna look at Greece for that. Can I tell you that we better be in a position to have wealth outside of the system where you will have no choices? Because now after they institute this, we have one global currency controlled by the International Monetary Fund, but they present a few different models.

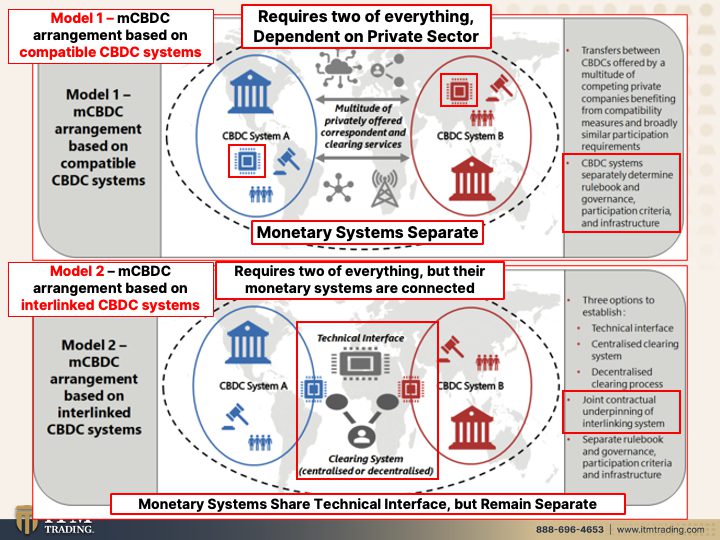

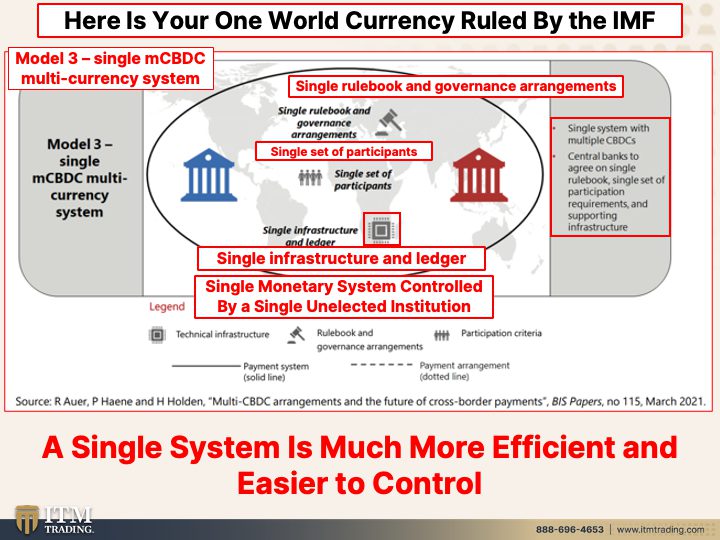

I’m gonna go through these really quickly ’cause they’re not really that important in my opinion. But in the first model that they lay out, and of course everybody’s gonna say, ah, requires two of everything. Well, it would require 190 of everything for each different country. Let’s consolidate that. The each CBDC system separately determines the rule book and the government’s participation criteria and infrastructure. Very inefficient model two, joint contractual underpinnings, interlinking systems. But it’s still separate system. So it still requires two or 190 in the case of how many countries there are. But their monetary systems are connected. It’s kind of what we have right now. But here’s the one that they intend to utilize. The one world currency ruled by the IMF, there is a single infrastructure and ledger. It is a multicurrency system. It is a single rule book and governance arrangement. Central banks agree on a single rule book, single set of participation requirements and supporting infrastructure. How convenient, how absolutely this is convenient. One place controlled by one entity. It’s much more efficient, but it’s much easier to control and you lose choices. I mean, for those of you out there that are my age, don’t you remember the days when if you were unhappy with something, you could just go to the owner of the store ’cause they were mostly mom and pops and tell them what you were unhappy about and then you could expect to change because they cared about you and wanting to retain your business. Can you do that now? Not really. You’re unhappy with Verizon or AT&T or any entity, frankly. And what do you get? You get people whose job is to put up a wall in front of you, block you, block you at every tart, and you’re not talking to the decision maker. So right now, well we have in theory anyway, a a a government in theory anyway, they’re very extraordinarily dysfunctional and we elect those officials that are supposed to represent us. Not sure that that’s really true either. I’ll leave that up to your judgment. But if you didn’t have to deal with any of that and you’re unhappy with something and it’s at the IMF, you’re not talking to anybody there that it’s just the way that it is and too bad, so sad.

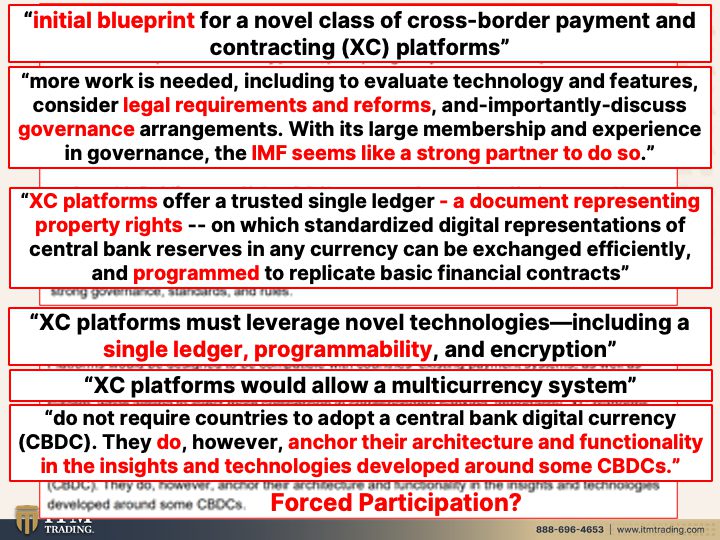

But the aim of this note, okay, is to offer an initial blueprint for a novel class of cross-border payment and contracting those XE platforms. Of course, they’re telling us that more work is needed. I’m not really a hundred percent sure that that they are being completely honest with us for how far along all of this infrastructure and this technology is. Maybe they do have a lot more work to do. Maybe they’re just telling us that they have a lot more work to do so that we’re not worrying about it. I think we’re gonna know one way or the other during this next upcoming crisis that is already unfolding. But they have to evaluate technology and features and consider legal requirements or reforms. So they have to legalize the theft of your wealth. They have to legalize what they’re about to do and importantly discuss governance arrangements. So who’s gonna govern it? They’re already saying that it’s the IMF and hey then that puts the treasury secretaries and the central bank chiefs completely in charge, which probably they are right now anyway, with its large membership and experience in governance, the IMF seems like a strong partner to do so. And these XC platforms offer a trusted single ledger, a document representing, oh my god, property rights. Have we not been talking about this forever? About how they want you to hold all your wealth. I don’t even have my phone in here on your phone, making it easy for you to spend your property rights. Frankly, this is what we’ve been talking about. Believe them on which standardized digital representations of central bank reserves in any currency can be changed efficiently and programmed to replicate basic financial contracts. You’re unhappy about something. What are you gonna do? Who are you gonna call the Ghostbusters? So to deliver these advantages, the XE platforms must leverage novel technologies including a single ledger and programmability and encryption XE platforms would allow a multi-currency system. Look, I can’t guarantee this ’cause it’s way above my pay grade, but in reality, I think this is it. I think this is absolutely without a doubt in my mind the setup. But don’t worry, right? Don’t worry. Do not require, does not require countries to adopt a central bank digital currency, a CBDC. You don’t have to have that. We can do this without it. They do, however, anchor their architecture and functionality in the insights and technologies developed around some C BDCs. So no, you don’t have to use it, but this program won’t work unless you have a CBDC. Hmm, isn’t that interesting? So are they in reality, whether you want to or not, forcing this participation, we vote with our wallets in gold and silver I trust, physical in my possession. I don’t trust these guys as far as I could throw them.

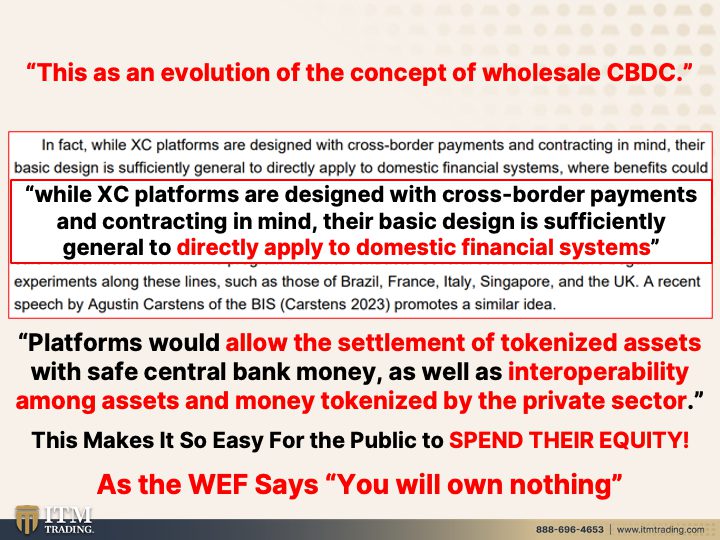

But don’t worry because everything has to evolve after all. And this is an evolution of the concept of the wholesale CBDC wholesale, meaning that it would move in the underbelly or through the commercial banking system, not retail, you and me, but they have plans for everything. So they first have to get us completely interconnected and then they have to make sure that all the laws are set up so that the IMF is in control, not the individual countries. It doesn’t matter now who you elect. Is it gonna matter then even less. Even less. In fact, while XE platforms are designed with cross-border payments and contracting in mind, their basic design is sufficiently general to directly apply to domestic financial systems. So we’re gonna get this in place globally on a bigger picture and then we can drill down and capture the individual. Woo-Hoo. That sounds like a plan to me. Do you have a strategy? Click that Calendly link below if you haven’t done it yet. Get your strategy in place. Platforms would allow the settlement of tokenized assets. Tokenized assets means you make a deposit or you register whatever it is that you have on a platform and they can tokenize it and send it anywhere in the world.

And they can tran they can, they can translate it into what they call safe Central Bank Money Bank. Personally, I don’t think central bank money is safe. Do you? Safe for who? Maybe that’s a better question. Safe for who? ’cause Certainly not for the public as well as interoperability among assets and money tokenized by the private sector. They’re laying this whole thing out to take complete control, but they don’t want you to realize it. So they want you to volunteer it. And a key program, we’ve talked about this a gazillion times, is that perception management, managing how you perceive things and how you move through the system. And what they want you to do is spend your equity. That’s what they want you to do. Because who can you complain to then? Who can you say, who can you point a finger at? You go, oh my God, it’s mine. I did it. I was so stupid, I shouldn’t have done that. Well, yeah, because you’re, you are simply doing what they’re guiding you or here’s a technical term nudging you to do, you will have nothing, but I’m not sure you’ll be happy. Nothing. No, ’cause then you’re gonna have to lease everything.

And we do know what happens when the IMF is in full control. Greece is a great recent example of that. The IMF needs to stop torturing Greece. Beware of Greece bearing gifts. Wrote the ancient Roman poet Virgil in the 21st century. Frankly, it’s the Greeks who should have been more careful about accepting offerings. But when you’re desperate, you’ll hold onto anything, you’ll grab onto anything, which is why it’s so important to come together in community and help each other locally as well as globally. We have to come together because that’s the only way we have to say no. And you vote with your purses if you are depending upon debt, which is what this crap is. It’s just debt. It’s a federal reserve note. A note is a debt instrument. If you’re dependent on this stuff, that’s your vote. If you’re dependent upon this stuff, that’s your vote because it’s the Greeks who should have been more careful about accepting offerings, specifically from the International Monetary Fund, which is now torturing the country in a misguided effort to get its money back. Well, that’s what they do, don’t they? Once, control of the monetary system was handed over to bankers in 1971. What do bankers know? They know debt and they know interest and they wanna collect the money that’s owed to them. And they wanna make you a debt slave. Don’t buy into this. Put your faith in physical gold and silver that you hold personally.

And I will repeat this again because I hope you see the writing in the wall. I can’t guarantee this, but to be perfectly honest with you, it’s the most logical. It’s already in place. Everybody’s got a whole bunch of SDRs through the IMF. It’s a basket of currencies. So what if you have a basket of CBDCs? You could have your local currencies. So we don’t think anything has changed. We have the the dollar coin and you have that overarching, that extra layer on top. So, hey, somebody in China can buy the equity in your house. Somebody in Bolivia can buy the equity in your car. And before you know it, you have to lease everything. You wanna make sure that you watch some of the recent videos that I’ve done on China’s gold binge quadrillion debt bomb. Taylor did a phenomenal job on this and on BGS, because when I got back, well actually not when I got back, I found my voice in Australia and I know what I’m supposed to do. And every darn time I say that, I get chills. This is really about community and it is about getting you protected so that you don’t have to bend to their will. That’s our opportunity and our chance. If everybody can stack as much as possible, if everybody can grow their own Food, Water, Energy, Security, Barterability, Wealth Preservation, Community, we can come together in community and secure your Shelter. We have a better chance of coming out of the other side of this mess in a much better position than we entered it because we will have the ability to retain some of our freedoms and some of our choices. That’s what I hope, that’s what I really, really, really hope. So if you haven’t already, make sure you subscribe to this channel. Leave us a comment, give us a thumbs up and share, share, share. And by the way, I am coming out with a five minute video that you can share with your family and friends that can’t see what’s happening. I’m gonna have it, you know, basically done for review. By next week it’ll go into the Thrivers group so that we can fine tune it. So stay tuned on the exact release date for everybody. But I’m hoping to create something that in five minutes, ’cause you can probably get anybody to sit down and watch for five minutes. And hopefully we together as community will make this powerful enough to at least open your friends and family’s minds that’s really what the goal is. Because financial shields, they’re made of physical gold and physical silver in your possession. And until next we meet, please be safe out there. Bye-Bye.

SOURCES:

Central bank digital currencies for cross-border payments (http://imf.org )

http://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-q2-2023/chart-gallery

Box A: The G20 Roadmap to Enhance Cross-border Payments (http://rba.gov.au )

Central bank digital currencies for cross-border payments (http://imf.org )

IMF envisions ‘new class’ of cross-border payment platform with single ledger (http://cointelegraph.com )

Central bank digital currencies for cross-border payments (http://imf.org )