Inflation Reduction Act: Spend Big Now, Get Benefits Later?

We have entered a new, extremely dangerous phase in this trend cycle with the Fed’s fight against inflation and the Inflation Reduction Act now into law. It’s going to get really interesting out there.

Do you remember when I told you that the system actually died in the 2008 “Great Financial Crisis†and was put on QE free money intravenous to the Wall Street Banks? All the inflation created by that free money was held in assets targeted by the Fed for “reflationâ€, though perhaps central bankers believed their own lies, that all that money printing did NOT cause inflation. In fact, according to their accounting, they couldn’t hit their 2% target for over a decade.

So when the pandemic hit in 2020, they created so much new money it made what they did in 2008 look like chump change. But this time the government kicked in with “stimulus†to the masses, though what was handed out to the public was still minor compared to the free money given to Wall Street corporations.

But the inflation genie escaped the market bottle, because even powerful central bankers are not more powerful than mother nature and the laws of gravity. They were slow to react, warning us all that they would allow inflation to run “hot†for a time, in order to get an “average†inflation rate of 2%. We were told that this inflation was “transitoryâ€. And now, they finally admitted that they don’t understand inflation.

I find this very interesting since the fiat money system was created because “not one man in a million understands inflation†and apparently, central bankers don’t understand either…when it’s at the end of a long term cycle.

And now we have entered into an elevated risk level in this currency lifecycle trend.

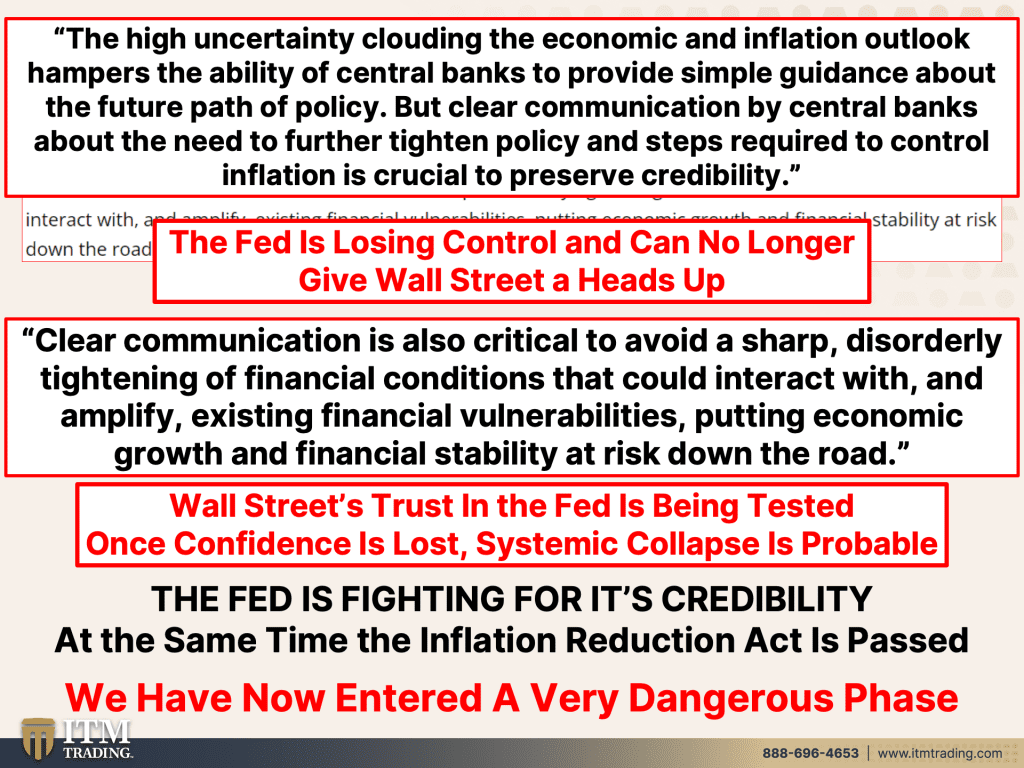

With Central Bankers fighting to get credibility back with Wall Street after volunteering it with the loss of forward guidance, one of their key tools of monetary policy.

Why is it more dangerous? Because when credibility is lost, ultimately with the public, there is no way for central bankers to control the inflationary monster they created, since no one believes or trusts them any longer.

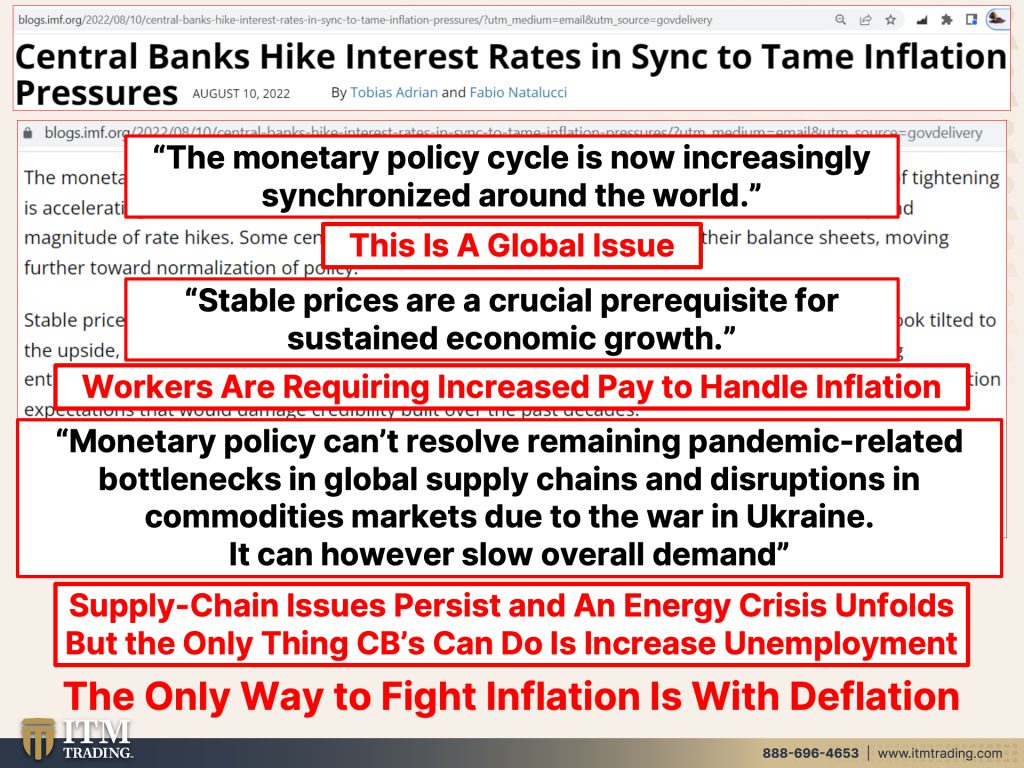

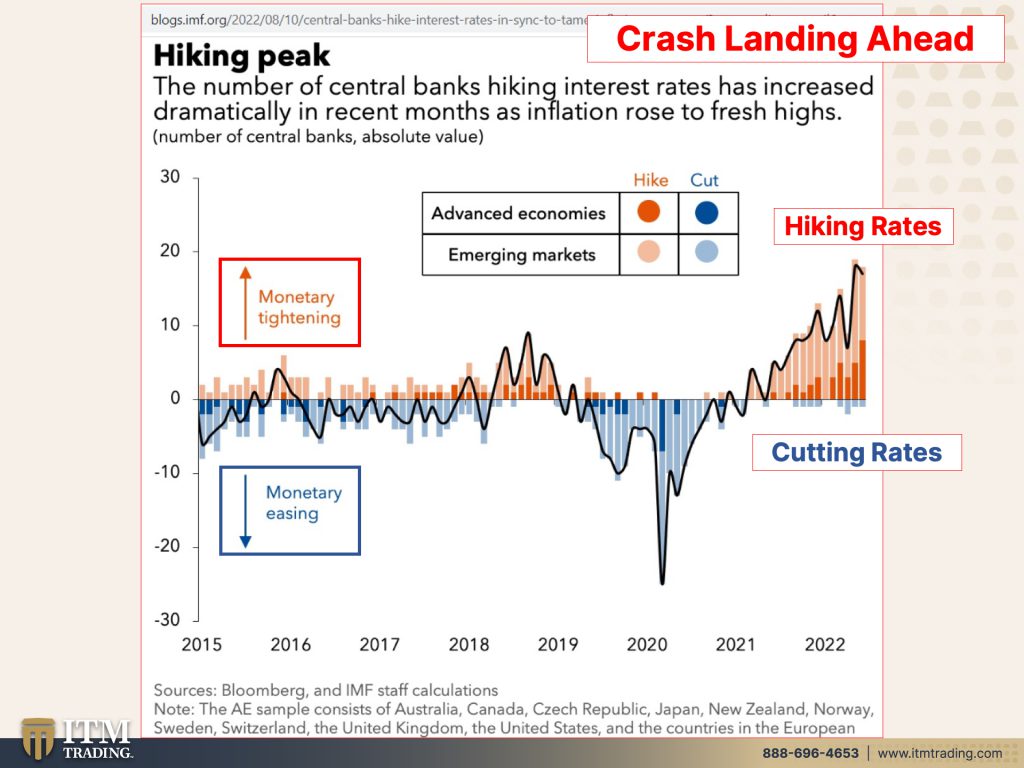

So, in an attempt to hold on to credibility, global central bankers must aggressively raise rates and tighten financial conditions. They admit their policies will not touch inflation caused by supply-chain bottlenecks and the energy and food crisis’ exacerbated by the Russian/Ukraine war. They admit that all they can control is credit demand.

Of course there is only one way to fight inflation and that is with deflation, just as there is only one way to fight deflation and that is with inflation and therein lies the rub and why central bankers are between a rock and a hard place.

The world economies are slowing, so you can see that all that new money and debt did NOT fix the problems that caused the GFC (Great Financial Crisis). Normally in a slowing economy central banks lower rates to inspire spending, but can they lower rates with global inflation at decades highs? Turkey has tried that and it hasn’t worked. But then, neither has raising rates.

So none of this is really about controlling inflation itself, they’ve already lost control of that as witnessed by their confessions. It’s really about controlling

“Expectationsâ€â€¦PERCEPTION MANAGEMENT.

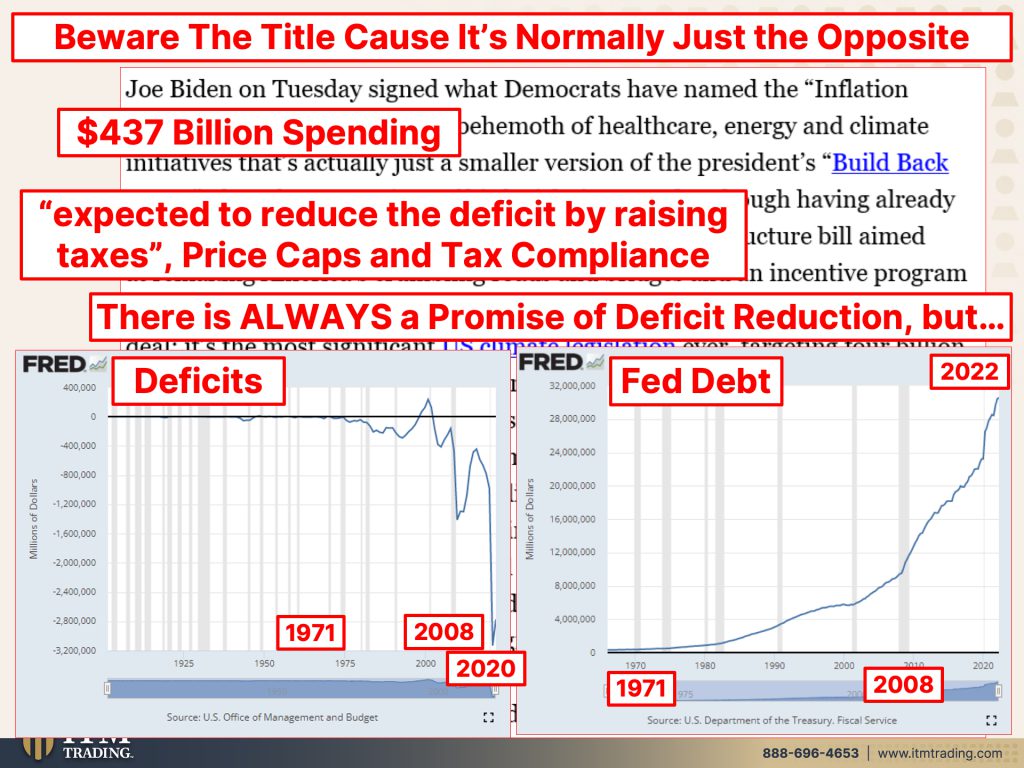

And now there is another wrinkle in the Feds plans, the recently passed $437 billion spending bill, “The Inflation Reduction Act†of 2022.

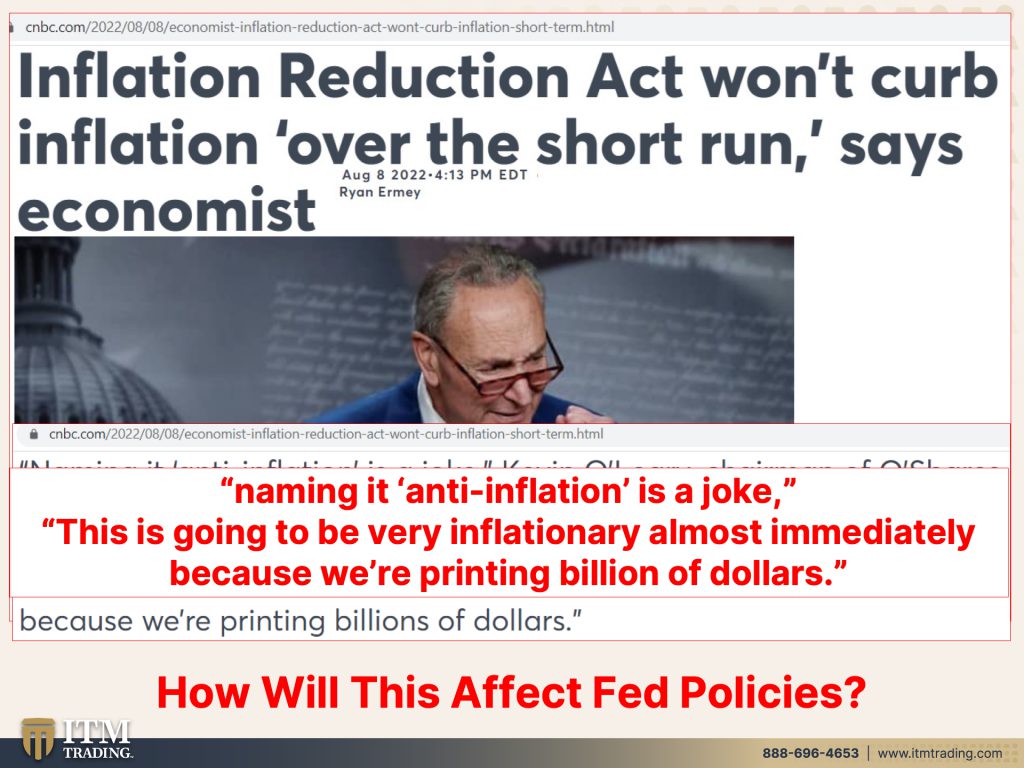

Will it actually reduce inflation? Maybe, but NOT in the near term. All this new spending will most likely stoke the inflation fires that the fed is trying to control. That could inspire them to get even more aggressive in their rate hiking cycle.

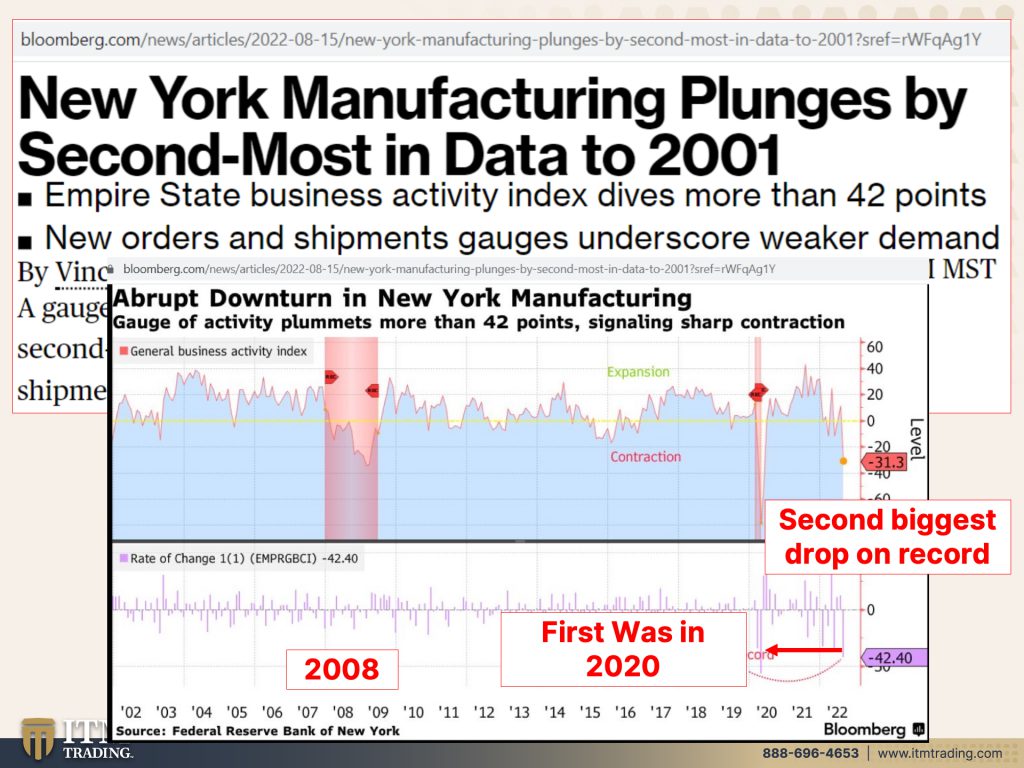

But there is help on the way, the consumer. The August PMI (Purchasing Managers Index) came in at the second lowest level since recording began in 2009. The lowest was at the beginning of the pandemic in 2020.

Consumers, being squeezed by inflation, have slowed spending. This is happening globally too. Me thinks there are no longer enough fiscal fingers to plug all the holes and cracks in the inflation damn.

We are at the end of this fiat money experiment. Personally, having been a banker and a stock broker, I look to history and repeatable patterns to show me what is most likely to protect me and my family and give us the best possible change to survive and thrive through this reset into a new financial system. Physical gold and silver.

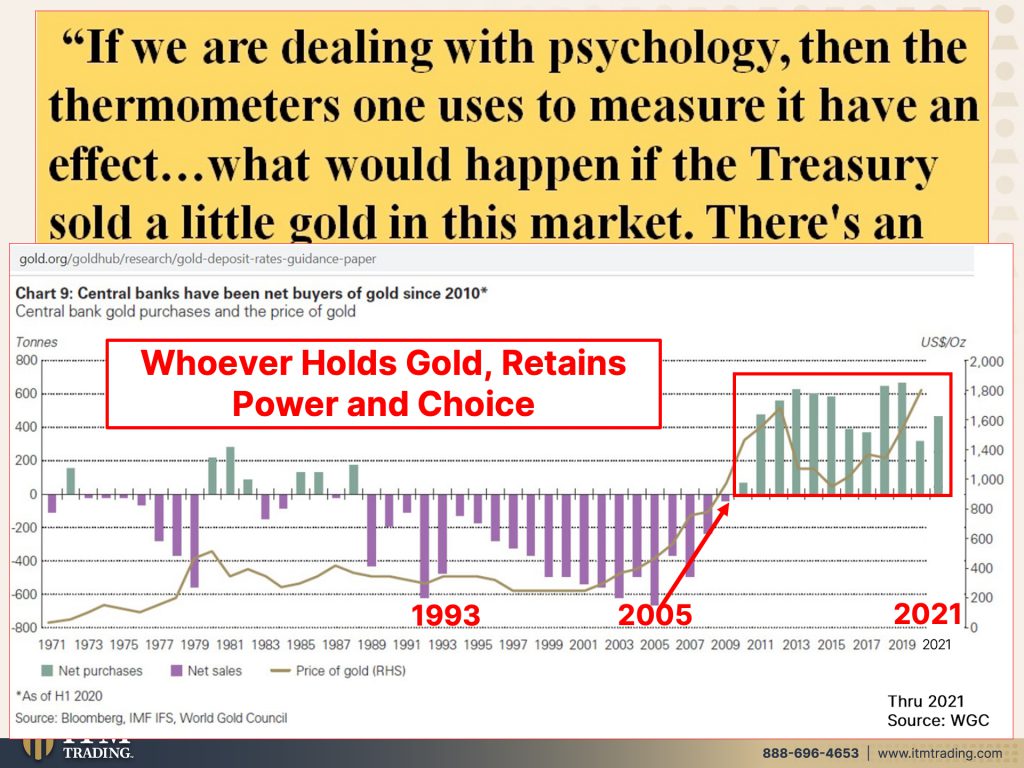

I also look at what the smartest guys in the room do for themselves. Since 2005 global central bankers have been buying gold at levels never seen before. They admittedly, don’t understand inflation but they do know good money. How about you?

SLIDES:

TRANSCRIPT FROM VIDEO:

We have just entered a new, extremely dangerous phase in this trend cycle with the Fed’s fighting inflation and the inflation reduction act now in law. It’s gonna get real interesting out there. We’re gonna talk about that today and ever so many more things coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading, a full service, physical gold and silver dealer specializing in custom strategies. And let me tell you, if you don’t have one you better get one. And by the way, this is a critical, critical piece that I’m doing today. So make sure that you share, if you haven’t subscribed yet, you better do it because things are counting down to the finish and you need to be in the know. So let’s just get right to it.

You know, central banks on a global basis are hiking to try and well, it says “tame inflation.” That’s not the real reason we’re gonna go into that. But the monetary policy cycle is now increasingly synchronized around the world. So you might recall that back in 2008, that’s when the synchronization of the global system really started to come to four with central banks, letting everybody letting Wall Street and the banks know what they were going to do, their forward guidance, which as, you know, if you’ve been watching me that they have recently stopped. But what this really means is that this is a global issue. You know, that, are you ready for it? Because it really doesn’t matter where it starts. It can start in China. It can start in Europe. It can start in the middle east, it can start anywhere and it can come home to roost right here, right on your doorstep. They also talk about stable prices are a crucial prerequisite for sustained economic growth. You know, we’ve talked about this too. What do they really mean by stable prices? Now, if you or I or any normal person hearing it, they go, well, yeah, there are fighting inflation. They don’t want those prices to go up. But what they’re really talking about is the employee’s ability to demand more money for the work so that it goes into a wage price spiral because corporations will pass those costs on. So what they’re really actually saying in here is that workers that are requiring increased pay to handle inflation must be stopped. They must raise that unemployment. So that workers do not ask for more money. No, that’s the way you can have a k-shape recovery, right? With all the money and that income and wealth inequality, all that extra profitability goes to the top echelon. The 1% and everybody else gets whatever’s left. So we must not have those workers be able to ask for a reasonable salary, but monetary policy can’t resolve the remaining pandemic related bottlenecks in the global supply chains and disruptions in commodity markets due to war in Ukraine. It can however, slow over all demand. So here, what they’re telling you is they really can’t fight the inflation. All they can do is lower demand by increasing interest rates, which means all those corporations that have all of that debt that they have to service. And they’re gonna be rolling that debt over into higher interest levels. Well, they’re gonna have to lay people off and it’s been quite interesting. We’ve talked about this recently. It’s been quite interesting because on the one hand we’re seeing lots of layoffs, particularly in the real estate sector and the technology sector. But at the same time, you walk down main street and what do you see help wanted help wanted help wanted? So we’re in an extraordinarily interesting period because we’re at the end of this currencies life cycle. I mean, it truly is as simple as that, but I want you to really keep this in mind because this is one of the things that makes it precarious. And I’ve told you this so many times, but it’s really simple. There’s only one way to fight inflation and that’s with deflation and conversely, there’s only one way to fight deflation and that’s with inflation. So for what, since the eighties, since we started this transition into the current debt based system, that’s really what the central banks have been fighting has been deflation, right? When the stock markets implode, when the real estate markets implode, when the bond markets that is all deflationary. So what do they do? They drop interest rates. They inspire borrowing and spending. They inspire inflation, but they’re out of tools. So that’s why you have all these dichotomies going on because we are at the very end. That’s why you see all this really unique behavior.

At the same time that the fed says they’re fighting inflation, you’ve got the PMI and other economic data. That’s showing a lot of slowing, right? So the consumer just isn’t really shopping as much as they were. Okay. This is the downturn and the PMI is the Purchasing Manager’s Index. So we’re gonna buy stuff to sell, right? So 2008 during the great financial crisis, there’s the downturn here it is in 2020 and then again in 2022. So this one that just came out is the second largest drop. The first one was in 2020, but both of those are much greater than 2008. And frankly, they only just started tracking this. So, I think it was 2009. Is this a PMI? Oh no, there’s another data. I’m sorry, can that one, it goes back to 2002 when they started tracking this data. So can you see how? Look 2008, the system died? I’ve been saying it since 2008. All they did was print a whole bunch of free money, give it to wall street and corporations so that they could reflate. I mean, go back the reflation trade reflate these assets. So over all those years in the federal reserve and the central banks are saying, oh, we just can’t hit our 2% target. Darn it. Well, we knew once they went to an average, that inflation was on its way because that inflation was held in the markets. That’s where it was held. Quite simply. Is there a crash landing ahead? Mm-Hmm <affirmative> okay.

According to the IMF, there is a huge number, as you can see of global central banks that are tightening policy, and that means making it harder to borrow by raising rates and maybe some other policies. You can see where all the loosening was from 2018, because we were being pushed into a recession by this was the period. When the central bank, the federal reserve was trying to run off his balance sheet and raise the interest rates. They couldn’t do it then. And quite honestly, they can’t do it now. They’ve got to do it for their credibility. We’ll talk more about that in a minute, but you know, they have gotten wall street addicted to free money. You cannot just pull that punch bowl away. And what about consumers? It’s consumers this time, unlike 2008, they could have never gotten away with just bailing out wall street and the banks. They absolutely had to do something different this time. So they gave a pitance comparatively speaking to the people in the form of stimulus so that they could keep shopping and keep those corporate profits going. We know we saw all of that, but now they’re in a tightening mode. What’s gonna be interesting to see is how far they can tighten before they have to do a pivot and loosen again, because they have said it repeatedly. And it’s just true. How do they stimulate borrowing by dropping interest rates? Well, when you’re anchored near zero, then that’s why you go into negative rates. So Woohoo, the ECB now has the rate said zero, but they’re still not positive. And when in this country, the average to cut the rates was five and a half to five and three quarters percent. You know, I mean, I hate to say this, but I’ve said it before. I’ll say it again. We will be going into negative rates. There is really not much of an alternative, but the high uncertainty clouding the economic and inflation outlook, hampers, the ability of central banks to provide simple guidance. This is the forward guidance that they talk about and the future path of policy, but clear communication by central banks around the need to further tighten policy and steps required to control inflation, which they already admitted they can’t do, is crucial to preserve credibility. So they gave their credibility away when they went against their forward guidance and forward guidance, letting wall street, letting the banks know what they were gonna be doing was a key tool that they gave themselves in 2008 when the system died. So they, they kept saying 50 basis, point 50 basis, point 50 base. And then they did 75. So now really what’s happening is they are struggling to get their credibility back because they have absolutely lost control of inflation. Even they are telling you, they cannot tell you what they’re gonna do cause they don’t know. So that means that wall street is flying blind. It’s kind of like this bridge in a hurricane. It swings back and forth and back and forth and back and forth until it just collapses. And that’s really where we are. This clear communication is critical to avoid a sharp disorderly tightening of financial conditions that could interact with an amplify existing financial vulnerabilities, putting economic growth and financial stability at risk down the road. Okay. So what they’re really telling you is that Wall Street’s trust in the fed is being tested right now when they gave away that forward guidance, which I was amazed that they were willing to give up such a valuable tool. You know, they know it’s being tested. And, and what we know is this, they no longer have the bank to bank confidence that was lost with interbank trading in 2008, 2015, with the Swiss surprise central bank to central bank confidence was lost wall Street’s confidence is lost. They are fighting to regain control. And that means, you know, when somebody’s fighting, it’s kind of like somebody I’m out in a boat. And I see somebody that’s drowning, I better stay in my boat and throw them a lifeline cause if I jump in the water to try and save them, because they’re so panicked, they will probably take me down with them. Is the fed gonna take us down with them? They certainly could. Once confidence is lost, Systemic collapse is probable actually systemic collapse is unavoidable. Once the public loses that, confidence. So you’ve got to get that the fed is fighting for its credibility, just like that drowning man in the, in the lake, don’t let them take you down with it. That’s what gold gold is your lifeline, physical, in your possession. That’s your lifeline that can save you from a fed that is bent on taking you down with it. But here’s the thing that I think is really, really interesting at the same time that the fed is doing all of this.

Well, our government just passed the Inflation Reduction Act and always beware of any title because whatever that says, it’s probably just the opposite. Do you see the problem? You’re starting to see the problem? Because in this bill they’re spending 437 billion. That’s all new money. That’s new money. They expected to reduce the deficit by raising taxes. They’re putting in price caps. They’re forcing tax compliance. So, you know, they always say, well, this is gonna be paid for by this and that. And the other thing, I don’t know, is that true because they always promise that. But I don’t know. Let’s look at this reality. Those are the deficits, the fed deficits. Does that look like any of those programs that they put in place in the past? And there are many, many of them, does that look like it reduced the deficit? I don’t think so. And this is gonna increase the deficit way before it’s going to reduce it. You can see where we started in 1971 on this debt based system. That’s what they did in 2008. And it was outrageous, do you remember how appalled you were at that period of time? And then this is what happened in 2020. You can see it. No, it’s not getting better. And what about the debts? This is gonna reduce the debts. Let me see can you look on this fed graph and show me anywhere that the fed debt has been reduced? It’s easy to spend other people’s money. This is taxpayer money. This is taxpayer money because when you reduce the deficits, what that really means is that you are not only spending all of the taxpayer money that comes in, but ever so much more. And we are paying interest on these. So I don’t know. I mean, you gotta do what you think is right for you to do, but the handwriting is on the wall very, very clearly on the wall. Do you really think, well, I don’t know, let, let’s kind of dig into this.

Let let’s dig into this a little bit more, then you can have your opinion then, you know, and by the way, don’t forget that the links to all of this research is in the blog as is a piece that I wrote about this. So it’ll kind of create a little meat around it, but today, yeah, this is the one that just started in 2009, the private sector activity contracts, again in August, aside from the dive in new orders. So that goes back to the PMI that we were talking about. Aside from the dive in the new orders during three months in the spring of 2020, the August reading was the lowest since the series launched in October of 2009. So all of this inventory that the stores have managed to build up as we were going through the supply chain issues and people had all the stimulus money to spend and spend it, they certainly did savings is back to actually lower than it was before it started. But this is also happening on a global basis. UK economy grinds to a near halt on the back of dwindling customer demand. And in the EU, the Euro zone PMI gauge weakens to 18 month low in August. They keep talking about how strong the consumer is. I guess they don’t read their own headlines. Yeah. If you’re in that 1%, yes, you’ve got wealth. You’ve got money. So you don’t have to slow your spending, but the 99% they’re slowing their spending because you have to, you know, if it’s choice between putting gas in your cart or food on the table, you know, that’s a hard choice for most people to make very hard choice.

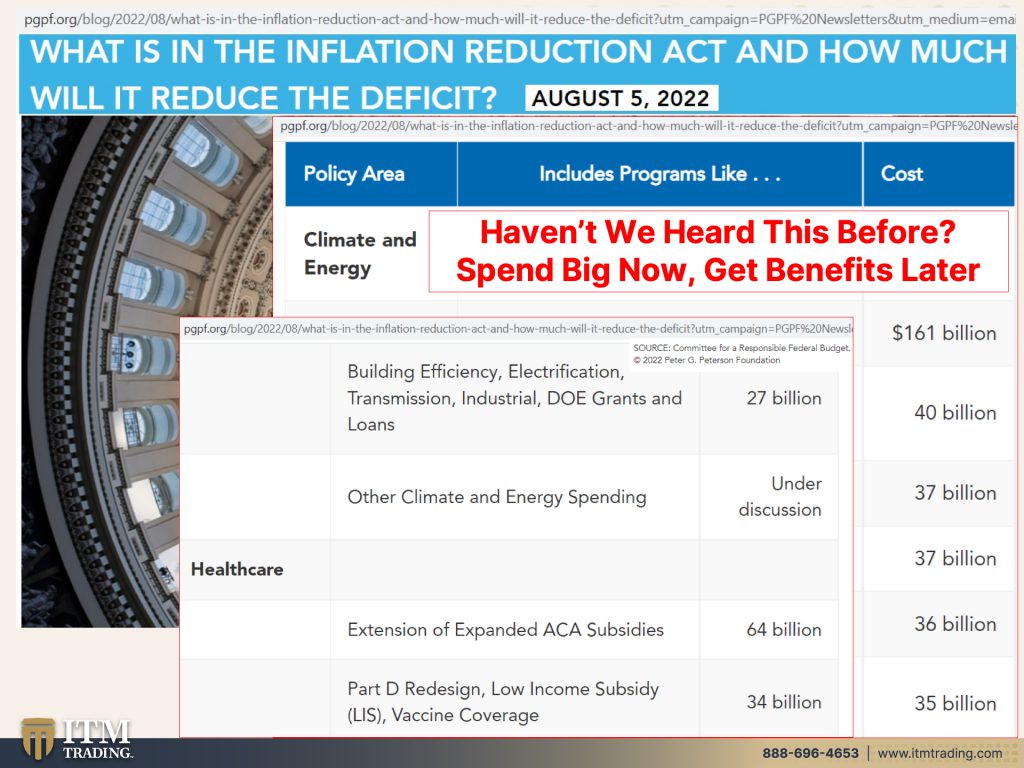

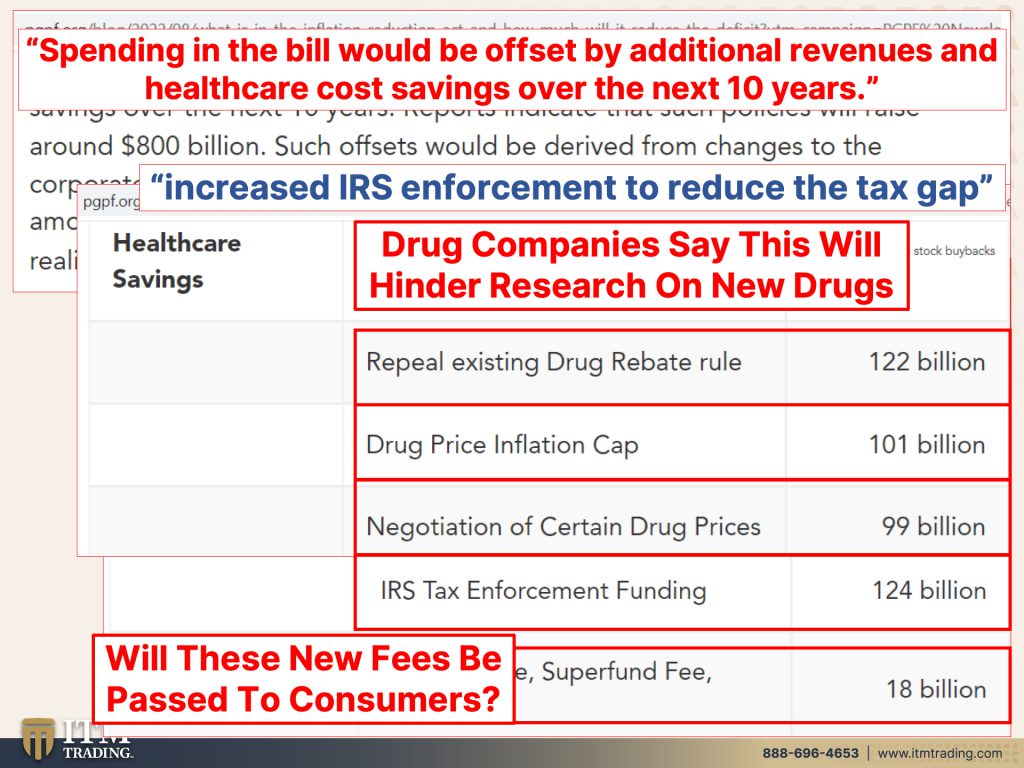

So let’s take a look at what’s in that bill just briefly. And remember you’ve got the links to everything. Oops, let me go back here. So there’s a lot of wealth that’s going into a lot well no…there’s a lot of new money. That’s going into climate change and energy, clean electricity. So tax credits incentives look, tax credit, tax credit, tax credit incentives. All right. So lots of money that they’re giving away plus healthcare, right? And lots for healthcare. Lots of subsidies, lots of coverage, etcetera. Yeah. Just keep spending. So how’s that gonna be offset? How are we gonna pay for that? Where at least the bill says, well, spending in the bill would be offset by additional revenues and healthcare costs savings over the next 10 years. I’ve heard this kind of stuff so many times, so have you. And it never works out that way, shocker, but Hey, once the bill has passed, what are you gonna do? So part of what they’re gonna do to close that gap is spend a lot of money for new/more IRS agents. Woohoo. How awesome is that? What I find really interesting is in their revenues where they talk about raising corporate taxes, a minimum tax a tax on stock buybacks, all of these things, boy, they just can’t really decide on that one. That’s under discussion. Maybe that discussion now that this has passed will go away because of course we know how much corporate America and well corporations of the world, global corporations grease those political wheels to get what they want. They’re gonna put $124 billion into new IRS agents. Well, I hate to tell you this guys, but most of the agents and most of the tax audits are for people making under $`200,000 a year. So who do you think this is going to impact the most? And then of course fees. So I’m wondering, well, we’ll talk about that in just a second. So fees, methane, super fund, other fees, fees, fees, fees. They’re going to, they’re gonna make that much. All right now in healthcare, how are they gonna save it? Well, they’re gonna repeal the existing drug rebate rule. They’re going to put up price caps on what they’ll pay for drugs. And they’re going to give themselves some more negotiation of certain drug prices. But what does that really mean? Because if you listen, I mean, there’s a great add on TV that we’re trying to discourage this bill from passing drug companies are saying they won’t have any money to research for new drugs if all of this goes into place. So we’ll see, because we do know drug profits have been the largest of any, but wow, we don’t wanna take those profits away from those drug companies or those corporations or those banks, Boo-hoo-hoo-hoo, you know, you and I, we are just like the right size to fail the big corporations, not so much, but I’m curious as to whether or not these new fees will in reality, be passed on to the consumer. So even though they’re saying that it’s not, they’re not going to raise taxes on anyone making over $400,000 a year. That is where they put the line on the wealthy and then the middle class, the reality is, is any of these costs in one way or another, any time that they’re making less money, they’re gonna, those fees, those costs are going to be passed through to the consumer and prices will go up. I don’t give a crap what they say, just wait and watch. I mean, if you’ve lived, I mean, does it cost you less now to live than it did a year ago? 10 years ago, 20 years ago, 40 years ago? And the reality is, is the inflation reduction act. Won’t curb inflation over the short run, right? Well, so the fed is battling inflation and raising rates to do the only thing they can do, which is demand at the same time that the bill that was just passed is going to be creating all sorts of new money. So, no, it’s not it, it’s not going to reduce inflation, not in the short term. And here I’ll put my neck on the line, not in the long term either, cause we won’t even get that. So naming it, anti inflation is a joke. This is going to be a very inflationary almost immediately because we are printing billions of dollars. This is not rocket science, but you know, somehow doing the same thing over and over and over again, even though you keep getting the same results. Well that’s, that’s the definition of insanity. And yet our government and our central banks keep doing it.

You wanna go down with the ship if you don’t get physical gold and silver in your possession, because the question is really how is this going to affect those fed policies? With all of this new inflationary impetus coming in, are they gonna get more aggressive with raising rates because they are battling for their credibility? And are you gonna be caught in the crossfire because they manipulate the price of gold so that you think, ah, it’s not doing anything. It’s doing everything. It’s your wealth insurance. Let me just remind you. This is back in 93. Let me just remind you of the fabulous Allen Greenspan. And you might recall my mother always used to said, but Lynn don’t you think he’s smarter than you don’t you think he’s smarter than you and I used to tell her, well, mom, if he believes the garbage coming out of his mouth, then frankly, no, he is not smarter than me, but I don’t think he did because of course, you know, he said something different before he became the fed chair. And he said many things different after trying to save his legacy, Alan too late, too late. But he brought this up in an FOMC meeting minute where they plan the rates. If we are dealing with psychology, then the thermometers, one uses to measure it, have an effect, meaning gold because gold is good money. Fiat is bad money. What would happen if the treasury sold a little gold in this market? Well, there’s an interesting question here, because if the gold price broke in that context, in other words, if they could suppress the gold price, the thermometer would not just be a measuring tool. It would basically affect the underlying psychology. Now what you’re looking at here, are gold purchases, central bank gold purchases from 1971 through 2021. And you can see here’s 1993. You can see that practice to suppress the price. They could sell it, they could lease it. They could do many things to suppress the price. But I’d also like to point out here in 2005, 2005, two years before the great financial crisis began to unravel. It was August, 2005. When we got the technical signal about the top of the real estate market. Do you think these central bankers might know something that you don’t know? They’re buying gold because what they absolutely know is whoever holds the gold retains power and therefore choice. If all of your wealth is held inside of the Fiat money system and the dollar, the Euro, the yen, whatever Fiat money you’re working in, wherever you are in the world, if that goes into or when that goes into hyperinflation and it has zero value. If what you’re holding can only be turned into Fiat. What do you got? 10 trillion times zero is still zero.

Make good choices. You must keep in mind and do what the smartest guys in the room are doing for themselves. They’re buying gold, I’m buying gold. I’ve been studying this on some level since I was 10 years old, frankly, you need to be holding it, owning it and buying it too. Forget what the price says. It’s our bargain take advantage just like these central banks are.

So I wanna make sure that you remember that we do podcasts on every single major podcast platform. So you can listen to us anywhere, anytime. And if you have not already started your strategy, please get it done, please, please, please get it done. We are running out of time. We have entered another dangerous phase. Anything can happen. So just click that Calendly link below and set a time to meet with one of our consultants and set up your own personal strategy. That will be based upon your goals, your circumstances, and what you have to work with. And don’t forget too, because you gotta have Food, Water, Energy, Security, as well as Barterability, Wealth Preservation, Community and Shelter. So the rest of the mantra, you can find on our new, Beyond Gold and Silver YouTube channel and website, where our goal is to accumulate a very large library with very knowledgeable people as well. So that wherever you’re starting this journey, there’s somebody there to meet you at that level and help you get a leg up. And if you actually have experience in any of those areas and you wanna share it, this is a great place to share it as well. So if you haven’t already make sure you subscribe, give us a thumbs up, leave us comments, share, share, share, share, share. And if you want to see behind the scenes of my urban farm and also of my bug out location, just follow me on Instagram at Lynette Zang, as well as Twitter. And remember we will never, ever, ever ask you for any level of money, you know, through a tweet or anything like that. So if they do, they’re not me. Okay. So please be aware of those fakers out there that are just, I would not want their karma. I’ll just say that. So leave us a review on apple or Spotify. Listen to us anywhere, leave us a comment. And until next we meet, please be safe out there. Bye-bye.

https://fred.stlouisfed.org/series/FYFSD

https://news.yahoo.com/u-private-sector-activity-contracts-135441303.html