HOUSING MARKETS & MORTGAGE BAILOUTS: Prices to Plunge while Opportunity Awaits… by Lynette Zang

Today, the Fed announced yet another $2 trillion injection announcing they will be buying, not only corporate bonds, but junk bonds as well. In fact, the Fed is giving almost everyone newly created money, though not yet announcing “universal basic incomeâ€, which I believe we will see soon.

Have more questions that need to get answered? Call: 844-495-6042

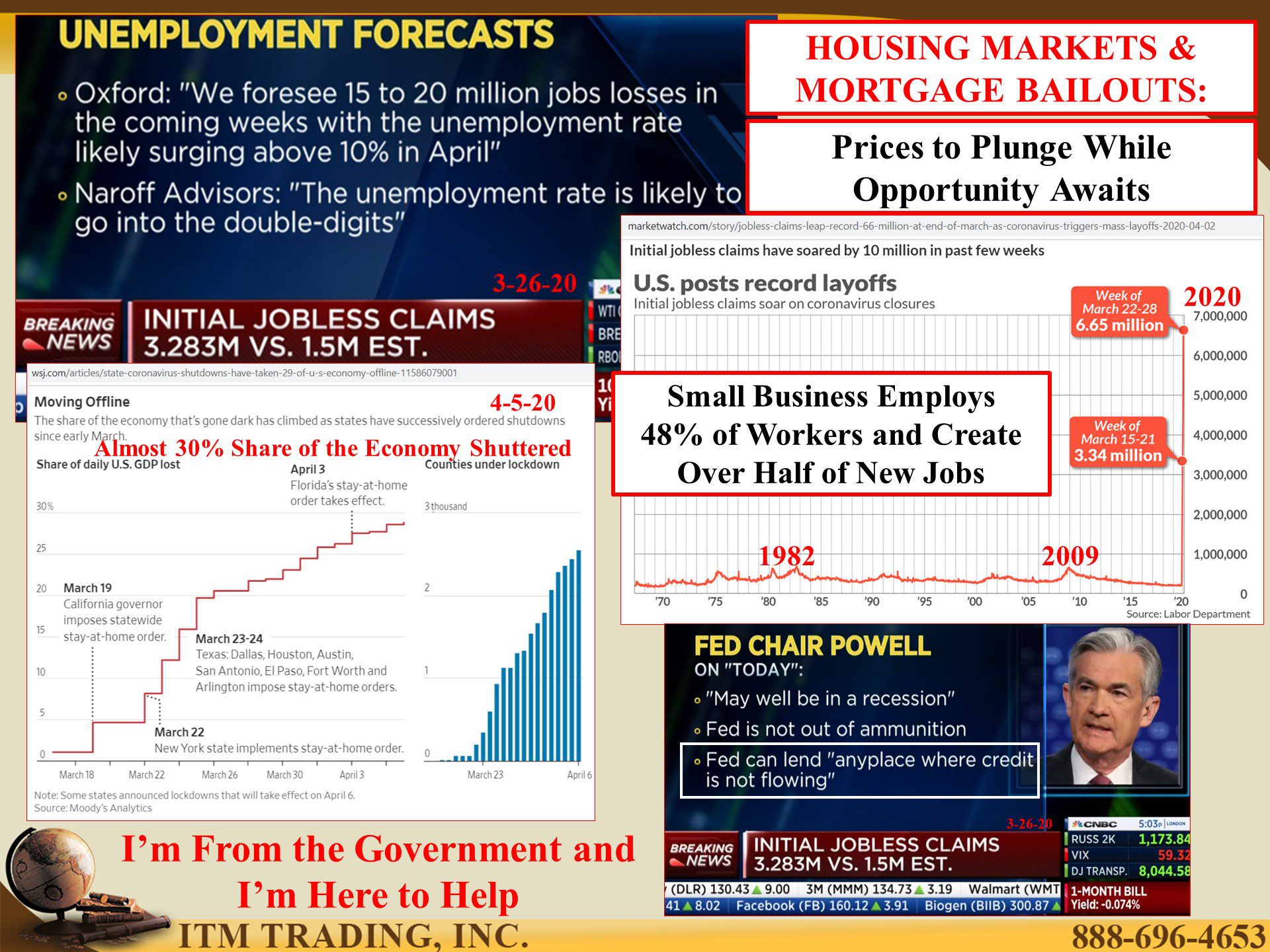

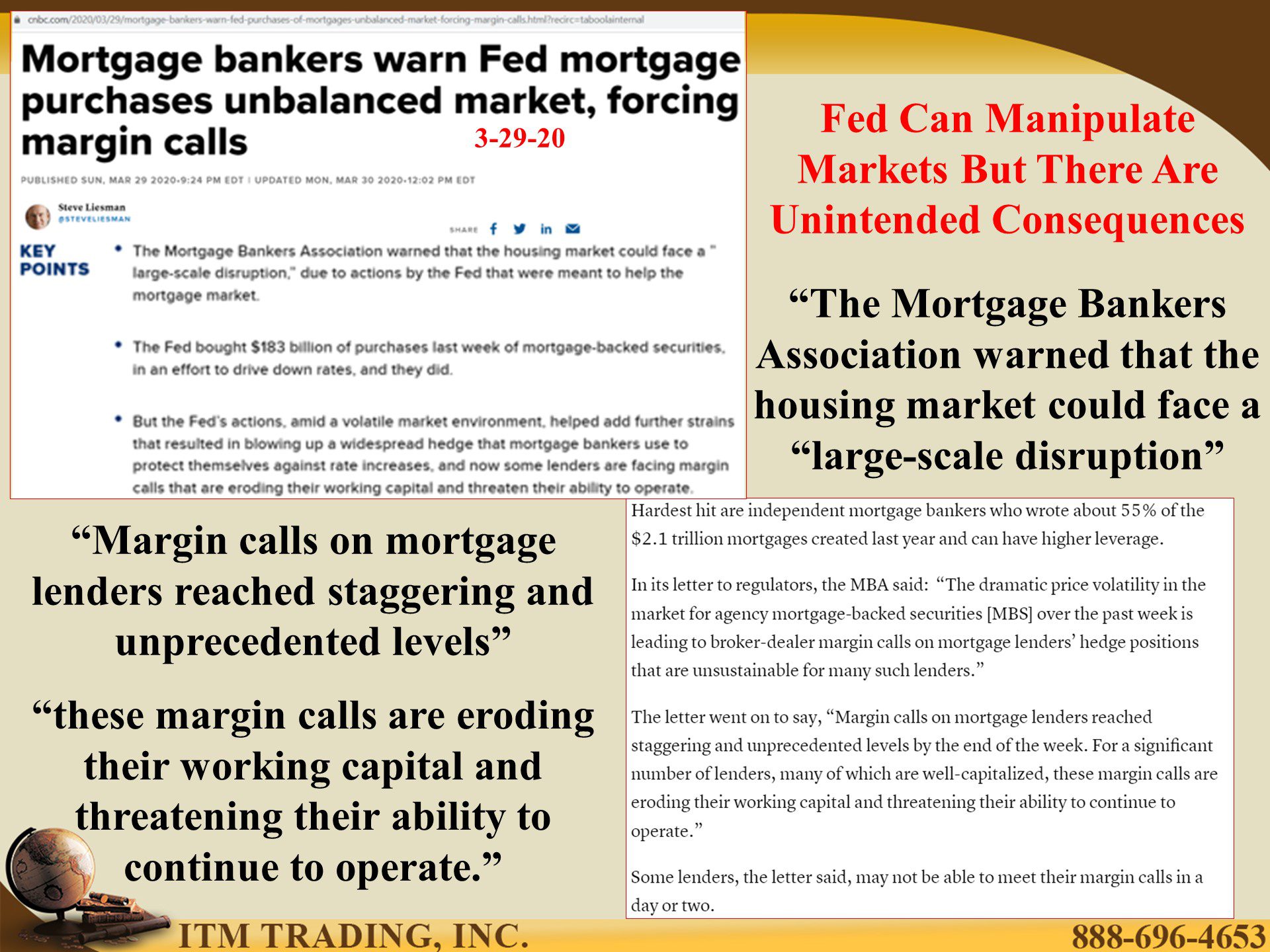

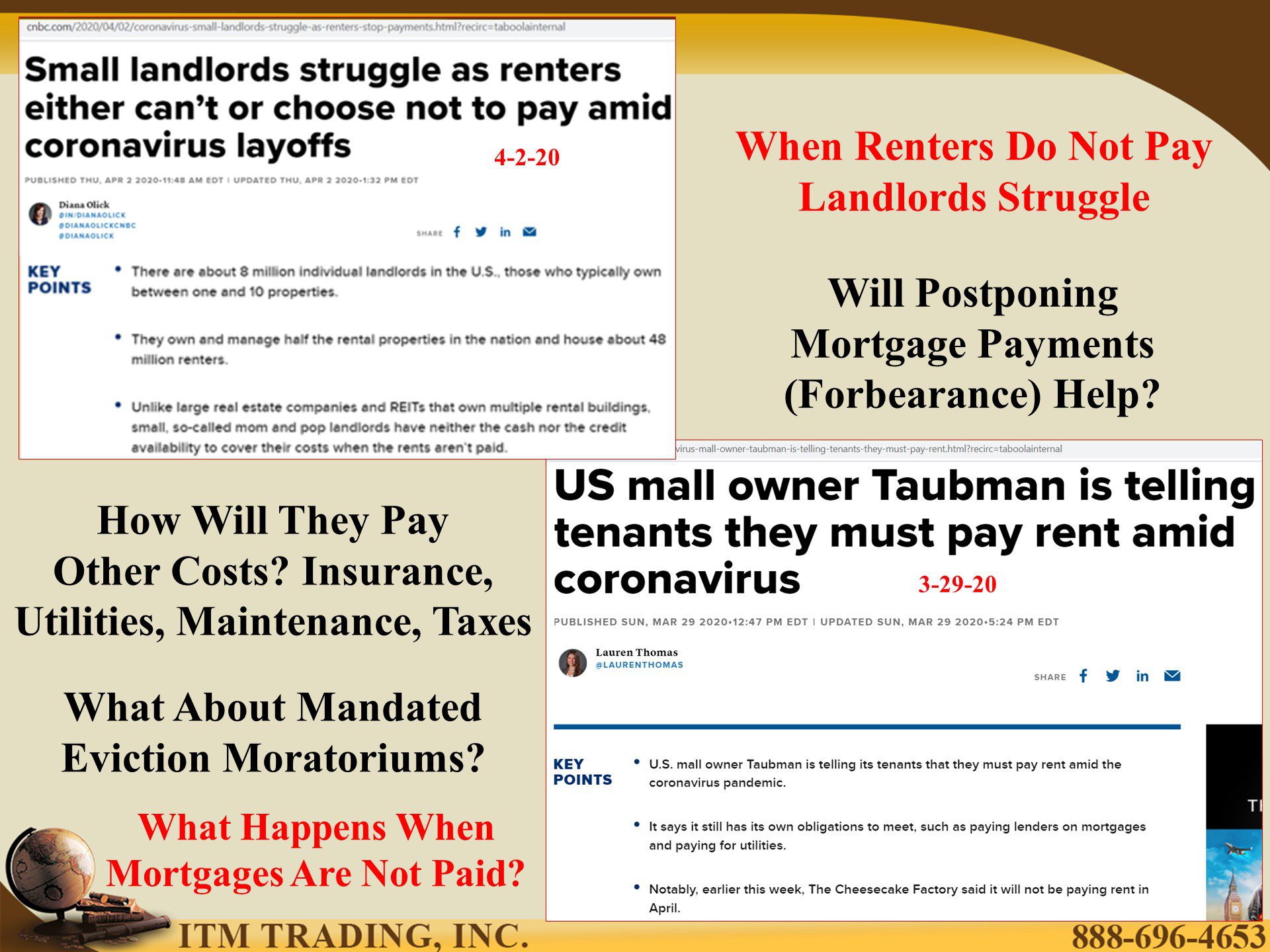

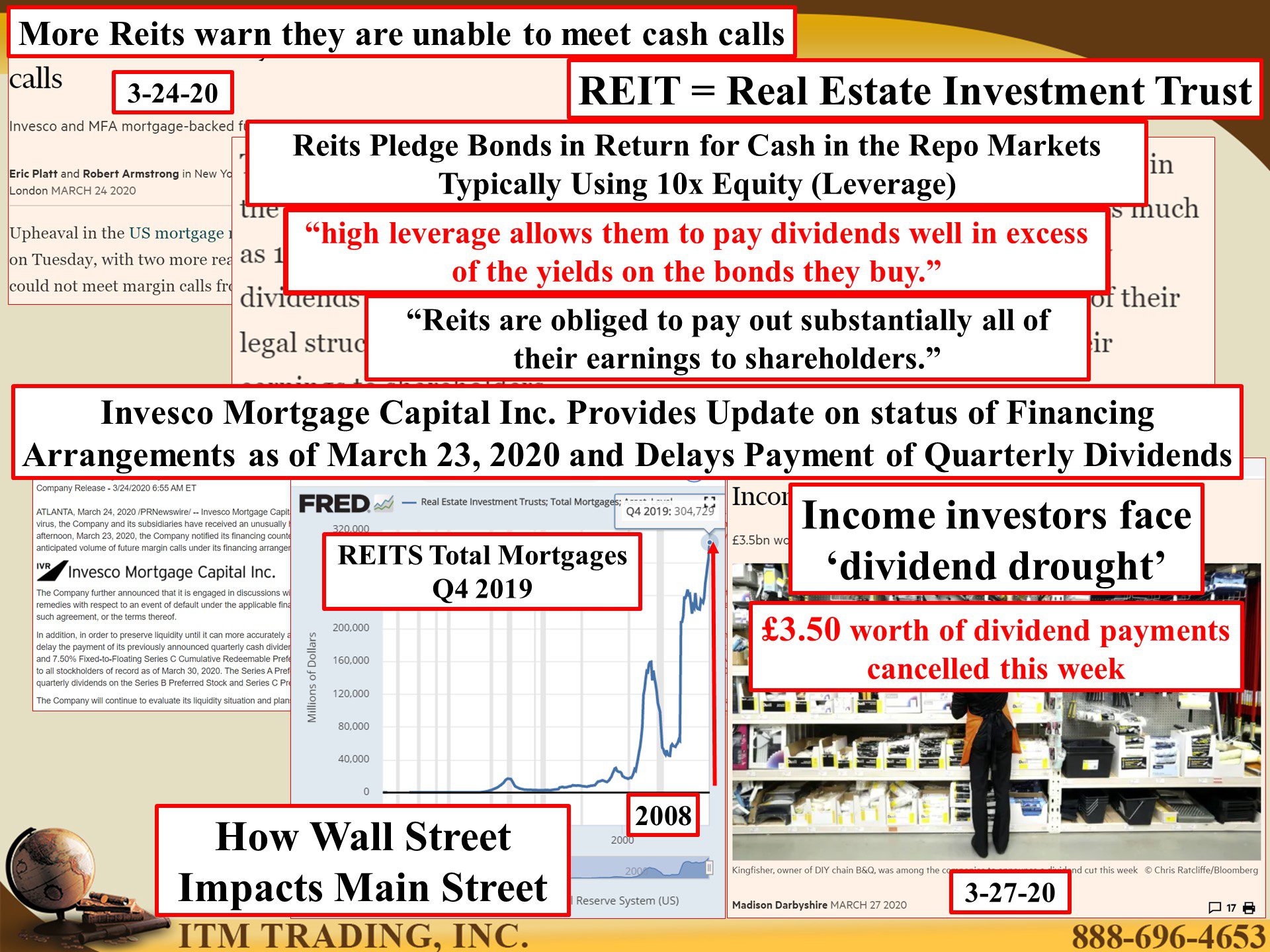

All that yet unemployment is exploding, overwhelming state unemployment offices and delaying payments to those who need it the most. With businesses shuttered and mass layoffs, many are having problems paying mortgages and rents. Since real estate is 30% of GDP (money that flows through the economy) the fed stepped in aggressively buying both residential and now commercial MBSs (Mortgage Back Securities). In the “unintended consequence†category, that has unbalanced leveraged trades in the private mortgage market putting that area in jeopardy.

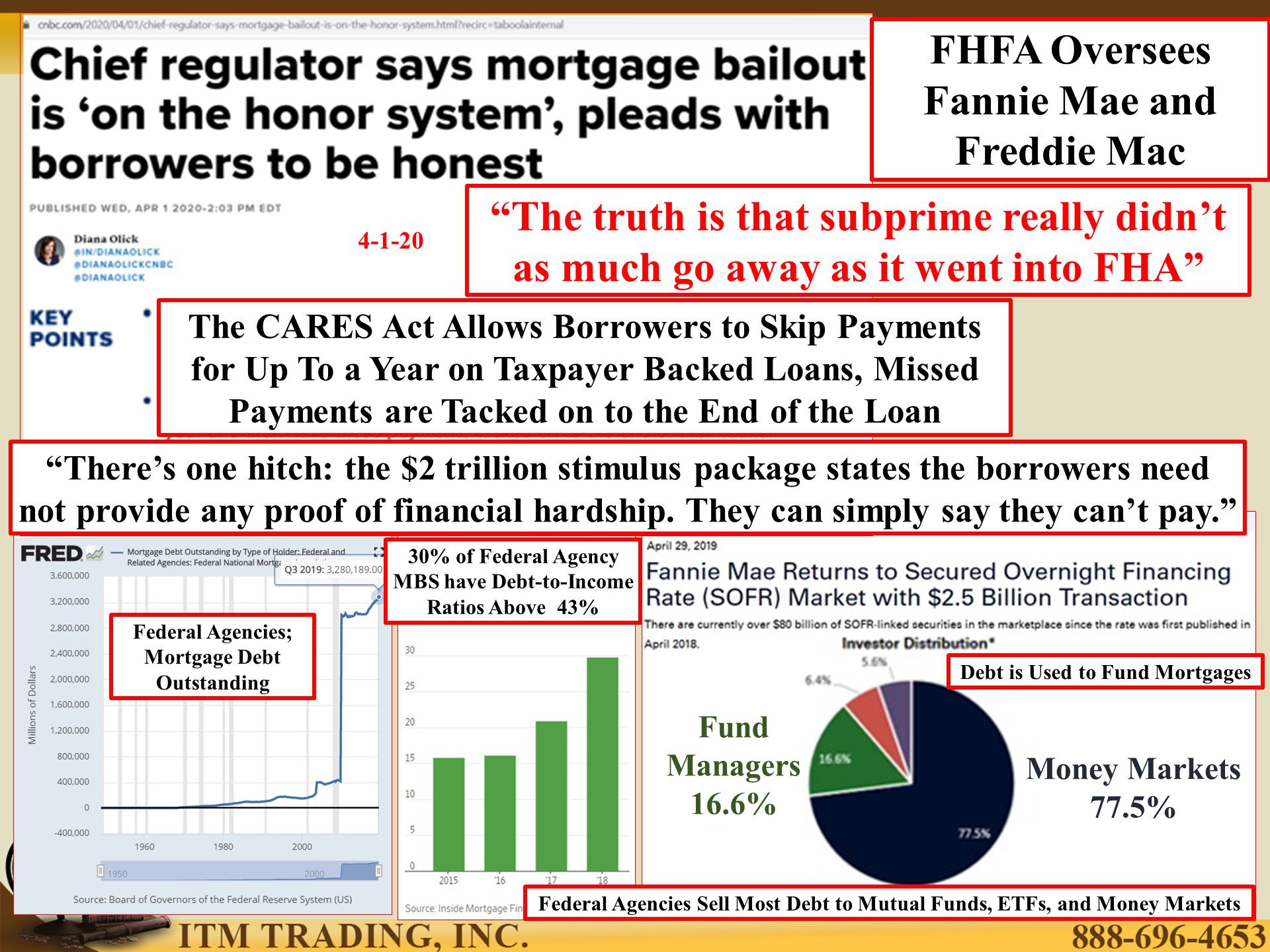

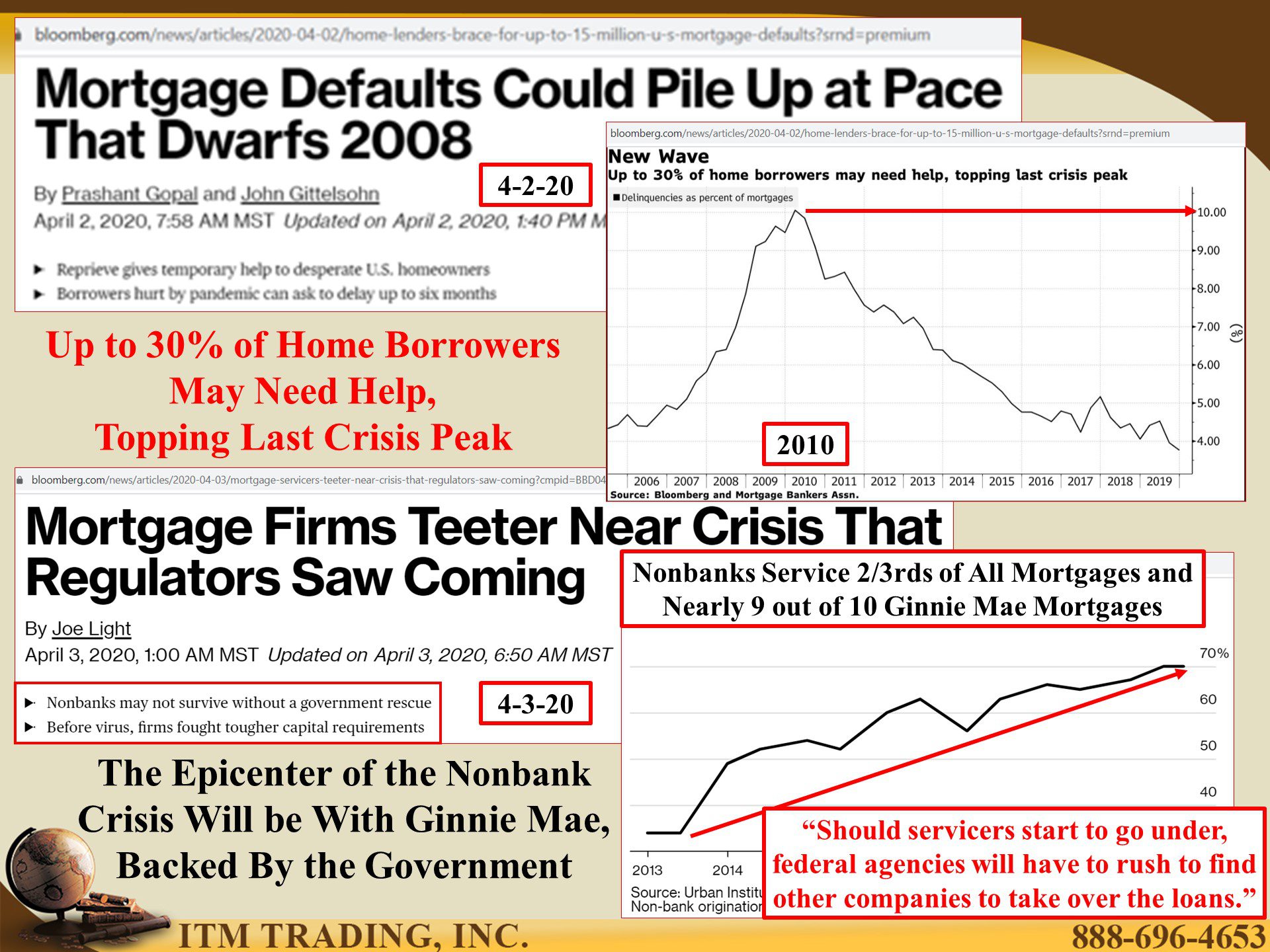

Additionally, the US government is offering mortgage payment forbearance delaying payments for up to a year on Fannie Mae and Freddie Mac mortgages and all you have to do is say you can’t afford to pay, so you’re asked to be “honest†about your ability to pay. The government does not, at this time, have the same level of control over private lenders., but my bet is that the Fed’s will bail them out as well, which has grown exponentially since 2008, as banks stepped away from the mortgage market. Private mortgage funding now comprises 70% of the mortgage markets.

The epicenter the nonbank crisis will be Ginnie Mae, which is backed by the US government, but provides mortgage money for lower wealth and credit quality borrowers. In fact, while nonbanks service 2/3rd of all mortgages, they service 9 out of 10 Ginnie Mae mortgages. “Should servicers start to go under, federal agencies will have to rush to find other companies to take over the loans.†Who will that be, Fannie and Freddie had to be bailed out in 2008?

Importantly, many of these mortgages were leveraged (typically 10 times) in REITs, (Real Estate Investment Trusts) that use the REPO markets to fund dividend payout activities. Additionally, these mortgages were sold as safe income tools. But as businesses are shuttered and people stop paying mortgages, many REITs are announcing the suspension of dividends, hurting income investors.

So much for the “reach for yieldâ€. Can the Fed and governments money creation machine save the day again, like it did after 2008? Likely no, because we had already been getting breakdown signals since December 2018 and much as Fed Chair Powell and President Trump tell us that the economy will go back to normal quickly after the coronavirus is under control, they economic damage is already done and, in my opinion, their money printing cure will only make things worse.

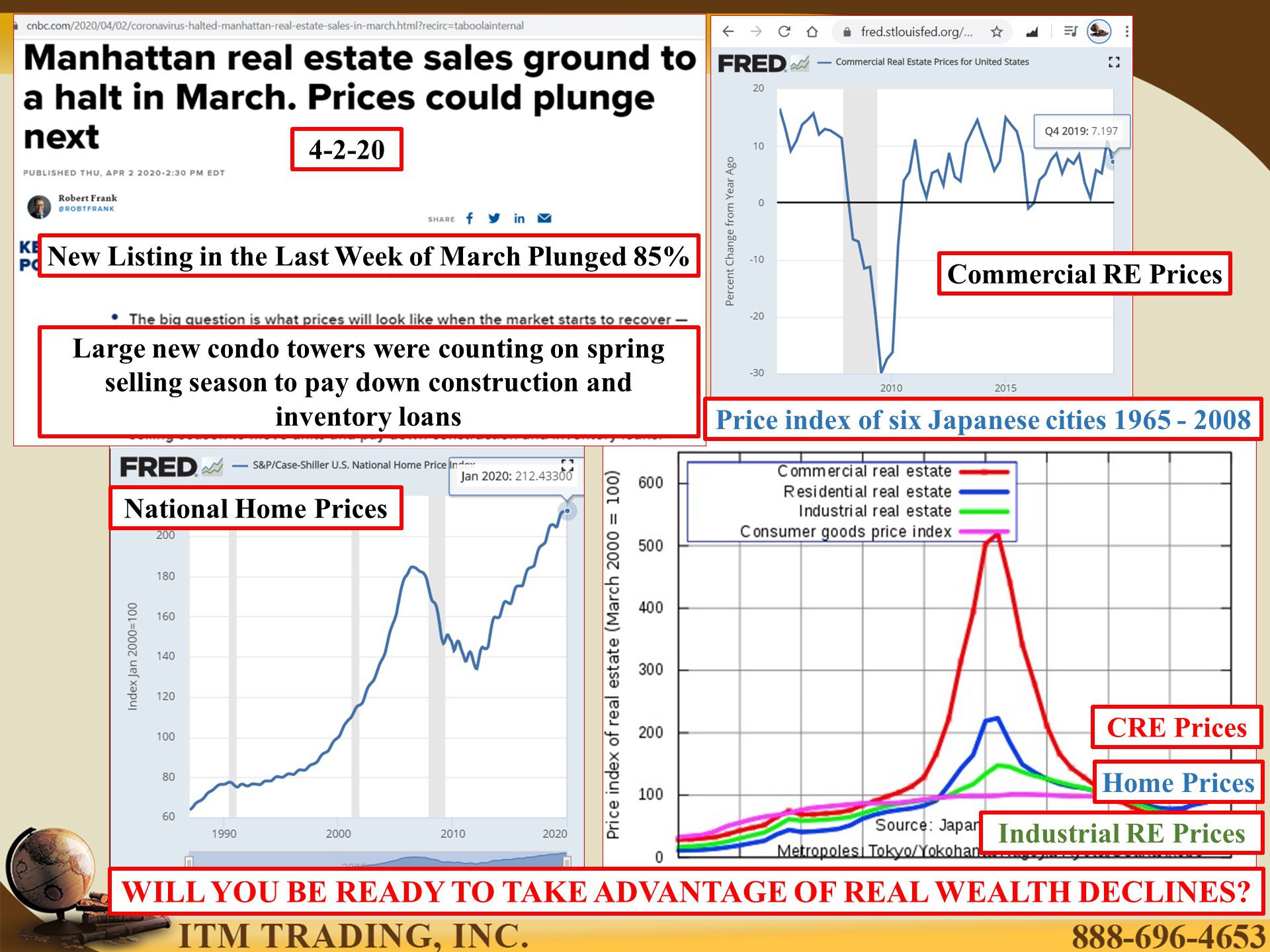

History always repeats and this time is not different. We can look at the real estate asset bubble that popped in Japan in the early 90’s. Commercial real estate dropped 95% and residential real estate dropped 85% from their overvalued highs. That’s what I believe lies ahead for the US real estate market. Will you be in position to take advantage of this opportunity?

You will if you hold your wealth intact. Six thousand years of history is a handy guide here too.

Do you think there will be no consequences from this new money tsunami that dwarfs what central bankers created since 2008?

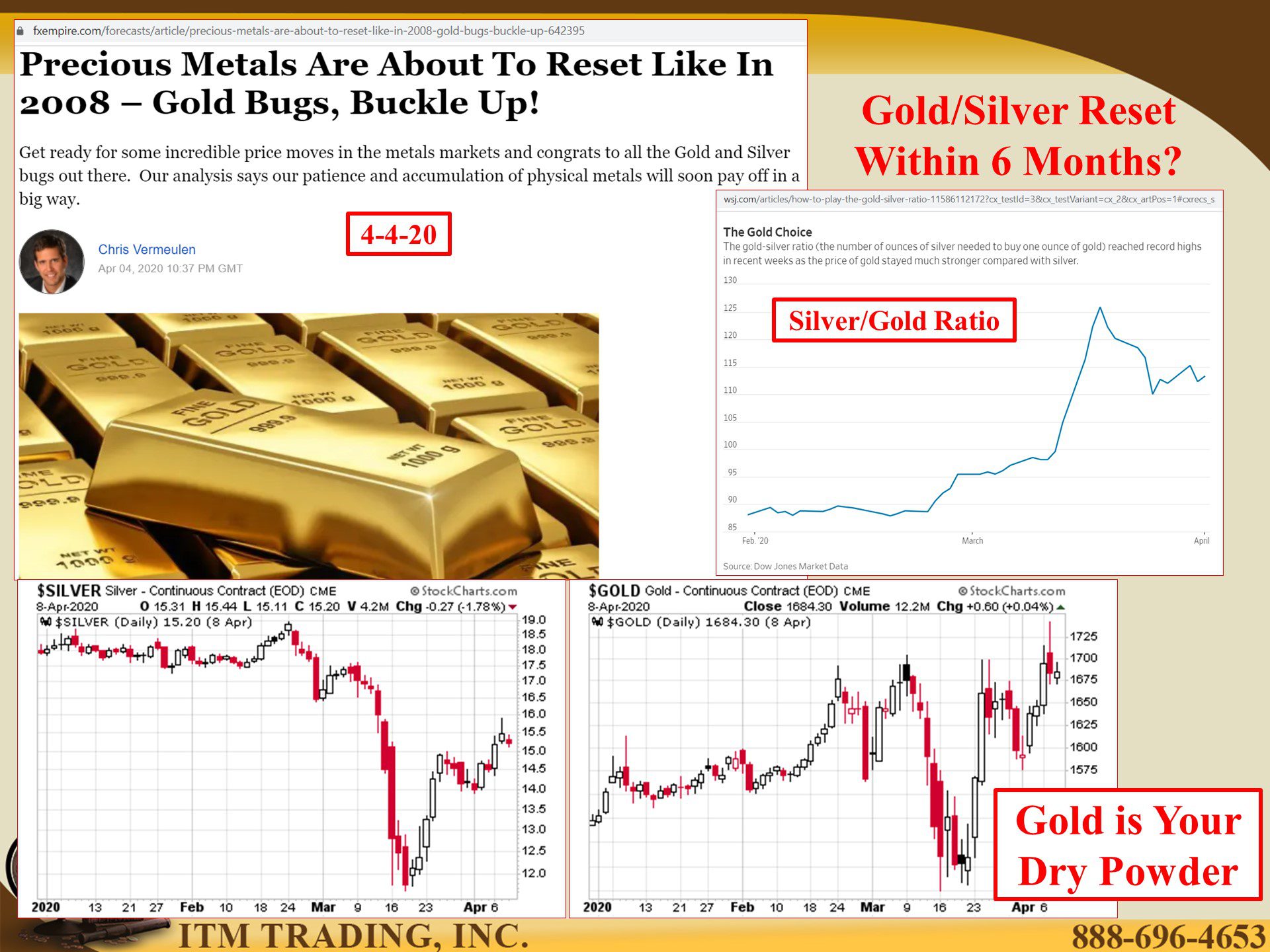

In yesterday’s interview with Egon Von Greyerz, founder of Matterhorn Asset Management who main focus has always been on wealth preservation and whose client base is the top 1%, pension funds and family wealth funds, he revealed the expectation of the short term gold reset coming within the next 6 months. And while that is not a guarantee, I believe that will be just the first of many gold and silver resets in terms of dying fiat (government/central bank) money systems.

The most important function of gold is to hold wealth over time. It has passed this test for 6,000 years. If you want to be in position to take advantage of what lies ahead, you need gold.

Slides and Links:

http://www.freddiemac.com/investors/financials/pdf/10k_021320.pdf

https://stockcharts.com/h-sc/ui

http://www.mfafinancial.com/file/Index?KeyFile=403390240

https://fred.stlouisfed.org/series/CSUSHPINSA