HARD LENDING AHEAD: Are the Credit Air Bags Ready? By Lynette Zang

Hidden under an unpayable mountain of debt and infiltrated throughout Wall Street fiat money products, is the CLO derivative bomb that, I believe, will take down the global financial system. Recent pattern shifts indicate that the trend has elevated to a new level.

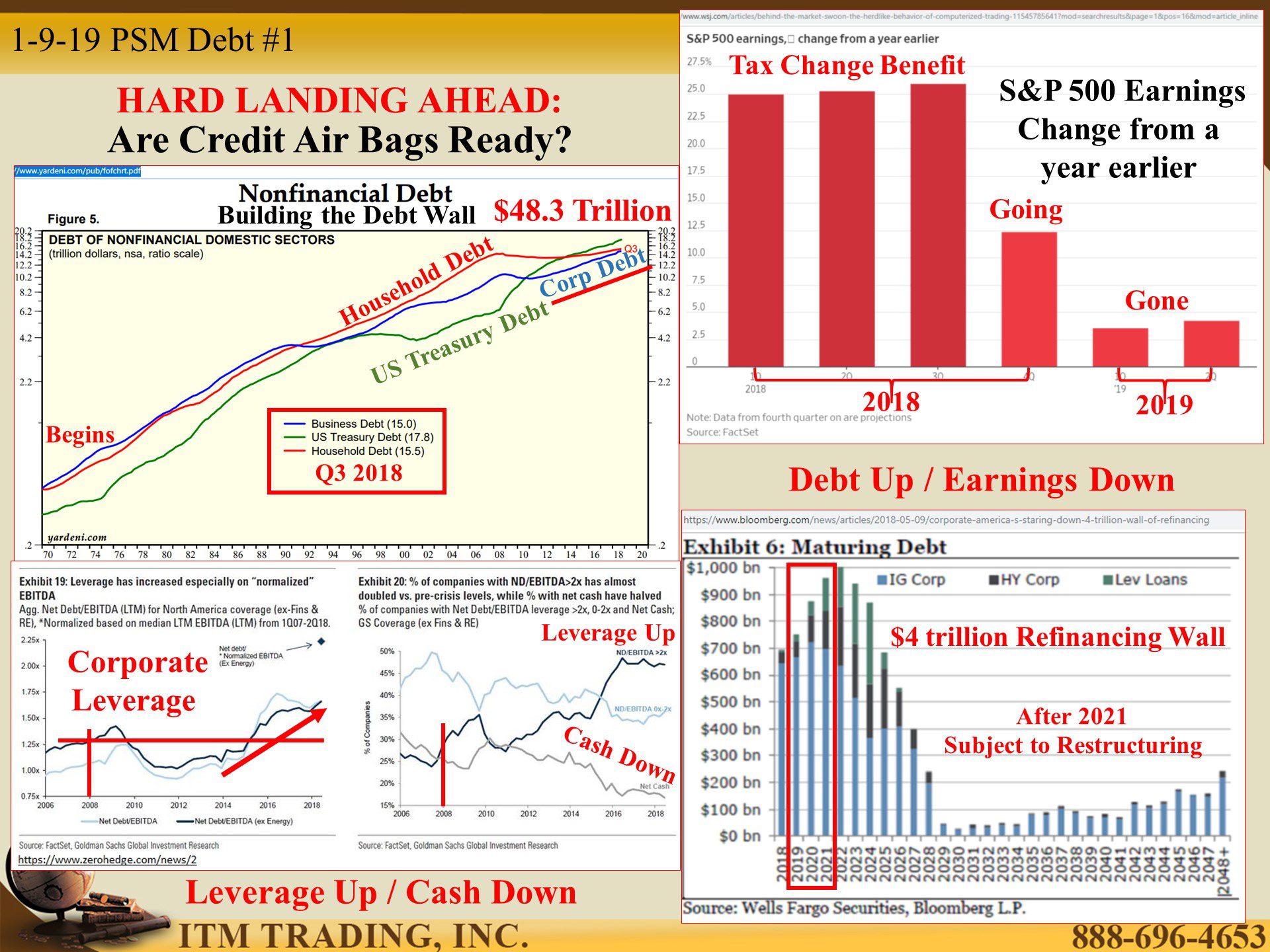

Addicted to cheap money, corporate leverage levels are higher now, than in 2008. Leverage is the level of debt assumed to the level of equity held. The higher the leverage, the greater the risk of default. Studies have also shown that the higher the leverage level, the lower the cash levels. What happens in a credit crisis?

According to leveragedloan.com “A leveraged loan is a commercial loan provided to a borrower that has a non-investment grade rating, by a group of lenders.†These loans fund many activities, like stock buybacks, dividends, mergers and acquisitions and leveraged buyouts.

A leveraged buyout is a transaction in which a company is purchased with a combination of stock and debt, with the company’s cash flow as the collateral. Perhaps debt used for mergers and acquisitions is self-liquidating debt, but the lion share is not. As a reminder, self-liquidating debt is used for business expansion and therefore, generates the revenue to pay off the loan. Refinancing, dividends and buybacks do not generate new revenue streams and requires payments out of income.

The global slowdown has become apparent and so has the decline in corporate earnings. Corporations have begun to hit the debt wall. In fact, just in the US, there is a $4 trillion refinancing wall beginning in 2019. Almost half is due between now and 2021, the balance must be shifted into new debt contracts. While some of that debt is classified as investment grade, much of it is in leveraged loans and junk debt.

CLOs are a derivative contract derived from leveraged loans. Derivatives are all about leverage, and CLOs typically add an additional 10 or 11 times leverage. They are all about speculation. In a reach for yield, large institutional investors (pension funds, mutual funds etc.) have been buying CLOs.

But now the tide has turned and investor funding and available credit is drying up for this risky debt. In fact, for the first time since 2008, no junk bonds were issued in December 2018. “This is clearly more than year-end jitters,†said Guy LeBas, a strategist at Janney Montgomery Scott. “What we’re seeing now is pretty typical for end-of-credit-cycle behavior.†Voila, they too are calling the pattern shift that indicates the end is close.

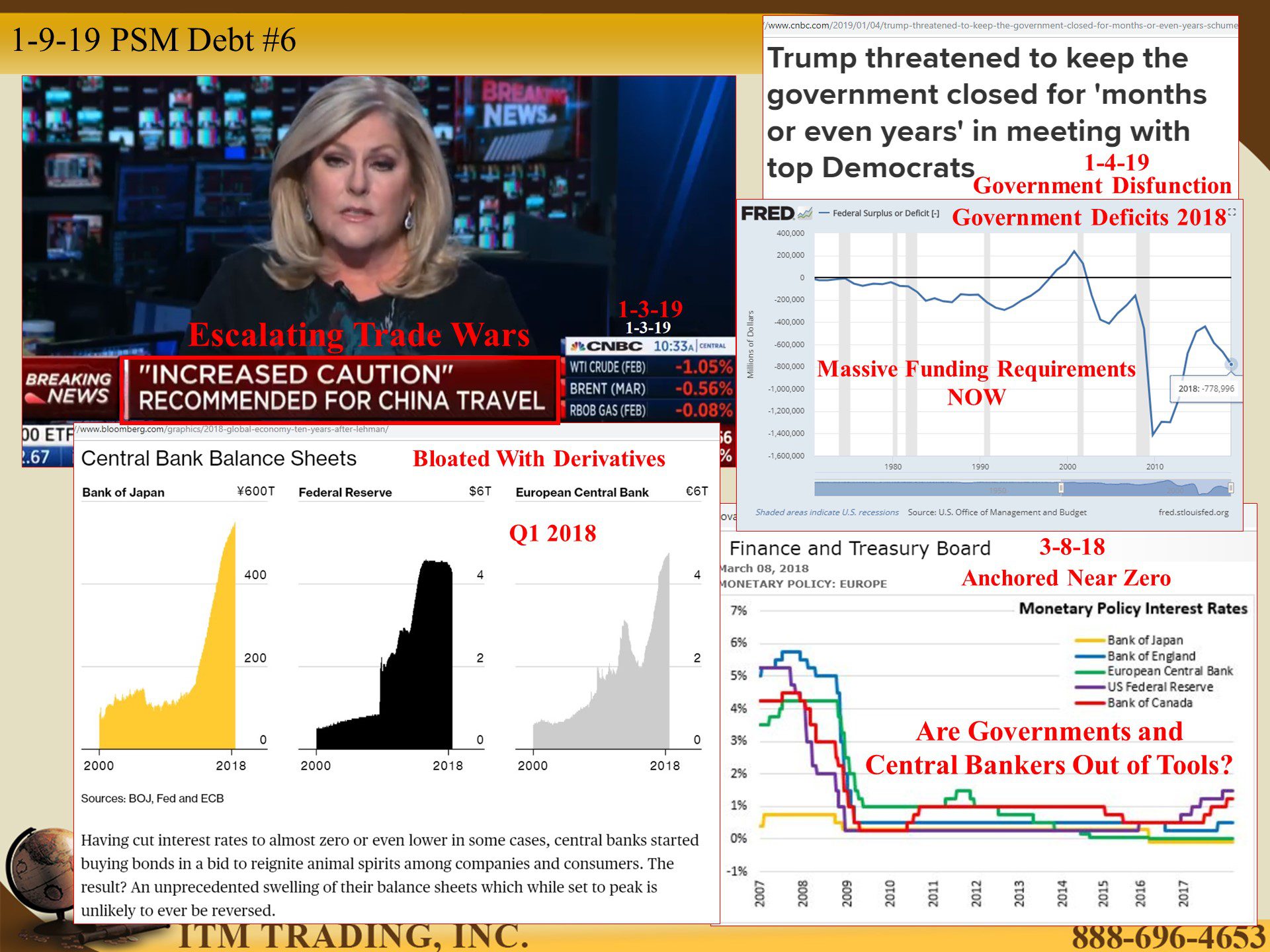

What about governments and central banks? They have their own problems; Trade Wars, Government Shutdowns, Bexit, Italy, bloated balance sheets and massive deficits with trillions in new government debt required. Who do you think will come first?

Slides and Links:

https://www.yardeni.com/pub/fofchrt.pdf

https://openknowledge.worldbank.org/bitstream/handle/10986/30851/IDS2019.pdf?sequence=5&isAllowed=y

https://www.zerohedge.com/news/2018-09-23/goldman-warns-default-wave-13-trillion-debt-set-mature

https://stockcharts.com/h-sc/ui

https://fred.stlouisfed.org/series/BAMLH0A0HYM2

https://www.imf.org/~/media/Files/Publications/GFSR/2018/April/…/figure1-9.ashx

http://www.leveragedloan.com/primer/#!definingleveraged

http://www.leveragedloan.com/help-refinitiv-lbo-leveraged-loan-issuance-tops-2017-levels/

www.Leveragedloan.com/primer/#!clos

https://www.ft.com/content/1acdfbe0-00be-11e9-99df-6183d3002ee1

https://asia.nikkei.com/Economy/Asia-s-economy-deemed-to-be-swayed-by-China-slowdown-in-2019

https://www.tradingeconomics.com/euro-area/manufacturing-pmi

https://www.Bloomberg.com/opinion/articles/2019-01-03/apple-s-china-iphone-woes-foretold-by-japan-machine-makers

https://www.canadapost.ca/tools/pg/manual/PGnonmail-e.pdf

https://www.wsj.com/articles/u-s-economy-fuels-boom-in-consumer-debt-11546007400

https://novascotia.ca/finance/statistics/news.asp?id=13644

YouTube Short Description

For the first time since 2008, no junk bonds were issued in December 2018. “This is clearly more than year-end jitters,†said Guy LeBas, a strategist at Janney Montgomery Scott. “What we’re seeing now is pretty typical for end-of-credit-cycle behavior.†Voila, they too are calling the pattern shift that indicates the end is close.

What about governments and central banks? They have their own problems; Trade Wars, Government Shutdowns, Bexit, Italy, bloated balance sheets and massive deficits with trillions in new government debt required. Who do you think will come first?