THE GREAT WALL CONTINUES TO CRACK: China’s Golden Solution By Lynette Zang

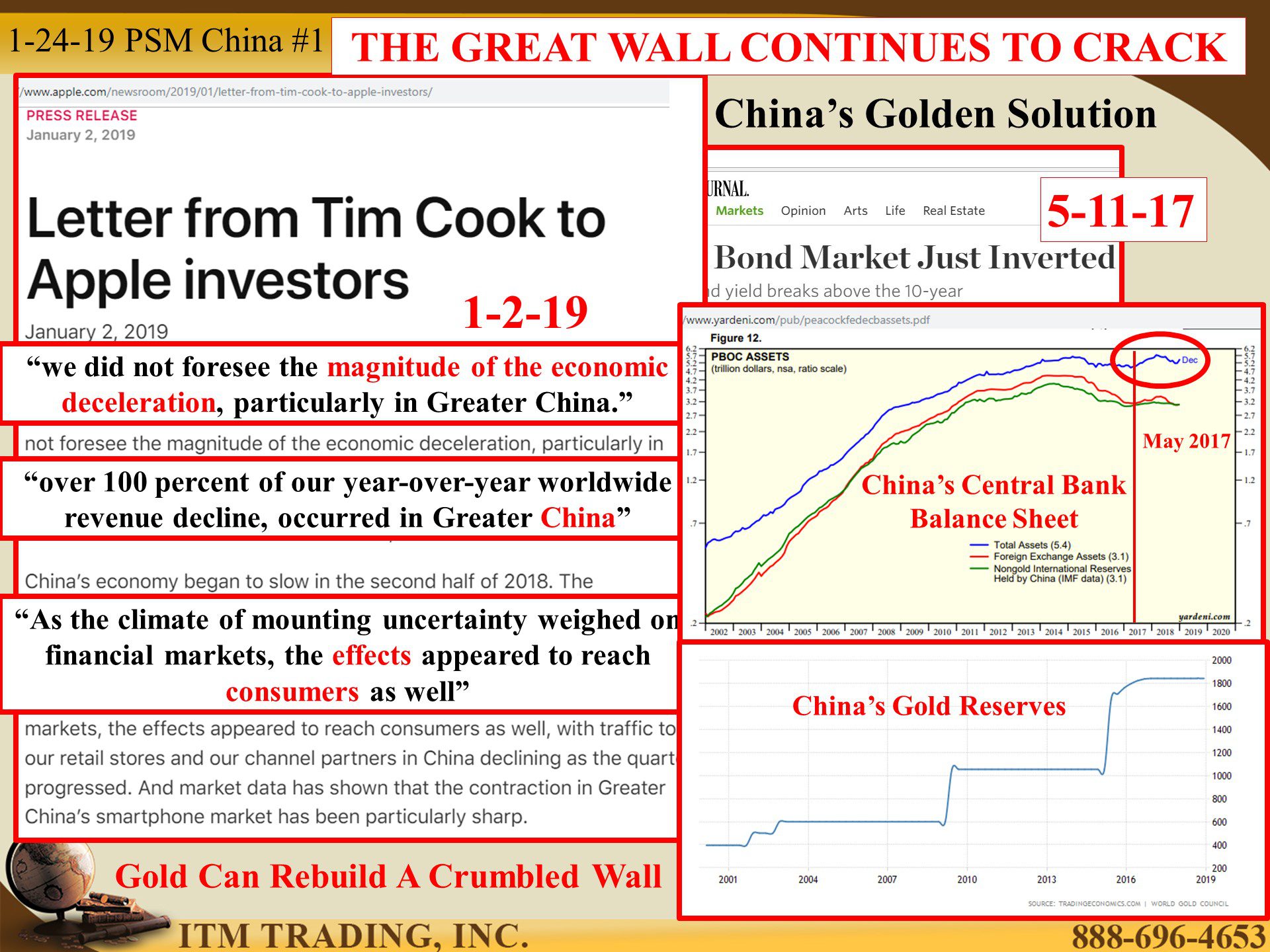

Trade wars continue between the US and China, the two largest global economies. In the US, they say the trade war is having an impact on China’s economy, which is certainly true, but on May 11, 2017, China’s shorter-term debt interest rates rose above longer term debt in a yield curve inversion, one of the most accurate predictors of a recession. So perhaps the trade war merely escalated the decline that was already in process.

Could that be why China’s reported gold reserves jumped in a true flight to real money safety?

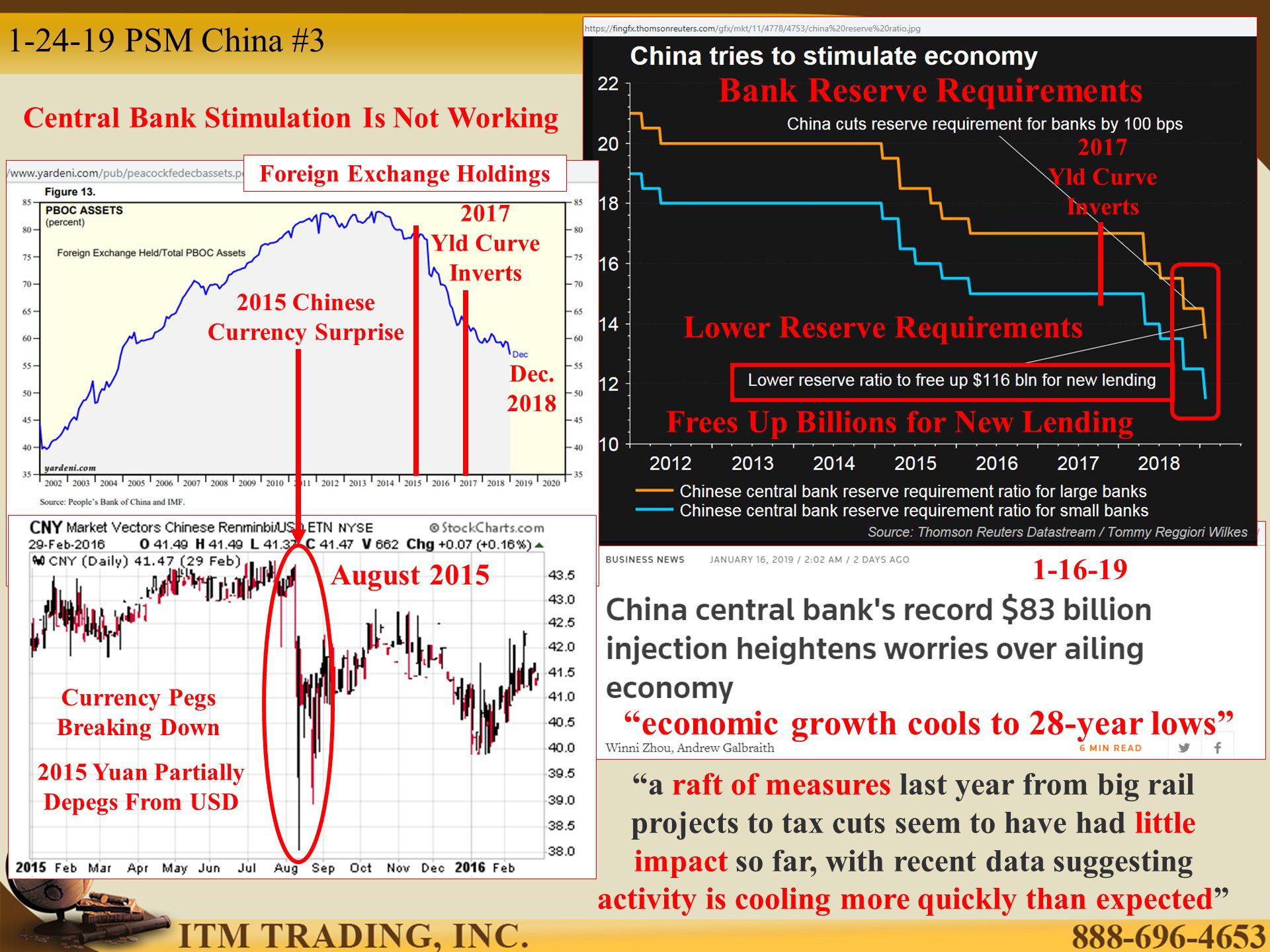

And perhaps that process really began in 2015 when a pin prick appeared in the Central Bank QE bubble.

On January 15, 2015 Switzerland surprised IMF members by breaking the 1 to 1 link (de-pegging) it had to the Euro, as the ECB was about to implement QE and negative interest rate policy, making maintaining the peg too expensive.

In August 2015, China surprised the world again, by shifting its long-held Yuan (renminbi) peg to the US dollar. But in my opinion, that was a confirmation that the global deflation had begun again.

On December 4, 2018, the US Treasury market experienced a yield curve inversion, which, in my opinion is a confirmation that we have entered a riskier and more elevated level in the deflationary cycle.

So big deal if we have a recession. We’ve had them before and ended up OK. Problem is, this time IS actually different, simply because the experimental tools created in 2008, no longer appear to work. In addition, with debt levels for governments, central banks, corporations and individuals at historic highs, there’s no wiggle room in either balance sheets or interest rates. But now, all debts become due as we near the end of the IBORs.

And because the global financial system is focused in just 41 systemically important interconnected institutions, it does not matter much if the first visible deflationary implosion happens here, there or anywhere. Ultimately it will happen everywhere.

Wall street media cheer leaders want you to stay, so we’re told of the strength of the consumer in the US, but China too, is reliant on consumption. Surprise! In December, exports fell 4.4% YOY, showing falling global demand beyond the impact of trade wars. Even worse, imports fell 7.6% YOY, showing rapidly falling local consumer demand. If the world is counting on consumers to inflate away the value of the debt, we may be in deep do-do because this data tells us that this is a demand driven decline.

Perhaps some of that demand driven decline has to do with current debt service consuming more and more current income. If incomes don’t grow how will individuals grow consumption and/or the debt that leverages that consumption? Then who will support the global markets? What tools can the central bankers come up with next?

Or will this next “recession†lead to the “Reset†we’ve been watching unfold since 2008. If enough risk has been transferred to the pubic, global elites may deem this next crisis too expensive to bail. I believe this is the case and it may be that others agree since holding physical gold outperformed global fiat assets in 2018, even as spot gold declined.

JP Morgan said that “Only gold is money, everything else is credit†J. Paul Getty said, “If you owe the bank $100 that’s your problem. If you owe the bank $100 million, that’s the bank’s problem.†Since 2008, we’ve watched governments underwriting bank losses under the premise of “stimulating†the economy. Yet here we are, over ten years later, moving rapidly into a global slowdown and I’m thinking, we all have a problem. Got gold?

Slides and Links:

https://www.yardeni.com/pub/peacockfedecbassets.pdf

https://www.apple.com/newsroom/2019/01/letter-from-tim-cook-to-apple-investors/

https://www.wsj.com/articles/china-bonds-send-fresh-stress-signal-1494500938

https://tradingeconomics.com/china/gold-reserves

https://www.cnbc.com/2019/01/14/asia-markets-china-data-dollar-moves-in-focus.html

https://stockcharts.com/h-sc/ui?s=$DJSZ

https://fingfx.thomsonreuters.com/gfx/mkt/11/4778/4753/china%20reserve%20ratio.jpg

https://www.yardeni.com/pub/peacockfedecbassets.pdf

http://www.worldbank.org/en/publication/global-economic-prospects

https://www.yardeni.com/pub/peacockfedecbassets.pdf

YouTube Short Description:

Trade wars continue between the US and China, the two largest global economies. In the US, they say the trade war is having an impact on China’s economy, which is certainly true, but on May 11, 2017, China’s shorter-term debt interest rates rose above longer term debt in a yield curve inversion, one of the most accurate predictors of a recession. So perhaps the trade war merely escalated the decline that was already in process.

On December 4, 2018, the US Treasury market experienced a yield curve inversion, which, in my opinion, is a confirmation that we have entered a riskier and more elevated level in the deflationary cycle.

JP Morgan said that “Only gold is money, everything else is credit†J. Paul Getty said, “If you owe the bank $100 that’s your problem. If you owe the bank $100 million, that’s the bank’s problem.†Since 2008, we’ve watched governments underwriting bank losses under the premise of “stimulating†the economy. It’s not working and I’m thinking, we all have a problem. Got gold?