GOVERNMENTS CLASH & MARKETS DON’T CARE: But Gold Does

The State government vs the Federal government clash is heating up with President Trump sending Federal Agents into cities that don’t want them there. In fact, Portland’s Mayor was in the crowd when Fed Agents fired tear gas into the crowd. According to the mayor, there was no need. But that’s not all, China vowed to retaliate over the forced closure of its consulate in Houston, in what many see as the new cold war between these two world powers.

Have more questions that need to get answered? Call: 844-495-6042

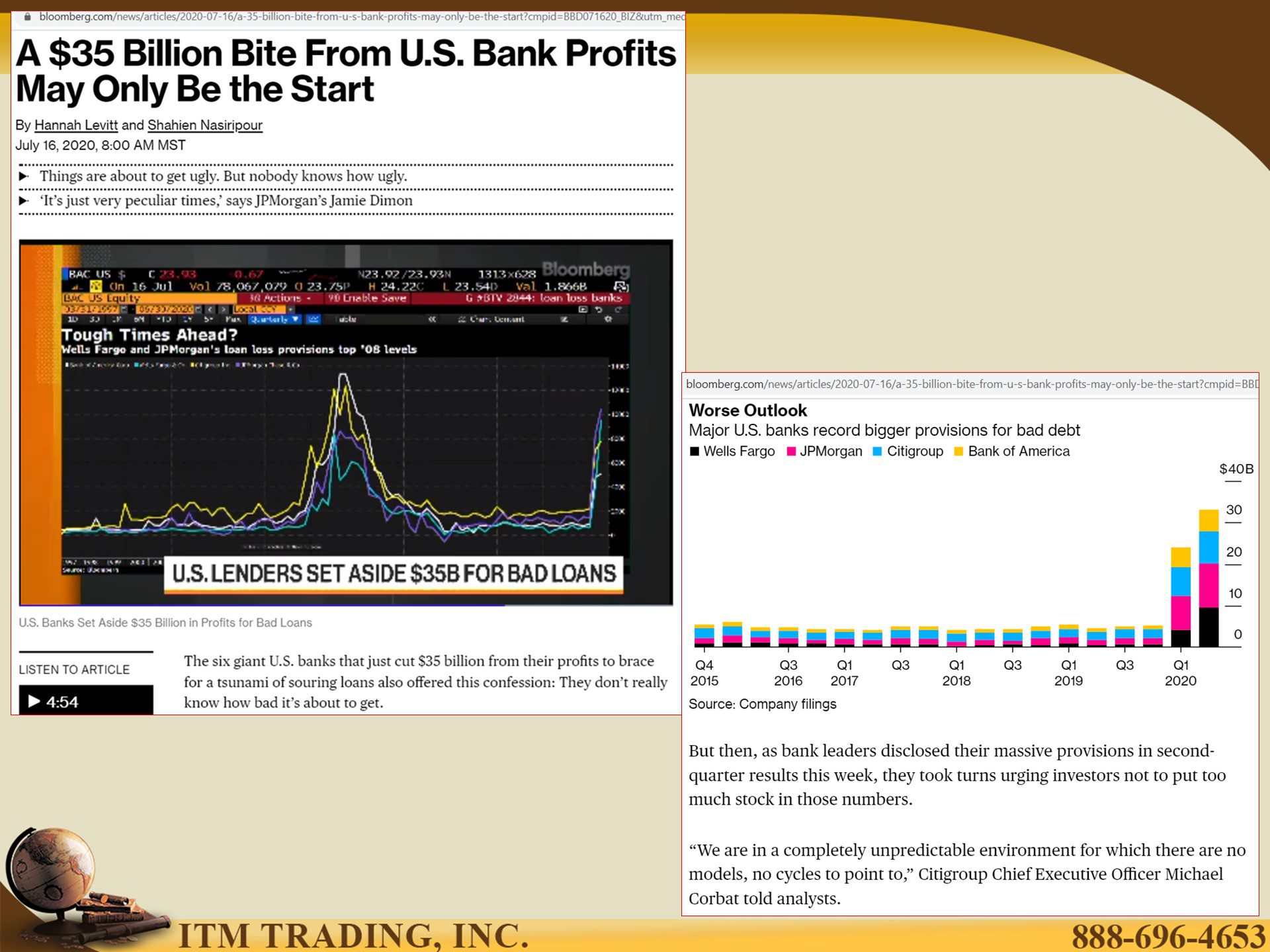

Additionally, the reopening of the US economy is struggling with many thinking that the rebound we saw in June, is already over in July. That was likely part of the reason big banks put aside $35billion in loan loss reserves while admitting “We are in a completely unpredictable environment for which there are no models, no cycles to point to.†In other words, it could be far worse.

With over 40% of all corporations suspending earnings guidance stock markets still managed to reach five-month highs. I certainly hope you do not have FOMO because, in my opinion, this will not end well.

But the real tell is insider selling. “Almost 1,000 corporate executives and officers have unloaded shares of their own companies this month, outpacing insider buyers by a ratio of 5-to-1â€. I always recommend you do what the smartest guys in the room do for themselves.

In the mean-time spot gold is very near the all-time 2011 high of $1,900.40. If you were thinking about entering this market, I suggest you get it done. Not because I’m worried about the price, because even at $1,900, it is still far below its fundamental value of near $11,500, but because the higher spot gold goes, the greater the demand for physical and the more narrow your choices become.

Slides and Links:

- NA

- https://www.ft.com/content/7d9a9f01-9c9d-43ce-99f6-6c31202f71e1

- https://www.bloomberg.com/news/articles/2020-07-16/a-35-billion-bite-from-u-s-bank-profits-may-only-be-the-start?cmpid=BBD071620_BIZ&utm_medium=email&utm_source=newsletter&utm_term=200716&utm_campaign=bloombergdaily&sref=rWFqAg1Y

- NA

- https://www.bloomberg.com/news/articles/2020-07-22/insiders-who-nailed-market-bottom-are-starting-to-sell-stocks?cmpid=BBD072220_BIZ&utm_medium=email&utm_source=newsletter&utm_term=200722&utm_campaign=bloombergdaily&sref=rWFqAg1Y