GOLD/SILVER RATIO IN HYPERINFLATION: Using Gold & Silver During Hyperinflation & Reset…by LYNETTE ZANG

Unless you’ve actually lived through a hyperinflationary and reset event, it’s challenging to understand what you will experience. But I believe that being prepared for just such event is crucial for your financial future since this is where, in my opinion, global fiat currencies are headed. We can see it in the insanity of the central bankers and their printing presses.

So what is most likely to enable you to sustain a reasonable standard of living and come out the other side of this reset in a better position? You may have heard of my personal mantra; food, water, energy, security, barterability, wealth preservation, community and shelter. These are all of the things we need to sustain a reasonable standard of living.

You might have noticed that I did not include fiat currency. That’s because, once confidence is lost, it has no market value and therefore, will not do you any good. But real money, physical gold and silver retain their purchasing power because they used across every area of the global economy and therefore, have the broadest base of buyer. In other words, there is ALWAYS demand for physical gold and silver.

Personally, I own both and believe everyone needs to own both. There are those that think silver will outperform gold because, according to the gold/silver ratio, silver is more undervalued than gold. And that could certainly happen in the shorter term (in terms of a trade), history shows us that during a hyperinflationary reset event, gold holds purchasing power (which is really what matters) better than silver.

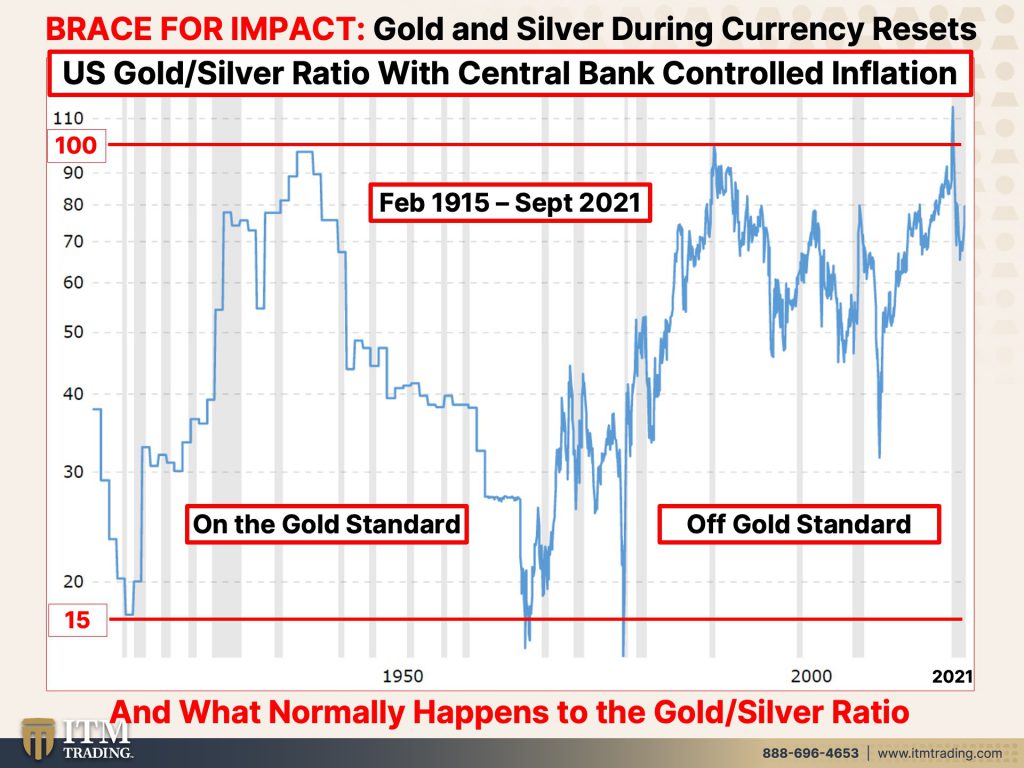

In 1913, 1/20th of an ounce of gold was equal in purchasing power to 1 ounce of silver, this is referred to as the gold/silver ratio. In the US’s central banks “managed†system, we’ve seen the gold/silver ratio go back to those levels several times and some think that will repeat. But what does actual experience tell us? That during a hyperinflationary reset event, gold holds purchasing power better than silver because while both have broad market use, gold is primary a monetarily metal and silver is primarily an industrial metal.

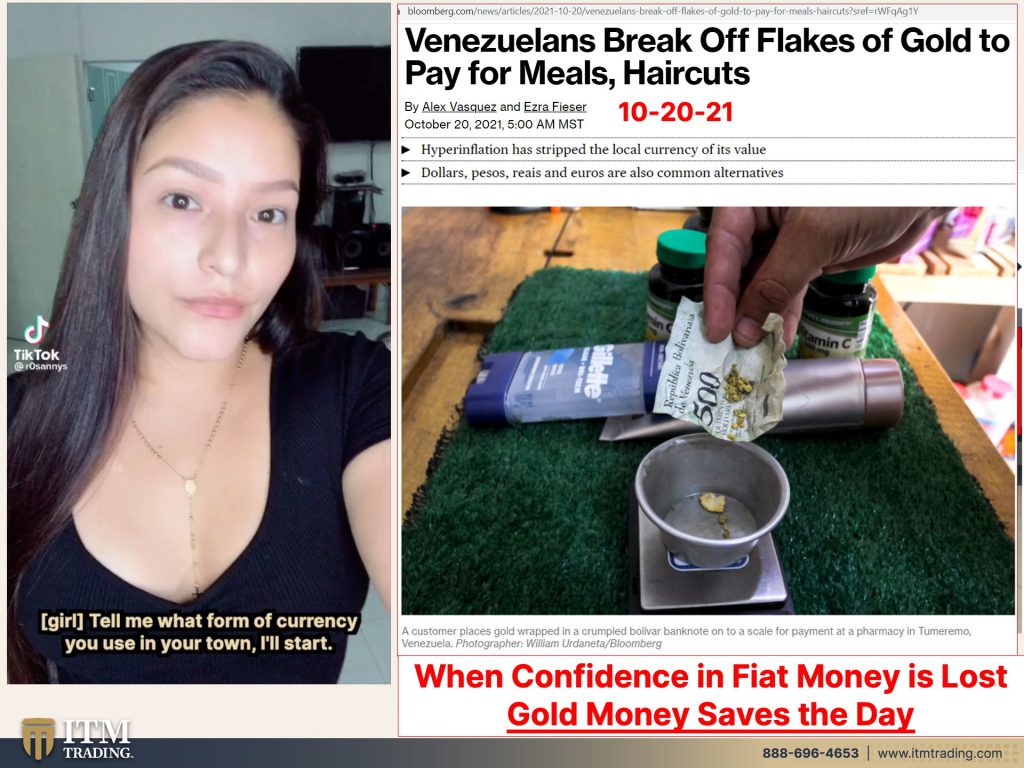

Of course, many people wonder how gold and silver can be used during hyperinflation asking, “who would take it?†To answer that we have only to look at recent hyperinflationary events in Zimbabwe and Venezuela. Where goods and services are actually priced in terms of gold and where gold is the preferred form of payment.

So here are some simple facts. No government mandated and central bank controlled currency has ever held purchasing power over time. One hundred percent of the time they go to their intrinsic value of zero. When governments “officially†reset, they do it against gold because gold is ALL intrinsic value. And I would rather spend silver (more of an industrial metal) for day to day purchases, while using gold for wealth preservation, growth and as a long term legacy for future generations. Because as Alan Greenspan said

TRANSLATION FROM VIDEO:

Before we begin. I have to let you know, I’m going to talk a lot more about this next week, but the yield curve inverted today with the 30 year bond now, paying less than the 20 year bond. So just kind of hold that in your hat because it’s really significant and just happened today. So I wanted to make you aware, but what I really want you to know about today, you know, the big question is how do I properly prepare for the global reset? What steps do I need to take to protect the wealth that is rightfully mine and that I’ve accumulated. And then how can I sustain my standard of living when everything else is collapsing all around me, just as important. How can I position myself for the greatest opportunities in both the pre and post reset environment. These are the subjects I’ve been studying for over 50 years, and this strategy has become part of my life’s work. I mean, it is really my life’s work. And so the first thing you must understand is how gold and silver perform in a complete hyperinflationary. And then the subsequent currency reset, because it’s very different than what you’ve traditionally been taught. I’ll show you the facts and all the data coming up.

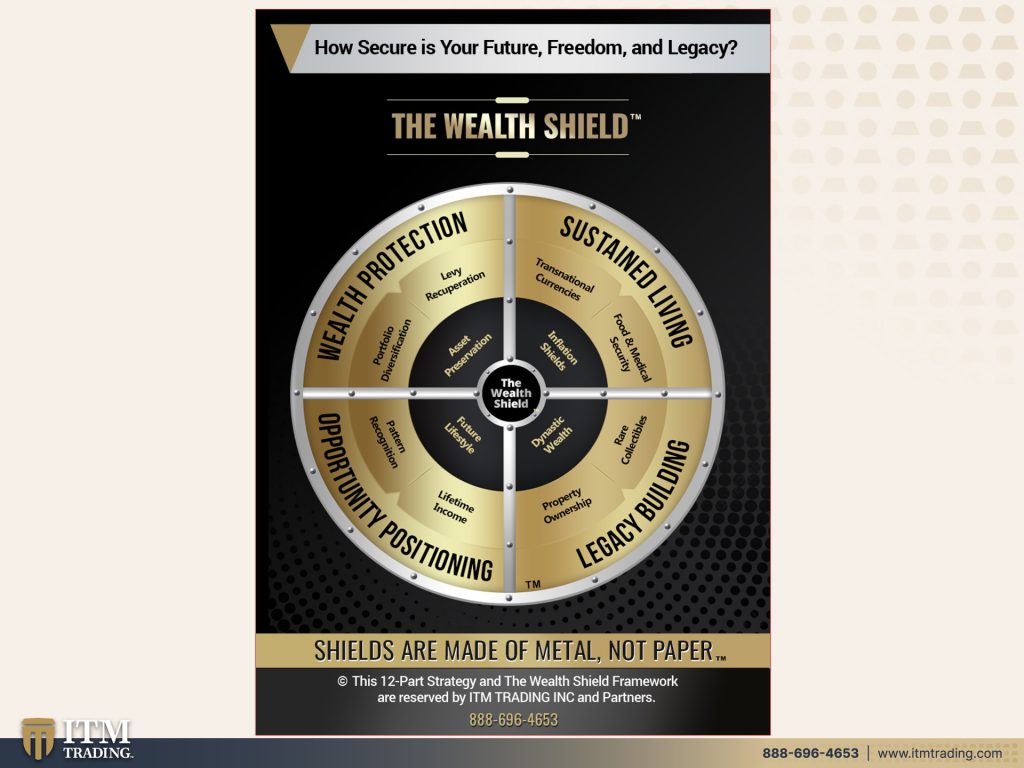

I’m Lynette Zang, Chief Market Analyst here at ITM Trading, a full service, physical gold and silver dealer specializing in custom strategies. This is our wealth shield. And the reason why I’m bringing this up is because we’re going to look at all of these pieces briefly today. But before we start, what I want you to understand is in this country, in the U.S., Here’s a dollar bill, here’s a silver dollar, and this, my friends is a gold dollar in 1913. All of these bought the same amount of goods and services. And can you kind of see the difference here between even the golden, the silver? So now let’s begin. I get so many questions on the gold silver ratio and people think, well, silver is way more undervalued than gold. So I should be buying all of this silver because it’s going to go up and blah, blah, blah. and I’m not saying that it’s not severely undervalued, both gold and silver are severely undervalued, but if you’re thinking about it, because you think it’s going to go up more than gold, then you’re thinking about it like a trade. And while trading may be fine at some time, that’s not always the case. And in a hyperinflationary reset event, this is not a trade. So these are the things that we’re going to talk about. And specifically even using gold and silver during hyperinflation.

But let’s just start with the gold/silver ratio in the U.S. Because that’s frequently what others will talk about. But what you have to understand about this is that this is the gold silver ratio with the central banks, controlling the inflation, and also how you think about gold and silver. Okay. So you can see the top part of the range. You can see the bottom part of the range, that 15 to one, that’s what the gold silver ratio is. You know, just like these two pieces. That we’ve got here’s one ounce of silver and one 20th of announce of gold. And these were equal in the beginning of this trend cycle. Clearly they’re no longer, you can also see what it looked like when we were on the gold standard versus going off the gold standard. What we’re talking about today is not a central bank controlled inflation rate, or, you know, or the central banks and the governments wanting you to think about gold and silver in a certain way. We are actually talking about when they lose control. And that is a huge difference. So let’s just dive right into that. And we’re going to start with I’m going to keep on the dollar for just a minute, just to show you, I’m sorry. Even as we were in a controlled environment all of these years.

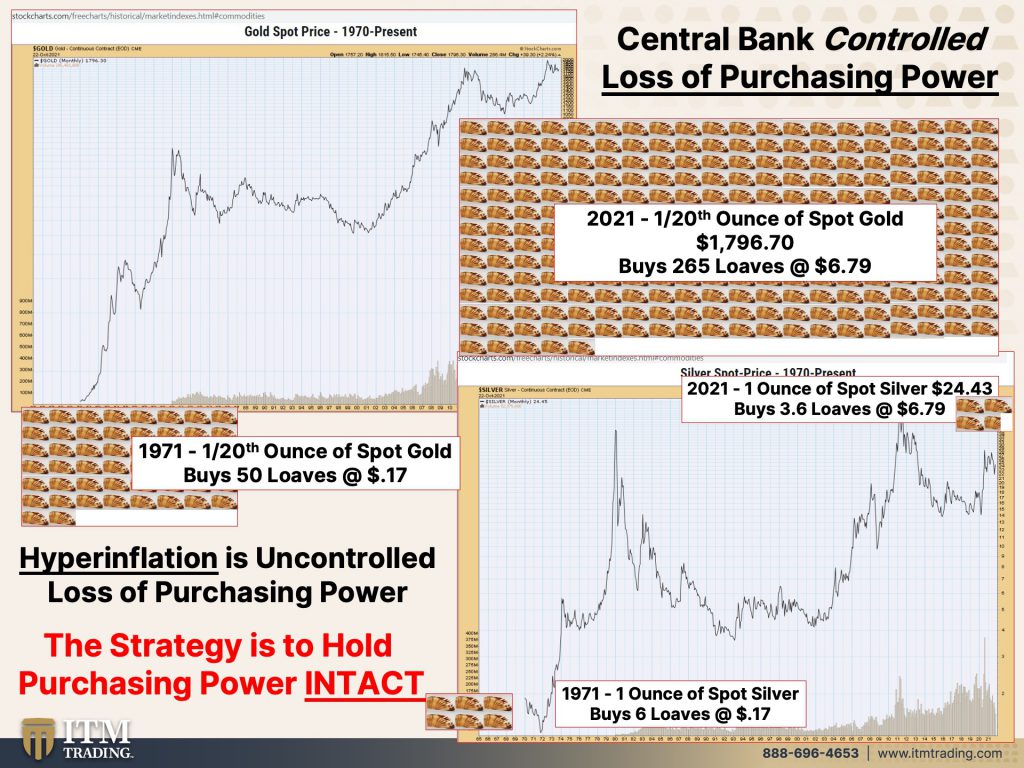

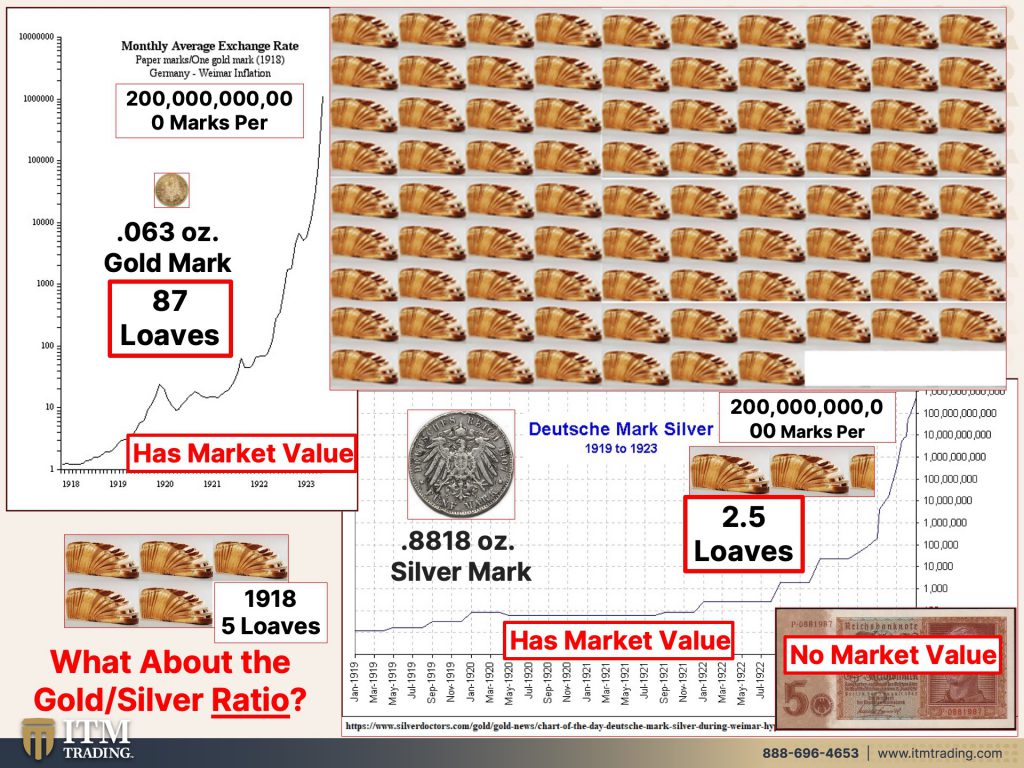

Okay. Well, back in 1971, when we completely went off the gold standard, you know, a 20th of an ounce of gold, this little teeny piece of gold could have bought you. Let’s see how many 50 loaves of bread when I did this. So just the other day was spot it’s a little bit higher now, or it could be about this range. Doesn’t matter. It would buy you that same little 20th of an ounce of gold would buy you what 265 loaves of bread. So clearly, I mean, wow, you could get about five loaves of bread back in 1971. Now you’re not even getting one loaf of bread with this. Okay? Now let’s look at silver in the controlled environment, because here it is, all right, in 71, you could buy six loaves of bread. And recently you could buy three and a half loaves of bread with this one ounce of silver, which is still more than what you could buy with this paper dollar, see the point. But hyperinflation is the uncontrolled loss of purchasing power. When the central banks lose control, when will they lose control? When you lose all confidence in the currency and you make different choices than staying in the currency, the whole point is to keep your purchasing power intact over time. And this is what’s happened to other places, okay? Here’s the German mark. And, and this is not the worst case of hyperinflation. It is the most well-known. And you know, I have naysayers out there that will say things like, well, that one doesn’t count or that one, well, guess what? When they all point to the same picture, yes, they’re all a little different, but frankly they all count in my opinion. So back in, you know, a loaf of bread was a mark. So back in 1918, when a Mark could buy a loaf of bread by 1923, it took, oh, let’s just see this hundreds, thousands, millions, 200 billion marks to buy that same loaf of bread. Let’s just look at this a little bit differently. And let’s look about, look at that gold silver ratio, because here’s the gold mark. And I mean, keep in mind, this is about the size. Can we see that this is about the size of what we’re talking about, right? 20th of an ounce of gold. So there you go. Now there’s the Deutsche mark, which is roughly, I mean, these sizes will be a little off, but you get the point. Okay. So both of them were equal in 1918 and they could buy five loaves of bread.

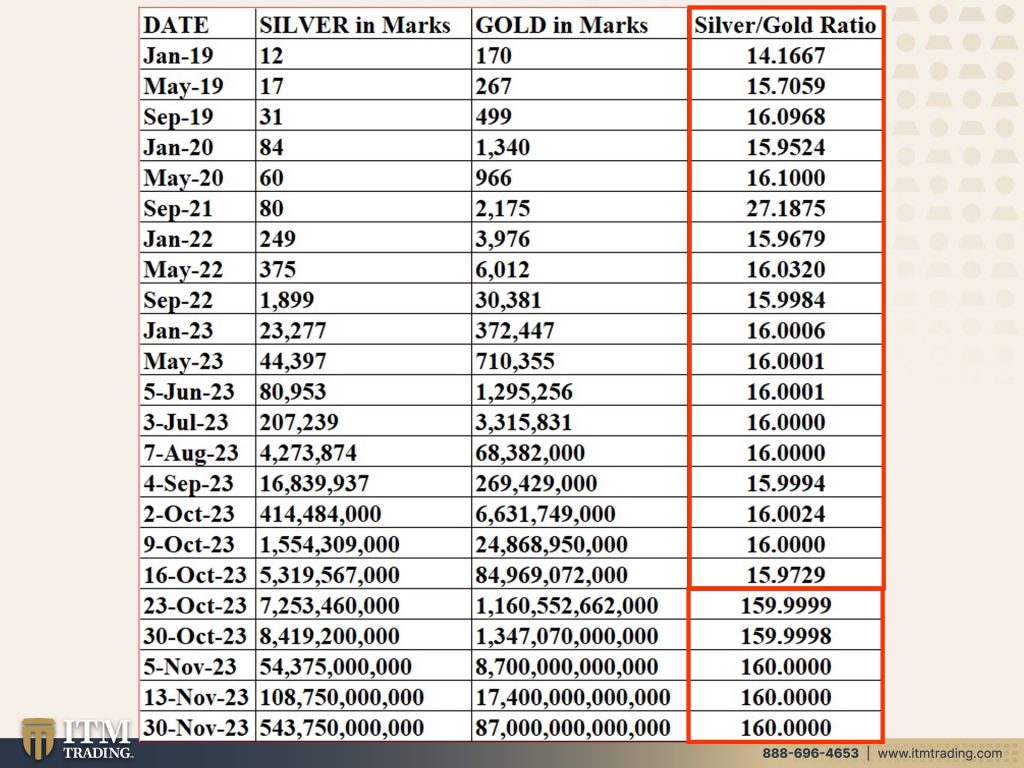

Then the price per mark went up. Now, obviously the gold still has market value. And wow, look at how many loaves of bread that that could buy, which is a lot, I think it’s 87. I’m sorry. There it is. Is 87 loaves. Whereas the silver mark also went up. You can see that in terms of the Deutsche mark, but it could only buy two and a half loaves of bread. So I think it should be pretty clear from this, that gold holds its purchasing power value better than silver during a currency hyperinflation. And then let’s look at it when we go to the reset because in a reset, I mean, in, during these circumstances, the mark has no market value. Nobody wants to buy it, hold it, or use it for trade because it’s losing value very quickly because all confidence was gone. This is what that looks like in table form.

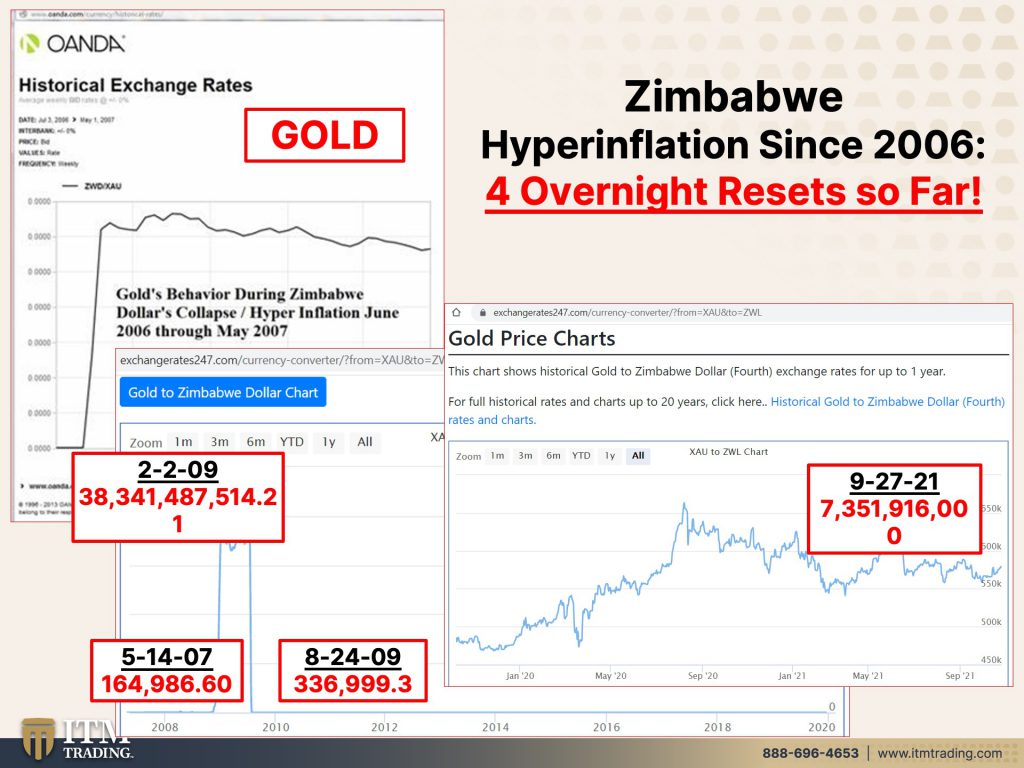

And you know, it did hold its ratio pretty good for a while until it didn’t. So, you know, if I’m looking at..and I own both. I absolutely on both. I think that just for size wise, I think everybody needs to own both, but for me, this is about the barterability and this is about wealth preservation. And then actually, even this is about growth. We’ll get into that more. Okay. So there’s the Deutsch mark, and I’m doing these pretty quickly and I just have three examples for you Zimbabwe, right? Well, so this is new. This is, well, it’s not new, but it’s recent and it’s still going on. They’ve had four count them four overnight resets so far. And they even went as far for about five years actually allowing foreign currencies to be used in their country because nobody trusted the new Zimbabwe dollar. This is what gold looks like in a reset, right? It just goes straight up. It just goes straight up. Now you can see it over here. This is going back as far as I could this graph on on Gold’s behavior. And then when they reset the currency, it’s not that gold dropped it’s that they reset the currency. So when they do that, this is another question I get all assets reset, except for debts somehow. I mean the bonds reset, but your debt somehow kind of maintains the value of the debt that you held. So this is what it’s done since 2009. And this is where spot gold is in Zimbabwe dollars. Now we’ll look at silver same way. Okay. They both, when they did their first reset back here in 2009, well, you can see both of them gold and silver. They look pretty much the same and when they did that reset and so all assets in terms of that currency, okay, they all go to zero stock markets look like this too, by the way.

And you can see it’s gone up from there, but now let’s take a look at the performance between gold and silver through frankly lots of Zimbabwe resets, because again, they’ve done it for count them four times. And here you go, where you’ve got gold that went up over 232,000 times. You had silver that went up 180,000 times. So definitely better than holding this garbage for sure on both gold and silver, but this is not a trade. And I hope you can see that it’s not a trade it’s about functionality in the last part. So since 2009, where gold has gone up in terms of the Fiat over almost 22,000 times, silver has gone up 1.46 times. So there you are in the Zimbabwe dollar and you can see that gold has outperformed silver since 2007. But again, who cares about the Zimbabwe dollar? Are you going to sell your gold or silver and turn them into Zimbabwe dollars? Heck no. Only if you’re going to immediately convert them into a good or a service and it should be clear that gold has held its purchasing power better than silver.

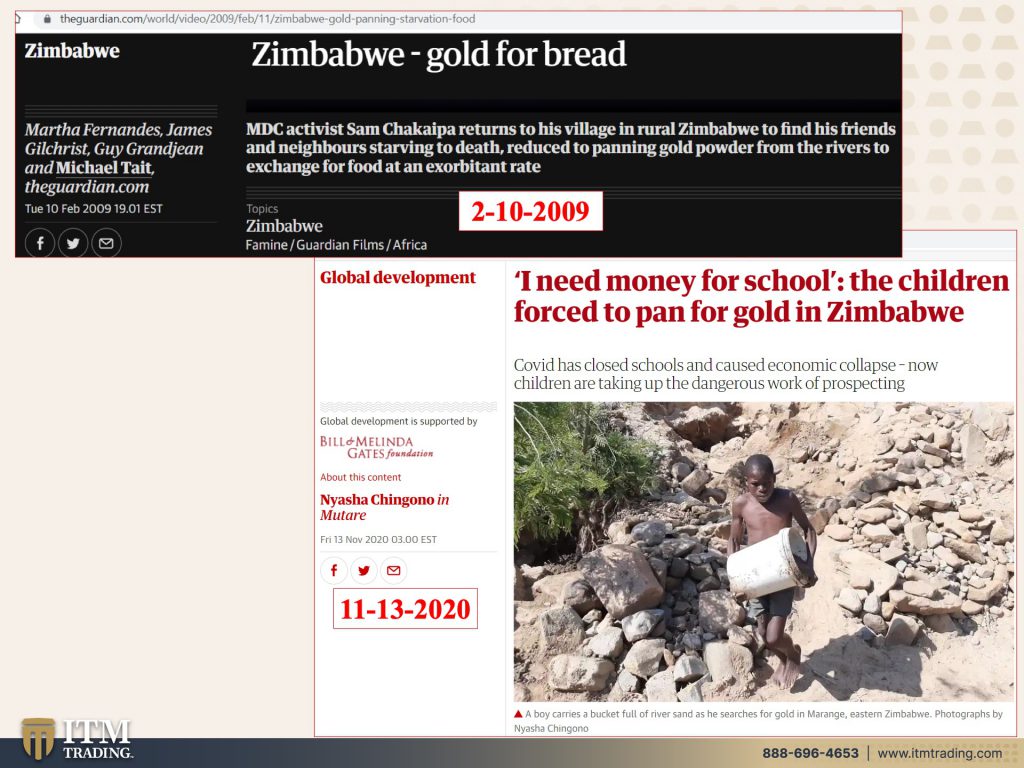

And by the way, when you’re talking about use, and we will be doing this more a little bit later in this in this video, but what do people do? They go out and they pan for gold in Zimbabwe and other places too. It’s not just there, but Zimbabweans went out panning for gold so that they could eat so gold for bread. They did that in 2009. And guess what? They’re still doing it because that hyperinflationary event is not over because lopping off all of those zeroes and they’ve lopped off a lot of zeros and tried a whole lot of financial shenanigans that doesn’t fix the problem because they don’t stop printing and spending. They don’t change behavior. They just change how that behavior is accounted for. And that’s why when you hear the term nominal or notional, you know, that whatever it is, that’s look that you’re looking at. Isn’t what you really think that it is. Even if you don’t understand it, you hear that term nominal or notional. Doesn’t mean anything? A trillion times zero, zero, you’ve got Zimbabweans that are billionaires, but they can’t buy eggs or a loaf of bread unless they have gold. Very simple.

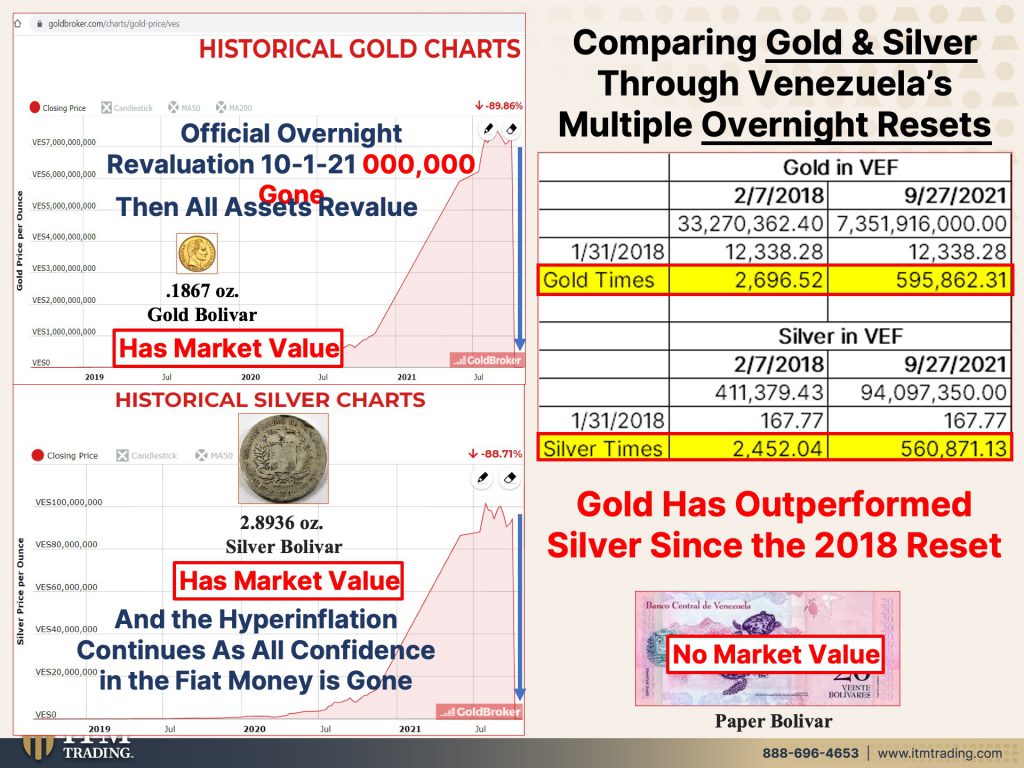

Now we’re going to talk about Venezuela, which, you know, I mean, both these countries I’ve been following and talking about for all these years, again, whether it was the currency or an ounce of silver, well, this is actually a lot more than announced. This is, and then I didn’t fix this. Forgive me. I just noticed it error in here because I used to have four of those silver dollars up there, but the rest of it will be calculated in an ounce. And here’s your little teeny piece of gold, so same kind of thing. And these are all coins by the way. But over in Venezuela. Well, we know they did an official reset back in 2018 and both gold and silver went up substantially in terms of the Venezuelan bolivar, but who wants the Venezuelan bolivar? And what happened to that gold and silver ratio after that, let’s take a look at it because it’s continued to move up again. When they do a reset, the it’s the value of all assets in terms of that currency, that’s been reset. So into that new currency and you’ll see a drop and we’re seeing it again because they just did another reset on October 1st. So like a month ago, here’s your silver, there’s your gold overnight official rate on October 1st, they lopped off six more zeros. That’s why you see this implosion. You see the same thing in the stock markets as well, but you can only convert those stock markets into the currency that’s died. What good is that? It’s no good at all. And the hyperinflation continues because they do not change their behavior. So, you know, again, both of them are performing and they are protecting whoever holds them, they’re protecting their purchasing power, which is key to sustaining your current standard of living. But this is not yet over. So we’ll just keep watching and keep going for it. Gold has again, out performed silver since the reset. What about the currency? It has more value as a napkin for an empanada. It has no market value. So how are people managing and how are they living on a day-to-day basis? Well, let’s take a look.

Now, first of all, I wanted to put this piece in here back from 2018, because if you have anything of value, you’ve heard me say this many times, first of all, anything that’s physical, there’s a finite amount and it is barterable gold and silver are more universally barterable. So in any form gold and silver are monetary at its base, is buying jewelry the most efficient way to buy it? No, it has a much bigger markup than buying coins do. And this is a little bit more recognizable, but is it money? Yes, it is gold and silver in any form is monetary at its base. And so a lot of people have sold and converted into the currency just to try and feed their family and keep things going then as well and sell gold and silver chains, bracelets, earrings, including pieces that have belonged to their families for decades or generations. So they can walk out the door of the pawn shop with enough money simply to eat at least for a while. Now, imagine if you actually planned for this eventuality so that you didn’t have to sell your heirlooms or your jewelry that you had your barterable position to go to the store with and your wealth preservation position, so that you’re holding your purchasing power intact over time. Now let’s kind of hear what that’s and see what that sounds like because you saw that other was 2018. This is a recent article in Bloomberg. Although I showed you this video before for those that have been watching me for a while back in July, let’s let’s look at that.

ENGLISH TRANSLATION: [girl] Tell me what payment method you use in your town, I’ll start. [girl] Here I am at a Chinese supermarket, we are seeing that the unit prices are in dollars/bolivars. The prices per bulk, labeled 0.4, 0.6, etc, That is in gold. Everything in bulk is in gold. Okay, then we are going to review the small items where they are all marked in dollars. Then I am going to weigh what corresponds to me in this pot weighing in gold. [girl] How much is it? [cashier] In gold or dollar. [girl] In gold. [girl voiceover] Here, I bought one soup and paid in gold. [girl] How much is it? [cashier] one point. [girl] Here it is. [girl voiceover] We use the low-denomination banknotes to wrap the gold. In this case we weighed a point and the rest was paid in cash/bolivars. [cashier] Everything else in cash? [girl] The rest in cash!

So I hope you can see it’s easily usable it’s global money. It has value no matter where you go on the planet. So while anything physical or any talent you possess is barterable gold and silver are universally recognized, universally barterable and therefore easier to barter with. And there’s some real life experience of what’s happening in Venezuela right now. So instead of selling their jewelry like they did, well closer to the beginning of this mess because Venezuela as well has been in hyperinflation for a while. Those that have the gold, see the difference between the rings there, you had to go to a middleman and they took their cut here. Now you just do it directly with the vendor, with the gold that you need, or the silver, you know, interesting fact, I couldn’t find a whole lot about the use of silver in Venezuela for the same function that I found is gold. But for me personally, since I’m all about function, silver, I would rather spend silver that has less value to me because this is an industrial metal. And we are going to talk about why gold outperform silver at the end of this video. So you’ll see that then.

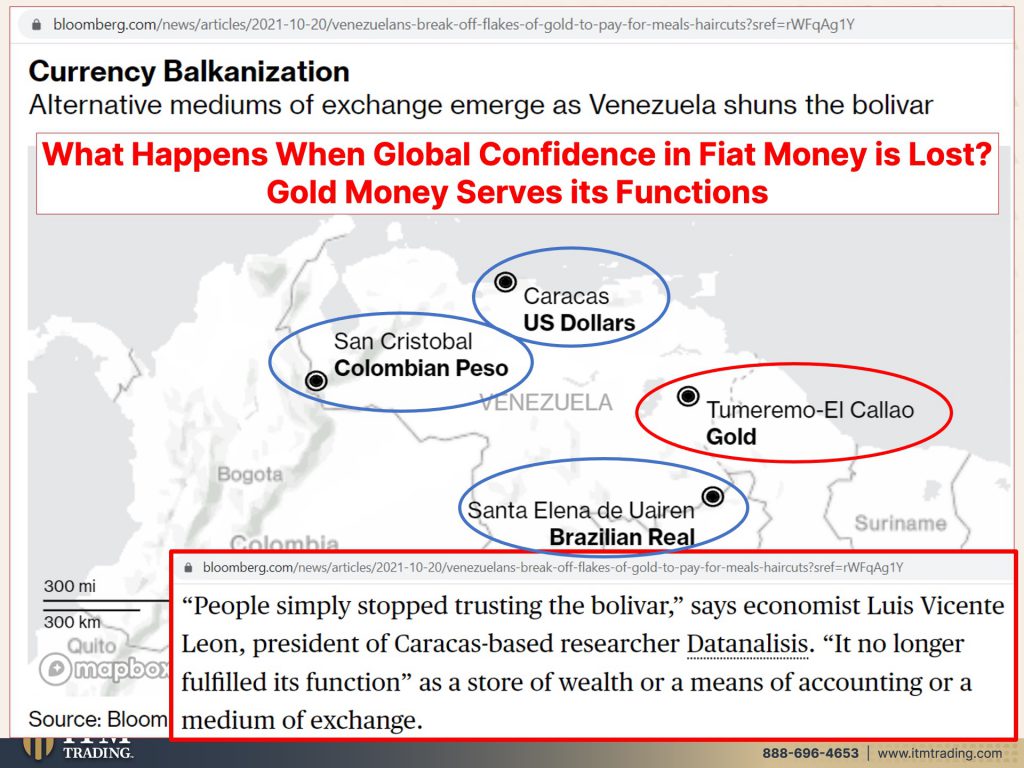

But gold money saves the day when all other currencies fail because in Venezuela, while they’re using a number of currencies and they say, people simply stopped trusting the bolivar That’s that loss of confidence that we talk about. Let’s see, it no longer fulfilled its function as a store of wealth or a means of accounting or a medium of exchange. And it didn’t perform the function of a means of accounting or a medium of exchange because it lost all of its value and look. There is, I didn’t bring pennies out here, but there’s less than 4 cents. There’s just about 3 cents left out of the original value of this dollar. I don’t want to throw it away in case I need it again, but, and only for showing purposes. So in Venezuela, they’re also using U.S. Dollars, the Colombian peso, you know, but, and Brazilian real. And I want you to keep in mind, they’re using the Brazilian real and I’m going to show you why in just a minute, but what happens since this is a global issue? What happens when all confidence is lost in the fiat money system, period, all of it, well then gold money serves its function, it rides in, and it really saves the day and where all of these are easily inflated away. And devalued gold does just the opposite because it is a savings based money and it has utility across the entire spectrum of the global economy. And we’ll look at that a little bit more.

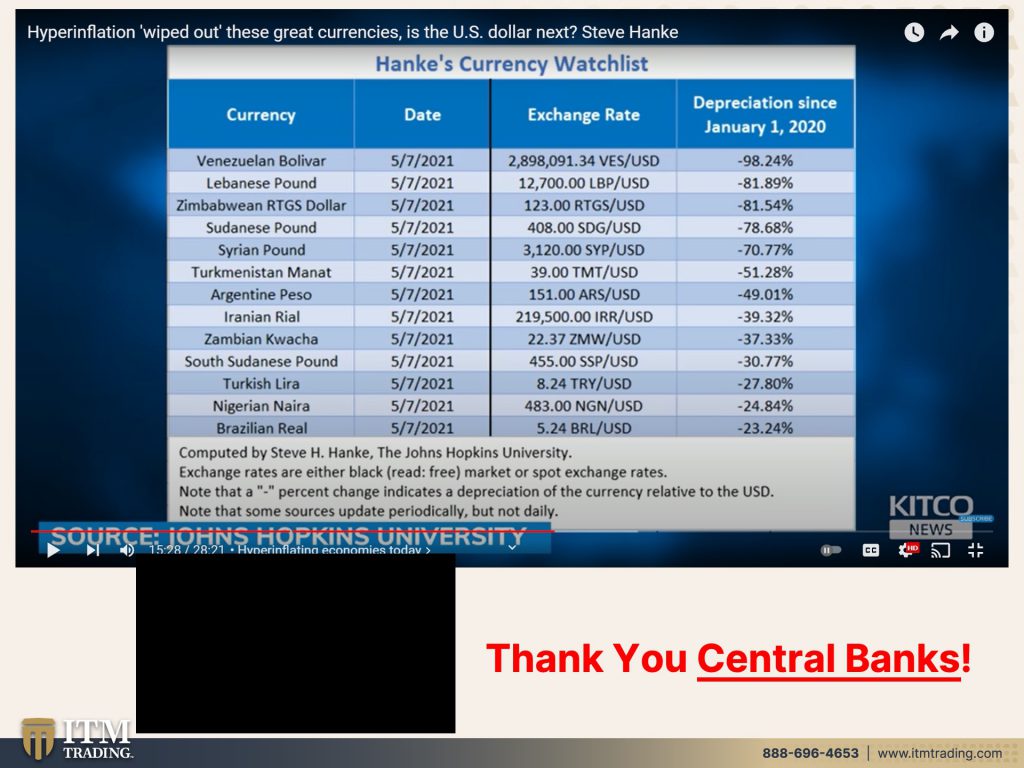

Now, many of you, if you’ve been watching me for a while, you’ve seen me use a lot of Hanke’s things on hyperinflation and he has a currency watch list, but I came across a very interesting interview. I’m going to, we’re going to try and get him on Coffee with Lynette. If anybody out there has a connection with them, we’ve tried before, but we’ll never give up until it happens. But listen to this interview that he did. And you’ve got the links on the blog:

The amount of value that these currencies have lost. That’s a, that’s a very easy way for people to get a handle on, correct. We’re talking about currencies failure and so failure to hold or domestic and international purchasing power. And as you can see, I mean, you, you start with with Venezuela 98% of its value and a little over a year, Lebanon on 82% a little over a year and Zimbabwe 82%, Syria 78%, 79%. And on down the line, the bottom one, there is a Brazilian real. It’s lost 23% of its value a little over a year. So it’s, it’s, it’s, it’s really a failed currency. Anyway, you cut it. The Nigerian naira they’ve lost 25% a little over a year. Turkish Lira is a big one, 28% loss. So the Iranian rial 39% Argentine peso 49% Turkmenistan manat 51%. So all of these are really failed currencies. All of them are produced by central banks. Central banking is the problem because the government, the government can’t finance it’s expenditures. And when they can’t, they run to the central bank and they say, turn on the printing press and print money. And when you do that, ultimately, you got a lot of inflation. So that means that domestic purchasing power, which is wiped out…And, and obviously with the depreciation rates, like the ones that we just looked at, they failed internationally. So you can’t buy anything internationally because to do that, those junk currencies as failed currencies ended the U.S. Dollar and, you know, get anything. I have a quick question about Lebanon. It’s interesting. Now officially the Lebanese pad is packed to the USD. So how is it that it’s able to appreciate the depreciate by 80%? Can you explain, can you explain it The only way [inaudible] black market and, and these depreciation rates that we’re seeing on this screen. Now I follow the black markets and all these countries every day. So, so the black market is the free market for the currency forget the official peg. It’s irrelevant. Not no, no, no, no one is no one is getting foreign exchange of the official exchange rate. Let’s Talk about policy now.

So thank you, central banks, you know, I mean, we know the central banks are the problem, all of this financial engineering and all of this, you know, all of this jury rigging and there are always unintended consequences. And honestly, do you really think this time is different? And do you really think we’re different because of the U.S. Because frankly we’re leading the charge. Well, maybe Japan led the charge, but they weren’t as powerful as the U.S. And we’ve been losing our position on the global financial stage. Let’s face it. So do you think that it might just be possible that we would lose global confidence, but if it’s happening to all of the currencies at the same time, which it is then where are you going to run? This is what you’re going to run to, right here, gold and silver. This is what you’re going to run to, because that is real money and it has value.

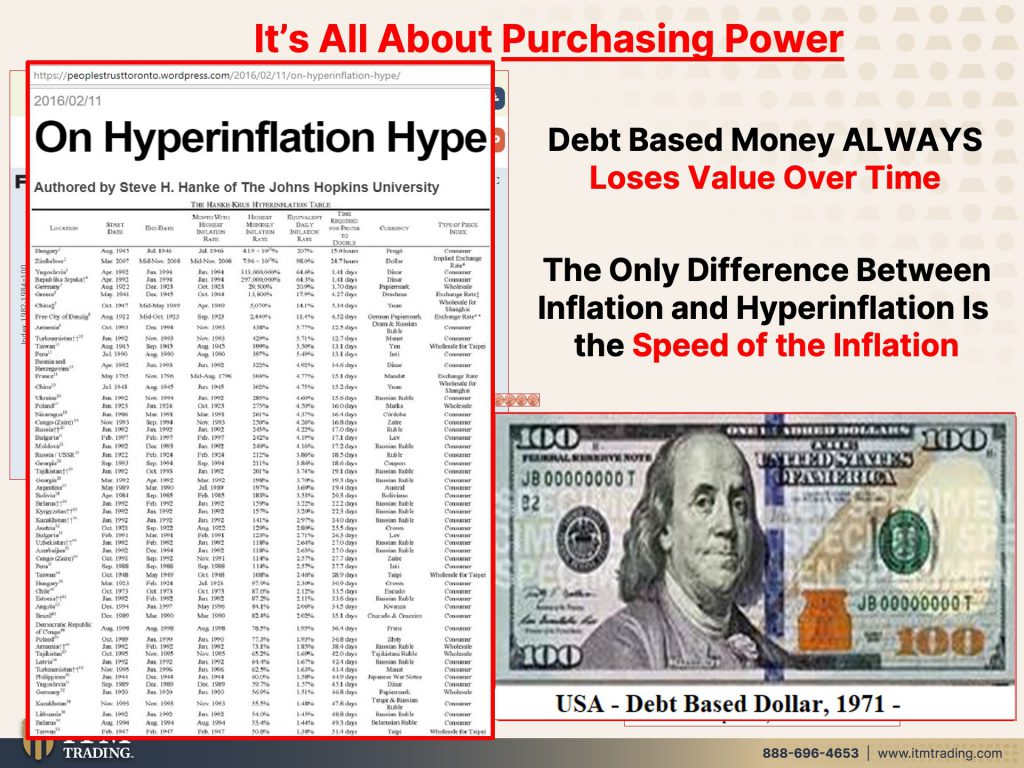

But let’s look at this inflation because it really is all about purchasing power. So we think, well, this is a dollar bill. Guess what? It was a dollar bill. Back in 1913, it was a dollar bill in 1971, but it doesn’t buy, nominally it’s identical, but it doesn’t buy the same. And you know that, I mean, that is, we’ve all, we all have that same experience, no fiat currency that has ever, ever, ever been created has withstood the test of time. The Ingenious experiment that the central bank has done these days, or since its inception in 1913, is to control the rate and speed of inflation. So they talk about deflation all the time. Let me just go back here for one second. This is deflation, excuse me.

Oh, I just got a tickle in my throat. I’m sorry. The stock markets or Fiat money assets declining that deflation. And there’s only one way to fight deflation and that’s with inflation. So into this next crisis, what are they going to do? Same thing that they’ve done, print more money and debase the currency, create more debt that can never, ever, ever, ever be repaid. They can do that until confidence is lost because I’m telling you the only difference between inflation and hyperinflation is the speed of that inflation. There are over 4,800 currencies that simply do not exist anymore. These are purely government based currencies, but gold and silver has been around for thousands of years. It is proven. It has with stood the test of time. And my bet is it always will, because much as they’ve tried to duplicate the features of golden silver in the lab, they’ve never been able to do it. So there’s really no substitute. Is the dollar going to be next? Yeah, of course it will be. And so all the Euro, and so only yen, because this is a global issue. People say, well, where can I go? You can go wherever you want, but is it going to be different wherever you go? Probably not. This is a global issue.

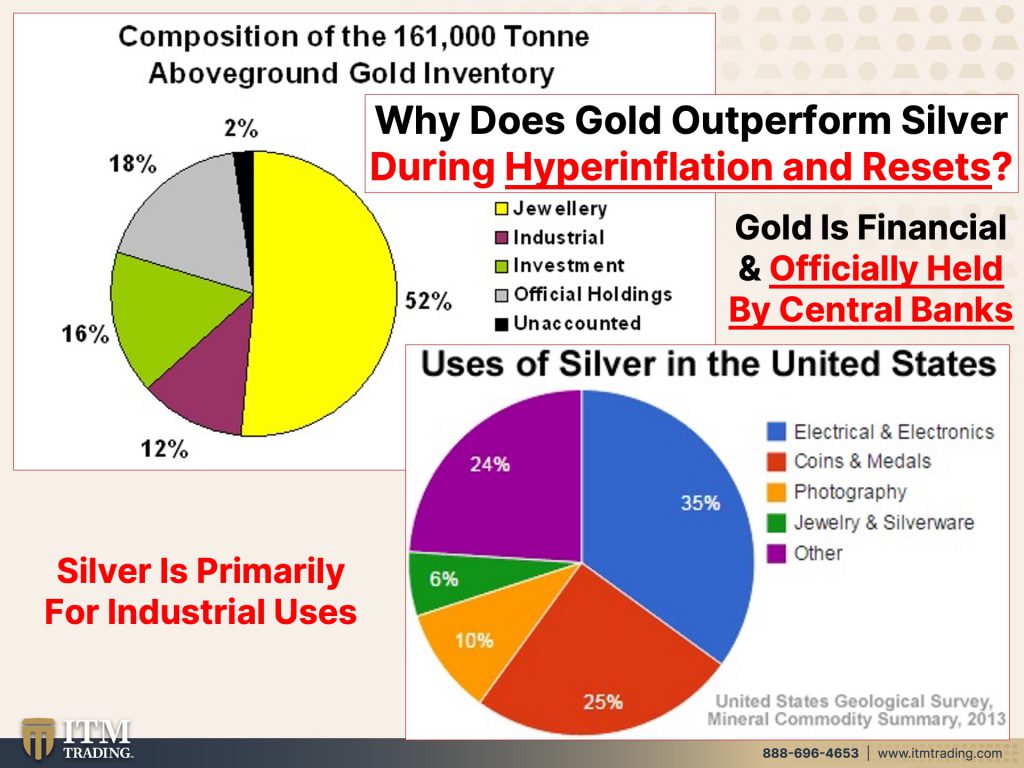

But the question is why does gold outperformed silver during hyperinflation and resets? So, I mean, that’s a good question with everybody going, oh, silver, silver, silver. I like silver. Do not get me wrong. I own silver. I like it, but I like it as barterability. But the real reason why gold outperformed silver during these events is because it is primarily while it’s used across the entire spectrum of the global economy. It’s primarily a financial instrument and central banks hold gold. So it’s classified by them as money. What does the Bis say, Bank for international Settlements? Gold is the only financial instrument that has no counter party risk. The only one. Okay. How about silver? Again, It’s used across the entire spectrum, but it is primarily an industrial metal. What happens during hyperinflation? Well, you know, have you heard of the great depression? So industry slows down. You know I don’t have technical confirmation yet that we have entered the beginning phases of the hyperinflation. I don’t, so I can’t say it because I don’t, but my head, my gut, my heart is telling me that we have begun the transition and central banks on a global basis are fighting like crazy. The deflating of the, of the stock market of the real estate market of the bond market. But we’ve got the world anchored near zero, even experiments to raise rates since 2009, every single one has failed. So what choice do they have really? But the same thing that didn’t work, the only tools they have are to use the same tools again, which are interest rates and money printing, but we’re anchored to zero. So that means we’ve got to go to negative rates and remember the yield curve inverted today, the yield curve inverted. We’re going to talk more about that next week.

I was very excited to present this to you. I hope that you got a lot out of it. I want you to know that if you go on our blog, that you can print out all of these graphs, you’ll have all of the links, use them, do your own due diligence, going into hyperinflation and going into the reset. This is what you want. There is nothing else that is proven to protect you. So this will protect you the best you need both, for me. This is about barterability. This is about wealth preservation, and I want to go back to the basic strategy. This is the wealth shield, and it’s based on my studies that I did since 1987 on currency life cycles. So you’ll have your wealth protection, your sustained living, your opportunity positioning and your legacy, building the foundation of all of those as gold and silver. But, in order to weather the storm, you need food, water, energy, security, community, and shelter as well. This is not the time to hesitate. This is not the time to worry about the manipulated spot market. This is not the time to wonder was silver is going to go up more than gold or is gold going to go? You need, you need them both for different reasons. So you can call the link below the Calendly link horse, or rather click on that Calendly link below and set up your meeting with one of our consultants to go over how this wealth shield can protect you. And until next week, please be safe out there because it is a hundred percent time to cover your assets. Buh-Bye.

SOURCES:

https://www.macrotrends.net/1441/gold-to-silver-ratio

https://stockcharts.com/freecharts/historical/marketindexes.html#commodities

https://www.exchangerates247.com/currency-converter/?from=XAG&to=ZWL&data=historical

https://www.exchangerates247.com/currency-converter/?from=XAG&to=ZWD&data=historical

https://www.investopedia.com/terms/forex/z/zwd-zimbabwe-dollar.asp

https://www.exchangerates247.com/currency-converter/?from=XAG&to=ZWL&data=historical

https://www.exchangerates247.com/currency-converter/?from=XAG&to=ZWD&data=historical

https://www.goldbroker.com/charts/gold-price/vef

https://www.miamiherald.com/news/nation-world/world/americas/venezuela/article222199935.html

https://www.youtube.com/watch?v=j5rNRY40uPo&t=1110s

https://www.cato.org/research/troubled-currencies

https://www.cato.org/commentary/hankes-inflation-dashboard-currency-devaluation-delusion

https://geology.com/minerals/gold/uses-of-gold.shtml