GOLD & SILVER MISDIRECTION: Everything is a Distraction from the Truth.

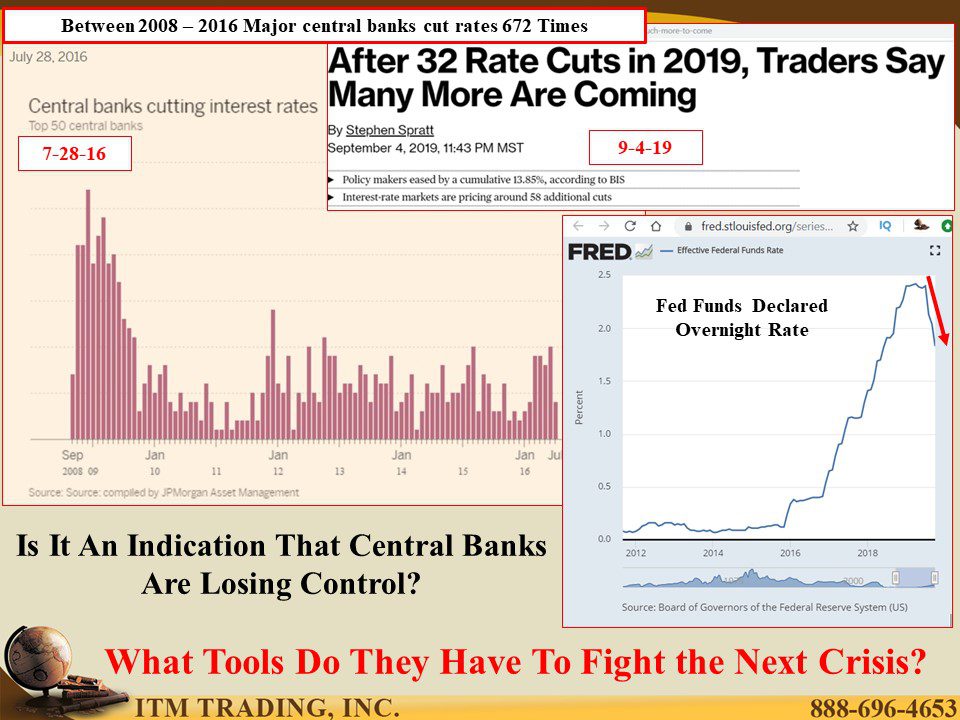

By September 4th, 2019, global central banks had cut interest rates 32 times and markets anticipated 58 additional cuts because the global economy was marching steadily toward a global recession. Stock markets were struggling, though still considerably higher than the end of 2018.

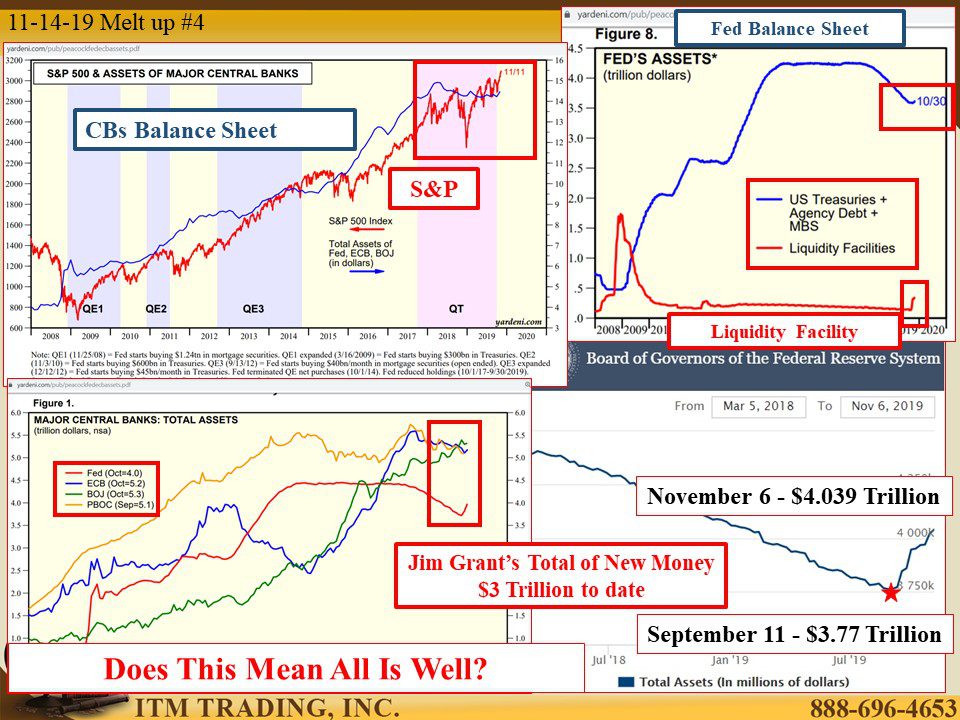

Then on September 11th, the repo markets froze when banks would not loan to each other and the federal reserve came good on its pivot promise of “Ample Reserves,” which is just another way of saying, banks can have as much new money as they want. Since then their balance sheet has grown from $3.77 trillion to $4.039 trillion on November 6. In addition, the Fed used their liquidity facility to inject even more in the banking system according to Yardeni Research.

Have more questions that need to get answered? Call: 844-495-6042

A major pattern shift happened on November 7th, global interest rates spiked up dramatically. With debt at nosebleed levels and the need to roll over and add to those debt levels, this shift poses significant risk to the already precarious global economy.

In addition, stock markets climbed to new highs with the fed promise of unlimited new money, also referred to as “Ample Reserve Policy,” woo hoo! According to Jim Grant on CNBC this morning, that total is now at $3 trillion with the expectation it will hit $10 trillion by years end. Can you wrap your head around those numbers? The last time we saw this level of injection was 2008, as the financial crisis was unfolding.

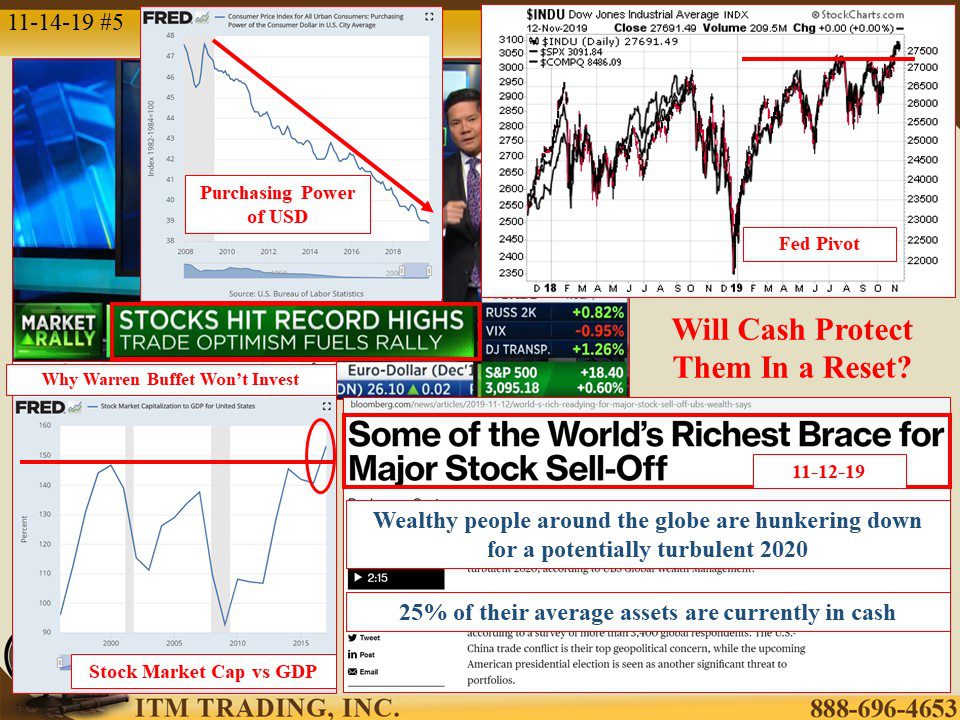

Yet magically, main street media is telling us that everything is looking so much better and that justifies higher stock prices even as many of world’s wealthiest investors sit on the side line and prepare for a “major stock sell-off†and the purchasing power of the dollar sinks to new lows.

And with no new positive changes, it is now risk off and spot gold and spot silver prices decline. For me it is an opportunity to buy physical gold and silver cheaper, just like many global central banks are doing.

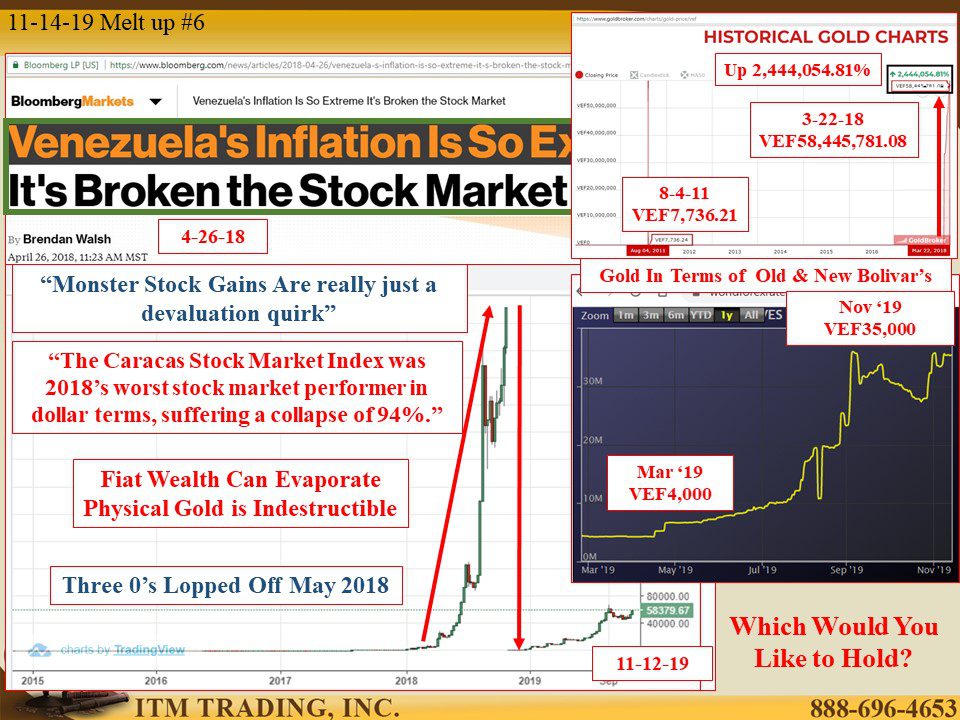

Perhaps they recognize the lessons from Venezuela whose stock markets soared 73,000% in 2018. Of course, that was in nominal terms. In valuation terms, because of devaluation, it actually dropped 94%.

But gold did what it’s done for 6000 years. It held its value and enabled those who hold it outside the fiat financial system, to remain self-sufficient and thrive.

Slides and Links:

https://www.bis.org/statistics/cbpol.htm

https://fred.stlouisfed.org/search/?st=Effective

https://www.bis.org/statistics/cbpol.htmYardeni.com/pub/peacockfedecbassets.pdf

https://www.yardeni.com/pub/stmkteqmardebt.pdfhttps://stockcharts.com/h-sc/ui

https://www.bis.org/statistics/cbpol.htmhttps://fred.stlouisfed.org/series/CPIAUCSL

https://fred.stlouisfed.org/series/DDDM01USA156NWDB

https://tradingeconomics.com/venezuela/stock-market