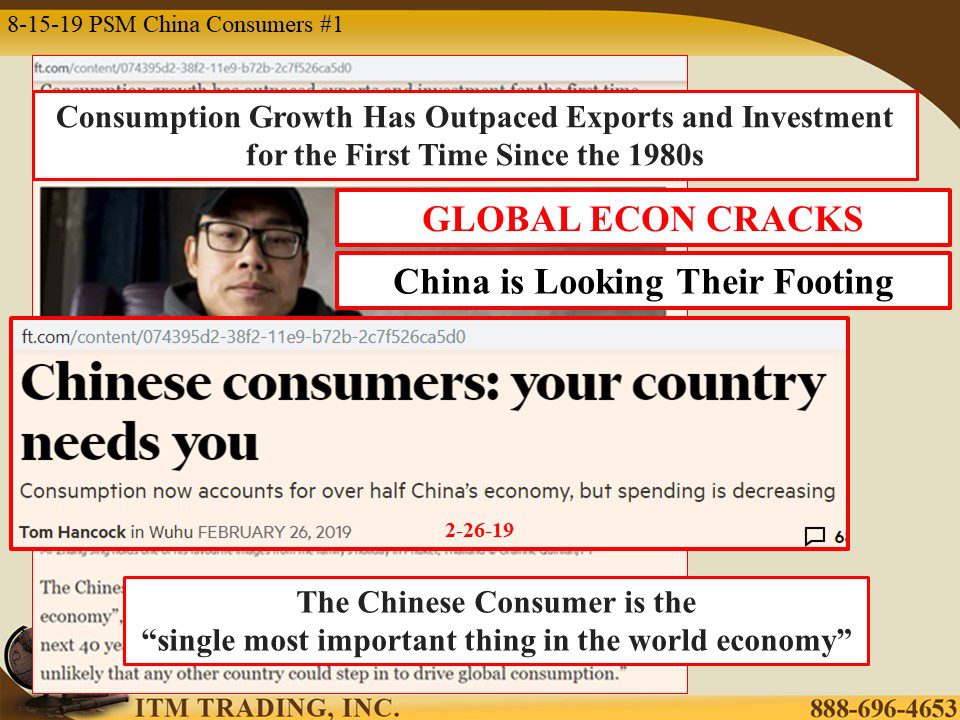

GLOBAL ECON CRACKS: China is Losing Their Footing

Like the US did in the 1920s, China has been shifting to a consumer driven economy. In fact, consumption growth has, for the first time since the 1980s, outpaced growth in both exports and investments and now accounts for a full 76% of China’s GDP. So, it’s easy to see why the Chinese government is counting on the consumer to weather the current economic decline that was foretold by its yield curve that first inverted on May 11, 2017.

In 2011 the consumer contributed less than 50% to the GDP. How did they accomplish this huge surge in consumer spending? By encouraging a huge surge in credit/debt and the use of technology for payment. The easier it is to pay, the less we realize what we’re spending.

But incomes were also rising as productivity rose until 2018 when the trade war began, exports slowed, and supply chains began moving to other countries. Income gains slowed and living costs continued to inflate causing consumers to save more and spend less on autos, real estate and other luxury goods.

What tool do central bankers use to encourage spending? Making credit available with an “implied†government backstop and encouraging bank risk taking. Thus, there has not been a bank failure in China for over 20 years…until July 2019 when regulators took over Baoshang Bank, a smaller local bank.

Why is this significant? Because the idea that a bank could fail (counterparty risk) has now been introduced. How eager will a bank be to take risk now that the government backstop is gone? Like the rest of world saw in 2008, China’s interbank lending is collapsing. This collapse is creating problems for the PBOC because it threatens their ability to control their economy.

The larger banks are the only banks to work directly with the central bank. Smaller banks depend on the large banks for financial support as they transmit central bank policy to the broad economy. If the large banks don’t lend, central bank “stimulus†efforts are thwarted. Perhaps that’s why the Chinese economy is showing the slowest growth since 2002.

How long will the trade war last? That’s anyone guess, but it looks like it’s likely to be a long and escalating war. Something that always accompanies currency regime shifts.

Even as President Trump postponed new import tariffs on some consumer goods to support consumption in the US through the Christmas holidays, China vows countermeasures for those new 10% tariffs that will go into effect on September 1st.

Ultimately it is the average citizen (consumer) that pays the biggest price as governments and central bankers steal purchasing power value away in a futile attempt to inflate away the deflation caused by massive unpayable debt levels.

But in a “Do What I Say and Not What I do Moveâ€, as China’s central bank adds more gold to their reserves, the are curbing gold imports in an effort to restrict USD outflows (dollar’s are typically used to pay for imported gold). This is critical because of all the USD debt issued by Chinese Corporations that must repay this debt in dollars. If these corporations are forced to sell yuan to buy dollars to service the debt, that would weaken the yuan further.

As the yuan falls, spot gold, in terms of yuan rises. Similar to spot gold moves in USDs, spot gold in terms of yuan is breaking long held resistance levels as it concludes a long-term cup formation. What does this mean? That the bull run in spot gold is just beginning.

Slides and Links:

- https://www.ft.com/content/074395d2-38f2-11e9-b72b-2c7f526ca5d0

- https://www.ft.com/content/34746fc2-a792-11e9-b6ee-3cdf3174eb89?segmentId=778a3b31-0eac-c57a-a529-d296f5da8125

https://tradingeconomics.com/china/retail-sales-annual

https://tradingeconomics.com/china/consumer-credit

https://tradingeconomics.com/china/households-debt-to-gdp

https://fred.stlouisfed.org/series/QCNPAM770A

https://www.bloomberg.com/news/articles/2019-07-31/china-s-generation-z-is-hooked-on-credit?srnd=businessweek-v2

https://www.newshunters.club/china-housing-market-cools-as-xi-jinping-douses-stimulus-hopes/

https://www.scmp.com/economy/china-economy/article/3020603/chinas-control-over-its-entire-economy-weakened-baoshang-bank

- https://www.bloomberg.com/news/articles/2019-08-15/negative-yielding-debt-hits-record-16-trillion-on-curve-fright

- https://www.xe.com/currencycharts/?from=XAU&to=CNY&view=10Y

https://www.kitco.com/news/2019-08-07/China-s-Central-Bank-De-Dollarizes-Buys-More-Gold.html

Like the US did in the 1920s, China has been shifting to a consumer driven economy. In fact, consumption growth has, for the first time since the 1980s, outpaced growth in both exports and investments and now accounts for a full 76% of China’s GDP. So, it’s easy to see why the Chinese government is counting on the consumer to weather the current economic decline that was foretold by its yield curve that first inverted on May 11, 2017.

Directly controlled by the government, the yuan peg to the USD is now breaking down through a series of devaluations.

As the yuan falls, spot gold, in terms of yuan rises. Similar to spot gold moves in USDs, spot gold in terms of yuan is breaking long held resistance levels as it concludes a long-term cup formation. What does this mean? That the bull run in spot gold is just beginning.