Financial Prison Systems: SDR, Unicoin, FedNow, and CBDCs

In a recent Q&A session, someone brought up the “unicoin” introduced by the IMF and the World Bank in their Spring 2023 meeting. I must admit, it was news to me. However, I always appreciate when our community brings things to my attention because that’s what we will discuss today.

CHAPTERS:

0:00 Catching a Wild Hog

2:02 Unicoin

4:55 White Paper – Unicoin

8:06 Meet Unicoin

9:34 What Global CBDCs Could Look Like

12:43 Electronic Cash

16:00 Tokenized Deposits

20:10 Making the Transition

23:20 Adoption

25:19 Creating Demand

28:30 Central Bank Demand

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

I’m gonna liken what’s actually happening right now. With Fed Now ,the CBDC’s, the SDR and the universal money like unicoin to the story of how to catch a wild hog. So one day you put the food out in the middle and we could call that money. We give the people the public money and the hogs come and they eat. You let them do that. You do that every day for a week, and then the next week you put out one side of the corral, just one little fence. Now they stay away for a day or so because they’re not used to that fence, but the food is still there and they want it. So they go and they start eating it. Now they’re comfortable with that fence. So one day you put up the second side of the, of that corral and at first, again, the wild hogs stay away from it for just a minute, but they don’t see any other activity and the food is there and they want it. So they go in and they eat it and you put up the third rail. Well, they’ve kind of experienced this before and nothing happened. So yeah, they get lulled into this false sense of security and they go in and they’re eating and as they’re eating you put up that fourth side and boom, you have them. In this video, I’ll show you who’s putting up the fences and quite simply how not to be the wild hog trapped, coming up.

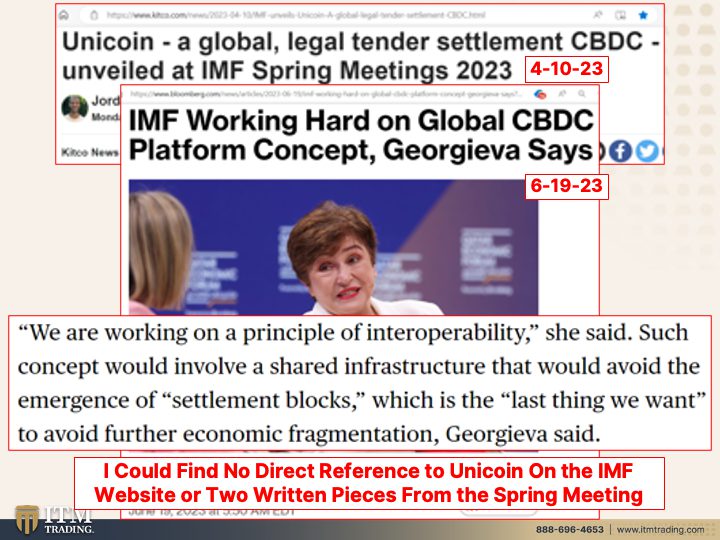

I’m Lynette Zang, Chief Market Analyst here at ITM Trading a full service physical, gold and silver dealer specializing in custom strategies. So you do not get caught like a wild hog. And somebody brought up in the Q&A recently about the unicoin and had I heard about the unicoin that was announced between the IMF and the World Bank at the spring 2023 meeting. And admittedly I had not heard, but I really always appreciate it when people bring things to my attention because at the minimum I do look at them and then if there’s something to talk about, we’re gonna talk about it. And that’s what we’re doing today. So this was announced back in April of 2023 and I thought, how come I haven’t heard about the unicoin? So I went in and looked. But in June, well we had the head of the IMF come out and say we are working hard on a global CBDC platform concept. So it kind of seems to tie in and we’ve looked at it before and I’ve always said the SDR made the most sense because it’s made up of all different currencies and they could put every single currency in it, making it easy to have a local currency and and a universal currency. We are working on a principle of interoperability. She said such concept would involve a shared infrastructure that would avoid the emergence of settlement blocks, which is the last thing we want to avoid further economic fragmentation. So let me explain what they’re talking about here because what she’s saying is that, you know what have we been hearing? We’ve been hearing about the breakdown of globalization right? Now in the eighties. That’s when that big globalization push started. I remember thinking to myself, ’cause I was a new stockbroker then, yeah, I can see some problems with this. And of course with the supply chains breaking down, etcetera, we saw the problems with it. So now what we’re told is that globalization is breaking apart. But I’ve also shown you in the past where for all the talk of the globalization breakdown, we’ve got the financial system that is getting even more and more globalized. And that’s what she’s talking about here. Those settlement blocks would be just that group of currencies. So when you’re looking at what the BRICS nations are doing, where they’re agreeing to settle trade in each other’s currencies, that’s what she wants to avoid. So what they’re trying to do is come up with a universal currency that everybody will use. And the IMF oh, well, let’s see who, we’ll just get into this a little bit more and we’ll see where this goes. This is really quite interesting. I could not find, but oh, I misspelled. But anyway, I could not find any direct references to the unicoin in the IMF or at the World Bank. So that set me down this rabbit hole. I’ve included those links so you can see for yourself.

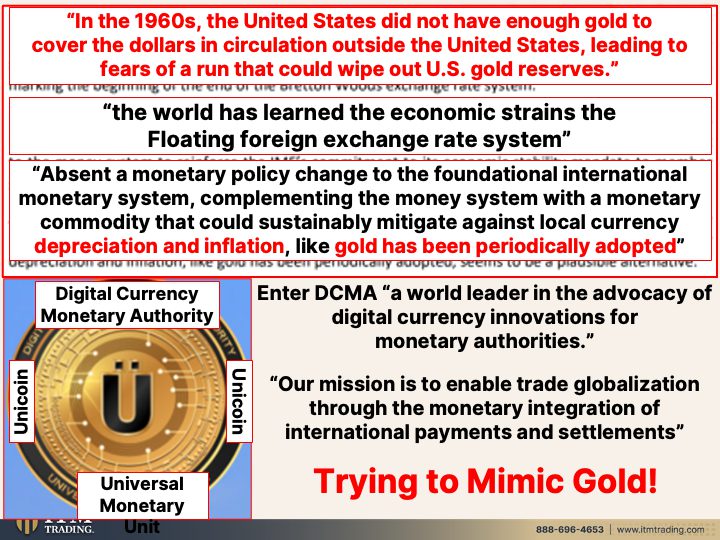

But in the 1960s, so this is from the white paper from the unicoin, in the 1960s, the United States did not have enough gold to cover the dollars in circulation outside the United States leading to fears of a run that could wipe out US gold reserves. Let’s talk about this statement for a minute because there are a few things that really stand out to me. Number one, they’re referencing a period of time when we were influx shifting from at least a quasi gold standard to a debt-based standard. And when they say that there was not enough gold to cover the dollars in circulation, what actually was happening was that gold was fixed at $35 to an ounce. That was the Bretton Woods agreement back in the forties. But the US in attempting to fund the Vietnam War and the other wars that were going on, but primarily in this case, the Vietnam War, they were printing more dollars. And so they were not staying true they were breaking the agreement that was agreed to in Bretton Woods, when you hear somebody say, well there’s not enough gold to cover a currency, that’s garbage. Because what needs to happen is the price of that currency, the price of gold in terms of that currency needs to be adjusted. The whole point of gold in creating fiscal responsibility is that it is finite, non-infinite like the printing presses, which are completely infinite, right? I mean they can do as many much of that as they want. So that’s the first thing I needed to talk about in here. The world has learned the economic strains of the foreign floating exchange rate system. And we have talked about that too because the Bretton Woods system pegged all global currencies to the dollar at $35 an ounce to gold. So after they reneged on that, we went to a floating rate system. And that’s why I just recently did a video on how do you value a fiat money? And that’s the way that you look at it. The floating rate system would be the US dollar against say the Japanese yet, or the US dollar against any other currency or any currency against another currency. None of it really reflects purchasing power loss. Absent a monetary policy to the foundational international monetary system, completing the money system with a monetary commodity that could sustainably mitigate against local currency depreciation and inflation like gold has been periodically adopted. So what they atte, what they’re attempting to do is create a derivative of gold, which is exactly what this is, right? Except this has inflation baked into it. Let’s move on. This is the unicoin. I’d like you to notice the color of it. We’ll come back to that. Enter DCMA, which is a world leader in the advocacy of digital currency innovations for monetary authorities. So what do we see happening right now? We see global governments creating all of these regulations around cryptocurrencies and digital currencies.

Brilliant to come out with one that is designed specifically for monetary authorities. It will be under a different set of rules. Digital currency, monetary authority. Okay? Our mission. So their mission is to enable trade globalization through the monetary integration of international payments and settlements. That makes things so easy. It says on here, okay, I mean this is really what these are about. It says digital currency, monetary authority, and universal monetary unit. And then it says on both sides, unicoin. So really what I want you to understand is always, I don’t care which currency system you’re looking for, only gold has maintained and hold all of the pieces that you need to have a good money system. Will this have a good money system? No, it won’t.

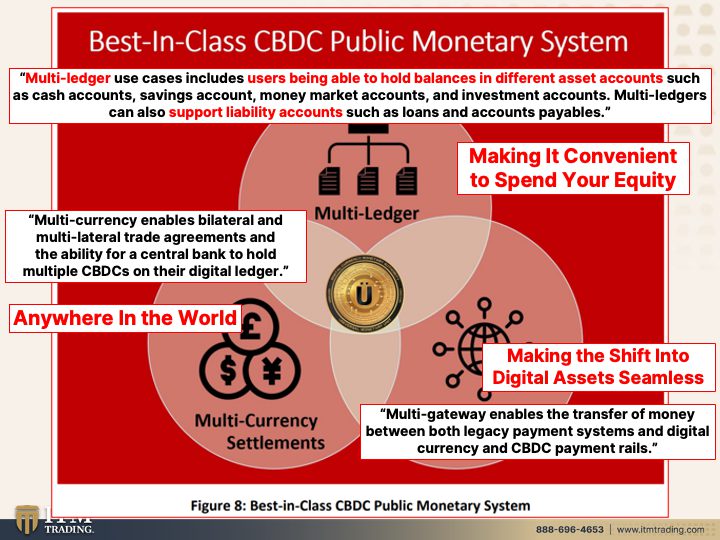

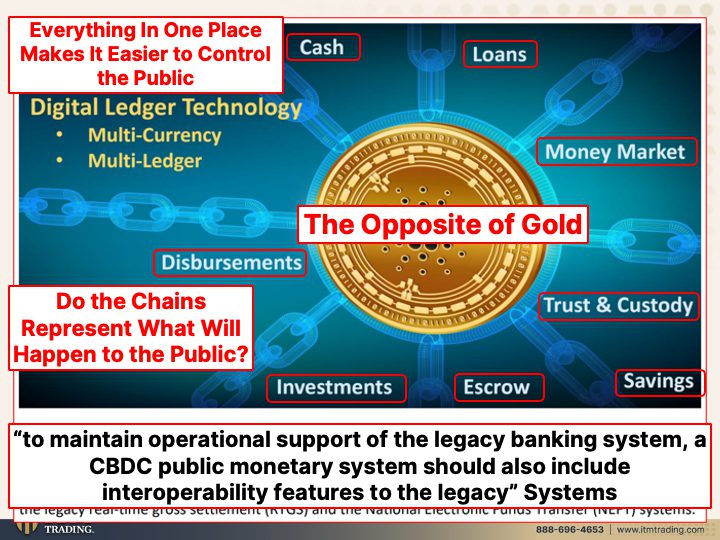

And I, and I have to tell you, even though I haven’t found anything in there, this is most likely, I mean, I thought it was absolutely a brilliant way to show you what this global CBDC is most likely to look at because you’re gonna have to have multi ledger, multi ledger use cases include users being able to hold balances in different asset accounts such as cash accounts, savings account money, market accounts, and investment accounts. Multi ledgers can also support liability accounts such as loans and accounts payable. So in other words, this new CBDC has to have its finger in every single pie that you or I attempt to accumulate. And it makes it a very convenient way for you to spend your equity. What I’ve heard over and over again is like, let’s take your equity in a house. Let’s say you have a hundred thousand dollars equity in your house. If you’re holding it on your phone, how convenient when you see this new shirt or this boat or this car, you got all of your wealth tied up here, you can access your equity. How easy is it to spend it, especially with perspective management, perception management nudging you in that direction. It it’s evil genius. That’s what it is. Multicurrency enables bilateral and multilateral trade agreements and the ability for a central bank to hold multiple CBDCs on their digital ledger. So again, like the SDR that is made up of, of whole bunch of different currencies, then that’s what they’re talking about for their modern day CBDC as well. So that means it can be used anywhere in the world. So pretty easy to transfer your, like say home equity to somebody in say China that’s buying your equity after you’ve bought that boat or what have you. So it makes wealth transfer around the world a whole lot easier. Multi gateway enables the transfer of money between both legacy payment systems, which means what we’re used to right now and digital currency and CBDC payment rails, which would then make the shift into these digital assets. And these digital cbdc really seamless, you would not see it. So what they’re talking about here is a best in class CBDC public monetary system, but best in class for who? For you? Because this is going to entice you so that at the end of the day, the world economic forum you will own, nothing comes true.

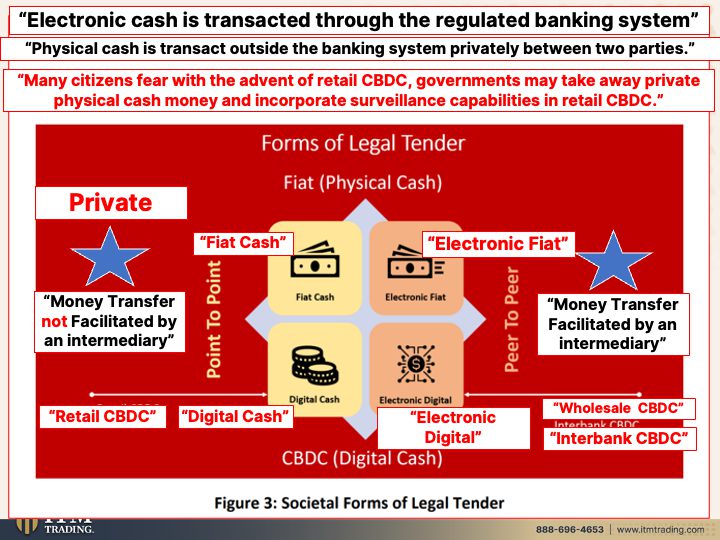

Now electronic cash is transacted through the regulated banking system. So that’s, this is how they’re doing it or how they intend to do it anyway. Here’s the money transfer facilitated by an intermediary like a bank or other financial institution. They have wholesale and interbank at the moment. And this is a peer to peer network. So from one kind of bank to another bank, right? Not to the public just yet. There’s your electronic fiat and here’s your money transfer that is not facilitated by an intermediary. Who’s that? Well that’s cash and all they have there is a retail CBDC. You and I are the retail public. So let’s be clear on who they’re talking about because the electronic fiat, which they want us to think of as cash, is still inside the system and still requires the bank in an intermediary. What doesn’t? Well, there are two things that don’t actually, digital cash does, but fiat cash, this doesn’t require an intermediary at this moment, as far as I know, there are no chips inside of it to track it. So I can go and buy something and when I use cash, it’s kind of virtually almost invisible. Now they’re also talking about it being, you know, private because cash is private. That’s what they don’t like about it. They like the inflation, they like the fact that that they know that people adopt the legal money of the state, but they don’t like its privacy and they don’t like that it’s point to point. So I can go out and I can spend this cash. That’s why I’m so adamant and I will not support a company that will only accept cash. And I’m very grateful to see that some states are coming out with laws to force, co businesses to take cash, but that goes completely against what the central banks want. It does, but I support that. Okay, so remember it’s cash and it’s private. Now there’s digital cash, but that’s not private. That’s point to point. But it still has to go through an intermediary because it’s intangible, right? What else can you go point to point? Physical gold, physical silver. And that is completely outside of the system, completely private. That’s what we like because many citizens with good reason fear with the advent of retail CBDC governments may take away private physical cash money and incorporate surveillance capabilities in retail CBDC’s. And they will also do it in the cash that they issue. They’re not gonna take cash away, obviously. They want you to volunteer it. And they’ve been working on that since the fifties. So that’s what they’re looking to do. Will we fall into that trap? I won’t. I hold most of my wealth and physical gold and silver.

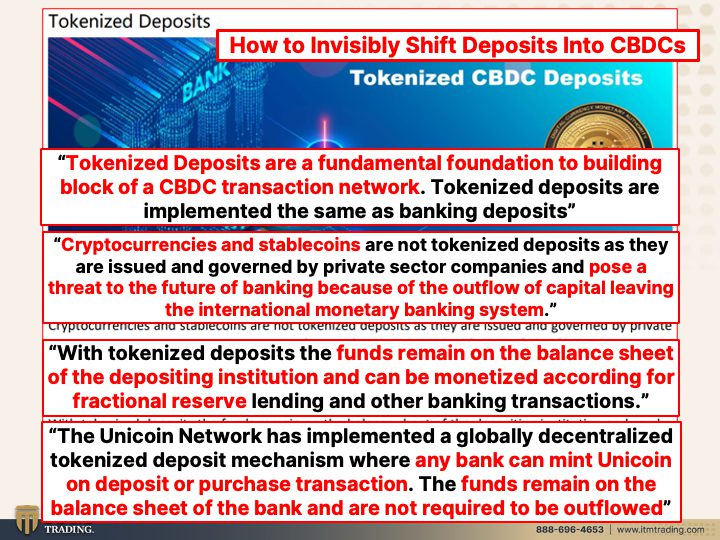

Now let’s talk about tokenized CBDC deposits because this is really how they can invisibly shift deposits into CBDCs by keeping things appearing to be the same. So you think nothing has changed when in reality everything has changed. So tokenized deposits are a fundamental foundation to building block of a CBDC transaction network. They gotta have you deposit your wealth so they can control it. Tokenized deposits are implemented the same way, the same as banking deposits. So you just go the bank, you know, you have your, your paycheck deposited or you go to the bank and you deposit a check. All right? Nothing has changed from your perspective. Cryptocurrencies and stable coins are not tokenized. Deposits as they are issued and governed by private sector companies and they pose a threat to the future of banking because of the outflow of capital leaving the international monetary banking system. So this is why they’re putting in all of these regulations. This is also why we don’t know who’s gonna survive all of these regulations and in the, which I didn’t put up here today, but in the BIS money flower, there is a small little area in that for private cryptocurrencies. But there is no way, and I’ve said this right along, that central banks are going to magically go, oh yeah, well we’ve been controlling the money supply for this long, it’s your turn now ain’t gonna happen. So we’re in the battle royale. But would they use private cryptocurrencies to get the public adjusted and and acclimated to them so that they’re more comfortable with ’em? A hundred percent. That is always the way that they work, with tokenized deposits. The funds remain on the balance sheet of the depositing institution and can be monetized according for fractional reserve lending and other bank transactions. So again, you know, with that sweep account where the banks get to sweep your deposits into sub accounts in their name and then use that collateral, rock and roll hoochie coo, they can do any darn thing they want with that money, that would not change. So you see how they’re building this universal CBDC to accomplish and support the banking sector And this central banks, the unicoin network has implemented a globally decentralized tokenized deposit mechanism where any bank can mint. So the question of how would these be created? Here’s the answer, at least in the unicoin, the bank can, any bank can mint unicoin on deposit or purchase transaction just like they create money, they loan it into existence. So where we right now are in a debt-based system and that’s how they create money, the unicoin coin is proposing that they mint it by either the deposits or transactions. So I’m gonna go buy that boat, boom, I got a whole bunch of new unicoin out there in the public. Isn’t that great? Isn’t that nice? You and I, how do you and I generate money? We work our butts off, but no, let’s not have the banking system work too hard. Let’s just boom. You wanna buy something? Okay, here’s a whole bunch of new money. What does that do to this money or whatever money is already out there? Well, for fiat it makes it go down. But for gold and for silver, but particularly gold is the primary currency metal, makes it more valuable even if they suppress the spot price.

`Now this I think is my favorite slide. And you’ll see, and if you, if you don’t, if you can’t guess it, look at all these chains. I just love how they’ve got this gold chain, the coin or this gold coin inside of all of these chains. But let’s just move on. ’cause They are after all the digital leader technology, but to maintain operational support of the legacy banking system. So you see, everybody’s asked, well won’t this kill the banking system? No, they’re gonna support it so that that can continue to exist as they’re making the transition and then maybe more fit into whatever’s gonna support the new system. But to maintain operational support of the legacy banking system, A CBDC public monetary system should also include interoperability features to the legacy system. And what’s the legacy system? It’s cash loans, money market trust and custody, which are stocks and bonds, annuities, all that stuff. Savings, escrow, which is your equity investments. And I love this one, which is disbursements, which means when they send it to you, and I find it interesting, and I don’t know if this was subconscious or conscious, I gotta be honest with you, but that’s the longest chain is the disbursements, which means the most vulnerable for getting cut off to be honest with you.

And my question is, do the chains represent what will happen to the public once they issue a CBDC public money? Because that’s what I think they’re gonna be able to control us in every way. So they want us to think that this is gold. That’s why when you look at all of the cryptocurrencies or any of the other digital currencies that the governments are making, what? They’re either silver or they’re gold. You think that was by chance, why aren’t they purple? Why aren’t they green? Right? Because they want you to think that they’re as powerful as gold. That they’re the same as gold. That’s not true. And in fact, it is the opposite of gold. This is freedom, this is choice. This is wealth universal. I can take this anywhere and have the same level of purchasing power. What’s the difference between this and all this other stuff that they’re talking about here? All of this is intangible. This is tangible. I hold it, I own it outright, period. This stuff they’re in control of. Look at those chains. Yes, a hundred percent absolutely everything in one place makes it so much easier to control. That means that they don’t like what you’re saying. Boom. No more disbursements. How fabulous is that? Now, it also needs to have a widespread adoption framework.

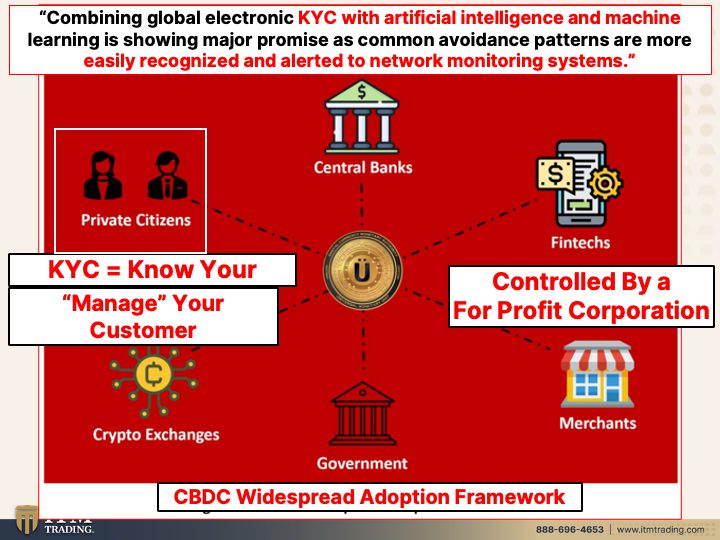

And how do they do that? Well, you combine global electronics, KYC, which is, which is know your customer, right? So they wanna know everything about you with artificial intelligence. And machine learning is showing major promises, common avoidance patterns are more easily recognized and alerted to network monitoring systems. I mean, think about what they’re saying there. Think about how you feel about that. Common avoidance patterns. So they’re gonna know when you’re trying to avoid something and they’re just gonna boom, shut you off or go in and take everything. I mean, you’ll have absolutely no choices, you’ll have no control. It’s really about managing like stronger nudging than they’re doing right now with perception management. And the problem with this particular one, and and I gotta tell you in my opinion, the coin is not going to be the one and the reason why. The only reason why I really say it and the reason why I talk, all right? The reason why I say that is because it is not owned by the big kahunas. JP Morgan’s, all the banks, Wells Fargo, Deutsche Bank, all that, all that stuff. If they were part of this, then I’d say this is the one. Because the other thing, and the reason why I still did this, even though I don’t believe that this is gonna be the one is because this is gonna be the structure. This is a warning, will you take head?

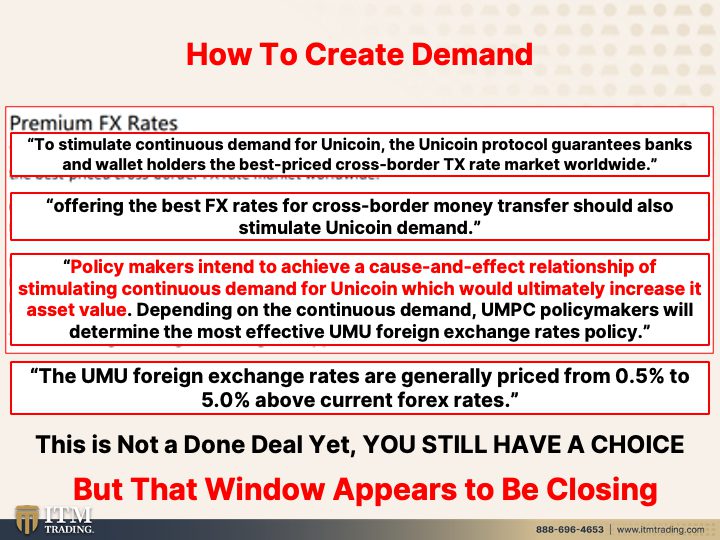

They know how to create demand. They just, they’re doing it through foreign exchange rates. So yeah, they don’t want one big currency, they want local currencies and then a universal currency. But to stimulate continuous demand for unicoin, the unicoin protocol guarantees banks and wallet holders the best price cross-border foreign exchange rate market worldwide. So they’re gonna undercut normal foreign exchange markets. So everybody goes through them ’cause they’re gonna offer the best foreign exchange rates for cross-border money transfer should also stimulate unicoin demand. Policymakers intend to achieve a cause and effect relationship, a cause and effect relationship of stimulating continuous demand for unicoin, which would ultimately increase its asset value. Well, what happened to the dollar when it became the world reserve currency? Artificial global demand. So all central banks have to hold it either through treasuries or cash or what have you, and it works for a while until it doesn’t.

So they’re looking at creating a universal coin, CBDC that would have achieved that cause and effect relationship increase its asset value, right? We look at Wall Street, we see spot gold going up. Oh, isn’t that great? We see spot gold going down. Oh, that’s awful. We see it staying flat, right? Why in the world do you believe Wall Street? I don’t, I lived in that belly and I’m telling you, I don’t believe them. I don’t trust them. I know better. That’s my mission to help you understand it and get out of the way. And how do you do that? You get out of the system. The U M U foreign exchange rates are generally priced from 0.5% to 5% above current Forex rates. So they’re gonna undercut everything. And I’m telling you, this is not a done deal yet. You still have a choice.

I don’t really think it’s gonna be unicoin, but I definitely do think that it’s going to look very similar to this. And you will be encouraged absolutely to spend your equity and when they have complete control over you, you have to do whatever it is that they want you to do. You do not have a choice. And what this tells us is that window is closing. ’cause If it’s not coined, I’m sure the IMF is working on their own. The SDR makes the most sense to me. It still makes the most sense to me because everybody already owns it. They still, they’re working with people, but they don’t have anybody that’s actually adopted it. And I, I dug really deep because, because I know that this is gonna be, it’s gonna have a similar structure.

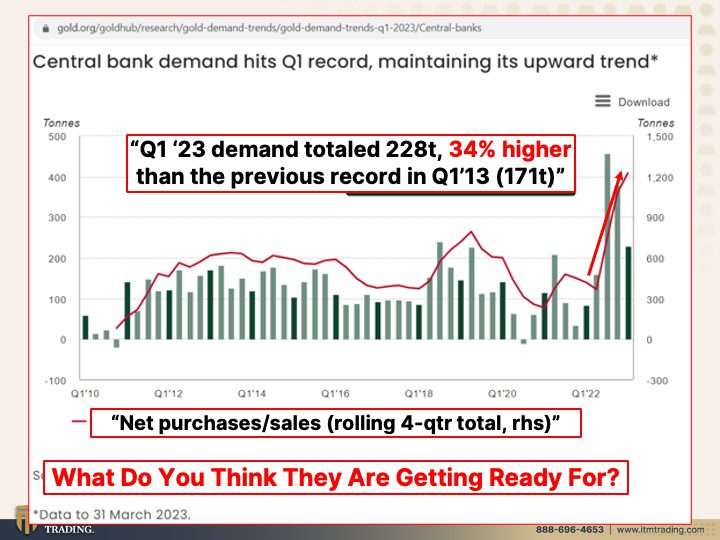

Central bank demand hits, first quarter record maintaining its upward trend. No Sherlock, because who knows more about money than central banks And their first quarter, 2023 demand total, 228 tons, 34% higher than the previous record of the first quarter in 2013, as we were still struggling with the great financial crisis, but also entering in Europe, the sovereign debt crisis. That was the last time. And, and it blew that out of the water because guess what, here’s 2013 and look at this first quarter. Yep. Yep. And it’s climbing higher. The net purchases, less sales. That’s a rolling. This, this line is a rolling four quarter. So you tell me what do you think the banks are getting ready for? Maybe it’s not the unicoin, but it’ll be a universal CBDC. They will attempt to force you into it. You vote with your purse or your wallet. This is how you vote. This is my vote. And I hope it’s your vote too, because frankly, it’s the only thing that’s gonna save us.

And if you haven’t clicked that Calendly link below and set up a time to talk to one of our experts, I strongly encourage you to do it right now. And don’t just talk to them because that doesn’t actually really protect you. It just helps you develop a plan, execute it, execute it, please. We are running out of time. But you need more than gold and silver. This is your foundation to make sure that you can maintain your wealth and be in a position to take advantage of what’s happening. ‘Cause You’re not getting out of the way. But you also need Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter. Get it done. And if you haven’t yet, make sure you hit that subscribe button. Leave us a comment, give us a thumbs up and share, share, share. This one is critically important, not because it’s a unicoin, but because that’s the structure that they’re going for. Just remember, this is your financial shield, physical metal, primary currency, metal, gold, secondary currency, metal, silver. Definitely not paper promises. And until next we meet. Please be safe out there. Bye-Bye.

SOURCES:

Unicoin – a global, legal tender settlement CBDC – unveiled at IMF Spring Meetings 2023 | Kitco News

Crypto/Digital Currencies News: IMF Working on Global CBDC Platform Concept – Bloomberg

https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-q1-2023/Central-banks