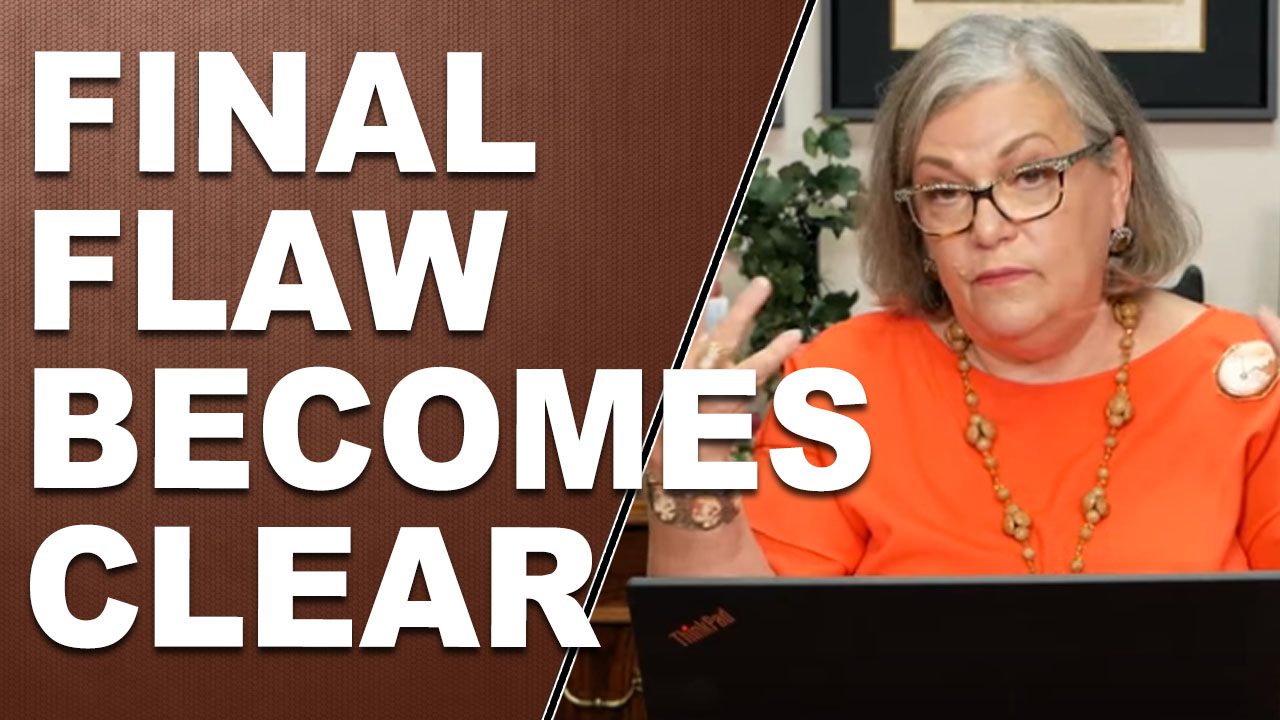

FINAL FLAW BECOMES CLEAR: US Consumers Are “Tapped Outâ€â€¦

On 8-2-19 President Trump announced additional tariffs of 10%, on all remaining imports from China, starting September 1st. While we’ve been told that the current tariffs did not impact the consumer (autos, chip makers, farmers etc.), this round of tariffs hits many consumer goods directly (laptops, clothing etc.). Good thing the Whitehouse postponed the new tariffs until after Christmas shopping, now scheduled to go into effect on December 15th. Are they concerned they might push the consumer too far? If they do, what are the implications? That consumption slows into a vulnerable market.

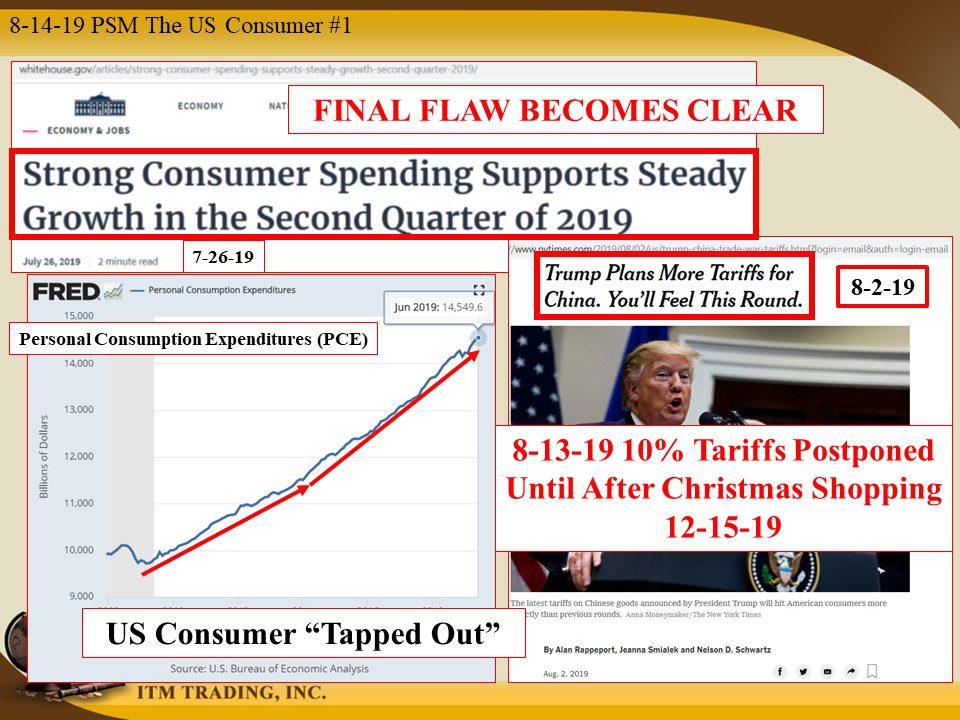

Both China and the US are counting on consumption to create the inflation central bankers so desperately crave. But inflation adjusted real wages are actually down 9.8% since 2006, the last time the 10 YR and 2 YR yield curve inverted, which occurred briefly this morning. Of course, you remember it didn’t become visible to the public until 2008, but the warning was there. Did you pay attention or were you caught off-guard?

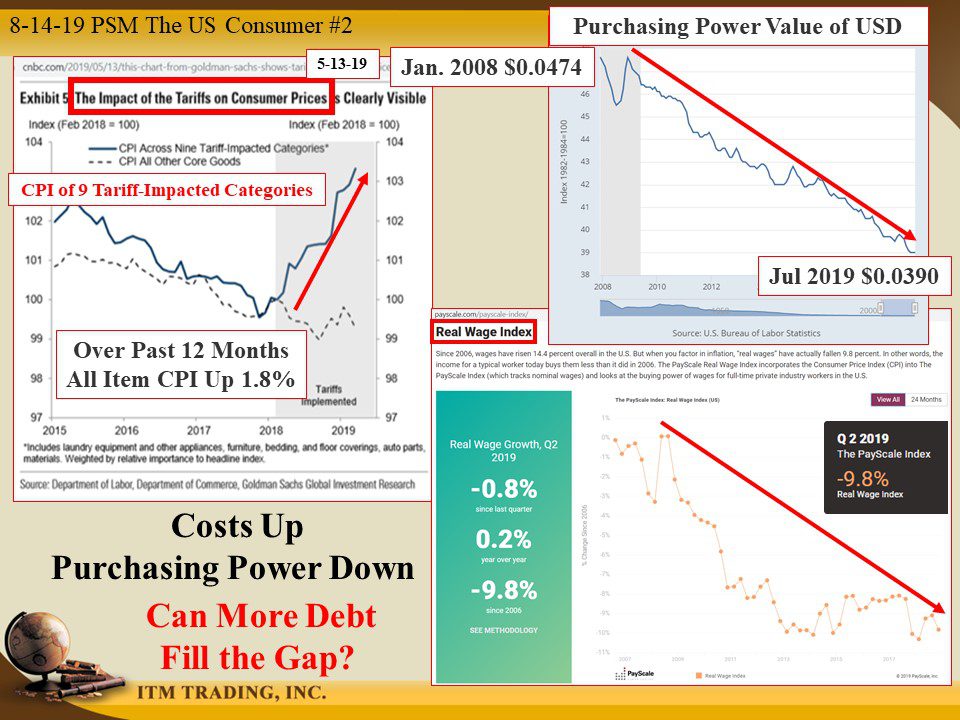

To fight the crisis, central bankers opened the credit flood gates and consumers offset the loss of income purchasing power with a lot more debt. According to the most current Federal Reserve numbers, the current liability level is $72.1 trillion in debt that must be serviced, paid off or rolled over. Though much of this debt has been “securitizedâ€, in other words, turned into wall street products that are then sold back to the public through “institutional investors†buying for pension funds, mutual funds, ETFs etc.

The big question is, can the consumer handle more debt?

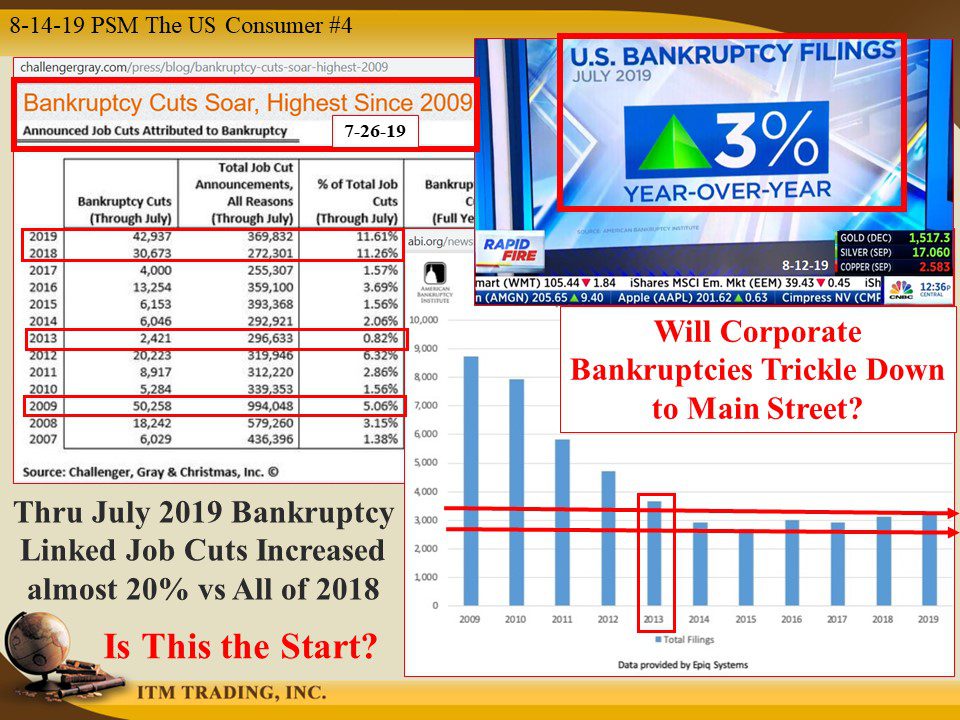

Perhaps we can find the answer in the most current bankruptcy numbers, which are up 3% YOY and the highest since 2013. But something even more telling is the corporate job cuts caused by corporate bankruptcy, which is at the highest level since 2009, in the depth of the financial crisis, though the corporate bankruptcy surge began in 2018. Personally, I pay a lot of attention to these signals and I would rather be two years too early, than one second too late, because that is when all choice is lost.

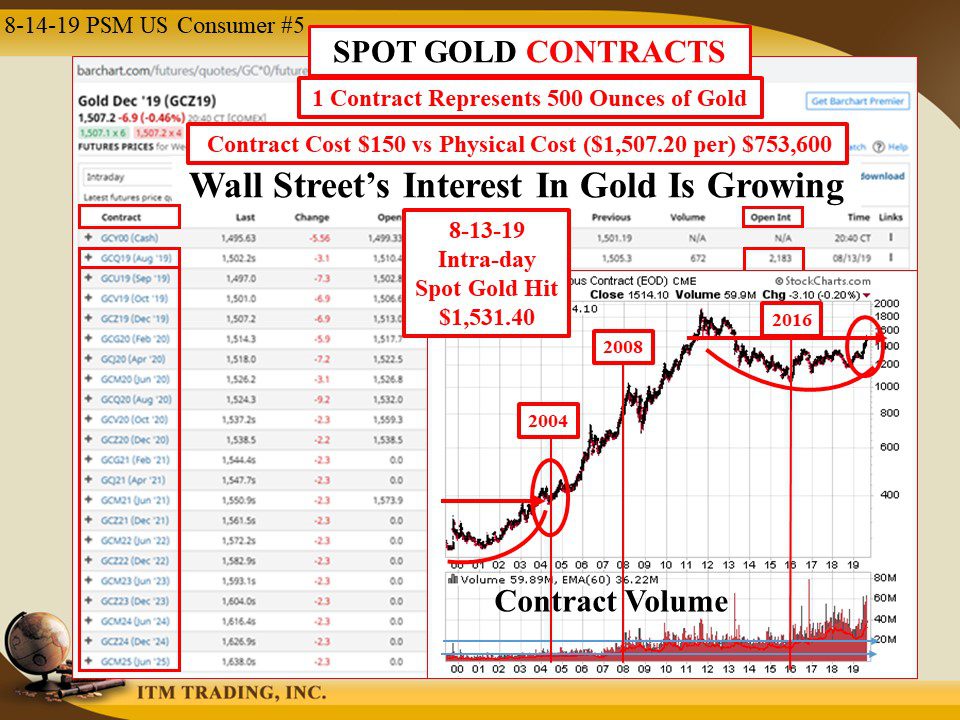

Another good indicator is the volume of the spot gold market. Since spot gold’s bottom in 2016, the volume on the exchange began to steadily increase. Since the start of 2019 the volume has been rapidly rising, pushing spot gold’s price through one resistance level after another, reflecting wall street’s growing interest in gold.

It looks like we’ve now entered the awareness phase in gold, where traders begin to participate, and fiat prices are most likely to push to new levels on it’s way to fundamental value. Don’t you think it would be a good idea to be in position before that happens?

Links:

https://fred.stlouisfed.org/series/PCE

https://www.wsj.com/articles/u-s-will-delay-some-tariffs-against-china-11565704420

https://fred.stlouisfed.org/series/CUUR0000SA0R

https://www.ecomcrew.com/trumps-china-tariffs/

https://fred.stlouisfed.org/series/MVLOAS

https://fred.stlouisfed.org/series/SLOAS

https://fred.stlouisfed.org/series/REVOLSL

http://www.challengergray.com/press/blog/bankruptcy-cuts-soar-highest-2009

https://www.abi.org/newsroom/chart-of-the-day/july-commercial-bankruptcy-filings-2009-19

https://abi.org/newsroom/chart-of-the-day/July-commercial-bankruptcy-filings-2009-19

- https://www.bloomberg.com/news/articles/2019-08-08/gold-rush-spurs-1-billion-into-etf-before-rally-takes-breather

https://www.barchart.com/futures/quotes/GC*0/futures-prices

8-14-19 IT FINAL FLAW BECOMES CLEAR: US Consumers Are “Tapped Outâ€â€¦â€¦..By Lynette Zang

Both China and the US are counting on consumption to create the inflation central bankers so desperately crave. But inflation adjusted real wages are actually down 9.8% since 2006, the last time the 10 YR and 2 YR yield curve inverted, which occurred briefly this morning. Of course, you remember it didn’t become visible to the public until 2008, but the warning was there. Did you pay attention or were you caught off-guard?

It looks like we’ve now entered the awareness phase in gold, where traders begin to participate, and fiat prices are most likely to push to new levels on it’s way to fundamental value. Don’t you think it would be a good idea to be in position before that happens?