THE GAMBLE OF YOUR FUTURE: Investment Risks You Don’t See Coming… By Lynette Zang

China is the 2nd largest economy and now has the second largest stock market, behind the US. Interconnected financial institutions create and support new markets and products, that’s called “financial innovation.†They have brought the Chinese stock markets to the world through inclusion in already established benchmarks that are used by institutional investors that invest money for pension plans and other retirement accounts. They are guided by established parameters that, in my opinion, are used to cover up risk transfer from the elite to the public.

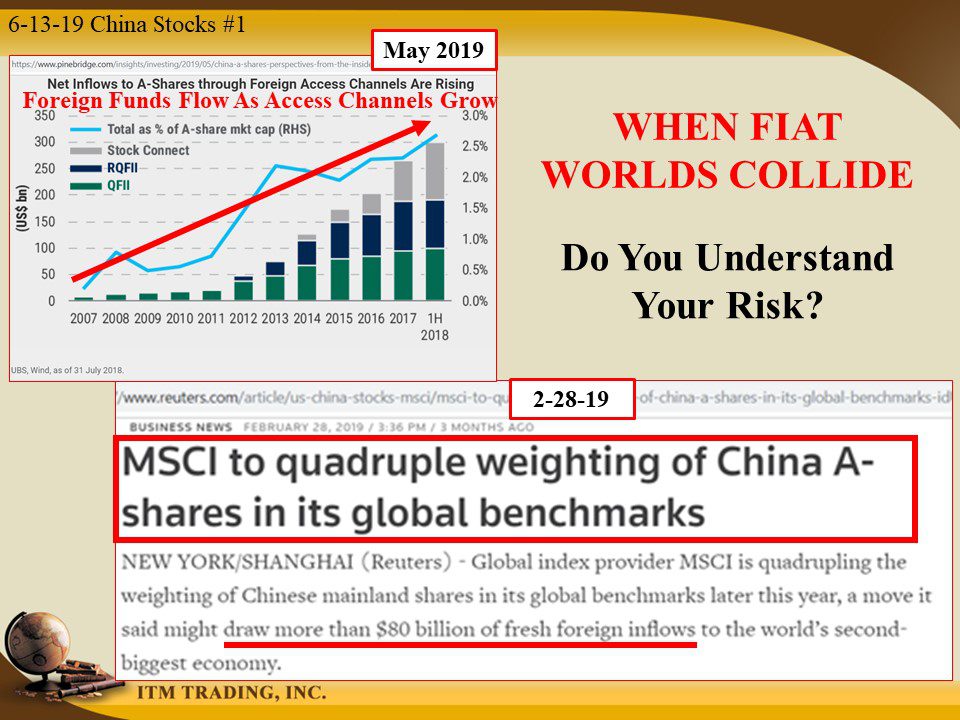

A current example occurred on February 28, 2019 when MCSI, a global index provider, announced they were going to quadruple the weighting of China A-shares in their global benchmarks, anticipating to “draw more than $80 billion of fresh foreign inflows†to support the Chinese markets and economy and keep the game going. Capping off foreign investment funds flowing into the Chinese markets that began in 2012 as new access channels were opened by the government and financial firms.

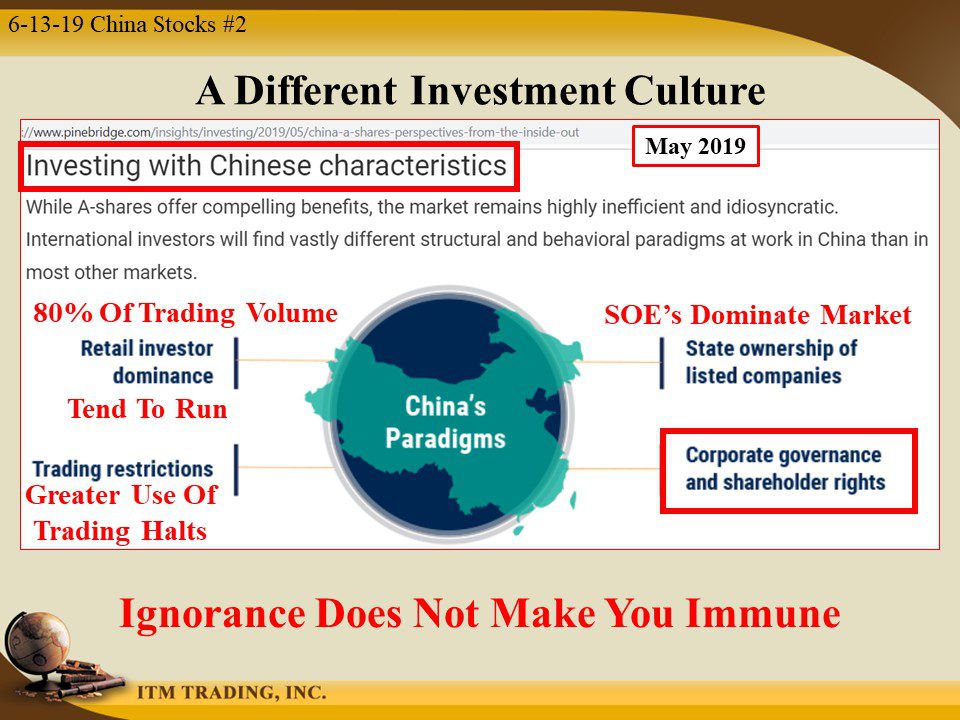

But China has a different investment culture than most other markets. Some liken the Chinese stock markets to the “wild west†when gambling and outlaws reigned.

Consider the retail investor and China’s push to a consumer driven economy, much like the rise of the middle class in the US in the 1920’s, this rapidly growing sector has more fiat money than ever and want to emulate the elite, and have seen a lot wealth created in the Chinese stock markets.  They want to and are encouraged to participate, yet do not have the experience of a seasoned investor and do not have a long-term approach to investing. Rather, they have more of a gambling mentality, buying and selling on impulse with only the short term in mind. Retail investor makes up 80% of the trading volume on Chinese stock exchanges. So what will support the markets during the next run?

Trading restrictions, like the inability to sell. Chinese companies have a broader base of legal excuses to stop their stock from trading on the exchange. As example, in 2015 during the surprise devaluation of the Yuan, trading was halted on over 51% of A-listed shares. They had the right to suspend trading for up to 3 months. Today, corporations can halt trading of their stocks up to 30 days. A lot can happen in 30 days.

In addition, State Owned Enterprise’s (SOE’s) dominate the markets, and many are zombie companies being artificially propped up by the government, who has a communist cell in every corporation doing business in China. What happens when supporting these companies becomes too expensive?

Perhaps the biggest issue lies in the lack of corporate governance and the lack of corporate transparency, which is why most global investors steered away from Chinese A-shares before financial companies like MSCI brought them to the global market. While some changes have been made, hidden leverage risks remain extreme, but might not become visible until the next financial crisis.

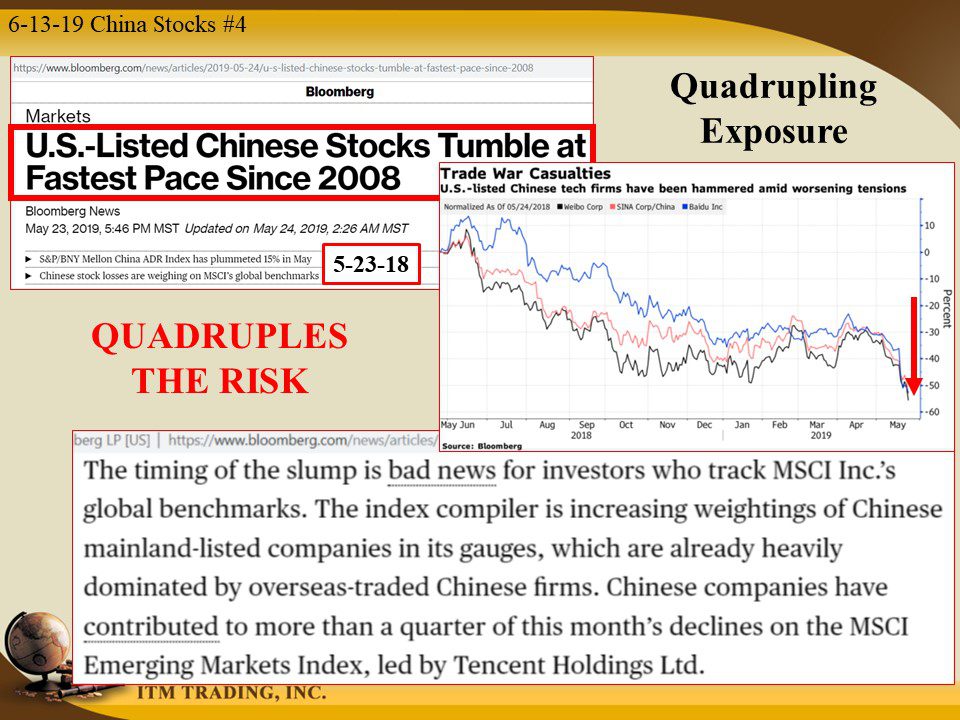

The recent market turmoil gave us a taste of what’s to come aa Chinese stocks fell at the fastest pace since the global financial crisis erupted in 2008. What happened to the extreme “stimulus†being provided to these markets by the PBOC, China’s central bank? Though the cash injection was the largest in Chinese history and interest rates are the lowest, the Chinese economy is sinking under a mountain range of debt and leverage.

Now MSCI is QUADRUPLING China A-Share exposure, which means that retirement funds will also have quadruple the exposure to these very risky markets. Did you know? Will your retirement wealth go with it?

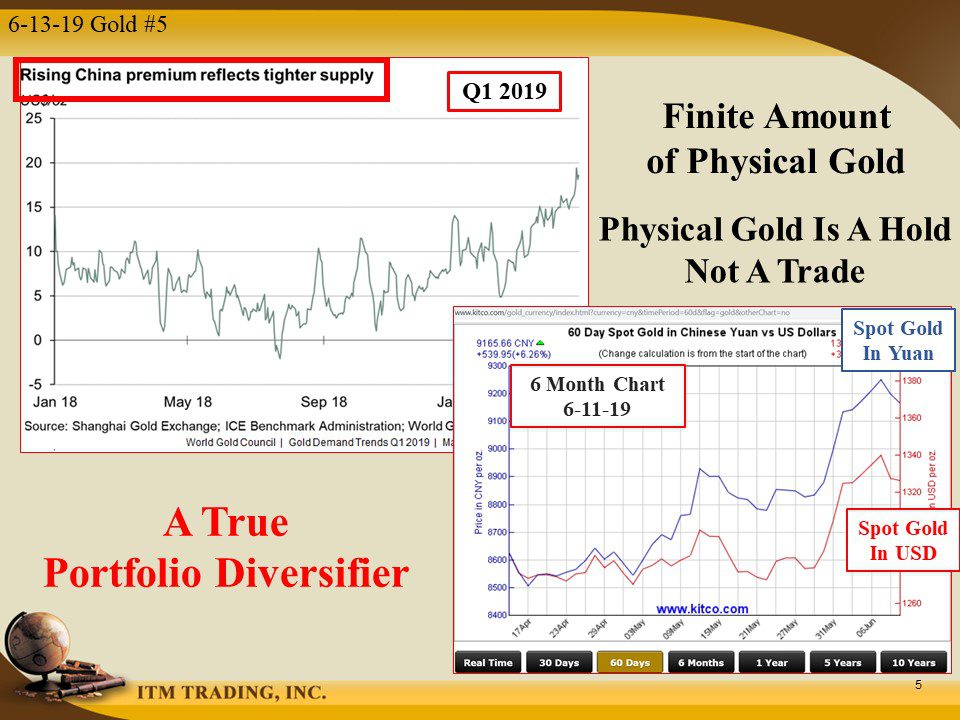

Because, while the Chinese people are gambling in the markets, they are also accumulating gold and the premiums are rising. Because, while there is an unlimited amount of derivative gold (fictional gold), there is a finite amount of physical. When demand exceeds supply, prices go up. When spot gold is manipulated down, the premium on the physical only markets go up to compensate.

While they’ll trade stocks, they hold physical gold, which is the true portfolio diversifier.

Slide and Links:

https://www.ft.com/content/3ea51148-632f-11e8-a39d-4df188287fff

https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-q1-2019

https://www.kitco.com/gold_currency/index.html?currency=cny&timePeriod=60d&flag=gold&otherChart=no

YouTube Short Description:

China is the 2nd largest economy and now has the second largest stock market and the world is invited to participate.

But China has a different investment culture than most other markets. Some liken the Chinese stock markets to the “wild west†when gambling and outlaws reigned.

While the Chinese people are gambling in the markets, they are also accumulating gold and the premiums are rising. Because, while there is an unlimited amount of derivative gold (fictional gold), there is a finite amount of physical. When demand exceeds supply, prices go up. When spot gold is manipulated down, the premium on the physical only markets go up to compensate.

While they’ll trade stocks, they hold physical gold, which is the true portfolio diversifier.