FED’S INFLATION RAMIFICATIONS: What The Labor Market Means for Employees

TRANSCRIPT FROM VIDEO:

You know what the Fed’s new inflation fighting tool is? Hmm. That’s what we’re gonna talk about today, coming up.

I’m Lynette Zang Chief Market Analyst here at ITM Trading a full-service, physical gold and silver dealer that specializes in custom strategies. And I’m telling you, you’ve never needed one more because wow, all those wage increases that we saw that’s what’s causing all this inflation. My goodness.

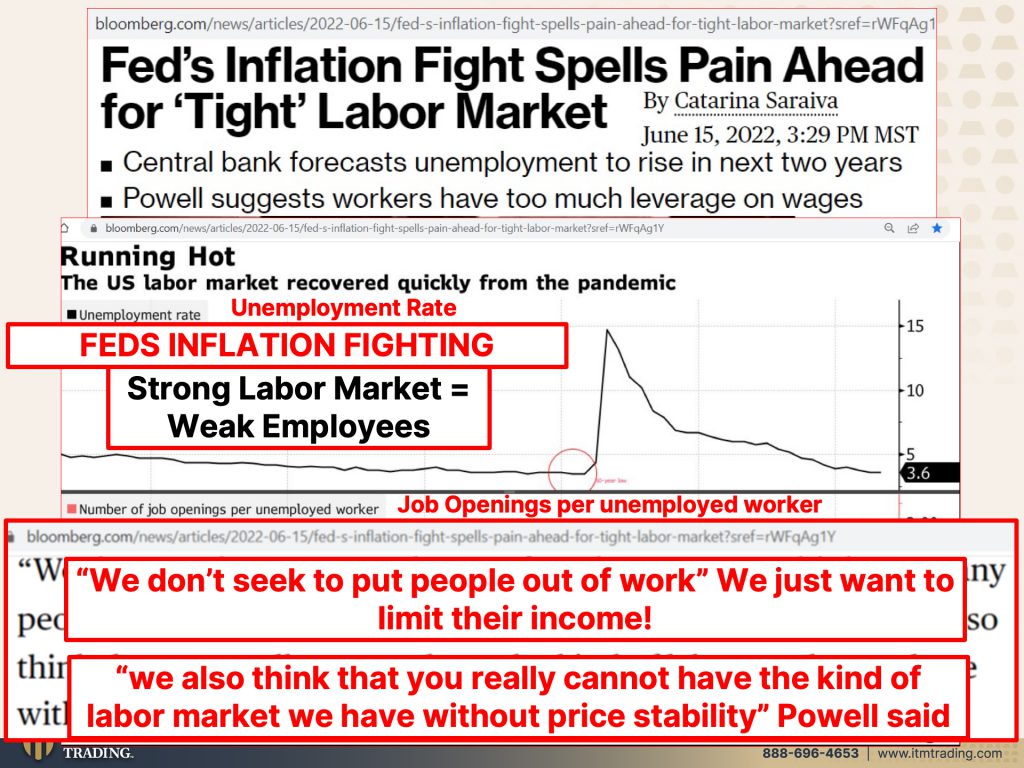

And so the Fed has come up and is now openly saying that they are going to fight inflation by weakening the labor market, because we should not have workers be able to demand more money because of the inflation. They’re the ones that are creating it. The workers are the, oh God, they’re awful. How dare they demand more money? <Laugh> in this rising economic inflationary period. But what does that do? It really spells a lot of pain. We’ve talked about this, we’ve talked about it. It is the public that suffers the most during these periods of time. And so they got a little bit of an edge, still not enough to keep pace with inflation and boy that just doesn’t work very well. So running hot, the US labor market recovered quickly from the pandemic. You know, those essential workers, etcetera. But here this bottom one is number of job openings right here. So there are a lot of job openings, but look at what’s happening here at the end, that’s starting to decline, but as the labor market has been so tight employees have been asking for more money and we know it doesn’t keep up with it, but they say, well, we, we don’t seek to put people out of work. We never think too many people are working and fewer people need to have jobs. But we also think that you really cannot have the kind of labor market we have without price stability. Now you and I might think that price stability means that the prices of goods and services remain the same, no price stability means that workers, that the inflation is low enough, that workers do not ask for a raise. They do not ask for more money. Now. I don’t think that’s true up at the top, but I love that. They say we don’t seek to put people out of work. Nah, they don’t seek to put people outta work. They just wanna limit your income, not the prices that you have to pay. I mean, they wanna limit that. They want that to move up just really slowly, but you can’t ask for more money because you’re the reason why we have all this inflation. We also think that you, that you really cannot have the kind of labor market we have without price stability. And what he’s really saying in here is that he wants unemployment to stay down, but he also wants wages to stay down. He doesn’t want you to have that leverage to go in and ask for more money. There’s a problem with that. There really is.

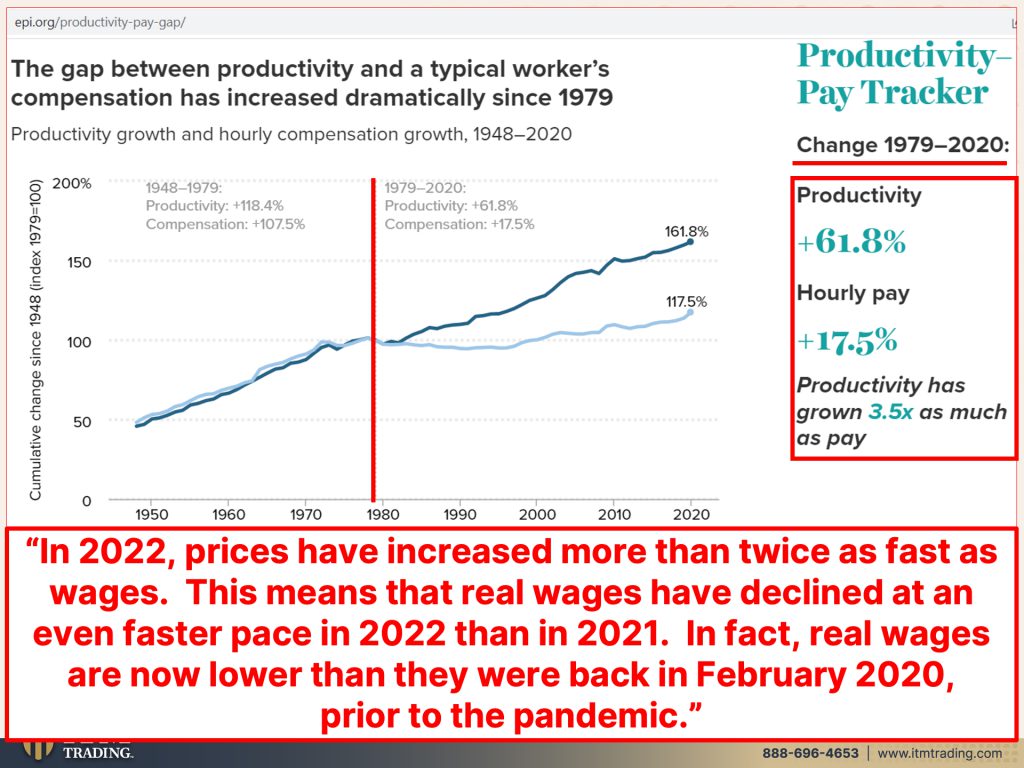

So let’s look at the gap between productivity and a typical worker’s compensation. And you can see that that gap has really grown since we went into, oh, let’s see. Isn’t this. When we were transitioning into a pure debt based system with the central banks in full control of inflation? So remember how I’ve always told you, and I mean, it’s documented, so this isn’t my opinion. This is documented that when they set the system, the Fiat money system up to begin with government based on inflation and erosion of purchasing power, governments wanted to be able to tax you invisibly. So there’s the inflation tax, but corporations wanted to pay workers less and less. But if you’re used to 10 bucks, you’re not gonna accept five. But if you can make that 10 bucks spend like five, well, then this is what you get. And you can see how as, as corporations were more productive, employees were compensated at that same level. I mean, they’re almost right on top of each other and actually a little bit higher in the employee part. But once we went into this new financial system, so on the other side of this, when they take us into the new financial system, do you think that’s really gonna be better for workers? Because what they’re really talking about is they need five years of growing to 5% unemployment to control and get us back to price, stability, where workers don’t feel like they can ask for more money, but where’s all this excess productivity going. I’m gonna show you that in a second. But in 2022 prices have increased more than twice as fast as wages. This means that real wages have declined at an even faster pace in 22 than in 2021. In fact, real wages are now lower than they were back in February 2020 prior to the pandemic. And I argue that while we have inflation at 40 year highs, we have real wages at 40 year lows in 1971, an average wage was 9,500 bucks and a family of four could live on one wage. Today, it’s up there, but you need two wages. And, and even with that, you’ve got millennials that are making 250,000 a year living paycheck to paycheck.

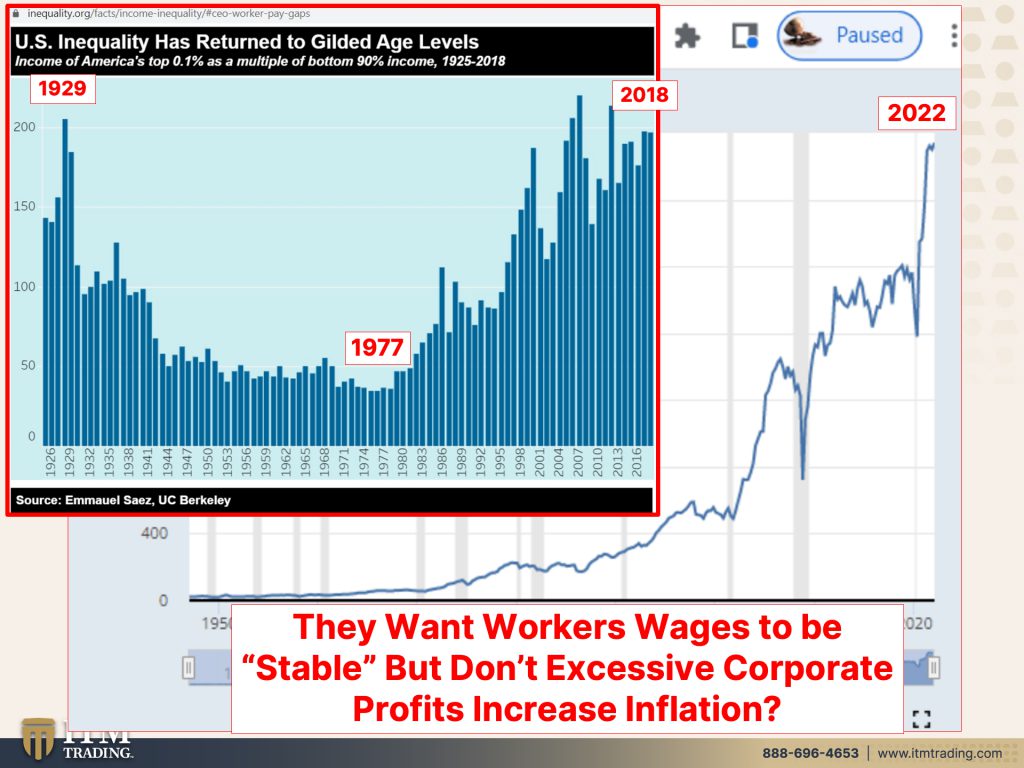

Something’s wrong here, but Ooh, any quad <affirmative>, but Ooh, inequality has returned to gilded age levels. In other words, going back to 1929, here’s where it was in 1977. This goes out to 2018, but my bet is, it’s a lot higher than that now, because these are corporate profits and this is 2022. They want workers’ wages to be stable, but Hmm, don’t excessive corporate profits increase inflation? I’m thinking they do as excessive CEO compensation at these corporations also increase those inflations, but that’s not what the Fed is targeting. Oh, no, no, no, no. Let’s make sure that the workers’ wages don’t go up. Let the CEO wages go up, make sure, make sure that those corporations are highly profitable. I mean, if you take a look at it, this is the shortest recession in history, right? 2020, because of all that massive amount of free money that they gave away. This is 20, this is 2008, right? Corporate profits were plunging. Oh no, no, we can’t have that. So you can see every time we hit a recession, what really goes up corporate profits go up. That’s why we had that income and wealth inequality. But somehow the prices that the corporations charge with these ginormous profits in there, no mm-hmm, they don’t add to inflation. Neither did all the Fed’s money printing that didn’t add to inflation. It’s those workers asking for more money in a tight labor market. Let’s loosen that labor market up a bit. Let’s increase that unemployment. Let’s have it run for a long enough period of time so that these workers get it out of their heads to ask for more money. See why I’m pissed off so much. I mean, please.

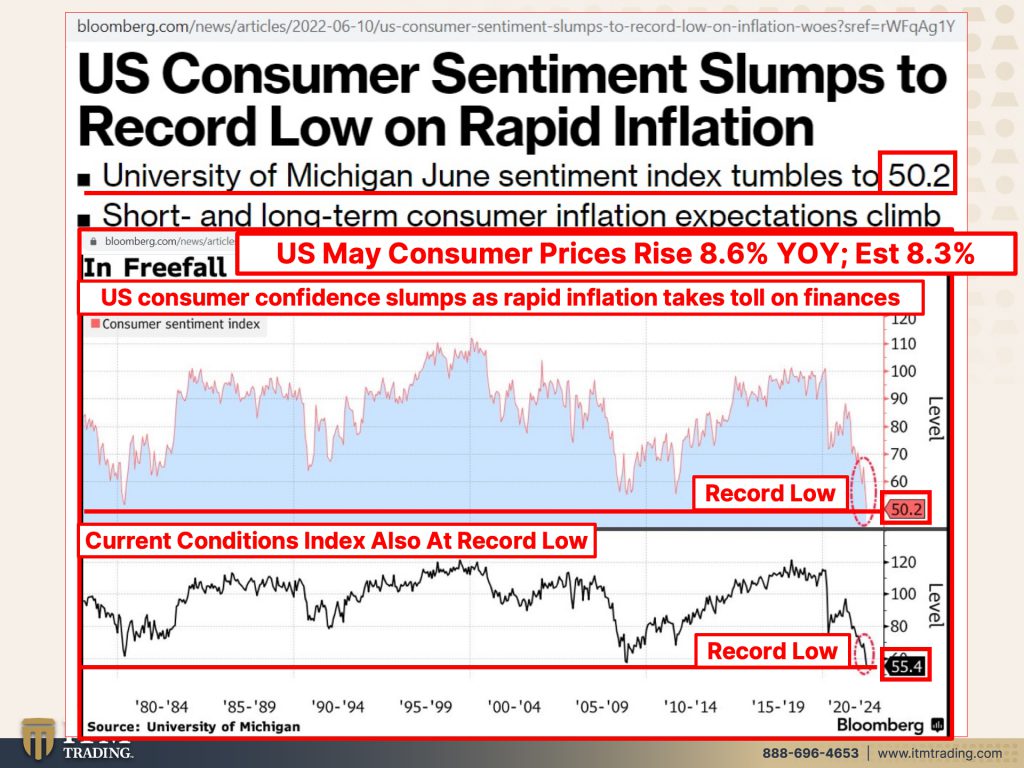

And with all of this shocker consumer sentiment slumps to record low on rapid inflation. In fact, the sentiment in June tumbled to 50.02, the lowest in history, short and long term consumer inflation expectations climb uh-oh uh-oh they don’t care about reality. They care about your expectations of reality, because if you expect inflation to go up, that’s why you ask for more money. If they can keep it at that 2% level. And you know, it’s not that noticeable. You don’t ask for more money though your living standards decline. And what a shocker US make consumer prices rose 8.6% year-over-year. They only estimated them to grow at 8.3. They haven’t got one of these things, right? Not one of them. Is that true? Or do they just not want you to know? I think they don’t want you to know. So consumer confidence, slumps as rapid inflation takes toll on finances. This is a record low. This is going all the way back to when this experiment started back in the seventies, we are now at a record low. That’s not good for those corporate profits because consumers are being forced to make choices. And so discretionary choices, do I need that new blouse? Yeah. I need food on the table. More than I need that new blouse. I need. Maybe I can Jerry rig my washer, which really isn’t even made to last very long anymore. They used to be made to last forever, but maybe I can’t make that choice right now. And these are current conditions. So what they anticipate this goes into those expectations that that perception management we have to, we have to manage how you perceive so that you move forward in a way that we want you to move forward. Not based on reality, based upon your perception. If you don’t hold it, you don’t own it. And your perception is irrelevant in a court of law or, or in the real economy. Your perception is irrelevant. It’s what the truth is.

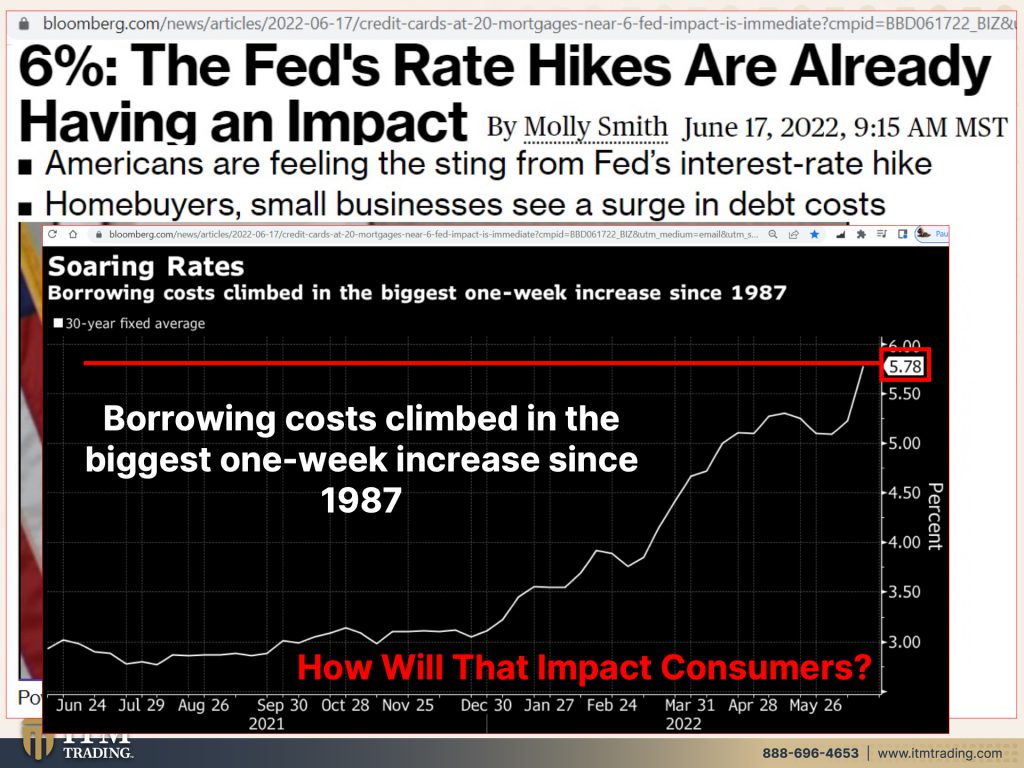

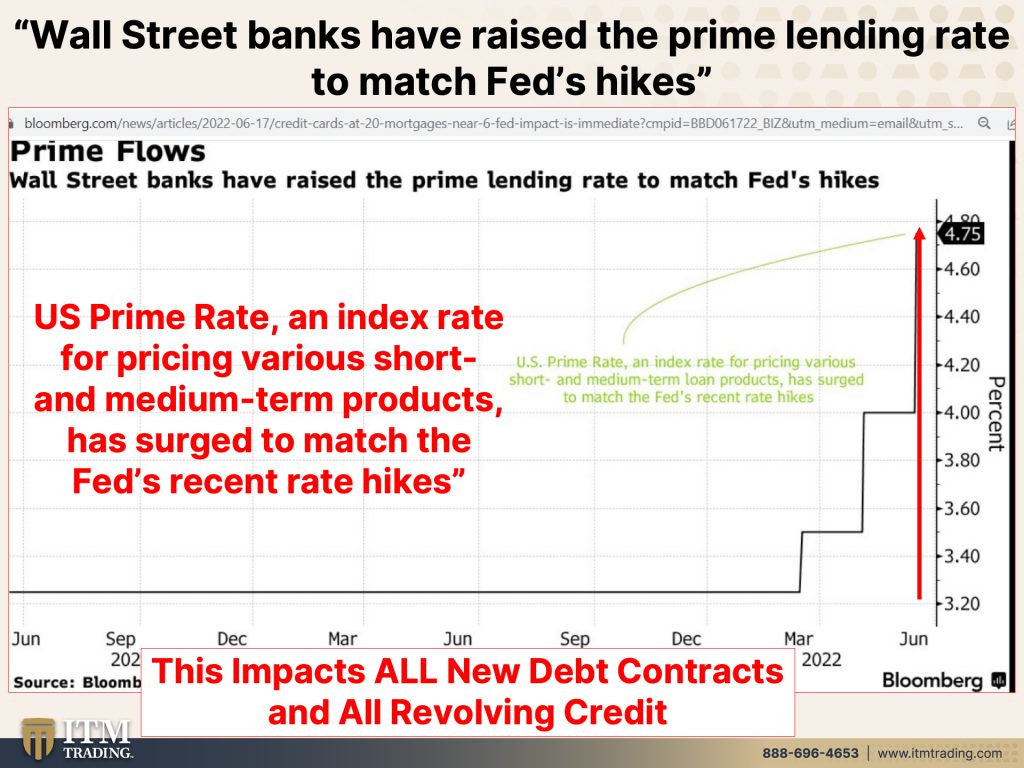

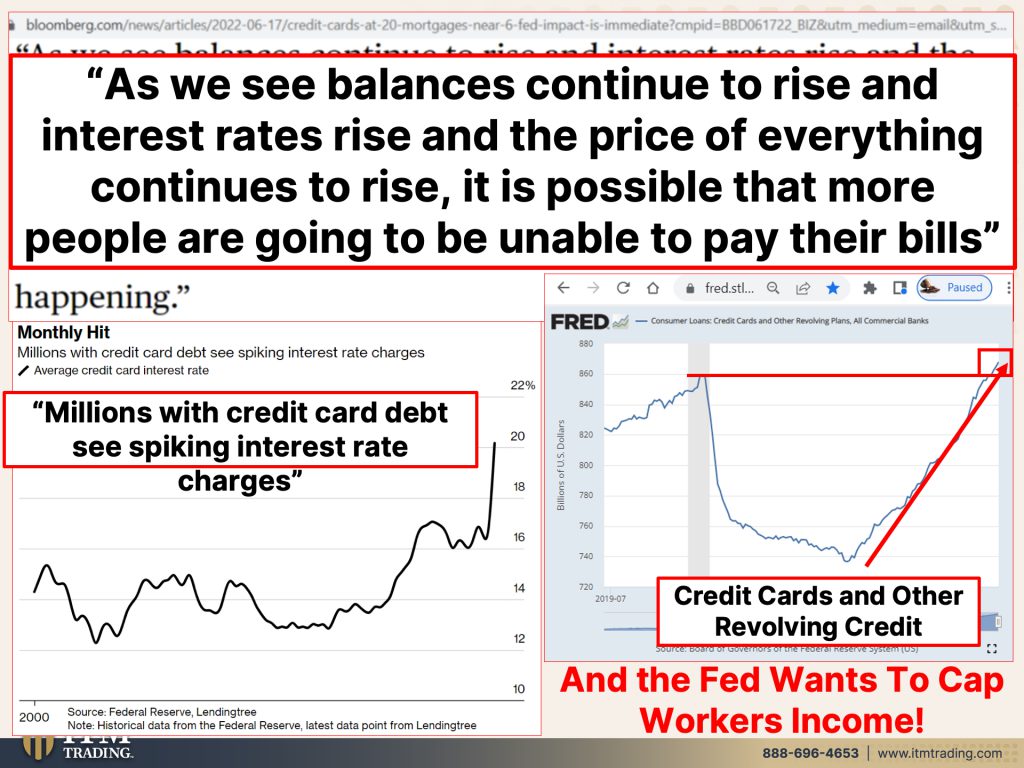

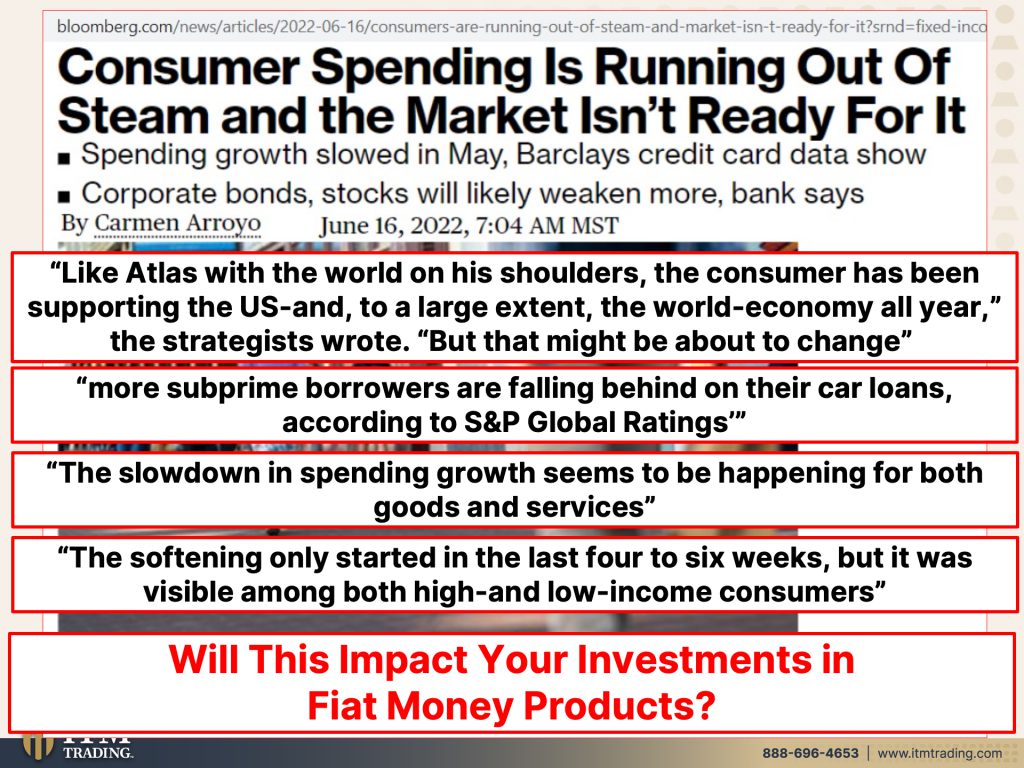

Because those rate hikes are already having a pretty significant impact soaring rates, right? So borrowing costs climbed in the biggest one-week increase since 1987. Now, what does that impact? Well, let’s take a look. Wall Street banks have raised the prime lending rate to match the Fed’s hike. The prime lending rate is an index rate used for pricing, all sorts of various short and medium term products. So what, what does that mean? Short intermediate term products. I mean, look at how much that’s gone up. Well, this is all new debt contracts and all short term. So revolving debt. Let’s take a look at those at credit cards because quite honestly what people have been doing to sustain a current standard of living in the face of all this rising interest rates is they’ve been using their credit cards again. And I actually should show you that right there, right? Revolving credit cards. When they got that, that huge windfall, they paid off, they paid down a lot of their credit card debt, but it’s even surpassed the levels of 2020 now, as people are making an attempt to maintain their standard of living and put food on the table and put gas in the car, those necessities, those necessities, and we aren’t even talking about, I mean, if you own your own home, your mortgage and you are in a fixed rate mortgage, that mortgage payment is fixed, but if you’re renting or you’re looking to buy something, yeah that’s all changed. As we see balances continue to rise and interest rates rise, and the price of everything continues to rise. It is possible that more people are going to be unable to pay their bills. Ya think? So that means more defaults. And what does the fed wanna do in the face of all these increases? He wants to cap worker’s income cap it. Boom. Okay. So what do you think that’s gonna do to the default rate, unintended consequences or fully intended consequences you choose, which I can’t tell you, but what do you think is gonna happen as you know, all these credit card balances are now subject to this massive spike in interest rates. Yeah. I’m thinking we’re gonna see a bunch of defaults and with the sentiment thus, and the interest rates, thus consumer spending is running out of steam, shocker, and the market isn’t ready for it because of all those lofty, lofty valuations, as the fed pumped, all that massive free money into the system and encouraged all of these corporations to take on enormous amounts of debt. “Like Atlas with the world on his shoulders, the consumer has been supporting the US”, we’ve talked about this before, “and to a large extent, the world economy all year”, the strategists wrote, “but that might be about to change.” “More subprime. Borrowers are falling behind on their car loans.” Well that drove all that subprime buying all that buying of cars and the supply chain breakage drove cars to huge lofty levels. And Hm, now they’re falling behind shocker. The slow down in spending growth seems to be happening for both goods and services. Oh, so it was a, when everybody was locked up, it was, you know, the demand and they had all this extra money. The demand for goods was roaring. Now we’re seeing a slow down in both goods and services. That’s a problem. The softening only started in the last four to six weeks, but it was visible Hm. Among both high and low income consumers. So everybody is being impacted, not just by the inflation, but also by the increase in interest rates. Of course, that the fed is doing to try and fight this inflation, slow down those corporations so that they fire more people, which we’re seeing happening in the tech industry, particularly lots and, and the real estate industry, particularly tech and real estate. Two very, very hot areas now have been cooling down and they’ve been laying off a lot of people. This is gonna trickle through we’re, you know, okay. Maybe we’re not at an official recession yet, but, and this is the, this is the death now, cuz they only have that one more tool, but will this impact your investments and Fiat money products? Well, I don’t know. You know, I mean with all that free money out there, stocks, bonds, real estate have exploded in valuations, but none of that really bothers me as much as all the derivative vets on top of those products, because that is such an opaque market that we really can’t see what’s going on in there. But with all of this volatility, I’m telling you there’s a lot at work there and we’re gonna wake up one day just like we did with the Lehman moment and it’s gonna be over. And this is why I’m encouraging you not to sit on your hands, not to wait and see the writing is on the wall. We are a consumer driven economy and that’s not just true in the US. China has been trying to move to a consumer driven economy and the consumer has been carrying the weight of the world on their shoulders. But that’s changing because there’s only so much consumption that one can do. There’s only so unlike governments, where there are no limitations to how much debt they can take on, especially when they have their central bank buying it, consumers have limitations. There’s only so much debt. And when you see them starting to fall behind on their car, on their debt payments, that’s usually a pretty good indication that this is gonna start to ripple through the economy. So if you’re looking at the 10% that can weather this storm, well, let’s hope that all their wealth isn’t held in intangible assets, the Fiat money products, because quite honestly the true valuation to them is based upon the purchasing power value of the dollar or the yen or the Euro, whatever that’s the real trend to pay attention to.

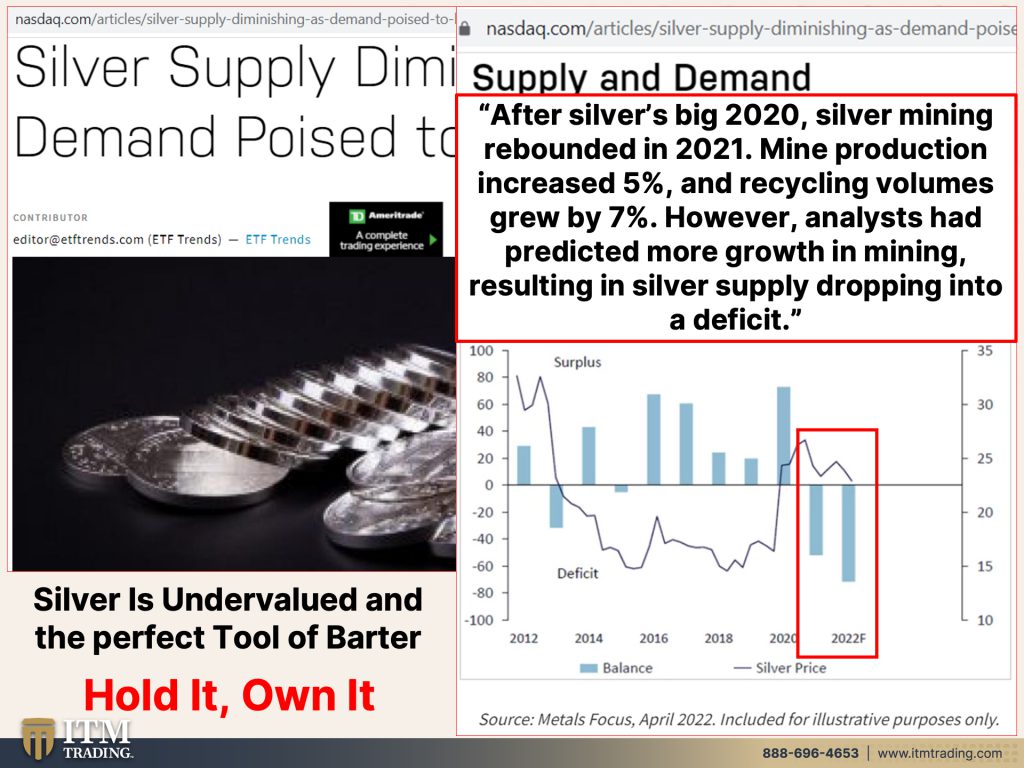

That’s why you need gold and silver. And what we’re seeing is that silver supply diminishing as demand, poised to blossom. We saw what happened in February of 2020, and we saw the ETFs, SLV and other silver SLV change their prospectus so that it isn’t based upon them actually holding the physical silver, because there’s a finite supply, whether it’s gold or silver or oil or a cup or anything, once you get physical, there’s a finite supply when you’re intangible, there’s an infinite supply. After Silver’s big 2020 silver mining rebounded in 2021, mine production increased 5% and recycling volumes grew by 7% because gold and silver in any form is monetary at its base. However, analysts had predicted more growth in mining resulting in silver supply, dropping into a deficit. Silver is severely undervalued and this is what I personally use as my primary tool of barter. I’m gonna be able to use my eggs and the produce that I grow and all of that. But quite honestly, silver is what I have accumulated, but there’s only so much because the difference cause people say, well, Silver’s more undervalued than gold. Maybe it is. Maybe it isn’t, but silver is the secondary metal it’s going to be impacted by the global growth or decline in growth. And at this level, it would just take too much to execute the whole strategy. So there’s a certain amount that you need and it’s based upon your current cost of living. If you call and talk to one of our consultants, they can help you calculate that out. But beyond that, you know this is what I use for my barterable tool. I have enough for a certain period of time, along with cash for myself and both of my children so that we always have real money to work with because when, when the power grid goes down or there’s other crisis’ that occur, things could get very local for a minute or two. So you need your barterable tool. And, and I use silver for it and it’s physical. So I hold it and I own it.

But there is more to everything than just gold and silver, that needs to be your foundation. But you know, Water is another key tool that you need cause you can’t live without water. So here what you’re seeing is how I converted my swimming pool into an aquaponic swimming pond. And a lot of the food that you see here is actually edible plus, you know, there’s issues around fertilizer, look at all this great fertilizer that I have for my plans. You’ll find this in a lot more on our new channel, Beyond Gold and Silver, because it really is all about Food, Water, Energy, Security, Barterability, so your silver, Wealth Preservation, so your gold, Community, so you have a variety of skill sets, as well as Shelter. Please get it done. We are fast running out of time and it should be very, very obvious to everybody now that what we’ve been talking about for years and years and years is really coming to pass. And my fear is, is that we’re gonna wake up one day and that’s gonna be it. And you’re not gonna have any options and choices. So get it done ASAP, do not wait, do not delay, do not allow all of these crisis all over the place, paralyze you get it done. Cause you know, without any doubt whatsoever, it is time to cover your assets. And here at ITM Trading, the foundation is gold and silver. So that’s really, really important, but you can also listen to us on our podcast on any major station. And if you would be so kind as to leave us a review on apple or Spotify, because it helps us get that message out there. And additionally, you can see all of the behind the scenes from the work that I do. Did we ever do the blooper reel? Not yet. We should probably we we’ve been accumulating. Edgar’s been putting together some blooper reels and they’re actually pretty funny. So we’ll be sharing some of those, but we share a lot of behind the scenes on Instagram @LynetteZang, and also @beyondgoldandsilver as well as Twitter @ITMtrading_Zang. So again, if you have not yet started your Gold and Silver strategy or even if you have started, but you haven’t completed it. Give us a call, talk to our consultants, get your strategy in place, get it executed ASAP. And until next we meet, please be safe out there bye-bye.

SOURCES:

https://www.epi.org/productivity-pay-gap/

https://fred.stlouisfed.org/series/CP

https://www.nasdaq.com/articles/silver-supply-diminishing-as-demand-poised-to-blossom