FED WARNING TAKE HEED: [PT. 2] Concerns for Economic Collapse

TRANSCRIPT FROM VIDEO:

The third concern is leverage in the financial sector. Now leverage is debt upon debt upon debt. How many layers of debt can you add with the same underlying asset and the more layers of debt you have, the riskier, everything is. So bank profits have been strong this year in capital ratios remained well in excess of regulatory requirements. That’s just about keeping you comfortable. Some challenging conditions remain due to compressed net interest margins. Yeah. With interest rates as low. And the banks lending has actually been, been flat or a negative. They aren’t making as much money through loans. Leverage at broker dealers was low. Leverage continued to be high by historical standards at life insurance companies, which was a question that was asked on Wednesday’s Q&A and hedge fund leverage remained somewhat above its historical average issuance of collateralized loan obligation, CLO and asset back securities ABS has been robust. Now both CLO’s. It was the CDO’s that took the system down in 2008. So the difference between the CDO and a CLO is that one is based upon debt. I mean, rather on mortgages mortgage debt, and this is based upon loan debt, which can be actually what’s behind it. And remember a CLO and ABS. These are all derivative contracts. So you cannot, an a derivative is just a big leverage bet layer upon layer of debt for the same asset that makes it extraordinarily risky and CLO’s are typically junk quality. So let’s take a look at that.

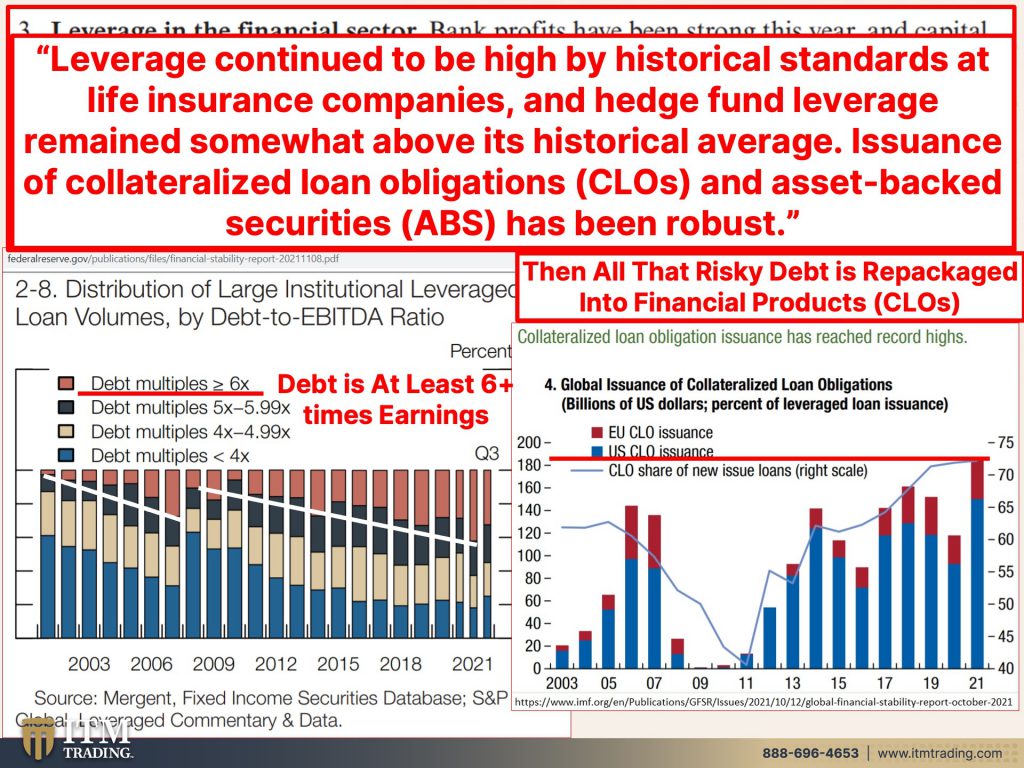

Here’s the distribution of large institutional leverage loan volumes by debt to EBITDA ratio. Now EBITDA is earnings before interest taxes, depreciation, and amortization. So what I want you to notice, we’re just going to look at the highest level. So these, all of these companies that I’m about to show you have at least six times the level of debt to their earnings, their earnings better not pull back or you a big problem. And what I like you to pay attention to here. And I know it’s a little hard to see, but you see this white line. This takes us through 2007. And the risk is of these loans grew until 2008, but guess what’s happening all over again is now they’re growing even more. And we’re looking at roughly 40% of these loans have very, very extremely high levels of leverage. This is danger, danger, danger, danger scares me probably cause I understand it. But all that risky debt is then turned into a wall street package and a wall street product and sold back to you. and remember what happened with the CTOs. They took all of this crappy debt. They put it into a package and because of their formulas, what was really crappy debt became AAA rated. So you have no clue, but look at the level of issuance at those CLO’s it’s the highest that it’s ever been the highest by a pretty wide margin. So this is risk upon risk. And when you’re talking about the financial stability of the U.S. Or the globe, it doesn’t matter. I showed you with the IMF’s financial stability report. We are in deep do-do and we are extraordinarily vulnerable.

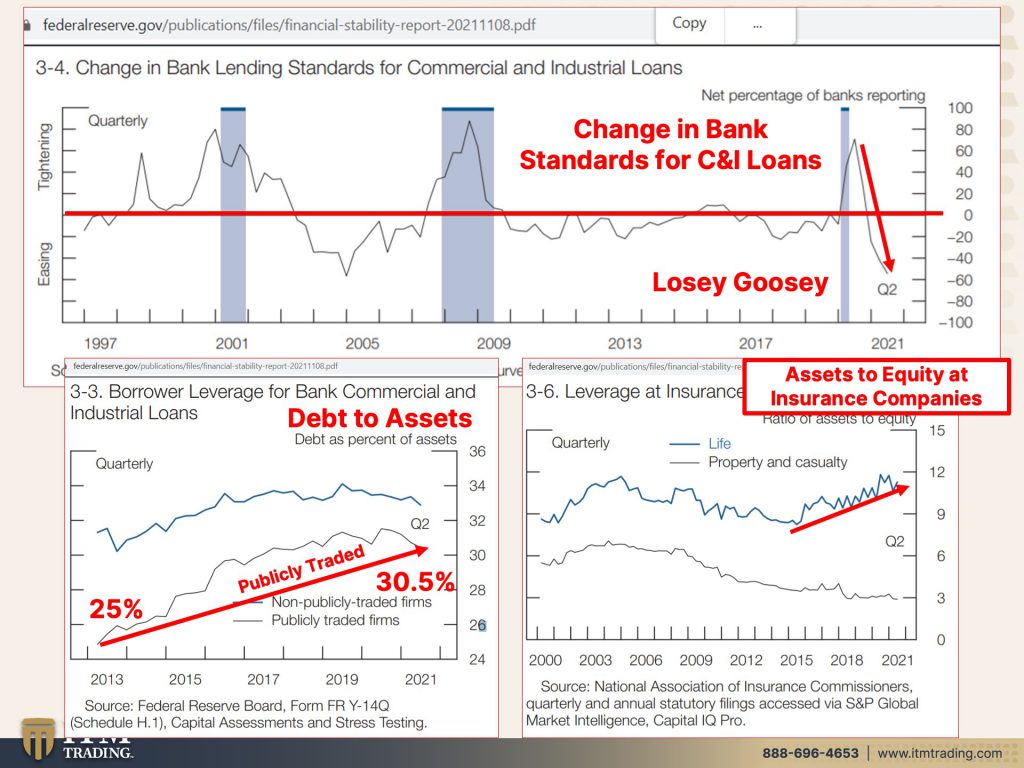

And again, changing bank standards for commercial and industrial loans. It is loosey goosey for individuals, not as loosey goosey, but for corporations. And that’s, who’s going to take us down. And it’s all of these derivatives now on the publicly traded companies that debt to assets has really grown from 25%. And this is just back to 2000 and oh, that magic number 2013. Wait until I show you what I’m going to show you. I was so excited when I saw this. I did a happy dance because I love it. When, what I’m talking about gets confirmed by the powers that be. But the debt to assets has grown quite a bit in the corporate level and leverage and insurance companies. So that was another question that came on Wednesday. Well, if it’s insured, except that any contract, which is what an annuity is or a life insurance policy or any of that, any contract is only as good as the counterparty to that contract and their claims paying ability. And this thing has a life of its own today, but, and their claims paying ability. So that can create a lot of problems. You think you have a guarantee, but if they can’t pay you too bad, so sad, who are you going to call? And what are you going to do?

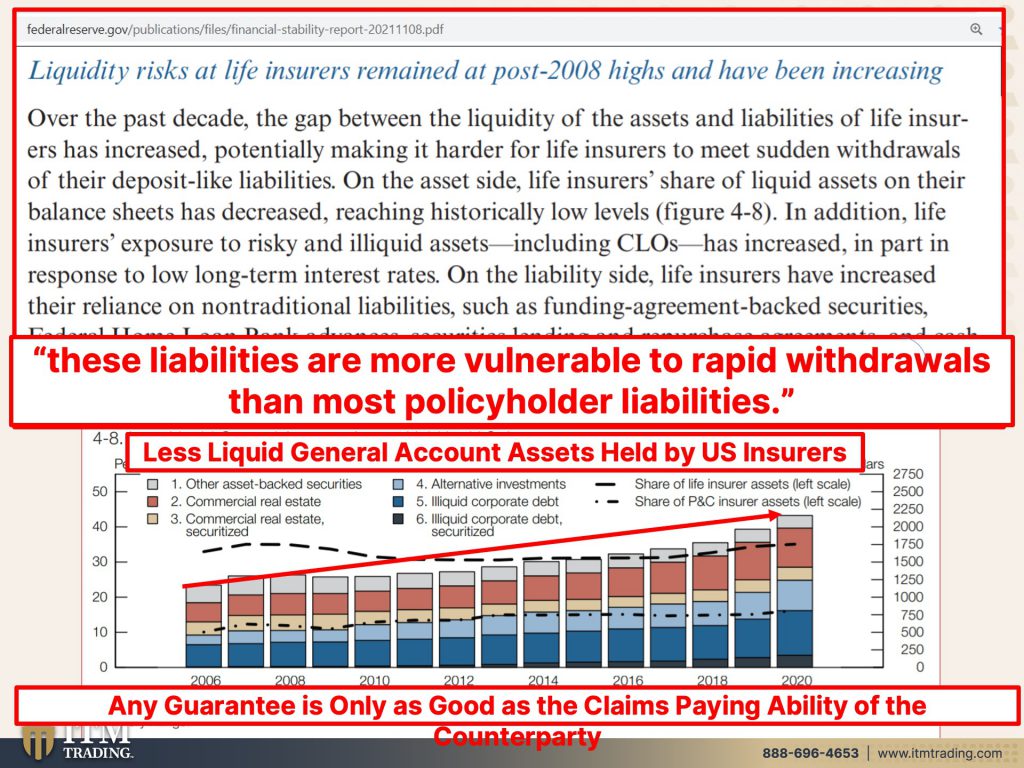

Liquidity risks that life insurers remain at post 2008 highs and have been increasing over the past decade, the gap between the liquidity of assets. So the ability to sell it quickly and liabilities of life insurerers has increased potentially making it harder for life insurers to meet sudden withdrawals of their deposit like liabilities. So those guarantees on the asset side life insurers share of liquid assets on their balance sheet has decreased reaching historically low levels. In addition, life insurers exposure to risky and illiquid assets, including CLO’s has increased in part and response to how long-term interest rates on the liability side. Life insurers have increased the reliance on nontraditional liabilities. And that doesn’t really matter. It’s all of these derivatives because they are reaching for yield. So when somebody like the question was, well, I’m guaranteed 6%, but the market is below that, right? So what does that mean? That means that they are taking on a lot more risk to generate those guaranteed returns. And if they can’t sell, if there’s a lot of people that make a demand and they cannot sell, this is so interesting and they cannot sell the assets to pay those liabilities fast enough. You’re not going to get your money. I mean, it really is that simple. Okay. on the liability side, these liabilities are more vulnerable to rapid withdrawals than most policy holder liabilities. So if they go away, there’s nothing you can do. And you can see the growth in less liquid assets held by you as insurers. And this is the list of it, but it doesn’t really matter. So if you go in and you want your money, you may have a hard time getting that out.

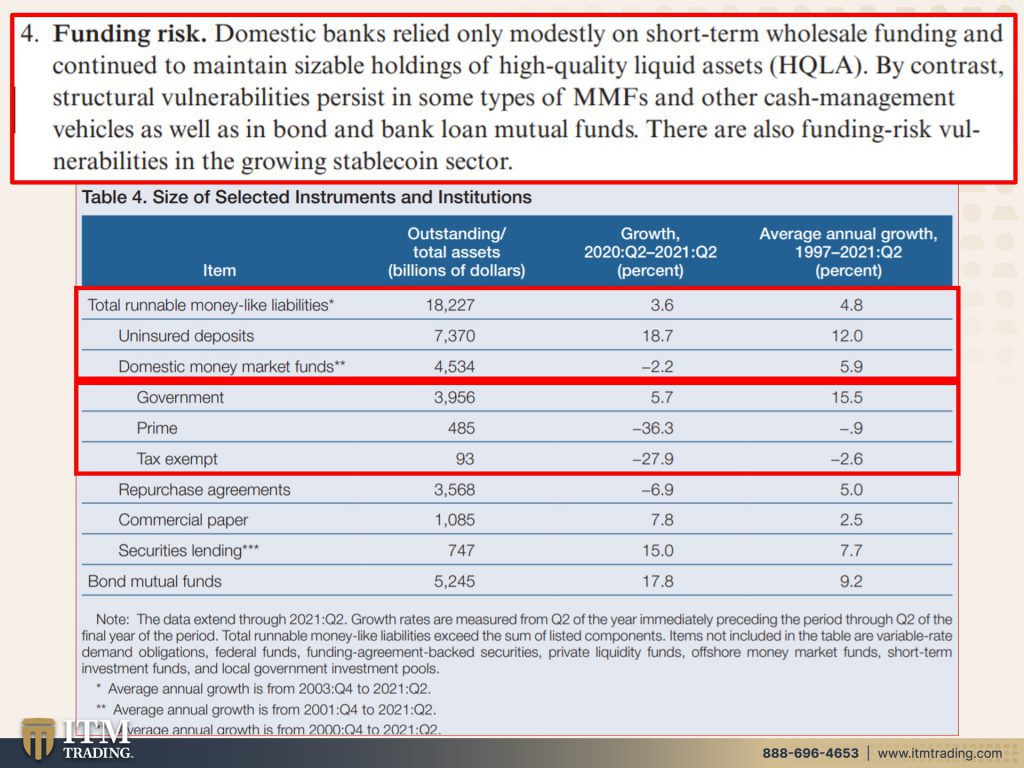

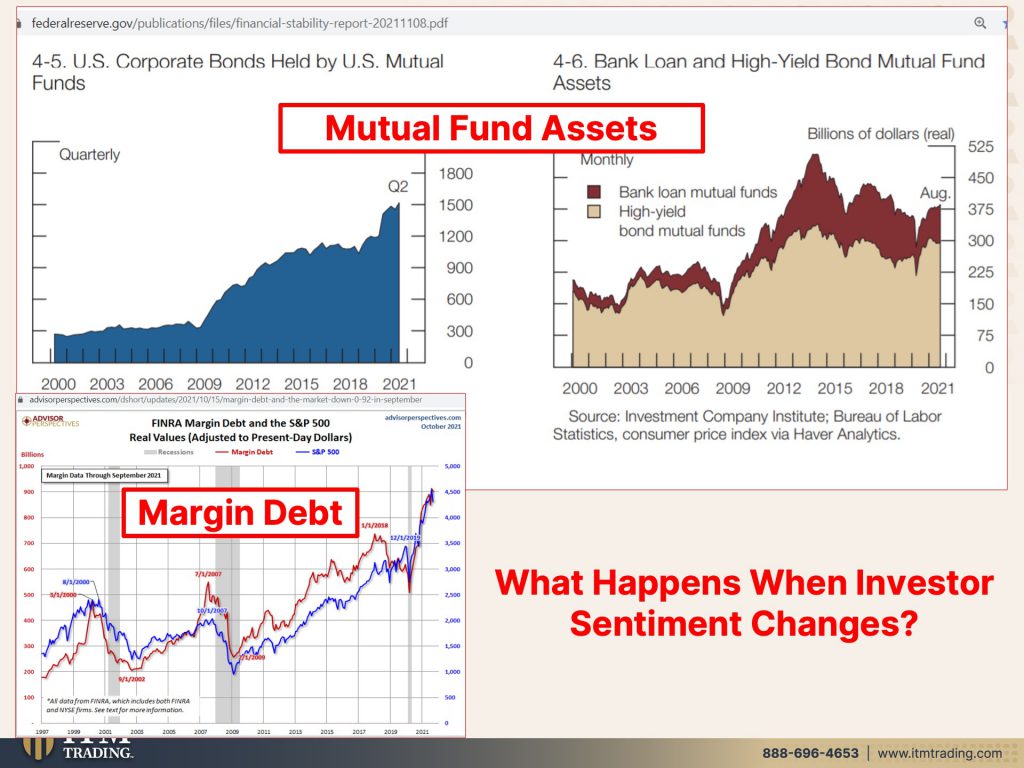

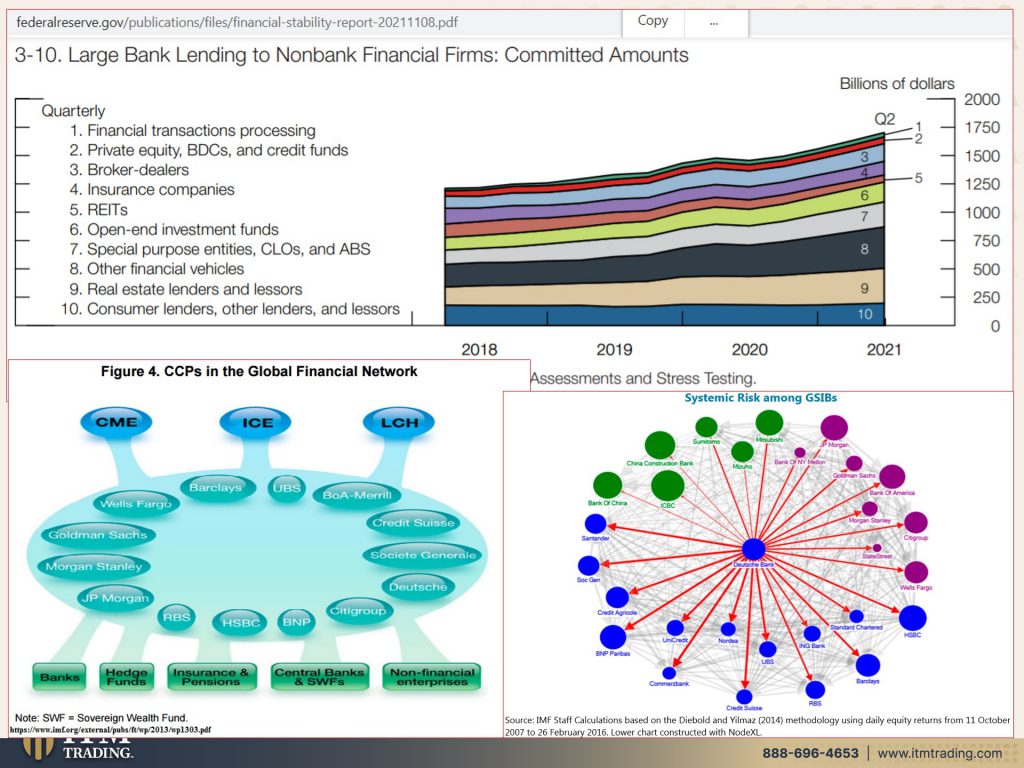

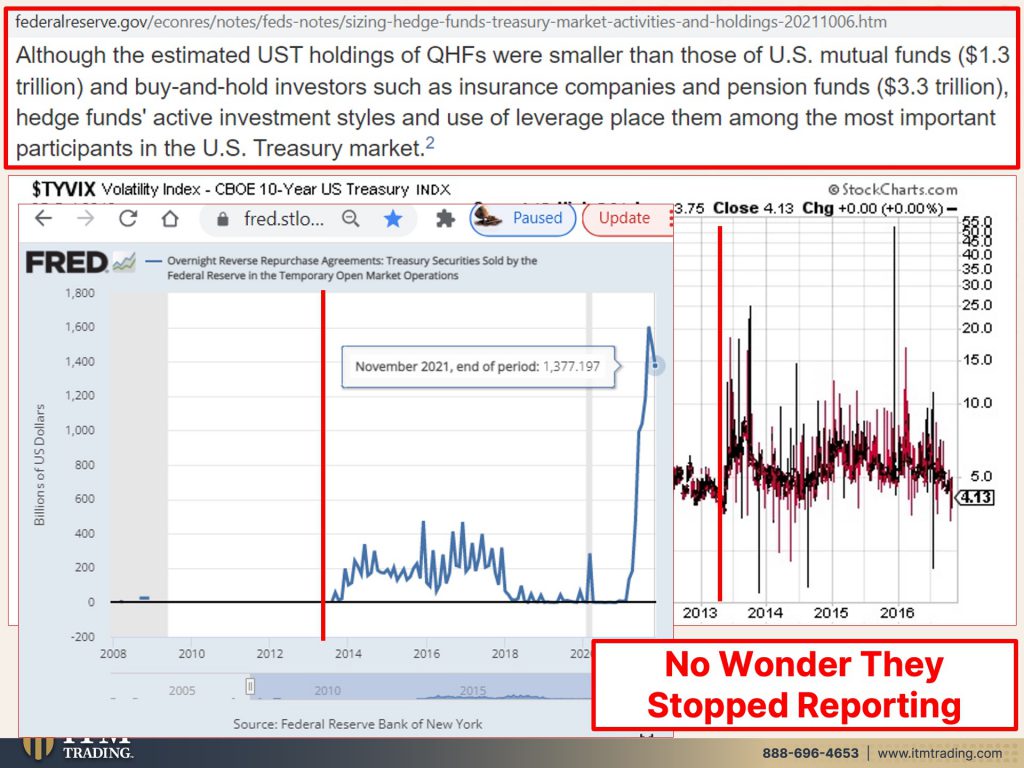

And then lastly, the funding risk domestic banks relied only modestly on short-term wholesale funding and continue to maintain sizeable holdings of high quality liquid assets. By contrast, structural vulnerabilities persist in some types of money, market funds and other cash management vehicles, as well as in bond and bank loan mutual funds. There are also funding risks vulnerabilities in the growing stable coins sector, which we’re not going to talk about stable coins in here. I’m just going to keep to this. But total runnable money like liabilities is over $18.2 to $7 trillion. And uninsured deposits have gone from an annual growth because of all of this new money sloshing around the system from 12% to almost 19% at the same time, money market funds. So people taking money out of the money markets and gone into the stock markets, what’s that out of the frying pan and into the fire. So those have actually declined quite substantially from a growth level percent of 5.9% a year to a minus 2.2. They’re talking about money market reforms, just like in 2008 money markets froze. And the funds went below a buck rather than changing behavior. They just changed the rules of that behavior to lock you in. And they’re going to do the same thing. Wow. This is just moving like really interesting. Okay. So those are money market funds. And we’ve talked about them quite a bit. These are the corporate bond mutual funds and the high yield mutual funds. If you’re nervous about it and you decide I’m going to sell those funds, that’s a run. If one person does it or a few people do, it’s not a big deal, but have a lot of people do it. It’s a big deal. They’re going to have to lock you out and also margin debt because when stock markets fall, you, if you borrow to buy stocks, then you get a margin call and you’re forced to liquidate or come up with a cash in order to maintain your position. What I find interesting about this graph is you never really saw them until 2020 be right on top of each other. There’s always been that gap. This is risk. This is what pushing the debt is, which pushing the stock markets and the real estate markets and the bond markets up, but that can reverse in a heartbeat. So that’s why it’s critical to keep those markets floating because when investors change their mind, they can run very quickly. Now we’ve talked a lot about how wherever this thing starts is going to globally spread. So what you’re looking at here are large bank lending to non-bank financial firms. And it doesn’t really matter who they’re lending it to. You can look at the list there, but the point of this is, is that wherever this run starts, it spreads through all of the banks, even when they’re clearing it through central counter parties, they are still attached to all of the systemically important banks. And therefore to you banks, hedge funds, insurance and pension, central banks and sovereign wealth funds, non-financial enterprises, corporations. So it doesn’t really matter where it starts when it does, whether it’s in China, whether it’s in the U.S. It will spread globally. If they can’t get, keep it under control. And frankly, what I’m gonna show you here is how they’ve really I mean, I’m not really sure exactly who’s in charge. My bet is, is the traders in the markets that are really in charge. Although the estimated U.S. Treasury holdings of qualified hedge funds, that’s QHS were smaller than those of mutual funds and buy and hold investors like insurance companies and pension funds, hedge funds, active investment styles, and use of leverage, place them among the most important participants in the us treasury market. And you guys have all seen this. I even showed you this recently, the $TYVIX, but now I understand exactly why they stopped reporting on it.

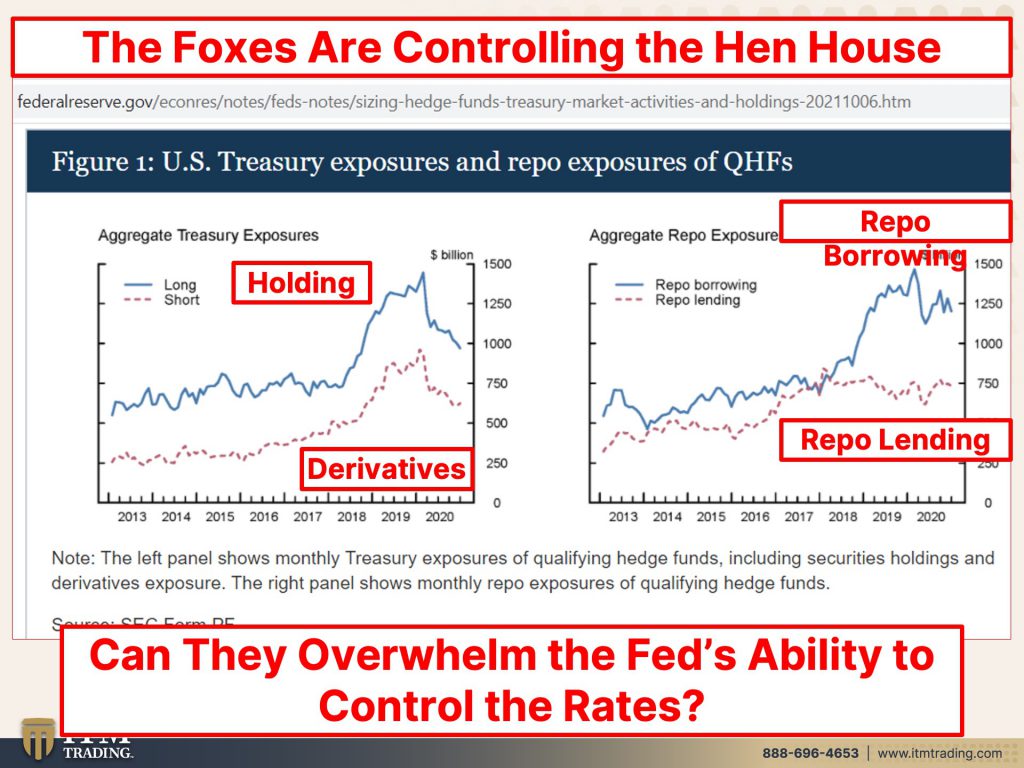

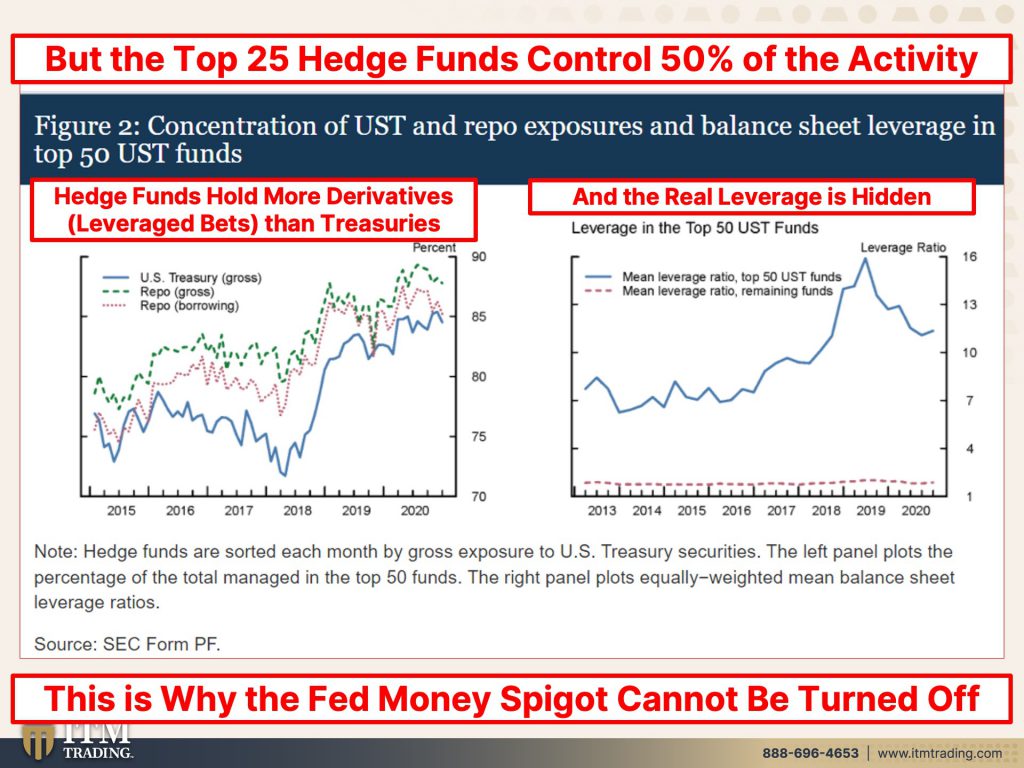

And you can see how there was just this normal flat. This is the foundation of the global financial system. And it’s just, you could count on those treasure prices were not very volatile, 2008 happened. And that what was once a dash started to go up and down. So more volatility and 2013, they handed it over to traders, which I think is really interesting. Now, what you’re looking at here are the overnight reverse repos we’ve also been talking about. So while the treasuries are the foundation of the global system, the money market funds, which are impacted by here is the plumbing of the global system. And so what this chart, what this chart shows you is where that shift, where they handed it over to the traders in the money market fund, or not just the money market funds, but in the, U.S. Treasury market that’s who is driving, what happens in those markets as witnessed by March 20th, 2020? Can you see this correlation? No wonder they stopped reporting it because this only goes to, let’s see right about here. And they knew that I can’t even imagine what the $TYVIX would look…it’d be off the chart. It’d be completely off the chart. It would probably make this look like super small, because it’s still, we had a trillion here and look at it. It hasn’t been even near that sense. So the most current reading November, 2021 was $1.377 almost $1.38 trillion in overnight repo markets, because the treasury exposure, okay, the long is what they’re holding this solid line. And the short is what they’re using in derivatives traders only care about a pickup in money. They do not care about financial stability. That’s not their job. Their job is just to make money. And they do that by the difference between the longs and the shorts by borrowing and lending. That’s how they make their money. So in March of 2020, they overwhelmed the Fed’s ability to control the rates. Let me show you what that looks like, because this is the percentage of activity in all of these traders, look at you’re at 90% in the repo market. So they’re buying these treasuries, but they’re buying them with borrowed money and then they’re selling what they don’t have. They’re selling them short. And that difference. I know it’s complicated, but the difference is what they make. And if they do it in big volumes, it can only be penny. It may only be pennies rather, but if they do it in big enough volumes, then they can make quite a bit of money.

This is going to be two, two films, because I’m going too long on this, but that’s okay. The top 25 hedge funds control 50% of this activity. And when you look at the leverage, so that’s debt upon debt upon debt upon debt to do it. You’re looking at about 12 times leverage, and you can’t even see it because these are derivatives. And what we know is that the derivatives reflect the fee, not the actual amount at risk. So this is why the Fed’s money spicket has to be turned on and it cannot be turned off. I know they’re going to try because they have to further credibility, but they’re not going to be able to. All they’re doing now is tapering buying a little bit less, but they’re not going to be able to do it.

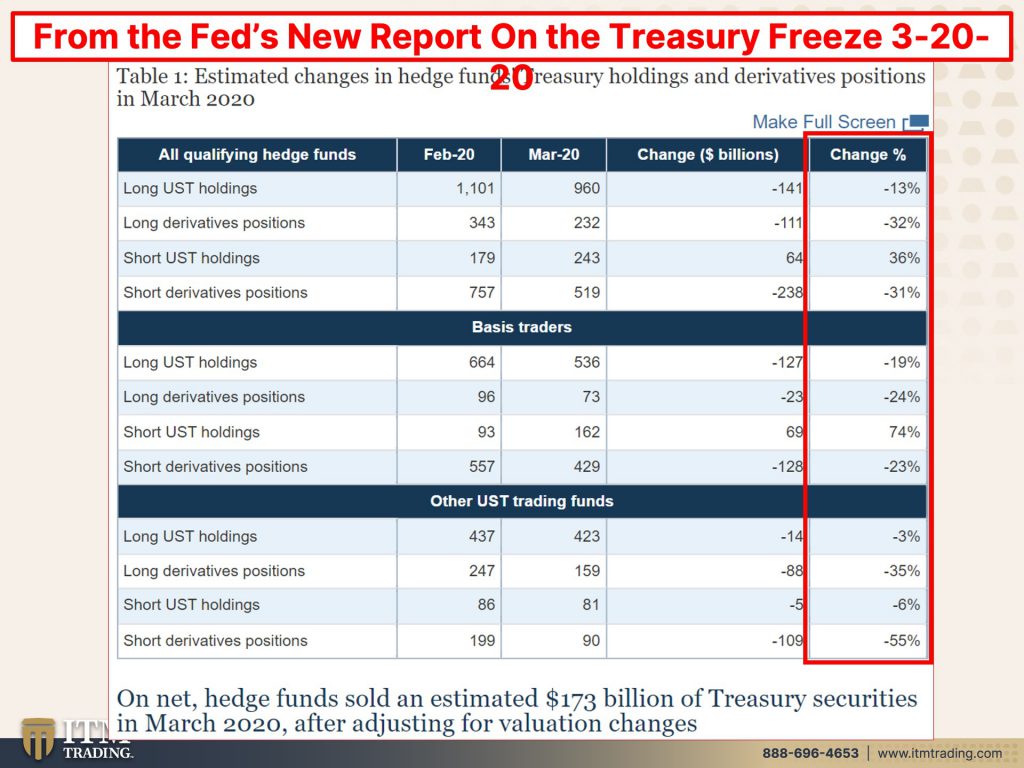

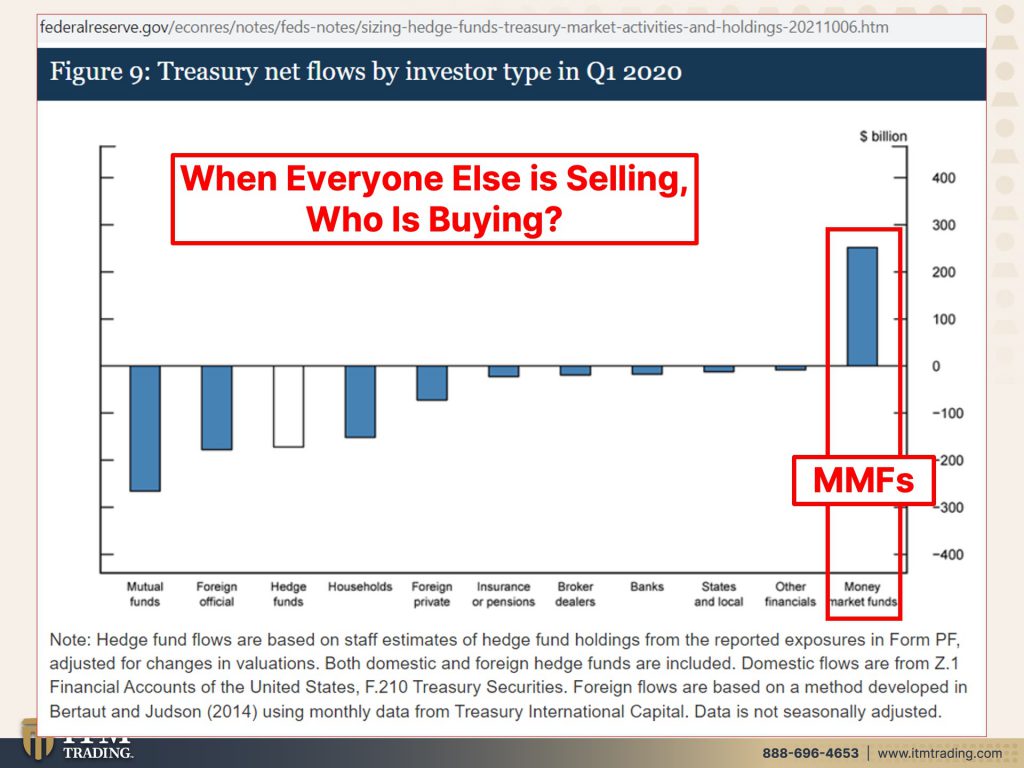

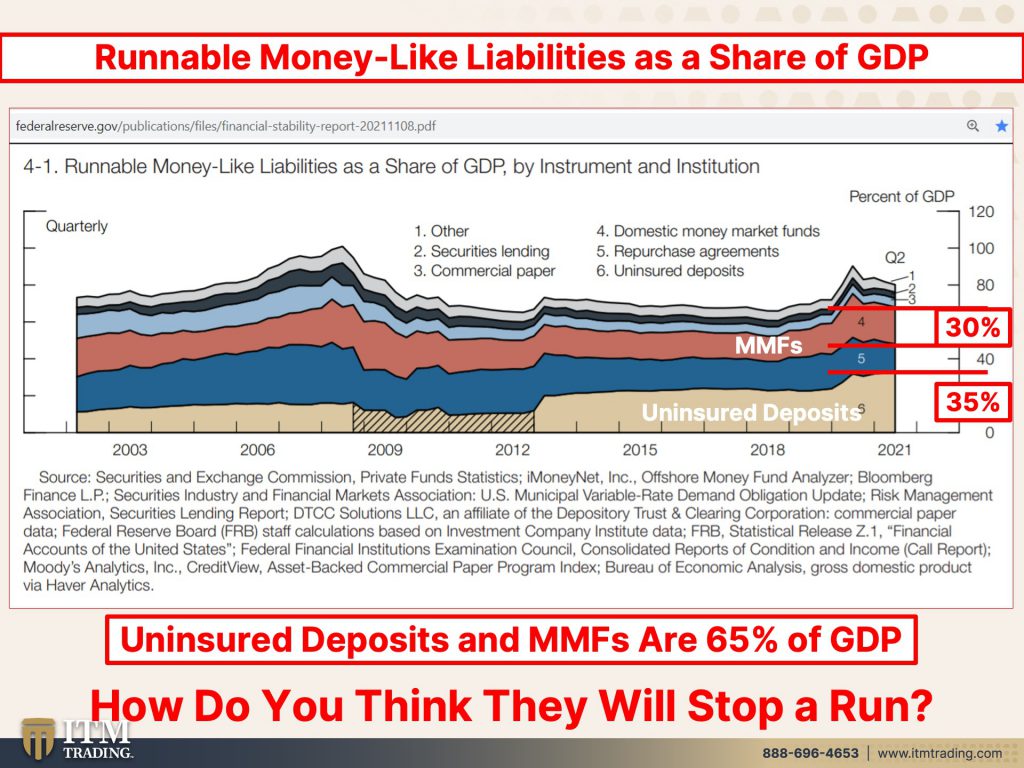

And this is from the March 20, the Fed’s new report on what happened in March with the treasury market that basically froze. So September, 2019, we had the first repo freeze, the money market freeze that they were wallpapered over. So you didn’t know it, but it had happened. And it’s continuing, you saw the spike in the reverse repos. Well, if you can take a look at this, you can see that all of these are really negative by a pretty wide margin, but the short, another words selling the treasury holdings by the hedge funds was up 74%. And what that really did is it overwhelmed the central bank, and that could happen and probably will happen again because when all of these issuers, when everyone else is selling mutual funds, foreign officials, hedge funds, households, foreign/private investors, insurance, and pensions, broker dealers, banks, state, and local governments, other financials, who’s buying it money market funds. So you think that this is all safe, but you know, it’s a place to try and control what really happens in that market. So you need to keep your money in the money market. So they have something to work with. It’s a problem. It’s a big problem, because if you get nervous about that money in the money market, if you’re the only one that’s trying to pull it out, you’re not going to have a problem. But if a lot of people go to do that, you will. So they call this runnable money like liabilities as a share of GDP and the total in runnable money market like liabilities is 80% of the U.S. GDP. But look at the growth and the uninsured deposits, uninsured deposits. If you don’t have insurance and you’re nervous, you can pull those deposits out. That’s 35% of the GDP, interestingly enough. They had to put something in between so that you’d see that money market funds are also 30% of runnable money like liabilities to GDP.

So between those, just those two pieces, you’ve got 65% between uninsured them and money market funds runnable deposits, 65% of all the money that flows through the U.S. Economy. That’s pretty darn risky. That’s why, if you want to get your money out, you better not do it when everybody else does. So when the crisis becomes apparent to everybody, that’s where your money is going to be locked. And uninsured deposits will simply be bailed in, but ask yourself this, when indeed there is a run, how do you think they’re going to stop that run? They’re going to say, you do not have access to this money. Who you going to call? Nobody, not even Ghostbusters can help you with that. So the time to act is now while you still have these choices? What I talk about all the time, the difference between today and the next crisis is in the next crisis, you will lose all of your choices.

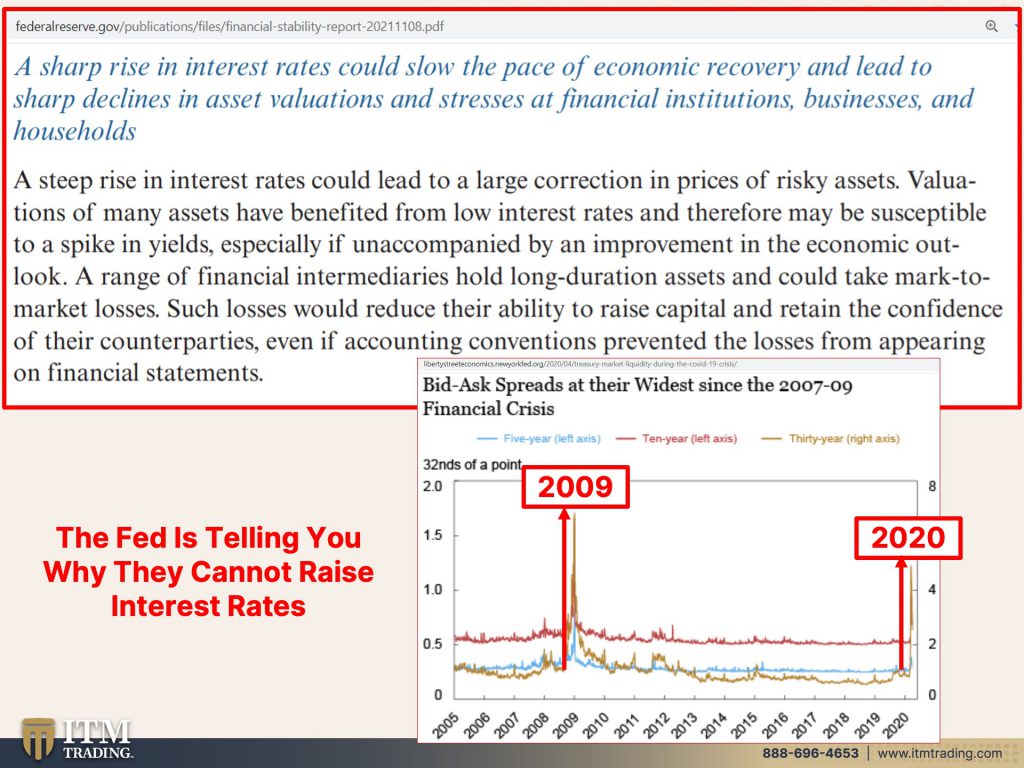

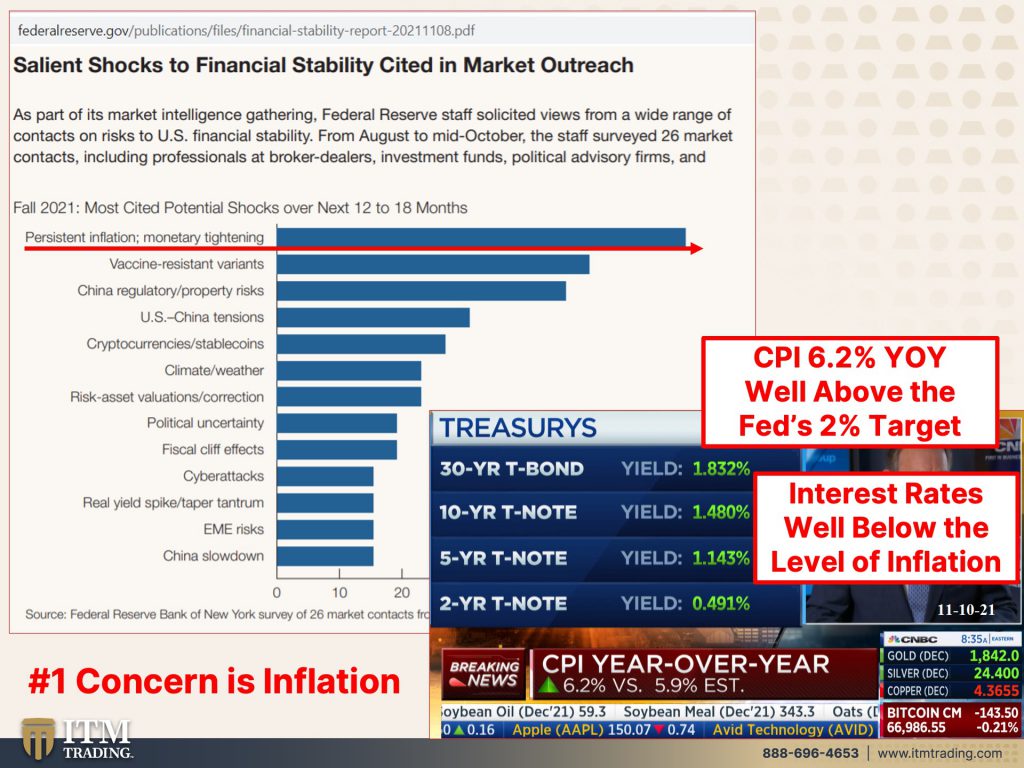

So a sharp rise in interest rates could slow the pace of economic recovery, you think, and lead to sharp declines in asset valuation and stresses at financial institutions, businesses, and households. So they always go, oh, but it’s the children who’s going to be impacted the most. Just like I heard them talking about today, raising the interest rates and when the markets implode well, after all the people, the public is going to be hurt the most. So that’s why they can’t raise the interest rates yet. Oh yeah. That’s, who’s going to be hurt the most. How about that mountain of debt that corporations are sitting on? I think that’s, who’s going to be hurt the most, but let me tell you the ones that are going to feel the most pain is the general public. So this also from that report shows how interest rates spiked in 2009 when the crisis unfolded. And again, in March of 2020, right? So the Fed and globally central banks are buying all this debt. Even though they’ve announced that they’re going to buy a little bit less, but they have to do it to attempt to control interest rates. The bank of Australia gave up yield curve control because the traders overwhelmed them. And I think that that’s, what’s going to have happen for all of the central banks. And this is why the Fed is telling you we can’t raise the rates. Now we cannot do it because the markets cannot tolerate increased interest rates. There’s just too much debt, but what’s the biggest concern? Guess what? That is persistent inflation inflation, which would cause monetary tightening. In other words, raising interest rates. Let me tell ya they’re good and try because of their because of their credibility, because this is a con game and that requires confidence, but chances of them succeeding are slim to none. And I think it’s interesting that today with the CPI at 6.2 year over year, and we know they juggle all of that, that is well above more than three times what the federal reserves target of 2% is, but I’d like you to look at the interest rates on the 30 year, the 10 year, the five-year and the two year. Yes, because they’re green, they went up, but they’re all lower. You know, I mean the 30 year bond is 1.832% in order or in theory, we’re watching whether or not this is actually gonna play out in reality, because there are a number of central banks, smaller central banks that are raising rates in an attempt to control inflation. And it’s not working very well. But in theory, if they raise rates, then there will be less borrowing and spending. And that will control inflation, except that the supply chain is proving a lot. Stickier. The supply chain problems are, are proving a lot stickier. And plus the, in order to inspire people to work, they are paying higher and higher salaries. We’re going to talk more about the advantage or the possible potential or the seeming advantage of the public in another video, but that’s why the dollar strengthened today and you see interest rates going up. We did see a plunge in interest rates too, because the markets are really concerned about a slow down in the economy. So we’ve got a lot of insane things that are not normal in these markets, but it’s all because of the central bank engineering, you know, their perception management, but the number one concern is inflation. It is not transitory. It is not going away. And as much as I hate to say this, you know more and more, I’m convinced that we’re at the start of the hyperinflation that we’ve been preparing for.

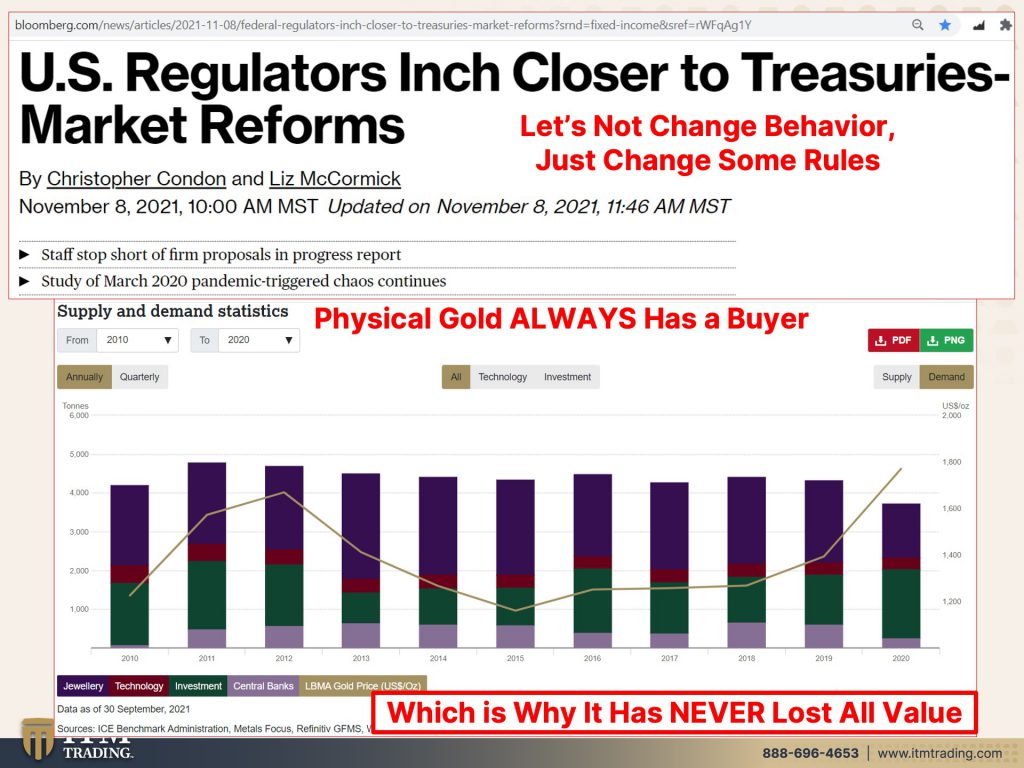

And just so we’re clear, let us not change behavior. So let’s not do anything different than what we’re doing. Let’s just change the way we present that behavior just change some of the rules. So, you know, they already handed the control over to the traders. Once you give them something, can you take it away? No, that is way too hard to do. It takes way too much time. But when you look at gold and what’s happening in that complex, did it go up today in the spot market? Yes, but that’s still a contract and it still doesn’t represent the true value of gold. What you’re looking at here is the demand from, oh, let’s see jewelry, technology, investment, central banks. And this line is the gold price. And what we know is central banks have been net buyers since 2010, and they started buying more gold back in I think it was 2005 or 2006. So before the crisis became apparent to you and they haven’t stopped and they are buying the physical markets, which is exactly what, in my opinion, I think you should do. And the reason why gold has been a proven inflation hedge over 6,000 years is because there’s the broadest base of buyer. So you always have demand sometimes less, sometimes more, but this is what they revalue or reset the currency against.

I know this was a lot, but we do not have good financial stability here or globally. This is absolutely a global issue. And that’s why it’s critical that you get in position today because I don’t know the exact moment that we’re going to lose choice, but I know that it’s close. I know that insanity can last longer than you would think, but it can’t last forever. Food, water, energy, security, barterability, wealth preservation. These are the things, community and shelter. These are the things that we all need to sustain our standard of living. And if you have physical gold, you’re going to be in a position to take advantage of the inevitable. That’s what history tells us. And let me tell you if it’s happened over 4,800 times and we’re doing the same thing. The best shot is that we’re going to get the same result. I do all of this work for you, but really come here my boy, this is who I really do it for, for your kids, for my kids, because I want them to have choices. What is this? You will own nothing and be happy. Everybody owns, or somebody owns everything. Anything that’s physical, somebody owns better. You be the owner than Wall Street. So I know this is a mouthful and it’s a lot to digest. Watch this more than once, make sure that you share it because next week I’m so excited about this. We’re going to have a boots on the ground Coffee with Lynette, with Arpad from Star Path Academy. And he’s actually lived through the Romanian hyperinflation. So I’m going to, we’re going to be talking to somebody that has had this experience. If there are any questions that you want me to ask, just send them into services@ITMtrading.com And mark in the subject that this is for the CWL; Coffee with Lynette or something like that so they know that it’s not just a normal question. If you like this, please give us a thumbs up. Make sure that you share and watch all of the videos because ignorance does not make you immune. It just leaves you vulnerable. So until next week, we meet you know, it is time to cover all of your assets. We do that with the wealth shield. The foundation is gold and silver, but you need everything. Food, water, energy, security, community shelter, as well as barterability and wealth preservation. So until next we meet, can you do this with me till next we’d meet, please be safe out there. Buh-Bye.

SOURCES:

https://www.federalreserve.gov/publications/files/financial-stability-report-20211108.pdf

https://www.gold.org/goldhub/data/gold-supply-and-demand-statistics