European Union In Crisis: What is at Risk?

The European Union was in jeopardy of breaking up during the sovereign debt crisis in 2013. Is history about to repeat itself? One thing we know for sure is that we can learn from history which is what our strategy is based on, historical patterns. We are here to help, give us a call at 877-410-1414 or Schedule a FREE Strategy Session https://calendly.com/itmtrading/youtube?utm_vid=HN6232022

📖 Chapters:

0:00 Introduction

1:33 Will the European Union Survive this Crisis?

6:17 European Union’s Future Plans

9:13 New Tool to New Debt Crisis

19:10 Fears of Sharp Downturn

21:35 Demand for Gold Remains High During Inflation

23:52 Outro

TRANSCRIPT FROM VIDEO:

No peg lasts forever. And the European Union is not an exception to that rule. It was in jeopardy of breaking up during the sovereign debt crisis in 2013. And guess what? Here we are, again, coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading, a full service, physical gold and silver dealer. Never has that been more important than now because everybody should be seeing, if you don’t hold it, you don’t own it. We’ve seen it over and over again. And we’re seeing it again in the European Union because frankly they’re facing another crisis and it’s not just about stagflation. It’s actually about fragmentation. Will the European Union survive this crisis that they have already entered?

Because they’re coming out and telling us, oh yes, we will. We will do anything. Whatever it takes, underscores commitment to contain bond, market panic. Because you see, when I talk about a peg, that is, you know, that is two entities acting as if they have the same economy. When in reality they don’t. So you have the German economy and remember Germany has already lived through hyperinflation. They understand what that’s like, and they are very, you know, they, they work hard. They save hard. They’re conscious of that. And then you have some Southern countries that are not as conscious about that. Like Italy and Spain back in 2013, it was Greece. Maybe Greece is there again. So when you have two different economies, but yet you’re under the same stipulations and the same agreements doesn’t really work because they earn different, they earn at different levels. So this is why no pegs ever last it would be kind of like if I had an income of, you know, a million dollars and you had an income of $200,000 and you were attempting to live at my level, but I had enough income that I could just pay for whatever I wanted. You had to borrow in order to get the same level of thing. At some point, you’re gonna run out of the ability to borrow, that’s what’s happening again over in the European Union, but don’t worry because we are firmly committed to contain unwarranted fragmentation that would impair monetary policy transmission. In other words, they are trying to figure out a way so that these Southern countries that earn different incomes than the Northern countries, that they won’t break apart, that they’ll be able to transmit their monetary policy throughout the entire European union at the same level. And I don’t really think that that is a possibility, but we’ll see.

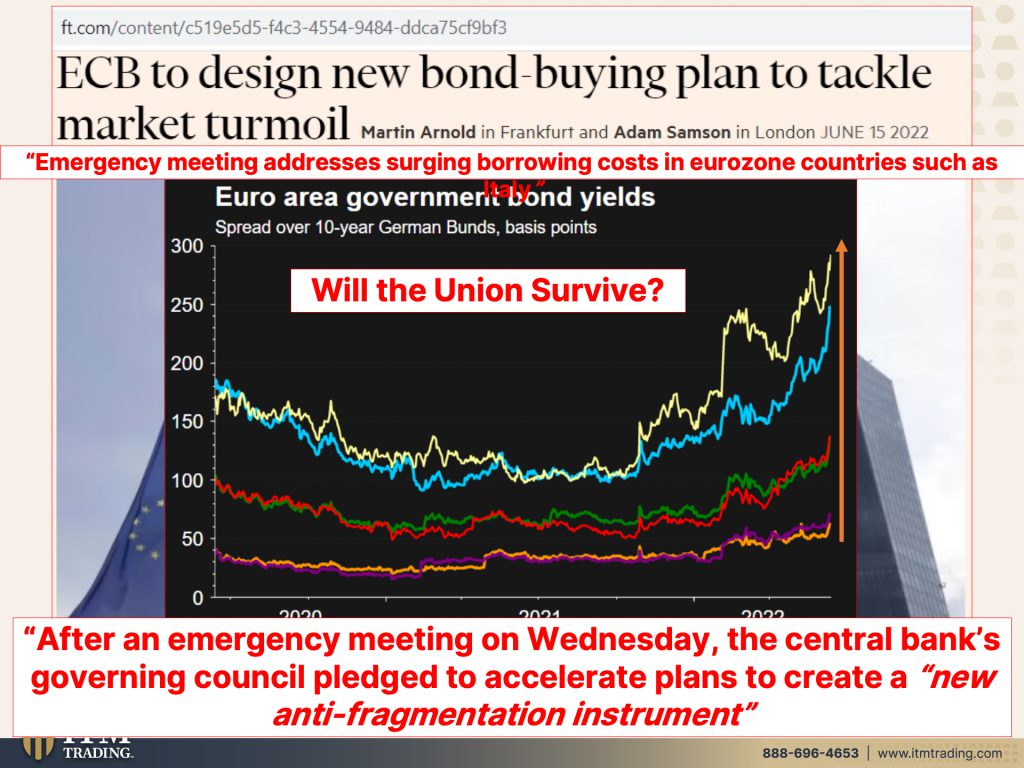

So what they’re gonna do, <laugh> because you never change behavior. Just change the rules. I mean, I love this and you can’t make this up, but they’re going to design a new bond, buying here, a new debt program to tackle this market turmoil. All right, everybody relax. Everything is under control. So there was an emergency meeting that addresses surging, borrowing costs in Eurozone countries, such as Italy. And this is what they’re talking about, right? So you know, you’ve got France, Belgium, Italy, Portugal, Spain, and Greece. And you can see that all of those interest rates are climbing, but particularly this is Greece. So Greece is in trouble. Again, this is Italy and this is Portugal and Spain right here. So, and this is the difference in interest rates. If the German bond were at the tenure, German bond was at zero, this is the spread over how much more that these countries have to pay above what the German tenure has to pay. And you can see that it’s spiking going into a crisis, but where it was kind of mostly contained in Greece the last time. Yeah. And Italy was in trouble, but they never got to that point of Greece. And so is Spain, I mean, all of these weaker countries it’s coming out again, you just can’t find fight it. So will the union survive? Ultimately, I personally say no because historically, no pegs, no economic pegs have ever, ever, ever lasted over a long period of time. And there are no exceptions. So I don’t think this is gonna be an exception either really, after an emergency meeting on Wednesday, the central bank’s governing council pledged to accelerate plans to create a new anti fragmentation instrument, in other words, a new bond buying program. So when, so what they’re gonna do is buy the bonds of these countries to drive the interest rates down. It’s not real, it’s all smoke and mirrors. And at the end of the day, because we’re going into a completely new financial, economic and social regime, this will break apart. I mean, I can’t guarantee it, but I’d go 99.999% sure.

But don’t worry cause good old Christine Lagarde who used to be the head of the IMF tells ministers the ECB plans for a limit on bond spreads. So that’s what they’re gonna do. They’re putting a range. Okay. So if this is the German 10 year bond and they’re, they’re not going to allow these other countries 10 year bonds to go above a certain level. Once they do that, then they’ll go in and start buying the bonds of those weaker countries. What a good idea. But there’s contagion in that. We’ll talk about that in a minute in Europe, the prospect of the ECB increasing rates for the first time, cause remember there are negative rates, so let’s get us to zero because we’re fighting that inflation. I’m telling you. Let’s see for the first time, since the sovereign debt crisis in the early part of the last decade. So they have not raised interest rates since 2009, but they’re gonna do it now to get us up from a negative rate to zero. Cause that big experiment was such a success. Look at those economy’s over there that those economies over there are doing, not, but hey, insanity is doing the same thing over and over again and expecting different results. That’s what, that’s what all of these central bankers are doing. It’s crazy. So, okay. So it’s stirring up concerns that the flaws in the currency block might again be exposed. We cannot have those flaws exposed. Let’s hide them by, by taking on more debt. Cause just take on more debt. That’s what you have to do.

The limited mechanisms for fiscal transfers between member states. See they’re not as unionized as they’d like us to believe. And the incomplete banking union mean that weaker countries can come under pressures in periods of financial turbulence, which is exactly where we are now. But I would like to point this out. The Euro hits a session high on her comments and yet the purchasing power of the Euro because they have a lot, they have inflation just like everywhere else in the world. The purchasing power value of the Euro is going down, down, down, but don’t worry because the Euro hits a session high. It’s a joke. It’s just a smoke screen. Look over here. So you’re not looking over there. The central bank has to address the fragmentation issue and the fragmentation issue is all of these countries breaking away from the block from that union, they better address it because it’s gonna happen anywhere.

Okay? So here’s the tool to avert debt crisis 2.0 and it’s taking shape because this is all a big fat experiment. All of this stuff that all of the global central bankers are doing is just a big fat experiment has been, actually has been since it’s been created every time they’ve gotten an unintended consequence, but let’s see president Christine Lagarde told Euro area finance ministers that the tool will kick in if the borrowing costs.. So if interest rates go up for weaker nations rise too far or too fast we kind of saw that, right, but they don’t have this new tool ready yet. A bond buying mechanism where other securities, I’ll just read it. Then we’ll talk about it. A bond buying mechanism where other securities in the ECBs portfolio. So all the other garbage that they’ve been buying in other words will be sold <laugh>. So is not to interfere with efforts to curb the price, the to curb the spike in consumer prices. Let me translate that. So what they’re gonna do is they’re going to sell garbage that they’re holding in their portfolio, which is gonna have an impact on the market. Is it other bonds that they’re gonna be selling? Probably so, so they’re gonna sell bonds that they’re already holding in order to buy bonds, new bonds, secondary market. Who’s gonna absorb that. We’re gonna see interest rates even go higher in these countries, unless what they’re gonna sell German bonds to buy Italian bonds. How’s that gonna work? It’s not gonna work. I’m telling you right now, they’re out of tools. They can’t fight this. They’re out of tools because they’re out of purchasing power. They have to attack your principle in order to buy new bonds. They sell, yep. Yeah. That should work. Not, I’m being completely facetious. Let’s not make any mistake about that, but we’re being so assured Europe does not face a fresh sovereign debt crisis. Of course not. Of course not. This is Ireland’s finance minister said current circumstances were completely different from the kind of crisis environment we were in during the early was like 2013, completely different where you had banks. Hm. Buying government bonds, the government loaning bank’s money to buy government bonds. This is called a doom loop. If either one of those entities goes down. Yeah, we got a problem. This is not completely different than the crisis that happened back in 2013. Not completely different, but if he says it must be true. What do you think? I don’t know. Surging inflation and freeing confidence. This is probably the single most important thing I’m telling you. Fraying confidence have sparked fears that the Eurozone is heading into a sharp down torn downturn. This is a con game. It requires confidence, inflation running at these high levels, shakes that confidence. Remember it’s not in the inflation. It is in the inflation expectations. This is what they’re doing is they are losing control of perception management. And it’s not just happening there. It’s happening all over the world. As the ECB joins other policy makers in lifting interest rates, those fears have intensified because we’ve got all of the short term debt that is rolling over into a higher interest rate environment. Therefore everything costs more. And when they lowered the rates down to zero, a big reason why they did that was to enable these corporations in these countries to refinance their debts at much lower levels. And consequently, maybe they actually thought that some of this debt would be retired, this higher coupon debt for the lower coupon debt. But what corporations did since they then and governments as well since they had they were, they were having to pay out less in those principle and interest payments cause interest rates were negative or zero or close to it rather than retiring that debt and getting themselves into a better fiscal position. They just kept taking on more and more and more and more debt. So into this mountain, this huge level of debt rolling over into a higher interest rate environment. That means that those payments are gonna be higher and higher and higher. And you’ll see more level of default, but you’re also going to see those zombie corporations that we’ve talked about. Those corporations that have not even had the ability to meet all of their interest payments at least three years, but the banks didn’t want that known on their books. So they would loan them more money to make those payments and take on more and more debt. You’re gonna see that whole game explode here pretty quickly. I can’t tell you exactly the moment, but we’re close.

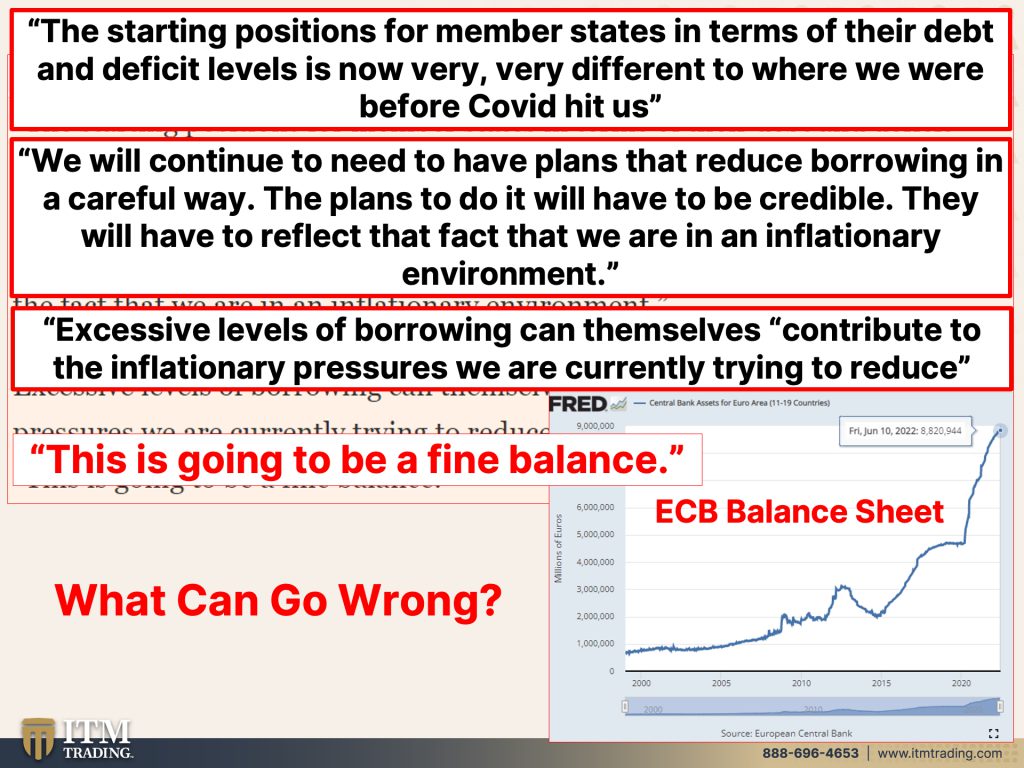

Now. He’s trying to tell us that the starting positions for member state in terms of their debt and deficit levels is now very, very different to where we were before covid hit us. Yeah, it was high before that hit us. It’s higher now. So this is the start, right? No wonder the interest rates are seeing a spike in those peripheral countries. Additionally, we will continue to need to have plans that reduce borrowing in a careful way. <Laugh> I mean, can they really do it? Come on the plans to do it will have to be credible because it really is all about confidence and they will have to reflect the fact that we are in an inflationary environment mm-hmm mm. So that means they have to, the theory is you raise the rates, you reduce the borrowing, but what about all of the rollovers? I mean, this is not a very well thought out plan or maybe it’s a perfectly thought out plan to take us into the crisis. That’s big enough to get us to accept the CBDC’s, Central Bank Digital Currencies that give them full surveillance capabilities.

I mean, think about it for the government. They wanna have the ability to tax, to do lifetime taxes. If they can see every penny that you take in and tax it right at that moment. Cause what are you gonna do? That’s a button push for them, that’s an algorithm. That’s not even a button push that’s a smart contract. That’s all I can say about that. Really excessive levels of borrowing can themselves contribute to the inflationary pressures we are currently trying to reduce. Yeah. Think <laugh> I mean seriously. Yeah. Think so. What he’s saying here is all of this debt that not just the ECB, that’s their balance sheet, but through June 10th, but all of the debt that all of the central banks all over the world, all that’s new money and oh my goodness. That could actually contribute to the inflationary pressures.

But no, no, no, wait, wait, wait, wait, wait, let me, let me take that back because it’s really the workers asking for more money so that they can, you know, attempt to live through this inflationary environment. You, you know yeah. Anyway, it’s not them. It’s other things. That’s the closest to an admittance that I guess we’re gonna get. But what he says is this is going to be a fine balance. So these guys that have gotten everything wrong, everything, everything they’re gonna do this and it’s gonna be fine balance. What could go wrong? Are you freaking kidding me? You got gold? You got physical gold and physical silver in your possession? As well as Food, Water, Energy, Security, Barterability, Community, and Shelter, get it done. They cannot do this. It’s a big fat experiment and it won’t work. It won’t work. You’re gonna sell off here to buy this here and that’s not gonna have, that’s gonna balance it up garbage.

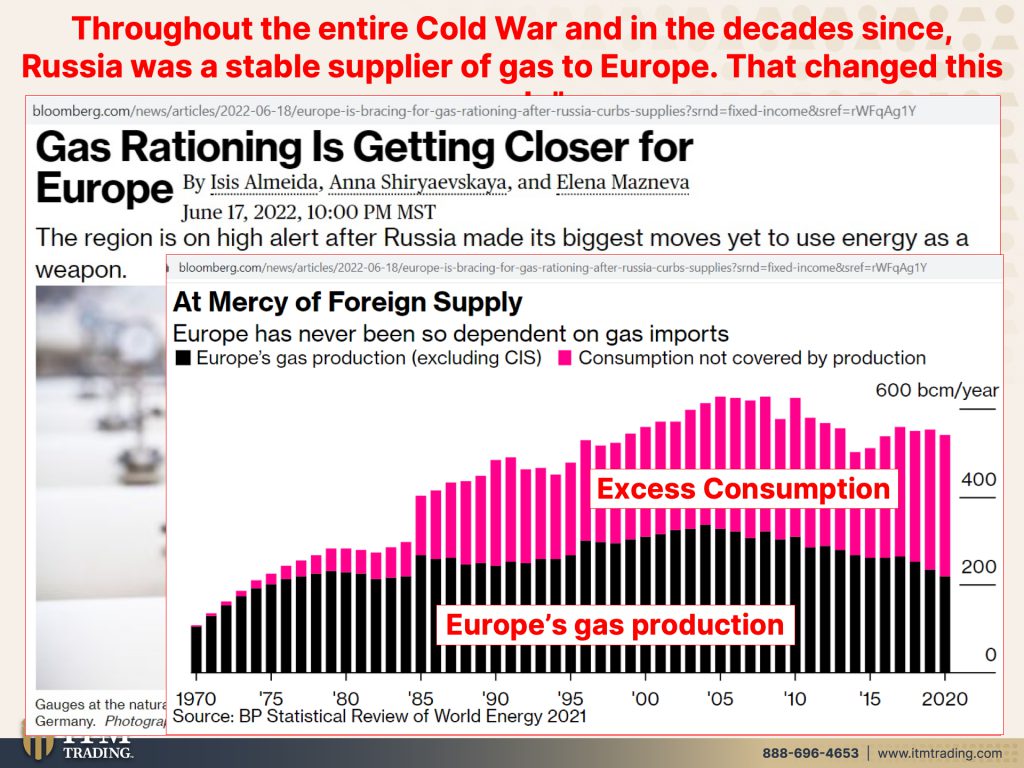

I’`m telling you right now, extreme garbage and their economies are not strong enough fears of being held hostage to ransom by Russia over gas has become a reality. What do you think that’s gonna do to their economy? Russia’s decision, which has reduced capacity on NS1 one by 60% and led to lower flows to countries from France to Slovakia has moved the energy crisis into a new and dangerous phase. But they’re gonna do this in a very balanced way. Really? You think? So the current situation is one of the worst outcomes we had contemplated raising rates is not going to make this issue go away. It’s not going to make inflation, go away. They’re doing it because that’s the only thing that they know how to do, but it’s not going to work. We are at the end, we are at the end of this Fiat, the current Fiat money experiment.

They want to take us into a new experiment. How’s that gonna work? We have to feel enough pain in order to say, help me, Mr. Bill, help me and accept whatever garbage they want to cram down our throats. You have to be as independent and self-sufficient as you can possibly be to be able to sustain a reasonable standard of living. Because what we’re really watching is the evaporation of most people’s standard of living in Venezuela. You got 90% of the population and abject poverty, 90%, I didn’t say a hundred percent be part of that 10%. You need gold and silver in your possession. Be part of that 10% because throughout the entire cold war and in the decade, since Russia was a stable supplier of gas to Europe and that changed this week. And so what they’re looking at there is the potential for gas rationing. And if you are just the right size to fail, guess who’s gonna get most of that rationing. Guess who’s gonna be in the best position for that because there’s your excess consumption. This is what their production is. And it’s been going down since 2004. You got a problem.

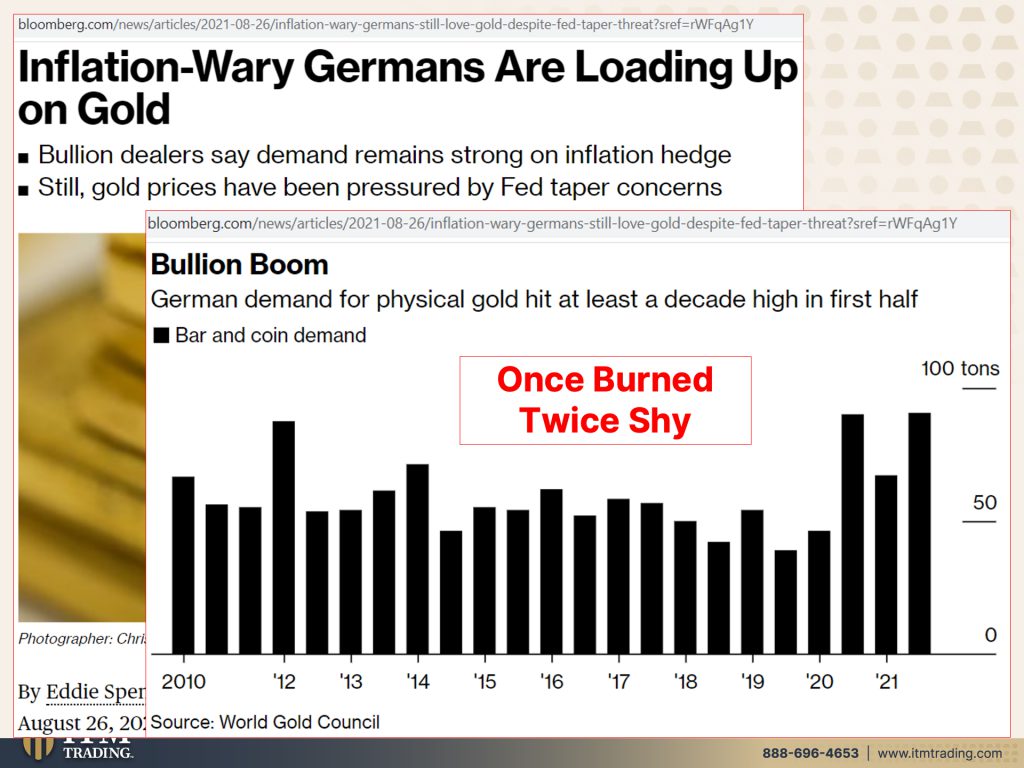

But the Germans, they know what to do. Inflationary Germans are loading up on gold. Yeah. Bullion dealers say demand remains strong on inflation hedge. Still gold prices have been pressured by fed taper concerns. Don’t buy the garbage German demand for physical gold hit at least a decade high in the first half. Yep. They know that because once burned twice shy, don’t be burned. Get your gold, get your silver while there’s still the time. And you still have as many choices as you have. I mean, we used to have a lot more choices, but we don’t. Those are drying up because once that gold…it’s physical. There’s a finite amount. Once it comes off the market, not coming back on again. So easy. And the truth is I’m sorry for being redundant, but I really want you to get this. If you don’t hold it, you don’t own it. And what we’re really seeing is the whole world imploding. We are at the end. No, there’s nothing that’s gonna save the system. It is too corrupt. It is too top heavy in debt.

And God knows the system that they’re gonna put us in. I mean, what’s going to restrain it cause they’re talking about it just on need. Oh, I wanna build a bridge. Okay. Here’s the money for it? Oh, I wanna buy a new blouse. Okay. Here’s the money for it. How much value does that have that money will have no value. And if it’s based on debt, which is another thing that they’ve been talking about, they gotta get rid of this mountain of debt in a hyperinflationary depression in order to take us into the new one, either way, you gotta have physical gold and physical silver, that’s gotta be your foundation because that’s, what’s going to help protect any wealth that you’ve accumulated Fiat money, wealth that you’ve accumulated that’s in the system that you’re counting on to retire on or to send your kids to college or any other thing.

It won’t be there. That wealth won’t be there, but you need the full range. Gold and Silver’s your foundation. But you also need that Food, Water, Energy, Security, Barterability, Community and Shelter you needed all in order to have a sustained, a reasonably sustained standard of living. I can’t even begin to tell you how grateful I am for April of 2020, because it showed me the hole, in my personal strategy. Do I have all those things down in Phoenix? Well, most of them I’ve tried to have all of ’em. Some things have been a bit of a challenge, but I have all of them up here or will I’m working on it. And I’ll be honest with you. I pushed a lot of things ahead of when I would’ve really liked to have done them because of how close I see we are to this. I can’t tell you that you’re gonna lose all choices on, you know, Tuesday morning at 8:35. But if that does indeed happen, how much better are you gonna feel? If you have Food, Water, Energy, Security, Barterability, Wealth Preservation, Community, and Shelter a whole lot better. I sleep well at night knowing that I could take care of my family. And even though my hot houses aren’t quite up yet, I have dried foods. I mean, there’s so many different ways that you can get prepared no matter where you are so that you are better off and I’m urging you to do it. Now I’m urging you to do it as quickly as possible. And I’m also urging you to share this, share this with as many people as you love as you don’t love. As you know, who’s on your Facebook page whatever, because ignorance does not make you immune. It just leaves you vulnerable. So if you like this, please give us a thumbs up make sure you leave a comment because it helps spread the word. And the more people that know what’s going on, the better off we are all going to be because this is our Community and this is what we’re doing. So you can find a lot of the behind the same, the scenes footage on where do we have that on Instagram @LynetteZang. And also because you do need more, you need gold and silver as your foundation, but you need all the rest of it too. So go join us on Beyond Gold and Silver on that YouTube channel, as well as there’s articles on the website, etcetera, and get yourself into the best position that you possibly can. You can also find more information @itmtrading_zang on Twitter. And of course, you know, we have the podcast. So we’re on all of the major podcasts.

Make sure that you leave us an comment that really helps to spread the word. But again, if you have not started your strategy yet, call us click that calendly link below, get connected with one of our Gold and Silver experts, get your strategies started. And if you have started, get it done. If you haven’t finished it. And I mean, even I’ve been working on it for a long time, I’m probably more ready than anybody else I know. And I don’t feel ready so I can imagine how you feel, but I feel more ready. I feel more confident because I have all of those bases covered, whether it’s down south or it’s at my bug out location. So until next we meet, please be safe out there. Bye-Bye.

SOURCES:

https://www.ft.com/content/c519e5d5-f4c3-4554-9484-ddca75cf9bf3

https://fred.stlouisfed.org/series/ECBASSETSW

https://www.ft.com/content/2da439ba-87d8-4a48-80ca-b6452d48669a