DON’T WORRY, SPEND MONEY: Undeniable Bad Advice & Negative Signals…

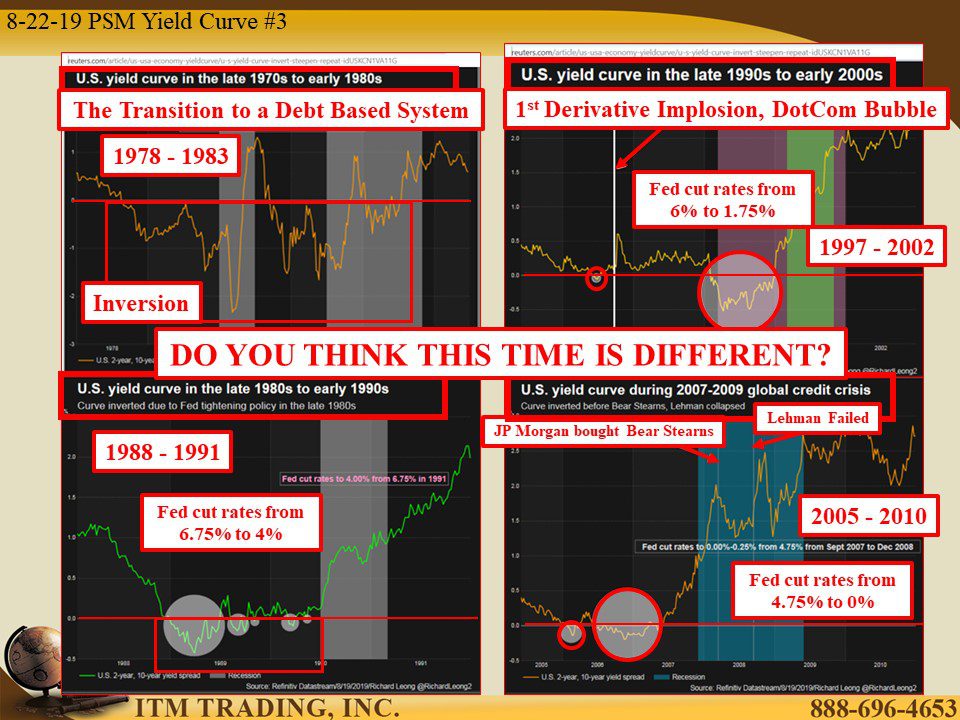

On August 22, 2019 at 7:15 am, the 10 YR/2 YR treasury yield curve inverted for the third time this month. The first inversion in this cycle was on August 13th. In addition, the 10 YR/3 MNTH inversion that began on March 22, 2019 has been consistently widening since it inverted on July 22, which historically, has told us a recession is either imminent or has already begun according to most economist including at the NY Fed and even Larry Kudlow, President Trump’s economic advisor.

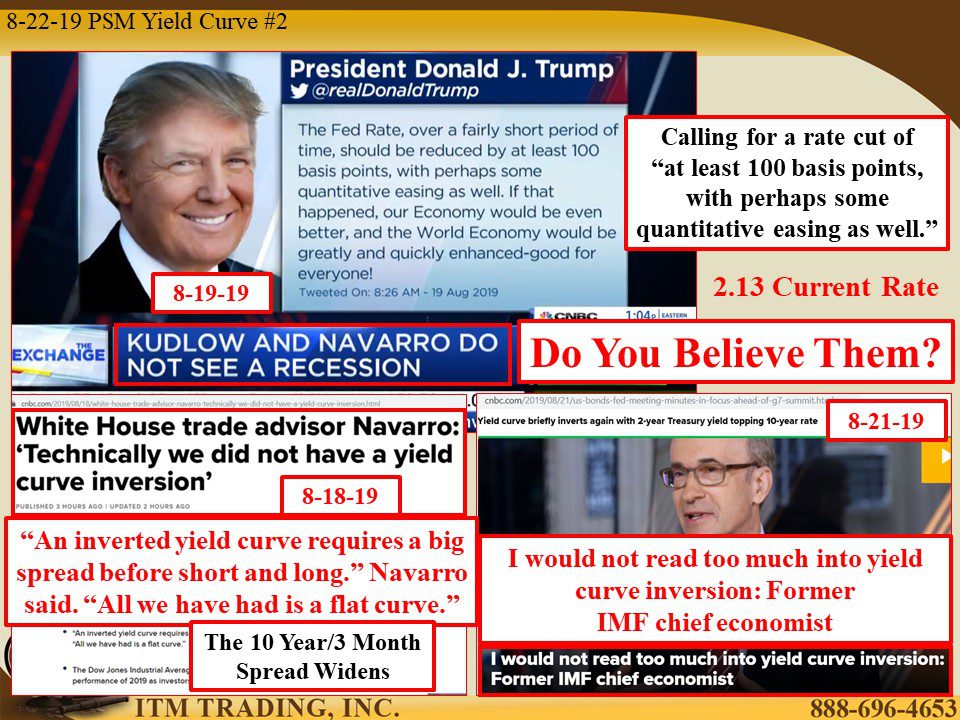

Of course, governments and central bankers cannot tell you the truth because the public would most likely run from the markets and the banks. And so, they sweat behind closed doors and spout nonsense to calm the public. Case in point; On August 19th both Larry Kudlow and Peter Navarro, White House trade advisor, said that they do not see a recession. Dear Larry, what changed from March 22 and the NY Feds researched confirmation? On August 18th Peter Navarro said “Technically we did not have a yield curve inversion†because “An inverted yield curve requires a big spread before short and long.†Mr. Navarro, have you looked at the widening spread in the 10 YR/3 MNTH?

Not to mention that, at the time of this writing, the overnight Fed Funds rate at 2.13%, is higher than the 30-year treasury bond at 2.07%! Of course, the Fed Funds rate is directly dictated by the Fed and they could lower them below all other rates. If the president has his way, that would be a full percent with some QE money printing as an extra bonus. Both of which are crisis era moves, and neither of which have successfully “stimulated†the economy. Just look at the escalating global slowdown, along with the explosion of negative yielding bonds.

And while the IMF will tell us there may be a problem in the future, central bankers and the IMF wants you to know that, even though inverted yield curves, especially the 10 YR/3 MNTH inversion, have foretold us that something nasty this way comes every single time. This time is different.

Oops, isn’t that what we hear EVERY time just before a crash? Though I will agree that, in some critical ways, this time is different since negative rates are a historic first, and so are inverted negative rate yield curves. Do you think this means the global economy is falling into a soft bed of fiat money clover?

How do you go bankrupt? Slow then fast.

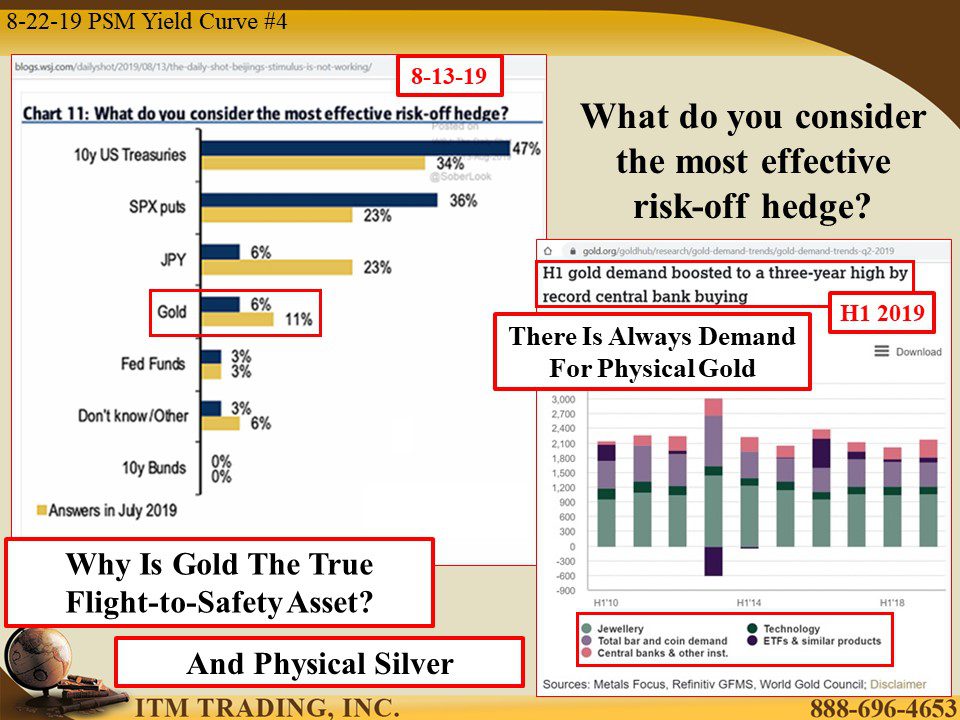

What can you do NOT to go bankrupt? Physical gold and silver, real money saving your purchasing power. When others must sell, you’ll be in a position to buy and personally, I believe that’s a much better position to be in.

Links:

- https://www.cnbc.com/2019/08/21/us-bonds-fed-meeting-minutes-in-focus-ahead-of-g7-summit.html

- https://www.cnbc.com/2019/08/18/white-house-trade-advisor-navarro-technically-we-did-not-have-a-yield-curve-inversion.html

https://www.cnbc.com/2019/08/21/us-bonds-fed-meeting-minutes-in-focus-ahead-of-g7-summit.html

- https://www.reuters.com/article/us-usa-economy-yieldcurve/u-s-yield-curve-invert-steepen-repeat-idUSKCN1VA11G

- https://blogs.wsj.com/dailyshot/2019/08/13/the-daily-shot-beijings-stimulus-is-not-working/

https://stockcharts.com/h-sc/ui

https://stockcharts.com/h-sc/ui

FOR YOUTUBE

8-22-19 IT DON’T WORRY, SPEND MONEY: Undeniable Bad Advice & Negative Signals……By Lynette Zang

On August 22, 2019 at 7:15 am, the 10 YR/2 YR treasury yield curve inverted for the third time this month. In addition, the 10 YR/3 MNTH inversion that began on March 22, 2019 has been consistently widening since it inverted on July 22, which historically, has told us a recession is either imminent or has already begun according to the NY Fed and Larry Kudlow, President Trump’s economic advisor.

Of course, governments and central bankers cannot tell you the truth because the public would most likely run from the markets and the banks. And so, they sweat behind closed doors and spout nonsense to calm the public.

They want us to believe that this time is different.

Oops, isn’t that what we hear EVERY time just before a crash? Though I will agree that, in some critical ways, this time is different since negative rates are a historic first, and so are inverted negative rate yield curves. Do you think this means the global economy is falling into a soft bed of fiat money clover?

How do you go bankrupt? Slow then fast.

What can you do NOT to go bankrupt? Hold physical gold and silver, where there is ALWAYS broad based demand.