CRITICAL CONDITION, DOMINOS FALLING: What’s Hiding Under These High Market Conditions? By Lynette Zang

All of a sudden, in the face of no change, global stock markets are moving up. In the US they are making new highs even as trade wars escalate and a possible government shutdown was postponed until December 20th. Merry Christmas.

In the EU, markets are now at four-year highs, even as a hard Brexit looms. And now we know why it had to be postponed yet again. Because of the 640 trillion euro derivative contracts that clear through the city of London.

Have more questions that need to get answered? Call: 844-495-6042

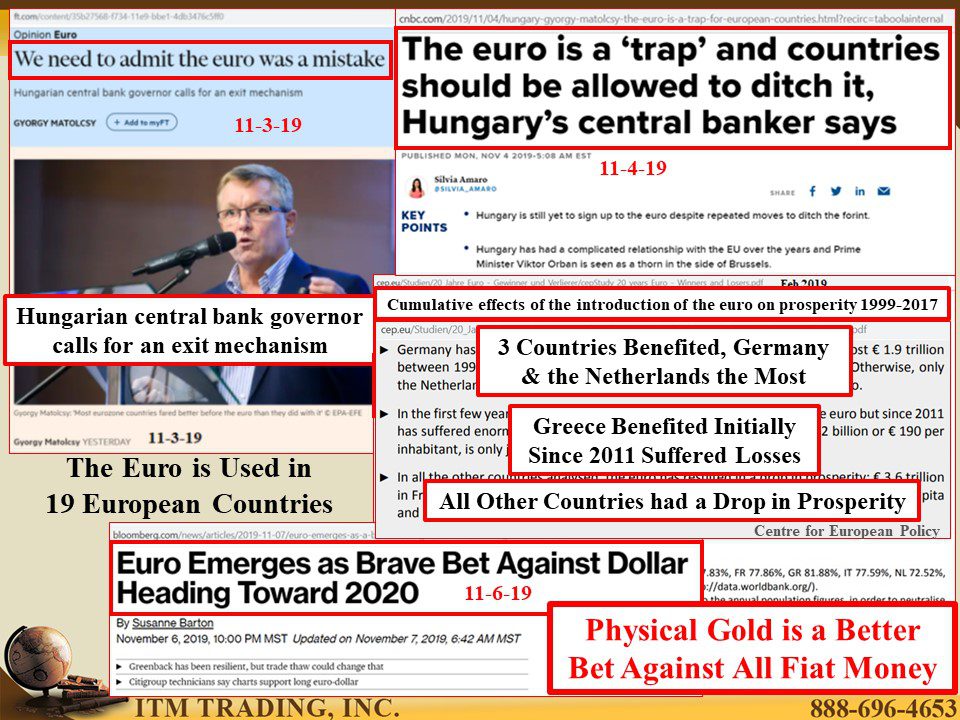

Bank “traders have stressed that there is no alternative venue for some types of contracts†(emphasis mine), in other words, they don’t know how to untangle the complicated derivative spider web and both the Bank of England and the European Central Bank are worried about the risks to global financial stability and a potential breakup of the Euro common currency currently being used in nineteen European countries.

All good reasons for stocks to go up, don’t worry be happy.

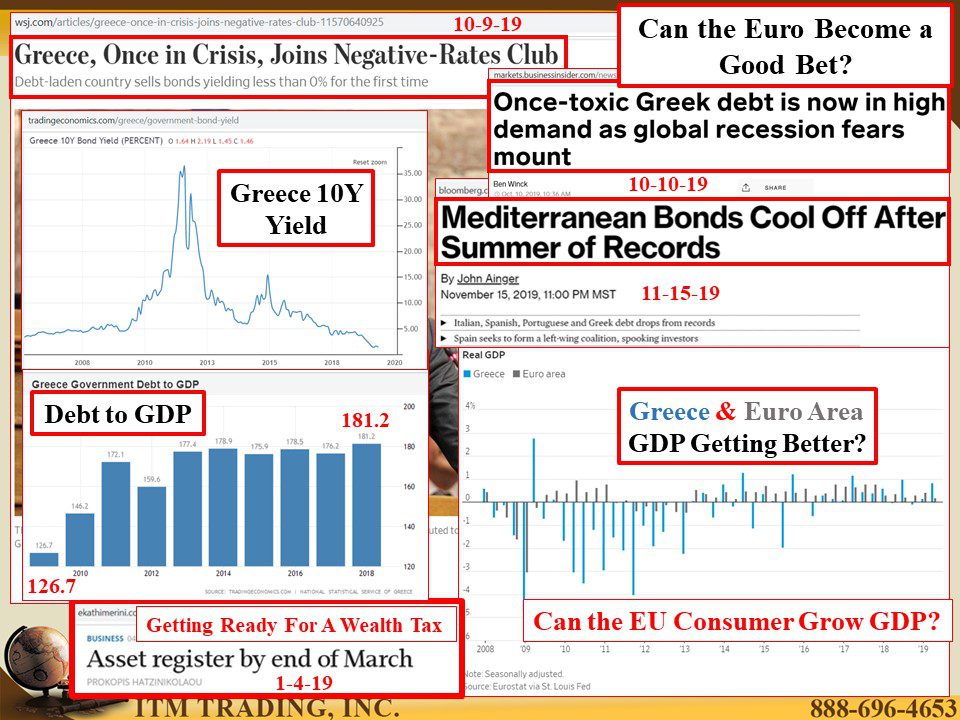

But there are some that are not happy with the single currency union and in fact, in a February 2019 study conducted by the CEP (Centre for European Policy) showed that Germany was the biggest winner in the union, with the Netherlands a distant second. Greece’s prosperity expanded initially but has dropped dramatically since 2011. All other participating countries have experienced a dramatic drop in prosperity since the single currency experiment began in 1999.

And now Hungary’s central bank is calling the euro a “trapâ€, stating that there should be an exit mechanism for those that want to leave the currency union.

Perhaps members are disillusioned with ECB (European Central Bank) promises of growth that never seem to materialize no matter how aggressive they get with negative rates and QE money printing. But don’t worry, the EU consumer will support economic growth. Or will they?

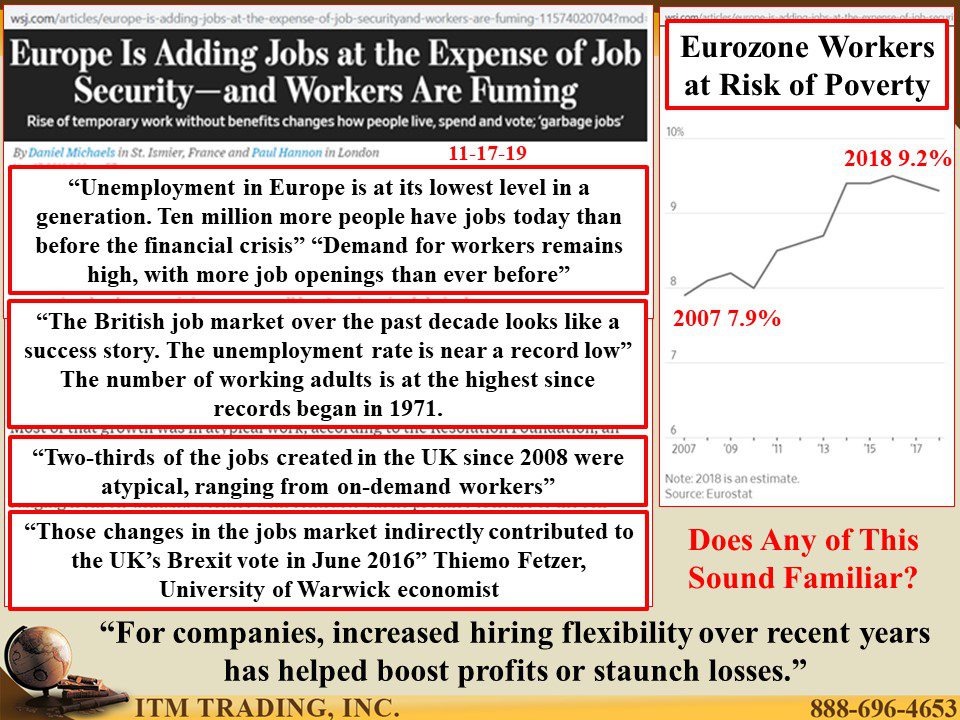

After all in Europe unemployment “is at its lowest level in a generation. Ten million more people have jobs today than before the financial crisis†as “Demand for workers remains high, with more job openings than ever beforeâ€. Sound familiar?

Additionally, “The British job market over the past decade looks like a success story. The unemployment rate is near a record low†with the number of working adults is at the highest since records began in 1971. The same is true in the US, so what’s the problem?

Normally, a tight labor force equals wage inflation and that was the central banker’s goal. But because most of the jobs that have been created since 2008 are “atypical†or on-demand workers with low pay, no guarantees and no benefits, what really been created is job insecurity. In fact, in 2007 7.9% of Eurozone workers were at risk of poverty. In 2018, into a booming labor market, the percentage of workers at risk of poverty has risen to 9.2%.

Therefore, rather than creating a booming global economy, income inequality is at the highest levels ever with most of the benefits going to corporations and the 1% and the world is slipping into recession because the inflationary money creation is remaining at the top and not flowing through the entire economies.

How has digital spot gold responded in terms of euro’s? It is concluding the cup formation (accumulation pattern) that began in 2013. But even more importantly, as central bankers understand that they are losing the inflationary war they are preparing to remain in power by accumulating physical gold at levels never seen before. What can we deduce from their behavior?

Those who hold physical gold are most likely to win.

Slides and Links:

http://www.ekathimerini.com/236250/article/ekathimerini/business/asset-register-by-end-of-march

https://www.wsj.com/articles/greece-once-in-crisis-joins-negative-rates-club-11570640925

https://tradingeconomics.com/euro-area/consumer-price-index-cpi