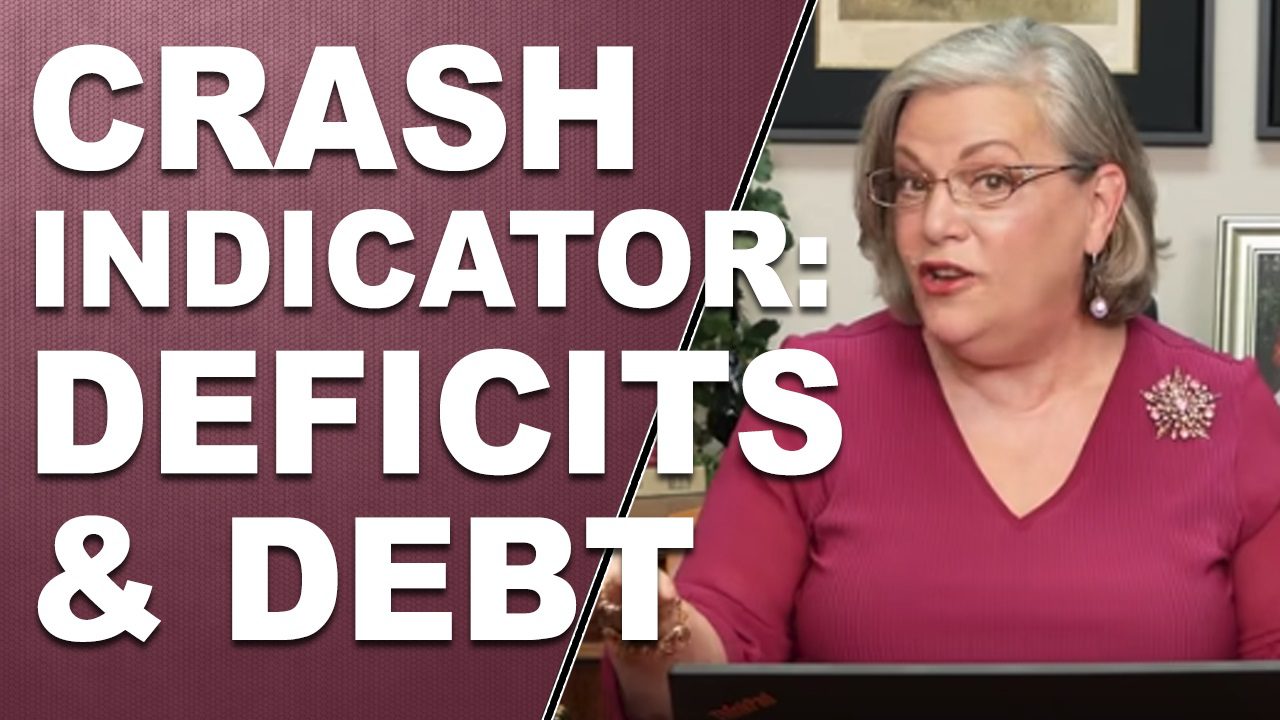

CRASH INDICATORS: Deficits and Debt do Matter

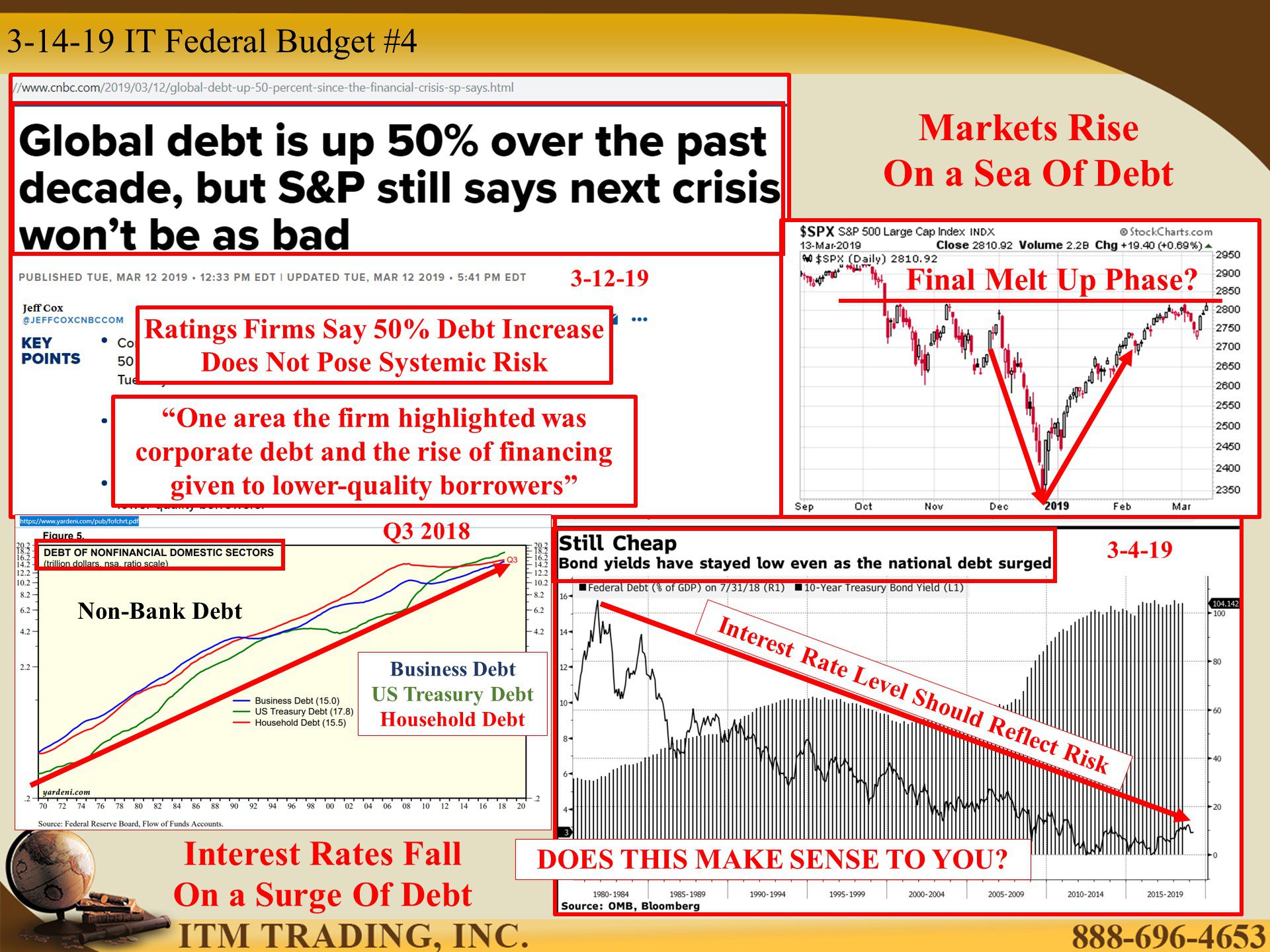

For the first four months of the current fiscal year, the US Federal Budget deficit exploded up 77% from the same period last year, reflecting the impact of tax breaks and greater government spending. Deficit spending is currently running at 4% of GDP, which is 38% higher than the long-term average deficit spending. But it does not reflect the cost of running deficits. For that, you must look to debt to GDP, which is currently running 105.4% and consists primarily of compounding interest.

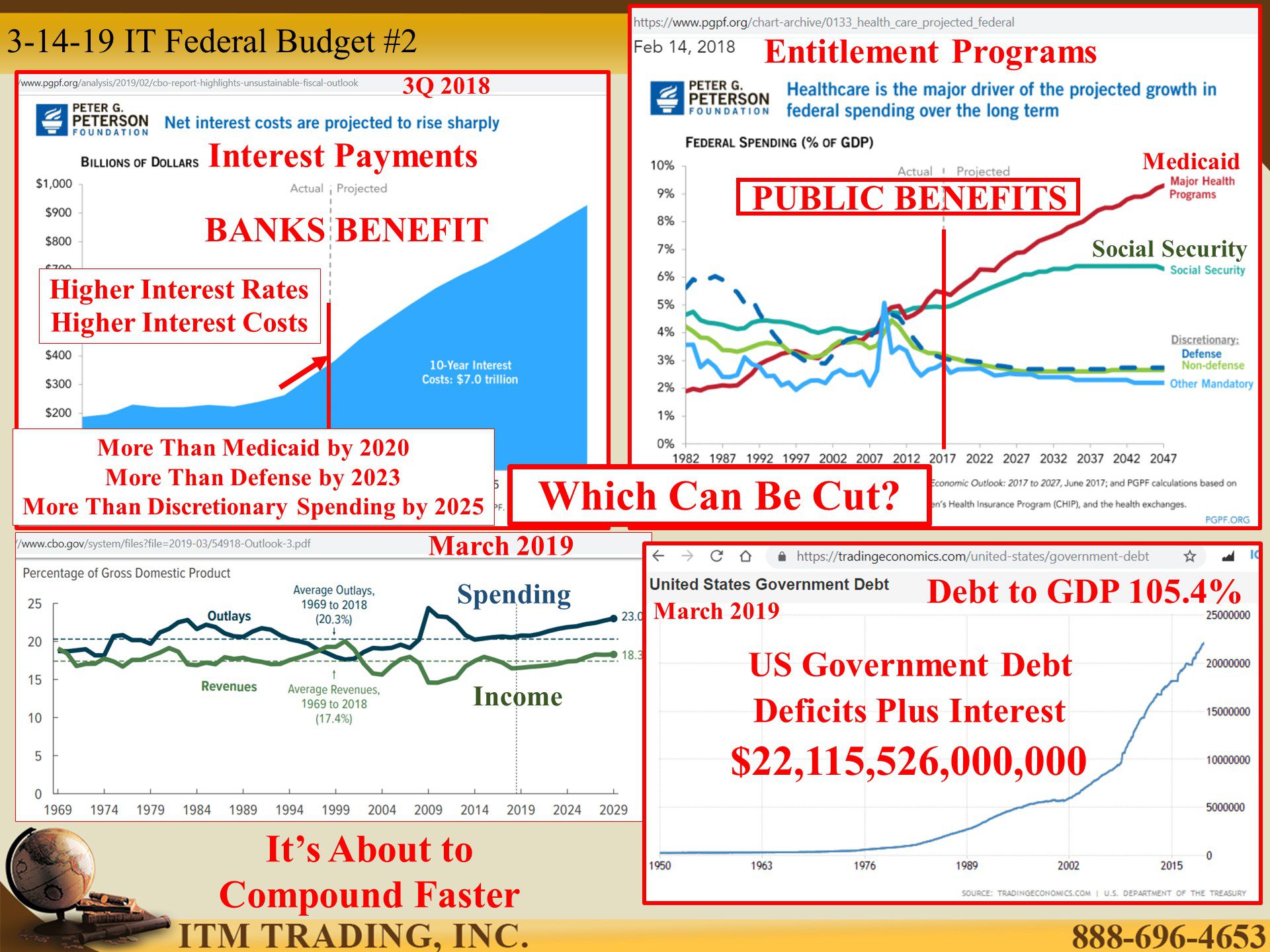

In fact, according to the Congressional Budget Office (CBO) March 2019 report, moving forward, they expect annual deficit spending to increase by an average of 51% YOY and that does not include interest payments. Put into perspective, that would be like you spending more than you make and funding it with credit cards, as compounding interest on those credit card balances continues to grow.

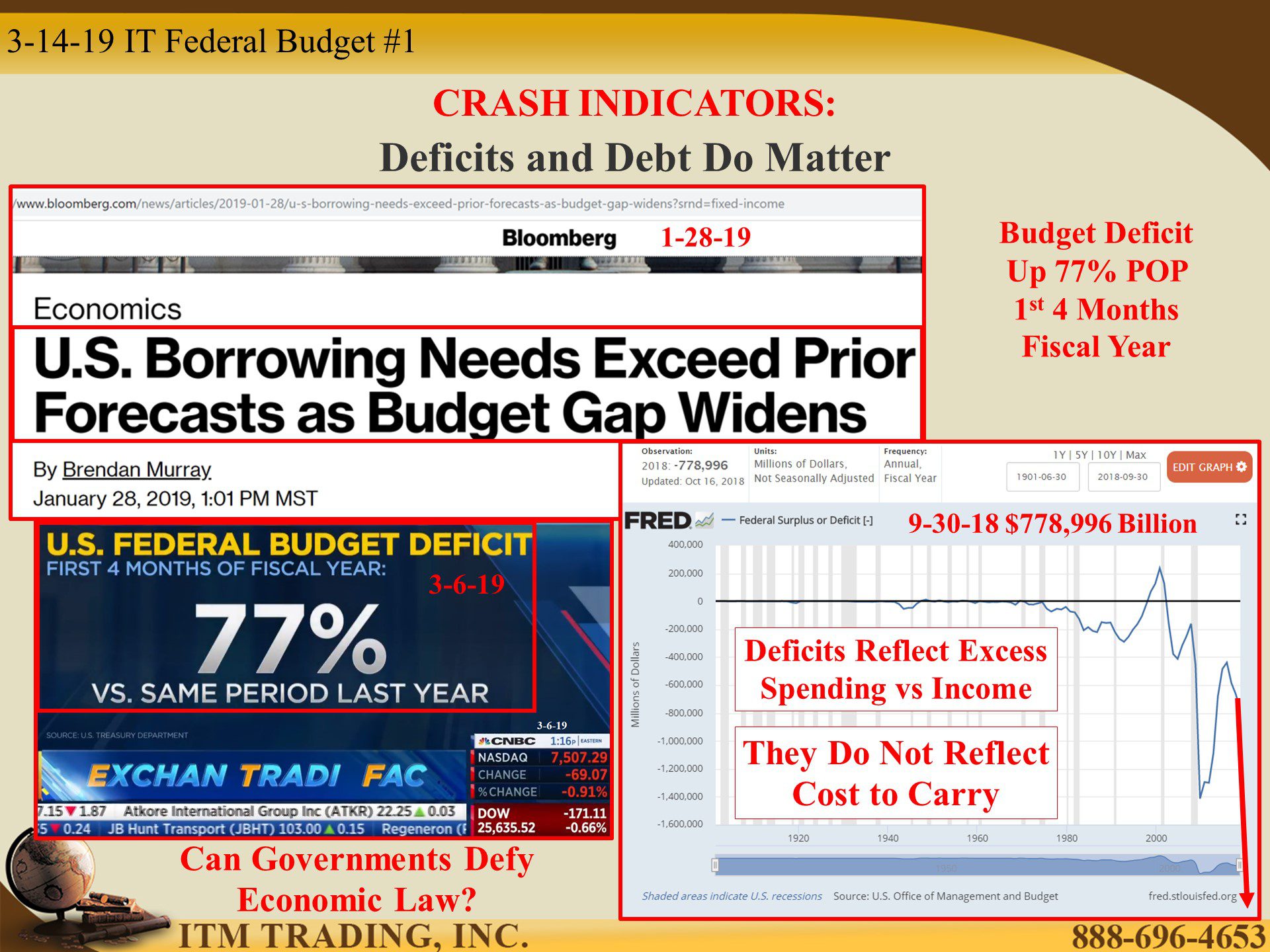

The lower the interest rate, the easier it is to roll over and take on more debt, while maintaining payments at similar levels. But government spending growth is not only about new programs. Entitlement programs, like Medicare and Social Security are exploding as the baby boomer retirement crisis continues to evolve. Since these “Pay As You Go†programs are already running deficits themselves, governments have to borrow to fund the difference.

I’ve heard talk about entitlement reform since the 1970’s. But the political fallout has guaranteed no serious effort in this direction, at least for now. At some point soon, there will be no choice. My bet is that the upcoming financial crisis will be used to justify reform, as we’ve seen in Greece.

But even when those reforms are put in place and even if governments STOPPED deficit spending, debt will continue to grow because of compounding interest. According to the CBO, interest spending could hit $1 Trillion per year by 2028. In fact, interest is the fastest growing part of the federal budget and is expected to exceed Medicaid costs by 2020, defense spending by 2023 and all non-defense discretionary spending by 2025.

And while this tsunami of debt has worked well to reflate stock and real estate markets, it has also created a lot more risk in the financial system, regardless of those that want you to believe that deficits and debt doesn’t matter, they will during this next financial crisis simply because governments and central bankers can merely postpone the inevitable as long as someone will step up to fund the debt.

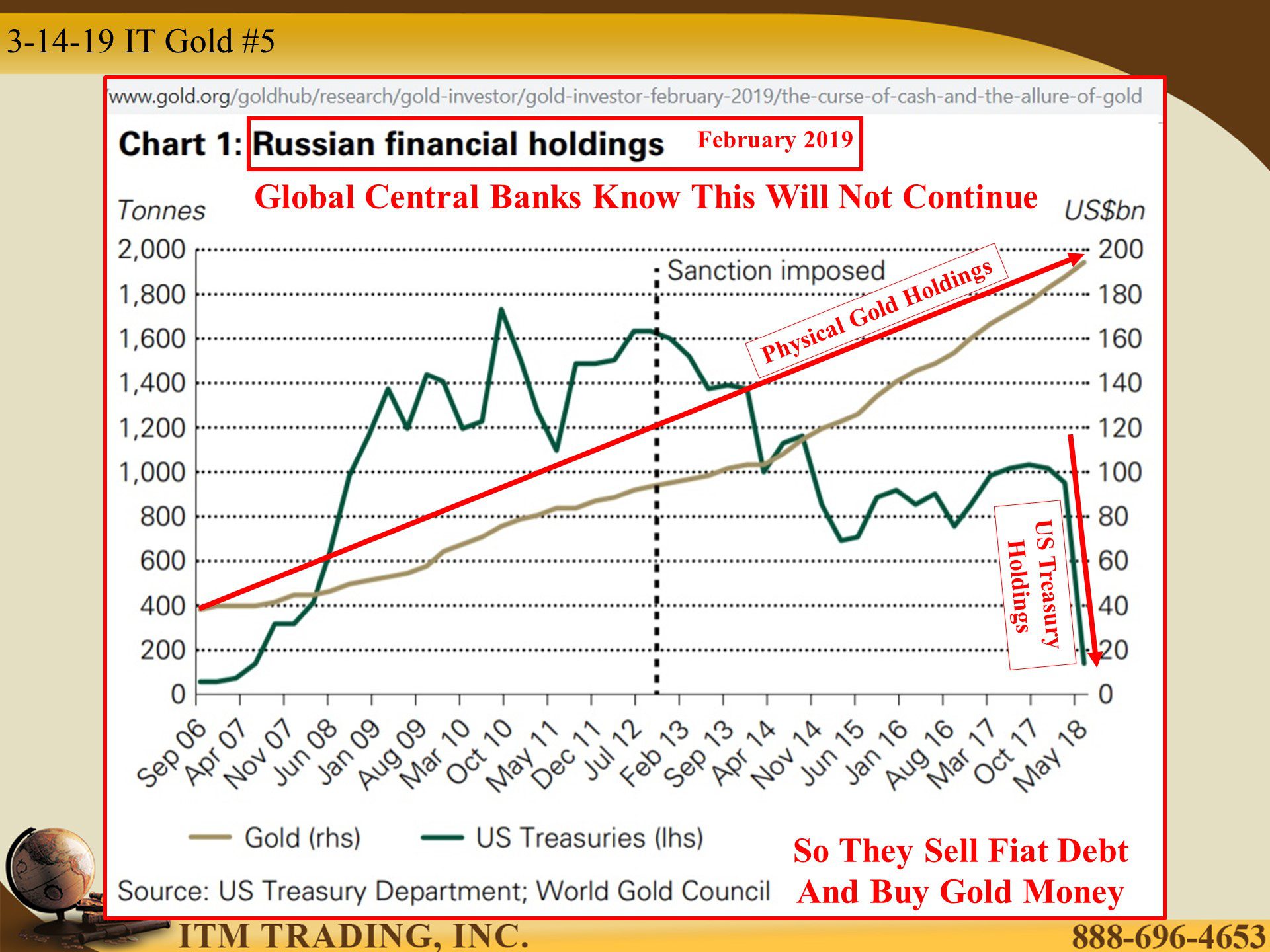

Since 2002, the market for US treasuries have changing as local central banks have been funding local government spending. In addition, most of the funding comes from the public, either through fiat money products like mutual funds and ETFs, or though government and central bank balance sheets, funded by taxpayers.

Globally, while central banks have been taking on more local debt, many have been divesting themselves of US Treasuries. At the same time, many central bank gold holdings are now at levels last seen when we were still on the gold standard. What does that tell you? In my opinion, enough risk has been transferred. Central banks are getting ready, are you?

LINKS:

https://fred.stlouisfed.org/series/FYFSD

https://www.pgpf.org/chart-archive/0133_health_care_projected_federal

https://tradingeconomics.com/united-states/government-debt

https://www.cbo.gov/system/files?file=2019-03/54918-Outlook-3.pdf

https://www.crfb.org/blogs/interest-spending-course-triple

- https://www.cbo.gov/system/files?file=2019-03/54918-Outlook-3.pdf

- https://www.bloomberg.com/news/articles/2019-03-10/visualizing-u-s-budget-gap-that-scares-everyone-except-markets

https://tradingeconomics.com/united-states/government-debt

https://www.cnbc.com/2019/03/12/global-debt-up-50-percent-since-the-financial-crisis-sp-says.html

https://www.yardeni.com/pub/fofchrt.pdf

https://stockcharts.com/h-sc/ui?s=$SPX

https://www.cnbc.com/2019/03/12/global-debt-up-50-percent-since-the-financial-crisis-sp-says.html

https://tradingeconomics.com/turkey/government-bond-yield

For the first four months of the current fiscal year, the US Federal Budget deficit exploded up 77% from the same period last year, reflecting the impact of tax breaks and greater government spending. Deficit spending is currently running at 4% of GDP, which is 38% higher than the long-term average deficit spending. But it does not reflect the cost of running deficits. For that, you must look to debt to GDP, which is currently running 105.4% and consists primarily of compounding interest.

In fact, according to the Congressional Budget Office (CBO) March 2019 report, moving forward, they expect annual deficit spending to increase by an average of 51% YOY and that does not include interest payments. Put into perspective, that would be like you spending more than you make and funding it with credit cards, as compounding interest on those credit card balances continues to grow.

Globally, while central banks have been taking on more local debt, many have been divesting themselves of US Treasuries. At the same time, many central bank gold holdings are now at levels last seen when we were still on the gold standard. What does that tell you? In my opinion, enough risk has been transferred. Central banks are getting ready, are you?