Corporate Monopolies & The Dark Side of Microfinance [Part 1]

The Fed clearly oversaw the consolidation that created Monopolies. What are we dealing with now?

📖 Chapters:

0:00 Intro

1:25 America’s Corporate Monopolies

4:35 The Foundation of the Money System

7:46 Microfinance vs. Financial Inclusion

11:01 The Five P’s of Financial Inclusion

16:36 Debt & Despair

18:08 India’s SKS Microfinance

21:24 For-Profit Lending

27:39 The Fed & Ukraine War Causes Economic Hurricane

34:11 Owning and Holding Gold & Silver

35:48 Outro

TRANSCRIPT FROM VIDEO:

The fed, the fed, the fed coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading, a full service, physical gold and silver dealer. It’s the only way that you want it these days, because we know if you don’t hold it, you don’t own it. And you have a whole team of experts that have had lots and lots and lots of practice in molding. How you think about things and therefore how you move forward. How many times can you be lied to when you do not know the truth? So today we have to talk about some of the other finger-pointing while they clearly oversaw the consolidation that created monopolies. What are we dealing with now? Well, a big problem is all of this concentrated power. So let’s just get started.

You know, truthfully unintended consequences is really garbage because when the Fed makes a move, they have sat there and planned out how it’s going to most likely roll out. And I’m thinking with all those PhDs sitting around the table, that they could think of any consequences of their behavior. That’s garbage, absolute garbage, but you and I, and our children and our families, we’re the collateral damage of all of this. And we’re the ones that pay the ultimate price because all we really have is an illusion that we have choices when the reality is. And particularly since the eighties, when perception management of the public was formalized under President Reagan and thanks to lots of help from media moguls, that’s when this program was formalized and we’ve been put in it. So now they’re gonna point the finger and say, oh, those American corporate monopolies that they encouraged, but they don’t say that piece make inflation worse. What a shocker, because when you have monopolies, you have a lot fewer choices than they have a lot less competition rise in corporate concentration.

When a few major companies dominate an entire industry is worsening inflation along with all the free money that you’ve given them to make all of these acquisitions and mergers and the green light. Go ahead. Yeah. Okay. Fed, you know, own some of your garbage, would you please, oh, wait. Yellen` the other day admitted that she was wrong on inflation. Oh, all right. Well, there you go. We got a little bit when industries are more concentrated and there’s less competition, however, that price hike becomes about 25 percentage points greater. And have we not seen the ginormous corporate profits during this from 2020 and actually, you know, 2008, it was all concentrated. And when they gave money to the public, you know, the stimulus money, you know, you wanna think that they were doing like a good thing to make sure that, you know, the public was okay, because look what happened in 2008, where they went directly to the source and injected all of that money in there, all that new money. I mean, would the public have tolerated that again? No. So they did the same darn thing. They just used a little different approach. Let’s give the public money to spend a pitance compared to what they gave the corporations, but let’s point fingers.

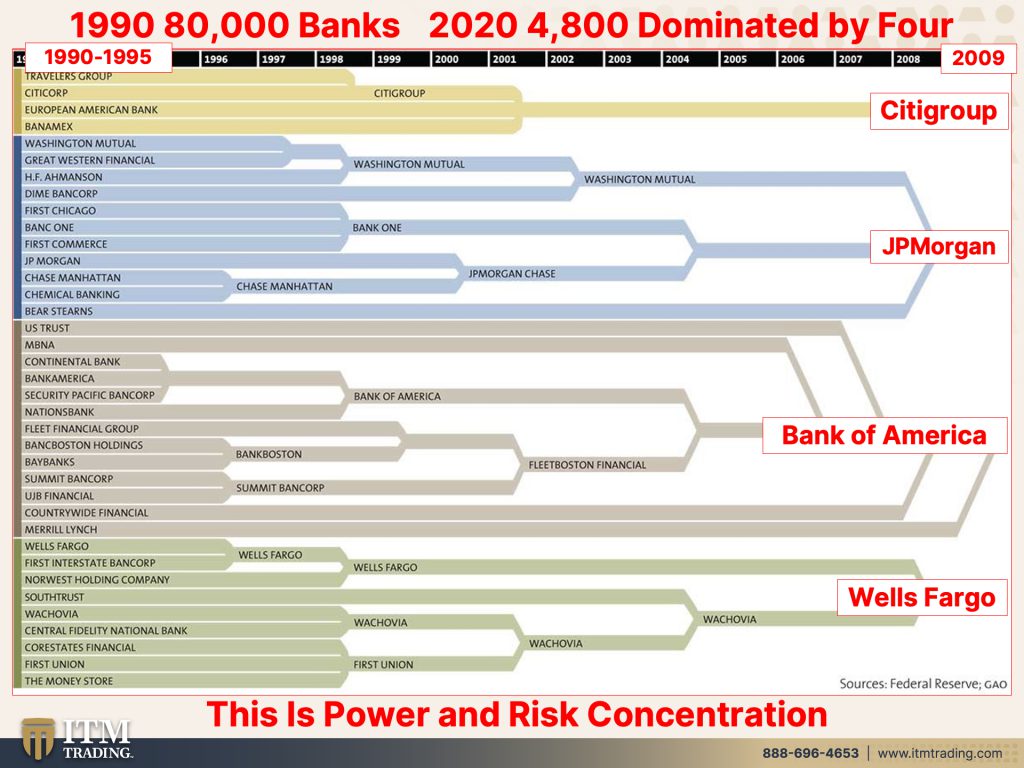

All right, let’s just look at this because we’re going to start with banks, which is the foundation of the money system. And these are the actual annual counts of banks and bank branches by year, starting in 1980 and going through 2020. And it should be pretty darn obvious from this graph that the branches and the number of banks have been reduced in pretty much half, but I’m gonna show you something else that should make you quake. And that’s this graph. Okay. Now I’ve used this graph before because frankly it’s quite true. So in 1990 to 1995, you had 80,000 banks now in 2020. Well, it’s saying 4,800, but they’re all dominated by the key four. So Citigroup, JP Morgan, Bank of America and Wells Fargo. Do you recall pretty easy to recall a lot of the manipulation and garbage that ha come out from all of these banks, but hey, they’re the ones that are dominating the banking system. Now we do have some FinTech coming in here. And so these banks have made it a priority these days to gobble up that part of the industry as well. And I’ve done a piece and Edgar. If you remind me, we’ll put that link in there. It was probably I’m gonna guess a year or so ago when I did a piece on what happens when you have the banks that have the public trust. And they’re very sticky when you open a bank account, you don’t just move bank accounts, right? You have the same bank account forever. So they’ve got that sticky relationship with a customer. And then you couple that with the with the Facebooks or the Metas of the world and the Google that gather all of this data and what we’re seeing is a marriage and a merger of the two. So now you got the sticky relationship and they know every darn thing about you and how you think.

I don’t know guys, what do you think? You think that’s a good thing, cause personally I don’t, and who’s enabled it, the fit, but it’s not their fault. It’s not their fault. Maybe this is just an unintended you know, consequence of loosening up all of the rules that enabled all of these mergers and took us into 2008, which was actually the third derivative crisis. What we have coming up is the fourth. And I’ll save that for another day, but you know, the banks they talk about, well, not just the banks, but the world economic forum, the IMF, the federal, everybody talks about inclusion.

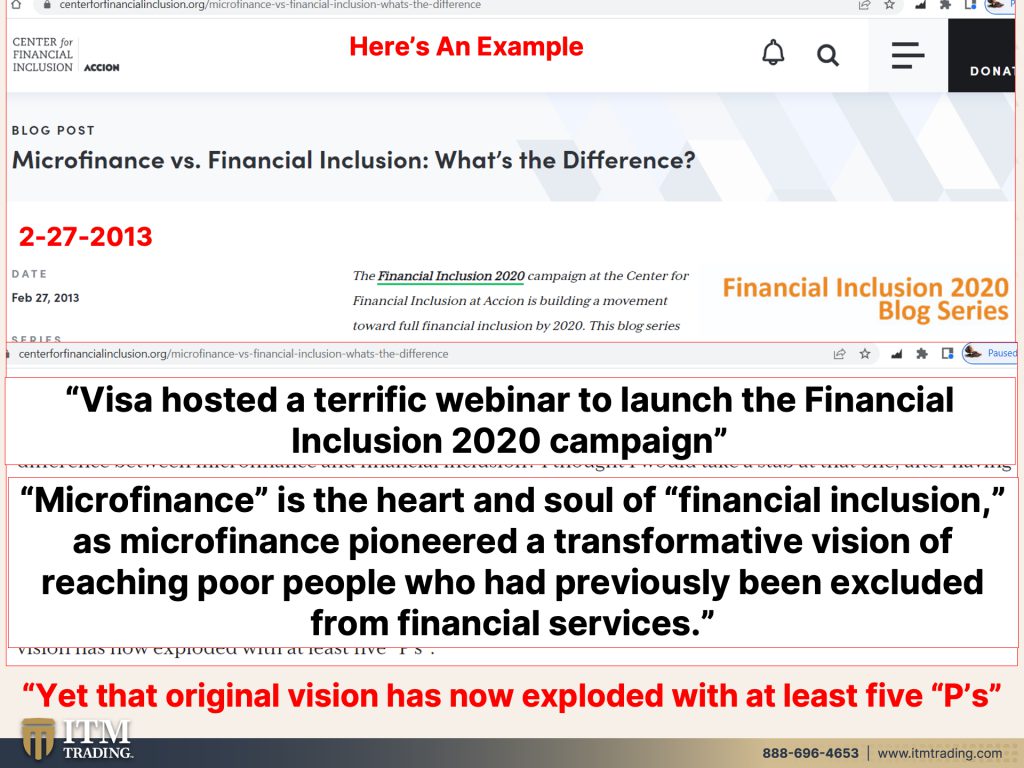

I wanna show you an example of banking inclusion and what that means. And you have to start with the difference between micro finance. So that’s small localized finance and financial inclusion to these people that have no clue about money or debt. And quite honestly we could broaden that because I would say that most people in this country have absolutely no clue about money or debt and therefore what’s really going on here. But financial inclusion is really reaching out to those people that are an extreme rural circumstance or extreme poverty level. And, you know, inclusion for them is let’s make sure they can take on debt. Well, I don’t think that’s inclusion. I mean, it is inclusion, but not in a good way. So here’s an example because you really have to see this, okay. Visa hosted a terrific webinar launch on financial inclusion in 2020 campaign. Well, visa is the credit card, right? What’s the reverse of credit. If I’m giving you credit and you actually take that credit, you now have debt. It really is quite that simple, but microfinance. So small localized finance is the heart and soul of financial inclusion because you’re going very, very local to these very, very, very naive people as microfinance pioneered a transformative vision of reaching poor people who had previously been excluded from financial services, oh my God, these poor people that live way out, they’ve got to be able to take on debt. They’ve got to those poor poor people. I mean, this is such garbage. I can’t even believe it. Now remember this first piece was from 2013. Visa did this in 2020, and yet the original vision, which was by the way, the original vision on microfinance was giving people small loans to start businesses. Remember there are two types of debt there’s self-liquidating debt, which was, was the original intent of microfinance. In other words, they would loan people money to start a business. And then that business would generate income and pay off that debt. And then there’s non self-liquidating debt. The government pays a billion dollars for a bomb and they use that bomb. It blows up and you still have the debt and you have to pull resources from other places to pay that debt. Or frankly, in the government’s case, just roll it over and add more, but all right.

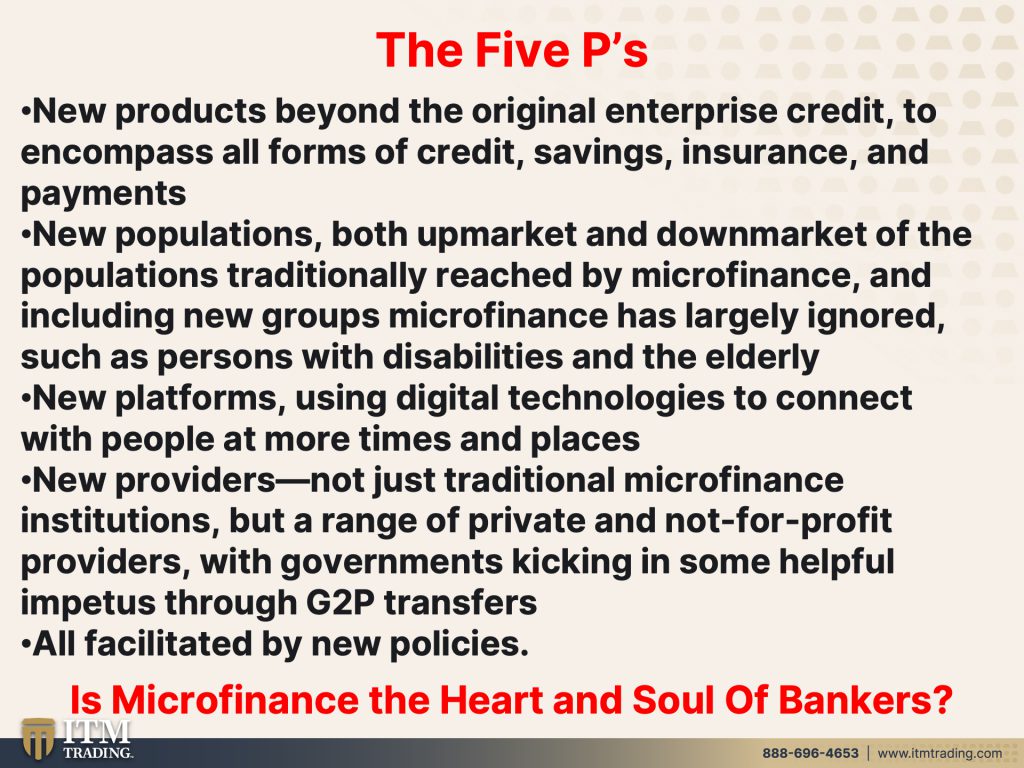

I digress. So that was the original vision and that’s not a bad vision, but once the big banks got involved in it that vision changed. Let me show you because there are they, what they call are at least the Five P’s. What are those FiveP’s? Well, let’s take a look at it.

Number one, new products beyond the original enterprise credit. So they would introduce to them, they’d get ’em in with those little micro loans that were supposed to help them create their own business and generate income to pay off that debt. Well, let’s give them credit cards. Let’s give them other kind of non self-liquidating debt. I mean, credit cards are definitely non self-liquidating debt cause you’re just spending that money, but that what you’re spending it on is not generating income to pay itself off. So you have to pull that income from other places.

New populations. Okay. So new areas of growth, both up market and down market of the populations traditionally reached by microfinance and including new groups that microfinance has largely ignored such as persons with disabilities and the elderly. Again, that don’t understand all these contracts that they’re signing and what that means for them. Really? Yeah. Let’s give them new products of non-self liquidating debt and let’s make sure that we find the weakest hands to put these products in. Now I’m not really a hundred percent sure on how this benefits the banks, other than now, once you have debt, you have interest on that debt and you’re not a corporation, which means you’re gonna pay a lot of interest on that debt and never get outta debt. You become a debt slave.

New platforms using digital technologies to connect with people at more times and places, right? So let’s give them all these smartphones that carries all their information on it. They can start filling that in. Don’t really understand any of this. So it’s all of this without the education. So they don’t get to make educated choices. We’re gonna look at the consequence of that in a minute.

New providers, so not just traditional microfinance institutions, but a range of private and not for profit. We’re gonna talk more about that with governments, kicking in some helpful impetus through G2P well, what is G2P? Let me show you. It is payments which are also referred to as government social protection payments. So social security in this country, Medicare, what the government, the stimulus with the government gives people that don’t make don’t earn enough money on their own. So Hey, they don’t have to worry about the microfinance because government’s giving them the money to pay these corporations and to pay these debts. Of course, that money is really also supposed to be used for Food and Shelter and Energy and all that other stuff. But Hey, they’ve got wealth that they can attach because the government gives it to ’em. These payments include government transfer payments, like social benefits, pensions, and unemployment benefits. So let’s make sure that they can take on lots and lots of debt. Okay. So with governments kicking in some helpful impetus through G2P transfers. So people feel like they have income coming in. All right. They don’t understand what they’re really agreeing to, but I could use a couple extra bucks right now for something else, other than starting a business, or even starting that business. Let’s just saddle this group with lots and lots of debt. In fact, that’s been their goal since we became a pure debt based system, debt, debt, debt, and more debt debt is always the answer. It’s not always the answer, but all facilitated by new policies.

So seems to me that there’s a bit of collusion that’s happening here between the banks and the microfinance companies and the governments that have to create new policies and new laws, but let’s get in there as quickly as we can.

So I would say I would expand that microfinance is really about the heart and soul of bankers, because if they can get the whole world indebted, you got just this little teeny population that gets to charge interest. Last time I checked. So it could be worse than this. Now that was 1% of the population. And 99% of the population pays the interest. So 1% gets to charge it 99% get to pay it. Yeah, I think microfinance and debt is the heart and soul of greedy bankers.

Shocker, big money backs, tiny loans. And guess what they’ve discovered those loans lead to debt, despair and even suicide because these people do not understand what they’re doing. Think about yourself. Let me tell you a story here. Think about the time that you got your very first credit card, maybe crazy as this may see, but you know, it’s regularly happening when you were in college before you even had a job Visa, MasterCard, somebody was giving you a credit card. You have no income other than your parents’ income, but they know that your parents are likely if they have the ability to do so, your parents are likely to bail you out. Same kind of thing, right? The government will keep sending you this money because the taxpayers pay for all of this, by the way, it’s not their money. They don’t do anything to earn money. They just tax you. That’s how they generate their income. And then they give it to people public. Like we just saw actually, even with the stimulus so that they could go out and spend and take on more debt because somehow these brilliant economists, that’s the only tool they have more and more and more debt. A tree does not grow to the sky. And this is it. This is the end game. But let me really show you an example of what happens when big finance gets involved. Even if it was a good idea to begin with.

We’re gonna go to India because they’ve been having a lot of issues around this, but you know, we’ve got take a Apple it’s buy now pay later all over the place, right? Even I think it’s apple or Google. I don’t know. One of those have now added that feature. And if you’ve gone online to buy anything and if it’s a hundred bucks, well, okay, you can pay the a hundred bucks, but here you can just put this on. And in four easy payments and a lot of people are having trouble with it because again, they don’t understand the debt they’re taking on, but when India’s SKS, microfinance went public in 2010, the fund management arms of Morgan Stanley, JP Morgan and George Soro’s Quantum Fund were among the investors. Are they, are any of those entities really caring about the public and the public’s wellbeing? I don’t think so. But SKS was the biggest microlender in the state of I’m gonna butcher this forgive Andhra Pradesh and was criticized by human rights groups and lawmakers there in 2010 after local media reported more than 200 suicides linked to over indebtedness. Now, if you’ve been over indebted and you have not known how in the world you’re going to pay those bills and you gotta feed your kids, or you gotta pay your payments or whatever, how much stress is that? It’s huge. It’s everything right? The associated press reported in 2012, that SKS managers had been aware that debt collectors were forcing borrowers to pawn possessions and harassing them verbally and physically, but we didn’t do anything wrong because everything we’re doing is within the legal letter of the law. So don’t change the law and don’t change behaviors. Shockers. If you’ve ever been harassed by a bill collector, will they even let it go further than that? Citigroup, a backer of Axion has helped channel hundreds of millions of dollars into micro lenders, including…sorry, Compartamos and Jordan’s Tamweelcom, which has reported dozens of delinquent borrowers to authorities landing them on police wanted lists. So back in the day, Charles Dickens, they had debtor’s prisons. If you didn’t pay your bills, you went to prison and very squalor conditions. Well, that’s true in India too. Now they’re saying that maybe the police don’t follow up on that. Maybe there’s other more important crime, but it impacts you. If you think you’re on a wanted list with the police, absolutely a hundred percent it impacts you.

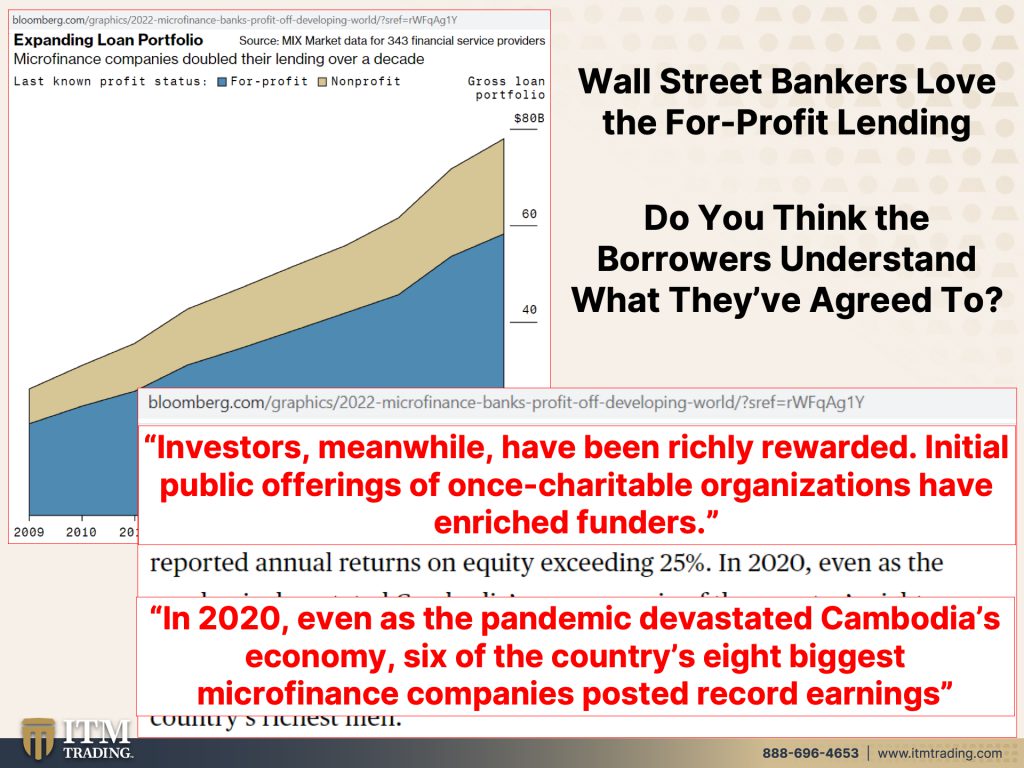

Wall Street Bankers love the For-Profit Lending. So remember these originally start out at not for profit, right? So you just pass the costs on directly. And it was about helping people start businesses. Yeah. That changed because do you really think that the borrowers understand what they agreed to? No, not at all. And, and, you know, you might say, well, they’re not very sophisticated, but the reality is is when you sign that mortgage document or you open that bank account, or you get that credit card, do you bother to sit down and actually read and make sure that you understand all of the terms in there? No, some guy sits down and says, well, this means this. And this means this. And this means this. And this means this sign right here, sign, sign, sign, sign, sign. And if you want the credit card or you want the mortgage, you sign, you don’t take the, you know, come back tomorrow because I need to get with my attorney and read this, cause I need to really understand what I’m agreeing to. That doesn’t happen. It should happen, but that doesn’t happen. And so what we’re looking at is how they have expanded. Oops. I wanna go back their portfolio because this area is not for profit. That golden tanish area, not for profit and yeah, it’s grown a little bit, but this is the for-profit area. I don’t know. What do you think? Investors, meanwhile, have been richly rewarded cause that’s what it’s all about. It’s not about the little guy. It’s what the little guy can bring and do for the big guy. Investors meanwhile have been richly rewarded, initial public offerings of once charitable organizations have enriched funders. This is already the 1%. This whole globe has been in a k-shape recovery for for well, since the federal reserve was installed. Anyway, because this was all by design all by design in 2020, even as the pandemic devastated Cambodia’s economy, six of the country’s eight biggest micro finance companies posted record earnings. And I didn’t put this in there, but I’ve shown you that graph from the federal reserve education department, the FRED and you can, anybody can go in there and put in the search bar, corporate profits and they’re straight up. Now they’re worried about us going into a recession, but I gotta tell you, there are some people that have been in recession or even depression since 2008 and since 2020 K-shape recovery for who right as financers have replaced philanthropists in the microfinance industry, consumer protection has been weakened. And that is true in every single area because the contract, these are all contracts. These are all contracts. The whole Fiat money system is based upon a contract. Not real. That’s why gold, silver, physical in your possession. That’s real. It runs no counterparty risk. All this other garbage is all counterparty risk. You didn’t write the contracts. You didn’t read the contracts and it’s concentrated power in fewer and fewer hands as I showed you before. That’s not really a good thing. I love this tax payer funded development banks, which could fix the problem cuz they could change the rules and then oversee it properly are instead channeling hundreds of millions of dollars, earmarked for poverty alleviation into some of the most predatory lenders.

I’m a taxpayer. I don’t want this to happen, but do I have a say over it? Not one word. There’s nothing that I can say, cause they’re not gonna reveal this. They’re just gonna rake in the money. And as we see in the banking system, send out all of those ill gotten gains so that when the next crisis hits, they have to be bailed out. Right? But all that money has left the firm and it’s not available in the next credit or credit crisis. So here’s getting a little more specific. This 63 year old grandmother was sentenced to prison for owing $845. Now we know most people in the, in the U.S. And is probably even worse. Globally cannot come up with 400 bucks in an emergency. And here she was sentenced to prison for $845. This is Tamweelcom a Jordanian microfinance company backed by Citigroup and development banks. They have brought cases against more than 1200 women for nonpayment of debt. Now, if you know, you have a warrant out for your arrest, how’s that gonna impact your life? Gonna be constantly looking over your shoulder. Maybe you won’t even leave your house. Maybe you’ll hide under a bed if somebody knocks on the door. So I ask you, how does this for inclusion? Ain’t that a great thing. And that’s what they wanna do to the, and this is what they’ve really done to the entire world. This credit machine was started in the fifties in the twenties was when somebody could first have unsecured or a credit line. So you can buy a farm. You can buy a piece of furniture. What have you, but you had to pay it off, right?

Jamie Dimon says brace yourself. This is just recently for an economic hurricane caused by the Fed and the Ukrainian war. So what do we have? But never where the blame really falls. Everybody needs to own their part in this, but they’re not gonna. So you have to see the truth because how many times can you be lied to? And you do not know the truth. Every single fricking time. You know, I said, there’s storm clouds, but I’m going to change it. It’s a hurricane Dimon said Wednesday at a financial conference in New York while conditions seem fine at the moment. And so when they seem fine, people just kind of sit on their hands, right? Nobody knows if the hurricane is a minor one or a super storm, Sandy, he added you’d better. Brace yourself. Dimon told the room full of analysts and investors. JP Morgan is breaking bracing ourselves and we’re going to be very conservative with our balance sheet. Jamie Dimon, head of the biggest bank in the world. The most powerful bank in the world is saying, brace yourself. How can you brace yourself? You can brace yourself with real money, gold. That’s how and real money, silver, physical in your possession. That’s how you can brace yourself. Even the Bank for International settlements knows of no better tool or frankly, what other tool can you use? What are you gonna do? You’re gonna buy stocks or any other intangible asset that you can only convert into the local currency so into dollars when the dollar is in, I, I could be wrong about this, but I am seriously 99.9999% sure that we’ve already begun the hyperinflation. We’re at the end of this currency’s life cycle. That’s the piece that most people don’t understand fully. And don’t really believe it’s hard to believe. And they knew that people marry the legal money in the state. So are you braced for this next hurricane? Because this is what I think is actually really going to happen with this. We’ll go into that recession. That is an official recession and the central bank will make the level of money, new money that they created in 2020. It’ll make it look like chump change. Confidence will evaporate because that’s the only thing that’s holding this system together. It’s hard for people to imagine that the dollar could go away. So they keep the name, they change everything and they keep it. But they need us really, really, really scared. That’s why we’ve lurched from crisis to crisis and kept everybody off balance because it’s hard for people to know what to do when they’re off balance, they go crazy. Don’t! Stay focused. This is the end of this currencies life cycle.

So let’s take a look at maybe how JP Morgan is bracing themselves. Oh, JP Morgan. This was September 2020 JP Morgan to pay 920 million for manipulating precious metals, gold, silver and treasury market. Wow. They did not admit any wrongdoing cause we never do anything wrong of course, but they settled it. And that’s what happens over and over and over again, probes into its trading of metals, futures and treasury securities. The authorities had looked at, but don’t worry because this is how they’re really protecting themselves. They dominate the gold and I’ll take it a step further. And the silver market, they dominate the physical metals markets, as well as the trading markets. They control the pricing. We’ve shown you so many examples of the price manipulation in collusion with the central banks, because a rising gold price is an indication of a failing currency. They do not want you to understand that this currency is on its last legs. I mean there’s no place, no other fiat currency to run to either. You stay in those paper, intangible assets, those digital assets, don’t go with the tried and true for thousands of years. Physical gold, whose most important function is to hold your purchasing power even over time. And it’s performed that function for thousands of years, any short term manipulation take advantage of it that’s what they’re doing. That’s what they’re doing. You should do the same darn thing. You take back your own control. You become your own central banker so that you can make choices that put your best interest. First.

Now, tomorrow, this was part one tomorrow. You’re gonna see part two of it where I’m gonna take a look at all of the other industries or, or many of the other industries anyway, and show you how they’ve been allowed to consolidate over time. So when they talk, you know, about preventing some of these mergers because it creates monopolies and all of that garbage, garbage, garbage, garbage, don’t believe a word that they’re saying, because they’re putting money ahead of you. You are the collateral damage, your wealth, your standard of living your family’s financial future. And possibly even broader than that. Because if you don’t have a good financial future, it’s kind of hard to do some other things that you might wanna do or position your children.

I would like to think that what I’m doing, and I know this anyway, by having my reserves in gold, physical gold, physical, silver, not exactly in my position possession, because obviously I’m too visible, but close enough that I can walk there. If I need to. That’s what helps me sleep well at night. And I’m certain it will help you, but no more procrastinating. If you’ve been sitting there going, “well wah-woh-wah-gold-wah-woh-wah-woh” Stop, stop. It does not serve you well with where we are. I’ve been saying all year, this is a pivotal year. We’ve got so much that’s happening in 2023. Get yourself into position to weather this hurricane, that boldly. And they’re trying to backtrack other people at JP Morgan are trying to take that back. But you know, I don’t always agree with Jamie Dimon and I wouldn’t consider him my bestie friend, but I do agree with him. There is a hurricane that is already here. We’re just kind of feeling right now. Well, maybe everything is fine. It’s not fine. Look at the purchasing power chart from the Federal Reserve. It’s not fine. They’re out of interest rate moves. They’re out of purchasing power to rob you of, we’re transitioning, get braced for it.

Now we’ve got part one, a part, two of the Fed’s financial stability report, where a deep dive into their findings. You need to know this. This is all about helping you make educated choices because the us and the global eco economic risk is, I mean, it’s just swirling so heavy, but you’re distracted because of war over here, gun violence over there, all sorts of tools what’s going on with Roe versus Wade, you know, civil rights and so many more things. Every single thing that you see around a currency collapse, I’m seeing right now, this isn’t something in the future. This is something that we’re already living through. Even if you can’t see it in the same way that I do, because this is where I’ve lived my life look around when things look this unstable in so many places, we’re headed seriously the collapse is already in process yesterday.

I had an incredible interview with Sean and Curtis from 5 Stones where we updated you on what they and I have been doing together on my bug out property to get ready because I’m telling you, grass is not growing under these feet. I feel extremely urgent. And I put my money where my mouth is. So you don’t wanna miss that interview. We ha we covered a lot of ground and I’m hoping that in some ways you can, you can take what I’m doing for myself and then adjust it for yourself. Now, here at ITM, you know, we’re doing the strategy or we do the strategy that I created based on my studies of currencies since 1987. And so it’s customized. So maybe you need some help tweaking it, but I’m letting you know what I do. So if there’s any way that you can implement it in your, for yourself and your family rock and roll hoochie coo. And if we can be of service in way, let us know. We will bend over backwards to do that because we are here to be of service. So if you have not yet started your gold silver strategy, just click that Calendly link below and call us and set up a time to talk to somebody and have your goals in mind. And if you don’t really know what those goals should be, they’ll walk you through it and help you define them. Once you define your goals, then it’s the right tool for the job. It’s just that simple. So if you like this, please give us a thumbs up. Make sure you leave a comment because that helps spread the word with their algorithms and share, share, share, share, share this video because I don’t want you to be lied to anymore. That’s what my work is all about. Educated choices, cause a hundred gazillion percent. It is time to cover your assets. So until next we meet, please be safe out there. Byebye. Bye.

SOURCES:

https://www.nasdaq.com/articles/americas-corporate-monopolies-make-inflation-worse%3A-fed-report

THE ILLUSION OF CHOICE AND SAFETY: Washington and Wall Street Merge

https://youtu.be/-V3m6K2Umq0

When Is The Whole System Going To Crash [PT. 1] Fed’s Financial Stability Report May 2022

https://youtu.be/KOW6qVBv2B0

US & Global Economic Risk On The Rise [PT. 2] Fed’s Financial Stability Report May 2022

https://youtu.be/3rD1KiT_cCc

https://bpi.com/do-bank-mergers-create-banking-deserts-the-evidence-indicates-no/

https://www.centerforfinancialinclusion.org/microfinance-vs-financial-inclusion-whats-the-difference

https://www.reuters.com/article/jp-morgan-spoofing-penalty-idINKBN26K325