THE CHOKE POINT: Oil Market Crash & Dangers of US Dollar. by Lynette Zang

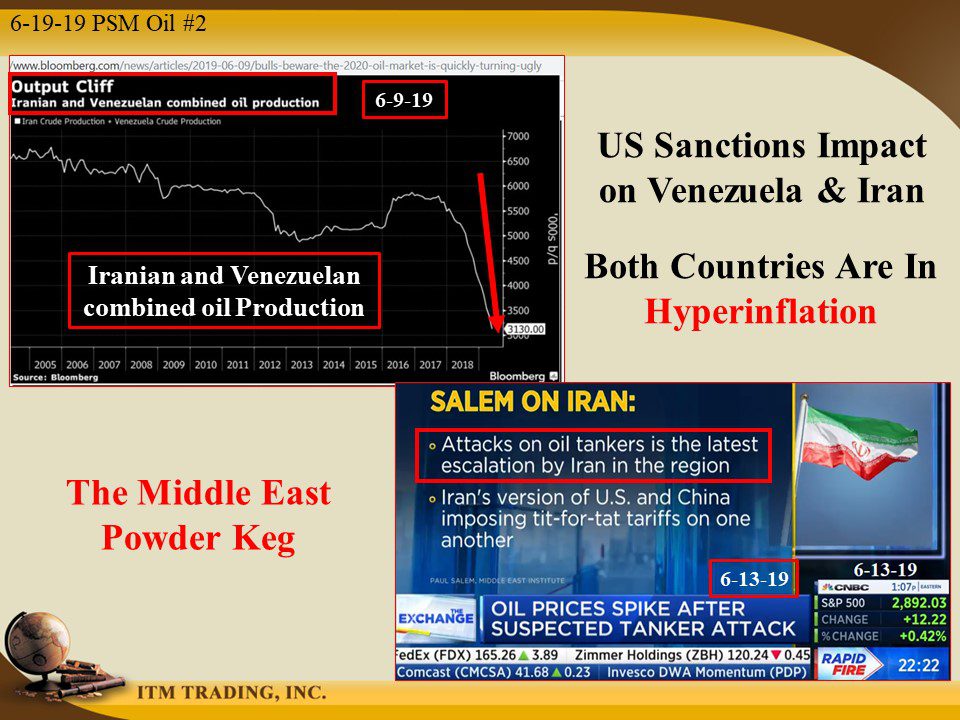

The Oil rally that started in early 2019 is over with spot oil off more that 20% from its recent high. The markets are looking at rising US shale production, diminishing demand because of the global slowdown and a deepening trade war that would dampen demand even further. This is what that markets are looking at. Are they missing the bigger picture or is this oil bear market being used to hide the middle east threats (plural) from the public?

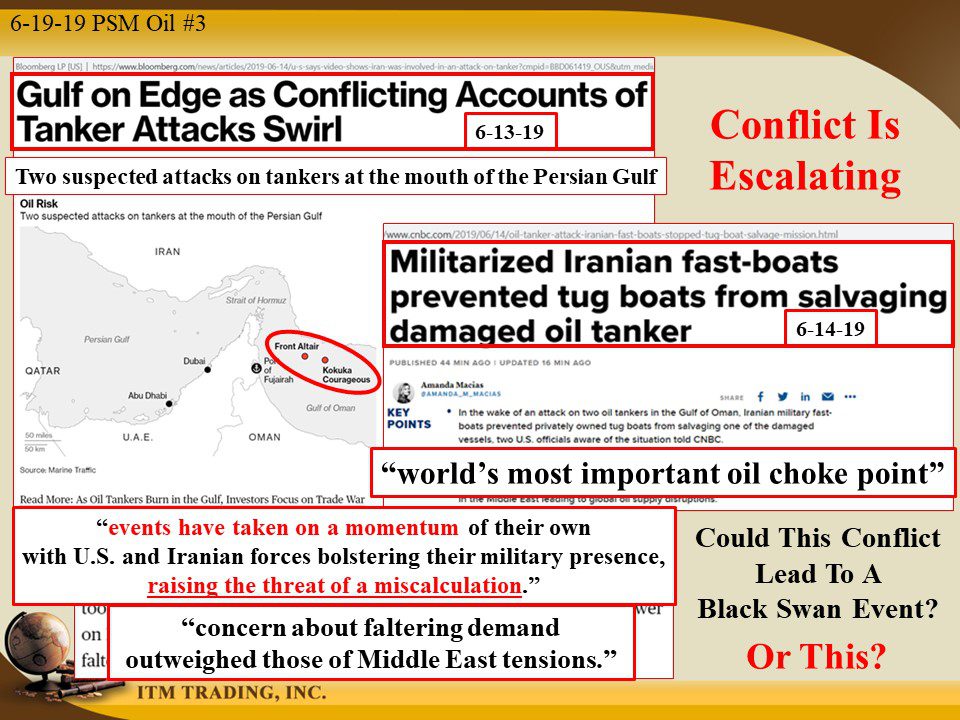

The first is the escalating Iranian/US powder keg as Iran retaliates for the US sanctions by creating chaos in, what is considered, the world’s most important oil choke point, threatening global oil supply. But “events have taken on a momentum of their own with U.S. and Iranian forced bolstering their military presence, raising the threat of a miscalculation.†https://www.bloomberg.com/news/articles/2019-06-14/u-s-says-video-shows-iran-was-involved-in-an-attack-on-tanker?cmpid=BBD061419_OUS&utm_medium=email&utm_source=newsletter&utm_term=190614&utm_campaign=openamericas Since oil is critical to global enterprise, do you think a “miscalculation†could cause a global shock that no one is expecting? Could this conflict cause a black swan event?

But that’s not all. An even bigger threat looms for the US dollar.

The Petro Dollar was used to retain the US Dollars status as World Reserve Currency. What that means, is that up until 2005 the world HAD TO use USD to buy ANYTHING outside their boarders and the US was the ONLY country that could pay global debt with THEIR OWN fiat money. While the shift began in 2005, as long as the middle east only accepts USDs for oil, there would be global demand for dollars.

Now, officially, that link may be breaking as Saudi Arabia is thinking of “stripping†the US dollar for the oil trade IF the US passes the No Oil Producing and Exporting Cartels Act (NOPEC) legislation that would essentially make it illegal for foreign nations to work together to set prices. This bill would strip foreign governments of the sovereign immunity protections given in the original petro dollar agreement.

Yet another probable, long held trade agreement change. Though this change would trigger the financial system reset, which is based on the USD. Do you think wall street knows this? Of course they do. Perhaps that’s why spot gold is moving up at the same time as the stock market, and the accumulation pattern that began in April 2018 comes to conclusion now.

The smart money has been accumulating, regardless of the fiat money price. They know gold is cheap wealth insurance, even above the current levels. They also know the time to buy insurance is BEFORE it is needed. Got gold?

Slides and Links:

https://www.bloomberg.com/news/articles/2019-06-09/bulls-beware-the-2020-oil-market-is-quickly-turning-ugly

https://www.stockcharts.com/h-sc/ui

YouTube Short Description:

The Oil rally that started in early 2019 is over with spot oil off more that 20% from its recent high. The markets are looking at rising US shale production, diminishing demand because of the global slowdown and a deepening trade war that would dampen demand even further.

This is what that markets are looking at. Are they missing the bigger picture or is this oil bear market being used to hide the middle east threats (plural) from the public?