Central Bank Indicator of US Economy Collapse -by Lynette Zang

There is a bank that is showing us what is most likely to happen. You could call this a canary in the coal mine. Well, what does that really mean? Coal miners used to bring a canary on their shoulders into the mine. The bird served as an early warning side of impending trouble and danger. The miners would closely observe the bird and if they noticed any signs of distress, they would evacuate the mine immediately. We’ve got a canary in the coal mine that is showing us distress and it’s time to protect yourself financially. Globalization is here and global central banks are all interconnected. This is a major sign of what is most likely to happen to the US economy and the world

CHAPTERS:

0:00 Canary in the Coalmine

1:19 Japan’s Purchasing Power

5:01 Bubble Economy

6:48 The Yen

8:26 BOJ ETFs

10:30 Same Thing Over and Over

12:07 Japan Phasing Out Yield Curve

14:00 Traders Eye 5 Basis Points

17:37 Create a Strategy

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

Buy gold and silver with ITM trading. Use the link below to schedule your free strategy call.

There is a bank that is showing us what is most likely to happen. You could call this a canary in the coal mine. Well, what does that really mean? Coal miners used to bring a canary on their shoulders into the mine. The bird served as an early warning side of impending trouble and danger. The miners would closely observe the bird and if they noticed any signs of distress, they would evacuate the mine immediately. We’ve got a canary in the coal mine that is showing us distress and it’s time to protect yourself financially. Globalization is here and global central banks are all interconnected. This is a major sign of what is most likely to happen to the US economy and the world, coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading a full service physical gold and silver dealer. But really we specialize in strategies, custom strategies to help you through this transition. And you know, I told you when the Bank of Japan extended its yield curve or the yield that they would allow, its 10 year bond to rise to, that they had to do that because I believe that were, that they were losing control of the bond market there.

And, and I’m gonna show you more about this because really I remember talking about the ends lost decade and then lost two decades and now lost three decades. But Japan’s buying power, that’s the one that matters the most to you and me. The purchasing power is near a 50 year low. It’s actually beyond this because this was back in January of 2022 and it’s only gotten worse. And we can see this in the flashback all the way back to the seventies before they opened up the financialization spigots of the end. And I’m gonna show you that too. But look at this trend. How do you know you have a negative trend when you have a consistent series of lower and lower highs? This is official, right? Japan’s been in deflation for decades and a while ago. I’m like, okay, well in deflation and prices it, it makes it appear that prices aren’t rising. But a wonderful viewer had written in, this is back in 2019, but is totally applicable today because I asked anybody living in Japan, what is your experience with inflation? And this is what he said, multi-decade resident in Japan here, do we have inflation? Yes, food stuffs show on average 20% either increase in price or decrease in size or both. This is my personal shopping experience, not government data, that’s what matters the most you guys, rural real estate remains depressed. Urban, less so because even those in rural areas with money to invest, put it into urban real estate because there is not growth in rural areas. By the way, government is spending money hand over fist demolishing buildings to rebuild better and newer fine. But where did they get the money for it? Great question. By the time anyone figures it out, it’s already gone. I notice a lot more imports from US. Weather, food stuff, supplements, etcetera. Hope this is helpful. It’s really helpful because all we hear is about the deflation, but the yen has lost value against the dollar even with prices rising faster in the US than in Japan. And we’re talking about this is what is happening right now. So even in deflation, the fiat, yen or any other fiat currency, any other fiat currency, whether it’s inflation or it’s deflation, they’re losing purchasing power because that’s by design. And when you get to zero, what do you gotta do? You’re gonna go negative. So the central banks want you to think that negative rates are a choice. Come on, would you really loan somebody money knowing you’re going to get back less unless they’re your children? It’s the only one I would do it for. Japan has been fighting deflation since the nineties. And this all of their experiments are the global blueprint. That’s why they are the canary in the coal mine because somehow central banks don’t get this. Global central banks don’t get this.

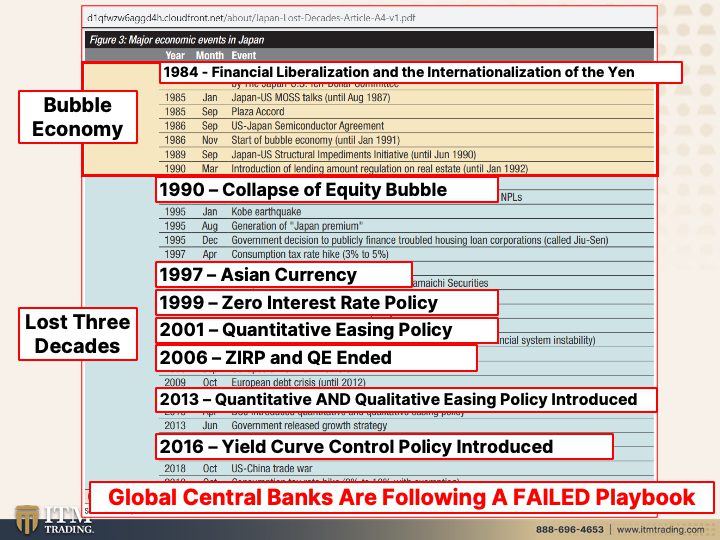

So let’s look at the boom. The bubble economy and when it started to boom was 1984 when they liberalized the and internationalized the yen. Woo-Hoo. They had a great six years until the collapse of the equity bubble in the nineties. And now it’s been a lost three decades. And this is the blueprint that global central banks are following. How comfortable do you feel? Because honest to goodness, this is from a real person that’s living in Japan. And I appreciate whenever I get that. 97 there was the Asian currency, the Asian currency crisis. But that is actually when the first derivative bubble imploded, long-term capital management. They introduced ZIRP, zero interest rate policy, quantitative easing. Do you see that? That the Bank of Japan has been experimental and instrumental and everybody else is trying this. ’cause They’re added tools. They don’t have anything. And the worst part about it is that they know that it’s failed. It’s failed for three decades. And I’ve had people say to me, well you know that’s Japan. And look it, they’re still going. Well the population is really suffering on a lot of levels, but frankly all of that money printing, everything that they’ve done, I’ll show you it doesn’t work. So I’d say that’s more of insanity. We’ll talk more about that. ’cause It is a failed playbook. You better get yourself into a position to weather this storm.

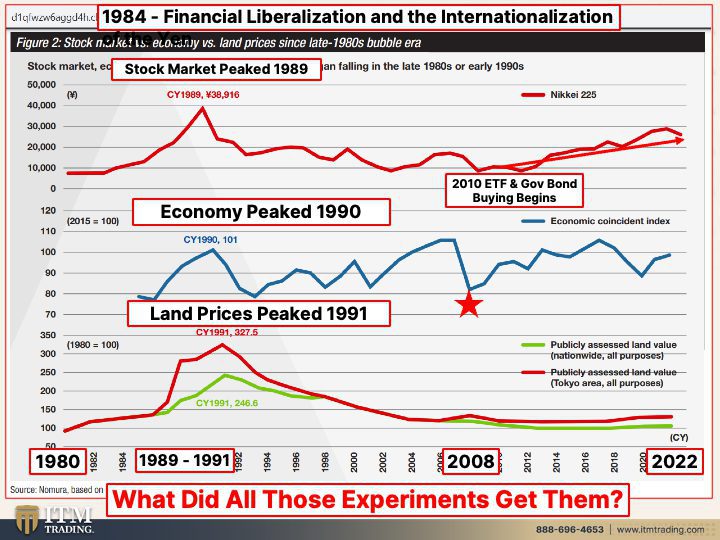

Now I thought that this was like super interesting and what you’re looking at is, okay, 1984, the the financial liberalization and internationalization of the end. And what do we have here? There’s your 1980, the stock market peaked in 89. The economy peaked in 90. It hasn’t gone back to these levels since then. And real estate prices peaked in 91. Now you tell me how well they’ve done. ’cause they haven’t done all of these policies, all of this money that they’ve put in. Well, it only worked between 1980, actually 1984 and to 1991. Those were the peaks in everything. There’s bottoms 2008. And in 2010, the government and the central bank decided that, wow, we gotta support this economy. So how are we gonna do that? Well, we’re gonna buy stocks, we’re gonna buy ETFs and we’re gonna buy bonds because there are not enough buyers to support it. So to the rest of the world, it makes it look like everything is is okay. But is it really? That would be a big fat no, A big fat, no. Nothing that they did worked. What did it get them? But very much in debt.

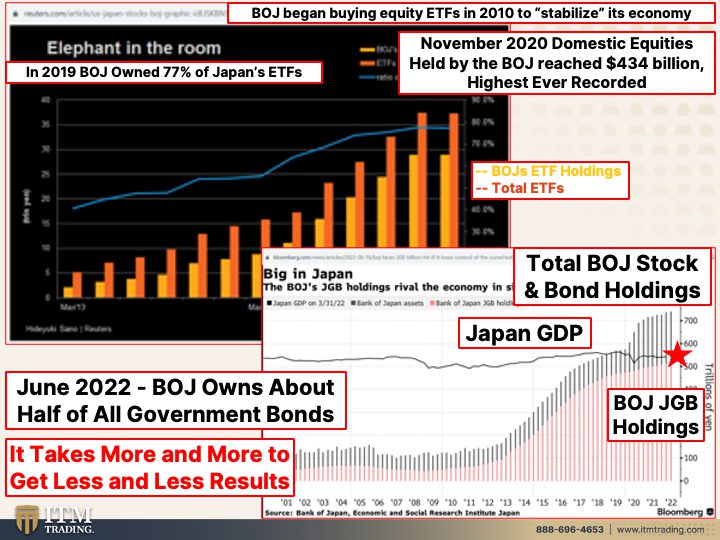

The Bank of Japan buying started buying the ETFs in 2008 or 2010 rather. And this lighter orange is all of the ETF holdings. So that the stock holdings. And back in 2019, which was the most current chart I could get, or that I found, the Bank of Japan owned 77% of ETFs. In other words, 77% of their stock market. Yeah, that’s pretty good. By November, 2020, the domestic equities held by the Bank of Japan reached 434 billion, which was the highest ever on record. Who did that support? But the wealthy in Japan and they have a big retirement crisis just like there is all over the world. And let’s take a look at the bonds because these, the red area is the Bank of Japan’s bond holdings. And they hold roughly 50%, about half of all government bonds.

Do you realize who ultimately pays this price? The citizens pay the price for all of this. The taxpayers pay the price for all of this. Does that mean that everything is hunky dory because the Bank of Japan had a rush in and support their stock and their bond markets? And they’ve been doing this garbage and crap and all this alphabet soup of crap since 1990. Oh, it’s been real successful, isn’t it? And what’s it done to the GDP? Flat, flat, flat. It doesn’t work people, all it does is transfer wealth. It doesn’t work. And it takes more and more to get less and less results.

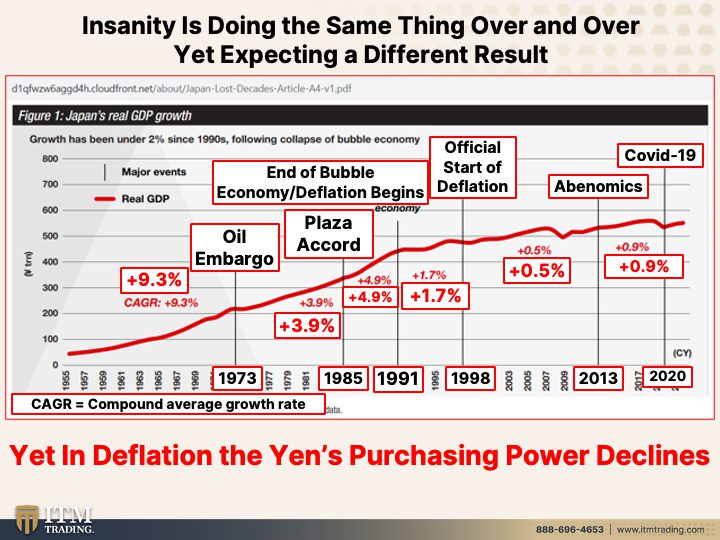

Insanity doing the same thing over and over again, yet expecting different results. So is the whole world insane? Well, the central bankers are absolutely, and they’re sociopaths. So they can’t really care what happens to us. But this is Japan’s real GDP growth. That’s all the money that flows through the economy. And the CAGR, which is what we’re referring to throughout this is the compound average growth rate, which by the way would include inflation and deflation. So the kickoff, they did great, they grew it 9.3%, then we had an oil embargo. Now is when the whole thing really starts to fall apart. And you can see between 73 and 85 okay growth. But once you hit 91, what happens to that growth? It stalls. This is the official start of deflation. But frankly it started at the bubble popping because when a bubble pops, whether it’s stock markets, bond markets, real estate markets, those prices go down. That’s deflationary. How do you fight deflation with inflation, with money printing, with creating something artificially pushing those interest rates down and new money into the system. Yet even in deflation, the ends purchasing power declines.

Shocker. So for those that always ask me about inflation and deflation, it doesn’t matter. You gotta protect your purchasing power doesn’t matter. And how are the markets reacting to what happened in the Bank of Japan? Well, the shock has Wall Street gaming out the global spillovers. We talked about the yen carry trade. We talked about the fact that the Japanese investor has massive investors all around the world. And if the Bank of Japan actually does start raising those interest rates or the markets raise those interest rates, then those investors would sell what they hold externally and buy Japanese stocks and bonds.

Their interest in Japanese futures. It’s the highest since 2000. Yeah, it’s very obvious what’s going on there. But what should be very, very obvious to everybody that’s watching is that all of this money printing, keeping rates into negative rates, nothing has worked. And now what are they gonna do? The Bank of Japan will have to navigate factors such as the potential repercussions of a spike in Japanese bond yields. ’cause What about all that debt that has to roll over? This isn’t just a US problem, this is a global problem. The currency implications and the unwinding of its incredibly inflated balance sheet. And what I love is when mainstream media in the US is writing about any of this stuff, they’re pointing fingers. Instead of looking in the mirror. Look in the mirror. Doesn’t this sound familiar? Look in the mirror.

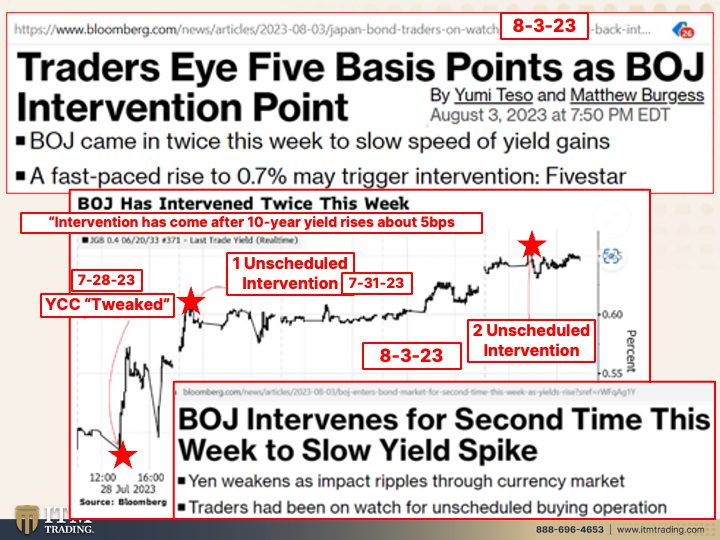

Traders, because after all, the only ones that really matter are the traders. The public doesn’t matter. It’s Wall Street that matters. It’s the banks making money that matters. That should be very obvious traders eye a five basis points as Bank of Japan intervention point. So in other words, when the bonds drop and the yields go up five basis points, they’re anticipating that the Bank of Japan will intervene. Hmm. Well is that so? Because quite honestly, yeah, in fact they’ve intervened twice. Now let’s think about the recent events. It was on July 28th that they tweaked, they really lost control and expanded the yield that they would allow without going into the market and buying bonds to artificially push those yields down. Right? So they decided to tweak their yield curve control, which didn’t do very well. Anyway, they have now, on Monday, the following Monday, they intervened in the bond market. They bought bonds. And guess what? On August 3rd they did it again. What do you think? You think this is working well for them? Because that looks like panic to me. What do you think? Does it look like panic to you? It it is really unscheduled. Unscheduled means a surprise. Unscheduled means that they’re shocking the markets. Will there be more interventions? maybe there’s gonna be another intervention. If there is, I’ll be paying attention because it has come after 10 year yield rises above that five basis point move. Well the traders know, don’t they? Of course they do. Of course they do. And how has this impacted gold? Because I told you whether it’s inflationary or deflationary, gold moves on it.

But this is the spot market. The yen to spot gold. And isn’t this interesting? Because gold, physical gold is what the global central banks are buying hand over fist to protect them. The paper gold, you can create as much gold that doesn’t exist. So look what happened to the spot market on 7/27 just before the central bank lost control of the yield curve. Well it dumped. Yeah, that makes sense. Then of course it climbed back up just before the interventions and what’s happened since it dumped. Yeah, that makes a whole lot of sense. In the meantime, what has Japan been doing with their reserves? They too have been building their gold reserves, haven’t they? And I want you to ask yourself this question. Does it make any sense that during a currency crisis, which is happening in Japan right now, that is absolutely a currency crisis? That the absolute best according to the bank for international settlements, according to the IMF, according to every central banker in the world, even if they don’t tell you outright, it’s something that has worked for 6,000 years, doesn’t it make sense that a top flight to safety asset would be on sale? Yeah, right. Take advantage of it. Get gold, get silver, but not paper. Make it the hard asset that you hold, you own. It’s outta the system. It avoids all of this geopolitical risk. And that’s according to the Bank for International Settlements. And Lynette Zang and many other people that understand money and understand good money, this crap is not good money. It actually has my face on it. It’s definitely not good money. And reflects the loss of purchasing power.

This is good money ’cause it’s the only thing that has ever actually had all of the components required to be a good money. This next iteration, the CBDC going cashless, if you don’t have physical gold and silver in your possession, you are gonna be in very deep do-doo. So if you haven’t set your plan in place yet, you click that Calendly link below. Set up a time to speak with one of our extraordinarily bright consultants. Get your personal plan and strategy in place, ASAP, and get it executed. We are in this together. So if you like this, please make sure that you subscribe. It’s important that you know what I’m trying to show you here. Do your own due diligence, follow those links. You come up with a different opinion. Rock and roll hoochie coo. I can’t tell you it’s not valid, but do your own due diligence. Don’t take anybody’s word for it. Don’t take the central banks and the government and Jamie Dimon, oh, everything is hunky dory. It’s not hunky dory. Heed the warning. Get outta that coal mine. Get to safety. If you like this, please give us a thumbs up, leave a comment and make sure that you share this video with anybody that you can get to sit down and watch it. And until next we meet. Remember, financial shields are made of physical gold and physical silver, not paper or promises. And until next we meet. Please be safe out there. Bye-Bye.

SOURCES:

https://d1qfwzw6aggd4h.cloudfront.net/about/Japan-Lost-Decades-Article-A4-v1.pdf

https://www.reuters.com/article/us-japan-stocks-boj-graphic-idUSKBN1XP0JC

https://www.visualcapitalist.com/equity-purchases-by-the-bank-of-japan-reach-a-new-milestone/

https://d1qfwzw6aggd4h.cloudfront.net/about/Japan-Lost-Decades-Article-A4-v1.pdf

Wall Street Is Gaming Out Global Spillover Threat From BOJ Shock – Bloomberg

Traders Hold Most Japan Bond Futures in 23 Years on BOJ Bets – Bloomberg

Traders Eye Five Basis Points as BOJ Intervention Point – Bloomberg