CENTRAL BANKS LOSING CONTROL: Real Estate, Interest Rates & Global Breakdown…by Lynette Zang

Many investors call us because they have a gut feeling the dollar is being inflated away to zero, and they’re correct. Not only because of the unprecedented money printing by the Fed resulting in the many different price inflations you’re already seeing everywhere, but also the radical increase of social change since the pandemic started, all seem to be “justifing” the next set of changes nobody wants to see…

And based on my research of historical data from previous Currency Resets around the world, I have been preparing for this event for over 20 years now. It’s based on the life cycles of all currencies; we just didn’t know it was going to come in the current disguise. The fact is we’re nearing the end. It’s my job to warn you while you still have time. In this video I’ll show you the status of the Central Banks, we’ll look at the latest info around the Real Estate top, and another major issue that reveals yet another failing block in our current Jenga Economy!

TRANSCRIPT FROM VIDEO:

You know, many investors call us because they have a gut feeling that the dollar is being inflated away and going to zero. And frankly, they’re correct. Not only because of the unprecedented money printing by the fed resulting in all of the bubbles that we see everywhere, but also the radical increase of social change since the pandemic started, it all seems to be justifying the next set of changes that quite honestly, I don’t want to see it. I don’t think you really want to see. And based on my research of historical data from previous currency resets, and there are lots of them all around the world I’ve been preparing for this event, frankly, since 2008. And even before that, but I didn’t think I’d see it in my lifetime. You know, it’s all based on the life cycle of currencies. And we just didn’t know that it was going to come. Now, the fact is we’re nearing the end and it is my job to warn you while you still have time, you still have choices. In this video. I’ll show you the status of the central banks. And we’ll look at the latest info around the real estate potential top. We’ll talk about that. And another major issue that reveals yet another failing block in this jenga economy coming up.

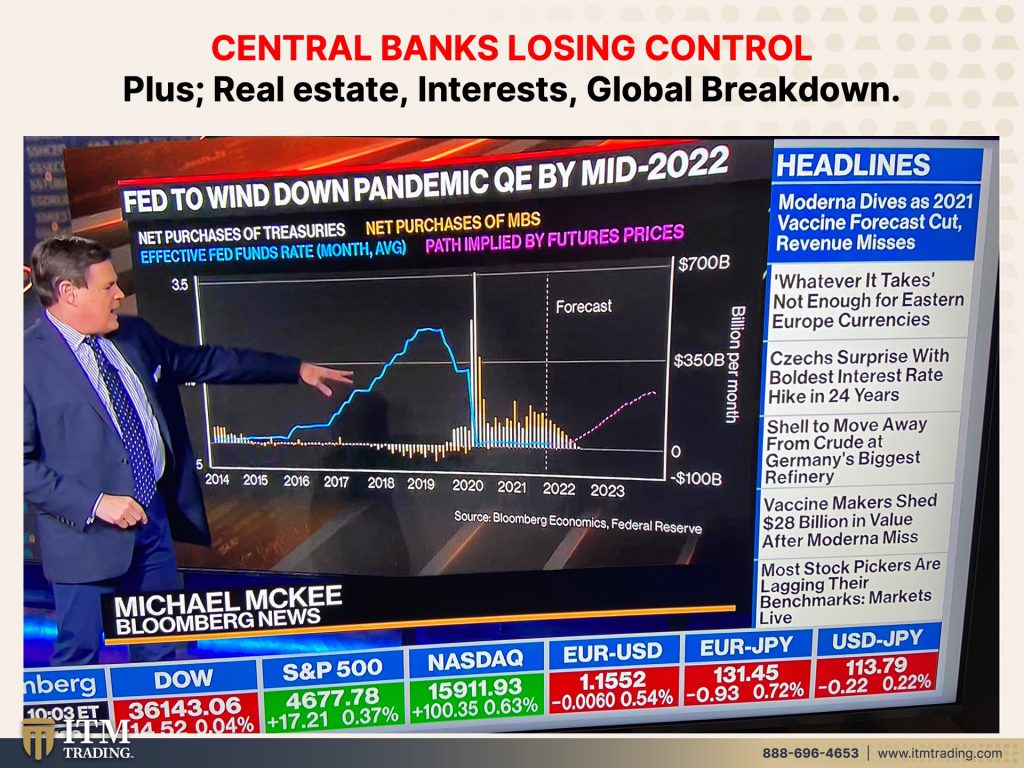

I’m Lynette Zang, Chief Market Analyst here at ITM Trading, a full service, physical gold and silver dealer, but really specializing in custom strategies to help you survive and even thrive through the reset that has already begun. And so we’re going to start with some latest news, because what I’m seeing is that central banks, and we’ve been talking about this, but they really are losing control. Now, what you’re looking at here is yesterday fed chair, Powell announced the wind down from the pandemic, right? So this is running off the balance sheet. Though we know that didn’t go real well the last time they attempted it, but okay, let’s, let’s say that they’re going to be able to do it. They have to announce it for any level of credibility and you can see how they plan on being done, running off all of that balance sheet by 2022 and mid 2022, and then they’ll start raising interest rates. So it’s not time to do it yet. It’s never going to be time to do it. I’m not saying they won’t try, but they will not. If, if even recent history is any gauge, they will not succeed at it.

And why won’t they succeed? Because they gave the market over to the traders because wall street and the financialization of the entire global economy. Well, you know, they’ve been working on it for a long time, but when the banks are in charge, what do you expect? And so I promised you yesterday that I would bring back this graph, this chart, because it’s important for you to say the $TYVIX, which they no longer publish because they really don’t want anybody to know what’s happening underneath the surface. This is the U S ten-year treasury bond. And look it back. Well, prior to 2008, it was like a straight line. In other words, the price did not move a whole lot. It was not volatile. It was pretty solid for a 10 year treasury, which frankly is what you want in a foundation. You don’t want a foundation that’s shifting and moving all the time. You want something that’s rock solid, not what we have anymore. In 2008, when the system died, what was once a dash then became a short line and you can see it. It’s really obvious. And look at 2013, because that’s when the shift to the traders taking over the control of those markets really, really started.

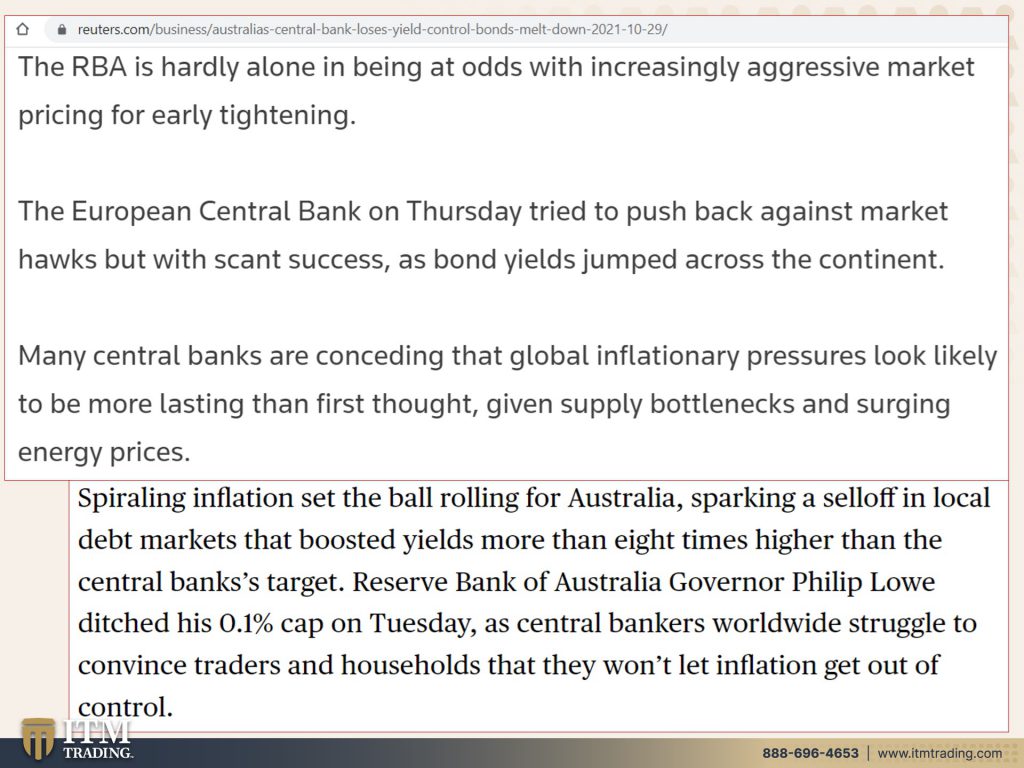

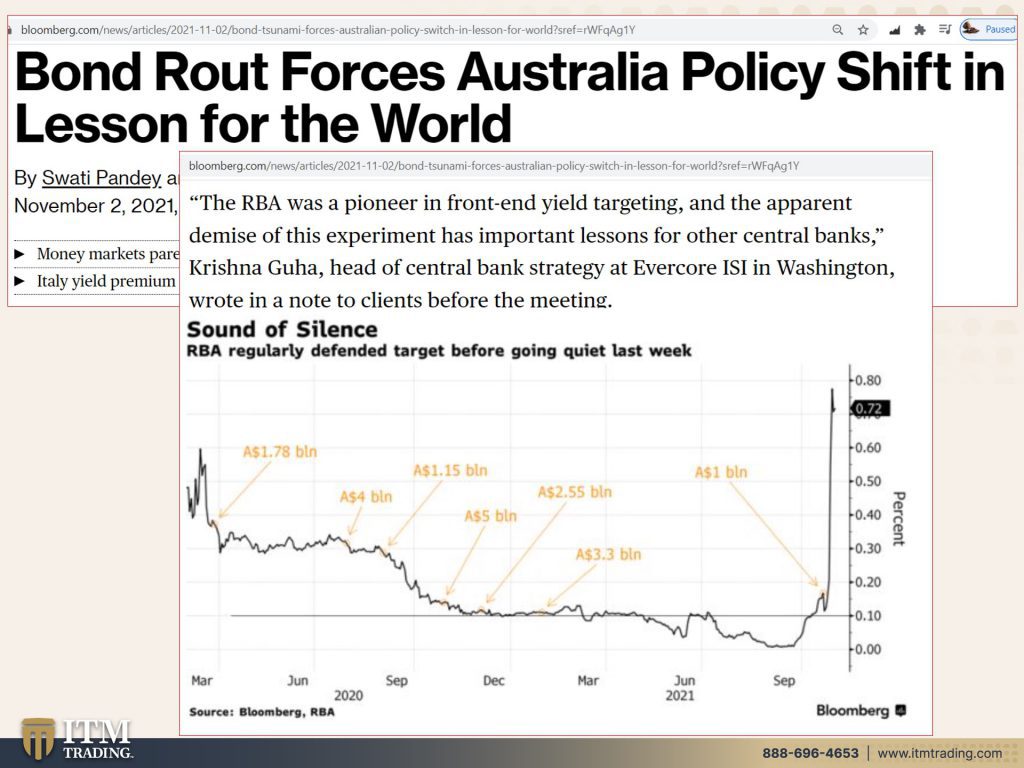

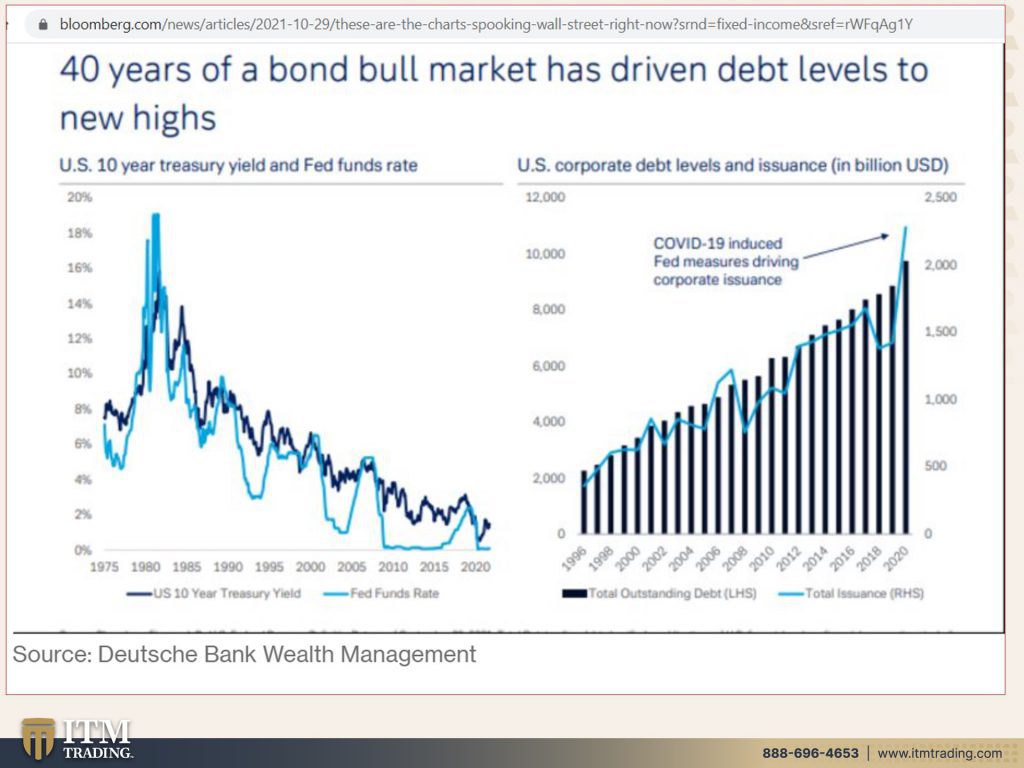

This is so significant and I’ll show you why, because a lot is now happening around the world. And we have to pay attention to this because just as this is in Australia, guess what? It’s going to impact everybody central banks are experimenting now, of course, and they’ve been experimenting now what’s interesting, particularly about Australia is that like Japan who made a failed attempt at yield curve control and yield curve control is about a central bank controlling every area of the bond market. Okay? So here’s our bond market and these are interest rates. And this is the principle. And this is when it’s issued. Okay. When the bond is issued at par, right? Which means thousand dollars thousand dollar bond, okay. Now we know this. When interest rates go down, the principal value goes up and you can see the longer the maturity, the more the movement, but the reverse is also true. When interest rates go up, the bond principle in the marketplace goes down. Now, if you hold it to maturity and presuming they don’t default on it, you’re going to get your thousand bucks back. But between now and then this is what happens to the principal value in the current marketplace of the bonds. So in yield curve control, if this is short term, this is intermediate term, and this is long-term what the bank of Japan and the bank of Australia attempted to do was if the longer yields were going up, well, they would go in and they would buy a whole bunch of bonds to push that down. That’s yield curve control, right? And it really is dependent upon the central banks, holding the market’s confidence in what they could do. So here we have the Australian central bank who had vowed and vowed and vowed that if interest rates were rising, they would go in and buy as many bonds as they needed to, to keep those interest rates at their target level. So they had an opportunity to do that, and they backed out Australia, central bank on Friday, really this quote Australia central bank on Friday, lost all control of the yield target key to its stimulus policy as bonds suffered their biggest shellacking in decades and markets howled for rate hikes, as soon as April now. Okay. I’m going to say a little something about that last part markets, howled for rate hikes. Well, just hold on to that, because what they’re really talking about is the trader’s opportunity to make money off of the move in the yields. Do they really want rate hikes? No, they don’t. Why? I’ll show you again. We’ve talked about it a million times. It’s because all of that debt is at nosebleed levels. And remember, okay, going back to this, right, this is short term, right? This is the overnight rate that most central banks control and say, this is what that rate is, but that you really think all of those funds, all of that hold these long bonds want to see their principal go like that. Heck no, right now that that can happen. And if you’re in a fund and you’ve got, you know, a hundred or 800 or however many bonds in there, and that happens to one of them. Okay. So, so honestly when they say they want yields to go up, frankly, that’s garbage. And, and we’ll get into that a little bit more.

So this had an impact on a global basis though, but they’re hardly alone at being at odds with increasingly aggressive market pricing. You know what they’re talking about is central banks against the traders, that’s what they’re talking about, right. And traders might have a better, you know, might have a, well, I don’t know, do they have deeper pockets in the central banks? or do you think he could just get too expensive? The ECB on Thursday tried to push back against market Hawks, but with scant success as bond yield jumped across the continent. Okay. So I’m telling you, these are even in advanced economies where this battle is really heating up. This is critical. It’s critical, it’s critical. Many central banks are conceding that global inflationary pressures look likely to be more lasting than first thought, given supply bottlenecks and surging any energy prices. And quite honestly, that’s only two reasons. But the reality is, is all of that money that they’re printing at these low interest rates have created a bubble economy have created that inflation.

That has been primarily not completely. We know our prices is your cost of living, Are they the same as they were in 2008? Because that would be a no right? So inflation is ever present in the current system. It’s that speed that they’ve been able to control. And they’ve been able to keep it really, I guess, not right in front of your face, but now it is right in front of your face. And people are starting to notice it. I mean, the public, this is a con game. It depends on confidence. My confidence in central banks gone a long time ago, but that’s because I read so much about what they write. And I watched so much about what they do for themselves, but spiraling inflation set the ball, rolling for Australia, as well as everywhere else in the world, sparking a sell off in local debt markets that boosted yields more than eight times higher than the central banks target.

What does that look like? This is what that looks like now. I’d like you to ask yourself a question. Did you know that that was going to happen here or here or here or here or here or here, right? The point is no, you see this straight up line. That’s what it’s going to look like when the whole market crumbles. We can’t tell you exactly the moment, but I guarantee you, well, I guess I can’t guarantee you. I can’t guarantee this, but in my very well-educated opinion, this is what we’re going to see all over the place, whether it’s the markets and you can just turn that right around and you’ll see them imploding when central banks lose control. I mean, as my grandson would say, when he wants me to get something, but he does want to be verbal. He’s really funny. But I mean, it really is perfect. I mean, look at this graph. And you know, could you imagine if interest rates or when interest rates really start to spike in the U.S. I mean, here you are sitting along as pretty as you please. And then interest rates go like that. Here’s your principle all the way down here. And I’m not kidding because so much of all of this garbage government bonds are held inside of pension plans. You know, IRA’s, ETFs. I mean, big rebalancing. If you’ve got a pension plan that targets your retirement date. So they hold the bunch in stocks and then they start to move it over into bonds.

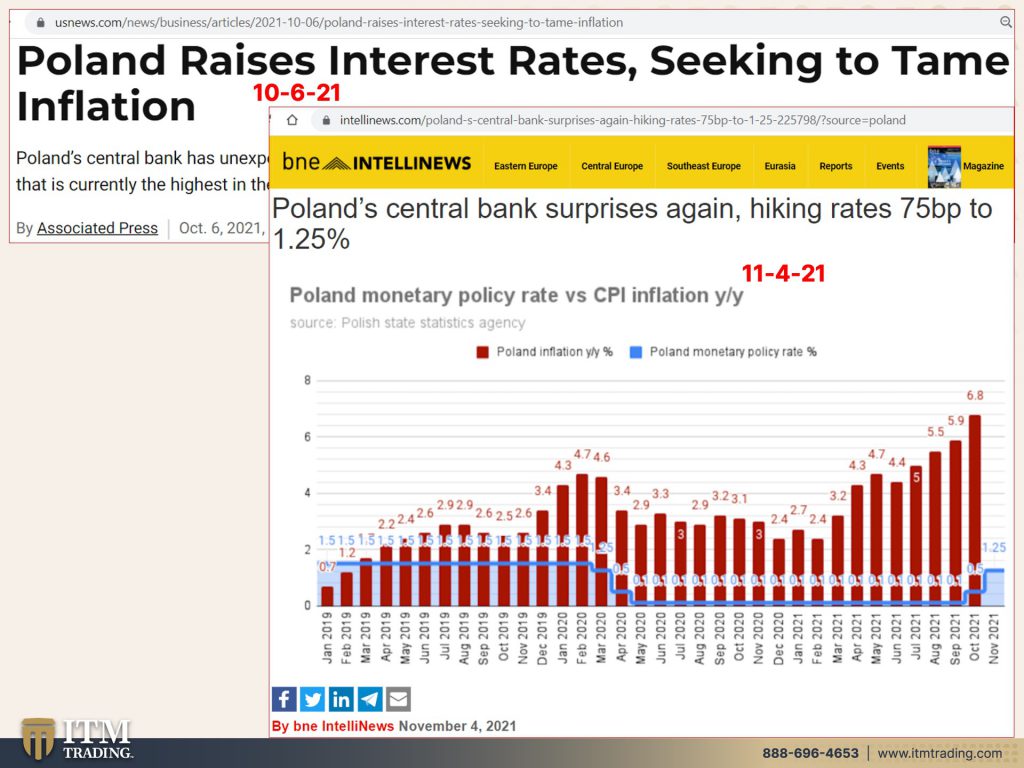

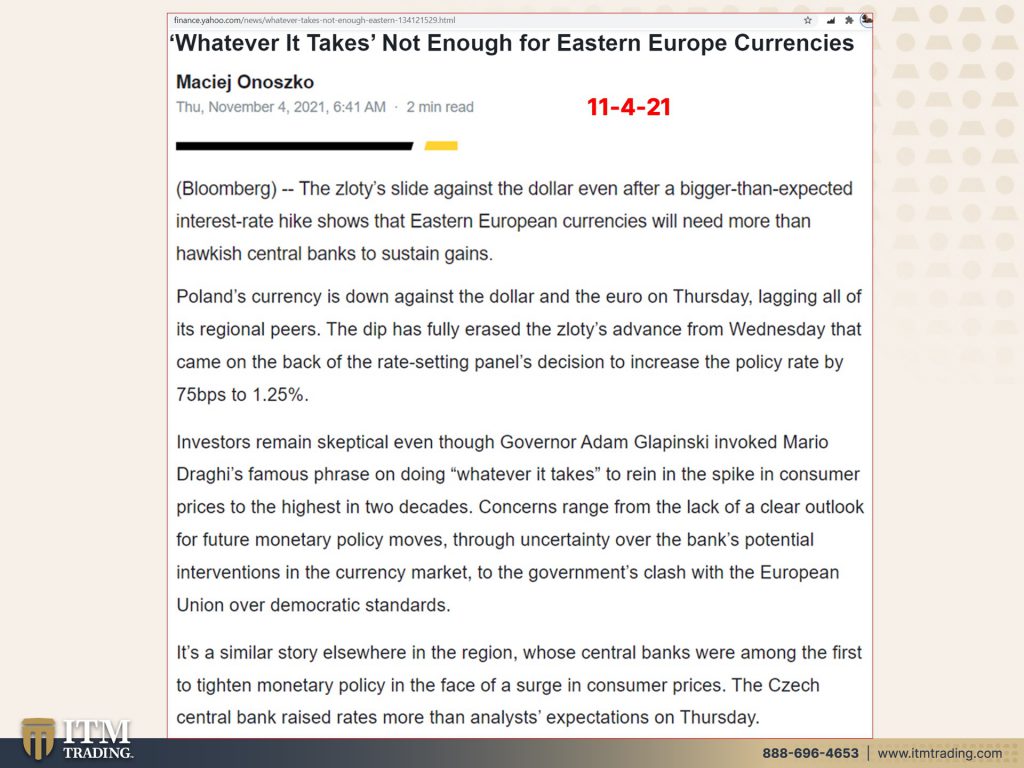

Is that really where you want to be? I think you really need to ask yourself now, I’m going to talk about Poland in here, because I think that this particular graph actually shows you the problem that everybody is having, and therefore it’s your problem too, okay, now Poland central bank unexpectedly increased their rates, right? But this is the official inflation rate. So you can see how the inflation has been going up because, Hey, it’s transitory. I mean, it’s been transitory since 1913, but I guess you could say a hundred years is transitory. I mean, in the bigger picture, what’s a hundred years, it’s a blip, but in our lifetime, it’s not such a blip, but this is the inflation rate going up. And central banks are between a rock and a hard place because all of the money printing is about, I mean, stimulating the economy, it’s stimulating the Fiat markets. That’s what it’s been stimulating. And so they can’t raise rates because of all of the debt that is going to have to be rolled over. Okay. But at the same time, you know, and here’s the other thing, okay, let me kind of back up. So I’m not getting ahead of myself. All right. Interest rates are the key tool for central banks to control the rate and speed of inflation, right. But if you’re anchored at zero and what do central bankers do to inspire borrowing and spending? They lower the rates when they want to slow down that borrowing and spending, they raise the rates. But because of all of the, that they’ve been doing and the supply chain shortages and the increase in wages and the demand for even higher wages, this is not transitory. And so if they raise rates, is that going to halt demand? Probably not. How high do they have to raise them in order to halt that demand? Because wall street is addicted to that free money. I don’t care what they’re calling for, but they’re stuck between a rock and a hard place, because even though yup. You see, they raised rates by more than ever expected. They went from a 0.01 to a 1.25 in about as many months since October, October 6th. Okay. So that’s a big jump, even though interest rates are really low, does the market believe it? I’m not so sure. And Poland’s got an interesting history anyway, of confiscating pension wealth, et cetera. So the Polish central bank came out and said, whatever it takes, Mario Draghi, whatever it takes. But apparently it’s not enough. The zÅ‚oty, that’s the currency Polish currency, slide against the dollar. Even after a bigger than expected interest rate, hike shows that Eastern European currencies will need more than hawkish central banks to sustain the gains. So in other words, what they’re saying here is the currency against the dollar, right? There, there are several ways to value any currency, one that we hear, oh, you got a strong dollar, you got a weak dollar. Here you’ve got a strong zÅ‚oty. You’ve got a weak zÅ‚oty it’s just one currency against the other, but both of them, both of them are losing purchasing power value, which is frankly, the value that matters the most to you and me. Poland’s currency is down against the dollar and the Euro on Thursday, lagging all of its regional peers. The dip has fully erased the advance from Wednesday, right? That came on the back of the rate setting panel’s decision to increase the policy rate by 75 basis points to 1.25 now, okay. Here’s the point when they raise the rates that attracts money to that currency, because if the rates are higher than what they can get elsewhere, then what traders or investors can get elsewhere. And so that’s why additionally raising rates while potentially slowing down demand also boosts the strength of the currency because you have money flowing into the currency to take advantage of those higher yields. Investors remain skeptical, even though the governor invoked, okay, his famous phrase, whatever it takes to reign in the spike in consumer prices to the highest in two decades. And we’ve heard about that from everywhere. Concerns range, from the lack of a clear outlook for future monetary policy moves uh oh, that goes to the credibility of the central bank and that credibility and that confidence is everything in a Ponzi scheme, everything to the government’s class, with the European union over democratic standards. It’s a similar story elsewhere in the region whose central banks were among the first to tighten monetary policy. So raising rates, in the face of a surge in consumer prices, the Czech central bank raised rates more than analyst’s expectations on Thursday.

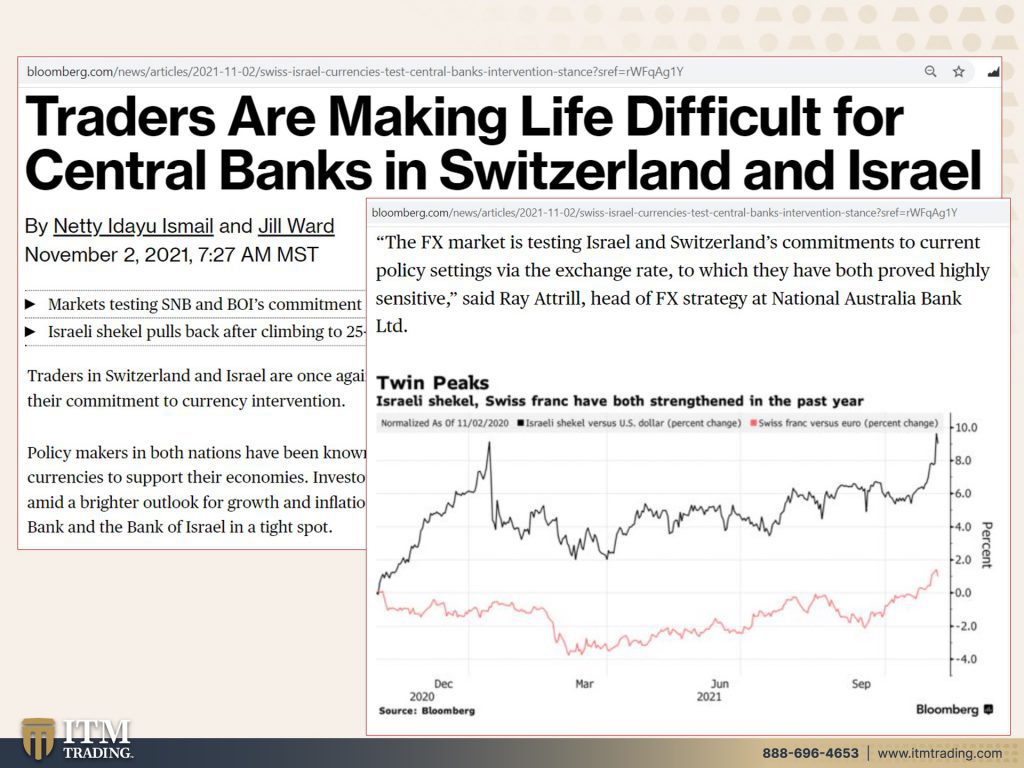

So you’ve got the U.S. That’s holding interest rates where they are right at zero because they can’t raise the rates. And they’re not the only ones that are holding it at zero. The bank of England came out today and said, they’re not changing the rates, but you have other countries that we’ve looked at before south America and Eastern Europe that are making an attempt to raise them. It will be a failure. Honestly, this is the 10 year bond yield. And you can see where it bottomed here, back in March of 2020 and where it is today. I mean, it was basically close to zero then, and this is where it is today. And what does that mean? It means all those retirement and pension plans, that’s, what’s happening to their principle. And in 2013 there, when he stole 40% of the government bonds out of the private retirement plans. That’s another story I’ve talked about that before, but I’ll do something on pensions here soon. So here’s the point. Traders are making life difficult for central banks everywhere, including Switzerland and Israel. The foreign exchange market is testing Israel and Switzerland’s commitments to current policy settings via the exchange rates. So you got the bonds and you got the exchange rates, right? Traders are taking over this whole market. Do traders really care about the stability of the markets? Heck no. They care about making profits. That’s what they care about. That’s their focus, that’s their job. Let’s see. The first exchange market is testing Israel and Switzerland’s commitments to current policy via the exchange rate, to which they have both proved highly sensitive because both Switzerland and Israel have a tendency to want to weaken their currency against other currencies, making their exports look more attractive. So they do make the exports look more attractive, but at the same time, they also hurt the people. So if you look at twin peaks, Israeli shekel, Swiss Frank have both strengthened in the past year, which is against the policy. So what do they have to do those central banks? Do you know, central banks all the time intervene in the currency, in the foreign exchange markets. If they want their currency to be stronger, then they buy it. So there’s less of it out there. If they wanted to be weaker, then they sell it so that there’s more of them out there. But if the traders want something different or they don’t think that the central banks will go in with the firepower, that they need to manage those markets, then yeah. It makes central banks’ life difficult.

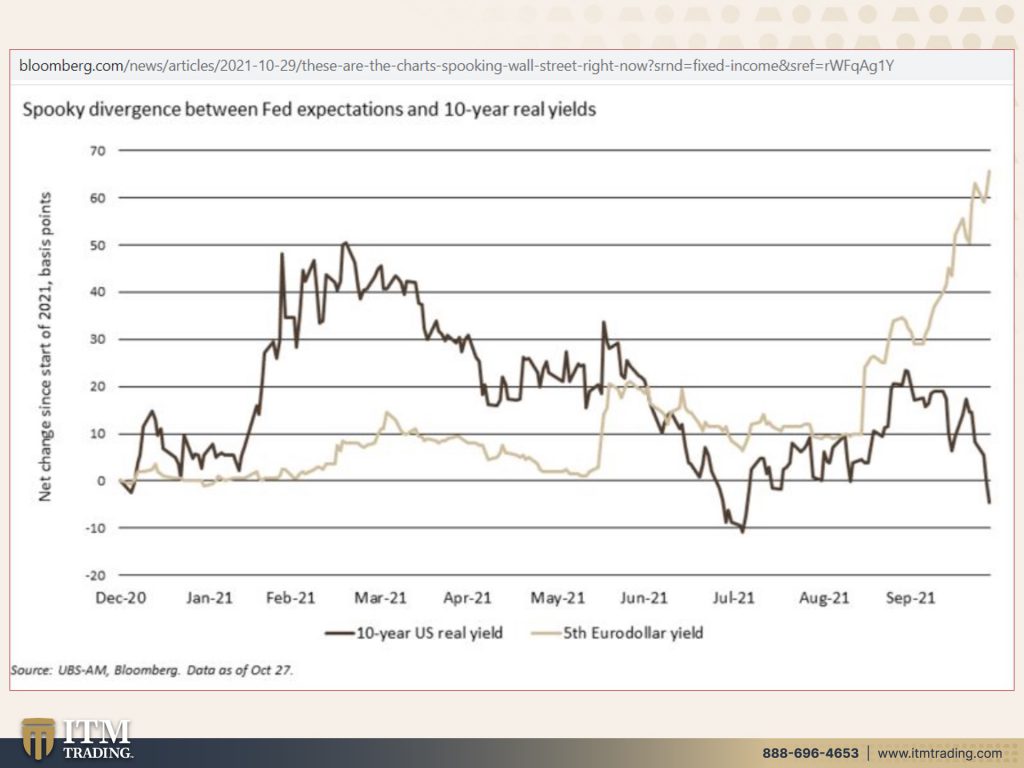

So what I’m trying to show you here is how that is really changing all around the world. And we now have is it a full blown war? I don’t know, but I think that it’s the start of the war, where the traders are really feeling their power and their oats and they’re testing the boundaries and what they can get away with the central banks. And the whole point of Australia was that why didn’t they go in like they said, they were going to do and buy a whole lot of bonds on the long end to keep those interest rates low. And the answer is because it got too expensive. So central banks will keep things propped up until it gets too expensive. And then the move is really swift. Now, lest you think that it’s only happening everywhere else. This is the divergence between Fed’s expectations, which is this black line here? No, actually that’s the yield, right? And the 10 year yield. So this is the Euro bond yield. This is the U.S. Yield, but that’s not really what’s happening now, but there is a divergence it’s different than what the central banks are talking about. That means that it is an obvious loss of confidence in their ability to pull this off. And you know, the last straw is the public, the first piece are the banks. I mean, we saw back in 2015 where the central banks with the Swiss surprise that central banks no longer trusted each other, then we also sought, well, actually started 2008 when when interbank lending plummeted, because banks did not trust banks to pay back their debts. Then 2015, it was central banks realized that the central bank over here, they may say one thing, but when it comes to defending their currencies or for whatever benefits, their little area, they’re going to do whatever they want, regardless of what they say, that’s just what happened in Australia too. They said, no, we’re defending it. We’re defending. And we’re defending it until they didn’t defend it. And the last vestige of confidence is in the public confidence in those central bankers, but here 40 years of a bond bull market has driven debt levels to new highs. There you go. I mean, you know, what can I say? They had a lot of ramp room and since this was their tool, can you see how they’ve lost their tool? Because we’re anchored to zero. Now we’ll just pay attention and see if they can pull this off and raise those rates. I personally don’t think so because every single attempt, every single attempt failed since 2009, every single attempt, including the attempt here in the U.S. So interest rates down, debt levels up. That’s it.

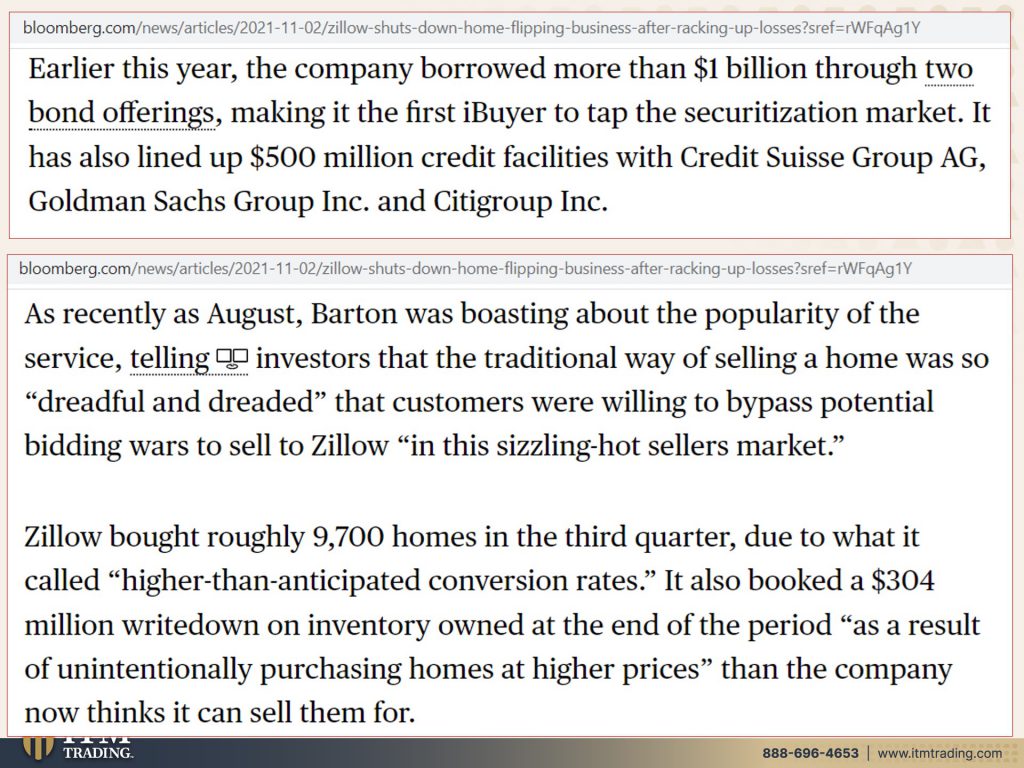

Now, the other thing that I wanted to talk to you about is what’s happening in the real estate market, because Zillow, I don’t think this is a one-off the way that Zillow was doing it you know, was really, it was a new way. I didn’t think it made a whole lot of sense. And here they’re proving it, right? We’ll see if this then spirals into other house flipping businesses. But my bet is that it will. Why are home prices up so much? We’ve talked about it because wall street is involved in home prices, right? The decision to abandon home flipping comes at the company’s third quarter results showed a loss of more than 380 million in the operation. The business had a major snag in recent months as Zillow tweaked its algorithms to make more aggressive offers, causing it, to overpay for houses. Now, listen to this last part, please, just as the heated U.S. Market began to cool slightly fundamentally, we have been unable to predict, future pricing of homes, to a level of accuracy that makes this a safe business to be in. Shocker! earlier this year, the company borrowed, who did they borrow from? Did you buy any Zillow bonds more than a billion through two bond offerings, making it the first eye buyer to tap the securitization market? It is also lined up 500 million credit facilities with credit Swiss group, AIG, Goldman Sachs and Citi group. Now here’s the point. This is what wall street has been doing actually. And in the real estate sector, going in, they’ve got unlimited. They’ve got access to basically unlimited funds at basically no interest rates or extremely low interest rates. Is it really any wonder that real estate prices have been ridiculous? So it’s not the mom and pops and the normal public that has created this real estate bubble it’s wall street. And this is really significant on a global basis, because both here in the U.S. As well as in China, real estate makes up about 30% of their gross domestic product. That’s all the money that flows through their economy. So it’s a really critical piece. And I mean, come on. Does anybody doubt that it’s a bubble mode? And does anybody really doubt that at some point, that bubble’s going to pop and I’m sitting here saying that this could be it just like I’m sitting here saying, I don’t know, this could be the start of the hyperinflation. We just have to pay attention. It’s what it looks like to me. It’s what it feels like to me.

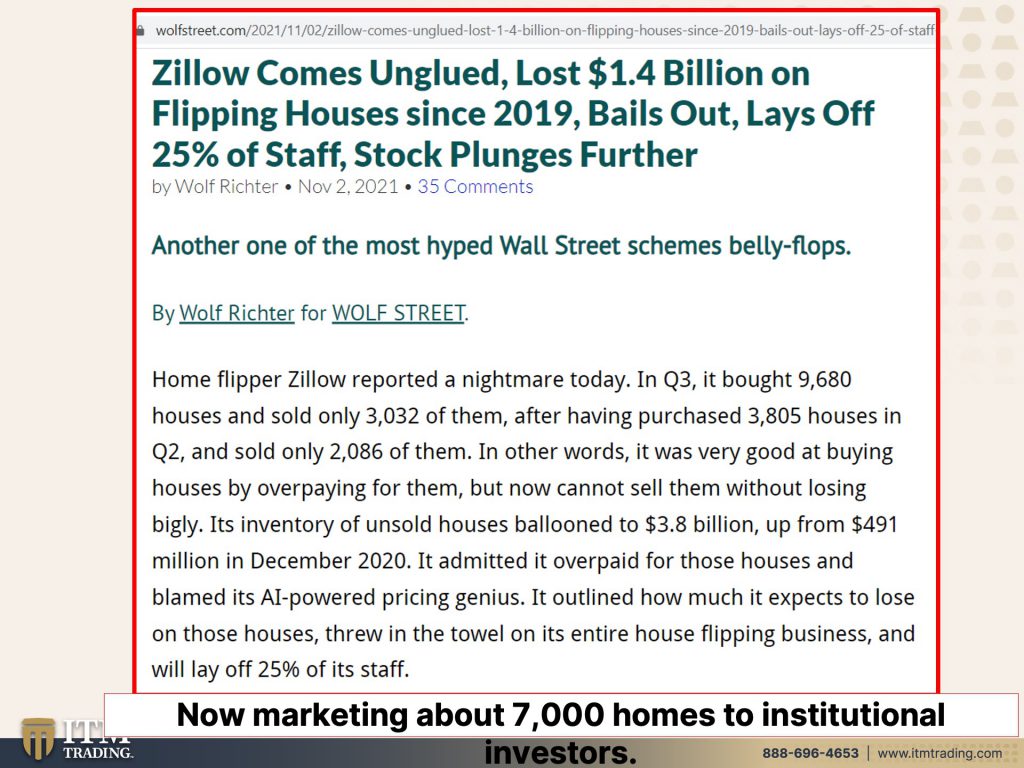

As recently as August, they were boasting about the popularity of the service telling investors that the traditional way of selling a home was so dreadful and dreaded that customers were willing to bypass potential bidding wars to sell to Zillow in the sizzling hot sellers market. But nothing goes straight up, nothing goes straight down. The mortgage moratoriums are coming off. The rental moratoriums are coming off. This is a set up for, you know, I mean, I do personally. I could be wrong. I’m going to say that I can’t guarantee this, but I think that definitely the top for real estate is in. Zillow bought roughly 9,700 homes, one entity, 9,700 homes in the third quarter, due to what it called higher than anticipated conversion rates. It also booked a 304 million write down on inventory owned at the end of the period. So it’s buying and it’s writing down cause they’re overpaying as a result of unintentionally purchasing homes at a higher prices than the company now thinks that can sell them for I’m glad for the people that sold and got more than they would have gotten in the market. So they’re, by the way, selling 7,000 homes to institutional investors. So what have we been hearing so much that we’ve been hearing so much that there’s no inventory, well, why doesn’t Zillow? Why can’t Zillow just sell it? They don’t, they would rather sell it to another institutional investor to try and control the prices at the top. I don’t know whether they’re going to be successful at that, but we’ll be paying attention and I’ll let you know. And I love, you know, I love Wolf Richter. I think the man is absolutely genius. I want you to follow the link and read this whole story, but home flipper, Zillow reported a nightmare today in Q3. Okay. But actually what, it’s the title lost 1.4 billion on flipping houses since 2009, 19, rather 2019 in the hottest real estate market ever. And they were in it at just the right time. They’ve lost 1.4 billion. So, you know, the bonds are probably safe.

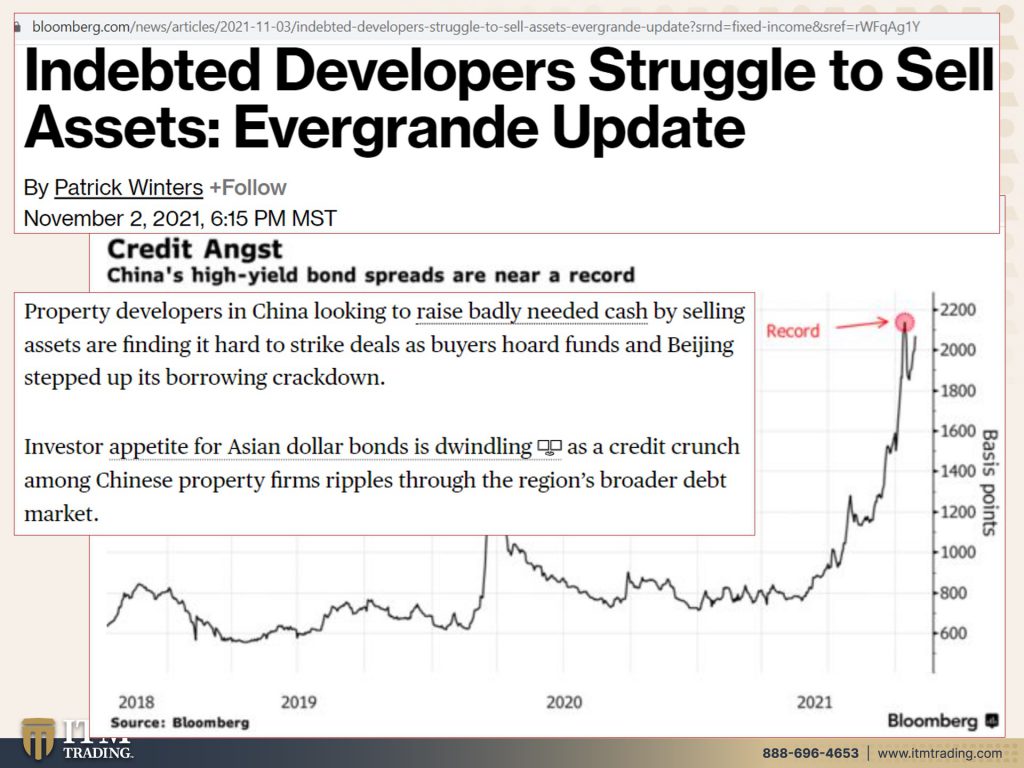

I hope you don’t know any of them. I really do. And lest you think that is just here. This is really where it started is over in China with Evergrande because it’s not just Evergrande, and yes from what I can see they actually did make their interest payment on Friday. However, that really doesn’t take away from what’s happening here. Property developers in China, looking to raise badly needed cash by selling assets are finding it hard to strike deals as buyers, hoard funds and Beijing stepped up, its borrowing crack down investor appetite for Asian dollar bonds is dwindling as a credit crunch among Chinese property firms ripples through the regions broader debt market. So what I’m really seeing is that this is now a global event and this is why between there and here and other places too. This is really why I’m thinking. I think we’re, we’re at a top and we’ve gotten previous indications that we could be near a top. And I do believe that. So those people that are rushing to buy real estate now. Do you really think this is a good time? I mean, everybody’s got to have a place to live. So as long as you have the ability to pay that debt off that mortgage off boom, in a moment’s notice, you gotta have a place to make your last stand, but for speculation or because you think it’s going to hold its value? I mean, do whatever you’re comfortable with, but I wouldn’t do it. And I did buy some real estate near a top for my bug out location. I had a specific purpose for that, but do I think I’m ever going to sell it? No, I’m going to pass it down from generation to generation.

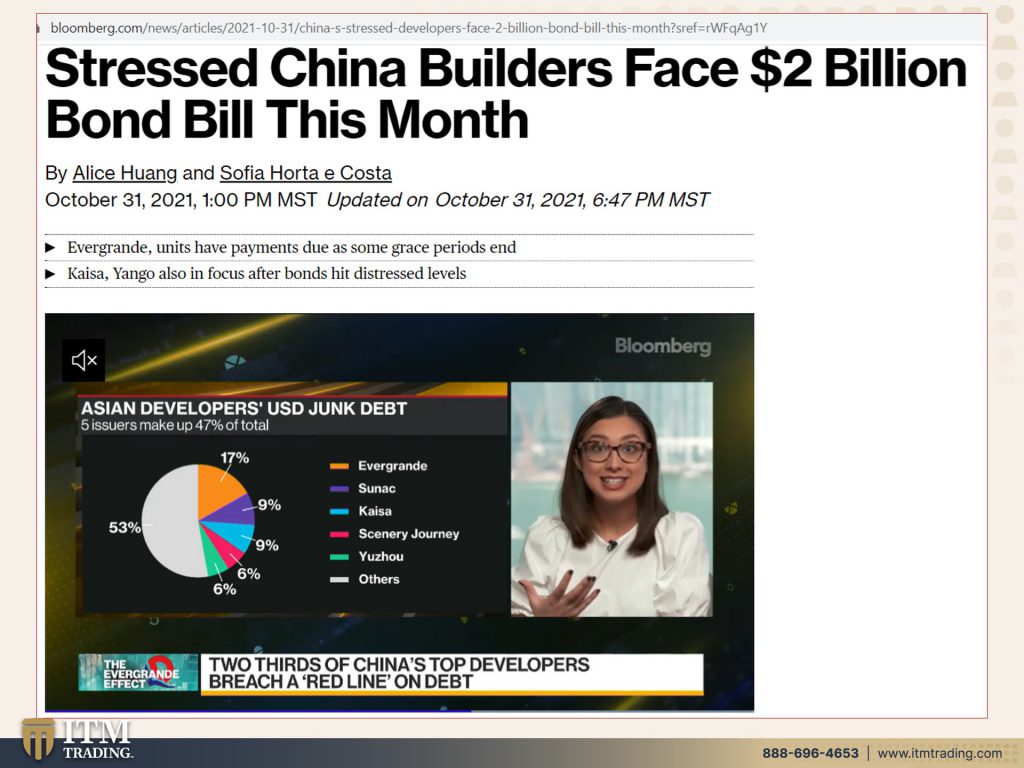

Stressed China builders face 2 billion bond bill this month, Evergrande units have payments due, Kaisa…whatever, but you can look here Asian developers in junk, U.S. Dollar junk debt. So two thirds of China’s top developers reached a red line on debt. And by the way, a lot of Chinese developers own property in the U.S. Just saying, and here’s another piece for those that think that real estate is a great investment right now. Well, over in Minneapolis residents voted in the ability to put in rent control. They can only raise it 3% a year. Well, what if your costs are higher than that? You got a problem. So there are things that happen in real estate, which I’m going to talk more about next Thursday on the 11th. You’ll see that cause that’s when I’m doing my 25 ounces of gold and I’ll probably do a piece all on real estate. That’s more, you know, currently what’s going on better than what I did today. But with all of these occurrences happening and with interest rates rising, this is significant. It looks like central banks are losing control of traders and traders with all of the derivatives on top of interest rates and credit and all of that, like they did in Australia, they can overwhelm the central banks ability to control the rates. This goes back to 2019. So we’re pretty close to those levels again. This is the two year bill treasury. I did the two year, the 10 year, which is this one. And I want to show you something interesting about it. The 20 year, the 30 year, you can see that the 20 year is higher than the 30 or so. We’ve got the start of an interest rate inversion, which is an indication of an upcoming. Well, they just say recession, but what we’re dealing with here is so much bigger than a recession. This is a complete reset socially, economically, as well as financially. And when it gets really, really bad. And remember people have been, you know, living with this fear for quite some time now. So people are really on edge and a crisis can justify. If people aren’t paying attention can justify what they want to do to yeah. Do next. I was gonna say, do to us next. Yeah. What they want to do to us next, don’t buy it. Don’t buy it. This quietly. And invisibly protects your wealth. This will pay off your mortgage. This will put you in a position to buy income producing assets. This will enable you to always put food on the table, etcetera, because both of these are used across the entire spectrum of the global economy.

So if you like this, please leave a comment. Make sure you give us a thumbs up and share, share, share. This is absolutely the time to be sharing all of this information because we are close. I can’t tell you it’s going to be Tuesday morning at 8:35, but frankly, it wouldn’t surprise me. Well, I’ll be shocked, but I won’t be surprised just like everybody else, because I’m not going to know one second before we lose all choice. So it is absolutely time to start your gold and silver strategy as your foundation. And there’s a Calendly link below where you can set up time to meet with one of our consultants and, you know, have your goals in mind, have what you want to accomplish in mind because a good strategy. That’s where it always starts. What am I trying to accomplish? And then you put in the tools that you need to accomplish that, but it is definitely more than gold and silver that you need because you also need food, water, energy, security, community, and shelter. These are the things that we need to sustain our standard of life and guess what even expanded and grow it. So until next we meet, please, it is time to cover your assets. So please be safe out there. Bye bye!

SOURCES:

https://finance.yahoo.com/news/whatever-takes-not-enough-eastern-134121529.html

https://www.rba.gov.au/speeches/2021/pdf/sp-gov-2021-11-02.pdf

https://tradingeconomics.com/poland/government-bond-yield

https://www.upjohn.org/about/news-events/rent-control-comes-midwest-what-can-residents-expect

https://stockcharts.com/freecharts/perf.php?$UST2Y,$ust10y,$ust20y,$ust30y