CENTRAL BANKS GRASP FOR GOLD: What Do They Know That You Don’t?…by Lynette Zang

As I’ve said for years, the Economic System is Globally Connected. The reason you’re hearing about a Global Reset, or The Great Reset, or the Economic Reset, is because it’s no longer hidden. It’s becoming obvious to a lot of people. What you may not know is the role Central Banks play in a complete currency reset like the one we’re about to experience. In this video, I’ll show you what they know that you may not, and we’ll look at their recent actions around Gold buying that will give you clues on what you can do for yourself.

TRANSCRIPT FROM VIDEO:

As I’ve said for years, the global economy is incestuously interconnected. And the reason you’re hearing about a global reset or the great reset or the economic reset is because it’s no longer hidden. It’s becoming obvious to a lot of people. And what may not know is that the role that central banks play in a complete currency reset, like the one that we are now experiencing. So in this video, I’ll show you what they know that you may not, and we’ll look at their recent actions around gold buying, that will give you clues on what you can do for yourself, coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading, a full service, physical gold and silver dealer specializing in custom strategies. And I can tell you absolutely, a hundred percent, every single person needs to have a strategy. And it needs to be based on your goals, just like they have strategies, meaning the government, the central banks, the corporations, they all have strategies based on their goals. And they know how to get you to do what they want you to do perception management. But you know, sometimes all these great plans go awry and you don’t really know. Actually, it’s pretty interesting because while, you know, I have had a lot of people say, well, sometimes I say that this is an experiment, but isn’t it all planned, etcetera, etcetera. And the outcome is what it is planned, but how you get to that is a big fat experiment. And it doesn’t always work the way they want it to work or we, or, and either way we might not really know what their real goal is. But what we do know is that at the end of this great experiment, the whole world will be reset socially, economically and financially. And I think that it’s critically important that you put yourself in a position to whether any outcome and maybe to benefit from it. because if you don’t hold your purchasing power, you have nothing to rebuild on.

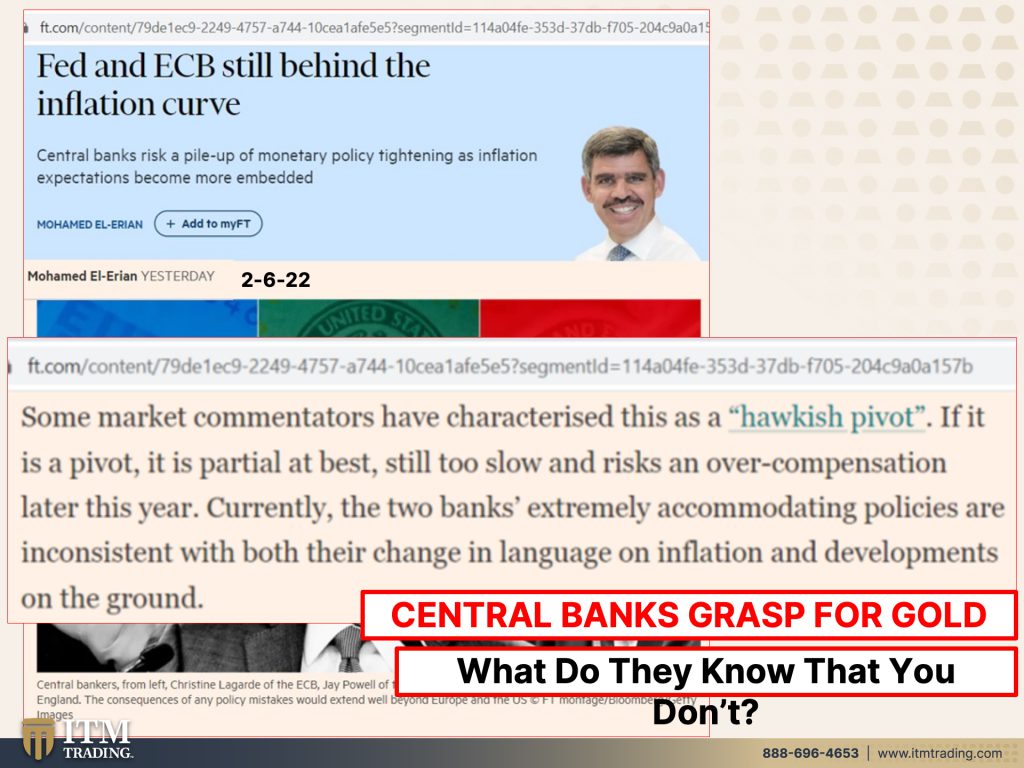

So let’s take a look at the central banks because in this particular case, I do agree with Mohamed El-Erian. Fed and ECB still behind the inflation curve and central banks risk a pile up of monetary policy tightening as inflation expectations become more embedded. Let me tell you, they’re going to have to raise rates, but there are going to be limits on that. Some market commentators have characterized this as a hawkish pivot. If it is a pivot, it is partial at best, still too slow and risks in overcompensation later this year, I don’t think they’re gonna be able to overcompensate, but Mohamed’s a pretty smart guy. Currently the two banks, extremely accommodating policies are inconsistent with both their change in language on inflation and developments on the ground. So remember my daddy, do what I say and not what I do. They don’t want you to be prepared all the while that they are definitely preparing themselves for the end of the current Fiat money regime. And so they can stay in power as we move into this new one. And quite honestly, if you wanna stay in power and in control of your future of your family’s future, then I think really you should take a page out of the central banks book now, not on the mean side, but on the other side.

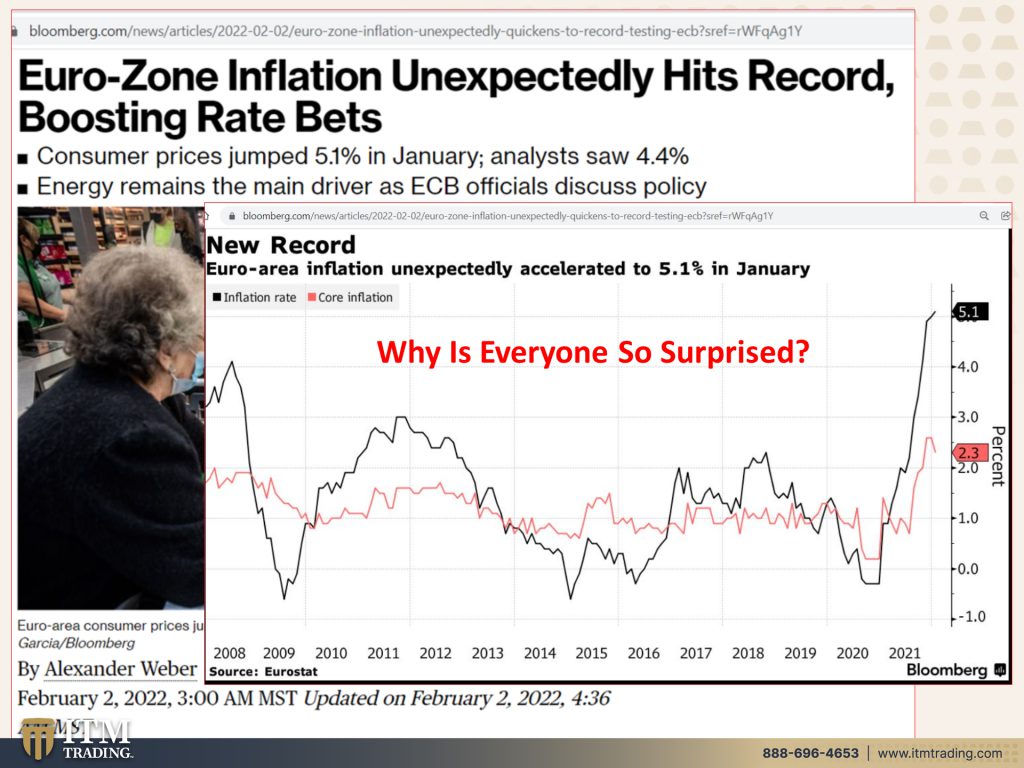

Surprised again, wow, European factories send inflation warnings as France overshoots and wow, all these people are surprised? and haven’t they been set the inflation right along. Why are you still listening to them? Are you surprised? You’re boots on the ground? You go to the grocery stores and to the stores to buy, you know, your energy and your food and everything. And they want you to believe that you’re only experiencing 7% inflation. And even that is surprising to them. It’s incredible, but you should not be surprised by any of this. “unexpectedly hits record” I don’t think so. Now, I know that we’re talking about the Euro zone in here, but that is one of the key central banks. And you know, they’ve held interest rates below zero. They have run that test since 2009. Well, Sweden was the first one to do it in 2009. So in the Euro zone, I believe they’ve run that test since 2010 and it hasn’t worked. And now with a global synchronization happening again, and this time I’m referring to bond synchronization and bond interest rates, and what is a bond? A bond is a debt instrument. So where people count on government bonds being the safest thing that you can do. I mean, I don’t buy it and I hope you don’t buy it either because governments can and do default and are out of their element. Their experiments are failing and they are losing control. And that is what this is really showing you. Central banks. Is it all planned? Yes, we have no purchasing power left and interest rates have been anchored at zero or below zero, even since 2008. And all of this money printing has been about buying time to get into position, to transition into that new currency. And I know the central bank’s hope is that it’s a CBDC a central bank digital currency that they program and they control. I don’t think that’s such a good idea. I think gold is a much better bet because you can always convert gold into any currency, any good or any service, but the reverse is not true. You can not always convert any currency into goods and services or gold for that matter.

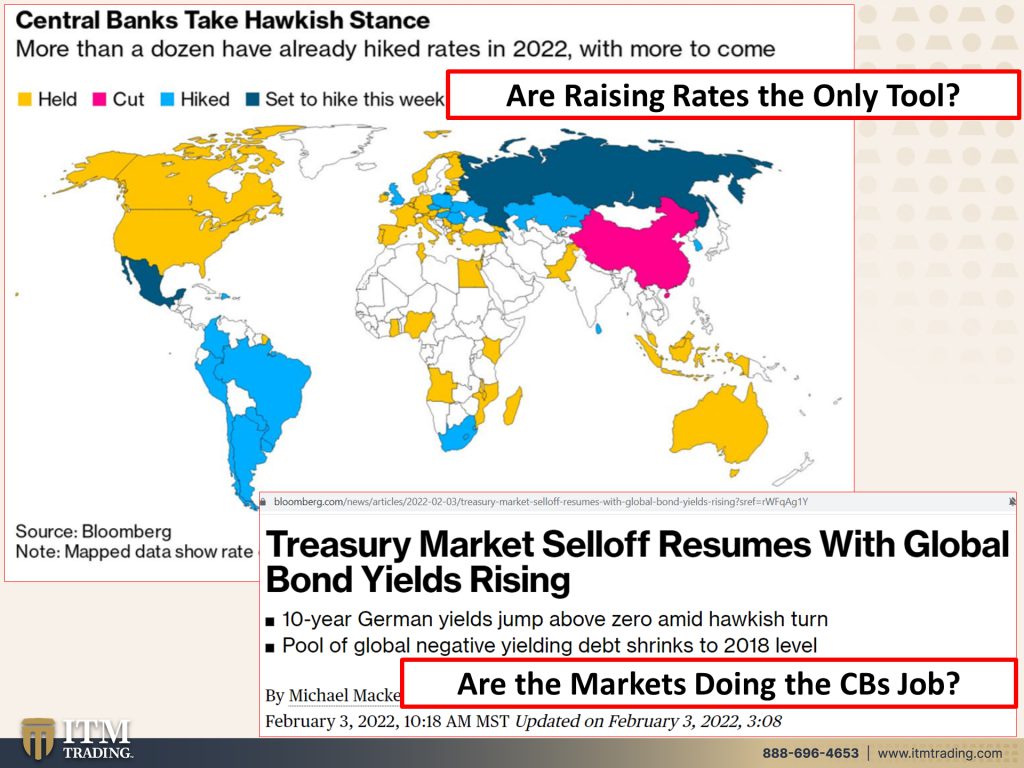

So with all of these surprises, well, oh, Christine Lagarde pivots on ECB hikes as switch in guidance seen soon. So what all these central banks, well, not all of them, but what the ECB and the U.S. Is really doing. The Federal Reserve is keeping interest rates low and continuing to pump in extra money into the economy and therefore pushing up inflation. So in this country, they are saying that they’re gonna do it until March. Okay. We’ve just entered February. They’ve been talking about that since November. This is ridiculous. I mean, it is absolutely beyond ridiculous. And so what are they saying? Asset purchase plans and other measures kept unchanged. So this is really a pivot. Heck no! And what’s gonna be even more interesting to see is when they do finally start to raise rates or they actually do finally start to “run off” In other words, sell their balance sheet or allow it to mature and not reinvest it, what that’s going to do to the markets and how long they will be able to maintain that policy. My personal feeling, and I could certainly be wrong this is just my opinion, is that they’ll do it a couple of times, but I’m not sure that they’re even gonna make it three. Even though we’re told there’s gonna be five or seven hikes and blah, blah, blah. I think it’s all garbage. We’re already watching the market’s whipsaw back and forth based on all of this uncertainty. But remember so much of highs are based upon debt and with interest rates going up that debt that gets rolled over then has to pay more interest. And we’ve got a plethora of zombie firms outing out there in the global economy, not just the U.S. not in Europe I mean Japan, everywhere. And they can’t deal with higher interest rates cause they can’t pay the debt that they have now, any of the principle, but central banks all over the world are now talking about and we’re going back. It’s not quite a synchronized move in this all though, the bonds move is synchronized, but look at anything in the gold, they just held the rate steady. So they’re talking and what they’re really trying to do is to get the markets to self-police right? Pushing, let the markets push the interest rates up and then maybe they can and wait on that. I don’t know. We’ll see what happens, but here in the red, so over in looks like Asia, they’re cutting. And then the blue is hiking. So emerging economies and then this black or dark blue is set to hike this week. So we’ve got, I mean, again, I’m gonna use this analogy, I’m sure all of you have seen a bridge in a hurricane and it’s kind of swinging back and forth and back and forth and back and forth until it collapses. And I think that’s what we’re seeing here now, because this is not a synchronized move yet, but the interest on the government bonds and the bonds that are out there are operating in a synchronized manner. But you have to ask because they always say we have all these tools. We have all these tools. And yet the only tool that you really hear about are raising the rates or running off their balance sheets. It’s the global, this is a global issue. Make no mistake about it. And the 10 year German yields jump above zero, they’ve been zero for a very long time. What does this tell you? This tells me that even though the plan is to make a transition to a new monetary system and they have to, there’s no purchasing power left and interest rates are anchored at zero and balance sheets are at nose bleed levels. Debt is at nose bleed levels. And now we have negative rates that the markets are pushing up. So no more negative rates have the central banks lost control because that’s what I’m thinking. I’m thinking and seeing that the central banks have lost control or at least at the minimum are in the process of losing control.

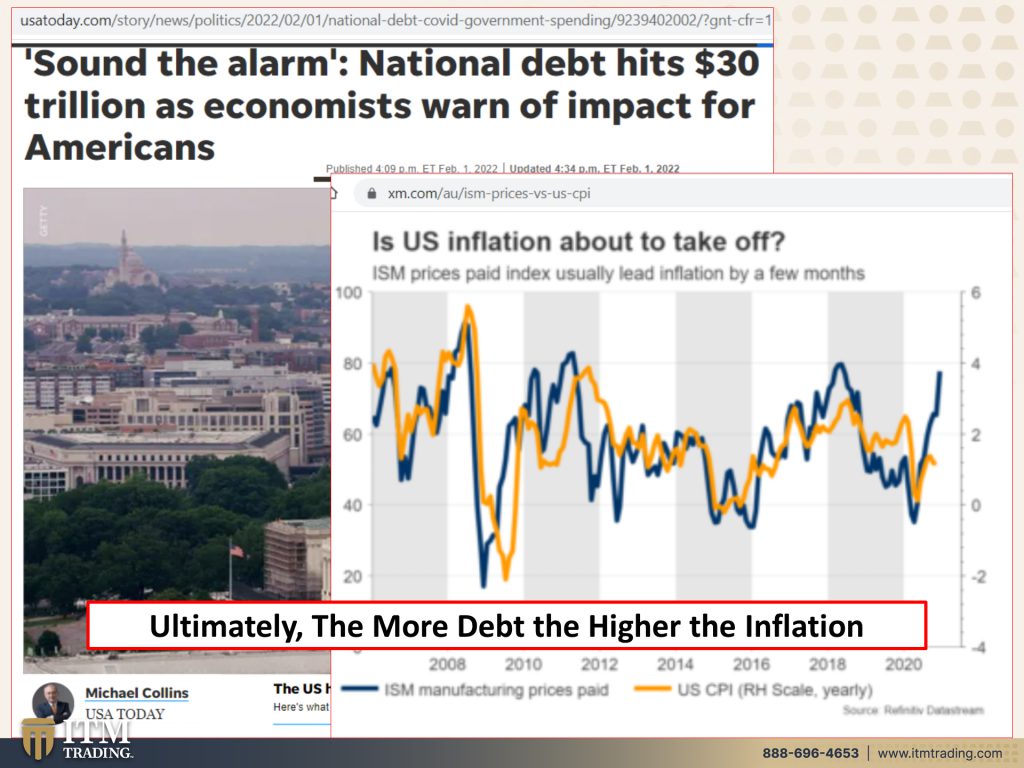

So here I love this sound. The alarm national debt hits 30 trillion as economists warn of impact for Americans. Well, I’m thinking that we’ve been feeling the impact of this never ending debt because the reality is, is that taxpayers are obligated to pay this debt. And in reality, everybody is obligated to pay this debt through inflation, by design, by design inflation, robs you of purchasing power so that you repay debt with dollars that have less and less and less value. I didn’t put that on this chart, but you’ve seen that many, many times and anybody can go to the FRED and then the search bar just put in purchasing power of the consumer dollar. And you can see it for yourself, but there comes a point where you have so much debt that it starts doing just the opposite. It’s no longer stimulus. And that happened in the nineties. And much as they’re like to say, central banks, meaning they central banks like to say, but inflation is coming down. The second half of this year or inflation is coming down. They don’t tell you what crystal ball they’re using to dictate that because in reality, a lot of the data that’s coming out, this is the ISM so this is manufacturing prices paid index, and it usually leads inflation by a few months and look at this spike right there. Inflation is not coming down. Wage inflation is not going to make inflation come down housing. I mean, everything that we use on a normal day-to-day basis, that’s not coming down at all, but remember, think about it because honestly, whether you’re an individual or you’re a corporation or you’re a government, debt works the same way. Now, of course, if you’re in an individual, you don’t have the same kind of pockets as the government or the central banks that can print new money at will. But if you…let’s just think about this for a minute, okay, let’s say that you just graduate from college. You’re living with your parents. You get a job. So you have, and they’re not charging you rent or anything. So everything you take in is disposable income, but you want a car to get to and from work, but you haven’t, you don’t wanna wait to save up all that money. So what do you do? You go out and you get a loan. Well, now you’re driving a nice and it’s kind of stimulating, you think, okay, well I’m driving this car, people around you. They don’t know that you took on debt to do it, but you’re making that car payment. So then the bank says, okay, making your car payment. How about a credit card? And you go, well, yeah, that would be great. So you run outta money on Wednesday, but your friends wanna go out on Thursday and you don’t get paid until Friday, but you got credit cards. So it doesn’t matter. So you go and you spend that money take on debt and that stimulates your economy today, but you’re gonna pay it off tomorrow. But the credit cards are so easy to use because frankly the more convenient and easy it is for you use money, the more money you spend. And so what do you do? You go, oh, let’s go on a trip. I mean, we, I wish we could go on more trips these days, but let’s go on a trip. And while you’re there, you just rack up all these bills, but Hey, you’re still making your payments. And then the bank says, well, how about a mortgage? And you go, well, yeah, I’m tired of living with my parents. I’m gonna take on a mortgage. Now you have lots and lots of debt. And as long as your income can keep pace with that debt, then you’re okay. But if it can’t, then if you lose your job, how are you going to pay those? Right? You are not government. You can’t go and print money to repay that debt. That’s why they say that government debt is the safest thing because they can print the money to pay you. The problem is every time they do that, the value of the money that’s out there that you and I are working for, trying to save and accumulate, loses more and more value. But if you lose your job and you cannot pay your debt, you have a problem. And that’s where we are. So what’s the answer to all of this?

Well, we’re gonna talk about that in a minute. But one of the things that always happens around a currency regime shift is a war. Now…This is probably gonna be a little controversial, but that’s okay because I am not in my mind, a hundred percent convinced that what’s happening between Russia and the Ukraine and the U.S. Getting all up in arms with the EU, etcetera. I’m not sure that that is really them versus us, or every, all the central banks and governments working together. Time is gonna tell, but you need to justify all of the money, printing all of the additional debt that you’re gonna take on. You need to justify why you’re gonna pivot, because I’m gonna tell you out without one doubt in my mind, of course I could be wrong about this, cause again, that’s just my opinion, but I know that central bankers, without a doubt, know that they’re at the very end of this Fiat money. The current Fiat money campaign were going to a new campaign and War is one of the things that they use to justify the money printing, to justify all of the abuse and the loss of freedoms, etcetera, etcetera. So now they’re gonna threaten Russia, banks, debt, individuals, and crafting sanctions. Maybe? But I remember back in the seventies with the oil embargo, that was also part of what happened around the currency regime shift. So I’m seeing a lot of these repeatable patterns happen right now. And it’s not really a big surprise.

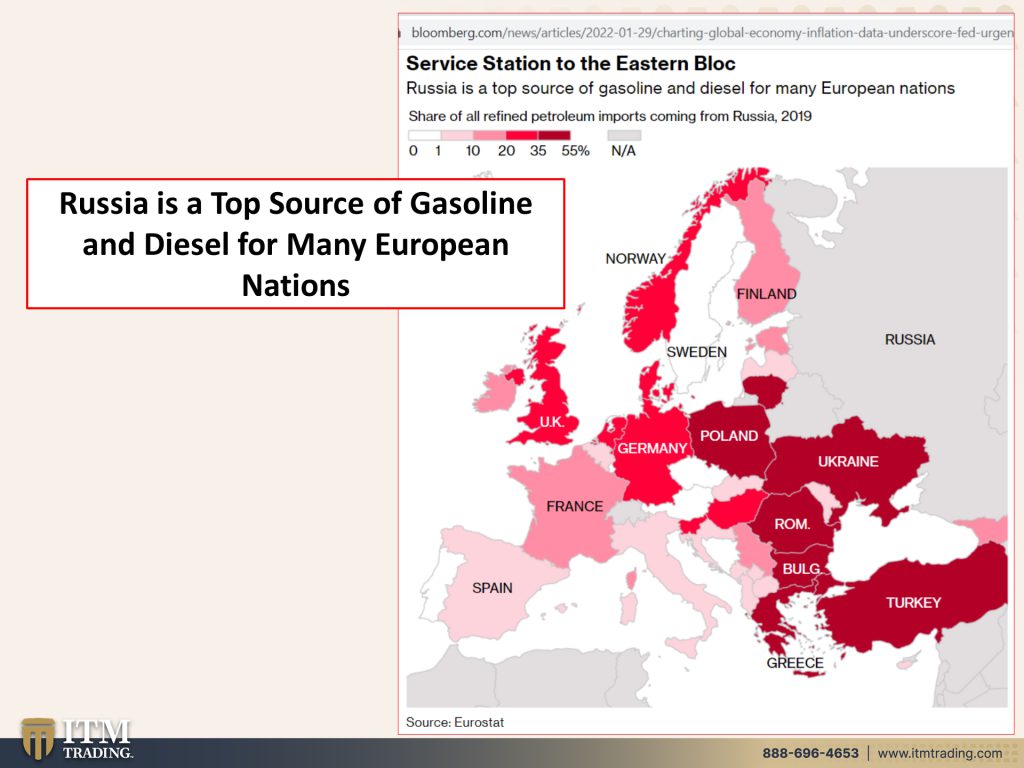

So if you take a look at the service to the Eastern block, I mean, Russia provides a tremendous amount of gasoline and diesel to many, many, many of the European and middle Eastern countries. So they have a vested interest in frankly not going to war, but, and do I really think we’re gonna go to war? I, I don’t know. I really don’t know. I’m just also not a hundred percent certain that this isn’t all planned out, but you see the thing about plans is the best laid plans of my mice and men can go awry because there’s just a few on the top that are part of the plan. And then the mass public that’s on the bottom that always takes it in the shorts. It’s always the public that pays the price, but there are more of us than there are of them. And so if we can come together in community, I don’t know, maybe it doesn’t have to be like this anymore. Look, we have to burn off this system. There’s way too much abuse in there, no doubt about it, but there are more of us than there are of them. And we can stand together in community and say no, that we want to retain our choices.

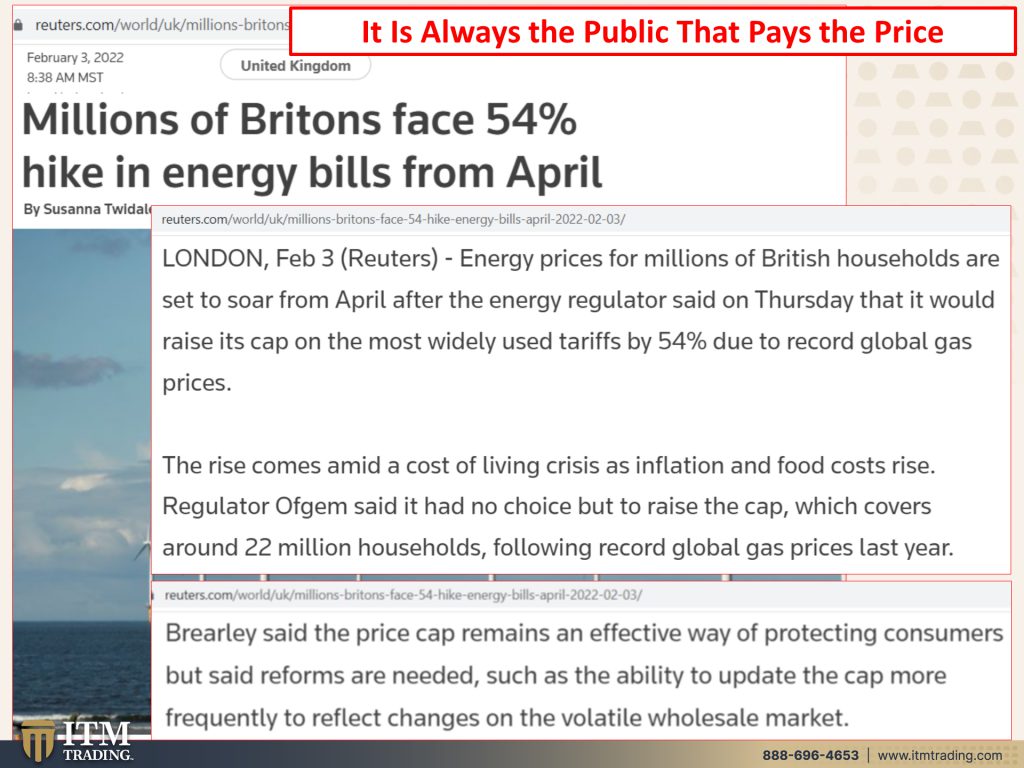

In Britain, they’re facing a 54% hike in energy bills from April, and it’s gonna get worse if there is a war between Russia and the Ukraine, but energy prices for millions of British households are set to soar from April after the energy regulator set on Thursday, that it would raise its cap on the most widely used tariffs by fifth 54% due to record global gas prices, not getting better. The rise comes amid a cost of living crisis as inflation and food costs rise. Hmm. Okay. Bearley said the price cap remains an effective way of protecting consumers but said reforms are needed such as the ability to update the cap more frequently to reflect changes in the volatile wholesale market. How about to reflect the new pricing as inflation takes over? because the impact roughly 15million British households are on floating rate plans. So yeah, let’s change that float more often because we don’t want, we don’t want the providers to be cut short, let the households pay for it. Let the public pay for it. Could send one in 10 British families into energy poverty. Because frankly, if you have to choose whether you’re gonna pay your energy bill or you’re gonna pay your food bill, both of them are rising at the same time, what ends up happening. And this always happens in hyperinflation as well. Food becomes the single biggest issue for most people. It’s really why I did the urban farm. It’s not because I’m a gardener or because I really wanted to do this and put this much time, energy and money into it. It’s because food becomes the biggest single issue for most people during these transitions. So you need to make sure it’s food, water, energy, security, barterability, wealth preservation, community, and shelter. Now, if British families have that in place, they have some kind of alternative energy source. Well guess what? Then they’re not gonna suffer as badly. And one of the things that we really have to prepare for, and if you haven’t already get started now and get it done is you need to have the ability to sustain your current standard of living as much as possible. This is critical. Do not be waiting, do not be waiting.

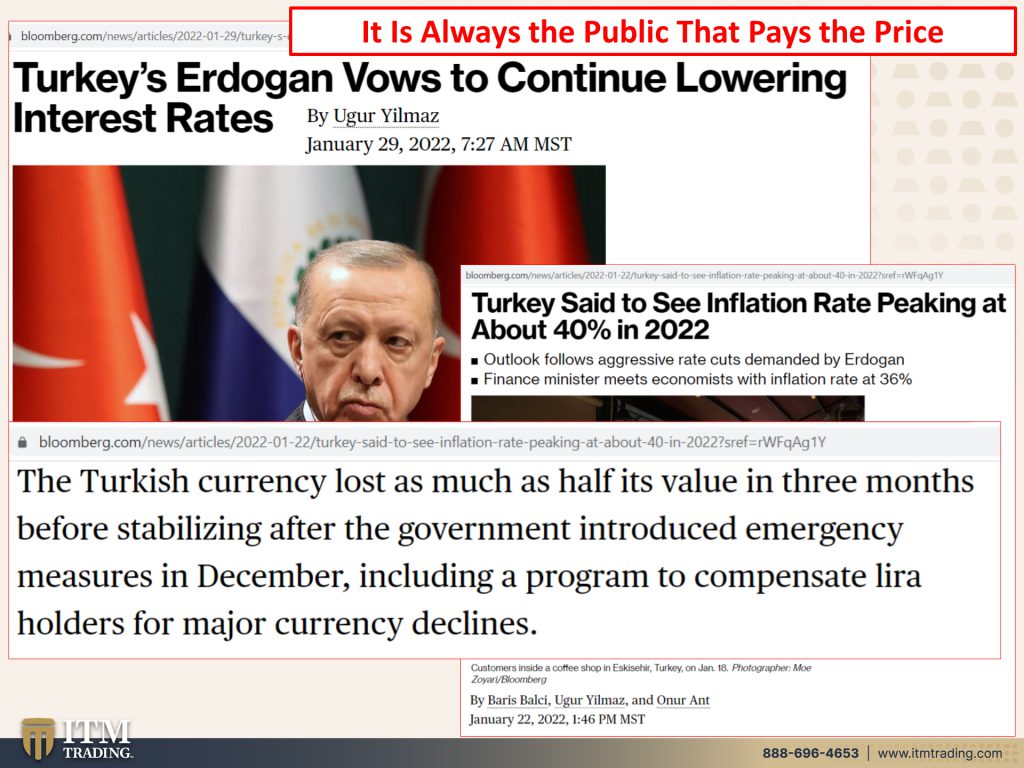

In another example, you know, in Turkey, they’re going to continue to lower interest rates. See this part is just a big experiment. They know what they want, but how do you get there? That’s the experimental part. And then they’ll make a choice and something will happen an unintended consequence. And then they have to create another experiment to counter that one and back and forth until they lose control, which I believe is where we are. They see it peaking at 40% in 2022…What, besides their random opinion, what do they have to go by to say, well, it’s gonna peak at 40%. Therefore they can say, oh, not hyperinflation, which is garbage because official hyperinflation is 50%, but who’s really suffering the most? He looks pretty well fed at me what do you think? I think it’s the people that are suffering the most. The Turkish currency has lost as much as half of its value in three months, three months. That means prices have spiked to compensate for the loss of value. We’ve talked about this before. So it’s stabilized because the government is gonna keep buying and compensating lira holders for major currency declines. How long can they do that? We’re gonna find out.

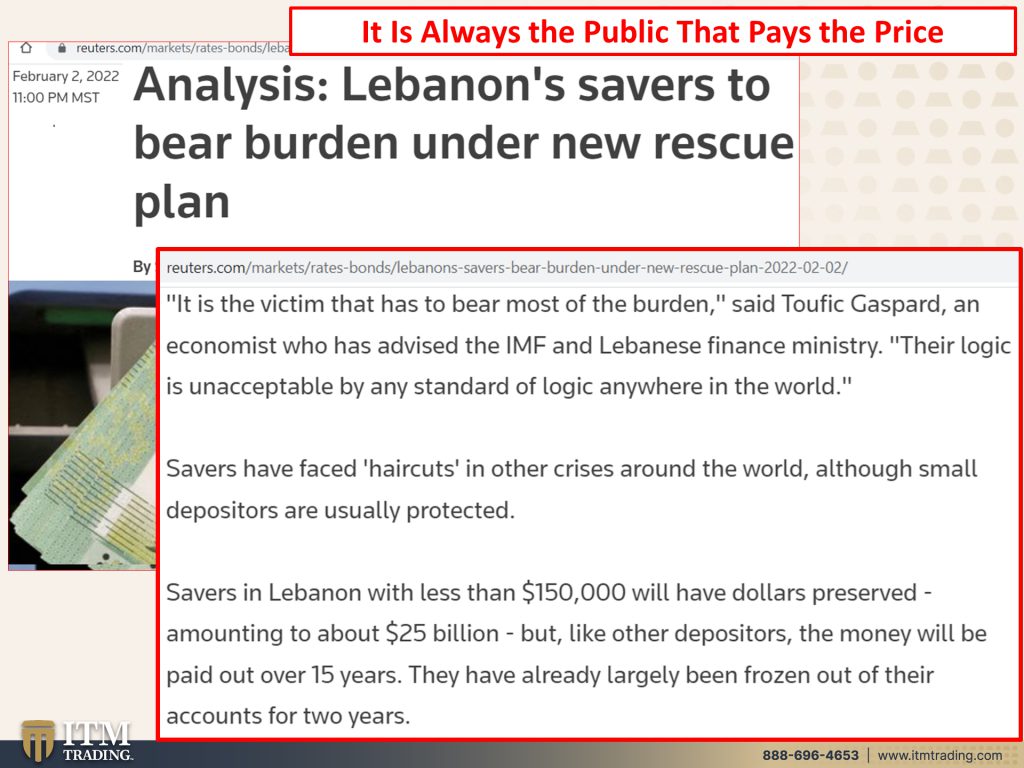

But also in Lebanon. So, you know, these are things that are happening right now. Why would you think that place would be immune? Because that’s over there and you are over here? You can see it looking at the prices on things that you buy every day. But I wanted to show you because so many people ask, well what does a bank bail-in look like? And in Lebanon, you know, they are having a bank bail-in right now, savers bear the burden. It’s the victim that has to bear most of the burden, right? Their logic, okay, let’s see an economist, blah, blah, blah, savers have faced haircuts in other crisis around the world. Although small depositors are usually protected. They’re usually protected, but they don’t have access to their money. And this time is no different savers in Lebanon with less than $150,000 will have dollars preserved but like other depositors, the money will be paid out over 15 years. They have already largely been frozen out of their account for two years, they’re gonna get a 75%. Someone will get a 75% haircut. Others will get a 55% haircut. This is what a bank bail-in looks like. I hope you’re ready. You need money out of this system. You need a certain level of cash. You need a certain level of silver. You need a certain level of gold. And if you wanna try something else like cryptos I mean, you gotta do what you’re comfortable with doing. I wanna see where all this dust is gonna settle in this whole space and I will do something about it. I just pulled up an IMF article that I haven’t had a chance to read yet, but I promise you I will. And if it’s worth you listening to, I will be reporting on that. But you have to understand, the financial systems, the most importance system to the central bank, not you or me. We are just about the right size to fail. And it is always the public that takes it on the shorts and pays for all of the abuses of the elites. Is that really what you wanna do? Because I guarantee you that is not okay with, with me. That is not what I wanna do, but central banks, what are they doing?

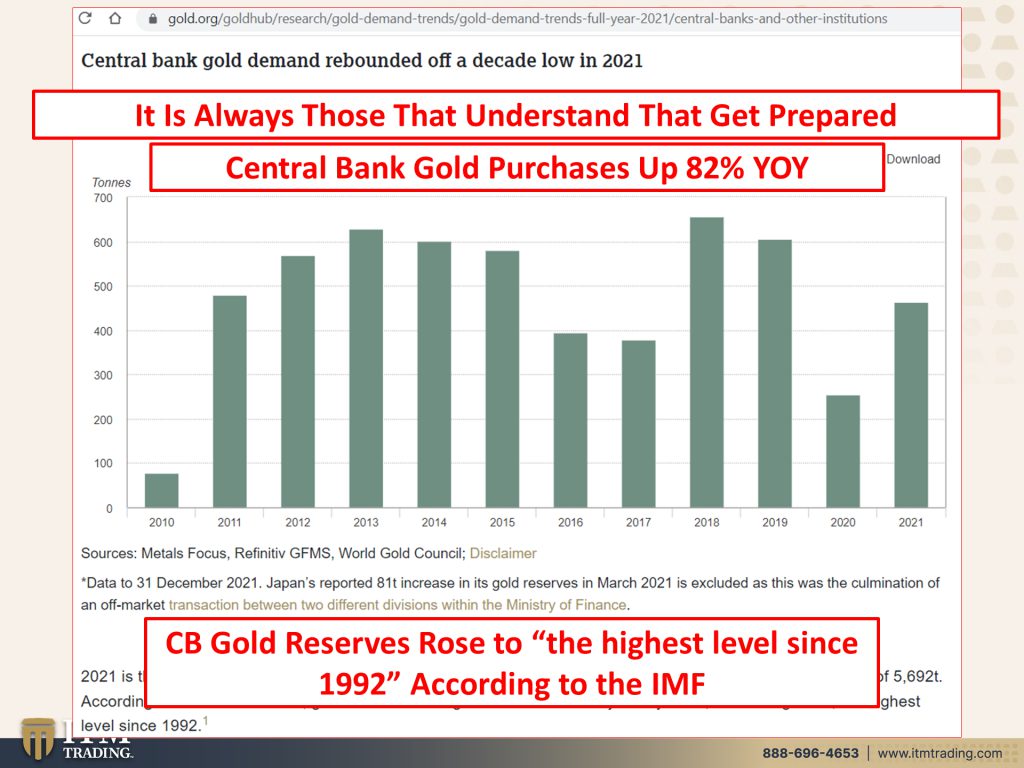

Always those that understand get prepared. So who knows more about money and what they’re doing and what their plan is than central banks? Now, who’s buying the gold? Has emerged from just, just emerging markets to advanced economies as well. And in fact, central bank gold purchases are up 82% year-over-year, 82% Importantly, central bank gold reserves rose to the highest level since 1992, as Warner would say, what does this tell you? That they are getting ready for the collapse, the complete transition and complete collapse. And again, I will tell you what in the world do you wanna hold when we go into this transition because if what you hold are dollars, we’re gonna have a problem with that. So I’ve got a couple questions that I’m gonna answer them. Que sera sera says, who is selling all this gold to central banks? Great question. Some of it would be in the open market. So gosh, why aren’t prices higher than they are? That’s actually kind of the next question that Gerald asked, what’s keeping silver so low? So I’m gonna answer both of those question cause they really are kind of related. So some of these purchases will be in the open market. Some of them will be from one central bank to another. Some of them will be from the IMF to a central bank, but in either case, both gold and silver are severely, severely, severely undervalued because these are the two monetary metals and a rise in gold price. Is an indication of a failing currency. And with silver, it it’s the secondary monetary metal, but it is still a monetary metal. So even a rising silver price can be an indication of a failing currency in the physical world. Both of those are finite. So who do you really want to own? The gold? I want me and you to own the gold. I don’t want the central banks to own it, but they’re buying it. And they are suppressing the price because that’s easy and cheap to do through derivative contracts. A derivative is derived from an underlying asset like silver and gold, but then it doesn’t, it can never convert into those physical gold and silver, but you can control an awful lot of gold and silver on just a regular CME contract. $150 controls, 500 ounces of gold and 5,000 ounces of silver. So by selling those derivative, it makes it seem like there’s a tremendous amount, more silver and gold out in the marketplace. And that my friends is what is keeping these prices so low. So you have a choice here, because you can actually believe the garbage that they want you to believe and stay inside the Fiat system. Anything that you can only convert into dollars, euros, yens, whatever that money is inside of the system, or you can have real money. Silver silver gold in any form is monetary monetary at its base that is truly outside of the system that is truly decentralized. That has a proven historic track record.

That’s what safety is about, seriously, and it is absolutely time. If you don’t have your strategy started, you better get started and get it done as quickly as you can. If you do have it started and it’s not completed, you need to move forward with that gold and silver needs to be at the financial base of your strategy so that you can live to rebuild another day. That’s why it’s considered the safest asset out there. So start your gold and silver strategy by clicking that link in the description below and set up a time to customize. I mean, that’s really what we do the best is customize your strategy for you. If you like this, please give us a thumbs up, make sure that you share, share, share, because people need to know what’s going on. Ignorance does not make you immune. It just leaves you vulnerable. And until tomorrow for Q&A, please be safe out there. Bye bye.

SOURCES:

https://www.xm.com/au/ism-prices-vs-us-cpi

https://www.reuters.com/world/uk/millions-britons-face-54-hike-energy-bills-april-2022-02-03/