CENTRAL BANKERS ARE SCARED: More Experiments Ahead?

Global central bankers know the current system died, when the interbank lending (via the LIBOR) collapse ushered in the financial crisis and openly “managed†markets. Central bankers experimented as they vowed to do whatever it took to save the banks and the government passed laws designed to instill public confidence. Though the real impact was quietly transferring risk from the elite few to the public taxpayer many, in the set up to the next financial crisis.

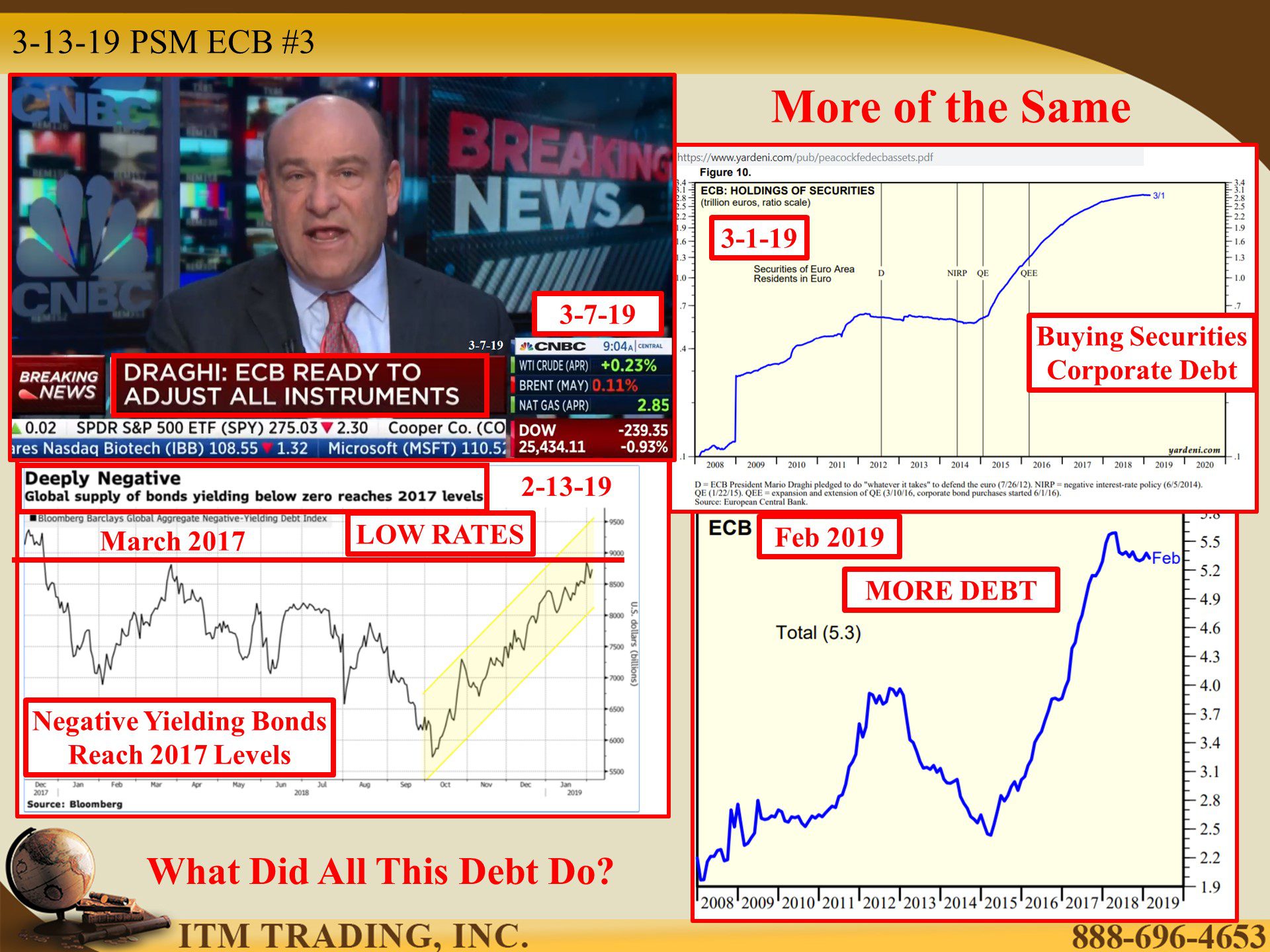

For the last decade, central bankers bloated their balance sheets and suppressed interest rates as they created a tsunami of free money. All to orchestrate synchronized global reflation in fiat money markets; stocks, bonds and real estate. In nominal numbers, there was success since those targeted markets hit all-time highs.

But when they tried to wean the markets from the free money drug, it became clear to the public, that the broad economic recovery was a lie, and the weakest link, the European Union experiment which is currently under threat by Italian banks extreme exposure to Italian government debt, and contagion to the rest of the EU, should a banking or sovereign debt crisis erupt (a likely event). Not to mention the threat of a derivative event, should Great Britain leave the EU in a “hard†Brexit.

Further, central bankers learned who’s really running the show and in a rapid about face, changed their minds. Not only will they stop running off their balance sheets (reducing the amount of punch in the bowl) and raising rates (charging for the punch) but they’ll add as much more free punch as banks want.

Insanity is doing the same thing over and over yet expecting different results. I don’t think central bankers are insane, but they may not know which experiments to try next (a topic we’ll explore next week). Or they may be set and need the next financial crisis to justify it. Which ever way, it is part of the reset we all need to be prepared for.

Perception management nudges the public away from real money safe-haven assets, even as gold is (and always has been) an integral part of the financial system. In fact, it THE key bridge to carry wealth from one financial system to the next, having survived as real money for five thousand years. In addition, the size (in terms of fiat) of the financial physical gold market, is larger many global stock and bond markets.

Why? Because only gold is real money, everything else is credit, that’s WHY, after all these years, it remains a globally recognized wealth shield.

LINKS:

http://www.kkr.com/global-perspectives/publications/outlook-2019-game-has-changed

https://www.nytimes.com/2019/03/07/business/ecb-european-economy-stimulus.html

https://www.bloomberg.com/graphics/2019-italian-banks/?srnd=fixed-income

https://www.bbc.com/news/uk-politics-47519637

https://www.yardeni.com/pub/peacockfedecbassets.pdf

https://tradingeconomics.com/euro-area/consumer-price-index-cpi

https://fred.stlouisfed.org/series/DEXUSEU

The EU may be the weakest link holding the fragile global markets together, because of the current threat by Italian banks extreme exposure to Italian government debt, and contagion to the rest of the EU, should a banking or sovereign debt crisis erupt (a likely event). Not to mention the threat of a derivative event, should Great Britain leave the EU in a “hard†Brexit.

Gold is the key bridge to carry wealth from one financial system to the next, having survived as real money for five thousand years. In addition, the size (in terms of fiat) of the financial physical gold market, is larger many global stock and bond markets.

Why? Because only gold is real money, everything else is credit, that’s WHY, after all these years, it remains a globally recognized wealth shield.