BREAKING NEWS: Credit Suisse Crashes and Global Banking System Crumbling in Real-Time

Are we on the brink of another global financial crisis? The contagion in the banking system is spreading globally and Credit Suisse’s recent troubles have ignited fears of a banking meltdown. As the largest shareholder pulls out, the bank’s stock slumps and investors become more nervous. It’s a crisis of confidence in the monetary system and central banks. In this video, we’ll delve into the precarious situation facing banks and examine the factors contributing to the instability in the global economy. Buckle up, this does not look good.

CHAPTERS:

0:00 Credit Suisse

3:02 Systemic Risk Among GSIBs

7:33 Gold & Silver as Protection

11:00 Wages & Inflation

18:22 Contagion

22:47 SVB Causing Domino Effect

26:02 LIVE QA

TRANSCRIPT FROM VIDEO:

Okay, third time let’s hope this is a charm, because yet again, another shoe has dropped as we watch the contagion in the banking system spread globally now. I’m telling you people, this does not look good, but we have so much to talk about. All of that is coming right up.

We’re told everything is fine. Nothing to look at here. We’re gonna backstop all your deposits, keep your money in this system. It doesn’t matter. But, you know, there’s this old saying, if I owe you a hundred bucks, I have a problem. If I owe you a million bucks, you have a problem. And so I would have to say that the whole world has a big problem.

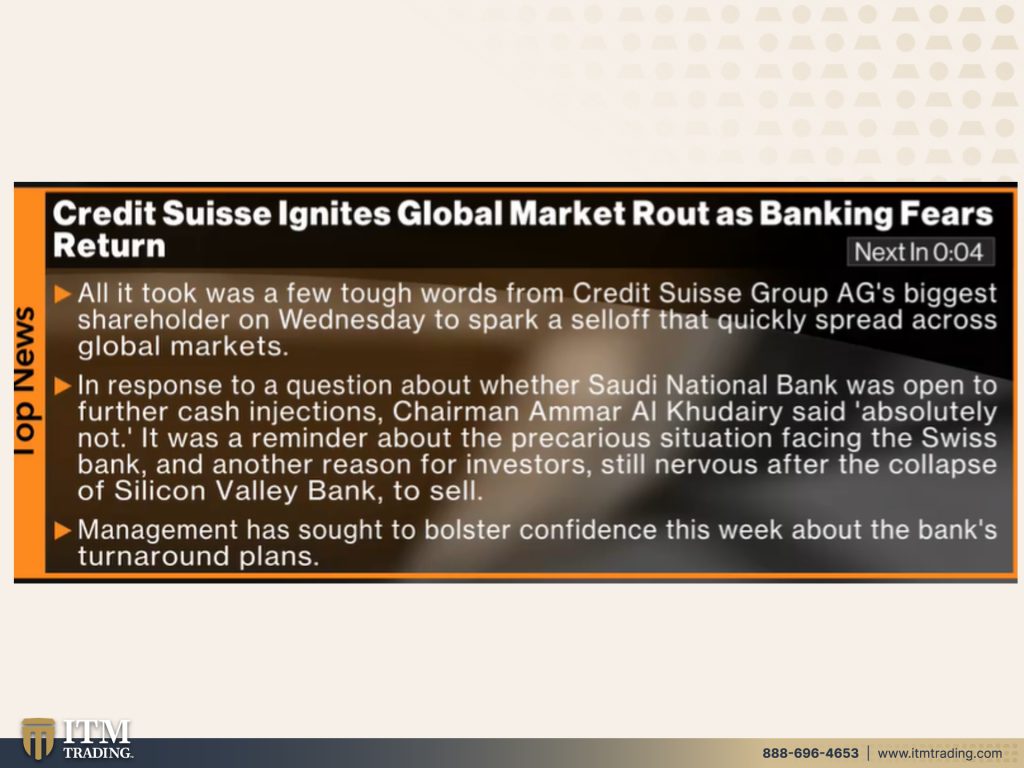

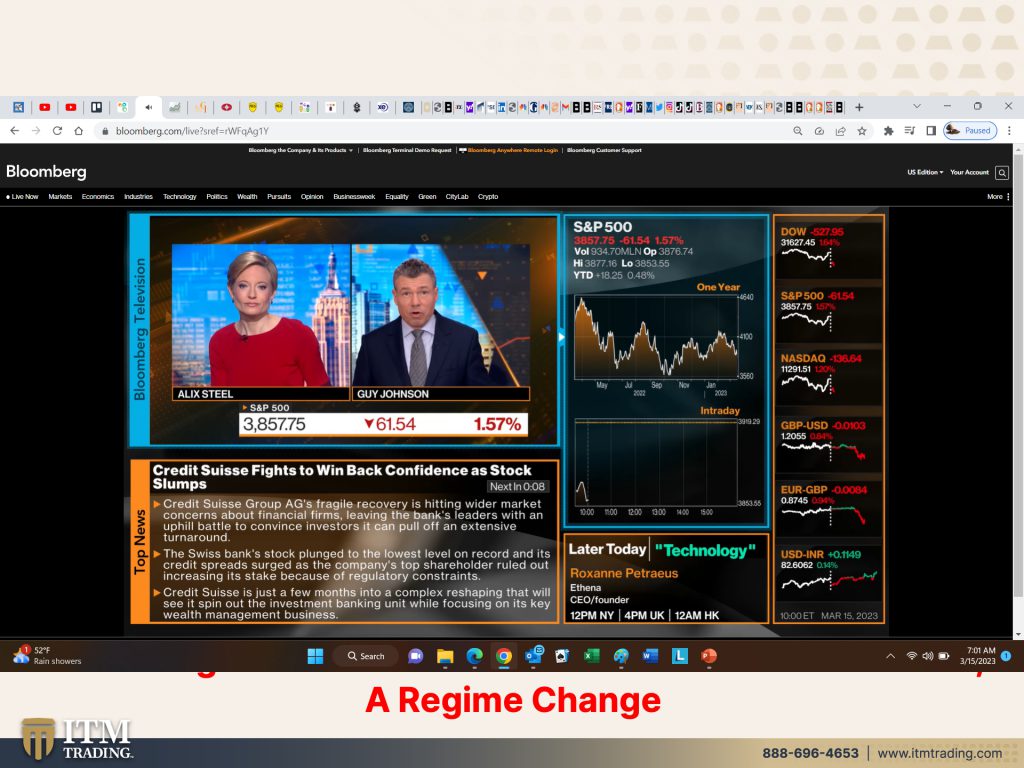

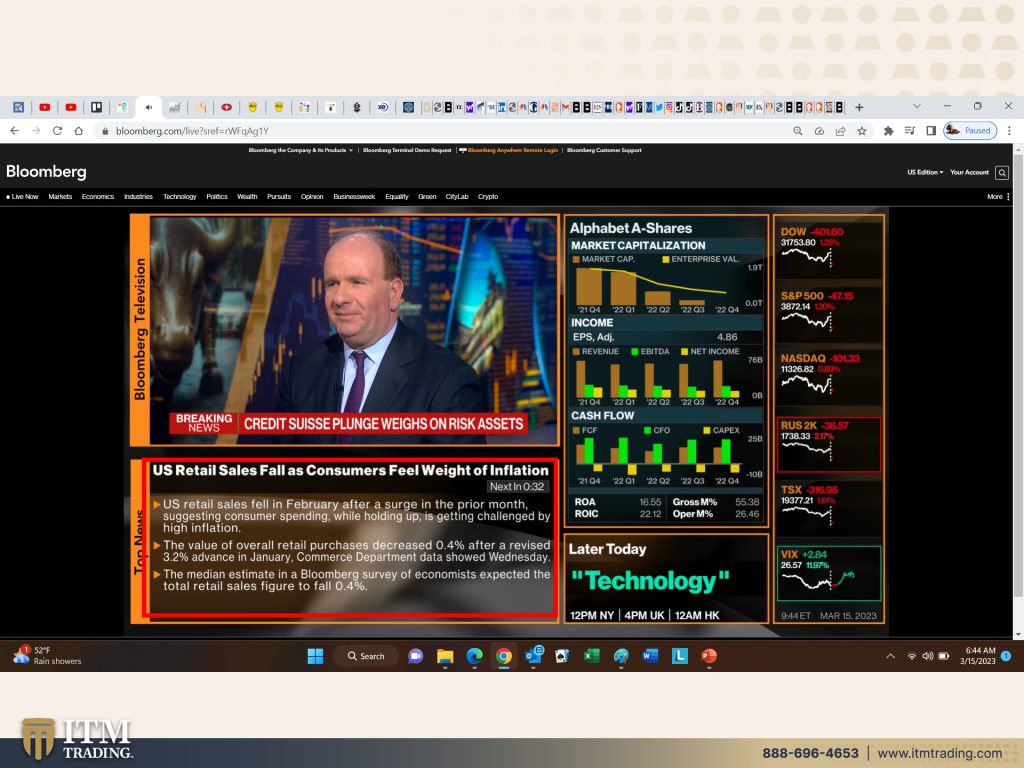

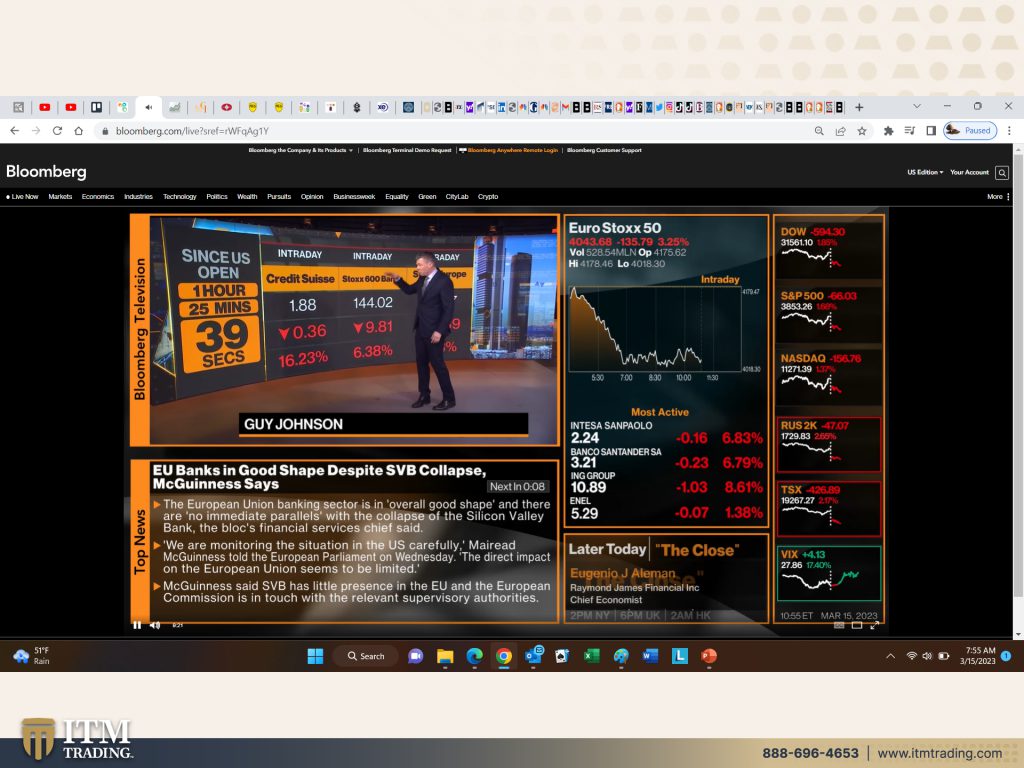

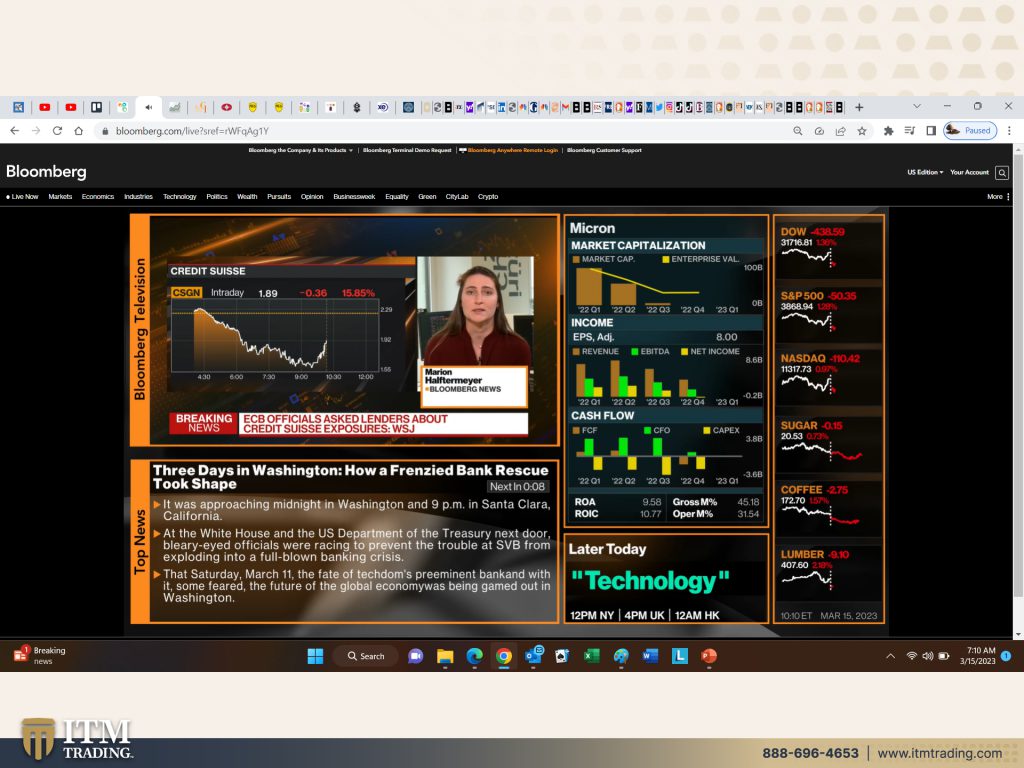

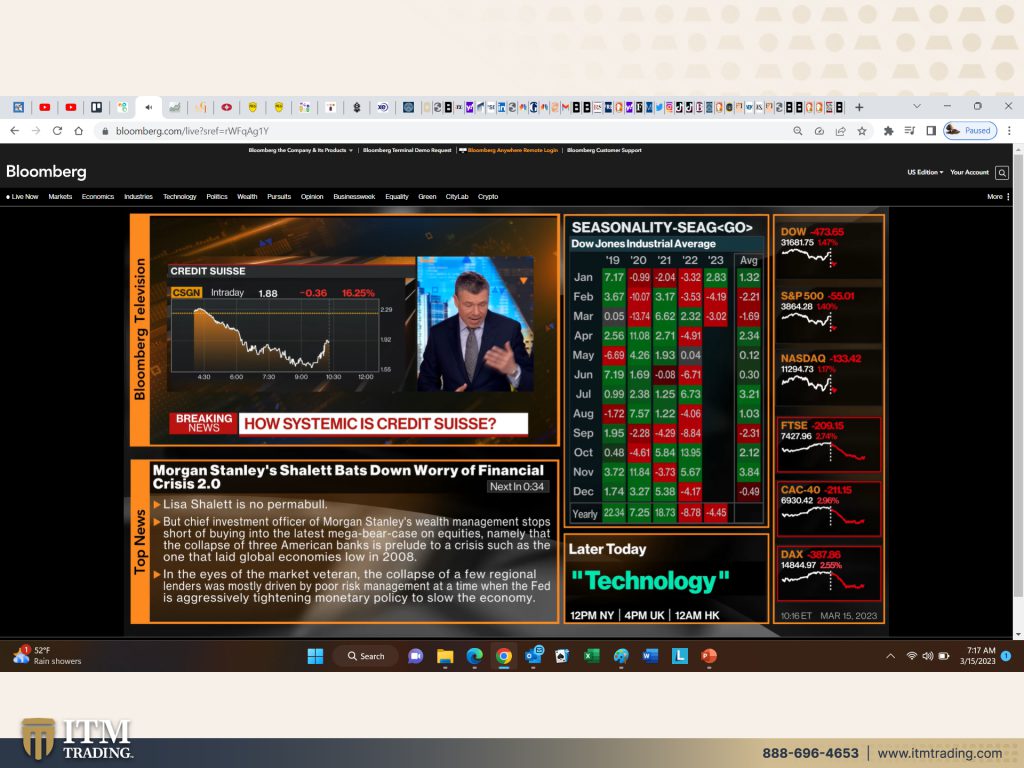

But what triggered it this morning was Credit Suisse. And so we had their largest shareholder come out and say, we will not invest anymore in credit suisse. And they had already Saudi Arabia had already bailed them out. So that set, everybody a flutter because frankly, well, more than a flutter, right? That spiked the fear credit suisse ignites global market route as banking fears return. Well, let’s see, were they only gone for a day? The dead cat bounce, all it took was a few tough words from credit suisse group ags biggest shareholder on Wednesday to spark a selloff that quickly spread across global markets. In response to a question about whether Saudi National Bank was open to further cash injections. Chairman Ammar Al Khudairy, I probably butchered it, I’m sorry, said, absolutely not. It was a reminder about the precarious situation facing the Swiss Bank. And another reason for investors still nervous after the collapse of Silicon Valley Bank to sell. Management has sought to bolster confidence this week about the bank’s turnaround plans. This is a con game. It’s all based upon confidence. And this is a crisis of confidence. And it didn’t just start now, it really fell with Bank of England. Remember back in September when they had to go in and buy guilds, right? Credit Suisse fights to win back confidence and stock slumps. That’s the whole part of it. And the confidence is now going away in the monetary system, in the banks and the central banks. This could easily and most likely will. I mean, looks like it is overwhelming. The entire central bank system.

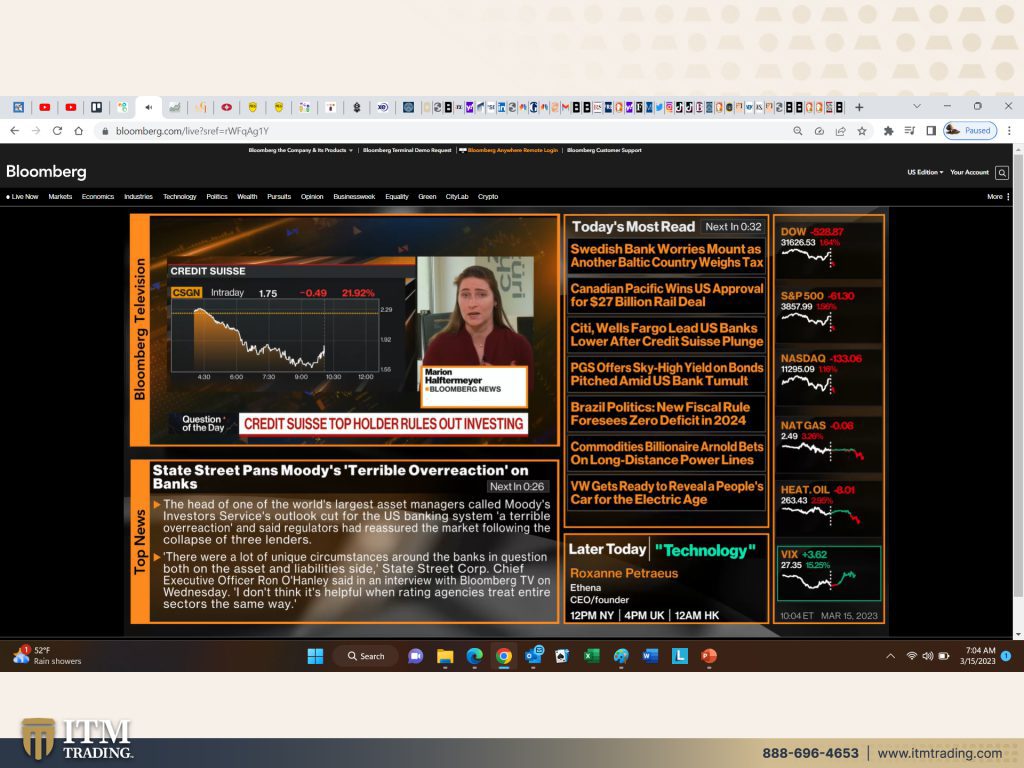

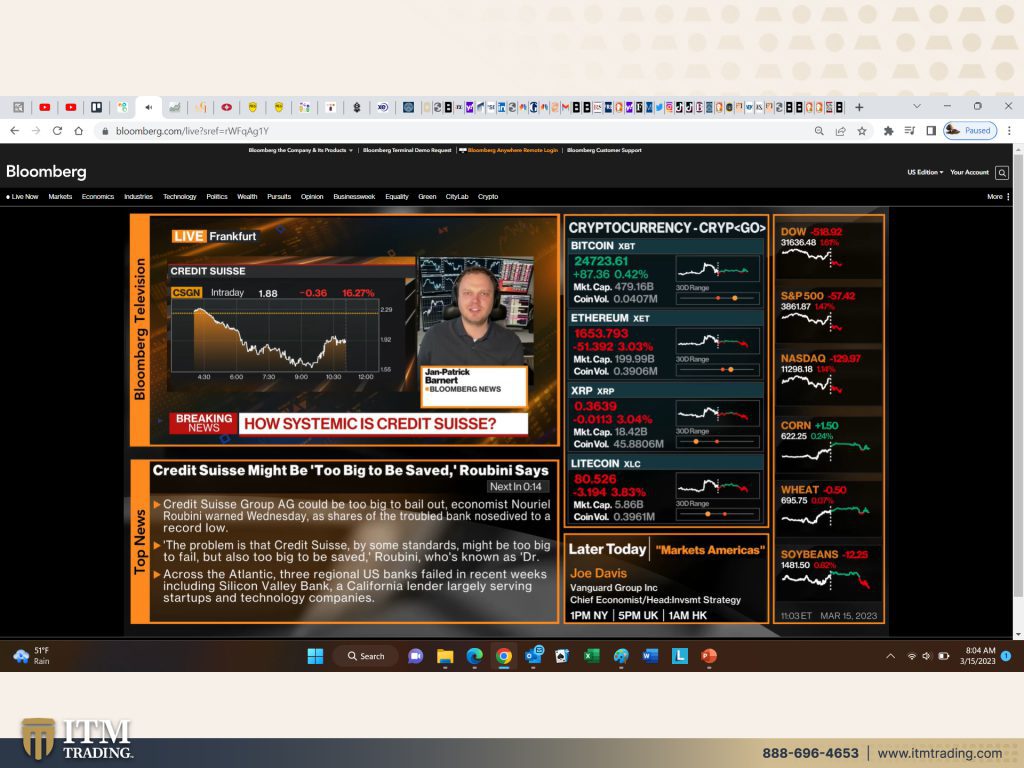

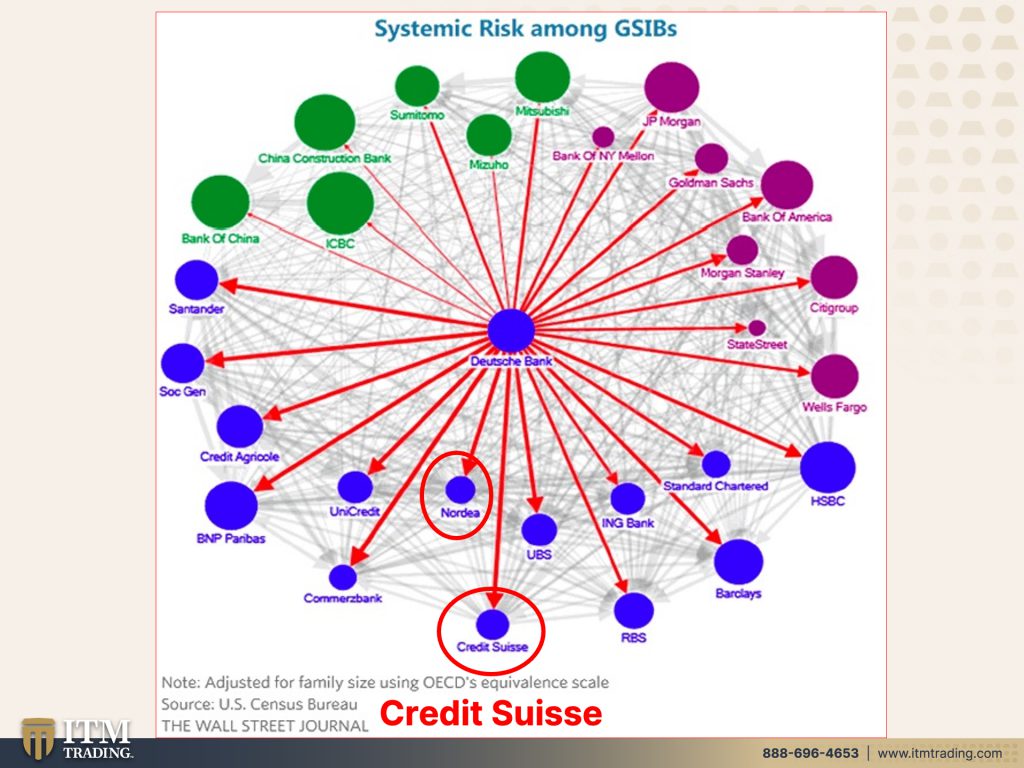

State Street Pans Moody’s, terrible overreaction on banks. Oh, poor Moody’s, who gets paid by these guys anyway, but Credit Suisse group could be too big to bail out. Economist Noelle Rubini, this is not good. Warren Wednesday. And let me show you why this is not good, because this is the GSIBs globally, systemically important banks, right? And here is Credit Suisse. And look at who’s in the middle, by the way. And that is Deutche Bank. But Nordea Bank is also in trouble right now. And they’re saying, well, it’s all different reasons. No, it’s all the same reason. It is the central banks pushing down rates to zero, keeping them or negative in a lot of these cases, negative for what? A decade and a half. And forcing people out, forcing these banks, enabling them to take on a whole lot more risk. So it is not a big surprise. Oh, let me grab that laser pointer. It is not a big surprise on how this is now going around the world. We saw it, we’ve warned you about it. And you know, I mean, honestly, you guys, you’ve been watching me. You know, I’ve been saying there’s gotta be a big crisis before June of this year. And I believe this is the big Black Swan event that I was anticipating to be perfectly honest with you.

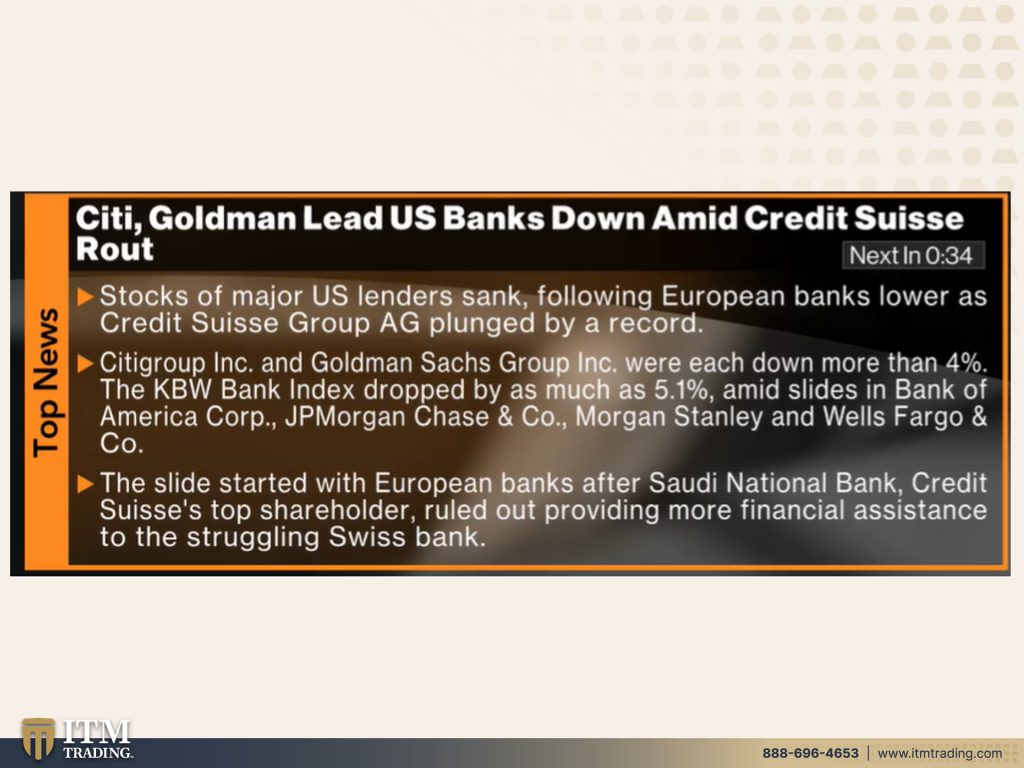

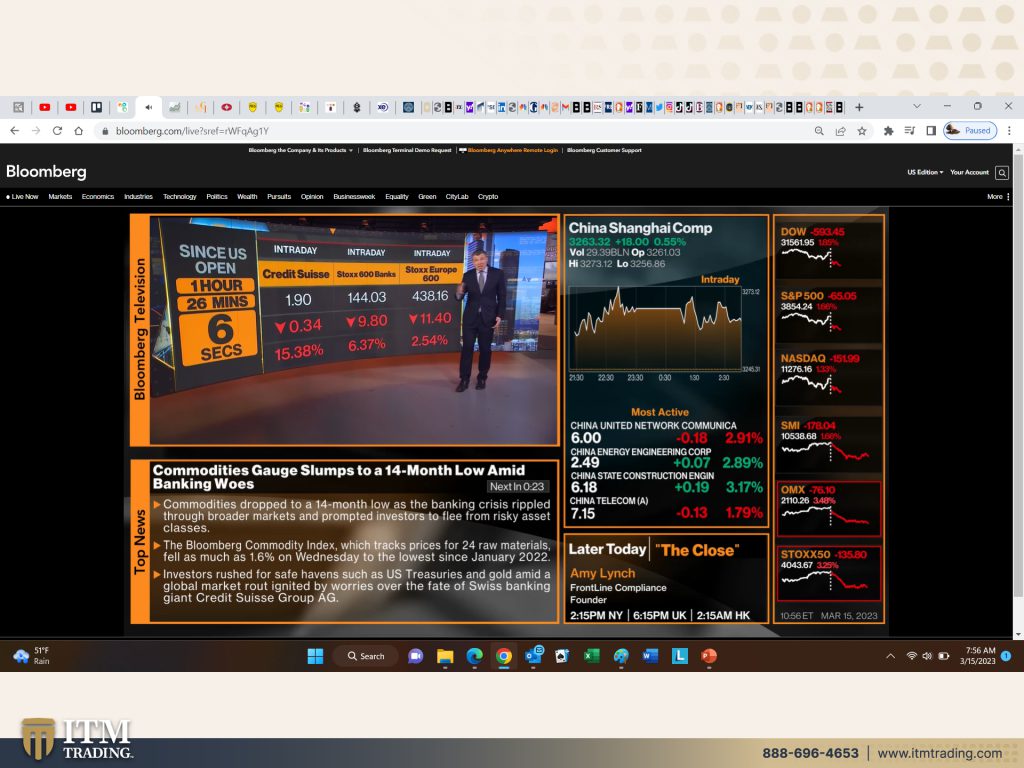

City Goldman lead US banks down amid credit suisse route stocks of major US lenders sank following European banks, lower as Credit Suisse Group Ag plunged by a record. Citigroup and Goldman Sachs group were each down more than 4%. The KBW, which is the the small bank index dropped by as much as 5.1%. Well, mid and small bank index dropped by as much as 5.1% immense amid slides in Bank of America, JP Morgan, Morgan Stanley, and Wells Fargo. The slide started with European banks after Saudi National Bank. Okay, we already talked about that.

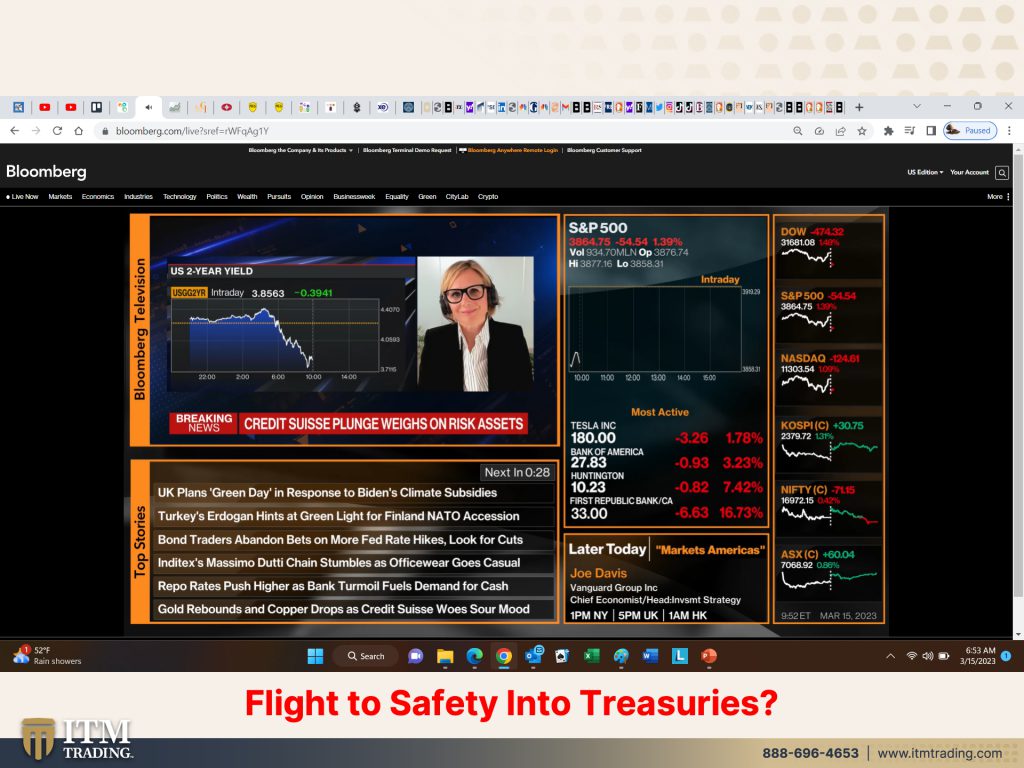

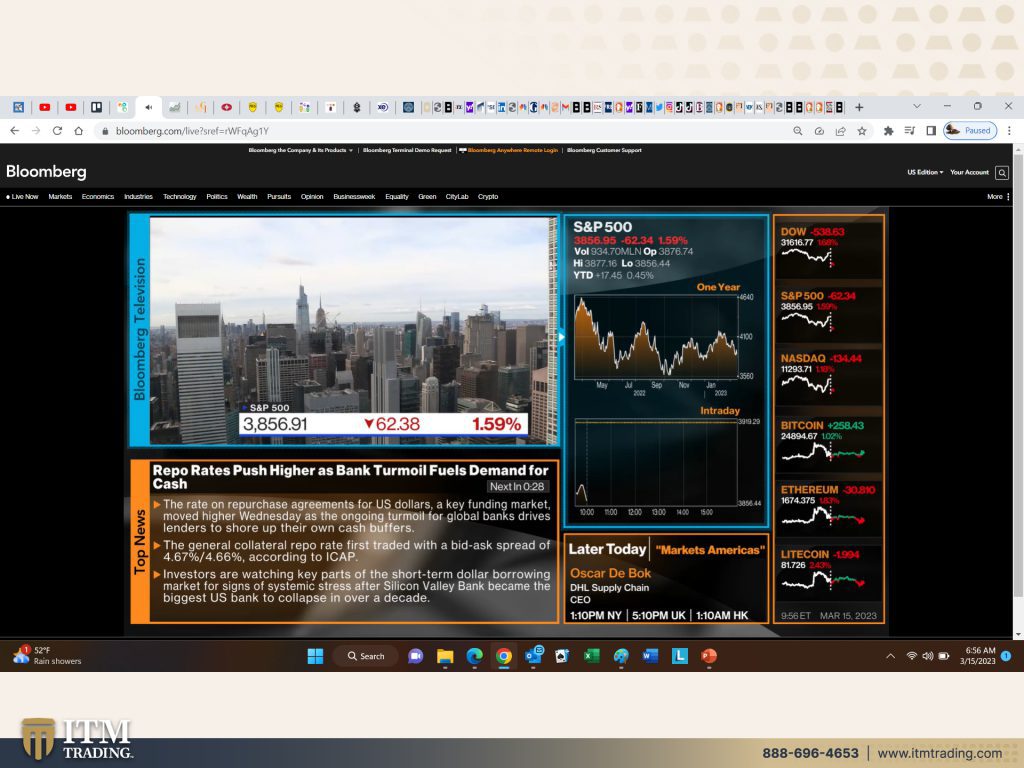

I’m sorry, this is like disjointed. It’s just, I’ve gotta grab it as I was watching it as I was getting ready to come in here this morning. But credit Suisse plunge weighs on risk assets. So it’s not just that, but they plan, let’s see, turkeys bond traders abandoned bets on more fed rate hikes, look for cuts. But there’s gonna be some justification for those pausing. I don’t know that they’re gonna cut. I, you know, it’s gonna be interesting to see what they do. They might just raise it a quarter of a point just to show people who’s boss, where they may pause it or they may cut it. We’re gonna find out and I’ll come on and we’ll talk about that too. But here’s the other part, and I’m gonna do a whole piece on the repo rates especially with the new program that the Fed has put out, where even if your assets are underwater though, with interest rates dropping, oh, do you have a pen? Can I have your pen please? Thank you. Okay. Remember, with interest rates dropping, what does that do to the principle of those bonds, right? It drives that principle up. So some could see that as helping the markets in their insane way. But repo rates push higher as bank turmoil fuels demand for cash. Well, yeah, it does fuel demand for cash, and it’s the newly created cash that the central banks are gonna end up doing this because what choice do they really have? And this is all they’re doing, all they’re doing. Because what’s happening as well is people are flying into the safety, no, I shouldn’t say the safety, flying into the perceived safety of treasury bonds. Here’s the problem though. Wasn’t the treasury bonds that created the issue to begin with? And haven’t we been talking about a lack of liquidity and problems in that market since 2015?

So here we are, 2023, these things happen. Slow, slow, slow until they happen fast. And it kind of seems like we’re in the happening fast right now. But don’t be lied to and don’t be fooled by their lies. This should show you no, nothing is safe except for this, because this runs no counterparty risk. It is the only financial asset, not according to me, but according to the Bank for international settlements, the Central Banker’s Central Bank, the only financial asset that runs no counterparty risk. Why are we having all of these issues right now? Because it’s all counterparty risk. All of it. If you don’t hold it, you don’t own it. Just that simple. Just that simple. So if you have not yet subscribed, you wanna hit that subscribe button because I’m gonna keep you informed of everything that’s going on, and we’re doing it all live because things keep unfolding and you wanna know about it.

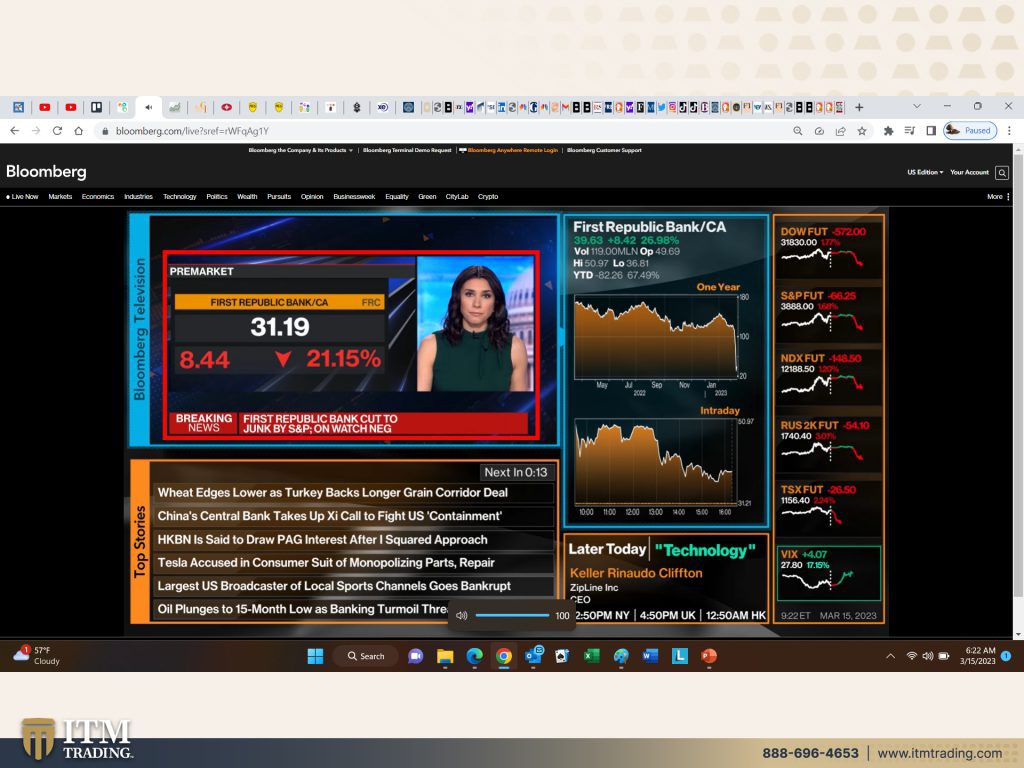

Also, if you have not put your strategy together, click that Calendly link below, make a time, I mean, as soon as possible, we’re really busy, but we’re working nonstop to support you and help you in your goals. But if you haven’t established your strategy yet, get it done. Get it done now and get it executed. ASAP I could tell you for a fact that I’ve been standing here going, thank God I’ve done what I’ve done over all these years, regardless of how crazy people thought, regardless of how people thought, oh, that can’t happen here. It’s happening. Okay, all right, let, let, let’s move on to this flight to safety because now First Republic Bank is cut to junk by S&P and on watch for a negative downgrade. And that stock is down 21 over 21%. But here’s the thing about that, and I think I’ve got a good headline coming up with it.

Here’s the thing about that, that was in the just barely investment grade. And the piece that I really want you guys to understand is that this stress is coming from what the grading services rated as investment grade. And you might recall some of the pieces that I’ve done over the last number of years where the grading services were complicit in allowing these corporations that should have been graded as junk graded at that, that level just above junk. Because once it goes below, interest rates go up. So we don’t wanna cost these companies anymore money after all. But also there are certain funds that cannot hold these assets if they are graded junk. So that means that they’re gonna have whoever is holding whoever is holding whatever that other bank is, whoever’s holding that bank. And now that it’s been downgraded, they are going to have to liquidate it, which will put further pressure on the stocks and on the markets as a whole as we watch the whole banking system implode.

In the meantime, US retail sales fall as consumers feel weight of inflation. Hello, come on. Have you been out there shopping lately? Of course, wages have not kept up, even though they’ve gone up a lot officially after you take into account inflation. They have actually gone down by officially one, I think it was 1.4%, but there could be some hope on the horizon for the Fed to justify not raising rates, cause US producer prices unexpectedly fall signaling easing pressure. So bottom line, the decline in the PPI reflected decreases in both goods and services. So the Fed could use this to justify a pause in raising rates. And remember, there’s always a lag time. Now once we go to CBDC’s, and I’m telling you, I’m telling you people, this is how it’s going to be positioned. They talk about having their, their finger on the button of the economy and making those changes real time so that they can see that what they’re trying to accomplish is accomplished or not. That scares me way more than this because all you have to do here to get out of the way of this, of the worst of this, cause everybody’s gonna be impacted, is hold your money and hold real money. Real money.

So let’s see, that’s the PPI. And now the New York State Manufacturing shrinks for a fourth straight month. So the bottom line that is the survey show declines in the measures of prices paid and received by the state’s manufacturers indicating that while inflationary pressures are stubborn, they are easing somewhat. Again, will this justify this fed pause? So maybe they can hide behind it because after all, how bad would it be if they paused to see what was going to shake out? Maybe they’re even gonna cut before the end of the week at the speed at which all of this is unfolding. I don’t know. But here’s another piece that helps that where the commodities gauge slumps for a 14 month low amid banking woes. So you see there is only one way, one way to fight inflation. And that is with deflation. And this is what’s happening in this banking crisis. This is highly, highly, highly deflationary. Now tell me, do you think that this solves our problems? I don’t think so. Not at all. PIM Co warns that not all cash is king as SVB debacle revealed. So Pacific Investment Management CO is telling its clients that while cash has become king with the Federal Reserve ratcheting up rates, the collapse of Silicon Valley Bank is making at least one thing clear. Not every form of cash is the same or safe, but let me tell you what’s true about every single form of cash, they’re all losing purchasing power value because the only tool, yeah, we’re gonna see the Fed pivot. We talked about this. The, they raised the rates until the system broke. They, they raised it and they didn’t give, they didn’t give the rate, increases time to run through the system. And they kept saying, just like they said with QE, well it’s not causing inflation. It’s not causing inflation. Well that’s cause that inflation was held in the markets. And as long as they could hide the truth of the problem and the leverage with the banking system, okay, there’s no problem, there’s no problem. But inflation, rapid inflation makes the truth clear in terms of inflation, public notices. That’s the last vestige of confidence. And this keeps heating up the banking crisis is now heating up at some point in here, probably pretty soon, this is gonna seep into the public consciousness.

Now I’m gonna have to look at mainstream news and see what they’re talking about because I don’t typically do that. But it’ll be a gauge of getting it out into the public because the only thing that’s holding any of this together, the only thing, only thing only thing is public confidence. There’s not any confidence anywhere else, but they’re trotting out and doing damage control and saying, you go, don’t have to worry about it, we’re back stopping everything, everything’s fine.

Nothing to look at here. What happened there Is there, this is here, it’s all different. This time is, it’s not different. And there is a massive amount of contagion and can you see it unfolding? Now, repo rates, I’m definitely gonna do a big thing on repo rates for next week. So repo rates push higher as bank turmoil fuels demand for cash. And I didn’t bring in my phone, but while the repo rates are are soaring, I noticed that the SOFR, SOFR rates were unchanged, at least at that moment. So bear with me on this because you might recall that it was the problem in the repo markets in September of 2019 that really kicked off this whole crisis and they papered over it. That’s when they started the printing presses again to paper over it. And then of course we had the whatever in March, 2020 that justified all this printing. So this crisis, what is this crisis gonna justify and are they ready to transition us into the next system yet? I don’t think so. But you know, and it, and it doesn’t happen that fast, you know, I mean I do get people saying don’t, I’m sorry, don’t talk about dates. Well, I never talk about dates unless I’m given a date. And when I’m given a date and I look at what’s happening, then that can tell me what the next most likely outcome is based upon any level of historic precedence. So I absolutely know, you guys know, I’ve been talking about it all year and probably started last year, the end of last year, that there had to be a crisis that would happen before June. Well, this is the crisis that’s happening. I’m gonna look more at the repo rates because this is money markets. So if you are hiding out in money markets thinking that you’re safe, you might wanna rethink that. You wanna know what’s safe? This is what’s safe in gold and silver physical in my possession. That’s what I trust. That’s what I have confidence in because it’s used across the entire global economy.

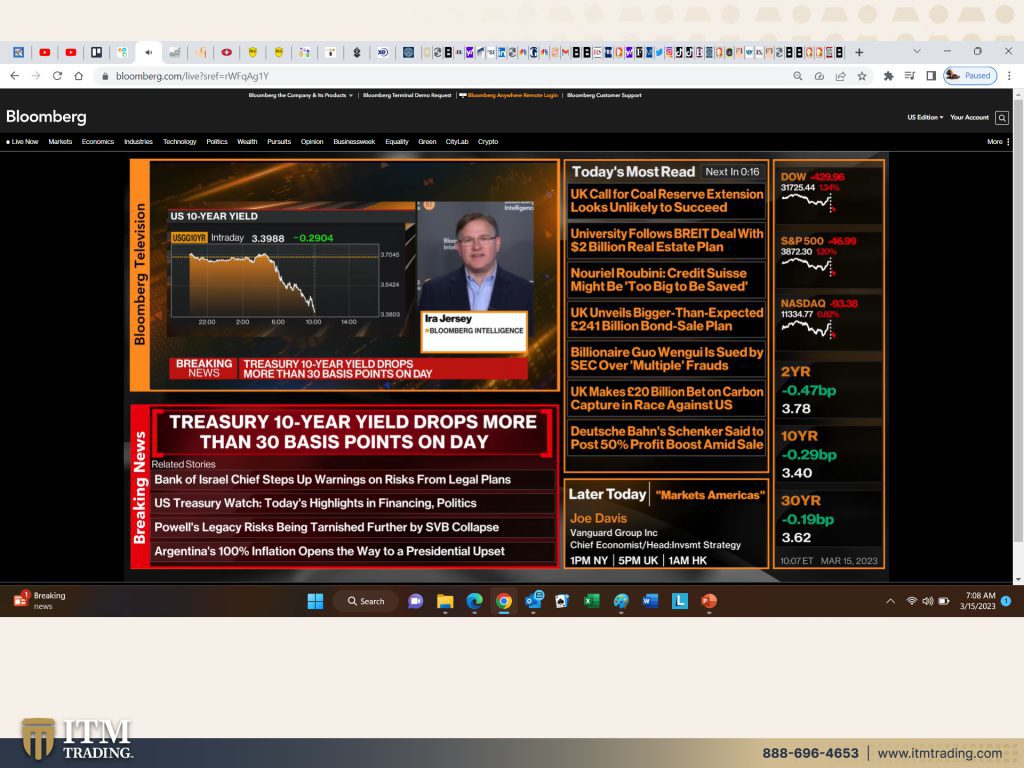

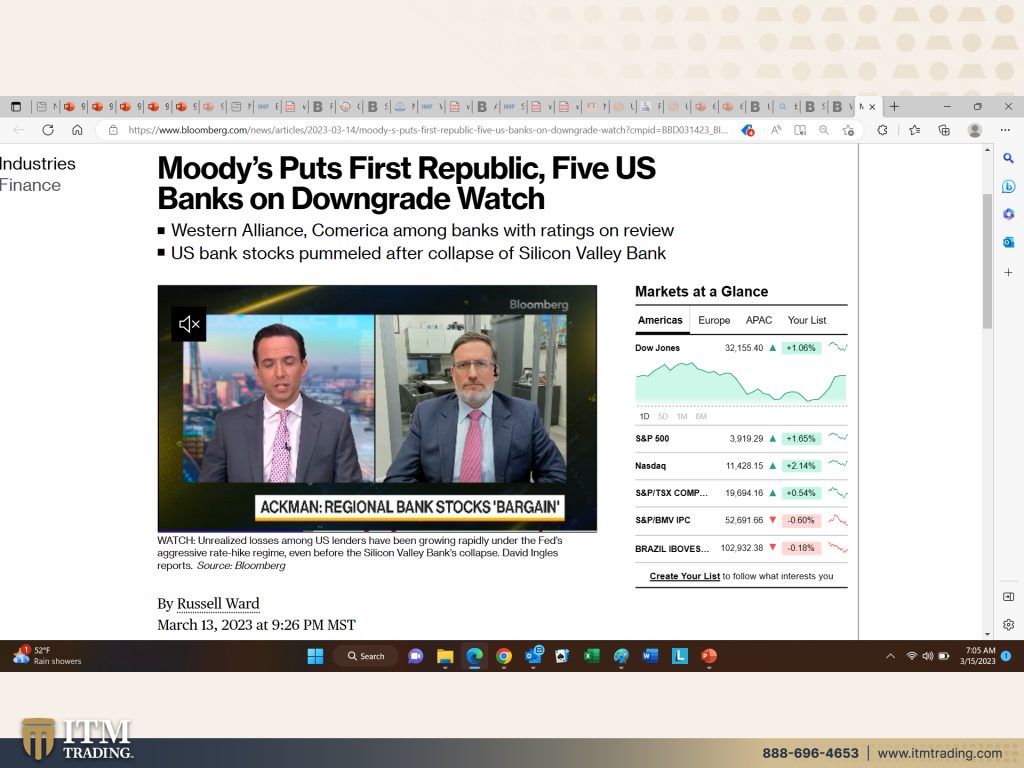

But in the meantime, look at this. I’ve never, not even during the crisis, have I seen yields drop this quickly. If this doesn’t indicate a crisis, I don’t know what will. This is critical and you need to be aware of it. You need to definitely <laugh>. I mean, we’re in crisis. Oh, there you go. That’s where this is. Moody’s puts First Republic and five other US banks on down downgrade watch Western Alliance Comerica among banks with ratings on review US bank stocks, pl pummeled after collapse of Silicon Valley Bank. But again, I, and I’ll, I’ll, I’ll, I’ll see, I’ll do something to remind you of this pull up the data because that area just about junk, there were a lot of corporations that if Moody’s and S&P were using their standard grading would have been rated junk. But hey, it’s been around for a long time. Like I think craft comes to mind as one of them. I could be wrong about that. But hey, you know, these are long-term companies, these are great companies. So understand too, with the crisis in the banking system, with the other collateral damage is that massive wall of all of that debt that needs to be rolled over starting this year. Well, if the banks are in trouble and they’re unable to do that, okay, that my dear are, you know, that’s just contagion. That is more contagion. EU banks in good shape despite SVB collapse. Oh yeah, the European Union banking sector is in overall good shape. You know? Yeah. All the banks are in overall good shape until they’re not. So, you know, I mean the time to get prepared is before the crisis. But as there was a quote from what I did yesterday that said, do not wait, get into your position now. It’s too late. It’s almost too late. We can still buy gold, buy it. It’s just as what are you gonna do? Stay in this when the only choice that they’re gonna have is this. And that’s the final destruction of everything. This is garbage. It’s garbage, it’s absolute garbage. First Republic Bank cut to junk by s and p on deposit outflow confidence is going away. And it went from an A minus so to a double B plus from investment quality to junk just like that. And if you’re sitting in those bonds, guess what that means for you because that means rates on them do go up and their principle value is going down. And I would not be surprised to see the FDIC come in and ultimately take over them.

And I, and I put in one of them. Do you know which one I did? And I’ll do it again. The FDIC’s failed bank list. Did I have that in the one yesterday or the day before? The day before. The day before. Can you pull that out and put it on this one too? Okay. So you can go in and you can watch this whole drama unfold as bank after bank after bank is now poised to collapse. I mean, and it, and really this is global. So part of the reason why I wanted to show you this is look at the German tenure as well. All of the yields in a flight to safety <laugh> are going down. But that is really out of the frying pan into the fire because it’s these government bonds and all that manipulation that the central banks have done and choosing winners and losers and putting it all on the shoulders via inflation and risk on the consumers and on the general public. And the general public. I don’t know. I mean, I can tell you when I went out and it was kind of going along my business, I didn’t see anybody stocking up on anything. I didn’t see anybody freaking out. Doesn’t mean that they’re not doing it because I don’t go out that much.

But you wanna be ahead of them of the rest of the pack. Three days in Washington, how a frenzied bank rescue took slate. Sorry, I’m just going too fast. Took shape. It was approaching midnight in Washington at 9:00 PM in Santa Clara, California at the White House and the US Department of the Treasury next door bleary-eyed. I know that feeling really well. <Laugh>, bleary-eyed officials were racing to prevent the trouble at SVB from exploding into a full blown banking crisis. Didn’t work. The Saturday, March 11th, the fate of of Tectums preeminent bank land with it, some feared the future of the global economy was being gamed out in Washington. Yep. And now the question is how systemic is credit suisse? Well, let’s just go back up here and I guess we’re about to find out, aren’t we? Because all of these gray lines go into all of the smaller banks and financial firms in the world. This is Asia, this is the US this is Europe and Europe’s banks are overall in great shape. I don’t think so. I don’t think any of them are because what they’ve done over the years is reduced, well at least in this country, reduced reserve requirements. So the banks had more money to gamble with and allowed more and more and more leverage. You know, Dodd-Frank, honestly I said it at the time and I’ve said it all along, it’s a joke. It was put in place, it was dismantled. It wasn’t even written when it was put in place and it wasn’t fully written when they started to dismantle it. But a lot of the allowances has been to allow the banks to have less reserves to protect your deposits and more leverage so that they can make more money on their trading activity. And this is all unraveling right now in real time.

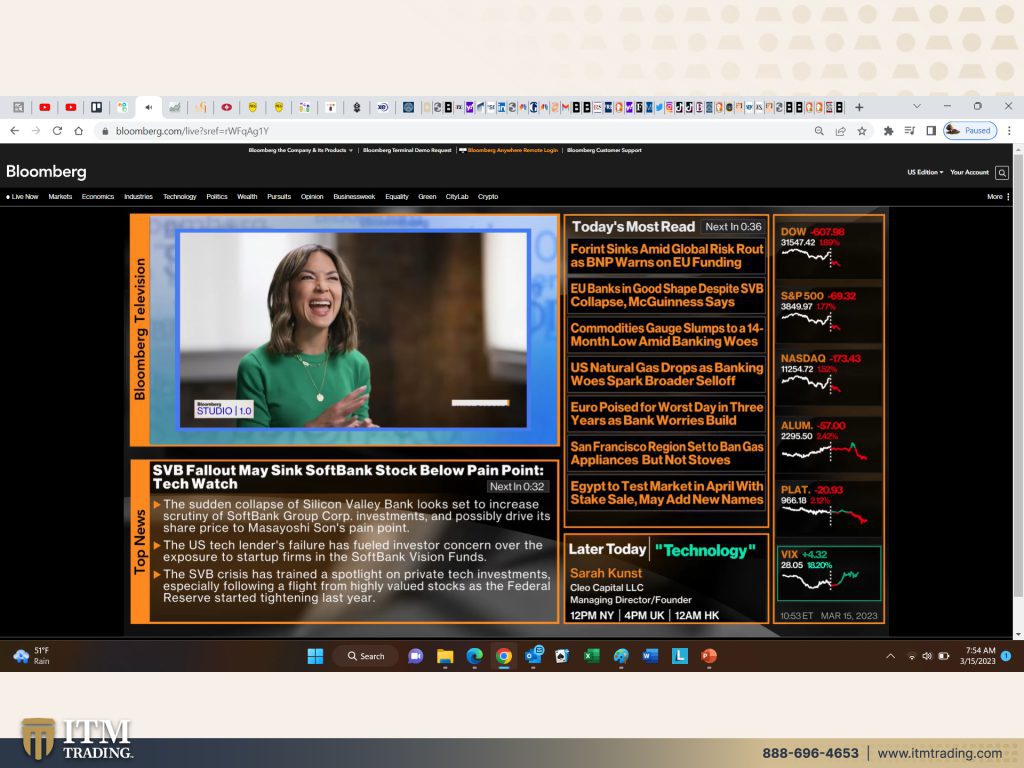

SVB fallout may sink SoftBank stock below pain point. So I pulled this one because I don’t care what area of the market that you might be in, and unfortunately they’re gonna be people that cannot get out because all they have to do is halt trading and say nope. Or you might, I’m sorry, be in something that you have absolutely no control over, like 403 B’s if you’re still working there, you can’t touch that money. And you have institutional investors that are investing your money and hey, wasn’t it a week before they went out that Kramer was saying how undervalued it was, right? SVB Bank, you should go and buy that stock. Go buy it. Well let’s hope institutional investors didn’t listen to them, but they’re not the only ones.

So that’s it for this morning. Are there any live questions? I’ll do some live questions now and then I will also be on at one and I’ll see what there is to update. But I will also do Q&A at that point. I think we probably have four or five questions anyway, plus more live questions.

So Graham 61 asks, when I went to my local bank to make a substantial withdrawal, only thing they could do was give me a cashier’s check. I declined. Took the max out of atm.

Uncle Robbie, does ITM Trading see the price of precious metals rising dramatic with the volatility? The answer is yes on the spot market. That is what we’re seeing. We’re seeing huge runs up, but what we’re also seeing is an increase in premiums. Now I’ll see if I can get a handle on that and would you make a note of it, Edgar? So I’ll go in and I’ll talk to Carl cause Eric’s not here today and I’ll get a handle on what’s happening with the premiums at the moment. But that’s really more of what is going to happen is that increase in premium as demand surges because this physical world, this is a true demand and supply market. The spot market is not, but it shows up in the premium on bullion. Personally, I don’t own any bullion. I want to be really clear on that because I don’t see any way around a confiscation. There is clear historic precedence, there is clear current precedence for it. And you know, if I own this, I’m still way below gold’s fundamental value and it’s in a different category. It’s in the category that’s owned by the elites and that’s what I want. That’s my wealth insurance.

Steven R asks, what about the deposits? Will they really give you money back or rather give you something like shares? Okay, so there’s two questions, however, it’s more than ever the time to get out of the financials, okay? So they went in because people are concerned about that. So that’s what happened Sunday night, the FDIC, the Treasury Department, the Federal Reserve and the office of the comptroller of the currency got together and said, look, we’re gonna come out and tell everybody we are going to backstop with the DIF fund insured plus uninsured deposits. So depending upon what they’re trying to do is stave off a broader bank run. If they can’t do that, then they probably will declare a bank holiday. So my recommendation is to get it while you can and what do you in the world are you gonna do with a cashier’s check? I mean, what is that? Right? That’s just garbage. I’m wondering, I know when I would take out cash, you know, substantial amounts of cash, I would have to give them notice and then maybe a week later I could go in and get the cash. So you might ask the bank if that’s a possibility and order in the cash. I would probably do that. Okay?

“M” asks, what do you think of moving out of USA? All USA companies moving to Mexico? Mexico joining BRICS, Mexico will be according to the WEF the fifth largest economy in the world by 2035. Well, a lot of people have made that choice. That’s not the choice that I’m making because as I showed you in that globally systemically important bank, this impacts the world. If you don’t already have everything set up in Mexico, it’s, I mean, I’m not gonna tell you that it’s too late, but, and I’m not moving to Mexico, I’m staying in the good old USA. I put my bug out location in the good old USA that I can get to easily. You can see by my background that I’m not there yet. Because we, because I wanna see once the public loses confidence once the public actually panics. And I don’t know, I’m gonna have to go out in the public for a minute. I know what I did a little bit and I said, do you know what’s going on? And they’re like, no, what’s going on? So, I know that it hasn’t really trickled through, at least to the few people that I talked to. But I don’t think you’re gonna be any safer in Mexico than you are here. And remember, Mexico did a complete currency revaluation in the nineties. So that’s entirely up to you. And it may be the world’s fifth largest economy by 2035. But we gotta deal with this right now, don’t we? Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter. Get it done.

And Janet asks, how will the fed bail out Credit Suisse without the public knowing? Well, they can do a lot of a lot of things behind the scenes by loaning credit suisse dollars if they wanted to do that. I don’t know that it’s a dollar issue at Credit suisse. I will be looking at it more, but this is all that I’ve had time to do so far. Maybe we’ll have some updates by 1pm, but I will definitely be live on air to answer questions. And I also have Fernando coming in. He’ll be in at 11. So we’re gonna do this in Spanish as well. So for those of you that have some Spanish speaking members, Fernando and I will be discussing what’s happening on our Spanish channel at 11. At 11 today, as well as do not forget that on Friday I had a phenomenal conversation with Mario Innecco on coffee with Lynette and it’s coming out this Friday, so like every day and tomorrow is Thursday and I have a really booked day, but I may try and and grab a few minutes in between my appointments. But I’m not gonna look pretty. I’m gonna warn you right now, if you get me tomorrow, you’re gonna get what you get <laugh>. And also make sure that you watch my Mantra Monday episodes and all of the stuff that we’re putting out on Beyond Gold and Silver to help you figure out what you can do for yourself so that you ensure security in Food, Water, Energy, everything.

Oh, David DuByne my good friend. I love you. Glad to see you on. I thought you bailed to your safe zone. Not quite yet, but we’re ready to, and I am ever so grateful. As we’re sitting here speaking right now, David they are finishing up the hot houses for the food to grow the food. I have lots of long storage food up there. We are already stuffing the freezers and everything. So, and even if I’m up there, remember you guys, I have a studio up there, so I will still be able to broadcast and get information to you even when I’m up there. So I’m glad that you’re watching David, you’re, you see this whole thing unfolding. You know, David was, I think you were either my first or second guest on coffee with Lynette when I first started the channel. So again, if you haven’t, make sure you subscribe because you need to know what’s going on. And I’ll keep coming on and keeping you updated. Leave us a comment, give us a thumbs up, share, share, share, share, share. And until next, we meet till 11 o’clock, which is in like 35 minutes. Please be safe out there. Bye.

SLIDES FROM VIDEO: