WILL THE FED SURVIVE? Not With Facts Like These…by LYNETTE ZANG

I think by now everyone knows not to believe everything they hear on TV, but in some cases (like today), I feel it’s important to “make sure” you all know the truth about what’s happening economically. In this case, there are some apparent illusions the FED is clearly operating on…facts that even contradict their own facts! And since my nickname is Data-Gal…I’ll be disproving those illusions in today’s episode. And knowing what I’m about to share could be the difference in keeping your wealth, or watching it disappear

TRANSCRIPT FROM VIDEO:

I think by now, everyone knows not to believe everything they hear on TV, but in some cases like today, I feel it’s really important to make sure you all know the truth about what is happening economically. In this case, there are some apparent fed illusions. The fed is clearly operating under interestingly enough facts that even contradict their home facts. Wow. And you know, since my nickname is data gal all be disproving those illusions in today’s episode and showing you the truth and knowing what I’m about to share, frankly, that could be the difference in keeping your wealth or in watching it disappear coming up.

I’m Lynette Zang, Chief Market Analyst at ITM Trading, a full service, physical gold and silver dealer specializing in strategies. And you I’m telling you, you don’t need a strategy. So yesterday said, chair, Powell went in front of all sorts of reporters and did a Q&A. And that’s what I’m going to show you today. I mean, to tell you, you know, look, how often am I at a loss for words. So I’m just going to let Palisades and then I’ll show you, cause he talked about transitory inflation,

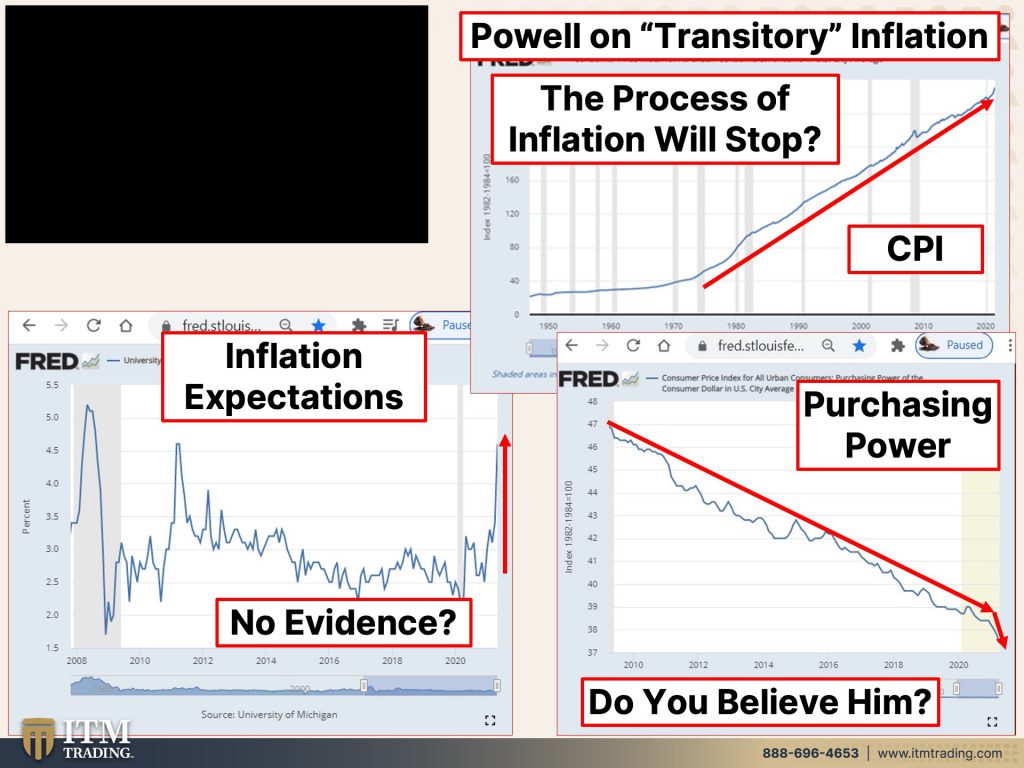

“Do about semantics. I’m going to take a cue from him and ask you about the term transitory. Cause I think of you as somebody who is so lucidly explained policies and programs in recent months and made a real concerted effort to explain them to the American public as a whole. I wonder about this term and what you would say to people who don’t know it, definitionally don’t know what it means and see crisis one up and wonder how long they’re going to have to wait. So just some broader definition from you. I’d like to hear just about what it means or how you understand it. And and quickly as well, you’ve talked about vaccines a bit and your colleague in Minneapolis has placed a mandate on vaccinating poise coming back to that bed reserve bank. And I wonder if that’s something that you would like to see or expect to see system-wide going forward. The concept of transitory is really this it is that the increases will happen. We’re not saying they will reverse. That’s not what transitory means. It means that the increases in prices will happen. So there will be inflation, but that the process of inflation will stop so that, so that there won’t be for what we, when we think of inflation, we really think of inflation going up year upon year upon year upon year. When you have inflation for 12 months or whatever it may be. I’m just taking an example and not making an estimate. Then, then you have a price increase, but you don’t have an inflation process. And so part of that just is that if it doesn’t affect longer term inflation expectations, then it’s very likely not to infect to, to affect the process of inflation going forward. So what I mean by transitory is just something that doesn’t leave a permanent mark on the inflation process. Again, we don’t mean I don’t mean that, that, that, that, you know, producers are going to take those price increases back. That’s that’s not the idea. It’s just that they won’t go on it. Definitely. So to the extent people are, are, are implementing price increases because raw materials are going up or labor costs are something’s going up. You know, the question really for inflation really is, does that mean they’re going to go up the next year by the same amount? So you’re going to be in a process where inflation, the inflation process gets going. And, and that happens because people’s expectations about future inflation move up and we don’t think that’s happening. There’s no evidence that it’s happening. All the evidence is that it’s not happening. But nonetheless, we have to watch this very carefully because this is, you know, we have two mandates, maximum employment and price, stability, price, stability for us means inflation averaging 2% over time. And so we’ve got to be very careful about that, but, but I, I, I think it’s a good point that it’s, it’s a term. What it really means is temporary. But then you got to understand that it doesn’t mean that, that, that the increases will be taken back. Some of them will be, but, but that’s not really what it means. In terms of so we’re, we’re working virtually here. And…”

Okay, so first of all, 2% increase is small enough that you wouldn’t notice it, but it still happens. You can see that, and let’s look at the purchasing power, right? Cause he said, there’s no evidence. These are all Fred charts. Now you might recall, or for those that are new to this, the big experiment that they started in 1913 was for the central bank to control the rate and speed of inflation. Inflation is part of their system because what it enables governments to do is to invisibly tax you. But if it happens too quickly, it’s not so invisible, right? And that’s really what’s happening right now is prices are going up a lot. In the meantime, you’re willing to work for less because what is money, money is a tool that enables a society to specialize. You have a banker, you have a lawyer, you have a guy out wall street. What have you, you’ve got a farmer and money is the tool to enable that specialization. But the average person they’re under the influence of this right? Purchasing power, those nominal dollars. It doesn’t matter how many you have. It matters what you can buy with them.

And so to keep the stock market going up while at the same time, you’re losing purchasing power. A trillion times zero is zero, but he’s saying there’s no evidence. He’s saying the inflation, the process of inflation will stop. Well, it hasn’t stopped where you see this really start to take off is, was that 1975, something like that, right? Once the federal reserve was in full control of the rate and speed of inflation. The problem now is that we’re at the end of the game. There’s virtually no purchasing power left. And honestly this in my career, this is the fastest that I’ve seen the loss of purchasing power. And by the way, what I would like you to do for this particular video is if you’re watching and you need me to explain something more than let Megan know, and she will let me know, and I will spend the time because I’m just pretty much beside myself with this garbage to be perfectly honest with you, but okay, let’s see if we can get this going

“…Or I’d be glad to. So if you look again, if you look at the the most recent inflation report, what you see is that it came in significantly higher than expected, but essentially all of the overshoot can be tied to a handful of categories. It isn’t the kind of inflation that’s spread broadly across the economy. It’s new used and rental cars. It’s airplane tickets, it’s hotels. And it’s a couple of other things. And each of those has a story attached to it. That is, is really about the reopening of the economy. So we look at that and we think that those are temporary things because the supply side will respond. The economy will adapt. We have a very adaptive, adaptable, flexible economy and labor market. And it’s a real, a real asset that we have. And so we think that inflation should move down over time. Now we don’t have any con much confidence, let’s say, in, in the timing of that or the size of the effects in the near term, I would say in the near term that the, the the risks to inflation are probably to the upside. I, I have some confidence in the, in the term that inflation will move back down again. It’s hard to say when that will be I will say though, that, you know, we inflation is half of our mandate price. Stability is half of our mandate. And if we were to see inflation, moving up to levels persistently that were that were above significantly materially above our goal. And particularly if inflation expectations were to move up, we would use our tools to guide inflation back down to 2%. So we’re going to have an extended period of high inflation. We think that that some of it will, will fall away naturally as the, the process of reopening the economy moves through. And it can take some time in any case, we will use our tools over time as appropriate to make sure that we do have inflation. That average is 2% over time”.

Over time, but they’re going to let it run political. Oh, they are going to let it run hot. Remember when they said from a target of 2%, because again, at 2%, they get their inflation. You lose that purchasing power. And after 10 years, and remember, it’s also compounding. It’s not that it goes up 2% and down 2%. And that’s what he’s talking about. It’ll keep going up. It’s the speed. And they are having trouble controlling the speed now. And I’m going to show you the tools in just a few minutes. I want to go through this, but you know, if, if you’re having to pay people, we know what’s going on out there in the workforce. And we know that wages are going up as they should. They will never keep pace with inflation. It’s not certain rising wages will be enough to outpace inflation.

Well, no, $%^&#* Sherlock that’s always been the case and that is by design. But the problem is, once you give somebody that raise, can you take it back? No, you cannot take it back. Now. The good news for corporations is you can see I’m being facetious, is that because of all of the government money that has been giving to the general population, they don’t care that the prices have gone up. So corporations have been raising their prices to include the raising wages and the raising costs. And then some which we’ll be talking about in a future video. So this is their opportunity to really juice their profits at the expense of everybody else. But can you see that their experiment is failing? It lasted a really long time. It lasted as long as there was some purchasing power value to take. That’s why we have to go to a digital currency. That’s because negative rates attack your principle.

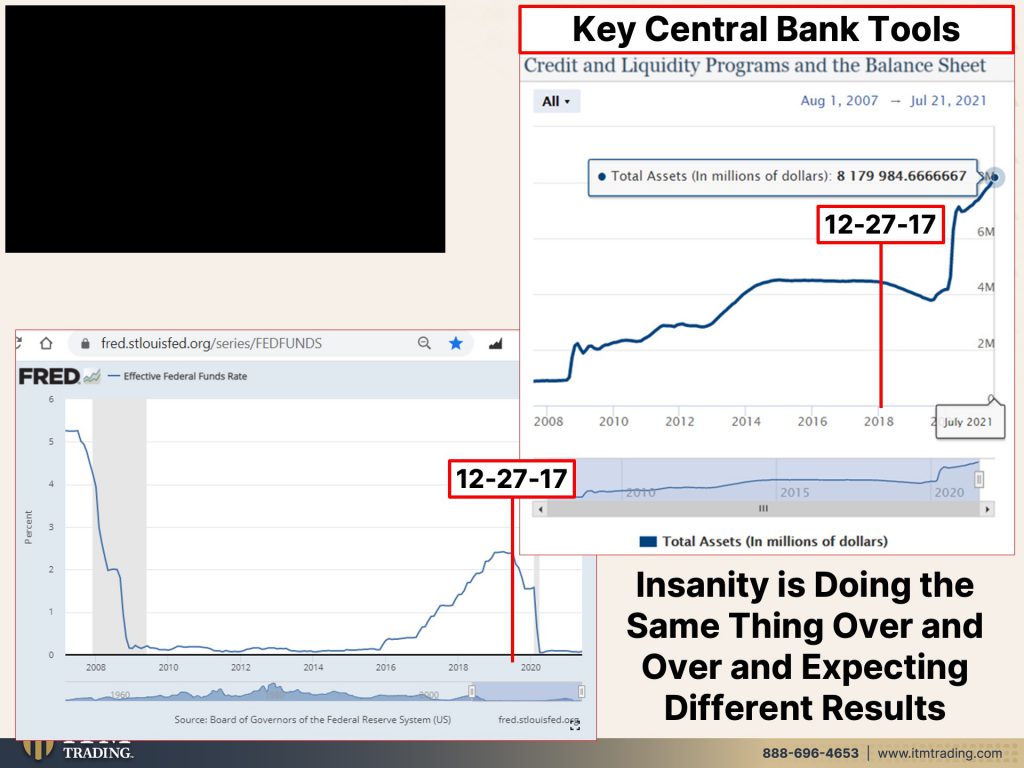

And if there’s no purchasing power left, what do they have left? They have principle. Now that is of course, assuming that we remain in the system and we will, for a while. I mean, we have not felt near the pain that we’re about to feel, but make absolutely no mistake about it. What this is showing you, what this whole video is really showing you, is that the biggest tools that they had, which the biggest tool is interest rates, right? You raise interest rates that slows down inflation because it slows down borrowing and spending you drop interest rates that inspires borrowing and spending. But when you’re anchored at zero and you saw the upheaval that just a half, not even a half a percent caused, we’re going to talk about that. Oh, I might’ve taken that out of this one, but we’ll be talking about that soon. We talked about the repo markets. Well, you got to know the tools don’t work anymore, and I’ll, I’ll show you that in a minute, onto the next soundbite, Greg, Rob and MarketWatch.

“Hi. Thanks for taking my question. Chair Powell. I go back to inflation a little bit. I’m just kind of surprised by your tone. It’s it seems like you’re just sort of warning that if inflation gets too high, you know, the federal act, isn’t it true that, I mean, a little inflation is good for the economy and, and that we it’s, somehow maybe we can get the economy out of this sort of base where we’re always going to be close to the zero lower bound. Isn’t there a good story to tell and you’re sort of panicking people.

Powell: That in mind. No, look, we as you know, we were targeting a moderate overshoot of 2% inflation. For some time we want inflation expectations to be centered on, on 2%. We feel like they may be a little bit below that. So the bigger picture is that you know, that, that, that would be a healthy thing. This is a different thing. This is, this is not that, that was the kind of inflation we were thinking about. That comes from you know, from a very, very strong labor market and, and a a booming economy. Maybe that, that was the kind of inflation with this. This is something different. This is really driven by the supply side, which is not able to hand it to handle this big spike in demand that we’re seeing as the economy reopens with vaccination and fiscal support and monetary policy support, the supply side, just all the world. You’re seeing the same thing, which is, it just can’t keep up. And there are labor shortages in a lot of places, the same sort of thing. So I, you know, there’s, there’s absolutely no sense of panic. I just I’ve explained, I think several times here today, that the best, my, my best estimate is that this is something that will pass. It’s really a shock to the economy that will pass through. And you know, if you, if you look at where forecasters are, people who actually write down a forecast for a living very, very strongly, they see it that way. Now we, but, you know, are we were actually responsible for this though? So we have to take seriously the risk, the risk case, which is that inflation will be more persistent, that it might actually move inflation expectations up. And that we might that the kind of things that might require a response. We, again, we don’t see that now, but we have to be on the alert for it. And people have to understand and believe that we will react if, if we need to. And we will. But again, it’s not, it’s not my base case. My base case is, is, as I’ve said, repeatedly is that inflation will move back down and, and no, we’re not. We, we have not at all changed our view. And I haven’t changed my view that inflation rates dropped 2%, moderately above 2% is a desirable thing. This is not moderately above 2%. This is well above 2%, but it’s also not the kind of inflation we were looking for. And this is really driven by a supply side shock”.

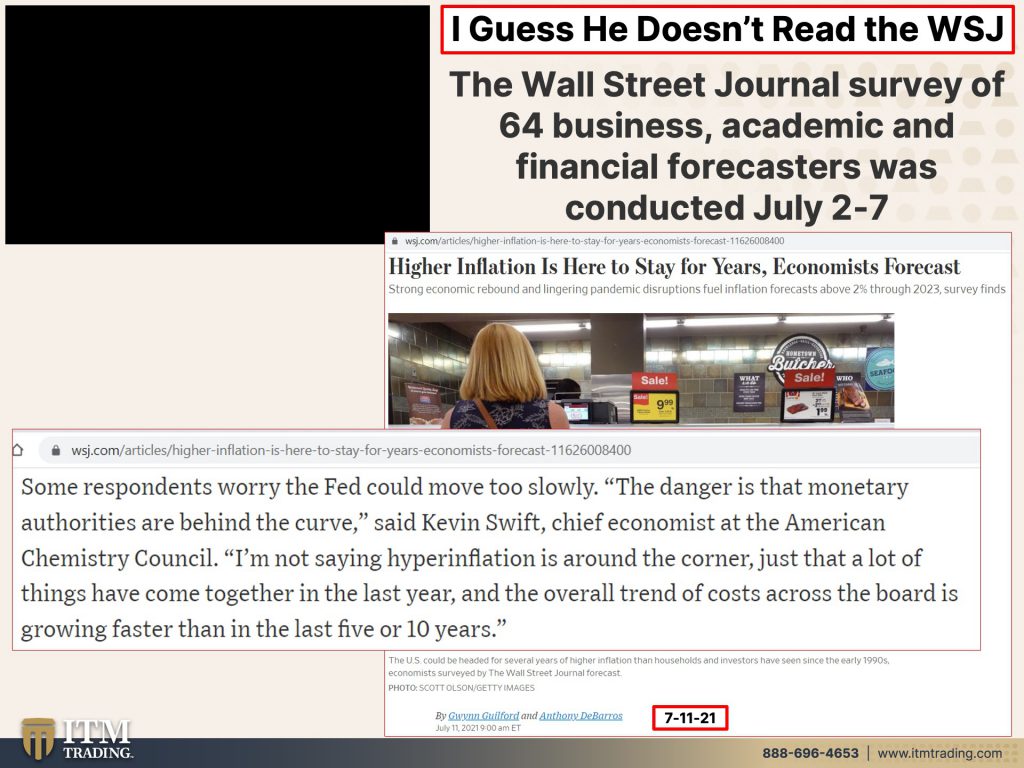

So here’s the danger, right? Because he’s dug in his heels and he is not moving. And this is the concern of all of these economists that he thinks agree with him. But I guess he just doesn’t read the Wall Street Journal. Some respondents worry, the fed could move too slowly. The danger is that monetary authorities are behind the curve, said Kevin Swift, chief economist that the American chemistry council, I’m not saying hyperinflation is around the corner. I’m saying that, just that a lot of things have come together in the last year. And the overall trend of costs across the board is growing faster than in the last five or 10 years. How about growing faster than it has since the eighties or the nineties. Right. And so what are they doing? They’re continuing to buy 120 billion it between treasuries and mortgage backed securities. They are continuing to hold interest rates near zero. So he can no longer, what I’m trying to show you here when they say is behind the eight ball. Yeah. They can’t control this inflation anymore. They’ve lost control. They’re out of tools. That doesn’t mean that they’re done experimenting yet, and they’re going to try and keep it together. So, you know, I know that it seems like Powell on new, old tools to keep money markets for freezing like 2019. Well, that’s because the tools, well this tool, the let’s see, where is it?

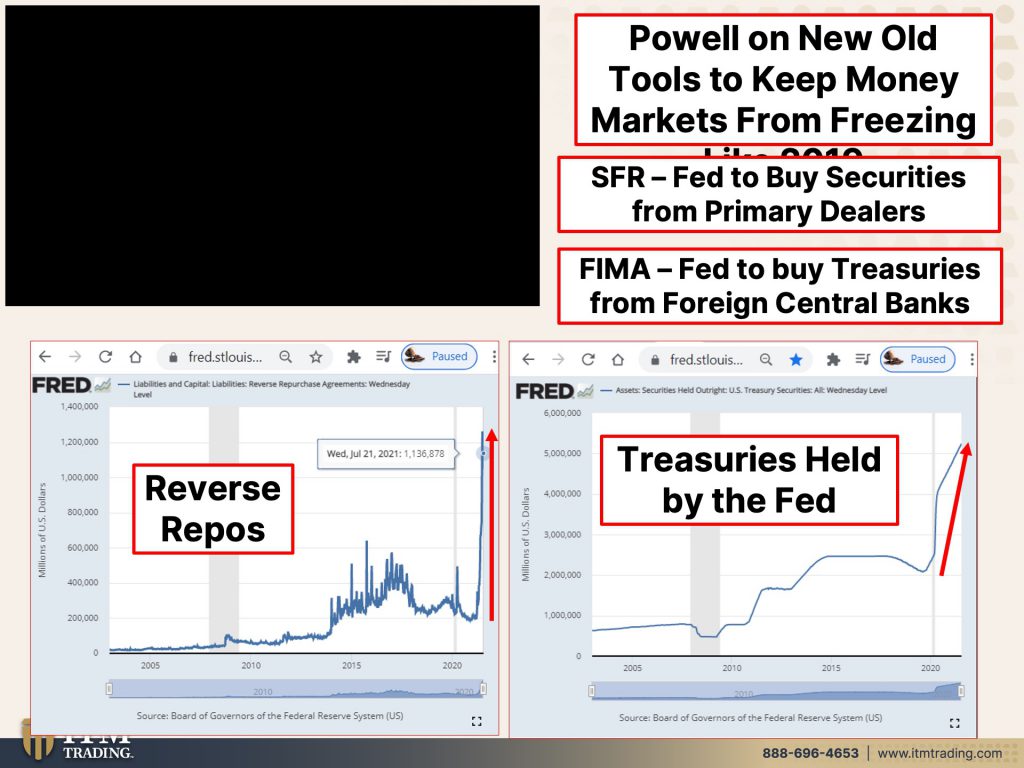

“Pretty much. Yeah. So I wanted to ask you about the standing repo facility and get your sense of what you think it will do for market trading conditions. And also kind of in a semi-related point on the reverse repo numbers have just gotten even bigger since you raised the reverse repo rate at the last fed meeting. And, you know, are you concerned to see, you know, nearly a trillion dollars a day, you know, pouring in through that facility,

Powell: So on the standing repo facility what is it going to do? So it really is a backstop. So it’s, it’s set at 25 basis points. So out of the money and it’s, it’s there to help address pressures and money market money markets that could impede the effective implementation of monetary policy. So really it’s, it’s to support the function of a functioning of monetary policy and its, and its effectiveness that that’s the purpose of it. And it’s set up with that purpose in mind. Your question on, on the the RRP (reverse repos). So we think it’s doing what it’s supposed to do, what we expect of it to do which is to help provide a floor for money market rates and help ensure that the federal funds rate stays within the target range. You know, it’s essentially, essentially what’s happening is that it just results in a lower aggregate amount of federal reserve liabilities that are in banks, in the form of reserves in a higher amount of federal reserve liabilities in money market funds in the form of overnight or RP balances. So that that’s all that’s really happening there. And we expect it to be high for some time it’s being driven of course, by by the relatively lower quantity of treasury bills and also the onset of the debt ceiling and the decline of the TGA, things like that. So treasury general account, we don’t have a problem with, with what it’s doing. It’s kind of doing the job we expected.

And you don’t See any issues with like, dis-aggregating, you know, markets from, you know, investing in private money market securities. You don’t like the idea that the Fed’s footprint in money markets is getting too big. You don’t see any issues there.

Powell: Not not really. Not at this point. I mean, money markets, private money market funds are, are choosing to, to invest because the rates are attractive. At some point the rates will not be so attractive as, as the whole rate cluster normalizes and, and you’ll see a shrink back down.

Okay. Thank you”.

What he’s really saying here, especially when the fed steps in what he does is he pushes out the retail public, right? So by raising those rates by that little bit that he did a week or so ago, I did a whole piece on it. Megan put the link in there. So you can go back and look at the one that I did on the repo markets. Now you tell me, does this look like, okay, maybe fed chair. Powell is not panicking. I don’t actually believe that. And I’ll show you that in a minute, but somebody is panicking because this is the reverse repo market. And you can see, I mean, it’s more than a trillion dollars a day flowing through that. So this is far more than just a backstop. And these are the treasuries held by the fed. And the fed is also buying treasuries that are issued and what the programs are, these overnight repos, which they used to use, the SFR that they stopped using once they did the reverse repos.

Well, now they’re pulling them back in because what they set up to begin with their net, that experiment is failing. And it’s failing because you can tell the spike and what happened in 2019 in September. It wasn’t that, that was then, and this is now that was a big fail. They knew the tools were failing. Now, can fed chair Powell, come out and say, I’m freaking out. The whole system is falling apart. All the tools that we come up with are not working, or it’s like a Dutch boy putting a finger in the dike and then the dike is going to break. Of course he can’t, he’s got to stay like calm and in control so that you don’t panic. But when you look at what’s happening underneath the surface, you need to be panicking. Well, you don’t need to be panicking, but you need to get into position because when this thing blows, it will blow big. And what they’re trying to do with these two programs is even more liquidity. Let’s look at that because these are the tools that he’s talking about. These are their key tools, anything else that they create, like those two programs that I just showed you are offshoots of this, but these are their two key tools. And why I always tell you that they are out of tools.

“Thanks very much, Michelle. Chairman Powell, you, you, you just alluded to the fact that you’re prepared to use your tools to slow the economy down. If need be to if inflation looks like it’s getting out of control. And I want to just try to understand that in the context of the framework and the forward dimes, does that mean you’d be prepared to raise interest rates, even if we’re not at maximum employment at that point, should you see this danger of inflation and too, well does it also mean you be prepared to raise interest rates even if you are still buying assets? Thank you.

Powell: There’s a, there’s a part in our statement or longer on goals and monetary policy strategy, which rich, I’m sure, I’m sure you’re familiar with which, which talks about that case in which the two goals are intention. Most of the time if you have high inflation, you also have a high employment that they tend to go together. This is a situation where they’re temporarily in different directions. We’re not at full employment, but we are having high inflation. We, we feel like we’re going to be making a good progress over the next, the course of the next a year, a couple of years, really toward maximum employment. This is a very strong labor market. If you look at the number of job openings compared to the number of unemployed, it’s, we’re, we’re clearly on a path to a very strong labor market with high participation, low unemployment, high employment wages, moving up across the spectrum. That that’s, that’s the path that we’re on. And, and it, it shouldn’t take that long in macroeconomic time to get there. So that’s, that’s what I think is really the likely case. And again, it’s not, it’s not timely for us to be thinking about, about raising interest rates right now, what we’re doing is we’re, we’re looking at our asset purchases and judging what is right for the economy and judging how we how close we are to substantial, further progress. And, and then, and then tapering, after that, the question you ask about, would we raise rates if we hadn’t finished cutting, hadn’t finished the taper hypothetical question, you know, we we’d face the the circumstance at that time. We could always just, you know, one thing one could do would be to just cut asset purchases all the way to zero, if you wanted to do that, but it’s just hard to, it’s hard to answer what you would do without knowing a lot more about the situation. Ideally, you wouldn’t be still buying assets and raising rates because of course, you’re adding accommodation by buying and, and removing accommodation by raising rates. So that wouldn’t be ideal. I’ll say that”.

Okay. And I’ll say this first of all, on the fed balance sheet chart, this one, I’m sorry. I apparently did not change the date. That’s 2018. So this was the last time that they attempted remember 2016. They attempted to raise rates. I said at the time, every single government, every single central bank, rather that has attempted to raise rates since 2009, ultimately have failed, failed, failed, and the fed was no exception to it. You see, they were way before the crisis hit. They were forced to lower those rates and they are anchored firmly at zero. So that means that that tool is gone. The next tool is negative rates. That’s one of the reasons why they’re rushing for the CBD CS, central bank, digital currencies. And this is the fed balance sheet. I remember when they attempted to very slowly, they didn’t sell any of those assets that they had purchased. What they did was allow not reinvest the interest where the principle, as those mortgage backed securities and treasuries matured. So they didn’t stop buying. They just didn’t reinvest. And guess what happened September, 2019, when the money markets froze. So all of this garbage has been done so that you don’t know it, and you don’t take steps to protect yourself, but we can see it. So he’s, this is really why I say that they are out of tools. If you’re anchored at zero, you can only go to negative rates and attack principle, but does that really get you out of the hole? And, oh, by the way, the reason why the fed thinks that a little inflation is good is because it’s easier to service the debt. You’re servicing the debt with dollars that have less and less value wages, theoretically go up and making everybody, making it easier for governments, corporations, and individuals to service that debt. Of course, for the normal person, for the average person, I should say by design wages, never keep pace with inflation because in that way, corporations can then make a lot more money. And that’s what enables wealth and income inequality. That’s what enables the gap, the system. But for them to say, well, we’ve got the tools, we’ll use the tools. Well, you know, you can see that experiments that they create fail. They may work for a minute, but they fail. And these are the two key tools. Anything else that they create is based on these. If they’re buying stuff from somebody else, that means they’re creating the money to do it. And every time they create new money, the money that’s already out there loses value.

It’s not a big surprise that inflation is starting to spike because I didn’t really show you this, but maybe I’ll go back and show you. Hold on, let me see. Okay. Inflation expectations. This is 2008, and you can see that big, huge spike in inflation expectations because of QA, oh my God, they’re printing all of this. And so it’s going to flow through and we’re going to have hyperinflation. Well, instead they redirected all of that new money into the stock market, into the bond market and into the real estate market. Right. They targeted those for reflation. So that’s where the hyper went in. That’s why you have these markets at the highest level ever problem is with the bond market. Is that, you know, well, I don’t know. I guess we’re going to test the limits of how far below zero you can go, because then it could be a trade, right?

You might remember interest rates, principle value. When interest rates go down, the principle value goes up. So if you’re a trader somebody that trades bonds, you don’t really give you don’t really care about the coupon because you don’t intend to hold it to maturity. So if they think that the fed is pushing down rates, then Wall Street can still make money on bonds. Now, normally the individuals are holding onto those bonds though. You won’t generate, you’re not generating any income from them now. And you certainly, well, when they’re negative, you’re going to be giving a principle.

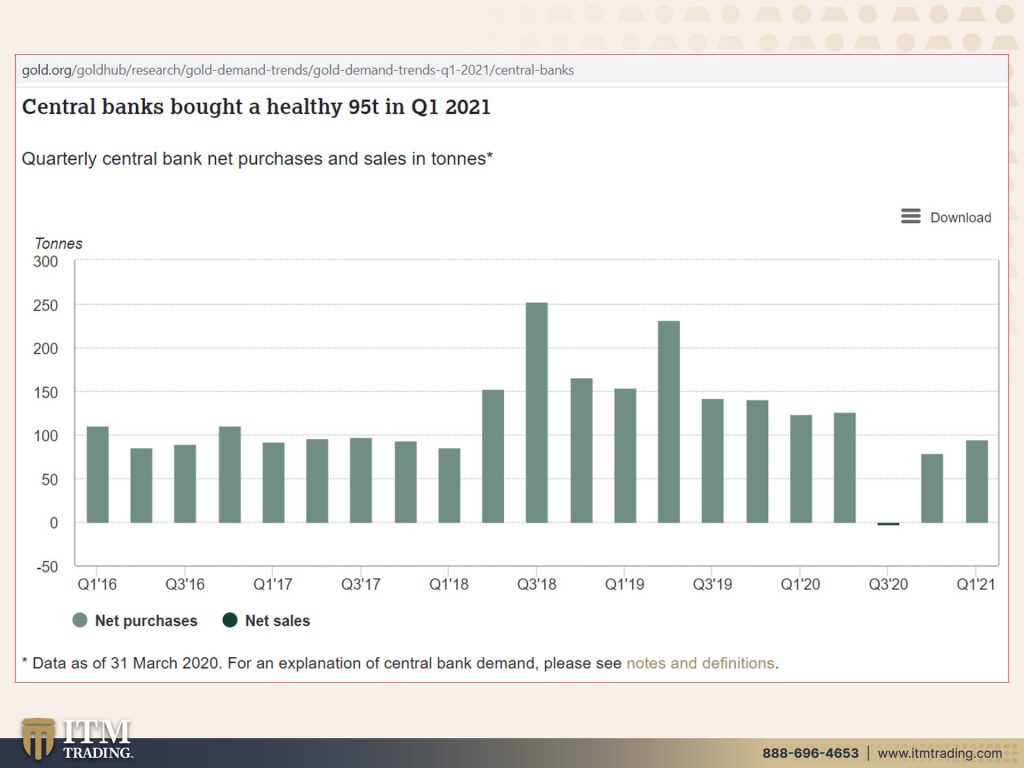

So loss of purchasing power, right? No evidence, right? There’s the inflation expectations. I’m sorry. I’m a little disjointed today. This has really had me upset to tell you the truth, because then you got to ask yourself, so, okay, what do I do? Well, why don’t you do what the smartest guys in the room are actually doing for themselves, which is buying gold. Central banks added 95 tons in the first quarter of 2021. Second quarter is not out yet where you see this. Well, that was March of 2020 during the, when the pandemic was really hitting and everything was shutting down. So central banks use their savings, their gold savings to survive that. And then, and now they’re building those positions because there is not one itty bitty teeny doubt in my mind. I know these guys know more about what they’re doing and what’s really happening than I do for sure.

And that’s why they’re buying gold. And that’s why I buy gold. And, oh, I forgot to bring some in here today. I’m sorry. You can tell how disjointed I am from all of this, the link to his whole speech. So you can hear all of the garbage that he’s choosing to spew is below and on the blog. Now tomorrow, you know I do have a coffee with Lynette with Martin north, and we’re going to be starting that shortly tomorrow. We’re going to release it because this was just really timely. And once I heard his speech, pardon me are really off because you guys know what’s my favorite question. How many times can you be lied to when you do not know the truth, if you’re watching this, you know, the truth, I guess he never bothers to go on the Fred. I mean, maybe they should just stop that whole thing so that we can’t see anything. I guess he doesn’t bother to read the Wall Street Journal, because guess what? Economists don’t think that this is just a short-term transitory thing, but what all of this is showing you all of this is that they are out of tools and losing control. It’s a con game. The reason why high inflation expectations are so important, the reason why fed chair Powell says well, it’s important that people know that we will act on inflation is because this is a con game. And that requires confidence. I do not. I do not. I do not have any confidence in these guys. And I certainly know that they don’t give a rat’s patootie about my best interest or about your best interest because you and I guess what, we’re not too big to fail. We’re the perfect size to steal our wealth. And once it’s gone, what are you going to do? You don’t have any way to rebuild gold, silver, physical in your possession, outside of the system, globally accepted, peer-to-peer real money. You got it. Decide what you want to hold into this. And when people say well, okay, okay. I think I have enough, you know, and you don’t ever have enough in this environment. You don’t ever have enough. Get it done people, please get it done. I cannot tell you the exact moment that we’re going to lose choice, but I can see the system falling apart. I can see the wheels falling off this bus. Can you? I hope so, because that’s what I keep trying to say, show you.

Next week, I’m going to be on with my good friend, Dustin. Nemos on the Nemos News Network. And I’m going to be having a coffee with Lynette, with Jason Hartman. And we’re going to be talking real estate. And we’re going to be talking about buying a city block with gold and silver. So, you know, if you look, if you haven’t already contacted us and you want to put a strategy together, which frankly you really need to do, just click that Calendly link in the description, and you can set a time that works for you at the time that you want isn’t available. Call us (888) 696-4653. You guys know I don’t usually talk about this, but I can see what’s happening. And I care. I care about all of us because we’re a community. And today was a great example of why, if you haven’t already, you need to subscribe and turn on that bell notification because when something happens, I’m going to come on and I’m going to tell you about it. Even if I have to move all my other work that I was intending to do, because also the OECD report will be next week, but I just could not let this one, wait, I just could not. I could not. Share this, please. People please share this with everybody and anybody, you know, because they need to know the lies. Ignorance does not make you immune. It just leaves you vulnerable. I don’t want anybody to be vulnerable from those greedy…too much of a lady to say it on air, but it’s critical that you do that. So if you like this, please let’s see if we can make this one go viral, thumbs up, leave comments, share, share, share, because we’ve got to work together to make this happen. More people spread the word. We need people to know really what’s going on. As you know, and without one little doubt in my mind, get your assets covered here. We use the wealth shield and the foundation is physical, gold and silver. Again, truly decentralized, truly out of the system. Real money that can protect you from the inflation and can protect you from the crisis. That lies just ahead, please, please. And then tell next we meet. Please be safe out there. Bye-Bye.