Why 66% of Consumers Are Dangerously Unprepared!

The debt bubble is already bursting, and it’s affecting various segments, including the triple BBB, the lowest investment-grade level. Why should you be concerned? Because it will result in fewer jobs, reduced incomes, and increased financial strain on consumers. In fact, some are resorting to buy-now-pay-later plans for basic necessities like food, which is not a sustainable approach.

CHAPTERS:

0:00 Debt Bubble Bursting

1:05 Is This Where it Begins?

5:03 Family Situation

5:42 Consumers

7:45 Costco Gold

12:24 Get Your Strategy

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

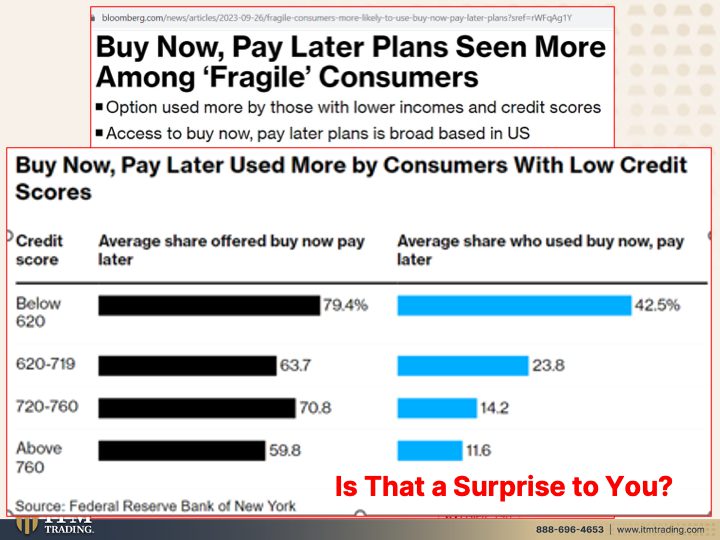

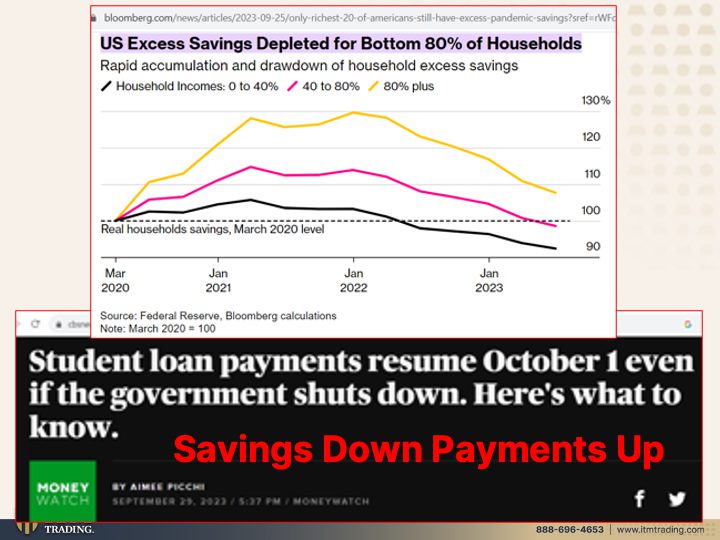

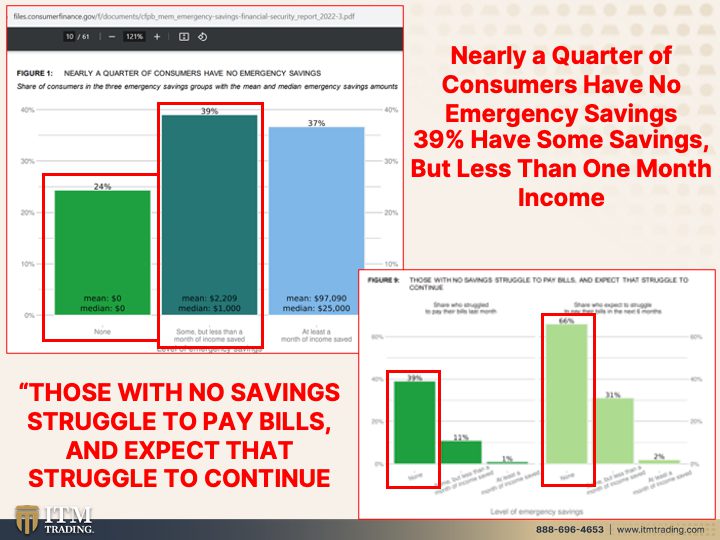

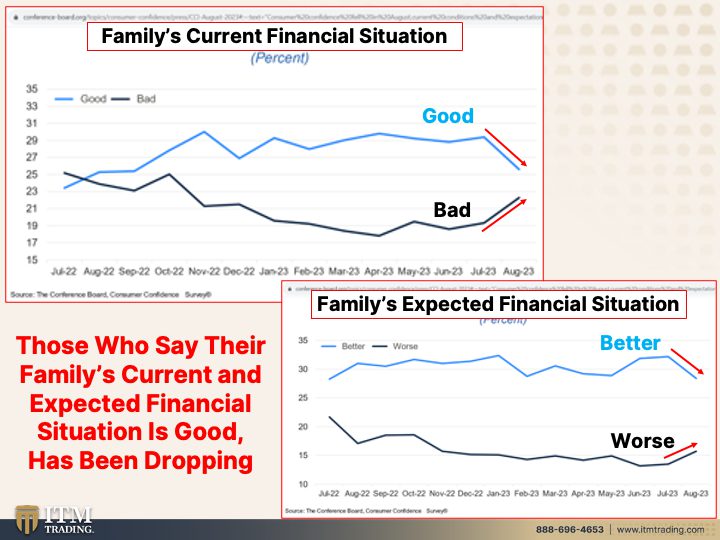

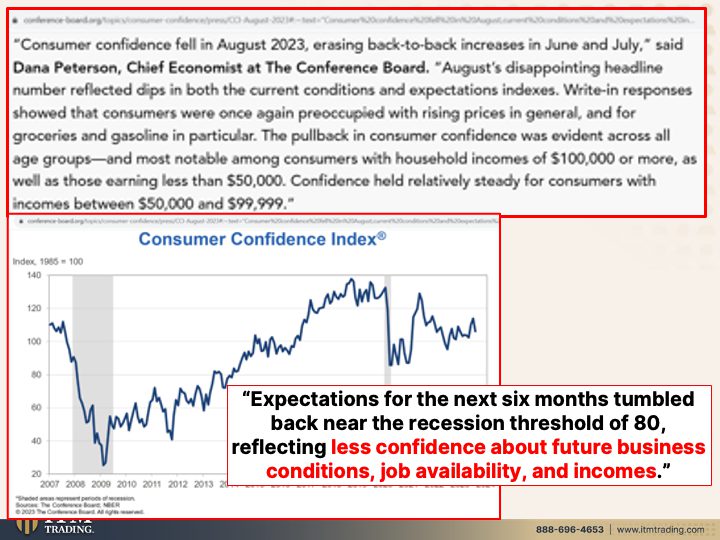

Debt bubble is bursting. Corporations are drowning in debt, and your neighbors are now scrambling to buy gold bars from Costco. Why did you say? Costco is now selling one ounce gold bars and they’re already selling out pretty fast here across the country. Yes, you heard that right. We are on the brink and your financial future is hanging in the balance. How did we get here and what can you do to shield your family from the oncoming storm? Coming up, I’m Lynette Zang chief market analyst here at ITM Trading, a full service physical gold and silver dealer specializing in custom strategies. And you need one if you don’t have it. Click that calendly link below. Talk to one of our consultants and get your strategy in place and executed. Because truthfully, the debt bubble is already bursting. Are you ready for this? It’s starting in the lower areas, but also the triple B, which is the minimum level considered investing grade. So what does that mean for you? Why should you really care about that? Well, there are a lot of reasons why you should care about that. But primarily this will lead to fewer jobs and fewer incomes and more income losses. And that ties in to what is supposed to be supportive of the entire US economy, and that is the consumer. But you have these by now and pay later plans. And we’ve seen where the people are actually using these plans to buy food, for goodness sakes. So people are having to go into debt and break down their payments for food. How do you think that’s going to turn out? But the option is used more by those with lower incomes and credit scores. Access to buy now pay later plans is broad based in the U.S. And as I said, we’ve seen some people even having to use it to buy food. But you can see the credit scores below 620, 42.5% is the average share who used the buy now pay later from that offering. And obviously, as you have greater income, etc., you will use it less and less. But still you can see that there is stress to pay for things today, even in the higher level of credit score, which could also likely lead to the higher level of income. Is that a surprise to you? It’s not to me, honestly. You could see that coming so easily. Of course, as inflation has raged through, incomes have not kept pace with it. And, you know, you’ve got to feed your family. You’ve got to do these things. And the excess savings from all of that free money printing that was going on during the pandemic, it is depleted for the bottom 80% of households. At the same time that you had student loan payments coming on board, it’s not going to matter, no matter what happens. These people had three years where they were not having to pay that. And guess what other things came up in its place. So what we see is their savings are down and payments are up, and that spells trouble in the debt markets. I thought this was really interesting is probably a stat that you’ve already heard, but nearly a quarter of consumers have zero zero for emergency savings and a full 39% additionally. So what is that, 63% of all consumers? Well, those guys have less than one month’s worth of savings. Maybe they only have two or 300 bucks. Wow. So that’s 63% have less than a month down to zero in savings in case of emergency. Can you see the problem brewing? Not only that, but those without savings are struggling to pay their bills today and they expect that to grow to 66% tomorrow, that they’re having trouble today. But they 66% anticipate it’s going to be an even bigger problem in the future next month and on and on and on. We’re a consumer driven economy. If the consumer can consume Houston, we got a problem. Those who say their family’s current and expected financial situation is good has been dropping. Let’s see what that looks like, because this is the family’s current financial situation there. It’s good, the bottom, it’s bad. And so as the good is dropping the current financial system for families is rising. It’s not a very good formula. And their expected financial situation, as you can see, that’s shifting as well. So the good the better is going away and the worse is rising. This is a recipe for disaster. When you are banking on these weak consumers to keep this game going. Of course, I don’t really think that they’re planning on keeping this going. Let’s talk about consumer confidence, because it fell in August 2023, erasing back to back increases in June and July. August disappointing headline number reflected dips in both the current conditions and expectation indexes. Right. In response has showed that consumers are once again preoccupied with rising prices in general. But wait. Inflation is going away, isn’t it? No. The speed in certain areas is cutting back, but not in all areas. So, yes, prices have not gone down and they’re going back up again. The pullback in consumer confidence was evident across all age groups and most notable among consumers with household incomes of $100,000 or more. As well as those earning less than 50,000. Confidence held relatively steady for consumers with incomes between 50,000 and and almost 100,000. But it’s showing you on the lower end as well as the upper end, that confidence, which is what we need to keep this whole thing going, is declining and not in a good way. Expectations for the next six months tumbled back near the recession threshold of 80, reflecting less confidence about future business conditions, job availability and incomes. And so when you are less confident, then you know you spend less. And that’s a problem. You take on less debt, you spend less, you’re going to spend your money on absolute necessities, not frivolities for sure. Costco, I love this. I love this for so many reasons that I’m going to tell you. All of them. Costco is selling gold bars and they’re selling out within a few hours. They’re selling the one ounce gold palm Swiss lady fortune bars. And their chief financial officer said the bars are in hot demand and don’t last long in stock. Now, let’s think about what this means, because Costco is definitely mainstream and you have right across the board a lot of people of all socioeconomic levels that go to Costco. Now, they have limited the quantity that you can buy 2 to 2 ounces. But what this tells me is that the mainstream, the public is starting to become more aware. I’ve had a request to do a video on the phases of a trend, so stay tuned. I will probably either have that for next week. I will have that coming up. But this would be an awareness piece that would anticipate. Well, could it anticipate higher prices on the spot market? Because that’s such an easy market to manipulate. You can create as much gold and silver for that matter as you want. That does not exist and never will exist in the physical markets. We’re already seeing premiums rise. We’re seeing prices go up more substantially. You find more truth in a market that is only physical. But I know that they’ve postponed this inevitable timing for a long time now. I mean, 2020, we’re in 2023. Hey, didn’t they just come to a meeting of the minds to postpone another government shutdown? Does that mean everything is hunky dory? You know, here you hear nothing about what happened in March and April with the regional banks as the B, etc.. Certainly that must be all fixed. Well, no, none of that is fixed. None of it. There is a crisis that is brewing and they are counting on weakness to support the strong or those that have the wealth. I should say the 1%. We’re heading into a problem. But Rose noted that the company seems to have accelerated its offering of dried food and other survivalist goods at a time when worries about the future are running high. Additionally, they’ve done their market research. I think it’s a very clever way to get their name in the news and have some great publicity. There is definitely a crossover of people living off the land, being self-sufficient, believing in your own currency. That’s the appeal to gold as a safe haven as people who lose faith in the US dollar. The public is nervous about the future as well they should be. Community can help those that don’t have money to buy gold and silver. Maybe they have lots of skills. Maybe they can plant a garden or build a house or fix the electric or fix the plumbing. If you can’t position yourself into the physical metal, become part of a community because somebody in there can. We just are expanding our little community that’s going up the hill. If we need to bug out, that’s a level of comfort for me. And the question is, what skills do you bring to the table? I’m bringing all of this. What are you bringing? So what are you bringing? That’s what I’m asking you. And look locally first for your community. Go globally. Because we are all in this together and we have to come together globally and be supported to meet people where they are and see how you can come together to be really a whole lot stronger. Because once the public becomes aware of what’s really happening to the currency, confidence goes away completely. You have hyperinflation. Are you prepared for that? I hope so. I really do. And if you haven’t done it, I’m going to be repetitive. Click that cowardly link below. Have a conversation with one of our specialists. Get your personal strategy in place and get it executed a.s.a.p. Maybe I can’t even call this the calm before the storm because there’s nothing really calm that’s happening out there. But I can see people going, Oh, look at that ten year treasury. Yeah. Do you think that’s safe? No. As the Bank for International Settlements tells us, gold is the only financial asset that runs no counterparty risk. Check out some recent videos that I’ve also done. Ruled by the IMF, where we talk about a warm world currency because that’s where they want to take us. It’s much easier to control if everything is one place. And who are you going to complain to? Right. You have no no options. Taylor Kenny did a fabulous video video on recession signals. So just you need to be able to look out there and see what’s happening and really understand it. They want you to think that this is just a soft landing or, hey, maybe we’ve already gone through it. That’s what they really want you to think. But that’s just setting yourself up for disaster because, frankly, this bubble has popped. We just haven’t seen the end of it yet. And make sure you subscribe. Leave us a comment. Give us a thumbs up and share. Share, share. Because we have to develop that community. We have to. For ourselves. I mean, I’m old. I don’t care, you know? But my children, my grandchildren, your children, your grandchildren, your great, great. That’s what I care about. That’s what I’m doing this for. That’s who you should be. Well, I can’t tell you what to do. You got to do whatever you’re comfortable with, what you know, this is so much bigger than just us. Till next, we meet. I want you to realize your financial shield is physical gold. Physical silver in your possession. And pleased. Until next week. Me? Please be careful out there. Bye. Bye.

SOURCES:

https://www.cbsnews.com/news/student-loan-government-shutdown-resume-start-date-october/