WHEN REAL ESTATE DROPS: [Pt.2] Your Mortgage During Hyperinflation & The Reset

TRANSCRIPT FROM VIDEO:

What will happen to your mortgage during hyperinflation and the global reset? Which countries historical data can give you clues? And more importantly, how can you protect and maintain your standard of living while also increasing your wealth base? You know, being in the space for over 50 years and heavily researching currency resets for the last 35, I’m going to only answer these questions, but I’ll also show you how to safeguard your real estate holdings and position yourself for the most profitable opportunities. On the other side of this mess coming up,

I’m Lynette Zang, Chief Market Analyst here at ITM Trading, a full service, physical gold and silver dealer specializing in custom strategies and never has it been more important to have a strategy than it is today. So this is part two because you know, people will always negate, oh, well that was over there. That can’t happen here, etcetera, etcetera. But, you know, I don’t know how many opportunities or how many times does it take you to see the same kind of behavior in the same kind of patterns before you might say to yourself? Hmm. If that’s happened a hundred percent of the time historically, and we’re doing basically the same thing, what is our best shot? I don’t know. I happen to think that we’re going to get more of the same. So here’s part two when real estate drops and we’re going to be looking at three more countries today.

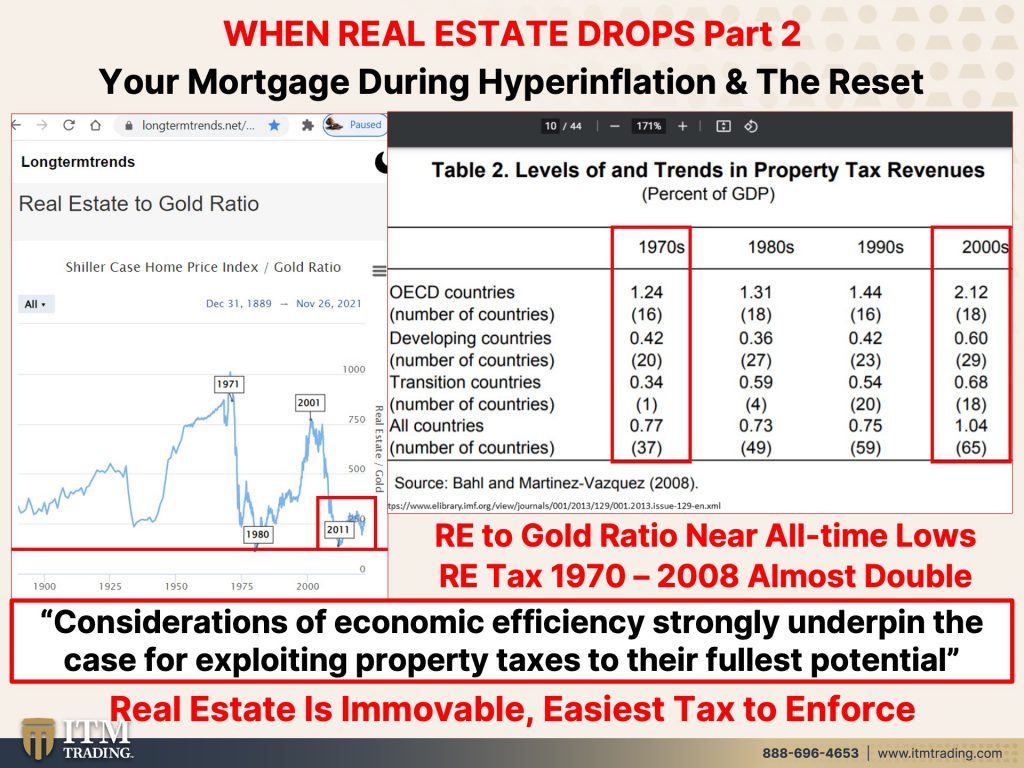

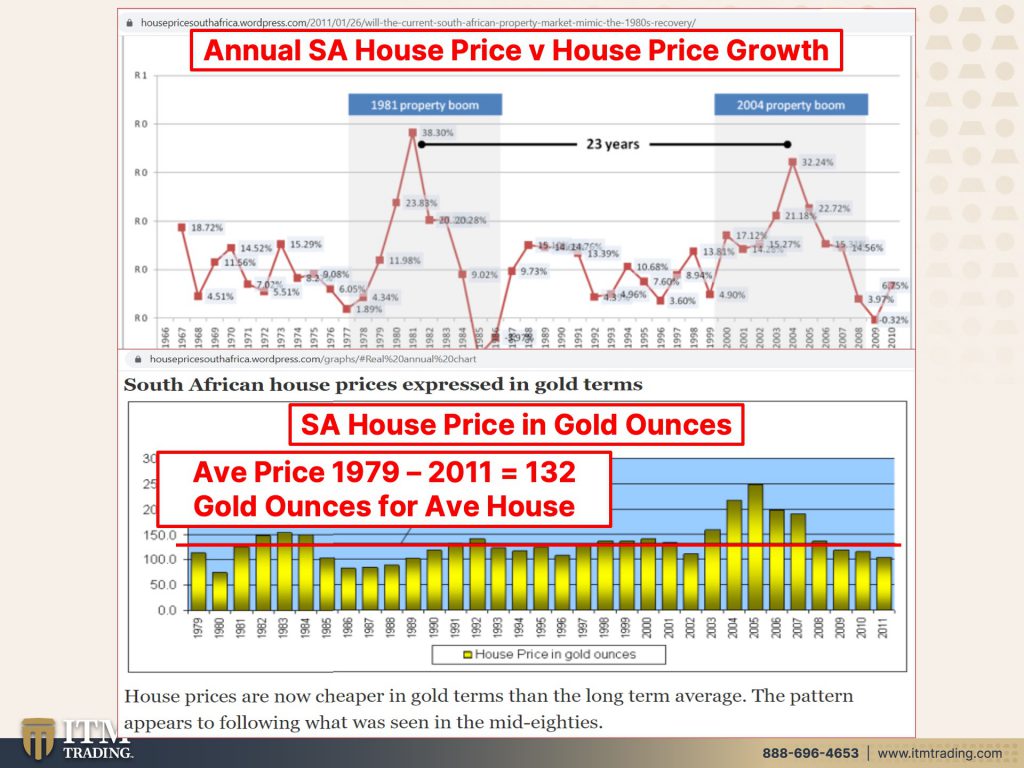

And you know, none of these are really, really a long time ago, but I want to talk more about the gold and silver ratio, because that’s what this graph is. And you can see it took more ounces of gold to buy the average house in 1971 than it did in 1980. And again, right? So we are somewhere near a low. Now the low was put in 2011, but as you can clearly see, we are still near the low. So that’s even going to get better. Let me show you the other part, the other threat, or one of the other threats to real estate is property taxes. So looking at it from a longer term view and OACD countries, which are developed countries, but actually even looking in all countries here, we were in the 1970s. And if you look to where the taxes are relative to the two thousands, and this actually goes through 2008, well, it’s almost double, not quite, but it’s pretty close to double. So the reason is, is because you cannot put real estate on your back and walk away with it. So it is considered immovable property, because you can’t do that. Now you can with gold or with silver, you can just pick it up, put it in your pocket and go wherever you want in the entire world, and have the same level of purchasing power. So let us begin because it is the easiest tax. And so you have to be able to protect your real estate, both the mortgages on there, as well as the property taxes and gold helps you do both.

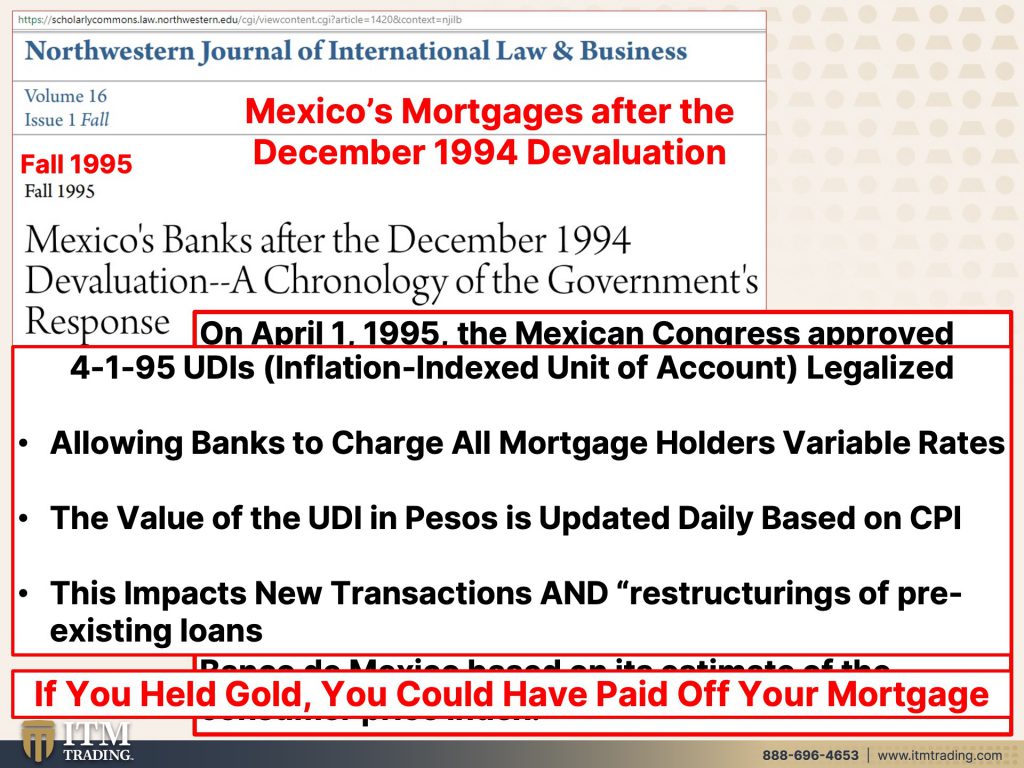

Now, actually the biggest paper, the most complete paper that I could find on mortgages looks at the Mexico devaluation in the mid nineties. And of course, you know, you have all of the links to all of this work and all of this research, just go to the blog and you can read more about this yourself, but what happened to the mortgages in Mexico just not that long ago in the mid nineties? Well, gosh, the government steps in and they approved UDI’s which are inflation-indexed unit of accounts. Now that means that as inflation grows, so do these UDI’s, and not in your best interest, this allows banks to change the mortgage holders to variable rates. So you never really know what you are going to be paying on that mortgage. Can you see that as a bit of a problem? The UDI is updated daily and it’s based upon the inflation index, the CPI. So it impacts both new transactions as well as restructurings of pre-existing loans. So it impacts the new loans. It impacts more importantly for you guys, the older loans as well. So if you held gold and you knew that this was coming, this would be a great time to capture some of those gains. Not you’re not going to sell all of it, but you’re going to sell as much of it as you need to, to pay these off. And that takes care of the mortgage issue. It’s just a function of timing, right? So you have to know when to do this, but further. So that was what was that? That was April, I think wasn’t it? Yeah, that was April of 95. Then again in August of 95, well, they passed it additional ADE program.

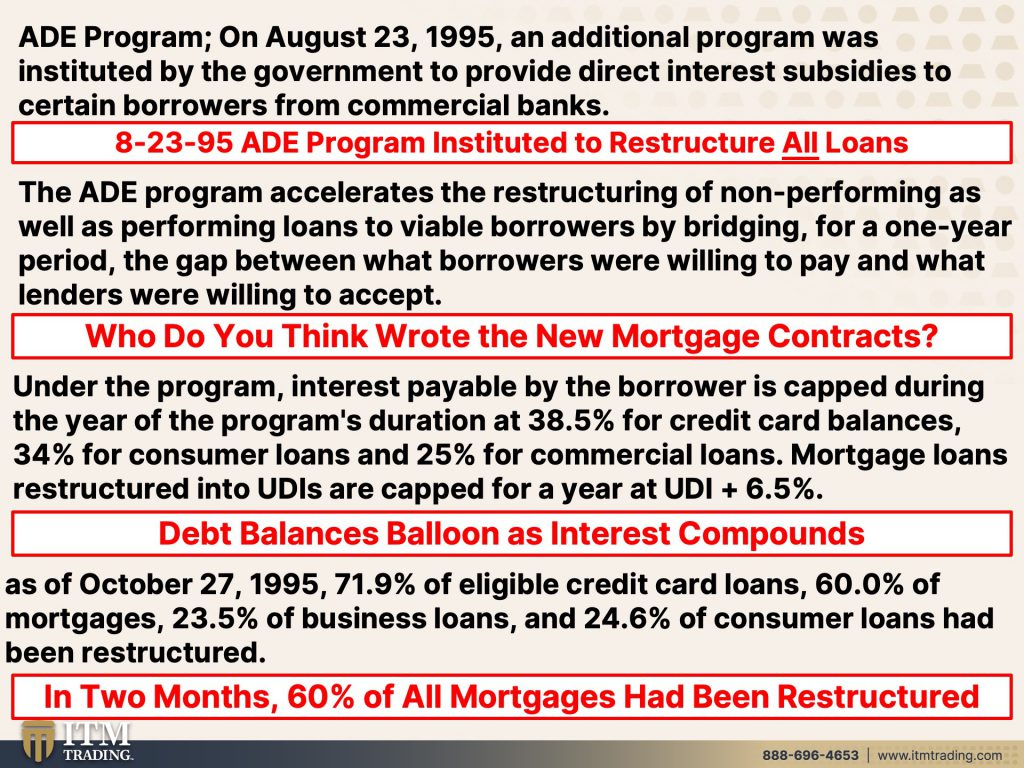

And this was about restructuring all of the loans. So even though you have a contract, governments can change the rules. And they’re about to change the rules on everything with libor coming up in 2023, but we’ll stay here for the moment. The ADE program accelerates the restructuring of non-performing. So you think, well, what if I keep paying my mortgage as well as performing loans to variable borrowers, by bridging for a one-year period, the gap between what borrowers were willing to pay and what lenders were willing to accept. So basically they gave you a year to get used to the program that was going into place, but this is all about restructuring and who writes those new mortgage contracts? Not you, the borrower. Yes, it is the lenders. Who do you think writes them? So under the mortgage, under the program, interest payable by the borrower is capped during that year, right? So they’re giving you a year to get into it used to, it kept during the year of the program’s duration at 38.5% for credit card balances, 34% for consumer loans, 25% for commercial loans. Mortgage loans, restructured into UDI’s are capped for a year at the UDI, which remember changes every day plus 6.5% percent. So if you hold any debt, this is a question that I get asked so much, which is why I wanted to go into it here. But if you are a holder of any debt that you cannot pay off prior to the hyperinflation, if it’s fixed rate, that buys you a little bit of time, but if it’s variable rate, that’s the kind of debt that you want to get rid of as quickly as possible and not carry, because any way it is going to kill you, it is going to kill you. You are never getting out of debt. You are never getting out of debt, debt, balances, balloon as interest compounds. Because if this is now the difference between what the borrower’s willing to pay or can pay, let’s just be honest about it. What have the ability to pay? and want the lenders are willing to accept. Then my bet is, and actually history supports this, that if you can’t pay all of the interest, that interest now goes onto the principal and you are compounding interest. And so you are in a much, much, much worse circumstance. That’s why it’s so important to have the ability, you know, to pay off any of that mortgage debt like that. And that’s the function of this. Okay. Not, let’s see what else I have here, not this, which is not slapped. There’s all different kinds of gold and all different kinds of silver for all different kinds of functions.

So for me personally, this is the kind of gold that I use to pay off my mortgage. And if you want to know more about that, talk to your consultant, because they’ll be able to go into that in a lot more detail.

Okay. So as of October 27th, 1995. So we were at April now, we’re at August now we’re in October, same year 95 by then, two months, let’s see 71.9% of eligible credit card loans were restructured. 60% of mortgages were restructured 23.5% of business loans. And 24.6% of consumer loans had all been restructured two months. You’re not really going to have a choice. So you want to make sure that you are in the best position possible, but for those that don’t have a choice and they start to lose their real estate. That’s what creates the real opportunity.

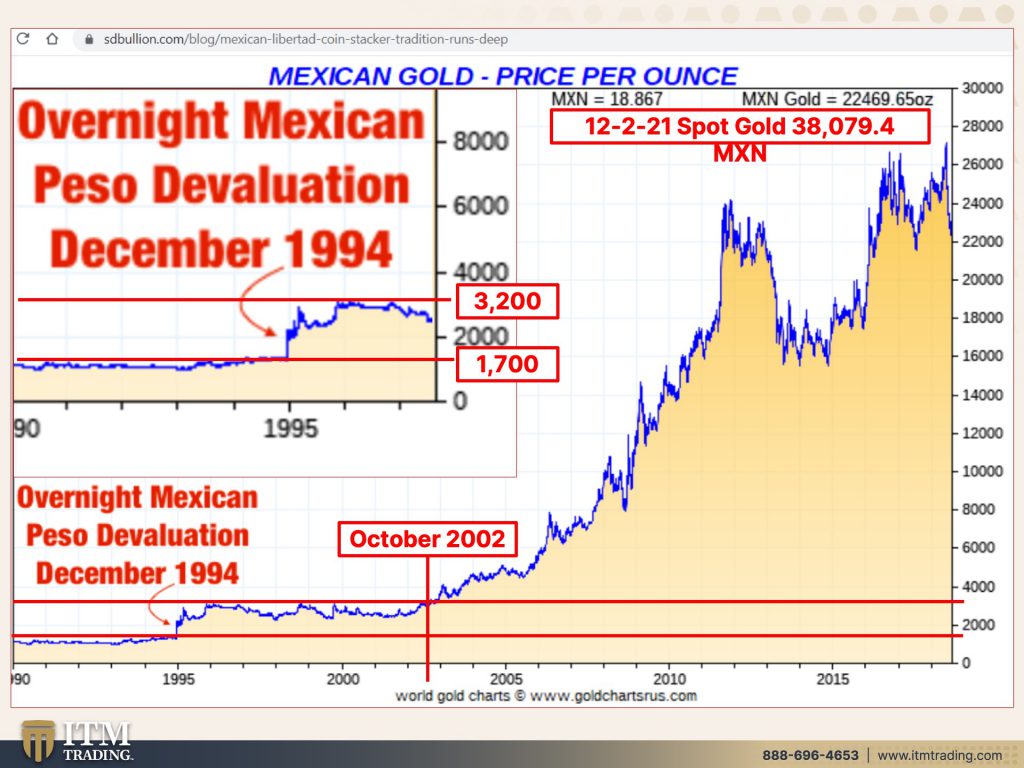

So this is gold to the Mexican peso to gold per ounce. This little area here is when that devaluation was in 94, 95. Let me show you that more closely. So you can get a better handle on, the scale of where we are, because even though they reset the currency, they didn’t back it with anything. And so all of the abuse that took place during that period of time, all of the restructuring, well, as you can see here, it continued to grow the imbalances because they’re all fiat and we are at the end. This is a global scale. That’s what I’ve been telling you. This is on a global scale. We are absolutely a hundred percent at the end of Fiat currency. This current experiment, we’re going to be entering a new one, but we’re dealing with this one now. So in Mexico, back in the mid nineties, here’s that revaluation. And just to give it a more of a scale for you, it didn’t quite, but actually it, it just about lost a hundred percent of its value. You can see that went from 1700, roughly to 3,200 that’s gold in terms of Mexican pesos. But here’s the other interesting thing because in October of 2002, that’s when I got the final technical confirmation that it was the beginning of the end of the Fiat money’s lifecycle. And this is true globally. It was true in the U.S. that’s what brought me to ITM because I saw this coming. And then I said, okay, this is where I’ve got to be. I’ve got to be in the metals and able to help people on that side. So I just wanted to throw that in there because I want you to understand these things take a long time. And I know that people can get impatient, but don’t get impatient. Just take advantage because a rise in gold price is an indication of a failing currency, these currencies are failing again. So even as they suppress the visible price through the spot market manipulations, that does not reflect the true value of an ounce of gold, particularly when you see this level of inflation. So if it almost doubled, could you pay off your mortgage pretty easily with it? Especially if you bought it prior to, so you take advantage, you buy it when it’s cheap, which is cheap, cheap, cheap. Now it’s severely below its fundamental value. And today this went through 2018. So I just pulled it up today. So you can see gold in terms of pesos are a lot higher today than they were even in 2018. And certainly in 95, you saw that.

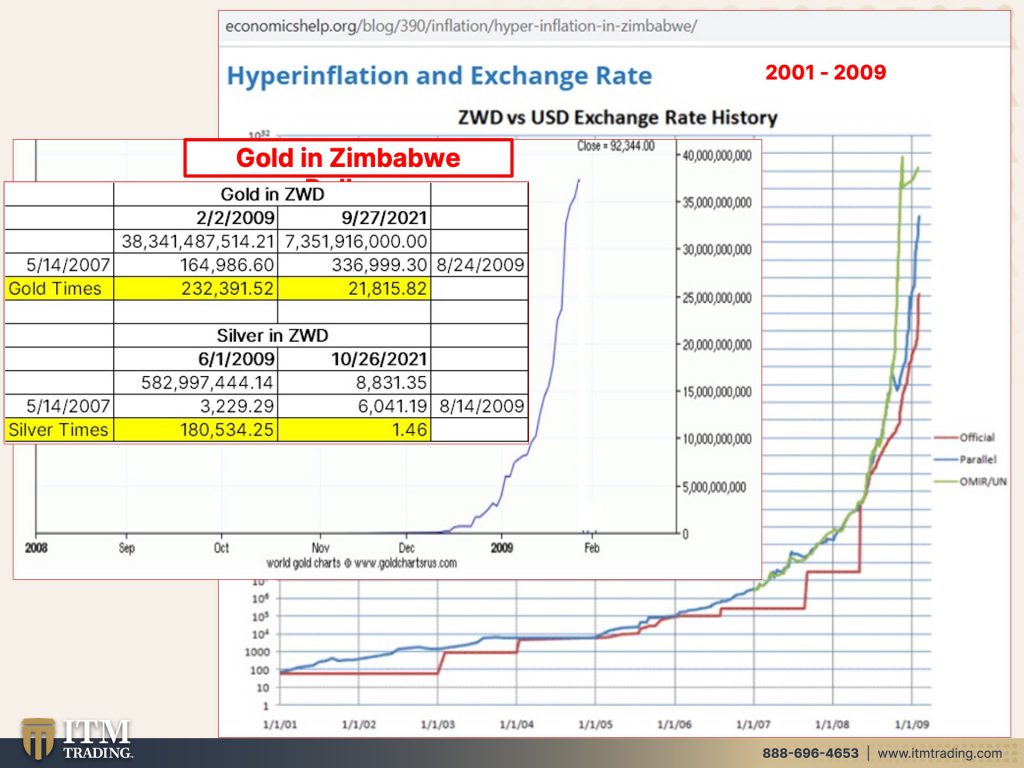

Now we’re going to go and talk about Zimbabwe. Now I happen to have a 10 Trillion Zimbabwe dollars. And on it, it says, I promise to pay the bearer on demand. Well, this currency does not exist anymore because when a government can say this is money, they can also turn around and say, not money anymore. And that’s happened many times. We’re going to be talking about that in another video. But I just thought, since this came in for a special thing that I’m doing for you guys shortly, I thought you’d like to see it. Cause I thought it was very interesting. Okay, but this is hyperinflation and the exchange rate and it’s in Zimbabwe. And it just goes from 2001 to 2009. And the red line is the official and you see, they hold it until they can’t hold it anymore. So this is inflation, the U.S. dollar both official and regular. And there is gold in your Zimbabwe dollars. Okay. You could kind of see how this has maintained its value. While this, you can’t buy eggs with it, you can’t buy anything with it. Just a little point and money for 6,000 years. Now I did this, not that long ago, back in September. So it’s still valid. And I thought I would show it to you how much gold even through the currency changes that have gone on how much gold and silver have actually held their value. As, frankly, the new currency continues to hyperinflate because you can’t just change the way that you account for things, which is what governments and central banks do. You have to change behavior. And until they’re absolutely forced to change behavior, why would they, right? Until for Powell, it became pretty darn obvious that he needed to stop saying “transitory.” When the inflation has been here since 1913, by flipping design, I’m glad he finally stopped saying transitory. Now we’ll see if he can stop buying. I mean, if he really thinks it’s a bad thing to keep buying all of these bonds and all with all of this new money, why don’t you stop now? Why do you have to do it slowly? Because the markets couldn’t deal with it and the markets are more important than you would and me. All right. Sorry about that.

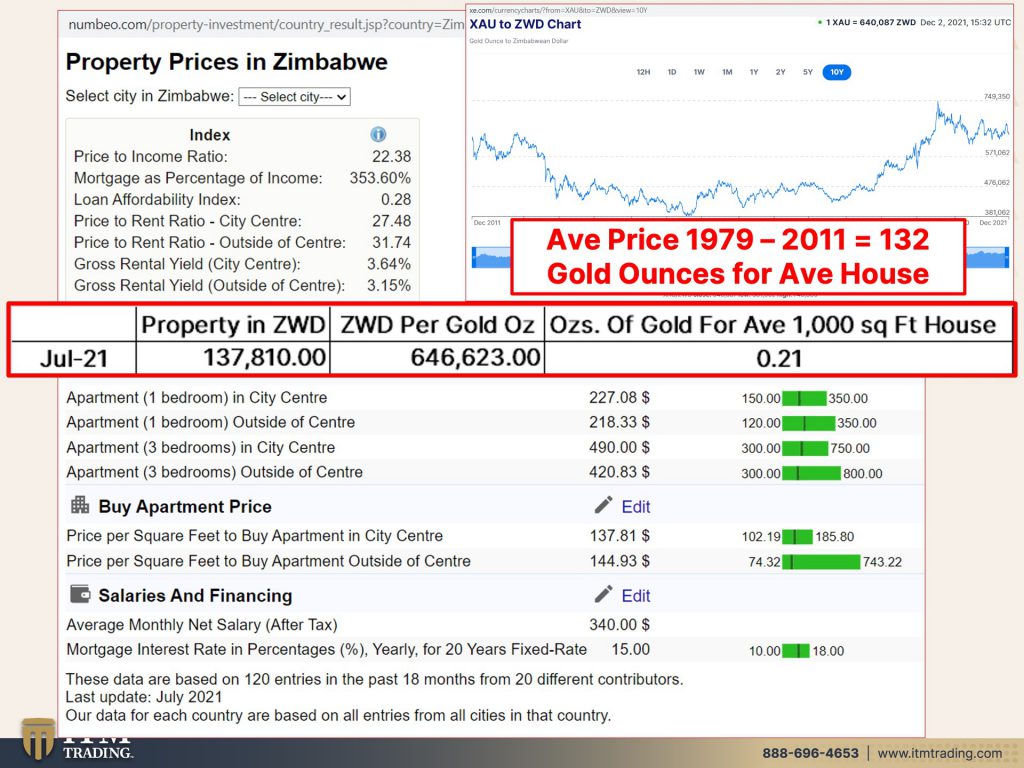

So this is in South Africa, that’s what SA is house price versus growth. And you, and then here is house prices in terms of ounces of gold. And you can see how much they really do reflect each other. But this of course only goes through 2011. However, what I want you to keep in mind as we’re going on to this next slide is that the average price of a house in South Africa, between 79 and 2011, took 132 ounces of gold to buy the average house. Okay. So there’s that number just for reference. And this is a current property prices in Zimbabwe. Now there are a few things that I want to point out here. Number one, is this mortgage as a percentage of income, it’s 353.6% to the average income, which is about 340 Zimbabwe dollars a month. So it is not particularly affordable. Additionally, if you were owning property and you are going to be leasing that out, well, let’s see gross rental yield in the city center 3.64%. Well, when the average is 10% and you’re only looking at 3.64%, it also helps, you know, how overvalued the properties are, but it’s hard if you own it and you rent it out, thinking you’re going to generate income from it. You need to have the ability if you own rental property, to support that property through a reset. Because as we saw in Germany, you know, most of a person’s income goes towards feeding themselves. Paying rent is the last thing you have to do. Plus governments put caps on it. Plus, as we saw during the Corona virus, they can say, okay, you don’t have to pay your mortgage. You don’t have to pay your rent. You know, even though the owners they subsidize the government lenders like Fannie Mae, etcetera, but the private ones, private owners of rental real estate, they still had to pay their taxes. They still had to pay their insurance. They still had to maintain the property. So you just need to be properly diversified and have gold in your portfolio so that no matter what comes up, you have money and wealth to deal with, right? Not a problem for you. That’s the goal. Okay. So as we know that this just went through 2011. Now, where are we today? Let’s take a look. I did it from July because that’s when this price was, and then I pulled the price of gold also from July in Zimbabwe dollars. So what once took 132 ounces to buy the average house now takes 0.2, one ounces. Can you see how a little bit of gold can buy an entire city block buildings and all? These are the opportunities that come in front of us, lie in front of us. As long as you have the gold to work with. That’s the key, because this will buy you, nothing, nothing. This will buy you lots of good stuff and things that you can then generate income on the other side of this mess.

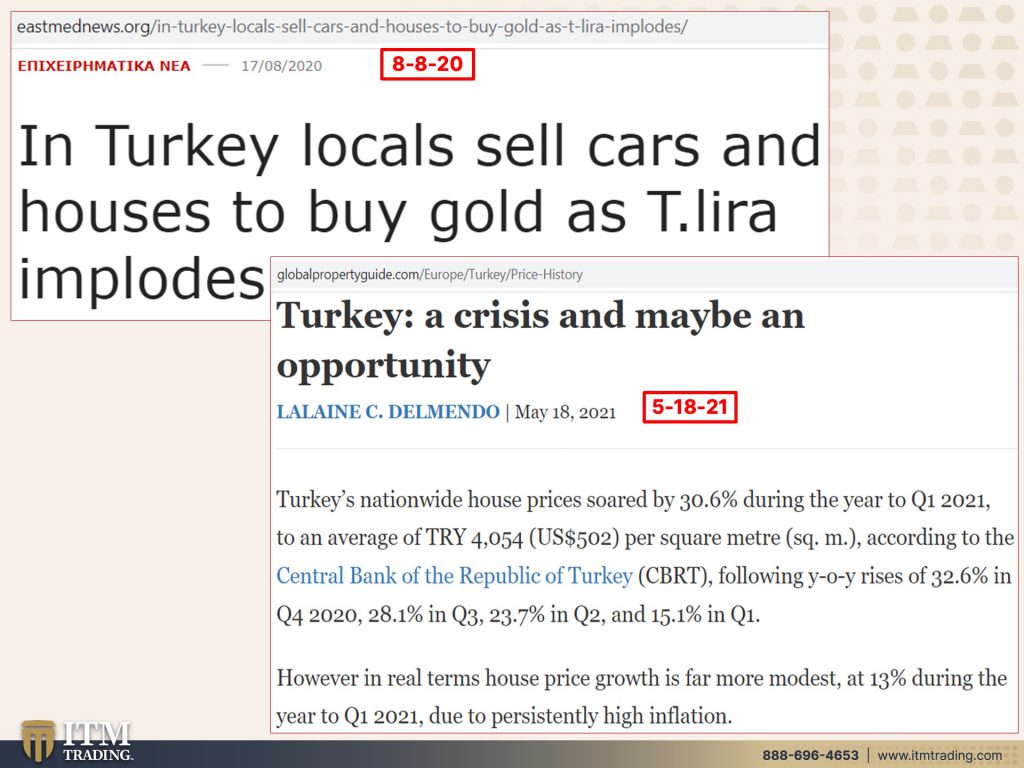

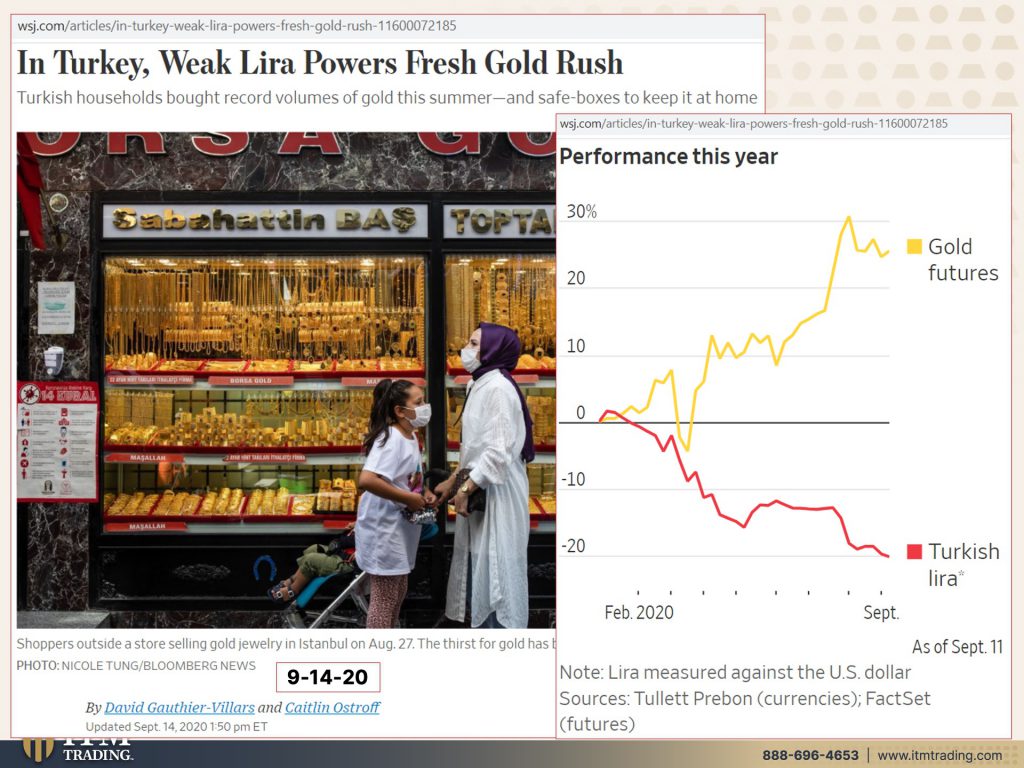

So let’s look at Turkey because we all know that Turkey well, I’m thinking we all know that Turkey’s currency is in major freefall right now. And Turkey’s President and central bank is approaching it differently than the traditional way, because they’re saying, he’s saying or is saying that the high interest rates are what’s causing the inflation. So what is he doing? Dropping interest rates into the high inflation and the markets don’t like that the Lira is not doing well at all, but this was back in 2020 Turkey, local sell cars and houses to buy gold as the Turkish Lira implodes. Well, it’s not over yet because no behavior is changing, but it does create an opportunity because the government, which I’m going to show you in a second, made some tweaks and changes just like they’ve done here and in Europe and all over the place to try and keep the, the real estate market inflated. And I’ll show you that in a minute. So did pretty well for a while because of the choices that the government made, but you also have people realizing it because Turks are more used to holding their wealth in gold. And you can see here’s the Turkish Lira. Now this is as of September 11th and there’s your gold spot. Spot is a contract. Again, does not reflect the true fundamental value of an ounce of gold, but Turks know that what it is. I know what that is. Anybody that’s lived through an inflationary, a hyperinflationary event knows what that is. And that’s probably why the Bank for International Settlements told us that gold held that home runs no political risk and is proven to be an effective inflation hedge, as well as a crisis hedge. Words to live by words, to not forget.

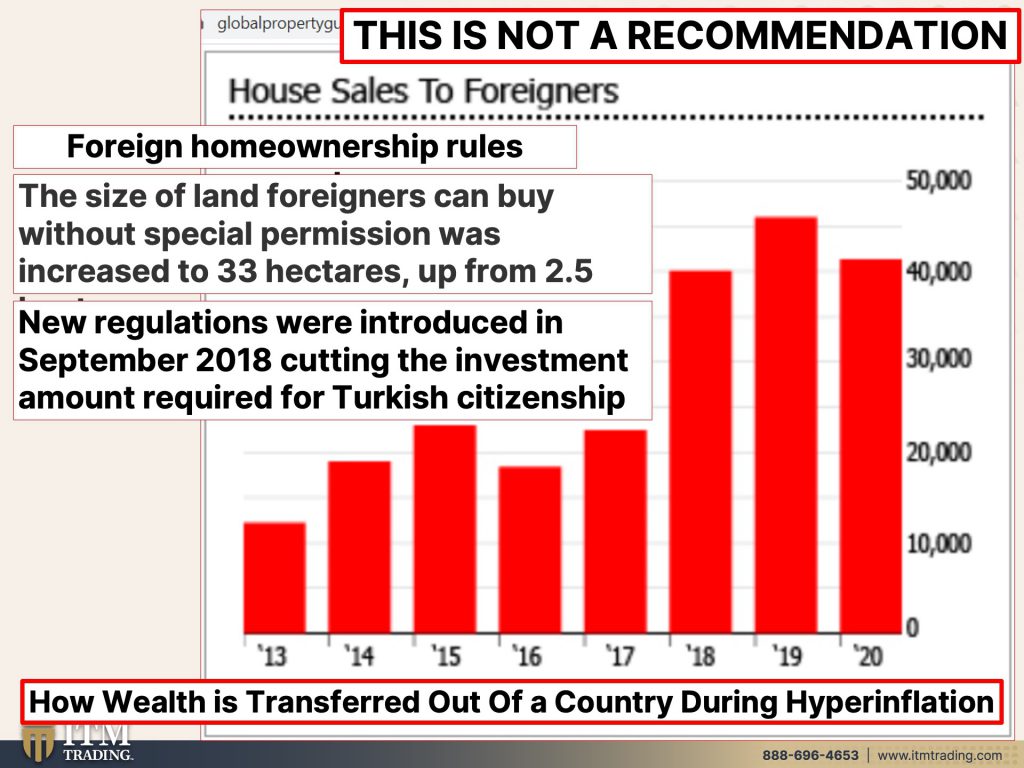

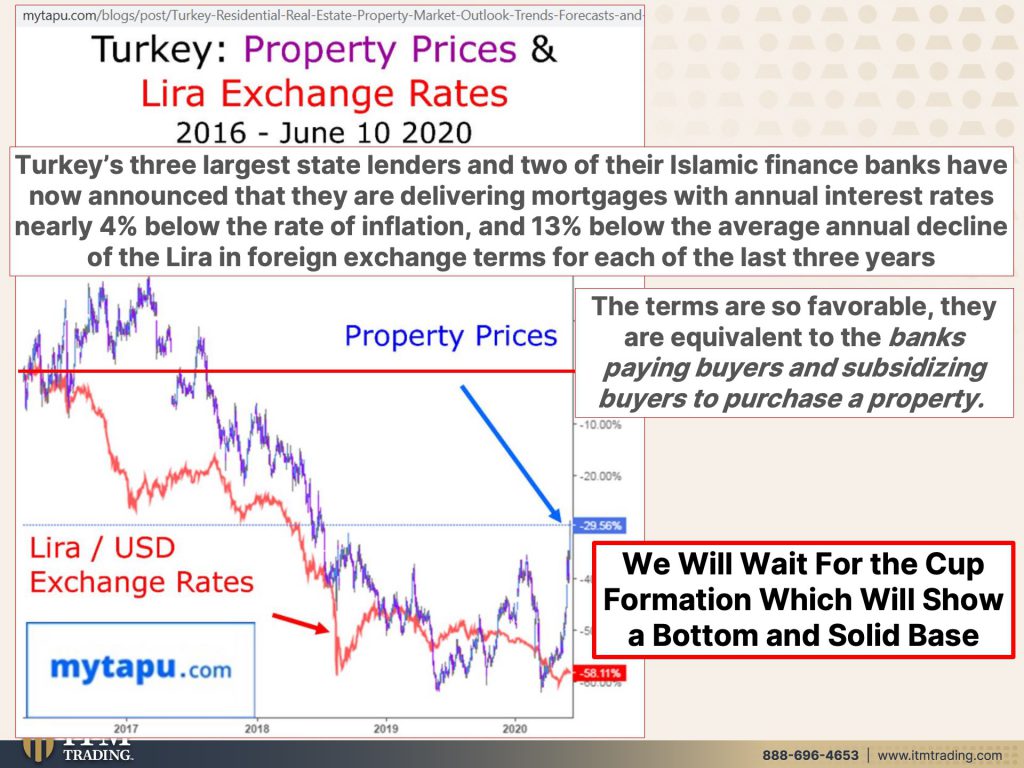

Now, I want you also to know that what I’m about to show you is not a recommendation. I’ll let you know when I am making a recommendation, but this is not it okay, because what the government did was change a lot of the rules for the foreigners to attract money outside of the country. But during a hyperinflationary event, this is how wealth transfers from the locals to foreigners. This may be something that you want to do, not yet, but maybe so. We’ll see. We have to, we just have to be patient and, and allow things to unfold. But if you’re sitting on a bunch of gold, then you’re going to have more opportunities wherever you are, than if you’re sitting on a bunch of Fiat, you’ll lose those opportunities. So they just ease the rules up so that, you know, the size of the land they could buy was a lot more. And to get Turkish citizenship was a lot less. And so, you know, this is how they attracted a lot of foreign buyers. And you can see that as the Lira declined in value against the U.S. Dollar, against gold, all right, you see what happened to the property prices once they changed those rules and they also did a bunch of things to basically give the houses away. But what I want to point out here is that this is zero right here. So here are your property prices. They’re still well below where they were back in 2018. Okay. That’s when it crossed that line, I will point out this little gap right here. I remember I told you, it doesn’t matter what you’re looking at when something gaps up or something goes down, the price must rise or fall to fill that gap. And here you go, you got it right here. So that gave you a little bit of hope, but what they were just doing, what was really happening was there was a technical fill of this gap. However, once they changed the mortgage laws, once they opened it up to more foreign investors, well, yeah, property prices rose. And we were seeing that on a global basis happening everywhere aren’t we? Turkey’s three largest state lenders and two of their Islamic finance banks have now announced that they are delivering mortgages with annual interest rates, nearly 4% below the rate of inflation and 13% below the average annual decline in the Lira and foreign exchange terms for each of the last three years. So you’re able to borrow money below the cost of capital, which is typically what corporations get to do, but wow, in Turkey, they’re allowing anybody to do that. Anything to boost real estate prices, the terms are so favorable. They’re equivalent to the banks, paying buyers and subsidizing buyers to purchase a property. Now, who’s it really costing? It’s costing all the Turkish people because the currency has virtually no value now, but they know that that’s why they’re rushing to buy gold. Now you might say to me, but look, it it’s going up. I mean, that’s the trick. You get things to go up and then people go, oh, I’m fear of missing out FOMO. I want it. I want it. Well, is this the time to buy it? No, it is not because there is not yet a solid base and a solid foundation from the asset needs to rise. We will be looking for this cup formation. And once we see that come into play, then we will know that we are somewhere near a bottom. This is not a cup. It’s too sharp. So we know that this rise is due to manipulation and changes through the government, through the central banks, wherever, right? That’s not what we’re looking for. We’re looking for a base, okay. It’s not going to be so smooth. You know, what’s going to bounce, but we will see a base. And when we start to see that base, move up slowly like that, then we’ll call it good. And then that’s the time to convert some of this, not all of it, some of this into income producing real estate.

So let’s take a look at this in terms of Turkish liras. This is as of December 2nd, I know the Lira has fallen even more today, but this will give you a basic idea. Now this is also current average price for a hundred square meter property. And there you go, right there, there are the prices. So taking the most expensive let’s see I’m probably butchering that. I’m sorry. But if we take the most expensive property divided by the current price of gold, in terms of the Lira, now only 3.09 ounces to buy the average house thousand square foot house. There you go. And it’s going to get better because you saw how much those home prices have risen because of all the manipulations. So it’s going to get much better than that. And there’s your 25 ounces of gold to buy, sitting block buildings at all. Now I know that we talked about Germany in the first video, but I wanted to do like full circle because Germans have this experience and they have the hyperinflation in their not too distant past. Now in America, we’ve had that as well, but it was prior to 1913. And so people forget about it and they think that can happen here. Yes, it can. Actually, I happen to have just like, there’s no value left in this. Well, guess what? This is a $10 gold certificate and I can’t use it to buy anything with now. I bought this and it cost me, I don’t know. I don’t remember maybe a hundred bucks or something like that, maybe. Right? So there’s where its value is, but this is no longer good currency because it’s a piece of paper. This however is still good currency. Still good currency. All right.

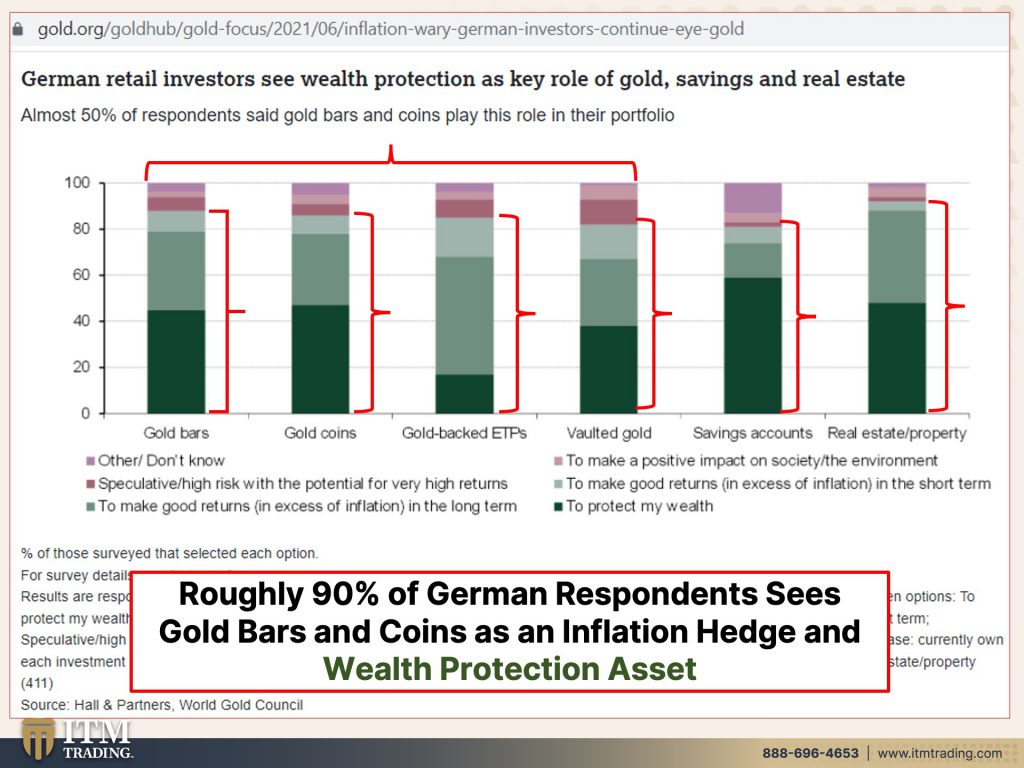

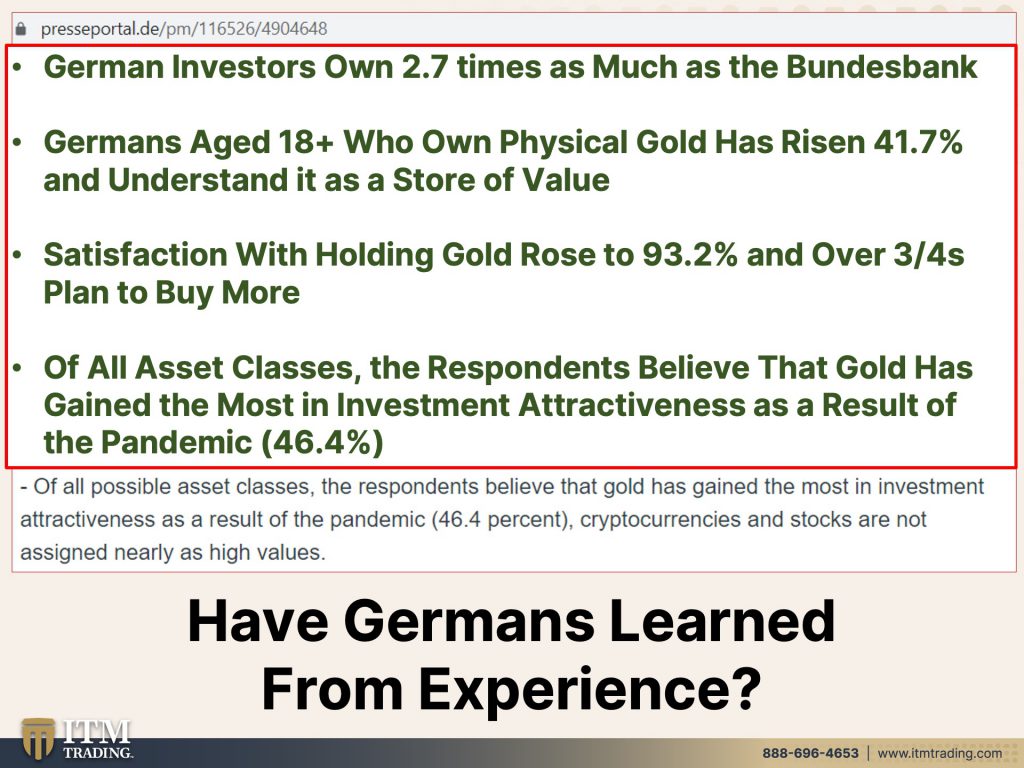

So this is, this was a survey done by done with German retail investors. And they wanted to talk about what they thought was good for wealth protection, et cetera. And what as a key role of gold savings and or real estate. So this is savings and the areas that I have kind of well with the brackets around speculative. No, no, no. To make good returns in excess of inflation, in the long run to make good returns in excess of inflation in the short run and to protect my wealth. Okay. So those are the three areas I was looking at. These are savings. Will that actually do what people are wanting it to do, protect them from inflation? You’re right in the fire with that. Then the other one was real estate. And people really think that that will work, but I’ve just shown you six different countries. And there’s like another 4,800 that you could look at. And you’ll see a very similar pattern that shows you that real estate does not work because it’s pumped and then dumped. You gotta have a place to live. I’m not telling you to sell your real estate, but I am telling you that you need to make sure that it’s protected and you need something that’s liquid to do that. And then here, here, here, and here, these are all gold. These are the bars coins, gold back ETP’s. Now these two are the intermediate and short term. So you can see that this is much more of a trading vehicle. The dark green is just to protect my wealth. You’re just going to hold it forever. These ETPs, ETFs, those don’t work because you don’t own gold. What you own is a contract that’s designed to imitate the manipulated spot markets. So even though people perceive that they’re protected, they’re not protected because the only thing you can do is convert them back into those currencies that have lost all value. And then finally vaulted gold. So if you look at these first two, particularly gold bars and gold coins, this is physical that you hold in your possession. Now for me, I don’t do anything with bullion. So I don’t have any gold bars and I don’t have any new coins. This is what I like because of my experience with my uncle Al. And I know many of you heard this a million times, but for those that have not heard it, and this was such a big influence on me in 1965, my uncle showed me two huge floor safes that were packed with pre 33 gold coins. It was illegal to hold more than five ounces of gold in 1964, except in the way that he was holding it. Yeah, that influenced me a lot because we’ve had a covert confiscation by price manipulation for ever for long before I was born. And all we’re waiting for is the overt form of confiscation. Is that going to happen? I don’t know, but if I’m holding this, frankly, it doesn’t matter whether I’m right or I’m wrong. I have the kind of gold that is less likely to be confiscated and that I can therefore use in the normal marketplace to buy up those income producing assets when the time is right. And we see that cup formation. So just to point this out, though, roughly 90% of German respondents sees gold bars and coins as an inflation hedge, and a wealth protection asset in line with what the bank for international settlement says, they’re right. The rest of these, the ETPs, they’re wrong about that one, a vaulted gold, maybe, but if you don’t hold it, you don’t own it. So you’re still running counter party risk. So for me, it’s the coins. And particularly it’s the pre 30 threes because it’s less likely to be confiscated. Plus there are other nuances. You just have to remember that there are everything needs to start with your goals, your goals, your circumstances, and then you allow that to drive what products you position yourself into, but that’s where you always have to start. What is it that I’m trying to accomplish? What is it that is really important to me?

And I see viewer question. I’m going to answer this question now. Thank you for putting that up. What happens to a country like Canada in a reset when the central bank holds no gold? We’re going to find out Wesley, but chances are pretty good. They will not be particularly powerful. And the new regime that’s coming in, that’s why we’re seeing most global central banks accumulating gold because yeah, I mean, Bank of England did that back in the what seventies kind of thing. Wasn’t very smart of them. And, and it was proven to be not as smart move. I think that’s, what’s going to happen to Canada as well because they have, they have, will have absolutely nothing to help them maintain their power in the global community. So my guess would be that any debt that they issue would come with a higher coupon, a higher interest rate on the global scale, they’ll do whatever they’re going to do locally, but globally, they just will not have the same level of influence even that they have today because that’s not as prevalent, but it’s getting there.

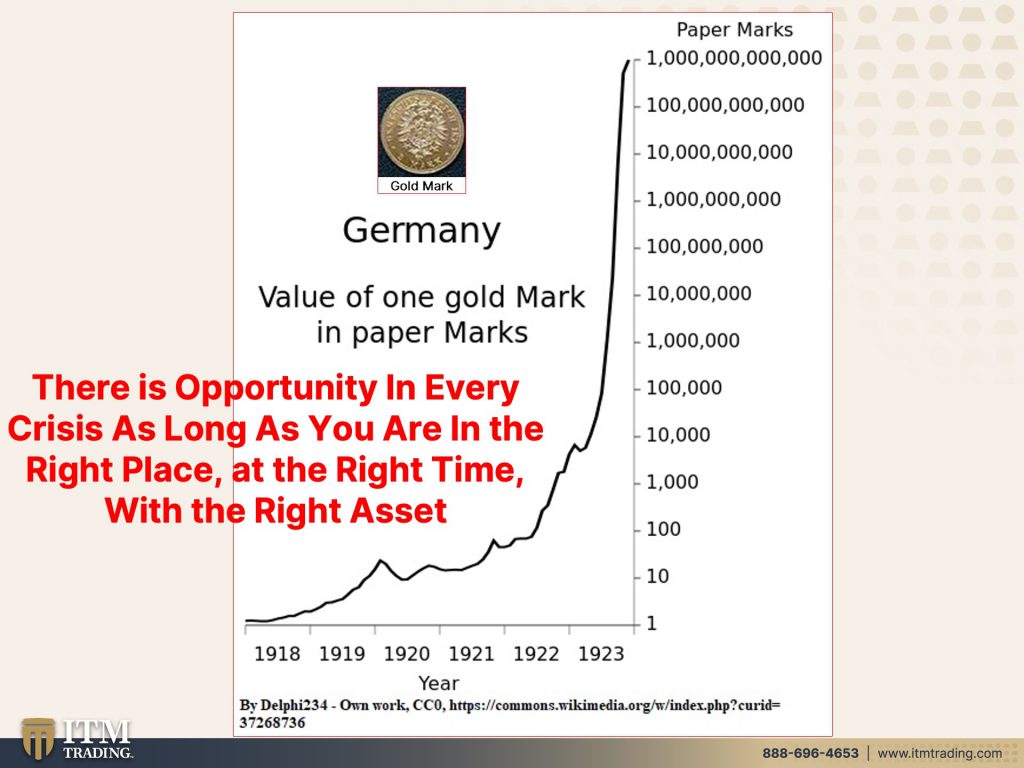

So, okay, let’s go back to, let’s go back to Germany and finish this up because what they discovered in this study is German investors own two point times as much as the Bundesbank as much gold as the Bundesbank owns. So I don’t know. Does that mean there’s going to be an over confiscation there? Well, there, they’re doing some really heavy handed stuff right now, so that wouldn’t really surprise me, but we’ll see this one, I loved loved Germans aged 18 and over who owned physical gold has risen 41.7% and understand it as a store of value, especially with the younger generation. So, you know, the younger generation actually recognizes perhaps some of the lessons of the past. That’s why they’re buying so much gold these days, satisfaction with holding gold rose to 93.2% and over three quarters plan to buy more. I’m very satisfied with my gold holdings. I bought more. I’m constantly buying more. So we’re right on target with that. And of all asset classes, all of them, the respondents believe that gold has gained the most investment attractiveness as a result of the pandemic, but most investment attractive. Let me just kind of clarify that, in the face of global central bank money printing and pushing for currency devaluations, and we’re in this huge test right now, because you’ve got some countries that are raising interest rates, other countries that are keeping them where they are, or even lowering interest rates. Central banks are between a rock and a hard place. We’ve got a global slowdown. So their theories would tell them that they need to lower the interest rates to inspire borrowing and spending. On the other side of that, you’ve got a supply chain bottleneck, and you have, and you have spiking inflation on a global basis. And so in their theory, they have to raise the interest rates, but either way, it’s not going to make a difference because this isn’t a demand problem, yet, because we’ve given so many people so much money, it will become a demand problem, but it’s a supply side problem and interest rates up or down, do not fix that. But you have to ask the question, have Germans learned from experience? Because what’s their experience? It’s this, this is their experience. They know what happens when a currency is absolutely printed into oblivion.

What I want you to see is that there are opportunities in every single crisis, but you have to be in the right place at the right time with the right asset in order to take advantage of them. And because calling it on a moment to moment basis is virtually impossible. I mean, I have a crystal ball. I even have a magic eight ball. Let’s see, what are the market’s going to turn? Oh, it looks a bit cloudy. Yeah, you think so? I would always rather be. I don’t care how early I am. I just don’t want to be one second too late, because if you’re one second too late, that’s it, you’ve lost all opportunities and what we know and what central banks, hey, the BIS, the Bank for International Settlements is a central banker, central bank. And what they have told us is that gold is the proven inflation and crisis hedge. What are we dealing with? We’re dealing with inflation and crisis. So if you haven’t done it yet, get your gold and silver, stop procrastinating. Please stop procrastinating. And along with your gold and your silver, you need food, water, energy, security, community, and shelter as well. These are all the things that we need, regardless of what’s happening in the economy. Gold as a foundation and silver, physical in your possession as a foundation for your wealth, puts you in the best possible position to weather the storm, proven for thousands and thousands and thousands of years, there is nothing else that can say that, nothing.

So if you like this, please give us a thumbs up. Make sure you leave a comment and make sure a hundred percent that you share, share, share, share, share these videos. Like Eric said yesterday. Okay. So we’ll look crazy. You don’t have to look crazy, but this is all data that you can go in and you can track and I’ve made it easy. You have all of the links and remember, you can listen to this anywhere, anytime on our podcast, because we’re on every major platform. And if you haven’t yet started your strategy, click that Calendly link below and schedule a time with one of our consultants. And remember you want to talk about your goals first, your goals, your circumstance, what you have to work with, get your strategy together for your gold and silver as a foundation. But again, also food, water, energy, security, community, and shelter. These are all critical and they need to be done. Now. They really need to be done. Now don’t wait. Don’t wait.

So until next we meet, you know, it is a hundred bazillion times important to cover your assets here at ITM Trading, we use gold and silver as the foundation to the wealth shield because you know, I mean, if you’re counting on this to protect you, I can do that with that. Let me see. Can I do that with this? Nope, because financial shields, good ones are made of metal, not paper or promises until next we meet. Please be safe out there. Bye-Bye.

SOURCES:

https://www.imf.org/external/pubs/ft/wp/2001/wp0150.pdf

https://www.elibrary.imf.org/view/journals/001/2013/129/001.2013.issue-129-en.xml

https://www.longtermtrends.net/real-estate-gold-ratio/

https://scholarlycommons.law.northwestern.edu/cgi/viewcontent.cgi?article=1420&context=njilb

https://es.wikipedia.org/wiki/Unidades_de_Inversi%C3%B3n

https://fred.stlouisfed.org/series/DEXMXUS

https://sdbullion.com/blog/mexican-libertad-coin-stacker-tradition-runs-deep

https://www.cnbc.com/2011/02/14/The-Worst-Hyperinflation-Situations-of-All-Time.html

https://investorchallenge.co.za/whites-cant-own-land-in-zimbabwe-excellent/

https://www.numbeo.com/property-investment/country_result.jsp?country=Zimbabwe

https://www.theglobaleconomy.com/Zimbabwe/herit_property_rights/

https://housepricesouthafrica.wordpress.com/graphs/#Real%20annual%20chart

https://twitter.com/steve_hanke/status/1171463820545409024/photo/1

https://www.economicshelp.org/blog/390/inflation/hyper-inflation-in-zimbabwe/

https://www.cnbc.com/2011/02/14/The-Worst-Hyperinflation-Situations-of-All-Time.html

https://investorchallenge.co.za/whites-cant-own-land-in-zimbabwe-excellent/

https://www.numbeo.com/property-investment/country_result.jsp?country=Zimbabwe

https://www.theglobaleconomy.com/Zimbabwe/herit_property_rights/

https://www.globalpropertyguide.com/Europe/Turkey/Price-History

https://eastmednews.org/in-turkey-locals-sell-cars-and-houses-to-buy-gold-as-t-lira-implodes/

https://www.xe.com/currencycharts/?from=XAU&to=TRY&view=10Y

https://www.wsj.com/articles/in-turkey-weak-lira-powers-fresh-gold-rush-11600072185

https://www.properstar.com/buying-property/turkey/house-prices

https://www.gold.org/goldhub/gold-focus/2021/06/inflation-wary-german-investors-continue-eye-gold

https://www.presseportal.de/pm/116526/4904648

https://www.jstor.org/stable/4545563?read-now=1&seq=9#page_scan_tab_contents