What Mainstream Media Won’t Be Telling You.

🗣 Remember The Great Recession that followed the subprime mortgage crisis in 2007 and 8? Liquidity dried up and credit markets froze in 24 hrs. The markets imploded while interest rates exploded, banks got bailed out as the public essentially went bankrupt. The Great Recession was the start of the money printing fiasco which is now running it’s course into a complete collapse of a system that was slated to fail from the start. All of that was a complete joke compared to The Great Reset which is now here. There’s two major differences from the Great Recession to the Great Reset. First is this has now become a global collapse situation. It’s the exact meltdown central banks did everything they could to avoid after 2008. Second is the final trigger that will take everything crashing down. They are strikingly similar as it relates to banks lending money to those who can’t pay it back. After over 50 years of research on economics and global currency resets, it’s my job to show you what’s happening behind the scenes -while there’s still a tiny bit of time for you to do something about it. Here’s what they will not be telling you on mainstream media…coming up!

CHAPTERS:

0:00 Introduction

1:42 CDO vs CLO

6:40 Wall Street CLO – No Rules

12:10 Dividend Payout

22:08 UBS Warns

25:40 Big Pile of Trouble

31:50 Gold Buyer Base

TRANSCRIPT FROM VIDEO:

But subprime is tiny. Subprime is a tiny, tiny blip. It’s not tiny. And again, it’s not just subprime. It’s the entire mortgage market. What In the world is happening on Wall Street? Let’s talk about the speed with which we are watching this market deteriorate. 2008, that was when this system died, liquidity dried up and credit markets froze. Boom, 24 hours, the markets imploded. While interest rates exploded, banks got bailed out. The public essentially went bankrupt. All of that was a complete joke compared to the great reset that I’ve been talking about since 2009. This has now become a global collapse situation. It’s the exact meltdown of central banks that did everything they could to avoid that after 2008. It’s the final trigger that is way bigger than personal mortgages that will take everything crashing down and be too big to bail out. Coming up.

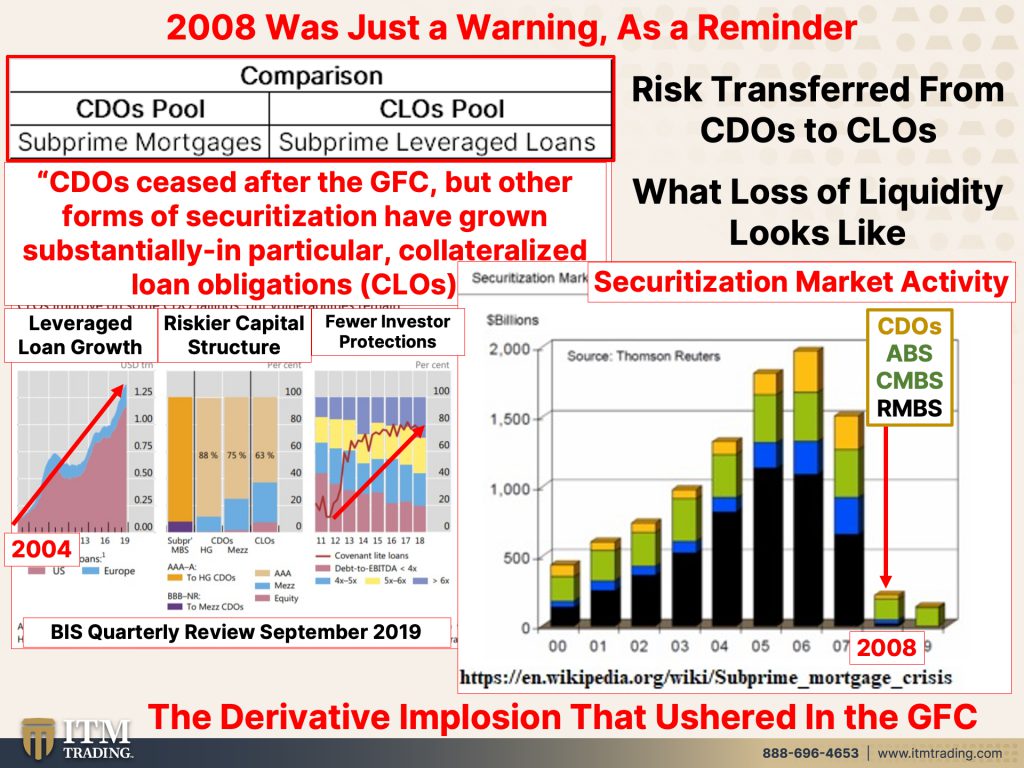

I have so many people that just ask me like, When, when? Well, I think the time is very, very close. Let me show you what I mean. Let me take you back to 2008, and here we are in 2022. This is a piece from the bank for international Settlements as Central Bankers Central Bank. And what they’re talking about here is the difference between CDOs, which is what top of the system. And what that is is a pool or a cluster bringing a whole bunch of subprime below credit, low credit quality mortgages together into a pool. And then somehow when you mixed all what they used formulas, and when you mixed all of those subprime mortgages together, they magically became AAA rated. And as AAA rating, they can go in many different investments like pensions and retirement plans, et cetera. So the CDO was a pool of subprime mortgages.

They essentially went away after the great financial crisis, But other forms of securitization, and remember, we’ve talked, everything’s been turned into a security have grown substantially, in particular collateralized loan obligations. So c l O, and again, that’s a pool or a bunch of subprime or below investment quality corporations that have borrowed and leveraged. So debt upon, debt upon debt. And then those, all those loans are put into this big pool of loans and chopped up and sold. Well, you know, really what’s happened is simply that the, the leverage loan growth took over where the subprime left off and it’s grown extremely quickly. And because everybody’s reaching for yield, thanks to the Federal Reserve and other global central banks dropping interest rates to zero. And there’s more to this. But additionally, because people were searching for that yield, they were looking for, they, they overlooked frankly, a riskier capital structure.

In other words, we’re gonna talk more about that as we move forward. But these are corporations that frankly, I wouldn’t wanna loan my money to. But hey, if they’re giving you more interest, although why you would risk your principle for the poultry little bit of interest they were paying, it’s beyond me. But at the same time that the capital became riskier. Well, those investor protections that were put in place after 2008 in the Dodd-Frank Act, eh, they were removed. Who needs those investor protections? So the chances of those that own CDOs by particularly individuals, I don’t think they really realize the risk that they’re actually taking. So in reality, we saw the risk that was transferred from CDOs no longer. Cdos aren’t around anymore to cs, but a higher level of risk now exists. Let me remind you of what the loss of liquidity. We’ve been talking so much about liquidity, the ability to buy and sell.

Whenever you have a market, you have to have buyers as well as sellers, or you do not have a market. And in 2008, I think you can see this is securitization market activities. So buyers and sellers of these assets were assets. These derivative products, which is what all of this is, is just a derivative. They went to nothing. That’s why I said earlier, 24 hours, some of you may remember it, those that were working in the mortgage industry at that time, I’m sure you certainly remember how quickly those markets dried up. So it was the derivative implosion of what we kept being told with just a little teeny part of the market like nothing. And yet that was the cause. The lack of liquidity in there ushered in the great financial crisis. All right? After that, you know, they put in all these investor protections and you also know that a lot of them actually never even were executed before they started removing them again, right?

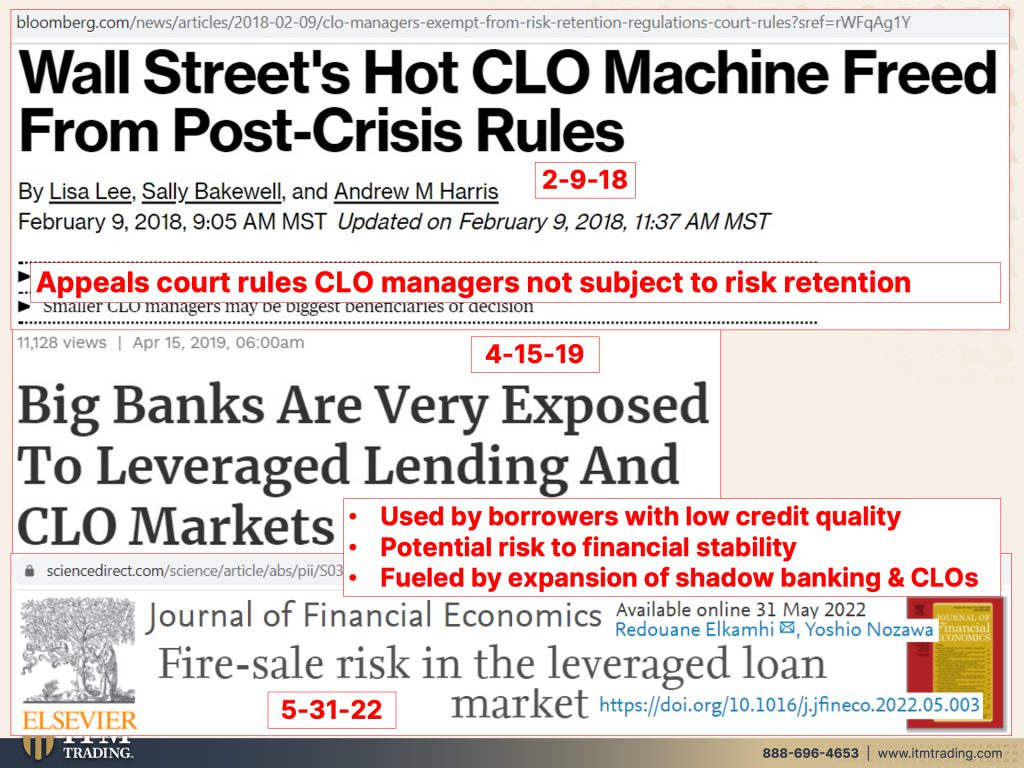

So we put in safety, we’re gonna see that again when they put a component of gold in the new currency to get everybody to trust it, to go back into it, to use the new currency. And then they’ll start to take the gold out just like they’ve done before. And just like they did here, right? So first they put in all these investor protections. You can trust it, you can feel confident. But then Wall Street’s hot CLO machine freed from post-crisis rules. Hallelujah. Really the appeals court ruled that CLO managers are not subject to risk retention. And what that means is they don’t. They can create all of this garbage and they don’t have to keep any on their books. That was one of the laws that was put in place, One of the rules rather, that were put in place because they felt like if the banks had to hold some of the bad, some of that, whatever they’re creating on their books, that they would take less risk.

All right, well, 2008, nope. Don’t need to keep any of that garbage on our books. We can make it as junky and garbage as we want. Except that the big banks, these commercial banks like Chase and Bank of America and City, all the ones that hold all of the derivatives in the F D I C insured banks, they are very, very exposed, right? Everything is interconnected. But how are these CLOs used? Because you need to be aware of this. They’re used by borrowers with low credit quality and they do form a risk to financial stability because they’re integrated throughout the system, not just in the banks, but in a lot of the financial products. If you have ETFs, mutual funds, annuities, variable annuities, et cetera, if you have any products at insurance companies, you could very well be exposed to this and not even realize it.

But whether you own them or you don’t own them, because the system is so incestuously integrated, everybody is going to feel this. And finally, this has been an expansion into shadow banking. Now, what does a shadow bank? A shadow bank is an entity that does a lot of what a traditional bank does, except that they do not take in deposits. Now, deposits in theory anyway make bigger banks less risk. Well, they don’t really make them less risky. I mean, you’re, once you make that deposit into their, into your account, then they’re moved into subaccounts and they can do as many seal. They can do anything they want with it once that equity is in your name. But you have to understand that with what the banks went through, and I’m sure you’ve heard how much safer the banks are now. Well, a lot of that activity, including the CLO activity, was moved to shadow banks.

So banks that do everything pretty much that main banks do, but they don’t have those deposits to use as a source of funds. And this is really a key thing. And I’m gonna come back to this. Bear with me. I’m coming back to it in a minute. Because now in a recent article, fire sale risk in the leverage loan market, because prices, well, as interest rates were staying low, the prices of these CLOs kept going up. You remember how interest rates, right? How interest rates and bond principles work, right? When interest rates were going down and being held down, bond principle loan principles went up. But now we’re in the reverse circumstance. So as interest rates go up, it impacts the principle of all of these loans. Why does that matter to you? Because banks and shadow banks have valuations that are based upon the value of the loans that they hold and some other things as well.

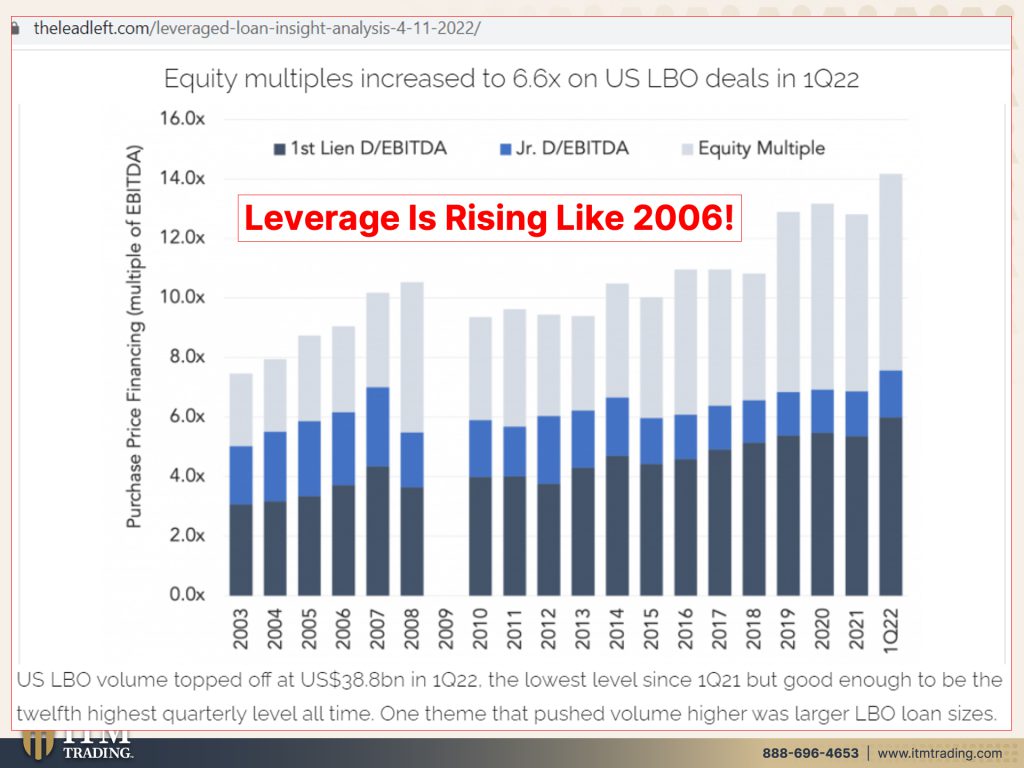

So that means as the interest rates are rising, these companies and those, that the lenders that issued these these clo that well, the leveraged loans and then the leveraged loans are put into as a pool put into a clo, right? They are risking their value, their our valuations are falling. It’s just that simple as that, right? Interest rates up principle value down, that makes it even harder to service the loans. Cause remember, these are loans were given to corporations with very bad credit ratings. In fact, we’ve got leverage levels that frankly are rising like they did in 2006, and they’re well above where they were in 2006. Here we are leverage, right? So leverage is debt upon debt upon debt upon debt and e and ebida, which you see here, E B I T D A earnings before interest, taxes, depreciation and amortization, right? So I don’t care what they say. Here is the evidence of the level of leverage that is in these corporations here in 2022. They can’t pay these loans back.

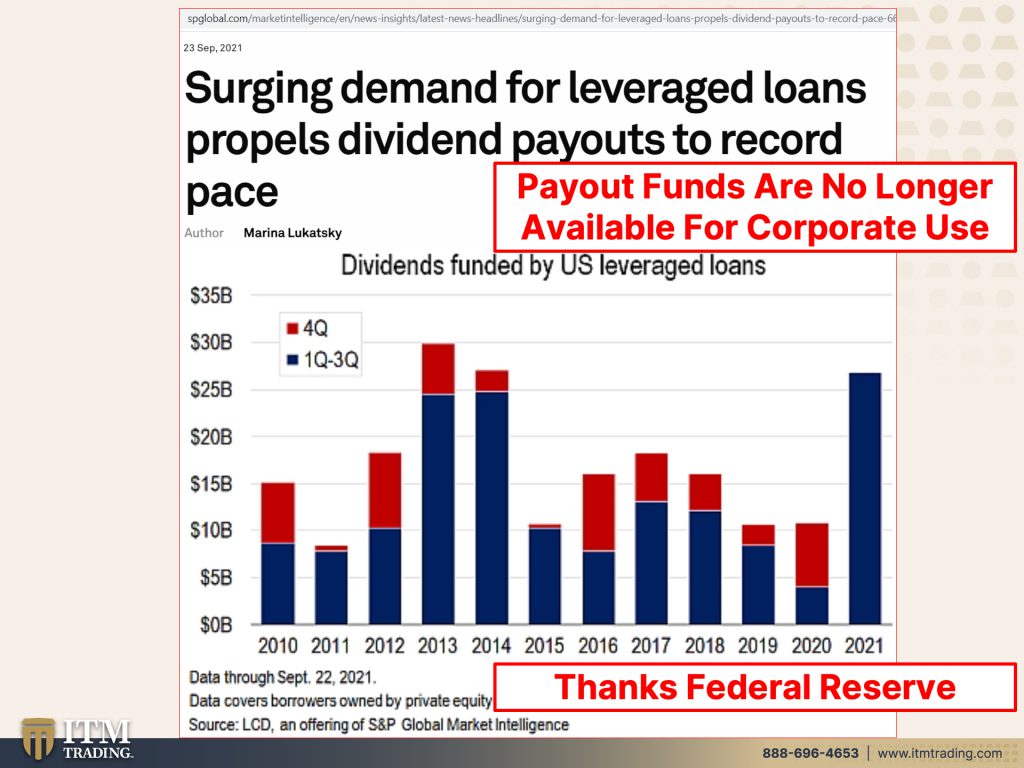

And let’s see, what were those loans used for? Many of them? Surging demand for leveraged loans, propels dividend payouts to record pays dividends, right? So the payouts, once they borrowed this money, it didn’t stay in the corporation to make the corporation better, to expand, to generate more money. Heck no, we don’t need all that money. We can borrow it cheap and easy. They use this money to pay out dividends. That means that money went out of the corporation. So what happens if the corporation gets into trouble and they have trouble repaying these loans? You tell me the money’s not there and you can’t get blood out of a stone, right? You can’t. So we haven’t entered the third, the fourth quarter yet. And actually this only goes, well, this goes through 2021, but you can see how much higher surging demand for leverage loans and these loans were paid out in dividends. That’s pretty substantial. And the key here that I want you to really think of is that once that money goes out of the company, it is no longer available to run your business or repay debt or frankly, do anything else. Thanks a lot. Federal Reserve. I think you, you know, much as you wanna say the banks are in a better position, which I don’t believe anyway. It’s not, look at all the d the derivatives they’re holding, but the corporations are in a much worse position. These are the guys that you bailed out in 2008.

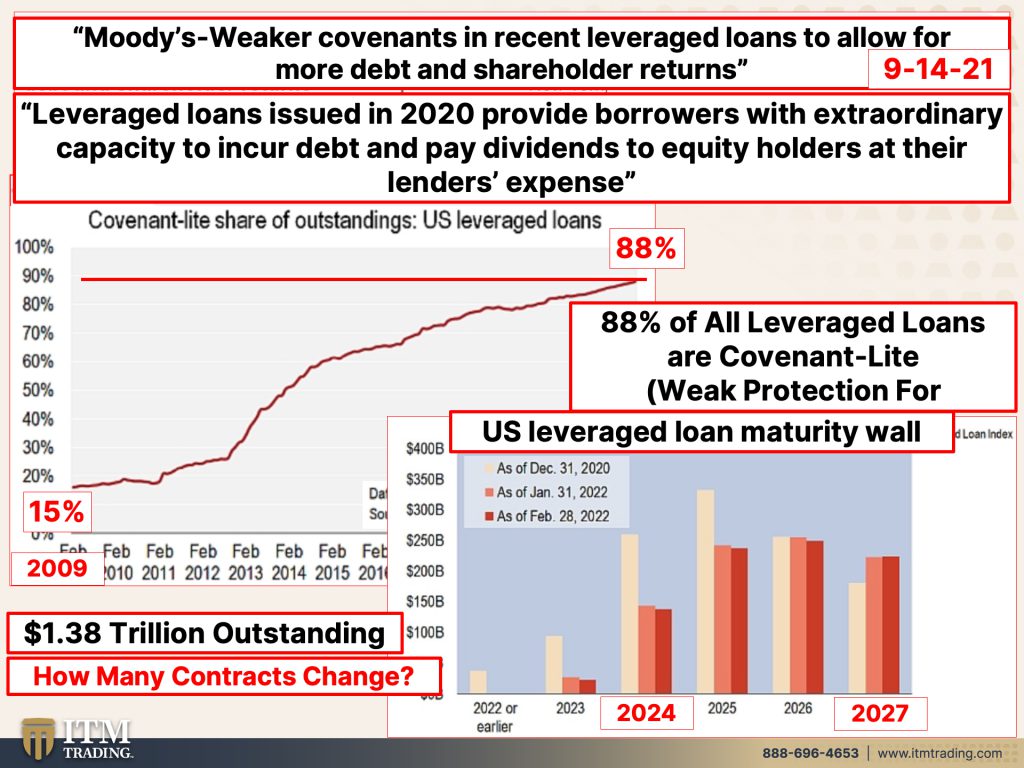

Yeah, good job. But according to Moody’s, the grading agency, and I have no love for them either, because what we see is going into a crisis, they always tweak the rules. And so you don’t know really how risky a lot of these corporations or municipalities really actually are because Moody’s does in all the credit rating agencies, well, I don’t know about all of ’em, but the big credit rating agencies, they’re competing to, to rate the credit where they, how they get paid. So that would be like me paying you to rate this video, You’re gonna rate it bad? No, because if I’ve got somebody over there that’s also willing to pay me to rate it, I’m gonna rate it higher. So that’s part of the problem that we’re dealing with now. But according to Moody’s weaker covenants, these are investor protections. Covenants are investor protections in recent leverage loans to allow for more debt and shareholder returns, not lender returns.

Cuz you buy a clo you are loaning them, your money shareholder returns paying out the dividends so that the money, they can even take on more debt to send that money to the shareholders not keeping it in the corporations leverage loans issued in 2020 provide borrowers with extraordinary capacity to incur debt and pay dividend dividends to equity holders at their lenders. You expense. Do you get what they’re saying here be and why? Because interest rates were at nothing. So why not borrow? They didn’t really use corporations money. Many, many corporations did not use this opportunity to reduce their debt levels. They did refinance a lot of it, but then they took on even more debt and even more leverage. And that money went out of the corporation. I cannot emphasize this enough because if it’s out of the corporation and the next crisis, I mean, God, we saw it with Boeing not that long ago where taxpayers had to step in because Boeing had sent so much of their profits out of the company.

Can’t call somebody and say, Hey, will you send me back your dividend? What are they gonna say? They’re gonna go, No, you’re crazy. I’m keeping it. Of course. So I would like you to pay attention on this particular graph is really, really important because in 2009, now remember these are covenant lights. So these are fewer and fewer investor protections, very minimal investor protections. In 2009, 15% of the leverage loans outstanding were covenant light. So there were greater protections for investors. Here we are in 2022, and guess what? A full 88% of all leverage loans are covenant light. That should make you just feel so fabulous. I know, I was thrilled to see that and I’m being very facetious. And not only that, but the US leverage loan maturity wall, right? So all these leverage loans, they really start and like, look at how big it is in 20 23, 20 24.

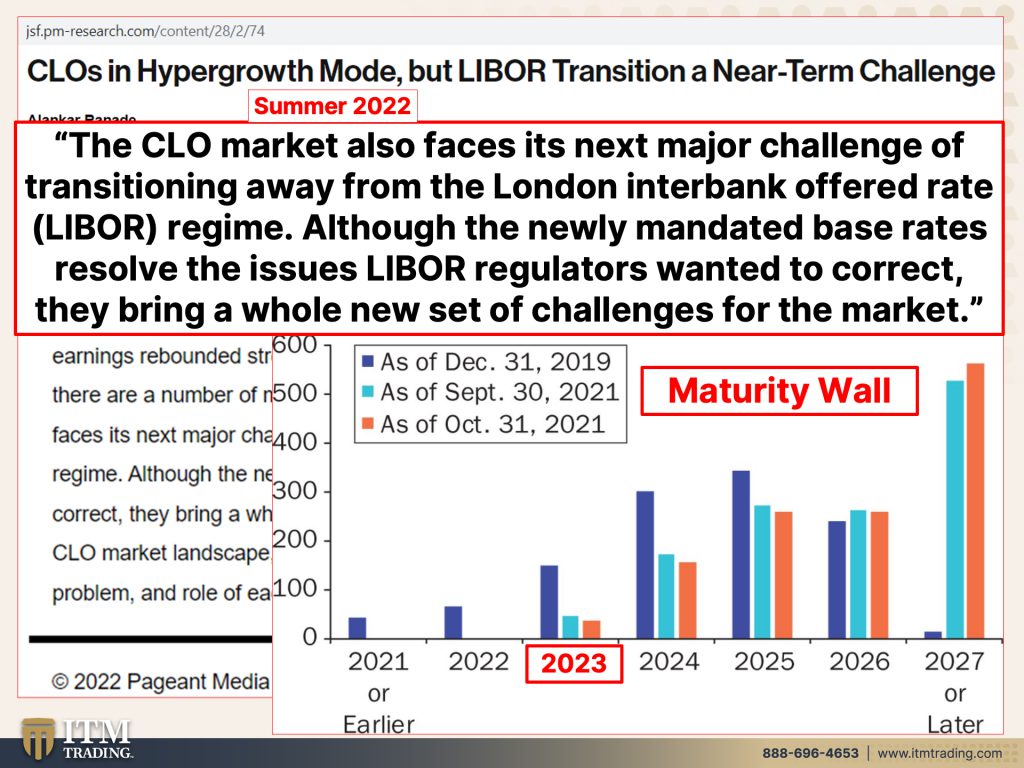

And then after that, going through 2027 doesn’t mean that there are no more loans due after that. It’s just what this graph was providing. And this is what I need you to understand. Most of these loans, and I’ll show you this, were done attached to li o r. And that means that they will be converting or have to convert to sofa by June of 2023, which is right here. So all of these loans and the debt that the money isn’t even there to repay. Yeah, I think we’re in deep due to the tune of 1.38 trillion and God only knows how many derivative contracts. So just leverage bet on whether or not these corporations are gonna fail. What’s gonna happen with interest rates or credit quo, et cetera. I mean, I don’t even have that data. So this is much, much bigger than what we see and how many of the value of these contracts that will change.

I don’t know. But what I do know is this, that sofa does not equal exactly the interest rate on li b o. That means that all the valuations in all of these contracts, whether they convert or they’re already, if they have to convert the value to whoever holds them, those shadow banks, main street banks, the big banks that have loaned the shadow banks the money. So the shadow banks can set up the loans for the leveraged loans. I mean, this is very interconnected and very, very complicated and it will not end well. They’ve been in hypergrowth and Li b o r transition is the next near term challenge. Shock or ruski. I mean, again, let’s take a look at this maturity wall and all that need to convert, right? This is not gonna be easy. This is a big experiment. It’s never ever, ever, ever, ever been done before.

And I think that it should be pretty darn obvious that the guys that are driving this bus are driving us into a wall and there’s nothing that, I mean, what can they do about it? Seriously, the clo market also phases it faces its next major challenge of transitioning away from the London interbank offer rate regime. The Li b o, although the newly mandated base rates resolve the issues Li b o r regulators wanted to correct, they bring a whole new set of challenges to the market. And by that, what they’re referring to are the change in the laws to put in safe what’s called safe harbors. Meaning that you can’t sue them, that no matter what happens, you can’t sue them. Great, I’m sure there’s gonna be a whole lot of happy people. And when we’re looking at this wall, you can see the level of debt that starts to come due in 2024.

I mean, I I I can’t tell you that anything’s gonna happen by Tuesday morning at 8 35, but what I can tell you is that they know that they’ve got a big problem with the CLOs. But with this whole transition, everybody’s mortgages, car loans, credit cards, any student loans, any debt that you’re holding, you’re gonna open up that statement after this transition. And what you owe is probably going to look a whole lot different than what you think you owed or what your last statement showed you that you owed. You’re not gonna be happy about it.

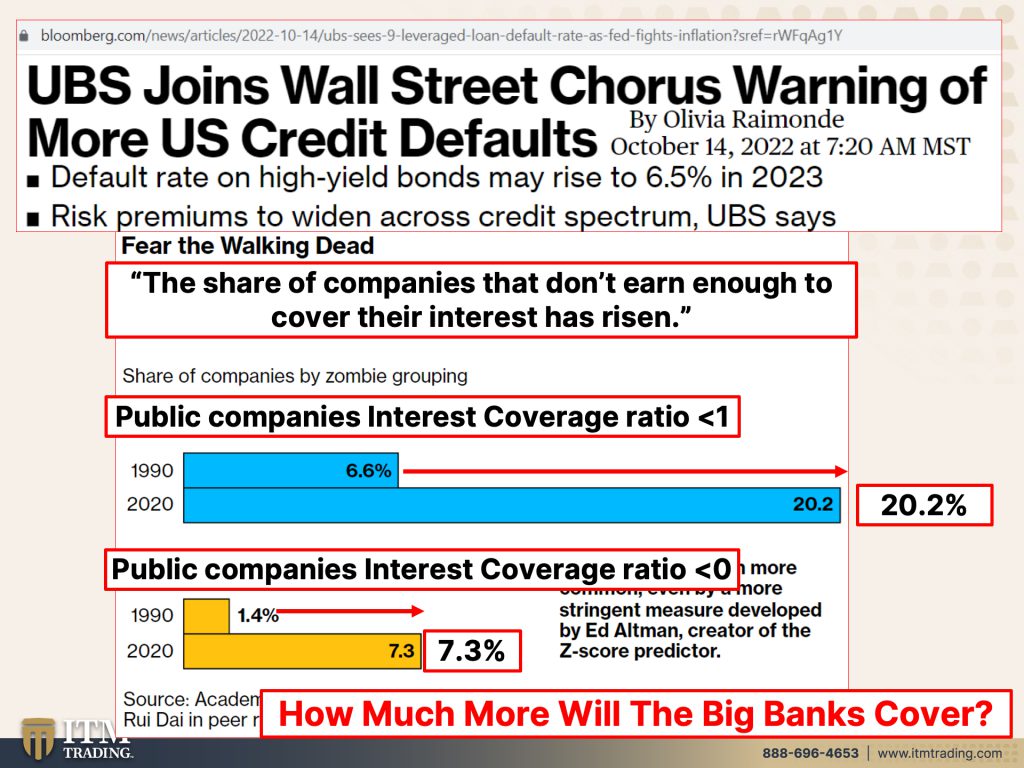

And look at this UBS who helped create this mess, by the way, joins Wall Street Chorus, warning of more US credit default swaps. You better lower those interest rates that I’ve been telling you forever. Central banks are between a rock and a hard place. It really doesn’t matter what they do, they’re going to mess it up. There is no path to this. But something else that we’ve talked a lot about, and it goes in here, you know, the title of this particular bar graph is Fear The Walking Dead. And it’s the share of companies that do not earn enough to cover their interest payment. Forget the principal. And so between 2009 and actually, and, and 2022, the banks have not wanted to show the bad debt on their books. So what they have done is simply loan these corporations that couldn’t meet their debt payments anyway, more money so that they can at least pay some of the interest on the debt.

Maybe not even all the interest, but at least it enables the banks to, to not classify it as a bad loan. Are they gonna be able to continue to do that? Because what we see is the share of these zombie companies, thank you, Japan, because Japan’s really the one that introduced that in 1990, the share of public countries with interest coverage below one, below one went from 6.6% to 20.2%. Wow. And the number of public or percentage of public companies with the ratio below one and zero has grown from 1.4% to 7.3%. Zombies have grown more common even by a more stringent measure.

So what’s happening to these corporations inside of this regime shift, especially with the interest rates going up? Can you start to see the problem? It’s like if your, if your interest rate was held at 1% and you could barely manage to make that payment, or maybe you couldn’t even make all of that payment and then all of a sudden it went to 10%, well, if you couldn’t make the payment at 1%, you think you’re gonna be able to make it a 10%. How much more does that impact your debt? Does that make sense? No, it doesn’t. But these are the crazy insane times that we’re living in where debtors are far more important than lenders, right? They’re gonna, they’re gonna remove your investor protection and take on a lot more risk and a lot more debt. And I’m wondering how much more the big banks are willing to cover so that it doesn’t show the bad loans on their books.

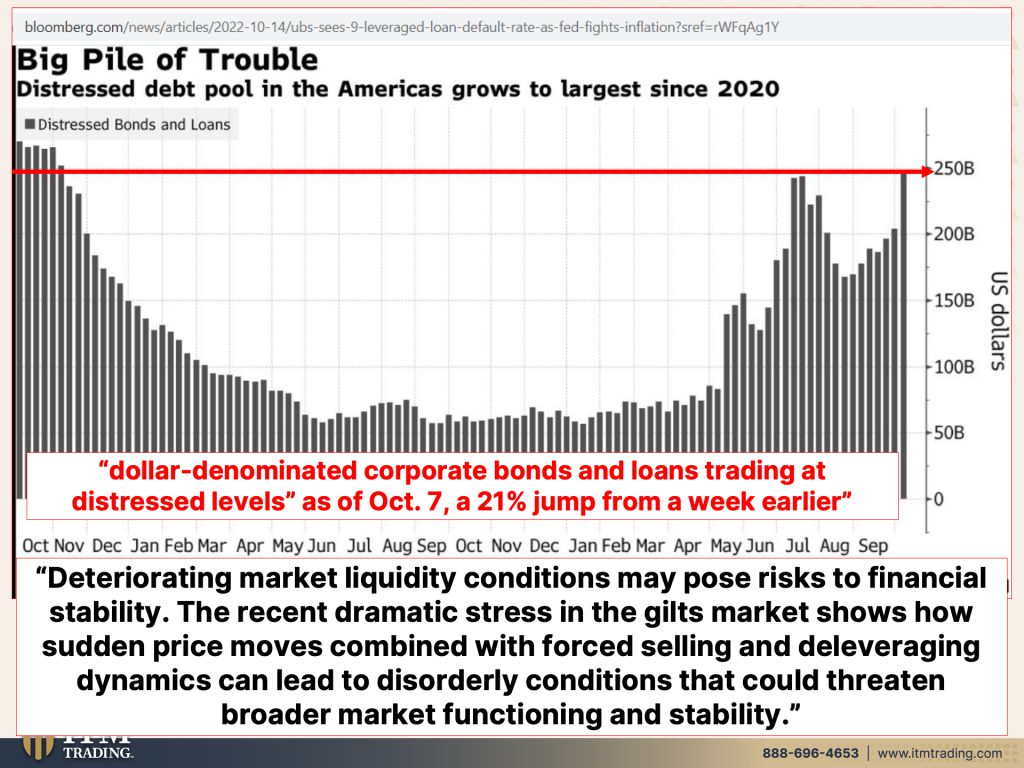

How much more can they forget? Even willing? But there comes a limit. And I think that we are very close to that now because we have this huge pile of trouble. Distressed debt pool in America has grown to the largest sense. Hmm, 2020. Well, what was happening in 2020? You had all sorts of loans that were given to everybody and anyone because we were in the middle of a crisis. Mm-Hmm. <affirmative>, well, supposedly, or even when this started, we weren’t yet in crisis. Are we in crisis now? Because if you’re just driving down main street, things look kind of normal. It’s when you’re paying attention to what’s actually happened that you go, Oh my gosh, this is not a good thing. And that’s what I’m telling you. This is not a good thing. Deteriorating market liquidity conditions may pose risks to financial stability. Do you think what I’ve talking to you about liquidity for years and now even Janet Yellen is talking about the treasury buying back treasury bonds because of the lack of liquidity in the flipping treasury market. This is supposed to be the safest, largest and most liquid pool. So you think if there’s a problem with liquidity in the treasury markets, there’s not gonna be a problem in the subprime, the below investment grade quality of these corporations, so many of which cannot even pay the interest on their debt and our compounding interest. This whole system has to reset. There’s really no choice about it. Dollar denominated corporate bonds and loans trading at distressed levels as of October 7th, a 21% jump from a week earlier. Are you kidding me?

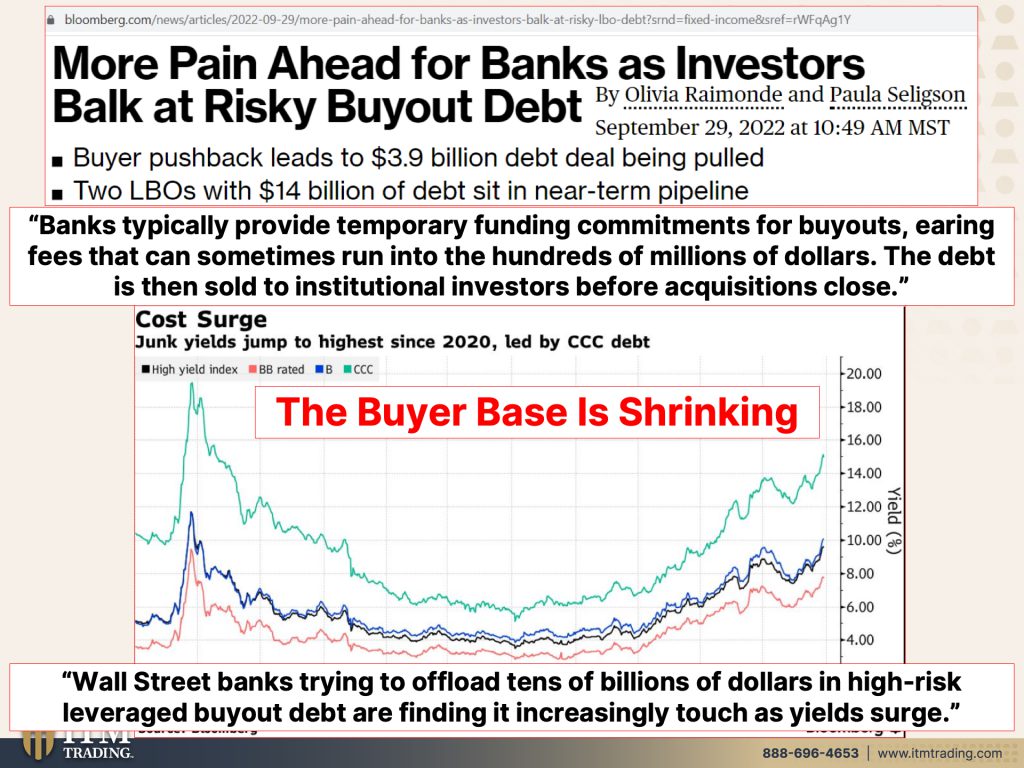

I hope you’re starting to see the challenge that we have ahead of us because that liquidity issue is not getting better, more pain ahead for banks as investors b, at risky buyout debt because now that interest rates are rising, I mean, tell me, would you really rather take on risky debt? Why would you jeopardize your principle that really, frankly, is the point of gold and the point of silver in your portfolio? Cause now is not the time to take on or hold or carry debt and risk. It is the time to get to a safe haven. And bank for international settlement says the only financial asset that runs no counterparty risk, the only one that’s your flight to safety. And I I I can’t stress it enough. Banks typically provide temporary funding commitments for buyouts earning fees that can sometimes run into the hundreds of millions of dollars.

That debt is then sold to institutional investors before the acquisi acquisitions close. So they’re short, they’re supposed to be short term bridge loans. But if buyers back away from these markets, then you’ve got a loan that you can’t sell now, it’s on your book and you don’t care as long as you’re selling this risk to somebody else. An institutional investors typically are buying, using your money to buy this crap with. So I’m glad that they’re backing off. But what I really want you to understand is that while Wall Street banks trying to offload tens of billions of dollars in high risk leverage loan buyout debt, they’re finding it increasingly tough as yield surge. And what that’s indicating is a shrinking base of buyer. You have forever heard me talk about what do you want? You want the broadest base of buyer because that’s when you have control over a true buy sell market, right?

You’ve got to have a buyer for every sale or you have no market. I mean, it really is just as simple as that. So what do you want? Do you want the most narrow pool of buyers that got one buyer, Okay, that buyer decides to go away. You got no buyers. That’s what the banks are facing right now. Or do you want the broadest pool of buyers? You see the difference? Physical gold, physical silver have the broadest base of buyers simply because they are used in every single sector of the global economy, unlike this garbage and the fiat money garbage, this stuff one market, which is the financial market, this also financial market, but medicine and, and art and everything else. This 1, 1, 1 area. And now when you’re looking at things like CLOs, who typically buys them are those institutional buyers. They’re the big buyers.

So they’re setting up for your retirement. How do you feel about that? You can’t count on these guys in this environment. But besides having the broadest buyer base, gold is physical. It’s real, not the spot gold market that you’re looking at, right? Because we’ve been watching premiums go up, we’ve been watching breakouts in this level of, of collectible coins and higher level of more rare, the ultra charities have a huge breakout. That’s the big money. That’s the money at the top. So what about gold? It’s indestructible with the broadest space of buyer. And you may have even seen this on TV because this is from Queen Elizabeth who recently passed away, and her septer and orb, which are made out of gold were created in 1661. That has with stood the test of time. Diagnostic wealth is wealth that lasts in families at least 300 years and survives currency regime shifts and wars and everything else.

But what Wall Street wants you to see, what the central bank wants you to see, what the government wants you to see is their version. And even in their version where the NASDAQ has dropped, what? 30 Yeah, 32%. And the treasury has actually, the price of the treasury has dropped 16%. There’s gold and has dropped 10% in spot gold contracts. While at the same time in the physical world, they’re breaking out. Because in the physical world, that is a true supply and demand market. China’s premiums are the highest that they’ve been through the last two crisis because demand has exceeded supply. You go to Wall Street’s products and gold spot contracts and all of that, right? They can make as much of that crap as they want. There are no limitations on that. But you go into the physical world and there’s a finite amount. So we’re going into a huge crisis. What do you wanna go in with this?

It’s what I think about that. And frankly, you’ve noticed the rapid inflation. I mean, if they can keep it low enough at a level you don’t notice. But when it runs really hot like it is, which they’re always surprised about, that’s who you’re gonna trust to take you through this. I don’t think so. I don’t think so. You give me real, you give me honest, you give me something that’s invisible and runs no counterparty risk. That’s what I want. It’s up to you. But one of our viewers really said it better than I could say it. So I had to bring it up. And I’d like to thank you, David, for this comment because it was perfect. I just dug up some c BDCs My grandpa buried years ago said nobody ever, never and forever could not have said it better. Dyna wealth lasts in families at least 300 years.

When you’re going into a knife fight, you want a butter knife or do you want the biggest machete in as many of them as you can fit on your body in case some flies outta your hands? You want the broadest base of buyer, something that has absolutely been proven for 6,000 years in history. And that’s when you, that’s what you get when you position into gold. You need it. I’m sorry. You need it. You need gold. You need silver because that’s proven and it comes with a whole base of buyer. That’s what you need going into this mess. And until next we meet, please be safe out there. Bye-Bye.

SOURCES:

https://www.sciencedirect.com/science/article/abs/pii/S0304405X22000976

https://www.theleadleft.com/leveraged-loan-insight-analysis-4-11-2022/

https://www.lcdcomps.com/lcd/f/article.html?aid=12491603