What Happens After the Longest Yield Curve Inversion in USA’s History?

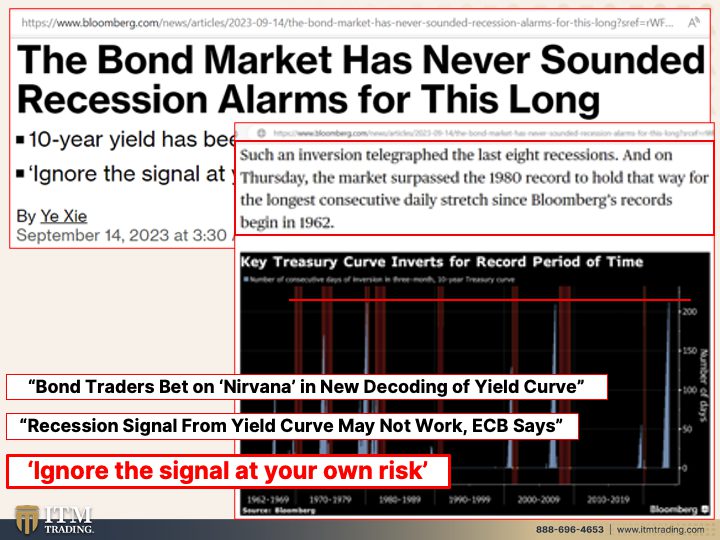

How many unprecedented economic challenges must we face before the public recognizes the severity of the situation? The bond market is in chaos and we are currently witnessing the longest recorded Yield Curve Inversion. When you add in the loss of credibility our Central Bank is experiencing in the Markets and the rare Triple Top in Gold prices over the last three years, it’s unwise to ignore these warning signs.

CHAPTERS:

0:00 Yield Curve Inversion

2:01 Bond Market

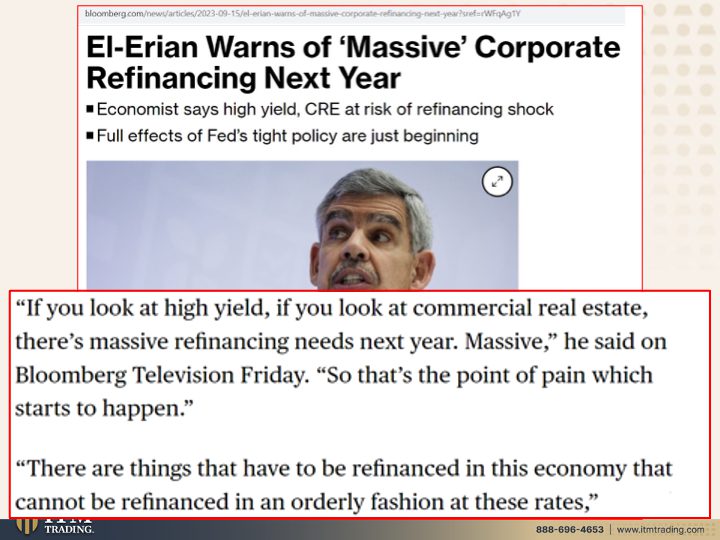

4:41 Massive Corporate Refinancing

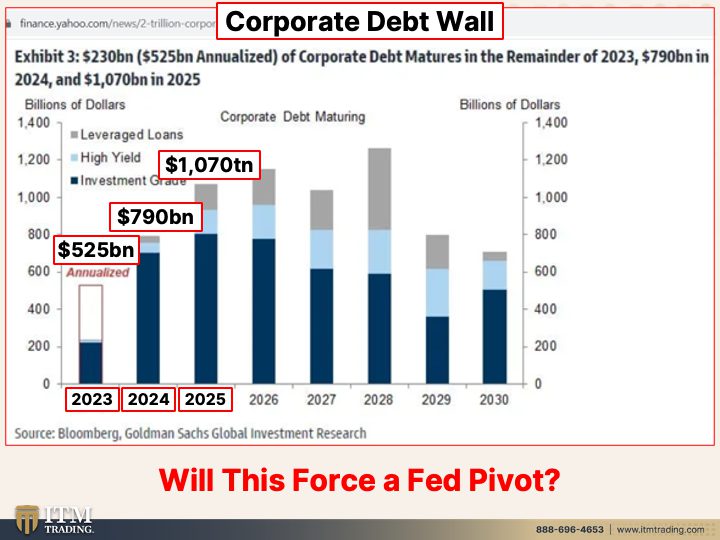

6:59 Corporate Debt Wall

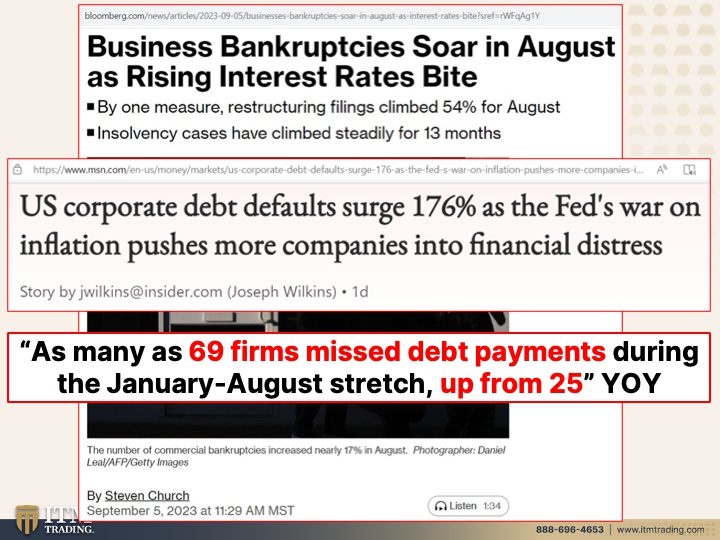

8:32 Bankruptcies & the Fed

12:25 Fed’s Rate Order

13:51 Fifty Cents on the Dollar

19:23 Government Shutdown

20:29 Triple Top

23:20 Build a Community with Us!

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

I am Lynette Zang, chief Market Analyst here at ITM Trading, a full service physical, gold and silver dealer part of the strategy. Which also includes food, water, energy, security, barterability, wealth preservation, community and shelter. Welcome to Mantra Monday.

We’re just gonna jump right in and we’re gonna talk about food because, guess what? There’s a food fight in Congress. And they’re looking at cutting back snap benefits, which is food benefits. And here’s the thing. You know, when people get hungry and hopeless and they think that they can’t feed their families, they do things they would not otherwise do. So I think our government is playing with fire on this. But the popular food assistance program is gearing up to become a major point of contention in the closely divided house, as lawmakers work to hammer out a farm bill, a must pass legislation approved roughly every five years that addresses agricultural to conservation to nutrition policy. The bill’s 2018 version is set to expire September 30th, coming up, and it is unclear if lawmakers will be able to pass a new version before that deadline. So what does that mean? Well, they’re looking at the cost. Food assistance programs make up nearly 80% of the mass of spending. Bill referring to the farm bill, which spent 860 billion in 2018. This year’s farm bill could run roughly 1.5 trillion. So almost double in just a few years. Hmm. Do you think inflation has anything to do with that? Because I do. Food is the single biggest issue for people as we transition from one financial system into the next financial system. I remember I was there in the seventies.

And how about this water? What you’re looking at are two maps. One, showing drought severity and how things are drying up between 1960 and 1986. And the other is drought severity between 1987 and 2013. This red area in here, I’m in Phoenix, so that speaks to that area. But the red areas, even into Florida, even up here, you can see are growing. And we need water for so many things, not the least of which is to create food and also sanitary reasons, et cetera. But understanding how forests and rangelands respond to drought is essential when managing for the effects of drought, particularly as droughts are forecasted to worsen over time. So for example, which you’ll get to see, I mean we’re not quite ready to do it up there yet, but at the bug out location, one of our plans is to strategically place rain catchment basins. So ponds, in different parts of the property for several reasons. One reason is for livestock, and we also then can grow more food around those watering areas. So hopefully the bears and the other livestock will congregate at the, the water gathering spots and not come up to the main food production areas. I don’t know. But if we give them what they need, then maybe they won’t. Another is for fire mitigation. But the whole point of these ponds is really about rain capture. So what are you doing to capture the moisture? There are lots of options out there. You need to find the one that’s right for you. But it’s critically important for you to have a plan.

As well as an energy plan. Not just food and water, but also energy. US annual heat related deaths 1,708 through 2022. But the real problem are the aging power grids. I mean, our government constantly talks and sets aside money, frankly, for infrastructur., But they don’t really use it for that infrastructure. This creates even more problems, this aging power grids. And if you hold all of your wealth on those aging power grids and the power grid goes down for any reason, you have no access to anything. So it’s critically important to hold some wealth, to hold some wealth, some wealth, outside of the system. Because all of this is barterable. Food is totally barterable. I like silver. It’s a little more universal and it doesn’t have a shelf life. But any skill-set as well is barterable. But energy is critically important that you cover that. Last year, Europe experienced over 60,000 heat related deaths. 60,000. Due to uncharacteristically hot weather. The problem was, in part, a lack of cooling infrastructure. But it suggests the fatalities that might occur in the US after a prolonged grid failure. So what are you doing about that? These are the things that we have to think about, not the second before we need them, but as long in advance as you possibly can.

Security. Deutsche Bank, Commerzebank, and ING Groep NV, are among dozens of companies worldwide whose client data were compromised when a criminal hacking group exploited a security flaw. And the more, and the more that we do online, the more of this hacking that we’re going to see. But remember, companies don’t want you to realize that they’ve been hacked. So even by the time you discover it, it happened a while ago, they already have your information. Now there’s different things that you can do. Personally, since I don’t need credit, I’m not taking on any more debt, I simply shut my credit down. If for some reason I decided that I needed it for a minute, then I open it up, do what I have to do and then shut it down again. Because that way if somebody has stolen your identity, and I can’t say that this is foolproof, it’s just something that I came up with when Experian had that huge hack. And I thought, wow, if somebody gets a hold of my identity and they start buying things, taking on debt with that, that’s not a good, that’s not a good thing. And I believe that that is indeed happening more and more frequently. Shutting down your credit, anybody that tries to access it to take out debt in your name, they’re not gonna be able to do it. And I just do it with the three key credit rating or scoring agencies. It is a, it is a way to protect your credit and secure your data and your information.

Coming to a theater near all of us because it isn’t just happening in Argentina. The debt levels are ridiculous everywhere and anywhere in the world. And we’re watching grading agencies, not that I put a whole lot of store of value in what they say. Because they will fudge their parameters to accommodate. But those, but those days seem to be like going away. S&P and Moody’s and Fitch, downgrading the banks. But really downgrading the sovereigns as well. And here, out of options and money, Argentina presses the panic button. How did they pick? How did they do that? They did an overnight revaluation. Okay, now so far this is only a 20% revaluation, but central bank hikes key rate to 118% from the current 97%. Officially the reflation rate is 116%. Gosh, has raising those rates really done it? No. But what all of this inflation has done is it is destroyed any vestige of confidence in the money, in the central bankers, in the government, and there’s your overnight revaluation. This has no intrinsic value. It is used in one place and it really has become only a tool of barter. That’s how they’ve trained us. Just spend it. It’s just a tool of barter. Except we have to work for it. And we’re trying to save. You try and save this. You know, it’s losing value. You save this, this is what happens when they do an overnight revaluation. This was 20% because Argentina did a 20% devaluation. When they do a thousand percent devaluation, this goes much, much higher. But at least it is closer to it’s fundamental value. We haven’t seen the last of this. We’ll be talking more about it, but you really need to know coming to a theater near you. Because What you’re really looking at here, is spot gold in terms of the Argentine peso. Which just lost a lot more purchasing power and it’s already lost a hundred, well if they’re running at 116% inflation rate? I mean, how do you go higher than a hundred percent? That is a massive loss of value. If it doesn’t happen, rock and roll hoochie too. But it always happens. It’s happened over 4,800 times. Why would you think that this time is any different? It’s not. They always want you to think this time is different. It’s not.

We’re going on to wealth preservation. China shadow bank crisis sparks protest by angry investors. Chinese investors protested outside the office of one of the country’s biggest shadow banks in a rare show of public outrage after the firm skipped payments on dozen of investment products. So first of all, what’s a shadow bank? It does a lot of things similar to banks, but it doesn’t take deposits. So in China, they issue securities. They invest securities. They do actually have private money management offices. So people send them money to manage, they create the securities, they put them into those securities. And it’s all in a pickup of interest. Why people would jeopardize their principle, which is just what’s happening in China right now, to get a little bit of an extra yield, is crazy. This is what protects your principle. Wealth preservation. It Doesn’t pay interest because it doesn’t have to pay interest. It runs no counterparty risk. There’s your counterparty risk. People ask me what counterparty risk is? There it is, counterparty risk. And you know, so what do you do? You’re gonna go there and you’re gonna go give a same money back. You know what? You’re not getting your money back. It’s gone. Demanding payment of high yield products that were pitched as safe investments. This is the perception. But frankly, in a court of law, perception means absolutely nothing. Look at what happened in 2008. Kind of the same kind of thing, right? Nobody went to jail. Why not? Because what they did was disgusting, unethical, evil and all those things. But it wasn’t illegal. And it’s not illegal in China either. The protests indicate trouble at the embattled, Chinese shadow bank are deeper than previously known. And underscore how the fallout from the real estate slump is spreading to the financial sector. And guess what? It’s spreading all over the place because the whole system is incestuously intertwined. And that doesn’t just mean China and China is, is not having an influence on the us. This is global. Do you own any MSCI? Or MSCI Global? Or MSCI China? Because a lot of that crap is put into pension plans, retirement plans, those institutional investors that invest your money. They don’t have any skin in the game. You have all skin in the game. But what this also shows is that when you push people far enough, they will revolt. China has had more protests over this past year than they have in decades. That my friends, is a huge big deal.

Because China’s underground community is really, really growing. This is a protest against, in China, against Covid restrictions in Beijing last November. The government lifted of panic controls in December after a series of public protests. This my friends, is what gives me hope. Because there are more of us, there are more of them than there are of the Chinese government. We have to come together and we have to say, no, this is not acceptable. And if they want to stay in power, they’ve gotta change their behavior. But if we don’t say anything, we just allow it. We just accept it as inevitable. I’m not going down without a fight. I am not going to accept the CBDC’s, and the restrictions, and the loss of freedoms, and the loss of rights. For me, ah, what have I got? Another 31, 32 years? But I’m fighting for my children, for my grandchildren, for my great-grandchildren, that have not yet even been born. That’s who I’m fighting for. And yes, so many people think, well, there’s nothing I can do. Well, you’re right, one person can’t. But it always starts with one person and then it comes together in a community, like Thriver’s community. And we can make a difference. I have huge hope. Huge hope. Because if I didn’t have any hope, why bother to do any of this? And I can’t tell you how many people say, well, you know, I’ll have guns and ammo and I’ll just come and take everything that you’ve done. Really? Is that who you are as a person? But if you come to me and you’re hungry, I’m not gonna kill you. I’m gonna feed you. And if we all had that attitude, if we all do unto others, as you would have done unto yourself, what a difference. And that’s what we have to start with. And we come together in community because we can make a difference. Join me, join me. Let’s make a difference. I love that.

US mortgage rates jumped to 7.09%. That is the highest since 2002. I remember getting my first house, so this would’ve been in 78 or 79. And I remember we paid like 12.5%. But housing affordability is really becoming a huge problem. Because you’ve got the prices of the houses that are still at nosebleed level. Even though in some areas they’ve come down, not in all areas. US housing affordability hits its worst point in nearly four decades. Well this, none of this is a surprise. It’s gonna get worse because it’s gonna take us back to those seventies with 12.5% or more interest rates, because we’re at the end of this currency’s lifecycle and everything is going to reflect that. So wait, right now it says 2002. You watch, it’ll go back earlier than that. Because we’re already seeing that in so many areas that they liken things back to the sixties, seventies, or eighties, early 19 hundreds or the 1930s. When they do that, what are they really telling you? They’re telling you we’re transitioning. Because Look, things are happening really similar to what happened in those two other periods of time. The time to get ready is now when we have the opportunity to do so.

And remember too, this is not all doom and gloom. Just gotta be in the right place at the right time with the right asset. And that means something that holds your purchasing power. That’s the right asset. So, and it’s invisible and it’s private. And it doesn’t mean it doesn’t need electricity or any other source of power. It’s globally accepted and has the broadest base of buyer. Because It’s used in every single sector of the global economy. And that’s what you want. When we’re transitioning into a new currency, do I think that they’re gonna bring out CBDC’s? Of course I do. That’s what they want. But we don’t have to use them. We don’t have to accept it. If we have wealth, if we have purchasing power, outside of the system, if we’re independent, and we’re inside of our own little community, we don’t have to accept the garbage that they want to cram down our throats. That my friends is a win-win for us because I’d like to see them out of office where they can’t do any more damage.

And if you haven’t created your own strategy yet, click that Calendly link below, talk to one of our experts, get your personal strategy in place. It is critically important that you do it now. Stop waiting. The system is falling apart. Stop waiting. Get it done. I’ve been working on the prepping part of this since 2010. And while I definitely do feel more ready than most anybody else I know, could I be more ready than I am right now? Yes, I can. And I’m working on that too, diligently. And I’ll get as far as I get. Get it done. And a good place to go too, if you feel like alone, come help us build the Thrivers community. Make it what you want. Come in and go, okay, how can I help? How can I help other members in this community? How can I help myself? What do I want? Let’s build it together. You can find it at thriverscommunity.com. But make sure that you subscribe to BGS, leave us a comment, give us a thumbs up. Share, share, share. And remember, we are all in this together. Until next we meet. Please be safe out there. Bye-Bye.

SOURCES:

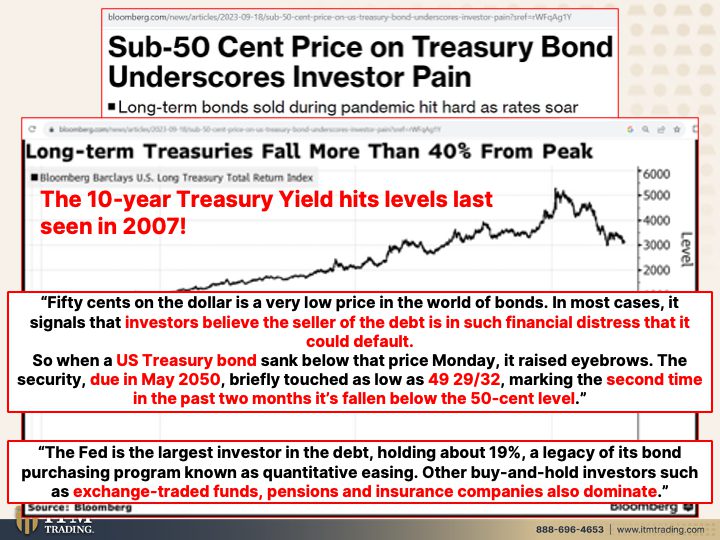

The Bond Market Has Never Sounded Recession Alarms for This Long – Bloomberg

Bond Traders Bet on ‘Nirvana’ in New Decoding of Yield Curve – Bloomberg

Recession Signal From Yield Curve May Not Work, ECB Says – Bloomberg

https://finance.yahoo.com/news/2-trillion-corporate-debt-wall-042143808.html

Fed’s Higher-for-Longer Mantra Has Doubters in Bond Market – Bloomberg

World Adapts to Fed’s Rate Order in 36-Hour Sequence – Bloomberg

https://www.xe.com/currencycharts/?from=XAU&to=USD&view=10Y

https://www.fidelity.com/learning-center/trading-investing/are-we-in-a-recession