Wall Street vs The FED – Either Way, You Lose!

Aren’t we just hearing how this upcoming recession, if we have one, we may have dodged the bullet, although the indicators of a recession have never been wrong, but maybe they’re wrong this time and if we do have a recession it’s just gonna be a mild recession and whoop-dee-doo. The Fed might slow down raising rates and what happens with the stock market? It explodes. But is that gonna tame the inflation? It is not. But what it will do is give those that are in power the opportunity to get you in just the right position to take the fall.

CHAPTERS:

0:00 Introduction

2:05 Fed Slows Down Rates

3:46 Stocks Losing Predictive Power

4:56 Individual Investors

8:07 On The Brink

11:16 Pimco

14:22 Did the Dollar Gain

16:03 Spot Vs Collectable

17:53 Wrapping Up

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

Aren’t we just hearing how this upcoming recession, if we have one, we may have dodged the bullet, although the indicators of a recession have never been wrong, but maybe they’re wrong this time and if we do have a recession it’s just gonna be a mild recession and whoop-dee-doo. The Fed might slow down raising rates and what happens with the stock market? It explodes. But is that gonna tame the inflation? It is not. But what it will do is give those that are in power the opportunity to get you in just the right position to take the fall, coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading a full service physical, gold and silver dealer specializing in custom strategies. And look, if you just think that everything is the same as it used to be, and so everything is just hunky dory, seriously think again because the public is being set up to take the fall yet again. Let’s talk about that.

You know, the Federal Reserve has been raising the interest rate 75 basis points and Wall Street doesn’t really like it. They want that to slow down, they want that to cool. Gone are the days when the Fed will say this is what we’re gonna do. And the markets believe them. They’re all off balance and all off kilter. However, a lot of these banks are too big to fail, but you and I, the taxpayers, the general public, we are just about the right size to fail. So let me show you what’s going on, because here US hiring solid while wages cool, giving Fed Room to slow hikes, whoop dee-doo. And how did the market respond to that? Well, they went right up, right? And so we’ve had this bit of a run in the stock markets because, and in the bond markets as well, because they think the fed’s gonna slow down raising rates. Historically though, as we’ve seen many times before that in order to really have a full impact on inflation, the Fed has to raise the rates above inflation. So what they’re trying to do is bring those rates down at the, of the rate of inflation down and keeping their Fed funds rate somewhere near here or somewhere below that so that Wall Street can actually still get into position and they’re hoping for a pivot. But how does that impact you?

Why do you even care? Isn’t that good for you? Because the stock markets go up. But here’s where we’re at. There is a war that’s brewing between the Federal Reserve that is saying rates are gonna be higher for some time ahead and Wall Street that’s saying, nope, there’s gonna be a pivot. Who’s gonna win this? Who has deeper pockets? Who has the ability to control more things? We’re gonna find out. My bet is, I hate to say this, that it’s gonna be Wall Street. Because Wall Street with all the leverage, they are too big to fail. The markets do not believe the Fed at all. And will the Fed decide to teach Wall Street to listen in order to regain their credibility and their power and their position? I don’t know. But the unintended consequences I could tell you of this battle royale will be felt by you and me.

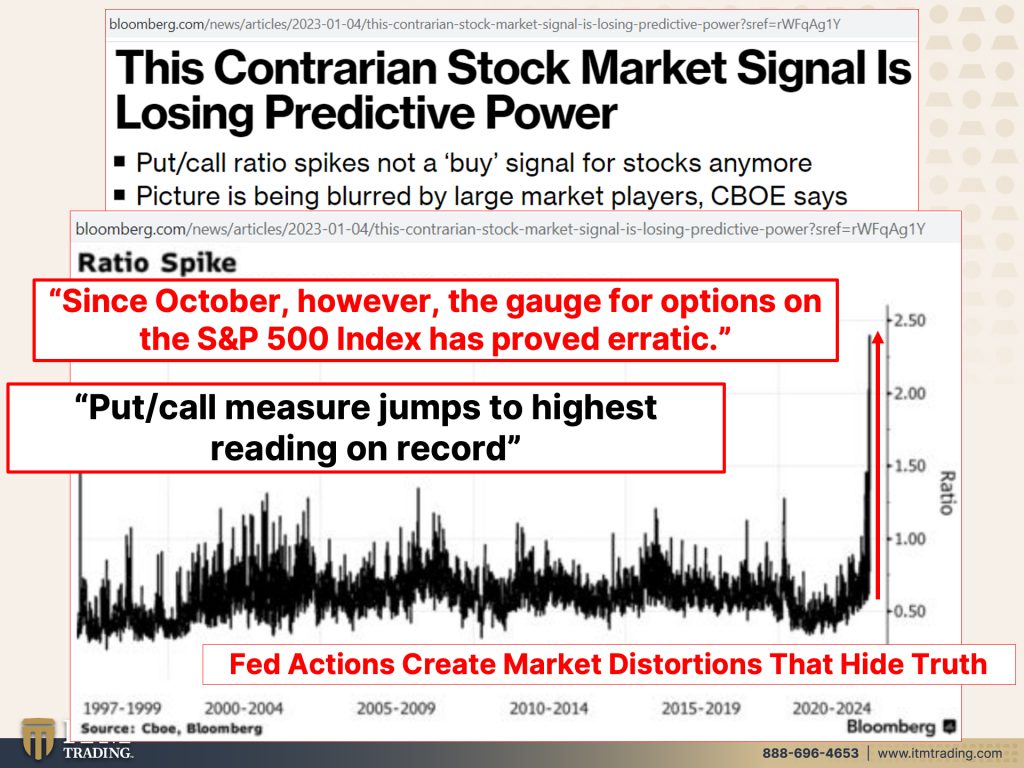

Now this contrarian stock market signal is losing predictive power. Oh shocker. Because the Federal Reserve has gone in and played so many, you know, tweaks and changes in this and that, that the normal markets, they just can’t tell you anymore. This happens to be the put to call measure and it’s jumped to the highest reading on record. This goes all the way back to 97. You can see how much higher it is now. But since October, the gauge for options on the S&P 500 has proved erratic because of all the Fed’s manipulation and also all of the manipulation by changing formulas and accounting procedures to make things look one way, when in reality they’re the different and it has jumped to the highest reading on record. And you can see that. But it’s all of the market distortions to hide the truth by the Fed actions.

So what’s happening? Well, the individual investors getting sucked right back in. You buy the dips. That’s what the Fed has trained us. You buy the dips, you buy the dips. Are they gonna be there to make sure that the markets explode the way they have been? So individual investors hang on in wild year for stocks while the pros are selling. Hmm, that’s what happened in 1929. That’s what happened in six in the sixties. That’s what happened in the 2000 and lead up. 2007. 2006, small investors dive into markets as institutional ones grow more bearish because there are more experienced, they’ve seen this before. I love it when I’m listening to Bloomberg or CNBC or any of those guys and the, the experts that are talking to me have never lived through a recession or never lived through a currency lifecycle issue. They keep referring back to the seventies, but they don’t understand what was happening during the seventies and the eighties. We do, I lived through it. I’m so grateful to be 68 and have had that experience under my belt. So why are you listening to these people that have absolutely zero experience with what we’re going through?

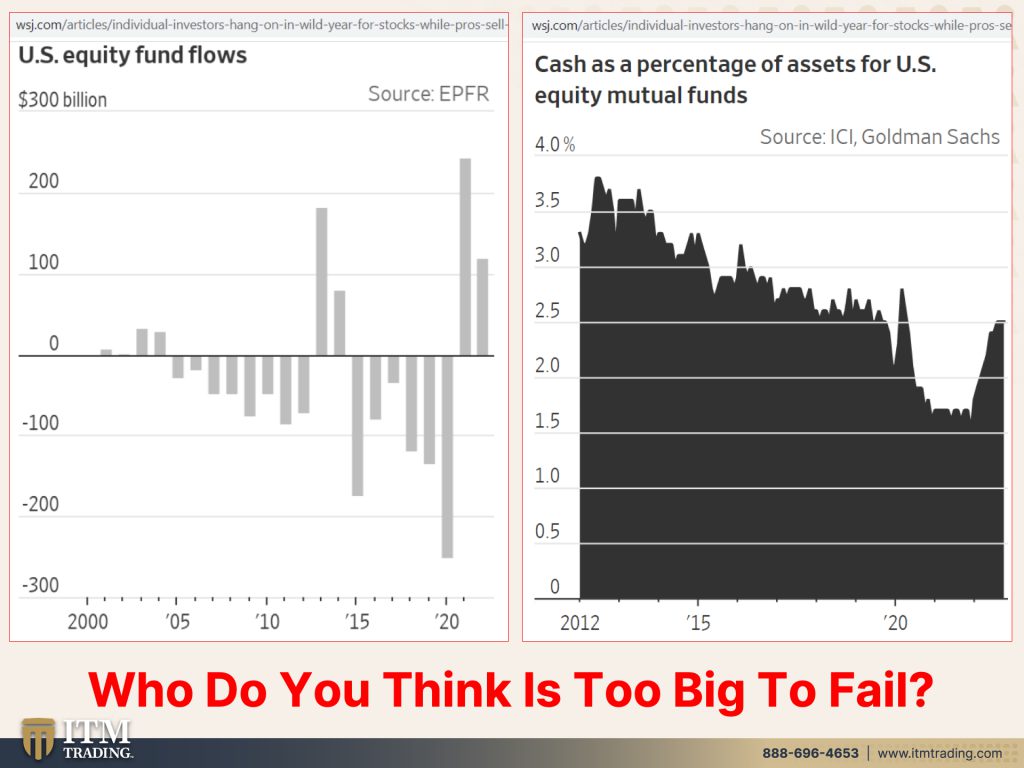

So here we can see the US equity flows in, but at the same time, cash as a percentage of assets for mutual funds is also growing. So this shows you the individual and this shows you the institutional. But you know, you gotta ask yourself who is too big to fail? It’s the big banks that are too big to fail because unfortunately you’re also probably sitting in mutual funds and the things that we have been taught were safe and what we should be doing. The classic 60-40 investment strategy falls a place there is no place to hide because as we have seen, look, this is back in 1937. You have to go all the way back to 1937 before you see the decline at this level. But it also happened in the early seventies and in 2008, just not as bad as today. But everything’s gonna be hunky dory. Don’t worry. Keep your money in the markets. Look at that all the way back to 1937 and what was happening in the thirties? Oh yeah, we were transitioning into a new system. When you had this, you could go into the bank and you could pull out a $10 gold coin and that would create restrictions around what governments could do. Then they transitioned us into this, which looks really similar so that you don’t think anything has changed when everything has changed. That’s what I’m trying to show you. They’re setting up a major change. Everything changed in 2008, whether you realize it or not, everything changed.

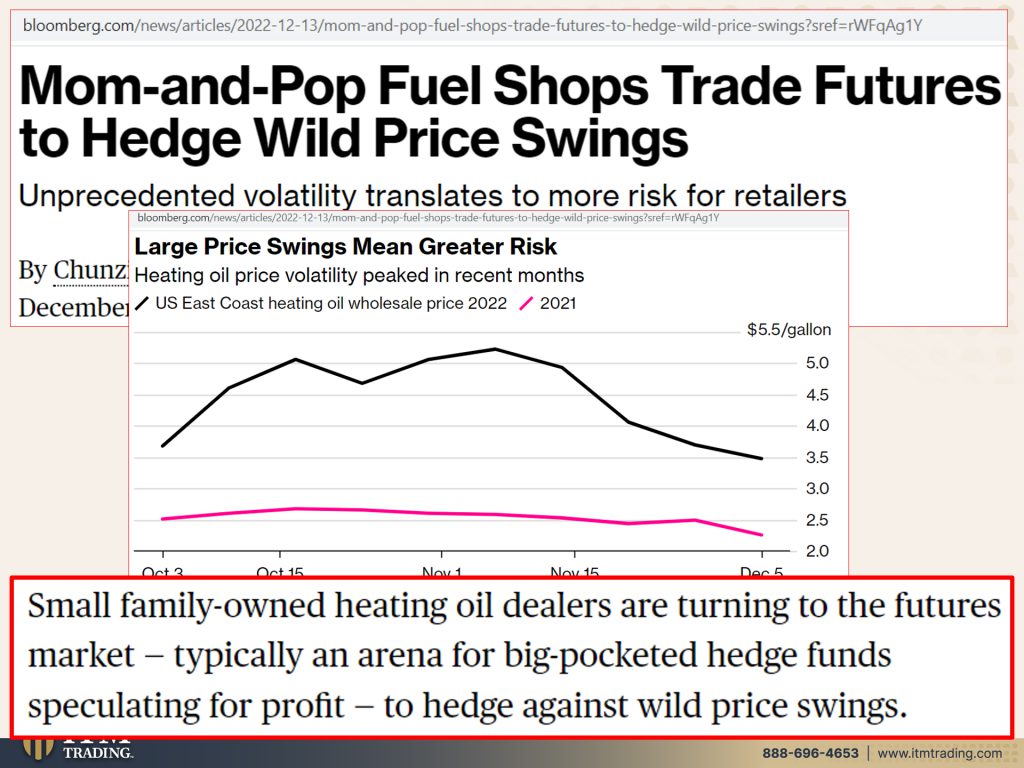

But now they’re ready to take us up to this next level. And mom and pop are pushed. So it’s the individuals and mom and pops that are pushed to the brink and they’re waiting into waters that frankly they are not really sophisticated enough to understand. So that means that it is pretty easy to take advantage of them. Mom and pop fuel shops, trade futures to hedge wild price swings. Why are we having all these wild price swings? It’s because the system is falling apart. Make no mistake about it. Do they want you to understand that? No, because then you’re gonna make different choices. You’re gonna get out of the system, but they want you to stay in it. However, is a mom and pop fuel shop in a position to really go up against the big guns? No they are not. And that translate to more risk for retailers. Small family owned heating oil dealers are turning to the future’s market typically in arena for big pocketed hedge funds, speculating for profit to hedge against wild price swings. We have talked about this and how every single asset in the world has been turned into a financial trading product. But you know, these are for professionals and you gotta read the fine print because frankly gold is the only financial asset that runs no counterparty risk. So you’ve got David going up against Goliath. Will David win? Well, if we all band together, the answer is yes, we can stop them.

But there you go. If you are counting on this income, BlackRock extends block on UK Property Fund redemptions, they would never do that here while they’re doing it in the UK. I love, I don’t love this, but the fund targets institutional investors and allows quarterly withdrawals only. And BlackRock initially blocked redemptions due for payment in September after a high number of requests over the summer. It will now delay withdrawals that were due at the end of December. Right? So if you don’t hold it, you don’t own it, regardless of what your perception is, you are under Wall Street’s control other fund managers including M&G, CBRE, Schroeders, and Columbia Threadneedle have all restricted withdrawals from UK property funds in recent months. If you don’t think that that can happen here, you need to think again, it can and will happen everywhere. That’s why you gotta have wealth outside of the system. It truly is as simple as that. That’s why this is truly a portfolio diversifier because I hold this, I own it outright. It runs no counterparty risk. If you don’t hold it, you don’t own it.

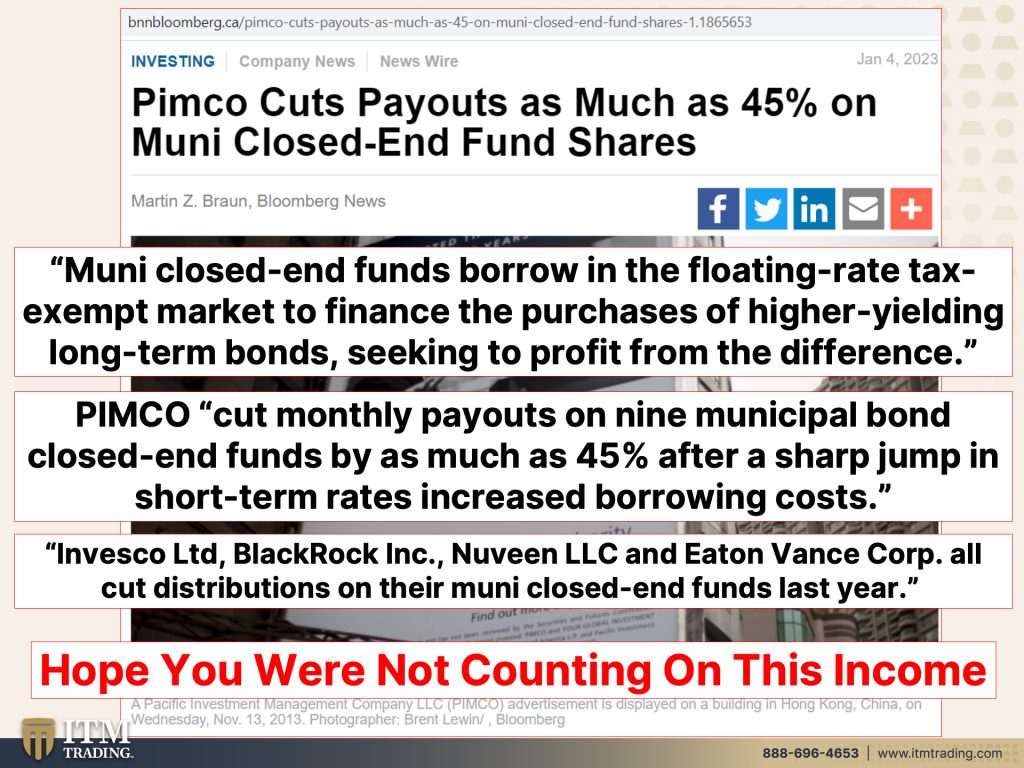

Even Pimco cuts payouts as much as 45% on Muni closed end fund shares. This in the US by the way. So if you’re counting on this income muni closed end funds borrow in the floating rate tax exempt market to finance the purchases of higher yielding, long-term bonds seeking to profit from the difference. So what that is is that is a maturity mismatch. And when everything’s going fine, you don’t notice that. You just, you can get your money out, no big deal. But when things don’t go fine, they just say, boom, nope, can’t have it. Well how can they do that? Because it’s not illegal when you make that deposit. It’s theirs, it’s not yours anymore. You’re paying for the risk, you’re paying them to manage this. But make no mistake about it. You have actually given them, loaned them that money. It’s not yours. Nobody went to jail in 2008 because it is not illegal what they did. Pimco cut monthly payouts on nine, nine, municipal bond closed and funds as much as 45% after a sharp jump in short term rates, increased borrowing costs. So when they just had those interest rates and the Fed said we’re gonna keep ’em low for a really long time, which they did, then they could create all these new funny products and benefit from them. But when that turns, who’s really the one that ends up holding the bag? It’s you. So you don’t own it, you’re paying for it, you’re taking all the risk. Does that seem like a good deal to you? Invesco, BlackRock, Nuveen and Eaton Vance, all cut distributions on their muni closed-end funds last year. And a lot of people think that municipal bonds are so darn safe. Yeah, well it depends on the kind of municipal bond it is. If it’s a revenue or a general obligation bond but not so safe. And when they’re put in these funds and then they do all of this financial engineering with them, it risks not just your income, but oh by the way, let’s talk about that for just a second because what are you getting paid on these 3%, 4%. So you’re gonna risk three or 4%. You’re gonna generate maybe three or 4% or even 5% of income, but you’re risking your entire principle. And if you lose your principle, how are you going to generate income from that? Now part of the strategy can replace this income in a very safe and secure way and then recoup that. So talk to one of our consultants about that. They can explain and walk you all the way through it. So this is not your issue.

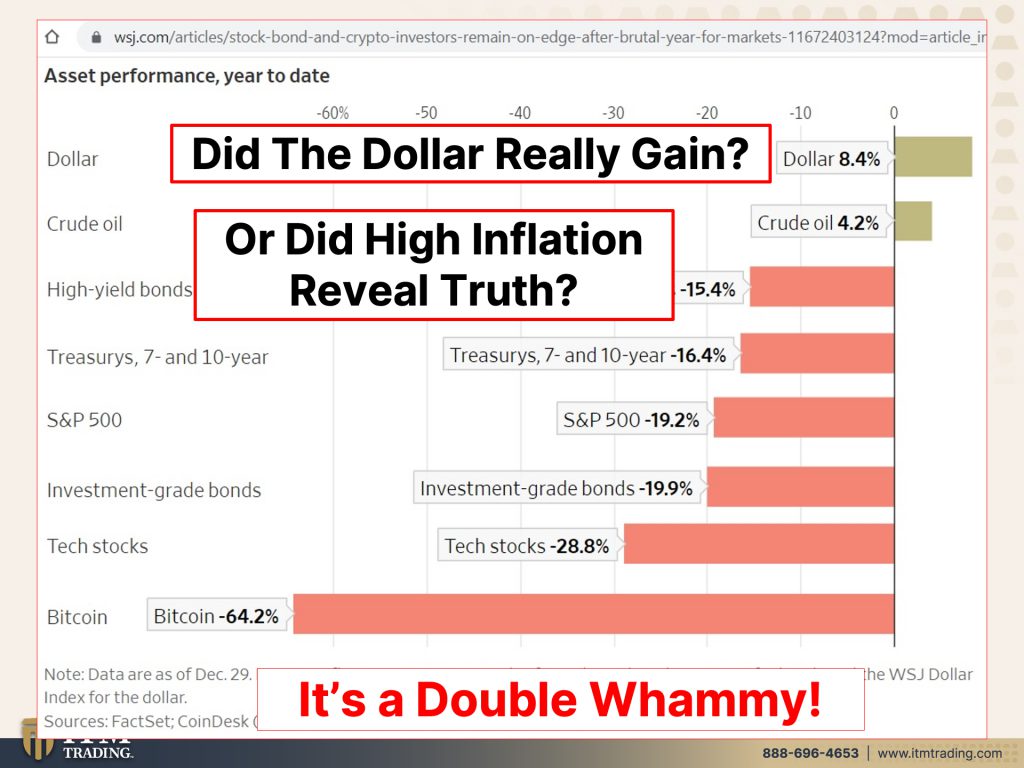

Let’s look at asset performances through last year. Well, the dollar through 2022 was a big gainer, 8.4%, but did the dollar really gain in value? Because at the same time we have had extraordinary inflation, which shows you the truth trend of the dollar, which is negative even though this shows positive. We’ve talked about this before. So that’s just the dollar against other currencies. But did that high inflation reveal the truth? Yes, it’s a double whammy, especially if you’re sitting in all these other high yield bonds, treasuries, 7 and 10-year S&P 500, investment grade bonds, tech stocks, Bitcoin, they all were in major negative territory. It’s just not the nominal dollars you lose. It’s the purchasing power value. What you can convert this stuff into because this looks like this and they made people think that this was the same as this. It’s not the same. It’s not the same, definitely not the same. So it’s up to you. You have to decide where you are most comfortable at, how much you are willing to risk. Personally, there is a minimum amount that I’m willing to risk because I’m in business, so I have to keep this garbage around, but I don’t keep more than I have to. Makes me very uncomfortable, especially with the bail-in laws and all of that. You have to decide that for yourself because by the way, there is a difference between the spot market and the collectible coin market.

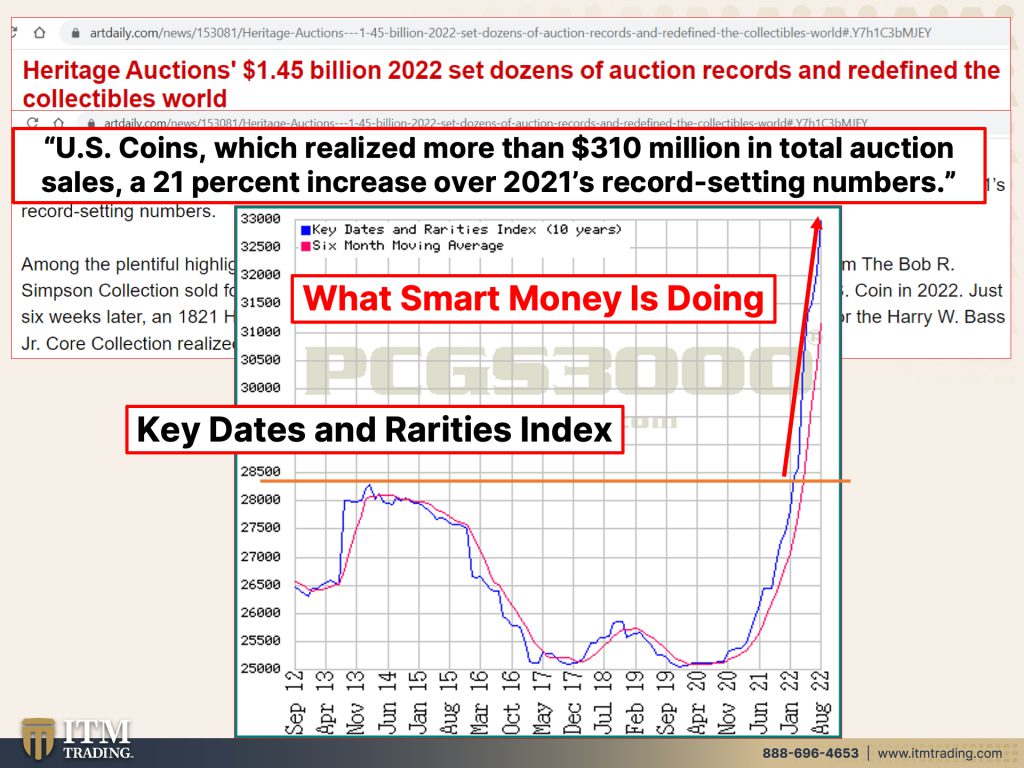

Heritage auction, 1.45 billion 2022 set dozens of auction records and redefined the collectible world. US coins, which realized more than 310 million in total auction sales, a 21% increase over 2021’s record setting numbers. They just want to buy enough time for those that they have targeted to actually benefit from all of this to get into position. This is key dates and rarities index. I’m pulling this up. This is not a key date or a rarity. This is a common date, substantially less expensive than key dates. But I’m pulling that up because this is what smart money is doing. Smart money has broken out, they’re piling into gold, they’re piling into collectibles because with this at the basis it’s monetary gold, it doesn’t matter. But this protects you. Are you right or are you wrong? If you own this, doesn’t matter whether or not you’re right or wrong. And these will perform because there’s a finite amount, unlike spot gold, which they could create as much gold as they want to. So don’t be fooled by the derivative you want the real thing. This is good money. This is what you want along with silver for barterability.

So if you haven’t seen it yet, you definitely want to see the piece that I did last week on the loss of the US dollar as the world reserve currency status. It’s critical because we have enjoyed this extremely, especially by global standards, lavish lifestyle, and that’s going away. So you need to understand where we are in that cause it’s a very, very big deal. Thank you Saudi Arabia. That enables us to retain that status. Well now, it’s officially going away. And if you haven’t done so yet, make sure you click that Calendly link below. Set up a time with one of our consultants to set up your own individualized personal strategy based upon your goals and what you have to work with, and it puts your best interest first, what a concept. If you like this, please give us a thumbs up. Make sure that you hit that bell when you subscribe, we’ll let you know when we’re going on air and leave us a comment and make sure that you share, share, share because ignorance does not make you immune, it just leaves you vulnerable. And that is the last position that I want any of you and myself and my family and people that I care about. It’s the last place I want you to be. And so until next we speak, please be safe out there. Bye-Bye.

SOURCES:

https://www.cnbc.com/2023/01/04/fed-minutes-december-2022-.html