Smart Money Abandons Ship: Dumb Money Takes the Helm

The global financial system is in chaos, and you need to act NOW to protect your wealth. In this video, Lynette Zang breaks down the alarming developments in the bond market, exposing the hidden risks that could wipe out your savings. From the destabilization of the Treasury market to the rise of inflation, Lynette connects the dots so you can protect your wealth.

CHAPTERS:

0:00 Smart Money

1:48 Foundation of the Global Markets

5:05 Maturity Bonds

11:11 Who’s Buying?

19:38 Treasury Pain Deepens

21:31 Free-Money Era

26:52 10-Year Treasury Yield vs. Spot Gold

35:35 Start Your Strategy!

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

As we approach the year’s end, a seismic shift is unfolding in the financial system. And this is huge because this is the transition that is going to eliminate and take care of the problem they have over pension funds, retirement funds, market makers, insurance companies. Oh, let’s see, who is the one that’s investing in all those? How about the normal public? And that’s gonna be a huge problem. I talked to you just recently about what was happening in the bond market, and yet we have involved to a new stage of it where the 10 year treasury, the foundation of the global system, has become completely unanchored. Is this new news? Heck no. We talked about it way back in 2015 and 2016, 2008, etcetera. And I’m gonna show you how we were warned about it. So the smart money positions into the gold and silver to protect you while the dumb money picks up the slack as the smart money leaves. We’re gonna talk about all of that. You’re gonna see it crystal clear and what to do about it, coming up.

If you have not yet set up your strategy and executed it, click that Calendly link below because clearly, clearly, clearly time is running out. As this debt bubble bursts bigger and bigger. You are not gonna know about the loss of your choice until it’s too late. So while you still have choices, get it done.

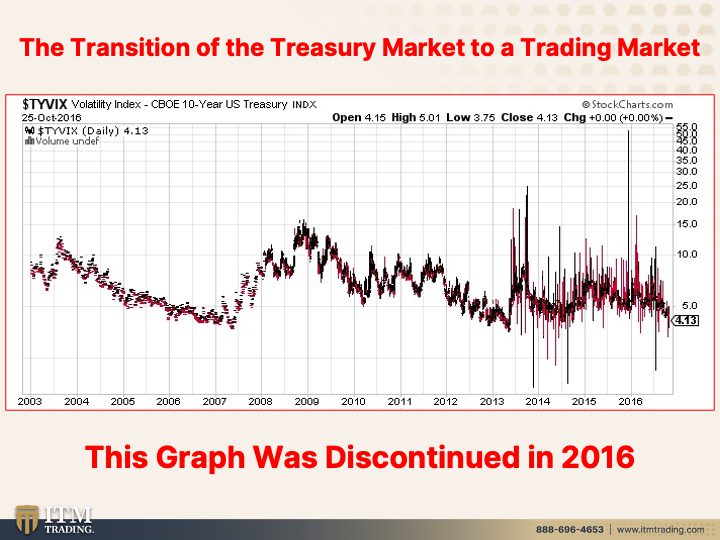

Let’s go to film. I gotta show them what in the world is happening. Okay. Now, I have shown you this transition from the treasury market. The US Treasury market supposed to be the most liquid and stable market in the world. It underpins the global financial system. It is the foundation. I’ve shown you this chart before they took it away from us in 2016, but what you’re looking at is the price movement in the 10 year treasury note or bond. The 10 years. It is more of a note, but I don’t wanna digress from that.

What I wanna show you is how over here, between 2000 and way before that, it’s a little dash, right? And what that means is that the price movement of the treasuries was very, very steady. That’s what you want in a foundation. You want a nice steady underpinning, imagine your house on something that is shifting. Does that work? No, it doesn’t. Your house is gonna fall down. Then 2008 happened, and what went from a dash became a line, and the price volatility in the treasuries became greater. Then move over to here to 2013 and you see massive shifts in it. Well, we know that there was a liquidity issue with the treasuries in 2015. That’s when this started coming up. But it was already in 2013. You can see it. Look at this. Look at, look at this price action and how much the prices change. And so they took it away from us in 2016 because God forbid, you should have a clear tool to show you what’s really happening in the treasury market. And let’s go now to 2023. But between 2015 and 2023, we have had a number of problems and issues that have come up in the liquidity, which is the ability to buy and sell treasuries without moving the price significantly. Why did they hand it over to the traders? Because it was so critically important that banks make money and they make far more money by trading these assets. So everything starting in the early eighties, really starting in 71 when we handed the control of inflation over to those central bankers who know what they know debt and they know interest rates and they don’t give a crap about you. So you can see from this one chart when the treasury market became destabilized and was handed over to treasuries, making it even worse, this is the foundation of the global markets. Now, maybe you and I couldn’t see it since they took that away from us, but we have been feeling it, and I have been talking about this.

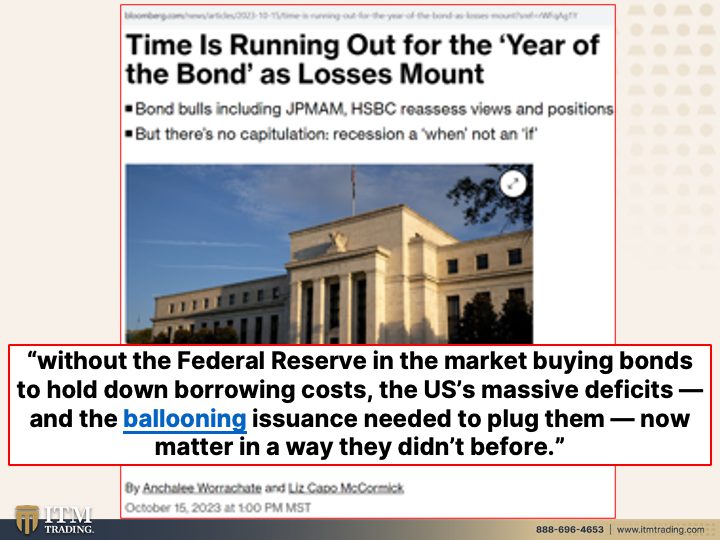

Let me take you current, I just wanted to make sure that you guys understood, because time is running out. This was supposed to be the year of the bond. Why? Because they felt that there would be a crisis and the Fed would pivot and lower interest rates. So forgive me if I do this, and you already get it, but this is interest rates. This is the market value of the bonds, right? So they have pushed interest rates down, which pushed the market value of the bonds up until they started going the opposite way. And they did it rapidly. And they did it quickly. I’m so glad that Bank of America came out and said, oh yes, our held to maturity bonds, bank of America came out today and said, no, no, we’re not gonna take any losses on our hell to maturity bonds. Yeah, nominally, if presuming there is not a run on the bank that forces them to have to liquidate what they’re holding to maturity, they will get the nominal value back. So in some ways that can be justified. But we are in crisis mode right now. Not tomorrow, not three weeks, not three years, not 20 years. Right now, and I hope you can see this because it’s about to get a whole lot worse. ’cause What was even stabilizing the market as much as it was was fed buying, right? That’s what third world countries do. But the feds started buying our government bonds in, in 99, the end of 99, 2000 because there were, or 2002, because there were not enough buyers in the market. It had already, the liquidity in the foundation of the global markets was already eroding without the Federal Reserve and the market buying bonds to hold down those borrowing costs. In other words, push down interest rates. The US massive deficits and the ballooning issuance needed to plug them now matter in a way they didn’t before. Because we are at the end of this game. And this garbage means absolutely nothing. Once the public loses confidence, and officially, you have no purchasing power left. It’s just that simple.

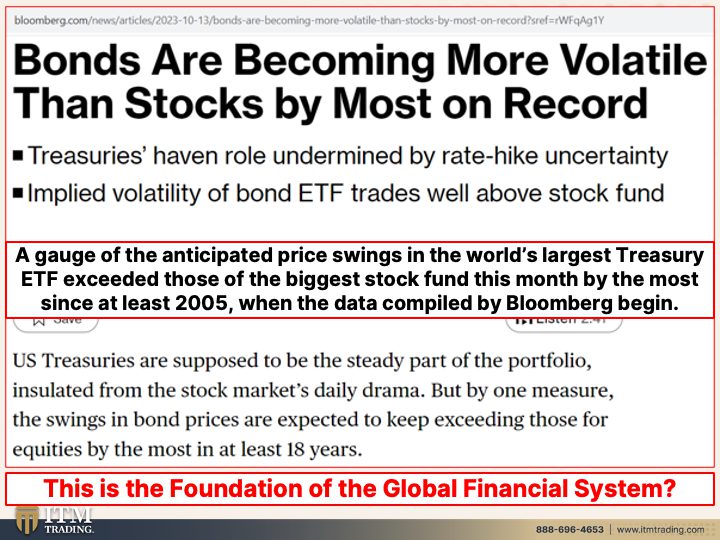

Bonds, this is the part, oh my God. So from 2013 to today, these things happen slowly because when they happen quickly, then you notice and you make different choices. But if it happens slowly, you don’t notice. You think everything is fine. And hunky dory. So they use derivatives and the Fed buys the bonds. They do all of these accounting tricks to make things seem stable when they’re really not. Bonds are becoming more volatile than stocks buy the most on record. OMG bonds are supposed to be the safe, the quote unquote safe haven asset, especially the treasury bonds. Because the Federal Reserve can print the money that they need or the government can, can print the money that they need to repay you what that money will buy you. That’s a different story because it will go to zero. It’s that close once. It’s almost there. Now, just that little bit of confidence. So US treasuries are supposed to be the steady part of the portfolio, insulated from the stock market’s daily drama, but by one measure, the swings and bond prices are expected to keep exceeding those for equities by the most in at least 18 years. Because that’s when they started tracking it. How about almost historically, ever, this is all perception management that bonds are safe. They’re not, they’re not. A gauge of the anticipated price swings in the world’s largest treasury E T F. So that’s a group of the treasury bonds. Bills notes exceeded those of the biggest stock fund this month by the most in since at least 2005 when the data compiled by Bloomberg began. Okay? So this is, I’m telling you, this is not historic norm by any stretch of the imagination. This is what they call diversification. You have stocks, you have bonds, you’re diversified. No you’re not. They’re all based on this crap and debt. And that debt bubble has been pierced by raising the rates which the Fed was forced to do to fight the fricking inflation that they created. Are you kidding me? And do you see anybody coming in to take responsibility and own their crap? No, you do not. You see finger pointing and other things coming up so that they can go, well, that’s why. And that’s why No, my friends, this is why you can’t do that with this. But you can do that with this easy peasy, no problems whatsoever. This is the foundation. I cannot stress this enough. This is the foundation of the global financial system. If your foundation is going like this, are you staying in that house or are you getting out? Personally, I’m getting out, but I got out when I first saw it.

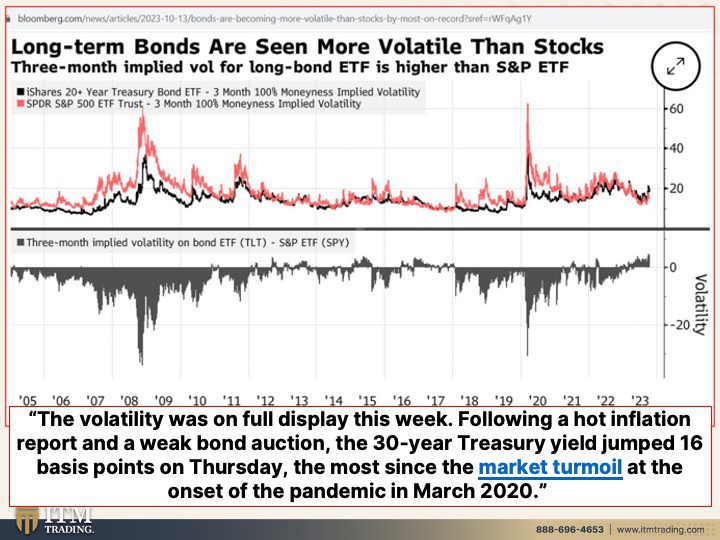

Long-Term bonds are seen more volatile than stocks. Let’s take a look at this because this is the 20 year treasury bond ETF, three months, a hundred percent. Moneyness implied volatility. I mean, seriously, what you’re looking at is the foundation of this that you’re working for and you’re using as your tool of barter. And you may even be attempting to save it for something in the future. Maybe an education. Hmm, maybe retirement, maybe something else. Why? Because you’re losing all purchasing power. That’s what this inflation shows you. The volatility was on full display that was last week following a hot inflation report and a weak bond auction. The 30 year treasury yield jumps 16 basis points. That may not seem like a lot, but that’s huge in what is supposed to be very stable, right? The most since the market turmoil at the onset of the pandemic in March of 2020. But Paul Krugman says, inflation has been tamed. It’s all over folks. It ain’t over folks. You still have a minute to get in place. You sitting in this stuff, you sitting in the stock market, the bond market, good luck to you, as my mother would say, good luck to you because you are not gonna farewell.

Beware the new treasury buyers because risk must be transferred. The old treasury buyers were more stable. They were, they were central bank chiefs. They were governments because the US dollar as the world reserve currency, they had to hold dollar denominated assets in their reserves. Okay? But they’re going away. Even our federal reserve, I mean, they may turn around and have to buy it again, but more price sensitive investors like hedge funds are piling in. Hmm. Well, you say, well why? Why do I care? You know, really about the hedge funds and oh, by the way, weren’t the hedge funds, the ones that got bailed out from Silicon Valley Bank and those other regional banks? But don’t call it a bailout, they just weren’t ready yet for you to notice that, that banks are going to be bailed in. You’ll lose whatever wealth you hold in that system. You’ll lose it even if they don’t because it’ll lose all purchasing power. Take your, you know, choose your medicine. That’s why I choose physical gold, physical silver in my possession. And why I believe you should too. Because there is a shifting demand as they shift the risk from the few to the many, which is just the right size to fail. And you, my friend, are in the many.

So who’s buying less? Okay? The Federal Reserve foreign investors, commercial banks and broker dealers, you can see that the Fed sold off 213 billion in the treasuries by the end of 2023. If they continue on the path they’re on, they will have sold off 720 billion. So they ain’t buying. Foreign investors went from a positive a plus of 376 down to 275 billion. Commercial Banks were also selling. So foreigners were buying. But commercial banks, that means J.P. Morgan, Bank of America, Wells Fargo, those are all commercial banks with ties directly to the Federal Reserve. And by the way, all those regional banks and community banks are depending upon these commercial banks as are you know, the anybody that performs that, that function. So minus 83 billion to minus 170 billion. So more than double and broker dealers. So these are supposed to be the market makers. All these entities are supposed to stabilize that price, which they aren’t doing anyway and haven’t been doing, especially since 2008. And especially since 2013. They went from buying 72 billion to a big whopping goose egg. Not a dime. Not a dime. So who’s buying? let’s take a look at this. Oh my goodness. Pension funds an insurance companies where they were selling minus 41 billion, they’re now buying 150 billion. So these are the institutional investors that are investing your hard earned money. Do you see this risk transfer? Who else is buying? Okay, mutual funds from 20 billion to two 75 billion. You can’t make this stuff up. And money market funds. So we’ve had a flood of people rushing into money market funds because they’re paying you a little bit of interest. And that’s going from minus where they were selling 751 billion to a plus 600 billion. Kind of looks like the money markets are buying all of the treasuries that this fed is selling. Hmm, isn’t that interesting? Hmm. Hmm. Isn’t that interesting? Do you see this risk transfer? Do you see it? I hope you do because if you only share one chart yet or one slide, you gotta share this one with your friends and your neighbors. If you need to print it out, ask your consultant at ITM, they’ll print it out. If you don’t wanna do that, go on the blog. You can pause it, you can print it out. Ignorance does not make you immune. It simply leaves you vulnerable. And they have been transferring the risk from the few to the many. And this is the final blow off. We, the treasury market is completely deed all of the, wait, I’m going back to here. All of the usual buyers that really aren’t sensitive to prices. The central banks in foreign investors, commercial banks, broker dealers, they’re going away. And you have pension funds and insurance companies, but it’s guaranteed. Well look on your documentation because those guarantees are only as good as the claims paying ability. That’s it. That’s counterparty risk people. That’s counterparty risk. What runs no counterparty risk. Physical gold, physical silver in your possession. And that’s according, that’s GR to me. But more importantly, that is according to the most powerful bank in the entire world, the Bank for International Settlements, this gold is the only, the only financial asset that runs no counterparty risk. All this other garbage that they want you to think you’re diversified in. It’s all counterparty risk. And you’re looking right at it. What’s counterparty risk? That’s counterparty risk. The claims paying ability. And have we not been witness over this last year or so to funds going, nope, you can’t have your money back. Nope. If you don’t hold it, you don’t own it and your perception means zero in a court of law zero. And it’s getting worse higher for longer.

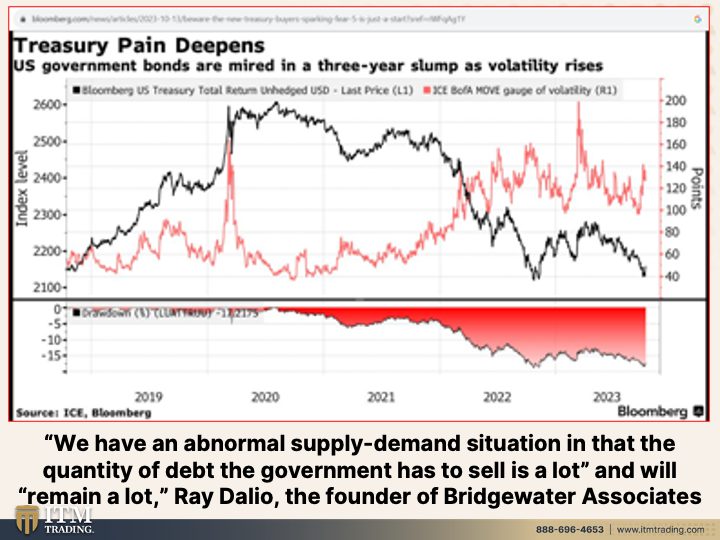

US government bonds are mired in a three year slump as volatility rises. That’s not good. We talked about the bond vigilantes, who are the bond vigilantes? Because that’s the way they say it. The bond vigilantes are demanding to be paid more to take the risk. Yeah, those are bond traders. And you saw when they significantly came into the market in 2013. So you got them getting out while you are getting in. Yeah, that’s gonna work out real well. What do you think? We have an abnormal supply demand situation and that the quantity of debt the government has to sell is a lot and will remain a lot. Oh, but don’t worry. Debts and deficits, ah, they don’t matter. Yeah, they matter. And that’s according to Ray Dalio. But that’s also according to me, and that’s according to every economist on the planet. The treasury is running huge deficits. And we were told so long that it doesn’t matter. Guess what? It matters because you’ve got this interest rates. Look at this. Okay? Is that what you want your foundation to look like? Not what I want my foundation to look like. I want it to look like this. I hold it and I own it along with Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter. And, and look, I know that I’m really keyed up and, and likely some of the recent videos I’ve done, you can see how keyed up I am. But that’s because I’m trying to warn you and I hope you’re hearing me. I really hope you’re hearing me.

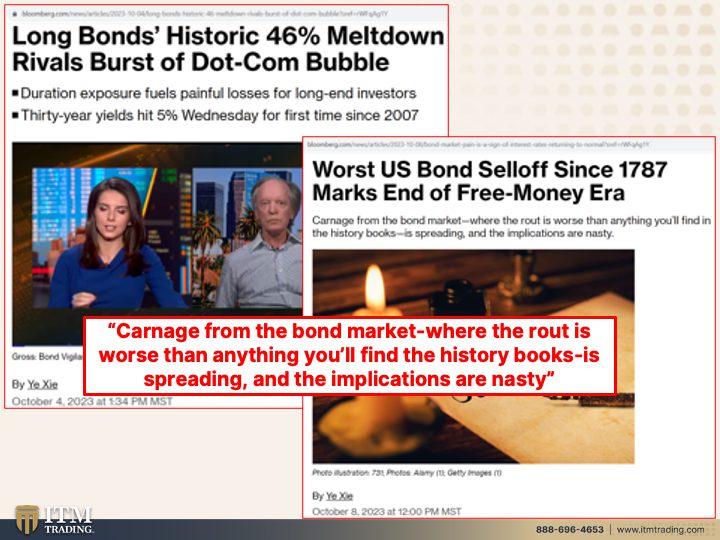

Long bonds historic, 46% meltdown. Rivals burst of.com bubble. Yeah. You think? Worst US bond sell off since 1787, not 1987, not even 1887. 1787. You think that marks the end of the free money era? What that really means, what they’re trying to tell you is get to flip and cover. Get a safe haven asset. Hold it, own it. You keep it in this. That’s what you’re looking at because that’s what creates this. This is a debt-based currency. Thank you so much. And boy, hasn’t the wealth already transferred? Have we heard about the difference between income and wealth? That’s gonna get a whole lot worse because that is the design carnage from the bond market where the route is worth than anything you’ll find in the history. Books is spreading and the implications are nasty. What else do you need to know to get to safety and to make sure that you can survive by creating the ability to ha to maintain a reasonable standard of living? Because everybody’s gonna be impacted by this. Even people that own gold and silver, now, they’re gonna be a whole lot less impacted because they’re gonna have real money to buy what they need. This is what I use for barterability. So community, community, we have to come together because we vote with our wallets. What are you going to vote for? This is my vote. As well as food, water, energy, security, barterability, wealth preservation, community and shelter. Get it done or become part of the community. So one person can do one thing, the other person can do another thing. And you can come together to help each other because that’s what community is all about. And we need both a global community and we need a local community. And that’s what thriverscommunity.com is all about. Come and help us. Time is running short.

Wider war in Middle East could tip the the world’s economy into we’re already going into a recession point. Fingers don’t look in the mirror and own your part in it. You flip in central banks, you flip in governments. I’m sorry, I’m so angry at them because their job is to lie and lie and lie some more. War always accompanies a currency regime shift. Look over here. Can I, And I’m, I’m telling you what’s happening in the Middle East is horrendous. It’s horrendous. But I can’t sit here and tell you that there wasn’t a plan for it. Just like Russia and Ukraine, I can’t sit here and tell you that because they’re all part of the IMF. All those treasury secretaries, all those central bank chiefs, they get together regularly and they have an agenda and they have a plan and they execute it slowly, but they want distance. They say it in almost every single report I ever read from them. They want distance between their policy choices and how it is introduced to the public because they do not want you or me to know that it’s coming from them. Let’s go cashless. Let’s have the retail public introduce that. And a lot have been complying. I prefer the ones that prefer cash myself because this is just going to be the excuse for the hyperinflation that quite honestly has already begun. And many think, and I’m one of them, but many people think that we are already in World War III. And as Ron Paul said, there is not a coincidence that the era of world wars and perpetual wars went. Okay. This isn’t an exact quote went hand in hand with the era of perpetual central banking because up until actually 1927, every central bank had a charter. In other words, their life span was either 15 to 20 years. And originally the Federal Reserve was also born with that charter. 20 years that would’ve put it at, Hmm. What date was that? 1933. And in 1927, for the first time ever, a central bank was gifted a perpetual charter. And this is where we are. But who did that help? Who did that benefit? Not you or me.

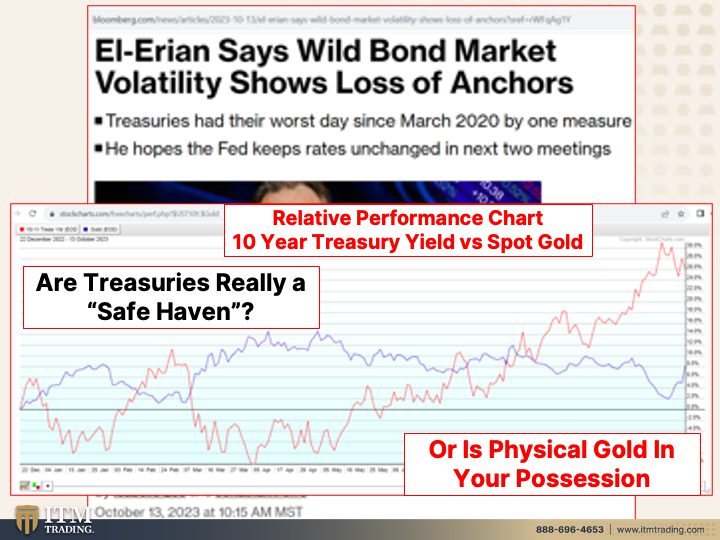

And when you have mainstream coming out and talking about the wild bond market, volatility shows the loss of anchors and treasuries had their worst day since March by one measure, he hopes the Fed keeps rates unchanged in the next two meetings because is that gonna really fix things? No, it is not. That bubble has already popped. And our future is in the hands of traders. And you can say that one way trading for a little bit of property or a little bit of pickup in this garbage. And you can say it in another way, traitors. Because our founding fathers wanted good money. Not this crap that historically has been debased over 4,800 times. Yeah, yeah. I mean, to me, this is just heartbreaking because I have children and I have grandchildren. I’ll have great-grandchildren and so will you because everybody is our children and our grandchildren and our great-grandchildren. And we have to come together to say no. And time is running out to do that. What you’re looking at here is a relative performance chart between the 10 year treasury yield versus spot gold. Okay? Because in theory, well in reality, gold pays no interest. It doesn’t have to. It’s the safest darn thing that you can do. So, hey, the treasury bond, it is a debt instrument and that pays you these. Oh, wouldn’t you rather have more of these? You don’t have to have any interest on this. It’s the safest darn thing you can do. But at the same time, inflation by design erodes what you can buy with this. So you’re getting paid less and less for the work that you do without you realizing it. And now the unions are demanding more money because the inflation is more obvious. The rise of the people has begun. Are we gonna have a revolution? Well, I hope it’s not a violent revolution. I hope we vote with our wallets and say no to their CBDCs, their digital surveillance economy, their ability to plant things in your head so that they can control everything you do. Or put, put it in your earbuds that you’re listening to. Maybe I’m old fashioned. I grew up in a time where privacy mattered. But I also think that the experience of the transition from at least a quasi gold back currency into a full fiat debt-based currency, I have that history. I remember what that was like. You guys that are out there that are a similar age as baby boomers, remember that. Remember how chaotic it was? Remember the Vietnam War? Remember the inflation and the stock markets decline and everything else that was going on? Civil rights, women’s lib, lots of things for you to focus on so that you’re not focusing on how they sold you down the river. Nixon said, Hey, if you just buy American, everything’s good. Lies, lies, lies. Because their job is to keep you vulnerable. My job is to help you make educated choices that puts your best interest. First, food, water, energy, security, barterability, wealth preservation, community and shelter. Do you really think that treasuries are a safe haven? ’cause they’re not Bank of America. Oh wow. We, we don’t anticipate any losses on our health to mature. That is such garbage. These commercial banks are drowning in losses from their treasury portfolio. The worst route since 1787. It’s nothing. It’s just that those that create those derivative, those risk betts control, whether or not there is an event from it and they’re opaque markets, we can’t see it until it’s too late. But all, everything I’m showing you today, everything, everything that I’ve been showing you for years and years and years is showing you the deterioration of the foundation. I don’t know how to make it more visible until it’s too late for you to make choices. So if you haven’t clicked that Calendly link, do it. Get it done, get it executed. Get your wealth. You do whatever you want. I can’t really tell you what to do. But your wealth held in this is at risk. It is at risk. And this black swan event, this crisis that will eliminate your ability to properly get to safety can happen any second. And I’m not gonna know it one second before, and certainly you’re not gonna know one second before, no counterparty risk. The only financial asset, gold, physical gold in your possession is the only financial asset that runs no counterparty risk. The counterparties are bailing. You have all the risk. What are you going to do about it? I mean, I’m just, I’m just as serious as a heart attack. It’s happening. People, the time to wait is gone. I don’t care what the spot market does. Let it go up. 52 bucks, let it go down. 52 bucks. That is just a paper market designed to manipulate what you do. Stop listening to them.

I just did a video that’ll go out, I don’t know, maybe this Thursday or the following Thursday on the trends and how to identify the patterns because I think we all need a reminder. Look at that video. Get to safety. Now that foundation is going like this and it’s visible to those that know, click that Calendly link. Get your strategy executed because you have to have what you need for your objectives. And that’s what we do different than anybody else. And this strategy is based on my studies of currencies and currency life cycles. Going back to 1987 is when I first started studying it. Ask your banker, ask your broker, have you ever studied currency life cycles? And if they say yes, I want you to ask ’em the simple question, then tell me how money is created and supported in this system. And if they start giving you a running around and all this gobbledy go, well, blah, it’s ’cause they don’t know. Here’s the answer. What supports this? Federal Reserve? Federal Reserve note, this debt instrument is the full faith. So you gotta trust the government and credit the government’s ability to grow more debt, which they’re saying even openly in mainstream media is declining.

They gotta get you to buy that debt. So what does the mainstream media come out? Oh, well, you’re gonna make so much money with this strategy because the fed’s gonna pivot and drop rates down. Maybe they will, but they’re fighting for their credibility and that makes them even more dangerous.

So if you haven’t done it yet, you make, make sure you subscribe because we are in a really dicey place right now. Leave us a comment. Please help us spread this information. Give us a thumbs up and share, share, share, share, share. I will be very shortly coming out with that five minute video. I think I got it dialed in by now. So stay tuned. And actually on these trend cycles and where we are, we’re gonna be breaking them down into itty bitty videos. So you’re gonna be able to share those too. Now I’m pooped, but I’m telling you I’m really upset and I hope I can impart how critical. It is critical to get it done as quickly as you can. Something is better than nothing, but coming together in community so that you don’t have to do it all. ’cause Frankly, I gotta tell you, I don’t think you have the time to do it all. I’ve been working on this in earnest since 2010 was when I managed to buy this property and start that food, water, energy, security, barterability, wealth preservation, community and shelter. I’ve been buying gold in earnest since 2002 when the formulas, the patterns just told me that the end was coming. Do I care that I missed out on some of these rallies? No, I don’t give a crap because I’m a technician and I’m a long-term strategist. I wanna know not what’s happening today because that’s irrelevant to me. I wanna know what’s gonna happen tomorrow so I can get into position to survive it and thrive through it. And that’s where we are right now. You can get into position to survive this and actually come out the other side of it better. But it’s not gonna happen unless you get into the position so that you’re in the right place at the right time with the right asset.

And with that, I want you to remember, financial shields are made of physical metals. Definitely not paper or lame promises. ’cause They know they’re screwing you. They know it. Until next we meet. Please be safe out there. Bye-Bye.

SOURCES: