Treasury To Collapse Economy & Markets

What if you woke up tomorrow? The stock market’s crashing, interest rates spiking, and your credit and debit cards were frozen. Nothing was working. Would you panic because you’re not prepared and out of choices? Or would you thank your lucky stars that you were properly positioned in advance? Your critical breakdown was in the foundation of our financial system, that indicates that we are very close to a collapse. U.S. Treasury Market is the foundation of the entire global economy and is in deep trouble. Liquidity is now at a critical level, which is the ability to buy and sell without huge price swings. That’s evaporated like the foundation of a house during an earthquake. This foundation is so fragile that the Treasuries openly discussed programs identical to what Third World countries have done in the past. Jerome Powell has told us they will also bring some pain to households and businesses, and you should believe them because of the Treasury market freezes. Everyone’s standard of living will be impacted. Do you think this can’t happen here? It’s already happening in the U.K., So let’s see what the data says.

CHAPTERS:

0:00 US Treasury in Trouble

1:21 Liquidity & Forced Selling

4:25 Foreign Holdings at Federal Reserve

6:14 US Losing World Reserve Currency Status

9:47 Markets Having Trouble Trading

15:02 10-Year Treasury Price Volatility

16:56 Drawdown = Selling

21:00 True Value of Gold

23:54 Set Up Your Strategy

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

What if you woke up tomorrow, the stock market’s crashing, interest rates spiking, and your credit and debit cards were frozen, nothing was working. Would you panic because you’re not prepared and you’re out of choices? Or would you thank your lucky stars that you were properly positioned in advance? There are critical breakdowns in the foundation of our financial system that indicate that we are very close to a collapse. The US treasury market, that is the foundation of the entire global economy and it’s in deep trouble. Liquidity is now at critical levels, which is the ability to buy and sell without huge price swings. That’s evaporating like the foundation of a house during an earthquake. This foundation is so fragile that the treasuries openly discussing programs identical to what third world countries have done in the past. Jerome Powell has told us “They will also bring some pain to households and Businesses” And you should believe him because if the treasury market freezes everyone’s standard of living will be impacted. Do you think this can’t happen here? It’s already happening in the UK. So let’s see what the data says, coming up.

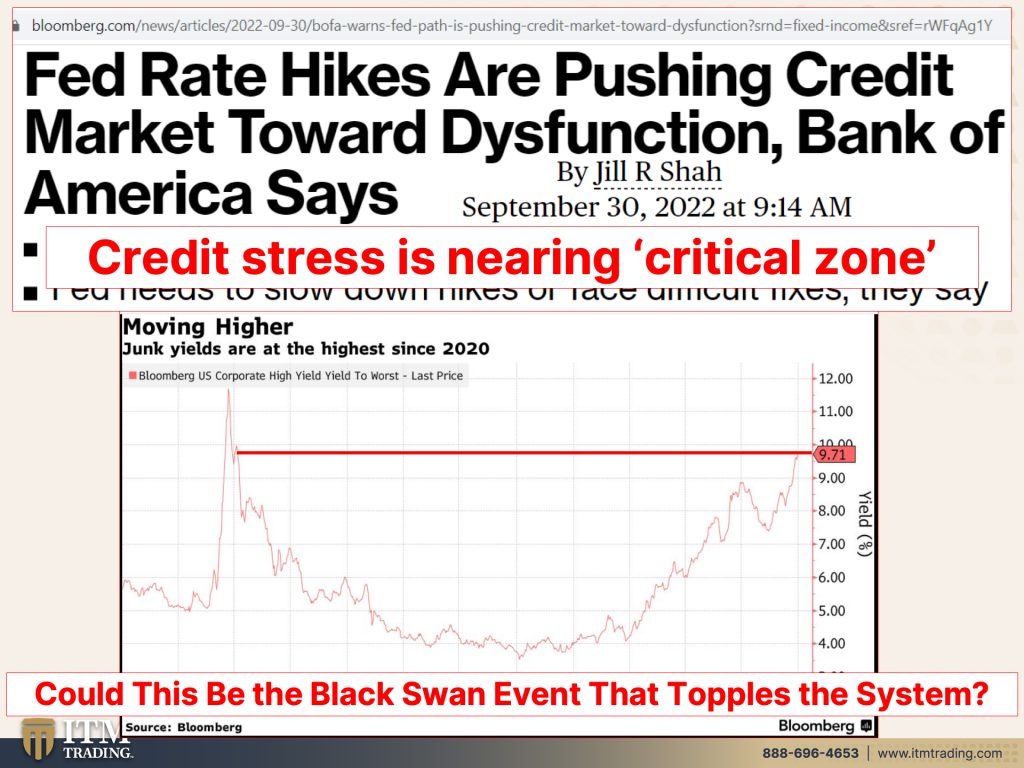

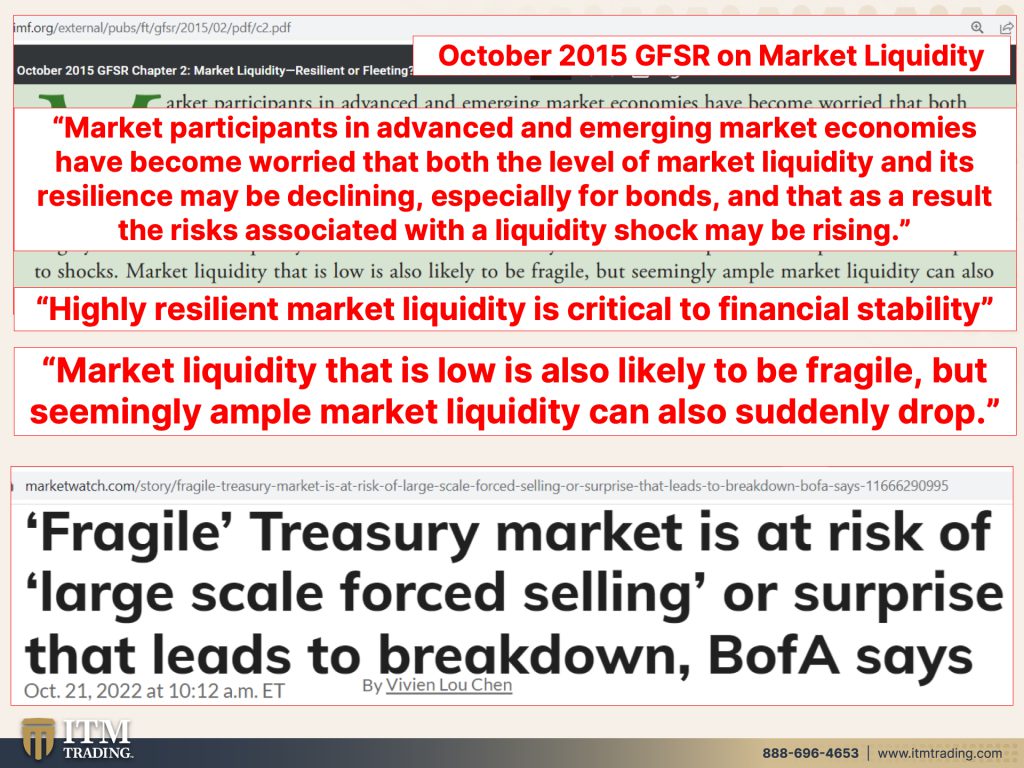

We know that the Fed and all global central banks are absolutely committed to raising interest rates and this is creating complete dysfunction in the bond markets and in specifically even the government bond markets, which is what we’re gonna talk about today. You can see that credit stress is nearing the critical zone. Could this be the Black Swan event that tops the entire system? But you know, it didn’t just happen, it happened. It started happening in October of 2015. At that point, and see if this doesn’t sound familiar to you. Market participants in advanced and emerging market economies have become worried that both the level of market liquidity and its resilience may be declining, especially for bonds. And that as a result, the risks of associated with a liquidity shock may be rising. Well, that is particularly worrisome since the treasury market is the foundation of the global economy and requires a highly resilient market liquidity in order to maintain financial stability. So definitely we’ve been warned and we’ve been paying attention to this, if you’ve been watching my work, we’ve been paying attention to this since 2015. Market liquidity that is low is also likely to be fragile, but seemingly ample market liquidity can also suddenly drop. And that’s exactly what happened back in October 2015 and the treasury market. Well, here’s an article headline from today. Fragile Treasury Market is at risk of large scale forced selling or surprise that leads to breakdown. What’s forced selling? Well, when the markets go down and, and you remember, let me just kind of remind you, here it is, okay, what happens with bonds? So these are interest rates and this is the principle of the bond. When interest rates go up, the bond principle goes down. So when they’re talking about forced selling, what that actually means is if they have borrowed to buy these bonds, which they probably have lots of leverage in the system, then they’re going to get what’s called a margin call and they’re gonna have to come up with money. If they can’t come up with more money, then they have to sell. That’s what they mean by forced selling And liquidity by the way too. That definition is the ability to buy and sell without moving the price too much cause there’s lots of buyers for all the sellers.

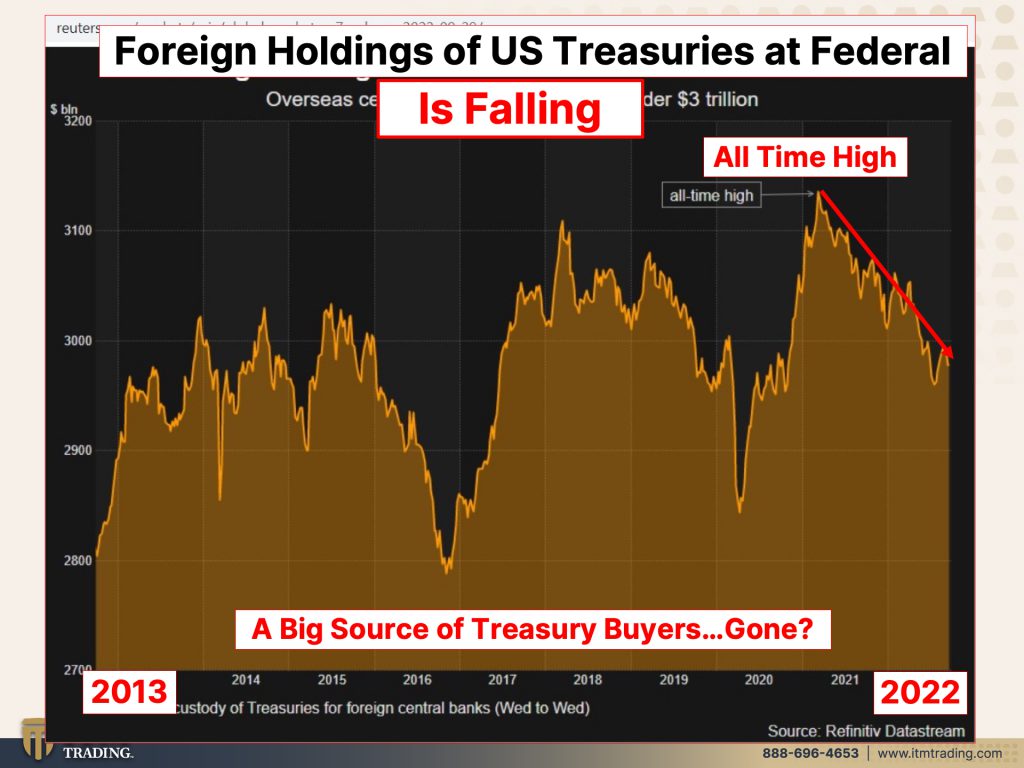

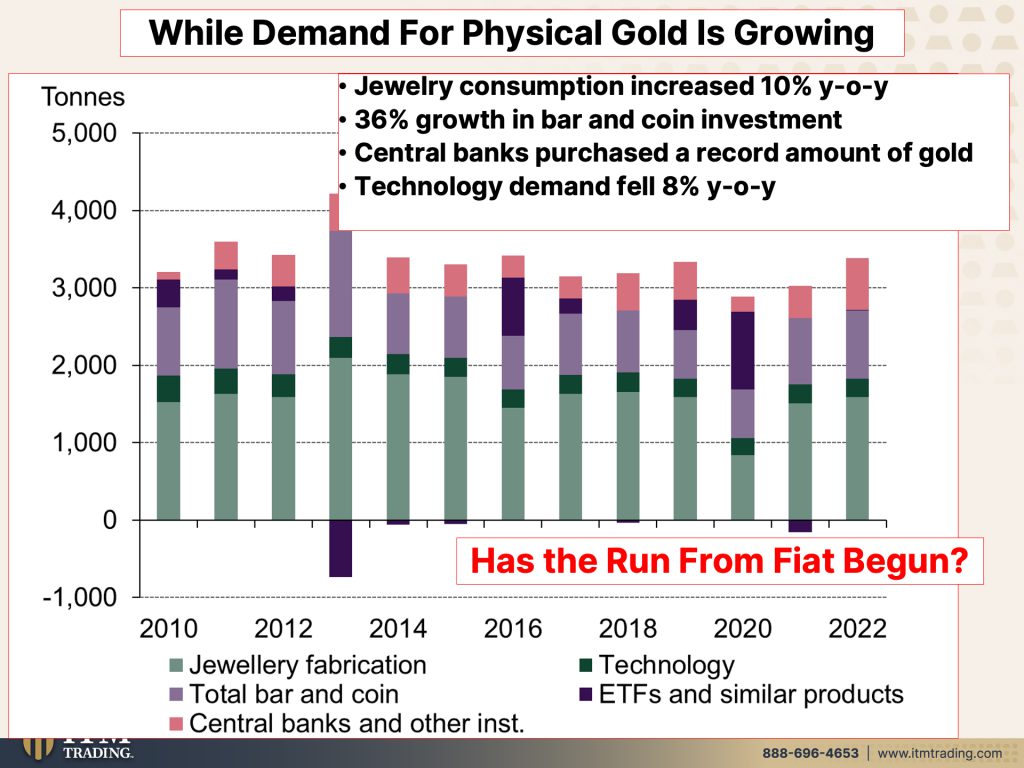

This is critical because what’s happened, and we’ve talked about this so many times, is the base of buyer of treasuries is also going away. What we’re looking at here are foreign holdings of US Treasuries at the Federal Reserve, and you can see that it is significantly declining from its all time high back in 2020, right? So this is a base of buyer that is going away. So is the Fed. I mean, presumably they’re starting to sell little bits of this market. So they’re supposed to not be no longer be buying, but rather also be selling. This is from the current third quarter of 2022 and we have jewelry consumption of 10% year over year, 36% growth in bar and coin investment. That’s huge. It’s because people are knowing that there’s just something not right. Good thing to follow your instincts.

But here it is, Central banks have purchased a record amount of gold at the same time technology demand fell 8% year over year as a reflection of the higher interest rates, loss of borrowing. We see what’s happening in the stock market. So in the paper market demand is declining in the physical market. That is a different story. And I’m wondering, has the full run from Fiat money products begun?

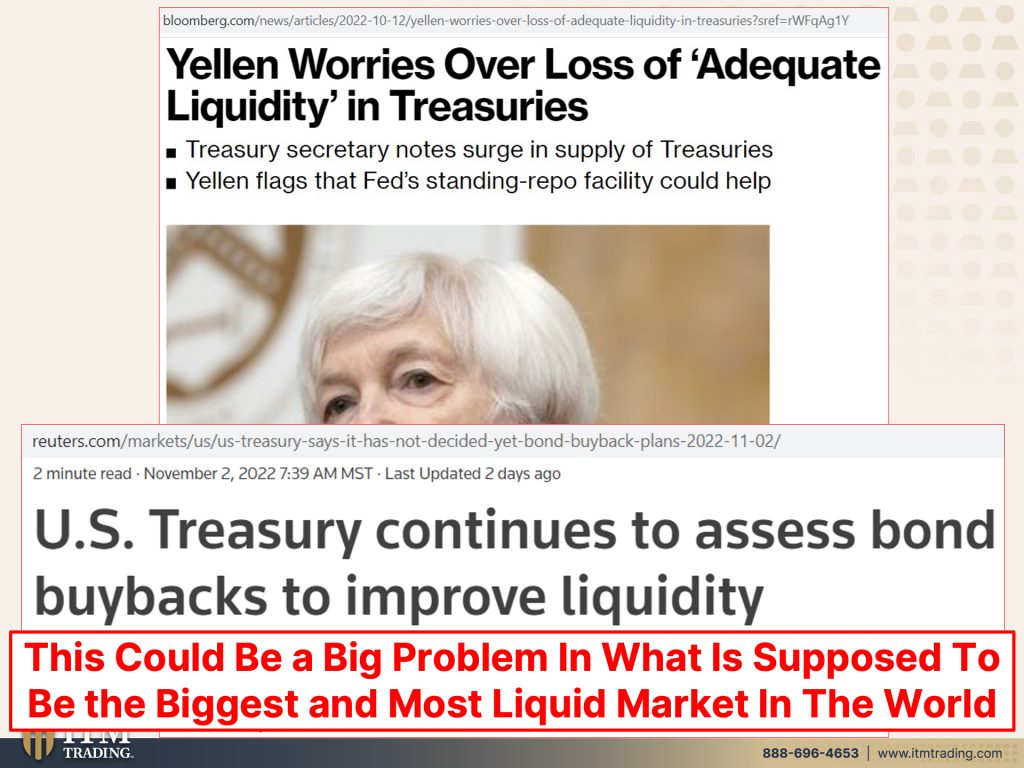

Certainly Janet Yellen is very worried over the loss of ‘adequate liquidity’ in treasuries. Although, you know, look, I I’m telling you right now, they know a lot more about all of this than I do. So why have they been ignoring it since 2015? US Treasury continues to assess bond buybacks to improve liquidity. In other words, the central bank can’t do it because they have their credibility on the line and they have, they have really stated that they’re gonna keep raising rates until the job is done. And also that they intend to sell off and try to normalize their balance sheet that is at nosebleed level. So you know who’s left? Who is left to buy the treasuries? It typically in advanced economies, it’s the rest of the world, but they’re going away. The rest of the world does not stepping in to buy the treasuries. So is the treasury department going to buy, issue more treasury? So take on more debt to retire some of the debt that’s already out there? Yeah, that’s what they’re gonna do. That’s like borrowing from Peter to pay. Paul, are you in any better circumstance? No, you’re actually in a worse circumstance because what this is really indicating to everybody in the world is that the US is losing its status, not just as the world reserve currency, but I want you to think about this and it’s a little complicated, but it’s so important that you get this, okay, what supports the US dollar? What supports this? The full faith and credit of the government. That’s true for any government debt these days. So let’s translate that. As long as you have faith in them, you trust them, right? Then you will continue to loan them money, extend them credit. What happens when you extend the government credit? New money is created into the system. So this is what supports and backs. I’ve already ripped this here. I’ll rip it again because that’s what it’s worth to me. But that’s what backs and supports what we work for, what we use as our tool of barter and what we try and save for future use, the ability of the government to take on more treasury debt. So this is an indication, a strong indication that they can’t do it. Now, the Federal Reserve first started buying back treasuries the end of 2002. So this isn’t really a new trend either, but on both cases it is certainly a huge leg up and something that we really need to be paying attention to because this is really a problem that is in the biggest, it’s supposed to be the most liquid market in the world. It’s the foundation of the global system. So when this crumbles, what in the world do you think is going to happen to the global system?

Now why would they think about that? Because liquidity metrics are flashing at crisis levels, making the debt market, that’s a key underpinning of global financial markets potentially So fragile. So fragile that another shock could impair its functioning. I don’t know, with the Windsor war that are floating all over the place and with the markets in disarray and the central banks committed to raising rates to try and save their credibility, do you think there could possibly be another shock around the corner? Because when traders in the 24 trillion US treasury market have trouble trading, it’s a matter of far wider concerns, especially since this is what underpins credit cards, mortgages, car loans, any sorts of debt that the individual takes on, that the corporations take on, and all those God knows how many countless derivatives that are built on top of this mountain. And similar to what’s happening in the UK, that they have to issue a ton more debt. The treasury expects to borrow 550 billion in the fourth quarter, which is 150 billion higher than they estimated just a couple of months ago in August. Now is that extra money to buy back treasury debt and to create liquidity in the markets? Because on the other hand, what’s also happening with the Fed raising rates, that’s like putting the breaks on the economy because this is a debt based economy, right? So raising rates, fewer people borrow and spend, that’s putting the breaks on the economy with the treasury. When they borrow 550 billion in this quarter or whatever they’re going to borrow, that’s creating new money and it stimulates the economy. So essentially you’re having your foot on the brakes on the gas pedal at the same time, that is schizophrenic, that is dysfunctional. And what does that do? It creates more volatility and more crisis.

And it represents the biggest systemic risk to stocks and everything else since a 2007 housing bubble. But this is much, much bigger, much bigger because the US housing market didn’t underpin the global financial system. But the 10 year treasury note does, if the treasury market fails to trade for a period of time, it is likely that the various credit channels, including corporate household and government borrowing insecurities and loans would cease. Yeah, it would just stop, stop just that fast. This could lead to events such as a US government default if auctions do not proceed because this is based on constantly creating more debt, more new money. We are at the end of this road. We are at the end of this currency experiments life cycle. I know that it’s hard to conceive if the spillover impacts to the dollar equity markets, emerging markets, consumer and business confidence. Yeah. Yeah. And when you stop and think that this is a con game and con games require confidence and what helps us create and support this is full faith and credit. So confidence, can you see how this leads into hyperinflation? Because that’s really the next step. Will the fed pivot when this market starts to implode if the treasury market can’t support it? Mm-hmm. <affirmative>. Mm-hmm. <affirmative>. Mm-hmm <affirmative>. And they will make what they did. I’m not gonna do that to poor Edgar, but they will make what they did in 2020 look like chump change. Just like what they did in 2020 made what they did in 2008 that was so incredibly shocking, look like chump change and that confidence is holding on by a thread. So if you think that that’s gonna enable anybody to hit that 2% inflation target, which is just the level at which you don’t notice inflation, think again because that level of printing will do a whole lot more than that.

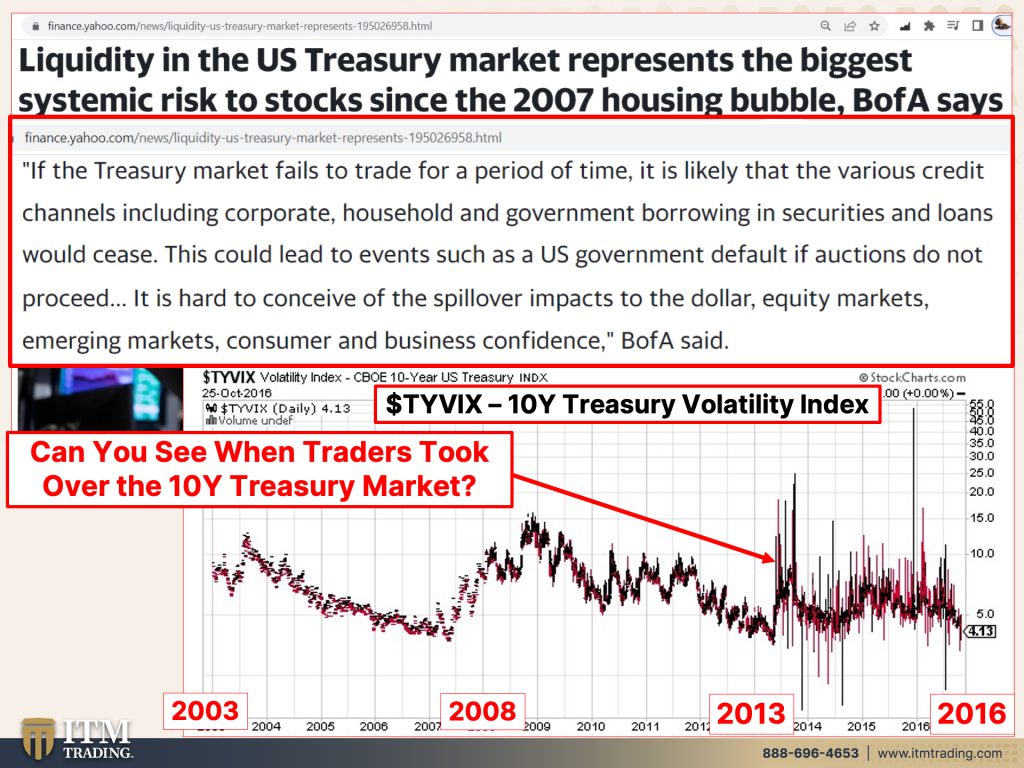

But I think it’s also really important that you see when the treasury market was taken over or handed to traders, this is TYVIX, the 10-year treasury price volatility, okay? And you can see early on 2000 they started tracking this in 2003 to 2008. What you have our dashes, right? And that means that the price didn’t change very much in the course of a day. And frankly, with the foundation, isn’t that what you want? But in 2008, the system died and it went on QE, heroin life support. So those dashes in price movement became up and down lines just a little bit though, not huge, right? But look at what happened back in 2013, handed over to traders. If this were an EKG, would you say that they’re having a crisis? Would you say that the patient is dying? Yes. So what was the end result of that? Well, they just stopped publishing. It went away. Gone, right? So I can’t tell you what it looks like today, but my guess is even worse than since 2013. This is the volatility. That’s the price action of treasuries. That is not what you want a foundation to look like. And can you see exactly when they took over? Because I think it’s pretty obvious from this graph. That’s why I like it so much. I just wish that they kept, kept it up so we could see what it looks like today.

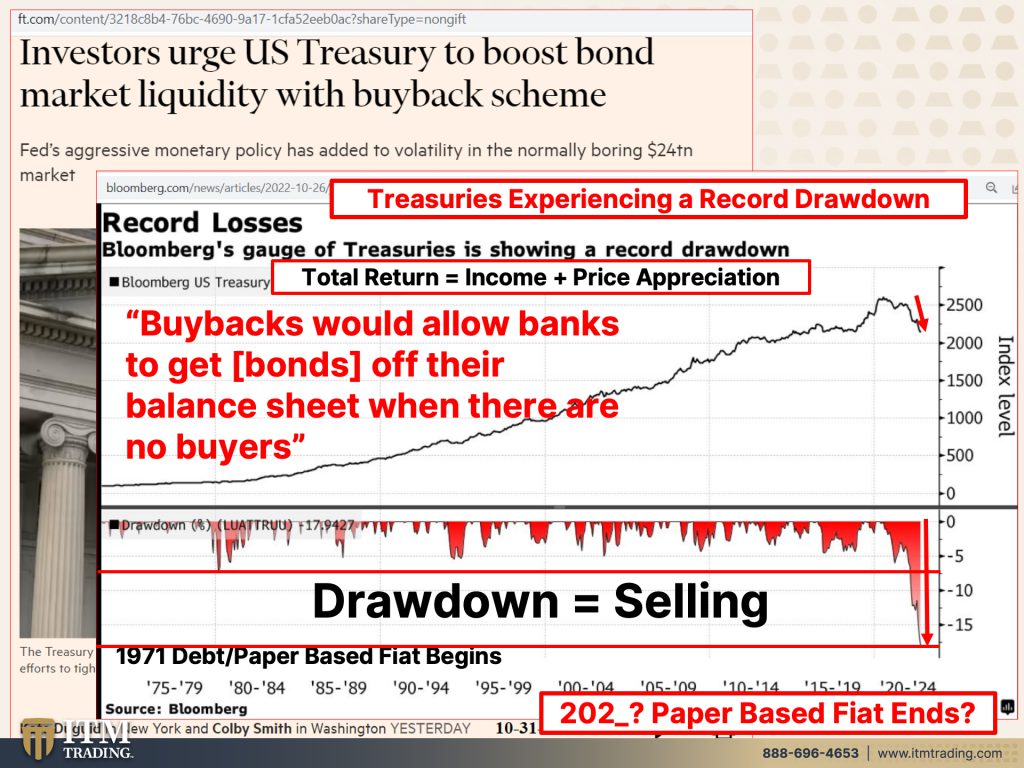

But what’s going on in the rest of the world is an indication. And of course investors, meaning Wall Street urges US treasury to boost that bond market liquidity with that buyback scheme. Well of course they want you to boost that liquidity. It’s Wall Street, they’ve created all these products on it, and yet look at these record losses in draw down. I’m gonna explain draw down in just a second, but first of all, what you’re looking at here is a total return of US treasuries, which is the, the income. So the dividends that the treasuries pay or the interest rather, that the treasuries pay plus price appreciation, right? Remember when interest rates go down as the Fed was pushing them down, what happened to the principal, right? It went up. So that’s price appreciation. But look at this. What’s happening right now? Treasuries are experiencing a record drawdown. So what’s a down that’s selling? Okay? They just don’t want you to realize what’s going on. And I’d like you to take a look at what that draw down treasury selling looked like between 1975 or 1971 when it started. And today, because I can’t tell you the exact moment that this paper based fiat market ends. But I can tell you, we are close. We are very, very close. And if the treasury market freezes, that’s it. It’s done. And I’m heading up to my bug out location. And I’m not kidding, I’m being dead serious about that. I am not joking because that’s where they’re selling to. And this was just as of what? October 26th, okay? That’s the lowest that we’ve ever seen inside of selling of treasuries. And that was during the transition to this debt based system. So I don’t know, you tell me, is this a good thing? No. And part of the problem is with all those entities and people selling who’s buying? No, no wonder. No wonder they want, wall Street wants the treasury to buy back the treasury bonds because that would allow bonds or banks to get bonds off their balance sheet when there are no other buyers. Okay? So that’s taking the risk from the banks and putting it on the shoulder of the taxpayer. Voila. Isn’t that what they always do? And you have to ask yourself how you feel about this because you may not fully understand it, but if you stop and you think about the fact that if you are inside of an earthquake, do you want to be in a place that is earthquake protected or do you wanna be in a little house and let that earthquake open up? Let that earth open up and swallow up that house? Swallow up all of the fiat money, wealth that you’ve managed to accumulate against all odds because inflation is baked into the cake. This is what’s solid, real and in your hand because of the base of buyer. So what you’ve been watching, and what I’ve been telling you about, not just in this video, but in even recent other videos that I’ve been doing on liquidity, is that the base of buyer for treasuries and fiat money products is going away. But you know where that’s no longer true?

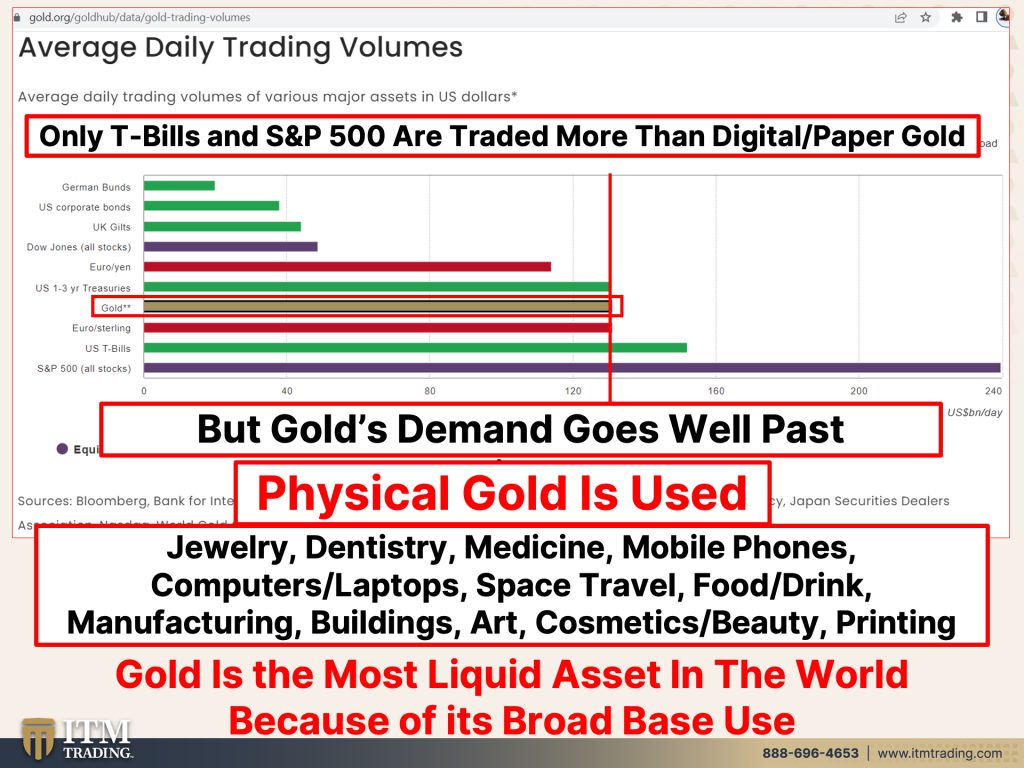

Well, let’s look at gold, because it’s very interesting. If you pay attention here, you see only T-bills, treasury bills, so short term and the S&P 500 are traded more than digital gold. How can that be? There’s a finite amount of this. There’s an unlimited amount of digital gold, and that’s what’s been suppressing the price. But gold demand goes way past intangible form, right? Unlike all those other stocks and bonds and annuities and all of these fiat money ETFs and mutual funds and all these other fiat money products, Gold’s Demand goes well past just that one area. Because it’s used in jewelry, dentistry, medicine, mobile phones, computers and laptops, space travel, food drink, manufacturing buildings, art, cosmetics, beauty, printing, and so much more. That’s why you always hear me say that physical gold, though this is true for physical silver as well, has the broadest base of functionality and the broadest base of demand. It is globally valued and the single most liquid asset in the world because it has the broadest base of buyer, unlike what is currently the foundation of the system, that has a narrow base of buyer that’s getting more and more and more and more narrow because it is only used in one sector. Gold is used and so is silver in every single sector of the global economy. What do you want going into this fight? What do you think is going to protect you from having your wealth swallowed up in this next earthquake that threatens to take all fiat money products all over the world down? Proven 6,000 years of history, proven foundation of diagnostic wealth, which is wealth that lasts in families at least 300 years. Proven, that’s what I want in this big fight.

So if you haven’t already, make sure you watch last week’s status of the reset, which is on the global financial stability report from the IMF. I can’t make this stuff up, you know, hiding in plain sight. I don’t have access to anything more than you have access to. I just know where to go and look. So follow those links, you’ll learn and go and look yourself. So without a doubt, get everything covered, move forward. If you haven’t already, click that calendly link, set up your strategy and until next we meet. Please be safe out there. Bye-bye.

SOURCES:

https://www.imf.org/external/pubs/ft/gfsr/2015/02/pdf/c2.pdf

https://www.reuters.com/markets/asia/global-markets-g7-column-2022-09-29/

https://finance.yahoo.com/news/liquidity-us-treasury-market-represents-195026958.html

https://www.ft.com/content/3218c8b4-76bc-4690-9a17-1cfa52eeb0ac?shareType=nongift