Treasury Notes: Short-Term Gains or Long-Term Regrets?

In a world where surprises can shatter financial stability overnight, we face a tough choice: Is chasing short-term gains really worth risking everything? With the national debt pushing through $33 trillion and your purchasing power literally vanishing, time is not on our side.

You should wondering—when the debt bubble pops, will there be time to react? Join me today as we explore treasury yields, debt bubbles, and the Fed’s moves, and discover how the 1% are preparing. The clock is ticking. Coming up.

CHAPTERS:

0:00 Gains or Regrets

2:19 10-Year Treasury Note Yield

11:14 Federal Reserve

13:14 $33 Trillion Debt

19:40 Purchasing Power

22:10 Smart Move by Central Bankers

25:44 Gold & Silver

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

In a world where surprises can shatter financial stability, boom, overnight we face a tough choice. Is chasing short-term gains really worth risking everything? With the national debt pushing through 33 trillion and you’re purchasing power literally vanishing. Frankly, time is not on our side. You should wonder, when the debt bubble pops, will there be time to react? Join me today as we explore treasury yields debt bubbles and the fed’s moves and discover how the 1% are preparing. The clock is tick, tick, ticking. Coming up.

I am Lynette Zang, Chief Market Analyst here at ITM Trading a full service physical gold and silver dealer, but really specializing in custom strategies. And you know, it’s always so much better when you actually have a plan. You actually have a strategy so that you can’t be distracted by the other manipulations that are happening. And you know, it’s a really interesting thing that’s happening right now, which our people are flying to the perceived safety of treasuries. And they’re hearing headlines like this because quite honestly, the buyers of treasuries, the Federal Reserve, foreign governments that’s been declining, they need the public to start to pick up and buy those treasuries. ’cause They’re issuing a ton of them. And I mean, there’s so many interesting things. Let me just go on.

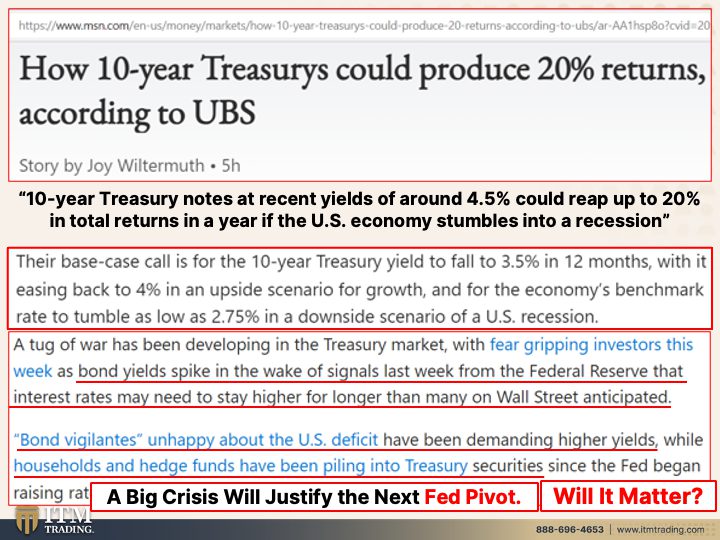

And so you’re gonna hear headlines like this, how 10 year treasuries could produce 20% returns according to U B s or according to this or that bank. And I wonder if that isn’t like nudging you to buy treasuries, which is out of the frying pan into the fire. We’ve been talking about the lack of liquidity in that market since 2015. And it’s only gotten worse since 2020. But the treasury yield, the treasury notes I’m sorry, 10 year treasury notes at a recent yield of around four point half percent could reap up to 20% in total returns in a year if the US economy stumbles into recession. Because they really want us to think, oh, alright, well, soft landing, or Hey, maybe we’ve already had the recession and we don’t know it. And so what they’re really talking about, remember this, interest rates, principal value when issued, value when issued. So treasury bond comes out, or any bond it doesn’t, or any debt instrument could be a mortgage, could be any debt instrument comes out with a stated interest rates when in the market, the interest rates go up, the value of that principle declines. The market value of that principle declined interest rates go down, the market value of that principle goes up. Okay? Now of course you are assuming that what you can convert it into called Federal Reserve notes wherever they are. Here’s an old one, okay? You’re counting on that retaining some level of value of purchasing power value. But when they’re talking about these 20% returns, that’s what the’re referring to their base case call is for the 10 year treasury yield to fall to 3.5%. So a percentage point in 12 months with it easing back to 4% in an upside scenario for quote unquote growth. And for the economy’s benchmark rate to tumble as low as two and three quarters in a downsize scenario, blah, blah blah. So what they’re really saying is, okay, interest rates at four point a half percent when interest rates go down to three point a half percent.

The market value of that principle of that note goes up and that’s how you get your 20%. Well, is that a possibility? Anything is possible, right? But they’re looking for a calamity for the Federal Reserve to do a pivot and drop rates. So let, let me show you. A tug of war has been developing in the treasury market with fear gripping investors as bond yields spike, right? As bond yields spike in the wake of signals last week from the end this week too, frankly, it, the spiking continues from the Federal Reserve that interest rates may need to stay higher for longer than many on Wall Street anticipated bond vigilantes. Now, bond vigilante is a bond trader that does not well, it’s a bond trader. Now these bond vigilantes are unhappy about the US deficit and have been demanding higher yields. So they’ve been selling bonds, which has been pushing those yields up. And the principal value down. Now everybody, banks, central banks, anybody that bought bonds since 2009 when yields were pushed to zero, they have a tremendous amount of loss. Tremendous, right? For this very reason. That’s why I always hammer that home. So you understand how bonds work, but bond yields spike in the wake of last week’s signal bond vigilantes, unhappy about the US deficit have been demanding higher yields. So they’ve been selling bonds while households and hedge funds, but it’s that household piece that have been piling into treasuries since this is what they anticipate A crisis ensues. The fed lowers the rates and pushes the nominal value or the market value of those bonds up. So bond vigilantes, bond traders are selling and households are buying. Maybe they’re buying directly because after all, they’re seeing this yield at four point half percent. And they go, gee, they’re, and what their stockbrokers telling ’em is, this is a safe yield, but why, why is it a safe yield?

Because the government can take on debt and print from nothing from that debt, the money to repay you. Of course when they do that, that’s what they’re doing. And that also means that the value of all of that debt or the money that they’re creating goes down and that’s what you’re gonna convert into. So just to recap, a big crisis, that’s what they’re counting on here, will justify the next fed pivot, even though the central bank is coming out and saying, no, no, no. So the que that they’re not is this higher interest rates for longer. So the question is that you have to ask yourself, alright, let’s say that this happens a big enough crisis. Yeah, absolutely could make the, the Fed pivot and push interest rates down in an attempt to inspire borrowing and spending. But will it matter? Will it really matter? Because if this has absolutely zero value, it’s not gonna matter. And that’s what I’m really hoping to get you to see. Because during an obvious crisis, there is a flight to perceived safety, hence the treasury bonds. But what’s the real safety? Physical gold, physical silver in your possession? That’s real safety. The other is simply perceived.

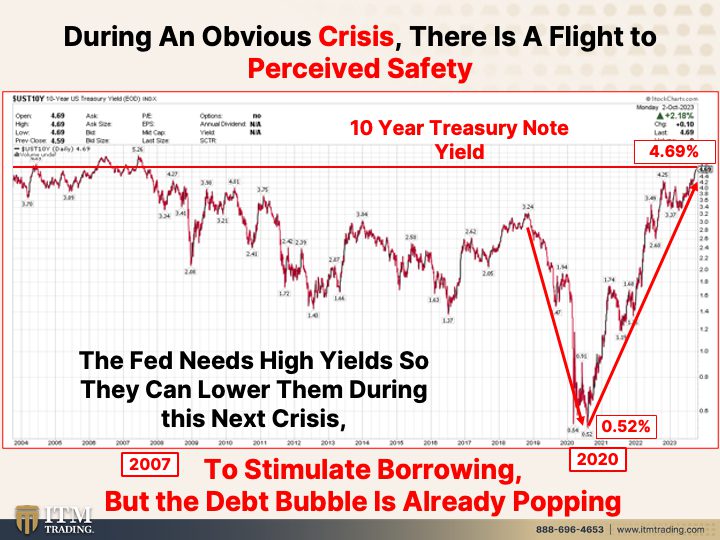

And let’s take a look. Now I know yields went up today, but this goes through this goes through yesterday. Actually understand this is the yield on the treasury note. The only difference between a bill, a bond and a note is the length to maturity. Shorter our bills. 10 year is note, 30 year is a bond. It’s the only difference either anyway, they are all debt instruments. So the big talk is really around the treasury yield and how much that has spiked. You can see how quickly it dropped. This is what they’re counting on to get you those returns.

But, and they went all the way down to 0.52%. Now they are at 4 69. Four 4.69% didn’t take very long to make that happen. Okay? And I believe they went up, I don’t know where they closed the day. But that means that all of those banks and all, and anybody that was holding treasury bonds that locked in these rates down here, they are hurting. They are hurting. We saw SVB, we saw the regional banks go out. They want you to think that that problem is fixed. It ain’t fixed. It’s so much bigger than just those regional banks and they know that they’re doing it. So between the feds are between a rock and a hard place because by raising rates, they’re jeopardizing the, the economy. And by lowering rates, they’re trying to fight inflation. Either way, they’re hurting everybody either way. We have a crisis brewing, no doubt about that. But just keep in mind the Fed needs higher rates so they can they can lower them into the next crisis. In so doing, they did pop the debt bubble. It is not something I’m waiting for to happen. It’s something that’s sitting here and happening as we speak. We just can’t see it.

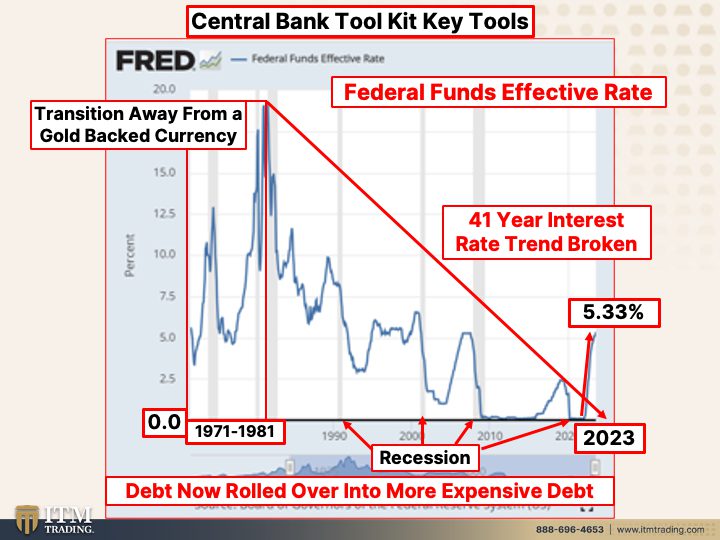

And I wanna point out that the Fed is out of tools. I want you to take a look at where we were, right? Transition away from the gold backed currency because we’re getting near there. Again, look at how quickly interest rates could spike. And every time they raise the rates, which you can see here, and you can see here, you can see it here. You can see it here. It caused a recession. This next one isn’t gonna be just a standard recession. It’s not gonna be a soft landing. It’s not gonna be a no landing. This is gonna be big because what they’ve really done is they have broken a 41 year trend cycle. And those do not go out quietly. And without a whimper, they may want you to think so because in that way then you’ll fly to the perceived safety. You’ll fly to fiat money assets, this garbage you’ll fly. I shouldn’t call it garbage. You will fly to the perceived safety of cash and other things. But the reality is you want safety. It’s this, because this is the only financial asset that runs no counterparty risk. All of that, including treasury bonds. That is all counterparty risk. And even if you get your principle back, what you can do with that principle, quite honestly is very questionable. And all of this debt, whether it’s government, corporate or individuals, guess what? It all either has to be paid, serviced, or rolled over. And the interest that it’s gotta be rolled over into is much, much higher. I don’t even know what credit card debt is, but boy, if you are carrying credit card debt, you are in deep, doo-doo because those rates are through the roof.

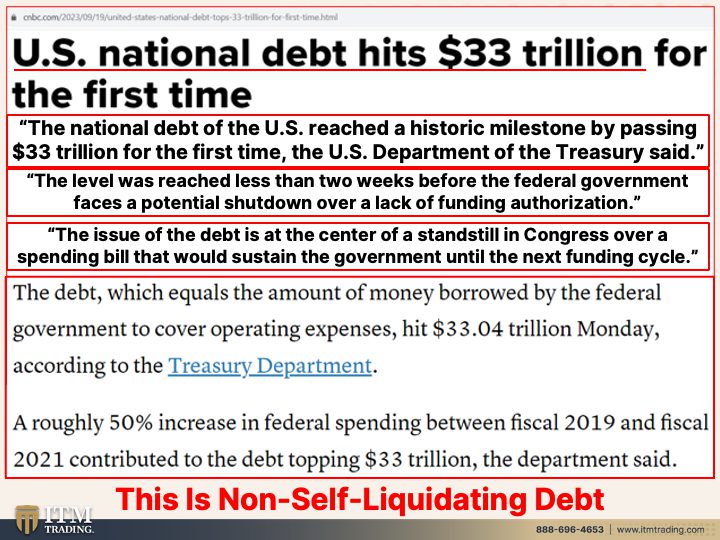

And not only that, but yes indeed the US national debt hits 33 trillion for the first time in 2009 when I did a study on, gee, if we’re only running trillion dollar deficits, why in the world are we servicing 13 trillion in debt? That wasn’t that long ago. That was during the last great financial crisis. We’ve got another one coming because the solution has always been grow more debt, grow more debt. I mean, what can I say? 33 trillion. Do you think it might, is there any chance in Hades that that is a payable debt? That would be, no, it is not a payable debt. The national debt of the US reached historic milestones by passing 33 children trillion for the first time. Hmm, the level was reached less than two weeks before the federal government faces a potential shutdown over a lack of funding authorization, gotta keep spending that money, gotta keep taking on more and more and more debt. And while they pulled it out at the 10th hour, so there wasn’t actually a government shutdown, all they did was postpone it till before Thanksgiving. You know, we are so divided, it’s ridiculous. The issue of the debt is at the center of a standstill in Congress over a spending bill that would sustain the government until the next funding cycle. Hmm, let’s look at that a little closer. The debt, which equals the amount of money borrowed by the federal government to cover operating expenses, hit $33.04 trillion Monday, a roughly 50% increase in federal spending between fiscal 2019 and fiscal 2021 contributed to the debt topping $33 trillion. But this is what you need to understand about this debt. It is non-self liquidating debt. Well, what the heck is that? Right? There’s two kinds of debt, self-liquidating debt and non self-liquidating debt. Self-Liquidating debt would be, you own a business and you expand, you borrow money to expand this business. And now you reach more customers. And so because you’re getting more customers and making more profits, you pay off that debt.

That is self-liquidating debt. But what do they say here? The debt, which equals the amount of money borrowed by the federal government to cover operating expenses. Operating expenses. So there’s no chance in Hades that that debt can be paid off. It just requires more taxes, more depreciation so that this cra this, these dollars have less and less and less value and they repay that debt with dollars that ultimately have no value.

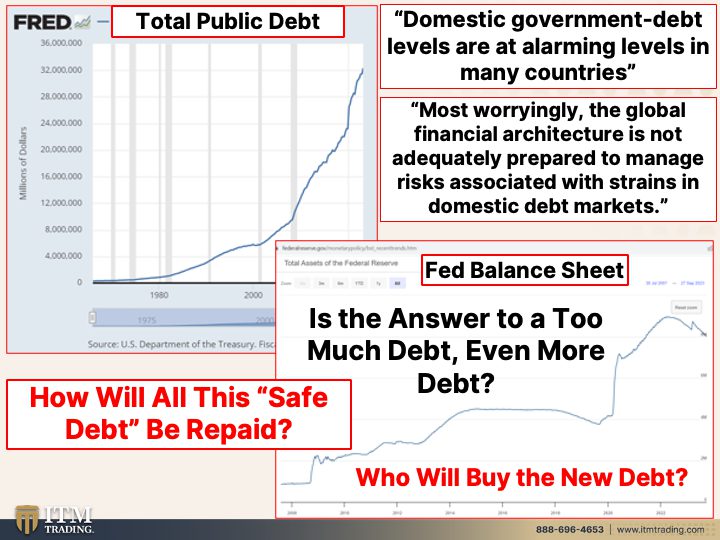

So what you’re looking at is the total public debt here. And can you see it ever even attempting to be paid off? And can you also see that every time it hits a gray bar, the speed at which that debt grows faster and faster and faster. I mean 2020, that’s almost straight up. Pretty close to straight up. And oh, by the way, the entity that’s been buying a lot of that debt, the Federal Reserve, and they have been since 2000, the Federal Reserve is trying to normalize their balance sheet. All of this debt that they accumulated is underwater. All of it. It started out before 2008 at 800 billion. Now it’s still at 8 trillion. Did you get that? $800 billion. $8 trillion. And they’re trying to liquidate it to just win a bond. Win a bond or note or bill that they’re holding, matures not rolling it over. So we’ve lost huge buyers in this debt. And what do they think the answer is? Okay? I mean, think about this logically. Is the answer to too much debt? Even more debt? Because that’s always been their answer. You can see it right here. That’s always been the answer. ’cause That’s how money is created in the system. Domestic government debt levels are at alarming levels in many countries. This isn’t just a US issue, this is a global issue. Most worryingly, the global financial architecture is not adequately prepared to manage risks associated with strains in the domestic debt markets. Well, if the fed’s been buying our debt, that’s the domestic market. And what they’re saying here is it’s hard to, it’s hard to roll that debt over if there aren’t buyers. And what about the individuals, right? So that’s why they need the public to step in. Well you might be sitting there and saying, well, I haven’t bought any of that. But if you have a pension or any kind of retirement plan, certain mutual funds, certain ETFs, those are institutional buyers that are buying on your behalf. If you have a 401K and you have a target date investment, that’s debt, that’s bonds, you have to ask yourself, are you gonna be the only buyers in this debt so that when this, when this game of musical chairs stop, you are the one that’s left holding the hot potato. Because my answer to that is yes. My answer to that is it will be the public that pays. ’cause It’s always the public that pays. So is this really safe debt? You’ll get your principal back ’cause they can create the money. I mean that’s, that’s nothing. They sure know how to do that.

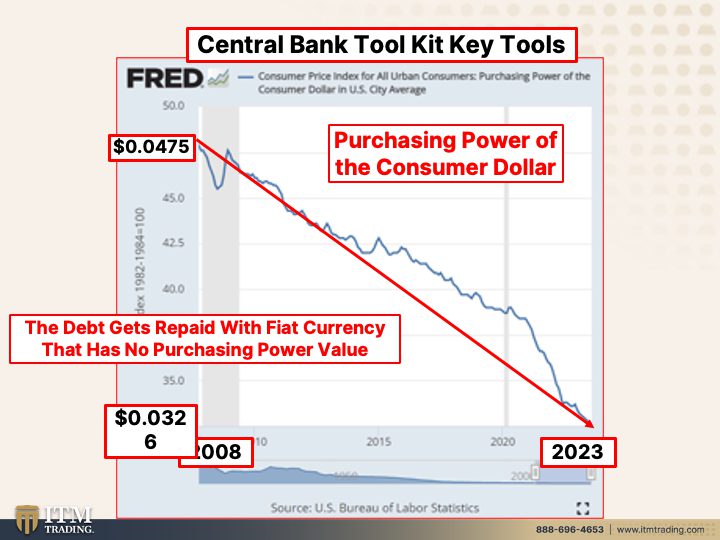

But what can you do with this? This used to be, this is a hundred dollars bill used to be able to actually buy something with it. Today, how much can you buy with it? You know that That’s the truth. You know, your personal experience with this stuff because it’s all about devaluation. This is the consumer price index. So the purchasing power of the consumer dollar since 2008, since the crisis became apparent to everybody, what was the answer to make it look like things were normal? Your purchasing power loss. And you can see how it’s been speeding up. What do you think? I mean, seriously, what do you think? It only goes in one direction. That purchasing power is not coming back. It never does. It never ever does because it’s been spent away. And oh, by the way, if you received the dollar up here and you tried to save it, look at that loss in purchasing power. They’ve been robbing you since the day you were born. Are they gonna stop now? Why would they? They don’t have any choice. They’re only option is to repay that debt with dollars or fiat money anywhere in the world. That is virtually worthless, worthless, worthless. It’s that nominal confusion. If you had a $20 bill over here and you got a $20 bill over here, it’s still a $20 bill. But what you could buy with it then and what you can buy with it today is vastly different. This is also a $20 coin. Hmm. Did this go down in value? No it did not. It went up in terms of fiat money. It held your purchasing power in tact, which in my opinion is the single most important thing that money is supposed to do. Hold your purchasing power intact.

The system is not on your side. And Ray Dalio, who anticipates a revolution and so do I, he also says the US is going to have a debt crisis that’s coming up. Can I tell you that it’s gonna be Thursday morning at at three? No, but it could be. The time to get prepared is now he even says how fast it transpires, I think is going to be a function of that supply demand issue. That’s the supply and demand of this stuff. So I’m watching that very, very careful closely. So I’m watching that very closely. Yeah, me too. Because a failure to reach an agreement could mean a government shut down and raise the perceived risk of the country’s debt. But it’s already a risk. This is not risk-free. Your principle may be risk-free because they can go ahead and just create more money and give it back to you. But it’s not risk-free because you can’t do anything with it once you get it, when all confidence is lost. That’s it. Now, I did put this together before Sunday, which is when they went ahead and passed the stop gap bill to not shut down the government. But you know, it’s gonna rear its ugly head again and again and again and again and again because we have such a divided and dysfunctional government. And are they really operating in your best half or in special interest best half? Think about that.

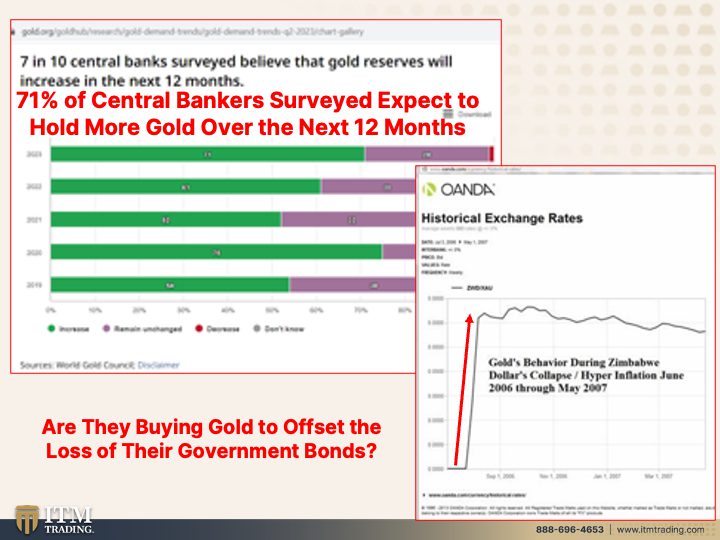

Because what we know is seven in 10 central banks surveyed believe that gold reserves will increase in the next 12 months. Hmm. Yeah. Let’s see if this was such an old relic, why do you think that 71% of central bankers surveyed expect to hold more gold over the next 12 months, right After they have bought more gold in the first half of this year than ever in recorded history? Hmm. What do you think they know and what should you know? They know how gold behaves during overnight resets because they take this, that has no intrinsic value. It’s used in one place and they reset it against this, which is all intrinsic value because it is used in every single sector of the global economy. And then guess what? This is how gold behaves when they do those overnight revaluations, that still lies ahead. But make no mistake about it, it’s coming. And that, I believe, is why they are buying so much gold to offset the losses that they’re already in by holding all that government debt and now at 0% and now ratcheting those interest rates up. But mostly because they want to retain their choices. They want to retain their power and their freedoms. And I’m thinking, so do you. I know that’s what I wanna do.

So if you haven’t already started your gold and silver strategy, click that Calendly link below and get it done. Have a conversation with one of our gold and silver experts so they can help put together a portfolio of gold and silver that gives you barter ability, wealth preservation, and opportunity positioning. That’s what we’ve gotta have. That’s why, I mean, wealth never disappears. It merely shifts location. Why not have the wealth shift your way? Why not retain your freedoms and your choices? Because they do wanna take us into a full surveillance economy, a full surveillance society. How can you say no? This is how you can do it. Along with making sure that you have Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter. Because then you are strong and we are all strong together. ’cause we’re all in this together. We can’t do it alone. I can’t fight the fed by myself. Who am I? I’m nothing. But if you join me now all of a sudden we’re all a whole lot more powerful and we can do this. We can really do this. We have to do this not for ourselves so much. We have to do it for our children and our grandchildren and those that are coming up the line because they’re going to use every tool they can think of to suck us in the system without us realizing it. That’s not okay with me.

So you know, we have, if you haven’t visited yet, go to Beyond Gold and Silver where we talk about ways to manage all the rest of the mantra pieces. And we try and meet you where you are. So if this is brand new to you, hey we’re there for you. If you’re an expert at any of these areas, join us. Help teach others, make our community more supportive and more powerful. You definitely should be watching my recent deep dive on ruled by the IMF where I’m talking about a one world currency. I mean run by unelected officials. I mean you all have no say and we’ve, we’ve watched this over the years. They do it slowly. They do it so that you think everything is normal and the same and it’s really not. And also Taylor Kenney did a great job on recession signals. I think she does fabulous breaking it down in really simple terms in a very short period of time. So definitely check her out. She’s great. I love her. I’m very happy that she’s joined our community at ITM Trading ’cause I feel like she brings a lot of value to the table. And if you haven’t subscribed here, please click on that link below and subscribe. Hit the bell. We’ll let you know when we’re going live. Leave us a comment, give us a thumbs up. And most important, share, share, share. Because financial shields, this is what they’re made of, not paper and promises that they have no intention of keeping. Real hard, tangible wealth. And until next we meet. Please be safe out there. Bye-Bye.

SOURCES:

How 10-year Treasurys could produce 20% returns, according to UBS (http://msn.com )

https://stockcharts.com/h-sc/ui

https://www.cnbc.com/2023/09/19/united-states-national-debt-tops-33-trillion-for-first-time.html

https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

https://www.cnbc.com/2023/09/28/ray-dalio-says-the-us-is-going-to-have-a-debt-crisis.html