THIS COULD STIMULATE REVOLUTION: People Are Recognizing What’s Happening…

TRANSCRIPT FROM VIDEO:

You know, it’s only a matter of time before the sheep turn into lions and we’re already seeing it across the globe and it may be coming to a theater near you faster than you think. And which side will you be on? And will you be armed with the proper knowledge and the proper tools, all of this, and more coming up.

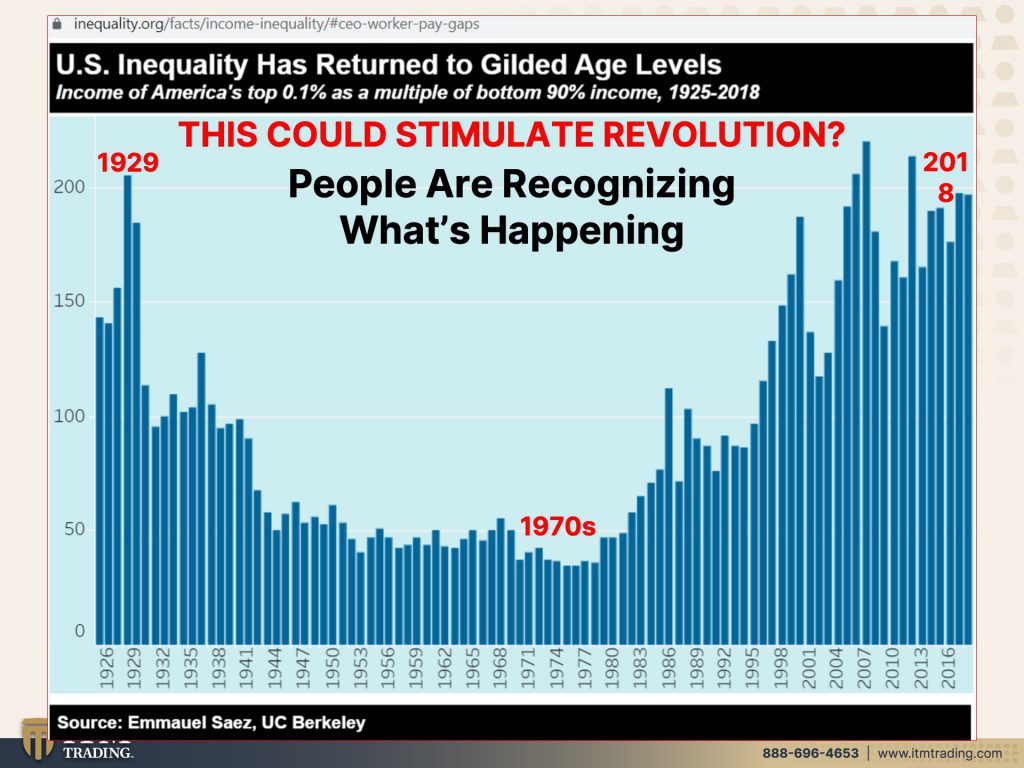

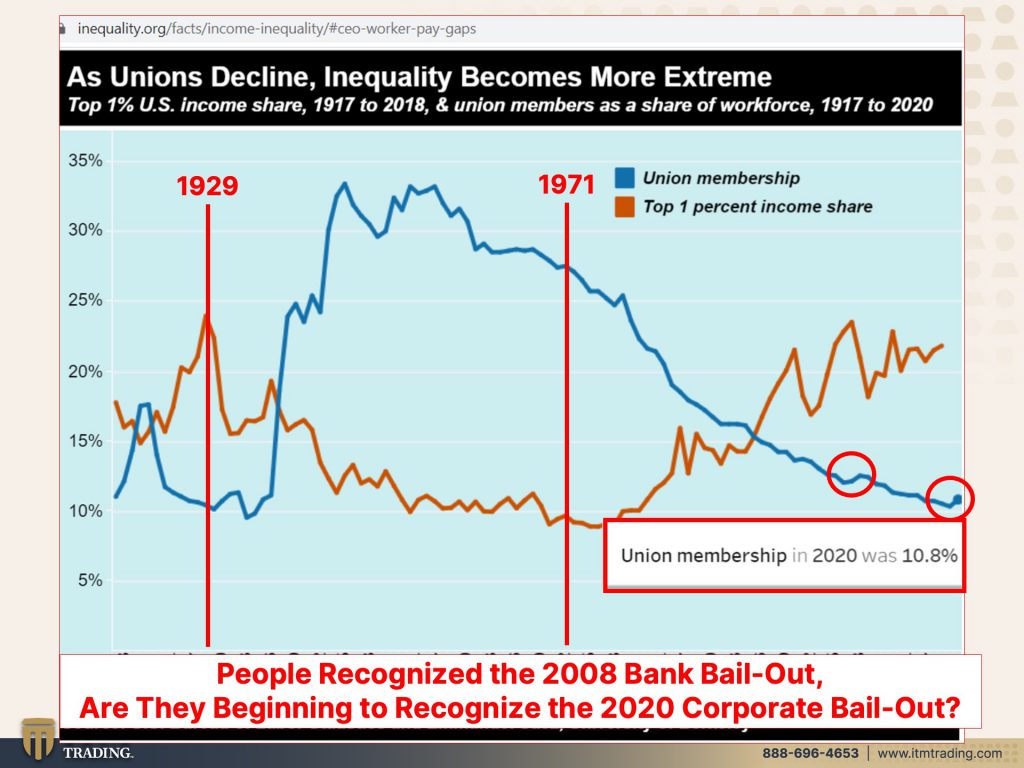

I’m Lynette Zang Chief Market Analyst here at ITM Trading, a full service, physical gold and silver dealer specializing in strategies. And it’s really interesting to me, you know look, I love getting older and what I love about it the most is having that 2020 vision of hindsight, for those of you that might remember back in 2008 after the crisis, when there was occupy wall street and a lot of protests going around globally. Well, I think that was the beginning because that’s when the system really died. Now we’re at the end. So there’s a greater revolution that appears to be underway, but of course, inequality has been around, you know, forever look at where income and wealth inequality was back in 1929. Well, we hit that level actually in 2006, this graph goes to 2018 but the reality is in the seventies, that is when we were all the most equal. And an average worker to CEO compensation was for every $1 that a worker made, the CEO made 20. Is the, that’s still the case? And how can that differential be so great. We’re gonna watch that now. Just bear with me here for a second.

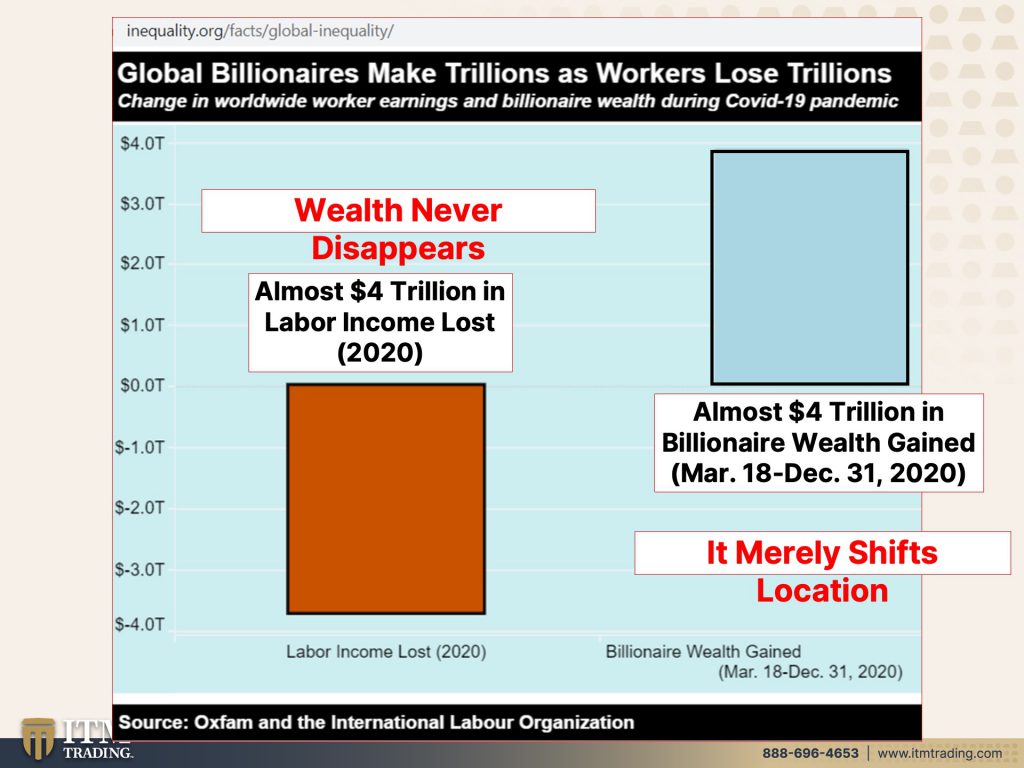

The reality is, is that people all around the world are really starting to recognize what is happening. And as you guys know, every con game requires confidence. And we are watching that confidence, not just slip away, because it’s actually been declining for, for a number of years, but getting to the critical level. Let me show you what I mean by that. When I came across this piece at inequality.org, I just about jump for joy because you know how I always tell you that wealth never disappears. It merely shifts location, and boy, oh boy. This is between March 18th and December 31st, 2020, where your average worker. So all the, those gig workers, low paid workers lost almost 4 trillion in labor, but guess who almost gained 4 trillion in wealth? The billionaires. Now, if this doesn’t show how wealth never disappears, it just shifts location because this is almost equal. So interestingly enough, in 2008, when we bailed out the banks, oh my goodness, everybody screamed. So this time could they just bail out wall street and the banks? No, no, no. They threw a pittance to the public so that it would not appear that they were really bailing out wall street, but this, oops, let me grab my little pointer, but this for sure shows you, they totally bailed out all of that stimulus. Well, we can certainly see from this who indeed got stimulated and that doesn’t really work very well when it be comes really, really obvious.

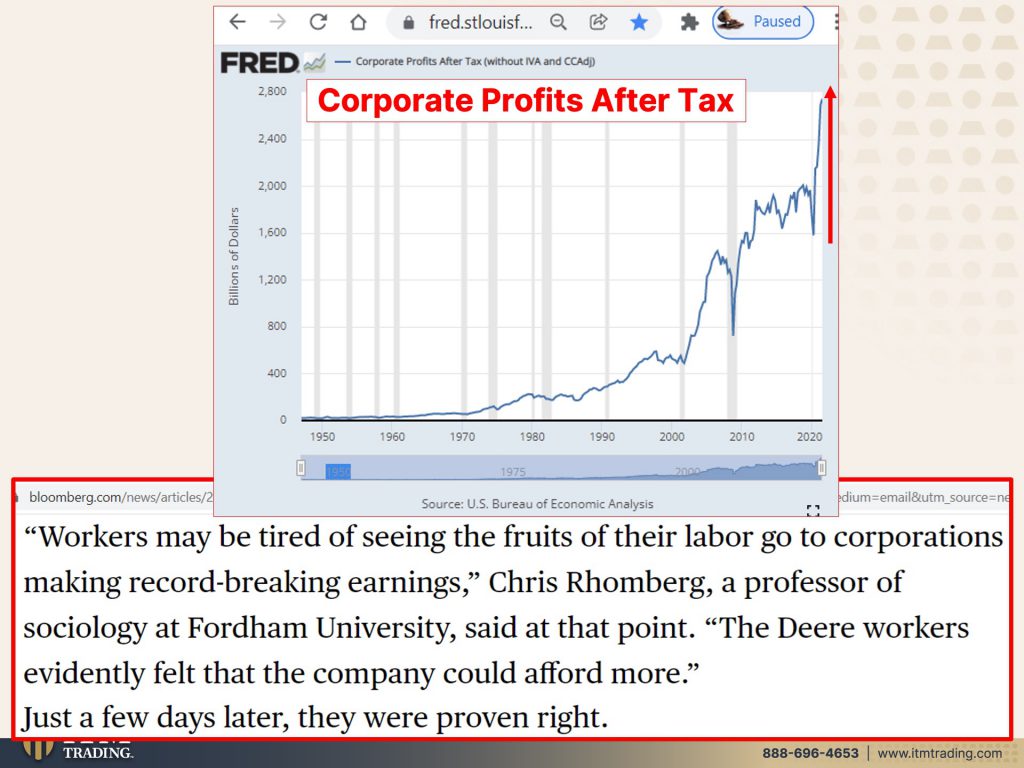

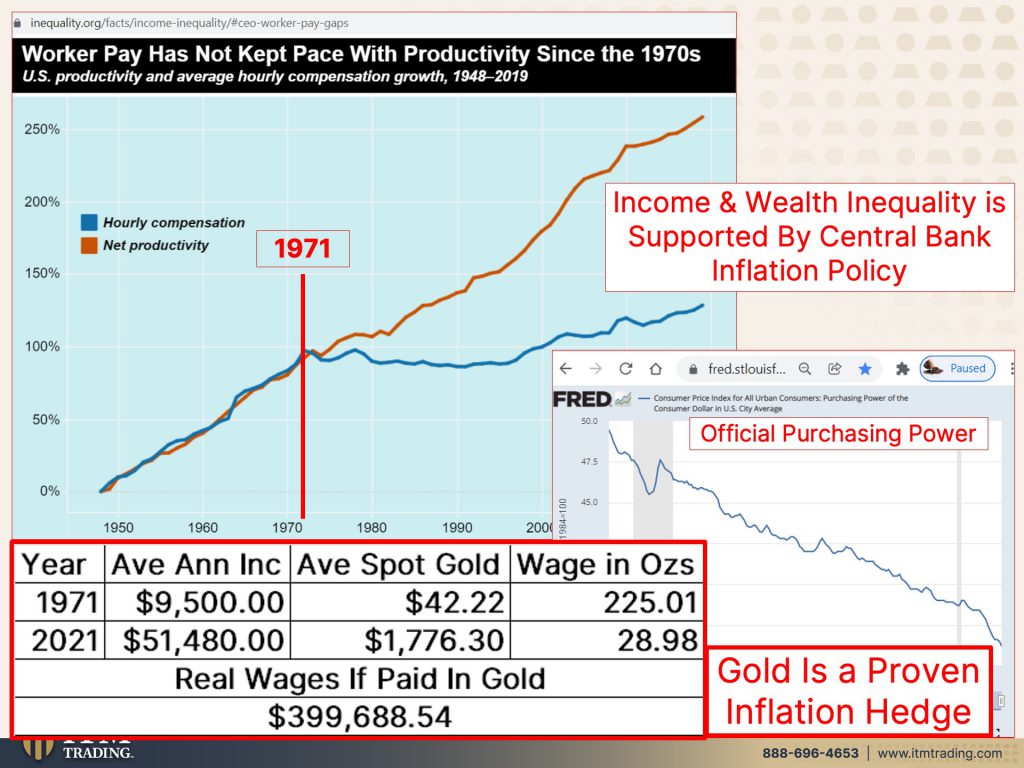

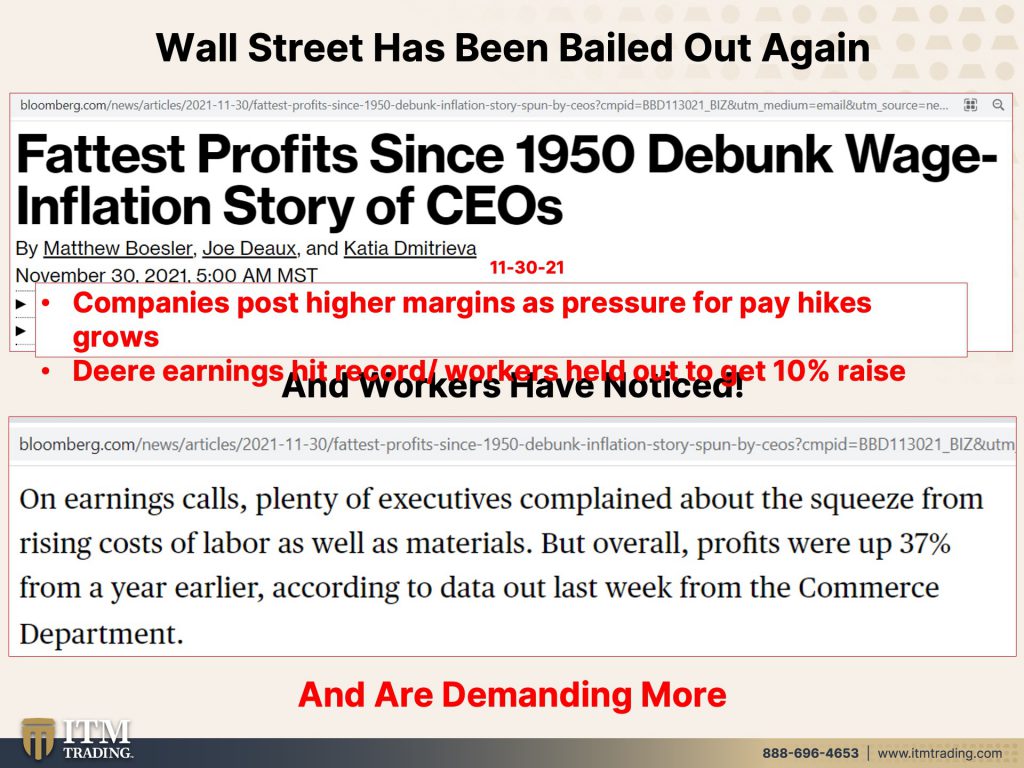

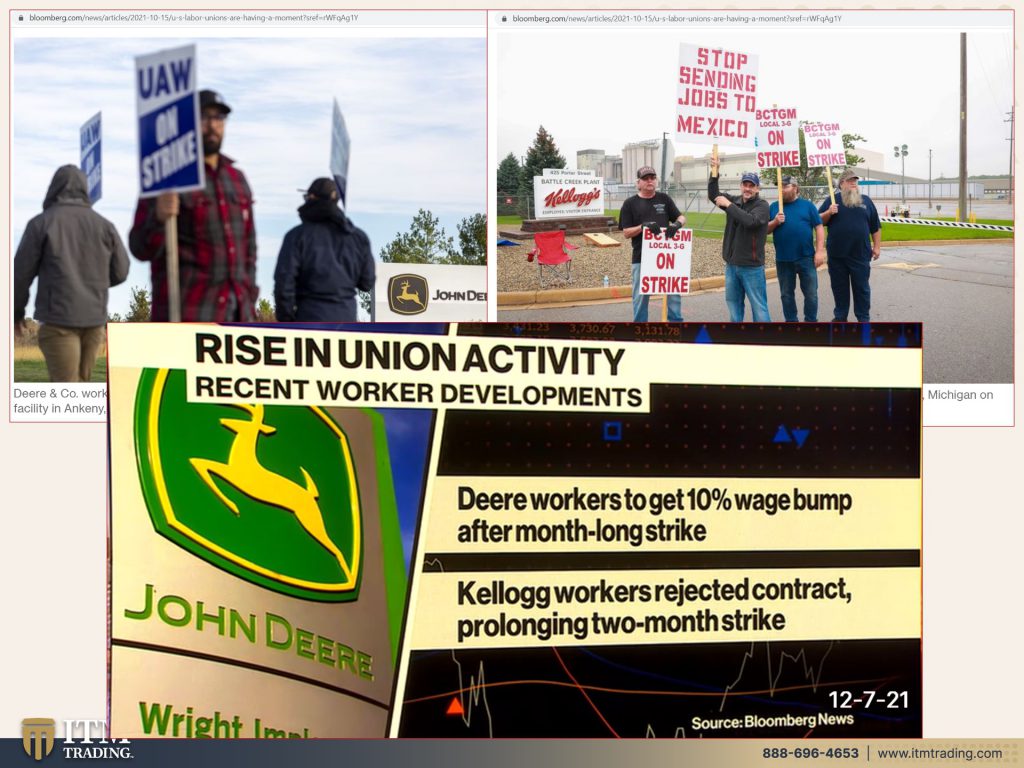

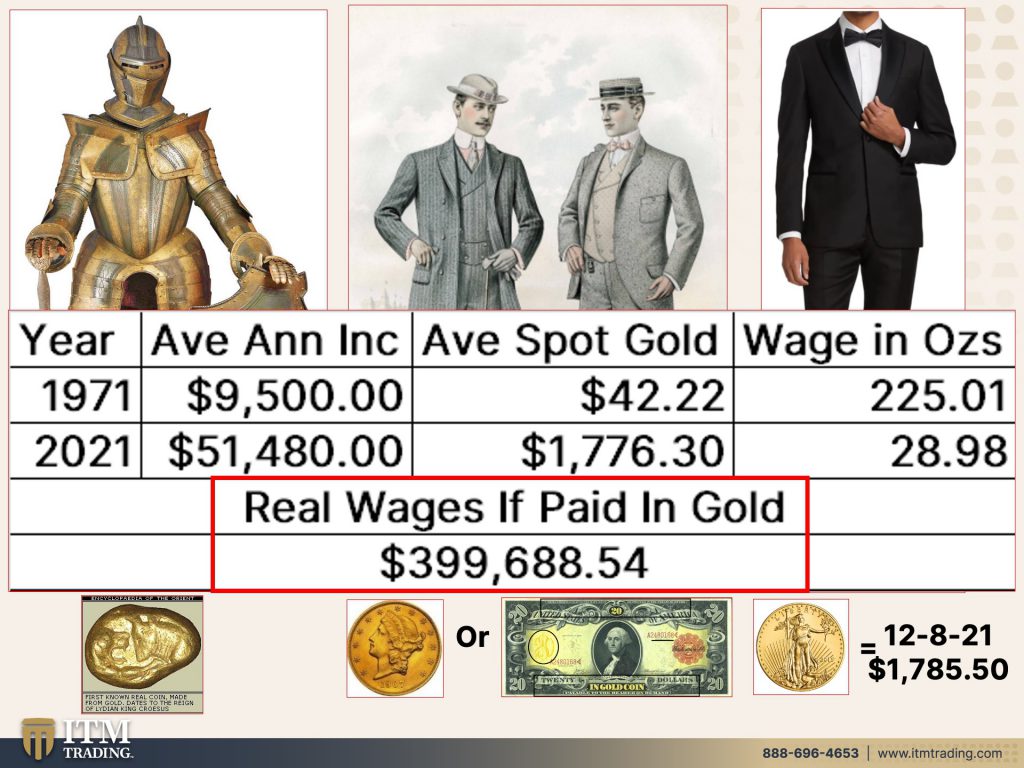

Now this particular graph are corporate profits after tax. And this is from the federal reserve, the Fred federal reserve education department and this little, which you can barely see that little line there. That was the in bitty recession that we had in 2020. And look at where corporate profits are, higher than they have ever been in history. Now, is this an unintended consequence or an absolutely intended consequence? There are a lot of things that you know, that I’m seeing. And I really is making me wonder what the consequence, if these were intended or unintended, but we’ll save that conversation for another day. However, this is a fact workers may be tired of seeing the fruits of their labor, go to corporations, making record breaking earning. The Deere workers evidently felt that the company could afford more. And just a few days later they were proven, right? So this is really what enables that income inequality. Oops, I’m not ready for that yet. Hold on. Sorry about that. Because remember all these gray bars represent official recessions, right? And this goes back to 2000 when the.com bubble burst. But more importantly, when the first derivatives imploded long term capital management, we’ve talked about that a lot. This is 2007, 2008. And here we are ever since then, this is really when they started the quantitative easing machine. But you know, we gotta save these banks. We gotta save these corporations it’s way more important than the little guy until it isn’t. And that’s where we are in this cycle right now, because I’ve told you this, and we’ve known this worker pay by design, never keeps up with inflation when they set up the system to begin with the Fiat money system that I’m referring to, to begin with governments like the inflation and the Fiat money system, simply because that is inflation as an almost invisible taxation and people just accept it. So they don’t have to go through legislation and make it more visible. But for corporations, they always wanted to pay you less. But if you were willing, you know, if you were working for 20 bucks and they wanted you to work for 10, they’re gonna go, no, I’m not working for 10. However, if they could devalue the currencies. So that the reality is is they’re paying you that $10 in purchasing power. Then that means there’s more money from them at the top. And you can definitely see this in this graph between productivity and hourly compensation. And let’s see, when did that separation occur? Oh my goodness. As we transitioned into a purely debt based system where inflation is controlled by the central bank and who benefits from whatever the central bank does are those that are closest to us, which are, excuse me, private corporations. So you can see certainly income and wealth and equality is supported by central bank inflation policy and government inflation policy. This has been true really since 1913 when they put, when they really installed it. But it went into full gear in 1971, after the fed had full control over the rate and speed of inflation, that’s what Nixon taking us off. The gold standard actually did completely cause I mean, quasi, we were before that, but let’s just stay. So this is the official purchasing power you’ve seen that graph a million times and it looks like it’s flattening out, but hmm yeah, no, the real crisis, which we never overcame, we just papered over. It happened in 2008. That’s really when the system died and then all of these experiments, what they did was push or purchasing power down. This is the most current chart on it. You know, you have all the links to all of this stuff over in our blog and you’ve got the link to the blog, go and look at these charts and really study them. And you’ll start to see that this is just a normal pattern that was installed and controlled by those central banks. But as a reminder, average wage in 1971 was 9,500 bucks. And the average pot price of gold, because it was fixed of the official price of gold that at that $42.22, then of course that changed, but we’re just talking about 1971. And that means that if you were paid in ounces of gold, you would’ve been paid 225 ounces roughly. Okay, well, if you never got a raise, but you were simply paid in the same number of ounces going through the average spot price this year, 2021 with the average wage. Wow. That, I mean, that grew hugely right? More than five times more and you go, oh my goodness, I would much rather get $51,000-$52,000 than $9,500. But a family of four could live with one wage earner on that $9,500 bucks at $51,000-$52,000 it requires two wage earners. And you’re still paycheck to paycheck as evidence by the stimulus checks, going people that made $150,000 a year or less. So if you had just been paid in the number, same number of ounces of gold, your wage, would’ve been $399,688.54. And I’m pretty much thinking that that would have, have kept pace with inflation, but the average wage, no by design. So all this extra money was able to now float to the top. And that’s why we have the extremes of income in wage and equality, just like we did at the beginning when this kicked off and all of that money was printed though. It was based on the amount of gold that we held in deep storage when the federal reserve was installed and they could then print like 2.4 times the amount of paper to the gold that they held in storage. They inflated it away. So that is probably the absolute best way to show you that gold is a proven inflation hedge. And that’s true going back 6,000 years. And I’ll show you that later, because if you think that wall street hasn’t been bailed out again, you really gotta think again, fattest profits since 1950 debunked wage inflation story of the CEOs because companies post higher margins. So the margins of large companies, we’re not talking about mom and pops here or smaller corporations that don’t have the leverage, but the large corporations have been able to maintain their margins or profit margins and pass those added costs on to you and me, the consumer, just referring to Deere in here, their earnings hit records and workers held out to get a 10% raise a 10% raise actually. And we’ll see this, doesn’t keep pace with the inflation that we’re really dealing with. And guess what workers have noticed, but here’s what the, here’s what the CEO said on earnings calls. Plenty of executives complained all about the squeeze from rising costs of labor, as well as materials. But overall profits were up 37% from a year earlier, according to data out last week from the commerce department. Yeah, because corporations can virtually borrow at zero. They, don’t talk about the debt levels in here, but this is all rigged. And so when they, and, and we’ve done reports before on how corporations are borrowing to pay out bonuses, dividends, stock buybacks, which benefit those at the top. But again, workers are starting to notice and they want more of this big pie that these guys have created for themselves.

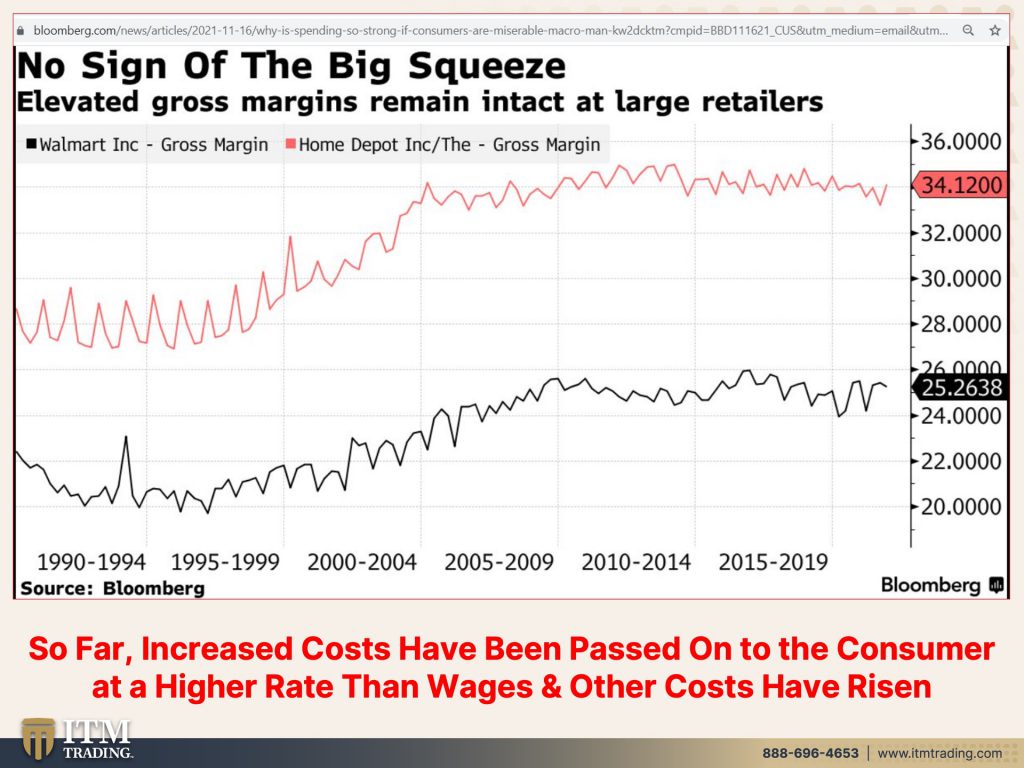

Gonna do this one pretty quickly, because these are no sign of the big squeeze. This is the profit margin. This is Walmart’s profit margin. And oh my goodness, that’s higher than it was back in nineties. So it’s near the highest levels. And this happens to be home depots. And again, the same thing, fat profit margins, profit margins for most corporations, large corporations, not small ones are up at the highest levels either, ever. And with all of the talk about the supply chain squeeze and all of the inflation that that’s caused it has it trickled all the way through, but when it goes to the company, they’re simply passing those, those increases onto you and me and how have the little guy been able to survive this with all of the spending? Well, that’s that little stipend that the government gave to the normal person, right? So the unemployment, extra unemployment insurance, as well as those stimulus checks and childcare tax credits on and on and on little bit for them. So, hey, they don’t mind so much the increase. Well, they do. They do let’s face it. And I don’t have it in this one, but where the savings rate exploded, the savings rate is now back to levels that it was, I think I showed you that in a video or two ago prior to 2008.

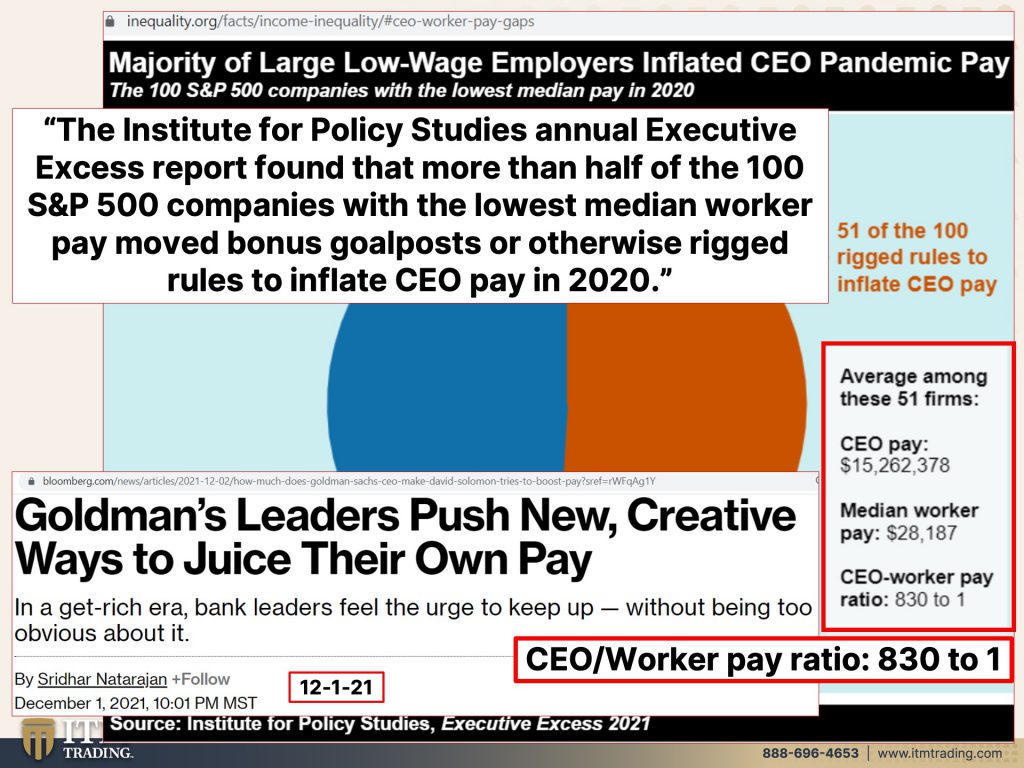

Now this image I think is critically important now, and I’m gonna explain it majority of large, low wage employers. So these are the ones that most of their employees are basically minimum wage or lower level kind of employees. Think of McDonald’s kind of company think about Walmart kind of company. Okay. So majority of large, low wage employers, inflated CEO pandemic pay, this is representative of 100 out of the S&P 500 companies with the lowest median pay in 2020. Okay. So among those hundred firms, 51 of them accelerated and inflated CEO pay right at the same time that they were cutting back and firing people. Isn’t that nice. The average CEO to worker pay ratio is 830 to 1. And what that means is for every $1 of worker pay, the CEO got $830. Now remember back in 1971, the average was for every $1 of worker pay, the CEO got $20 is 830. I mean, is that really justifiable? I’m not saying it should be a one to one, cuz obviously it shouldn’t be, but people are noticing workers are noticing. The Institute for policy study annual executive excess report found that more than half of the hundred S&P 500 companies with the lowest media worker pay, moved bonus goal posts or otherwise rigged rules to inflate CEO pay in 2020. And Goldman’s leaders pushed new creative ways to juice their own pay in a get rich era. Bank leaders feel the urge to keep up without being too obvious about it. So let’s get sneaky and do this, but it’s getting kind of obvious 830 to 1, kind of obvious at the same time when inflation is near 40 year highs and the CPI will come out tomorrow, so I’ll tweet about that. You know, if you’re not watching the Twitter, you should, because I will tweet about a lot of this stuff these days. Now, you know, it shocks Americans, the average wage earner, is this gonna bother the billionaire? If it costs more money to put gas in your tank or to buy groceries or to do anything, no, it’s not gonna impact their lifestyle at all, but it will impact those that are making, you know, the average wage, 51 52, 55,000 a year. It’s going to have a very large impact on them.

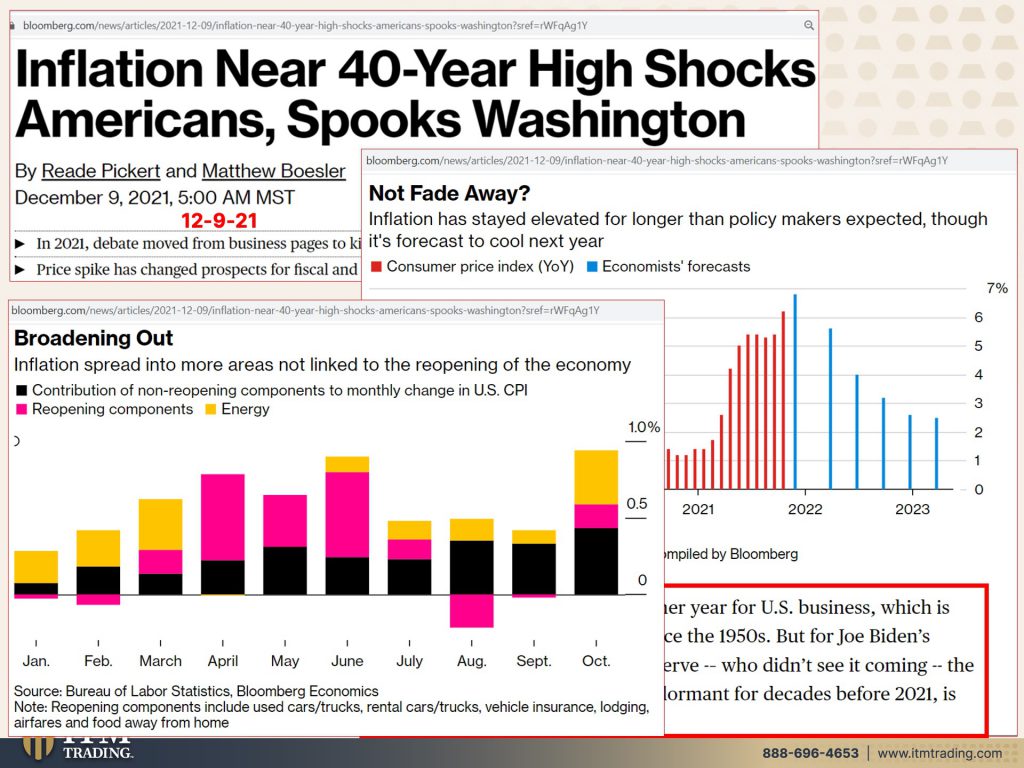

And thank goodness they’re saying it’s no longer transitory. So the fed said that it admits that they’re wrong. I mean, they didn’t actually come out and say that they’re wrong, but they did say they were gonna take transitory out in the language. Well, if they’d asked me, I’d have told them right in the beginning, nuh-uh, cause I knew it as soon as they went to an average, 2%, I told you guys, then I said, okay, watch out inflation be coming. And indeed it has. But what I always love, is inflation has stayed elevated for longer than policymakers expected though. It’s forecast to cool next year. And what is the basis of that? So maybe used cars aren’t going to inflate as much or maybe real estate? I don’t know. They’ve gotta keep real estate inflated. Maybe there’s gonna be some changes there, but it’s just garbage because they love to just say, well that’s gonna change next year, but they don’t give you a real good reason for it.

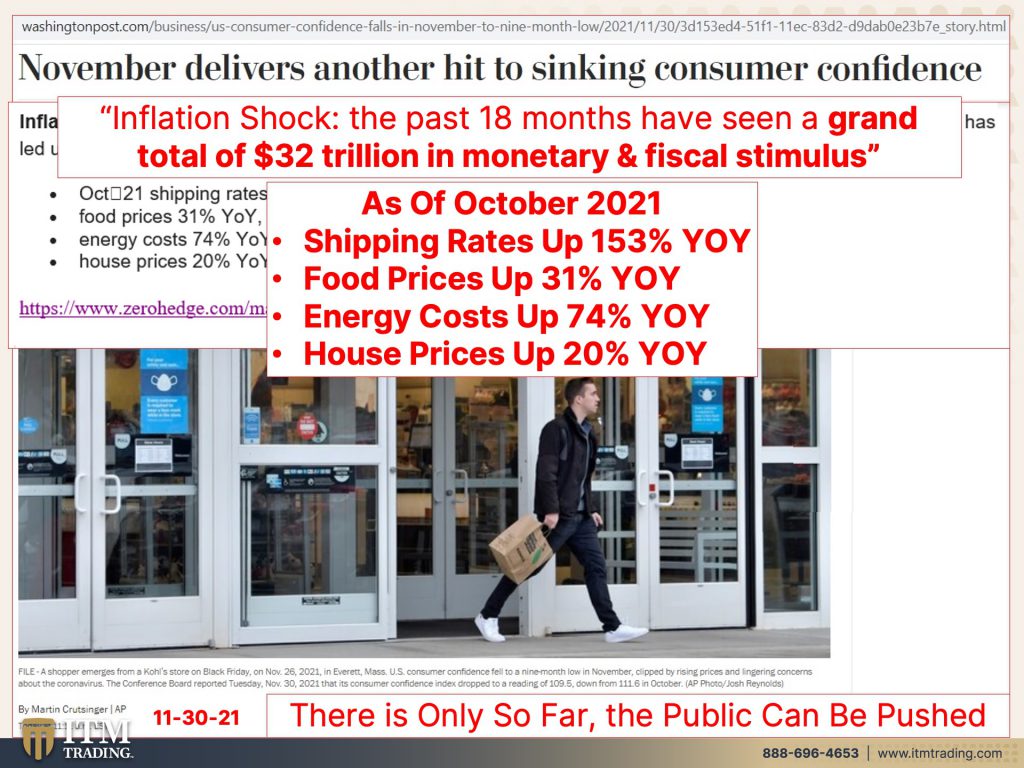

Higher prices help deliver a banner year for U.S. Businesses. Thank you, inflation. That means our GDP growth. No, it was inflation that made it grow, which is posting its fattest profit margin since the fifties. But for Joe Biden’s administration and the federal reserve who didn’t see it coming, a blind monkey could have seen it coming, please. The sudden return of inflation, largely dormant for decades before 2021. I don’t know you saw the graphs, the purchasing power, just continuing to slide, but that that’s not dormant. That’s just what they want you to believe. That is perception management, price stability is not a constant decline. What it’s, an amount of decline of loss of purchasing power that you can count on and that’s supposed to be stable? Give me a break. I mean seriously, the sudden return of inflation largely dormant for decades before 2021 is looking increasingly traumatic. You think? But here’s why, I mean I’m not saying that they won’t, I don’t know. It’s gonna be really interesting because we’re now seeing, you know, we’re seeing the feds speed up it’s taper, which means just buying a little bit less bonds and I’ll do some more about this next week because the repercussions from that choice is showing up at a very interesting time, considering that at least part of libor ends the end of this month and we’re gonna be talking about that next week for sure as well, but the inflation is broadening out. And once you give somebody an increase in wages, you can’t take it away. You can’t take it away. So I’m saying inflation is here to stay. We may even be at the beginnings of our hyperinflation. I mean, it feels like it to me. I can’t say that I’ve got technical confirmation, but it really does feel like it to me. So this is the contribution of non reopening components to monthly change in the CPI. And this is October. Wow. Okay. That is the highest that it’s been going back to January, but it’s been pretty consistent since last January. This is energy. The gold one is energy and these are the reopening components, their contribution to inflation. So the inflation is broadening out in all areas. This is not going away. It’s only speeding up. And how does that impact the consumer? We’re a consumer driven economy. November delivers another hit to singing consumer confidence. The masses, the public are getting disillusioned. I know they’re still spending money, but guess where that’s coming from credit cards, you know, in the beginning when they had all that extra money, the smart people paid down those variable rate credit cards. But now that data is showing a spike. Again, I’m telling you do not want variable rate debt going into this because we don’t know what’s gonna happen to interest rates. Yet. There are too many things coming up. We’ll talk more about that on another day. But what I do want you to see is that, you know, I don’t know why they couldn’t see this coming because inflation shock the past 18 months have seen a grand total of 32 trillion with a T in monetary and fiscal stimulus. But that should not have any impact on inflation, right? Oh my God, that’s just a blind monkey knows better. So here we go. As of October 2021, year over year shipping rates up 153% food, a 31% energy, 74% house prices, 20% now, quite a honestly, those shipping rates and the housing, that’s not fully reflected in the CPI yet. We’ve got more to come and tell me why that’s going to magically and suddenly change. Yes. If we can create a smoother supply chain and we can get actually moving on a regular basis, then the cost of shipping should come down, but it’s not coming down overnight. So I don’t know why they magically think that it’s gonna change by next year because we’re at the end of the year and this is what we’re going into. And the CPI is just beginning to reflect. And I’ll talk more about that next, we’re gonna have a busy week next week I’ll just say. But the reality is, is you can only push the public so far before they start pushing back.

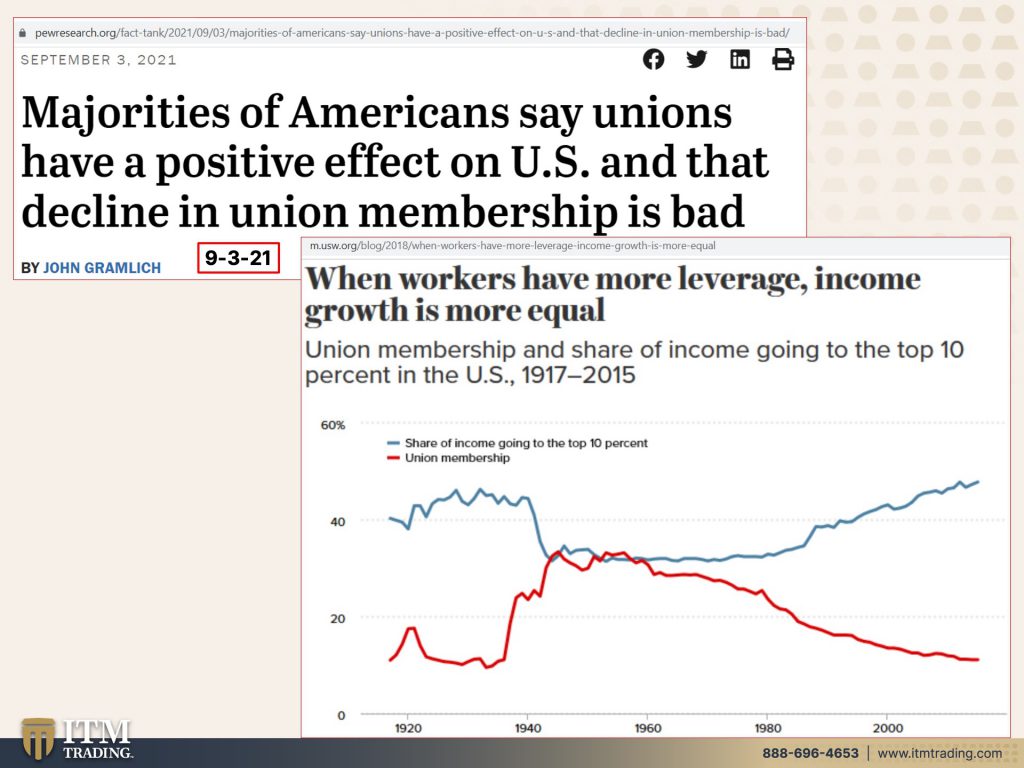

I wanna talk a little bit about unions here because unions, which is this blue line that’s union membership and that peaked in the forties and in the fifties. And you know, I’m old enough to remember cause I was born in 54 and I’m old enough to remember. IBM was big in Kingston, New York where I was raised. And I can remember my parents talking about it cause they had a lot of IBM-ers that bought houses from them. And you know, usually back then you went to a company and you stayed for 30 years, you stayed your entire career cause they had the private pensions and they gave you a lot of benefits. And so unions weren’t as necessary because the corporations really stepped that up. And so we saw a major decline in union membership and by the way, this red line is the top 1% income share. So you can see where was in 29. It was really high. And guess what it is again, two. Here’s 1971, so the decline was already in play, but people’s memories are very short and they already had an opportunity to change the thought process over that 30 years. So why be a part of the union we’re being taken care of? But after 1971, a lot of things changed. The IRA was born, right? And then the 401k. So they started shifting the onus of retirement plans from the corporation defined benefit. So the corporation is liable for the performance of their assets to defined contribution, which means that the employees are now responsible for navigating the wall street mess. And, and I’m telling you how many people really understand what they’re getting into. That’s why it’s so easy to transfer the risk and transfer the wealth. And then in 2008, for those of you that were, and you remember occupy wall street, you remember all the bailouts and how everybody was so upset because wall street really just ripped through the global economy. And you know, a lot of people felt a lot of damage during that period of time. I mean, you know, people were losing how everything, and so you can see a little blip up here in union membership, but then that was all papered over. And hey, we had the gig workers that came into play. So you had more flexibility, lower wages, more flexibility. You were making it on tips, but he here’s another blip again. Now I can’t tell you whether or not this blip is going to continue to go up. My bed is it will, time is going to tell us. But as of 2020, the end of 2020, we did see a little bit of a search about the same level as here. So we’ll just have to watch this, but you can really only push people so far. And 2008 is not that long ago. People remember and you know, the cerveza virus was very handy and tamping down all of the protests and revolts that were happening around the world. Think Hong Kong, the democracy, etcetera. So can they tamp it down again now? Not so sure because inflation is now entrenched and even a person that I really don’t care for at all. Larry Summers who allowed over the counter derivatives to, you know, explode without regulation. Okay. I mean, I am not a fan, but he even says the same thing. So sometimes we agree, but you know, it is what it is. However, a majority and a search report recently done by pew, majority of Americans say unions have a positive effect on the U.S. And then a decline in union membership is bad because when workers have more leverage like they do right now, they’re trying to get more people to come back into the workforce, even paying money. You know, then of course you have those mandates that are saying you can’t work without certain things. So it’s kind of an interesting period of time, but when workers have more leverage like they do right now, income growth is more equal. This is union membership. The other one, this just goes through 2015, the other on the union membership went through 2020. Share of income, going to the top 10% in the U.S. This is this blue line. And you can see that the share too as the unions declined, the share of the income going to the top 1% has grown, shocker.

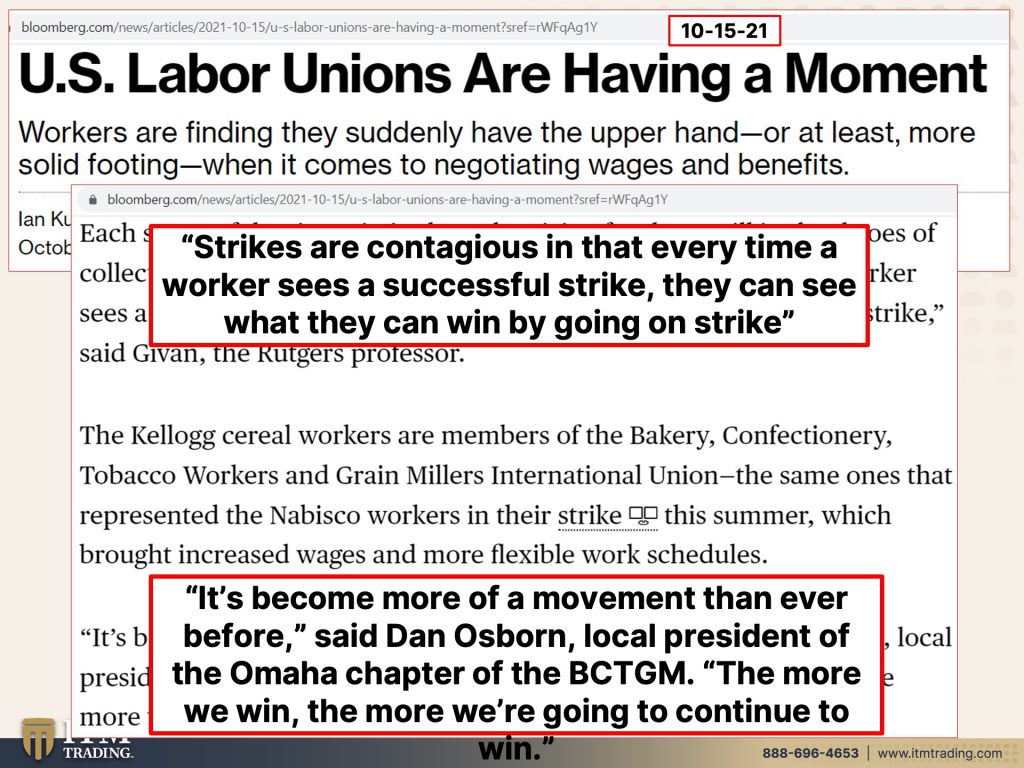

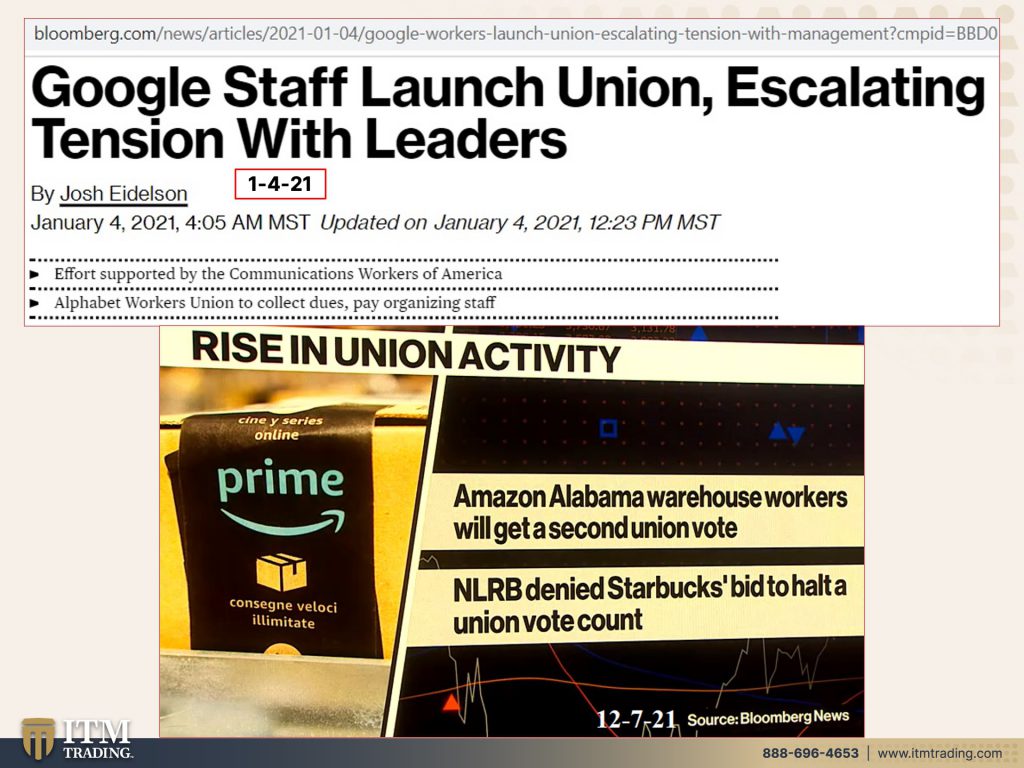

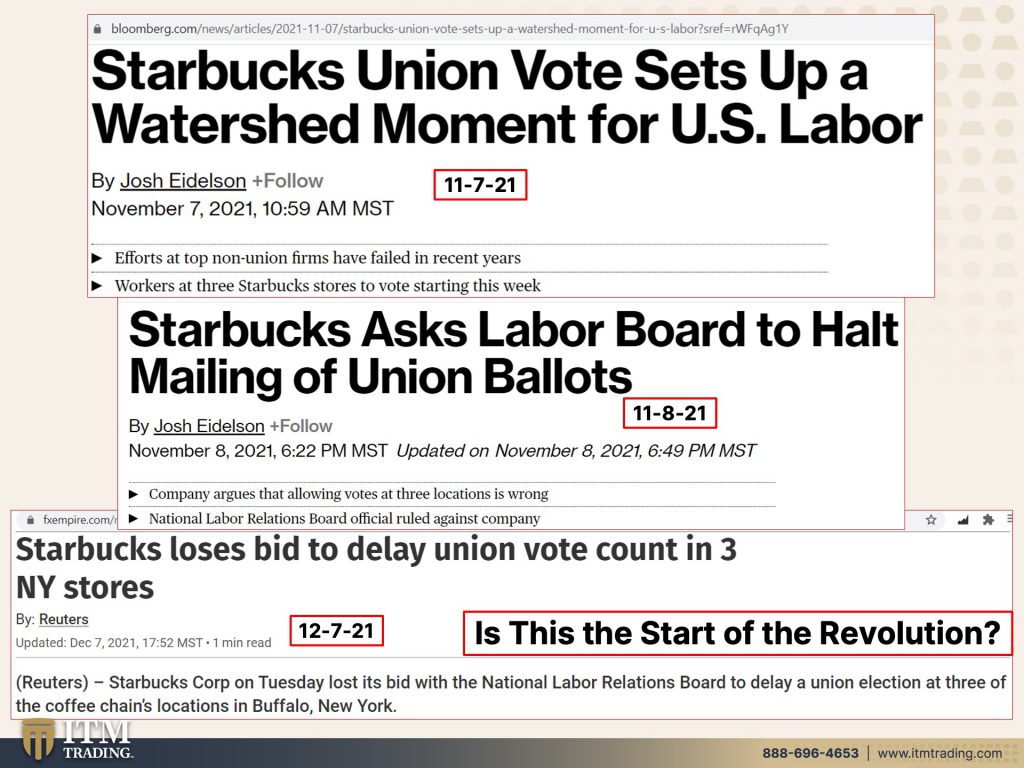

So labor unions are having a moment. They are finding that they suddenly have the upper hand because of what’s happening in the labor force. And they’re demanding it. Here you go, strikes are contagious. So that’s what I think is likely to grow. In that every time a worker sees a successful strike, they can see that they can win by going on strike. So it’s becoming more of a movement than ever before we need this. The more we win, the more we’re going to continue to win. So take that Google, Amazon, Starbucks, Deere, Kellogg, these large corporations and just a little bit to show you how they are really? Oops. Yeah. 11-7. That’s right. My eyes saw 12-7 for a second. I had oops, but Starbucks union votes set up to watershed moment for U.S. labor of course, Starbucks at the labor ball board to halt mailing of union ballots. But no, they can’t delay it. So ta-da, we see this movement growing steam, and this could be, this could turn into a huge revolution, to be honest. And we need a revolution because we need people to come together in community and say, no, what you have been doing to us is not okay. We have to do this to protect our children and our grandchildren and those that are coming after us for those that are as old as I am.

So, you know, here’s the reality of it. 6,000 years ago, you could buy a suit of armor with an ounce of gold. At the turn of the century, you had a choice. You could use a $20 gold coin or a $20. This is not a gold certificate, but this is a $20 bill. Either one of these would’ve bought a really nice mans suit. Guess what? Mans suit, 1917. This is Georgio Armani, a peak lapel single button suit $1,795 bucks. And as of the close yesterday spot gold, which is manipulated, as we know was $1,785.50. It still buys a man’s suit. Gold protects you from inflation over time. They manipulate anything in the short term, take advantage of it. You know, what have we been seeing in the market? The market goes down and people are rushing to buy it. The trouble is is you can only convert what you get out of the market into dollars. Who’s oh, let me just kind of remind you of this. Let me go back here. Where is it? Here it is. Okay. Let me just kind of take this away for a second. Look. This is the purchasing power of the dollar. Since they installed the federal reserve. Look at this, they lost 50% right out of the shoot because they printed $2.40 for every itty bitty ounce of gold that they had in deep storage. That’s how they kicked things off. Look at what’s happening in the stock market. Look, what’s happening to the cryptocurrencies. Stock market went up as they printed all this money. You all have heard about the roaring twenties. Well, we have the roaring twenties again, but it’s about sucking you a system that ultimately will rob you of everything. You gotta have this, you gotta have this and this it’s a piece of paper. It’s nothing.

But if I throw this, I might hit my dog because he is down there. He might wake up, but, or this, okay? There’s something to it. I can’t crumple them up. I can’t tear them because true financial shields are made of physical gold and silver, true shields. You’re going into a battle. You want a piece of paper. You want a shield? You want something made out of metal. Something that can protect you. The battle is heating up. Perhaps the revolution has already begun. Perhaps this is just the start of it. Or the resurgence of that started back in 2008 because the problems in the system are not gone. And you know what? This is the end, December 31st parts of the libor go away. Now some of it has been extended and I’m gonna talk a lot more about that next week because the derivatives that are tied to the libor, if they keep going on the path that they’re going on, even into 2023, they can’t get out of this mess.

You need to be protected. It is time to cover your assets. And I prefer the metal that’s been proven. And even the bank for international settlements says that gold is perfect, it’s a perfect protection inside of a crisis circumstance. If you don’t think we’re in a crisis, there’s this bridge in Brooklyn I’d like to sell ya, because the only tool that central banks have is that! That’s it. That’s what they have! Has that worked yet? No, it’s made it look like some thing has worked. Don’t change behavior. Just change the way you account for that behavior, but that behavior will come back and bite you in the butt and see that I woke up Oliver, who has been a very good boy. So quiet today.

You know, if you have not yet seen the boots on the ground interview with Dr. Elda Pema, you wanna do that because she has actually lived her family’s lived through two hyperinflationary events. She as an economist, she was studying economics in Bulgaria during that hyperinflation. And she wears a gold coin around her neck as a constant reminder, her that it can happen anywhere. And guess what? I hate to say this, but it’s gonna happen everywhere. The test is in raising rates, lowering rates, trying to fight the inflation they’re between a rock and a hard place. So if you like this, please give us so thumbs up and make sure that you share, share, share, share this content. This is so critically important for people to understand and make a comment, leave a comment. And you know, if you have not yet started your gold and silver strategy, please get that done. It’s based upon repeatable patterns that we see every time as currencies die, this Fiat money experiment, this currency experiment, it’s dying. It’s at the end. It’s at the end. I don’t even care if Oliver eats that, cause it’s nothing. So, I’m sorry if I got a little worked up, but when I see this and, and honestly this has actually been a piece that I’ve been wanting to do for a really long time. Get your gold, get your silver, get your strategy, food, water, energy, security, barterability, wealth, preservation, community, and shelter. Get it done. We don’t have all the time in the world. Please get it done. And until next we speak, please be safe out there. Bye bye.

SOURCES:

https://inequality.org/facts/income-inequality/#ceo-worker-pay-gaps

https://fred.stlouisfed.org/series/CP

https://inequality.org/facts/income-inequality/#ceo-worker-pay-gaps

https://www.zerohedge.com/markets/chief-strategist-markets-are-about-be-hit-three-shocks

https://inequality.org/facts/income-inequality/#ceo-worker-pay-gaps

https://tradingeconomics.com/commodity/gold

https://www.usw.org/blog/2018/when-workers-have-more-leverage-income-growth-is-more-equal

https://www.bloomberg.com/news/articles/2021-10-15/u-s-labor-unions-are-having-a-moment

https://www.pbs.org/newshour/economy/starbucks-fights-expanding-unionization-effort-at-its-stores