The Truth Behind the Banking Collapse and How to Protect Your Wealth…by Lynette Zang

Don’t be a deer in headlights! Lynette Zang, Chief Market Analyst at ITM Trading, believes that the Silicon Valley Bank is just the beginning, the dominoes are already falling and that the current system is headed for disaster. In this video, she examines the recent market activity, the rollback of the Dodd-Frank Act, the withdrawal run on FTX, Silvergate and she demonstrates why it’s more important than ever to hold onto what you own. Don’t miss out on this eye-opening analysis.

CHAPTERS:

0:00 Dodd-Frank Act

4:53 FTX $6 Billion Run

9:02 CBDC

12:38 Rising Rates & Bail Out

15:42 Who Owns SVB?

19:54 Central Banks Buy Gold

TRANSCRIPT FROM VIDEO:

So let me ask you something. Have you been convinced that everything is just fine and hunky-dory? Because of course, everything is backstopped and hey, the Fed came in and created a new program and, you know, and let’s see what they’re gonna do with interest rates. Well, personally, I am not convinced that everything is okay, in fact, just the opposite. So let’s take a look at this. Coming up.

I am Lynette Zang, Chief Market Analyst here at ITM Trading of full service, physical, gold and silver dealer specializing in custom strategies. And the strategy includes all of this, right? So this is the current harvest from my gardens, and I’m very happy about that, to be honest with you. But let’s take a look at what happened.

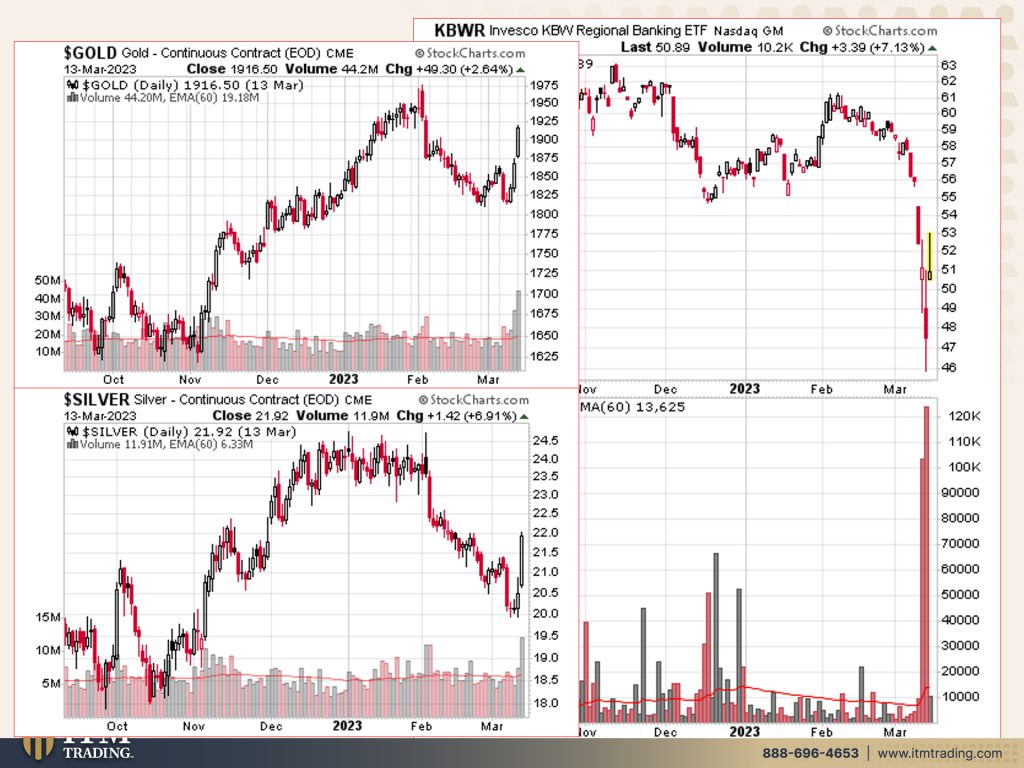

Now, arguably, I don’t know where the market closed today because I’ve been busy in here, but this is what was happening this morning. And my personal opinion is, well, no, technically this is a dead cat bounce. Okay? So this is the KBWR, which is the regional banking ETF, and that’s a nice little bounce. But look at this gap over here. It would not surprise me because all gaps must be filled. Here’s a little technical lesson. All gaps must be filled. I can’t tell you exactly when, but I can tell you they will be, would not surprise me for it to go in and fill this gap before it then goes to plunge again. The other thing I’d like to point out, and, and again, this was first thing in the morning, is look at this selling pressure, huge amount of selling pressure two days in a row as the, that index tanked. This morning the selling pressure was not that great, but how did gold react to it? Well, you can see it moved up quite a bit in spot gold terms. And again, you see the volume here has increased, eh, a little bit more than what’s the norm? This is substantially more than what’s the norm. And here’s silver. Okay? So you see similar behavior between both of these in terms of volume and in terms of price action. Now, what they’re saying is that this was all caused by President Trump’s rollback of the Dodd-Frank Act. But and I’m gonna do something deeper on this if you guys want me to because this wasn’t the first, I mean, as soon as they wrote the Dodd-Frank Act, as soon as they legalize it, all of the terms and the rules were not written. They weren’t even written when these, when they started to roll back, let alone a lot of the pieces instituted. However, Bail-in was and Bail-in still is, although we almost saw it in this country. And then they got scared and these said, no, we’re gonna backstop everything. We’re gonna talk a little bit more about that. Also thought it was interesting when I pulled this slide. This is back from 5-24-18, 2018, and there happened to be Spot gold at 1304 and spot silver at 16.65 and the Dow at 24,742. But what this rollback really did was it allowed more leverage, fewer investor protections and less oversight. Who does not know that that is not a recipe for disaster? Just like when President Clinton rolled back Glass Steigel, which in 33 had separated risk taking investment banks from deposit taking banks. Yeah, well, after all banks will police themselves. What’s the big deal? And that’s really what’s the start of the end of the whole system because it’s more about leverage, which is kind of debt upon debt upon debt upon debt upon debt, right? Lots of layers than it is about protecting investors and you know, who got bailed out Anyway, interesting on that.

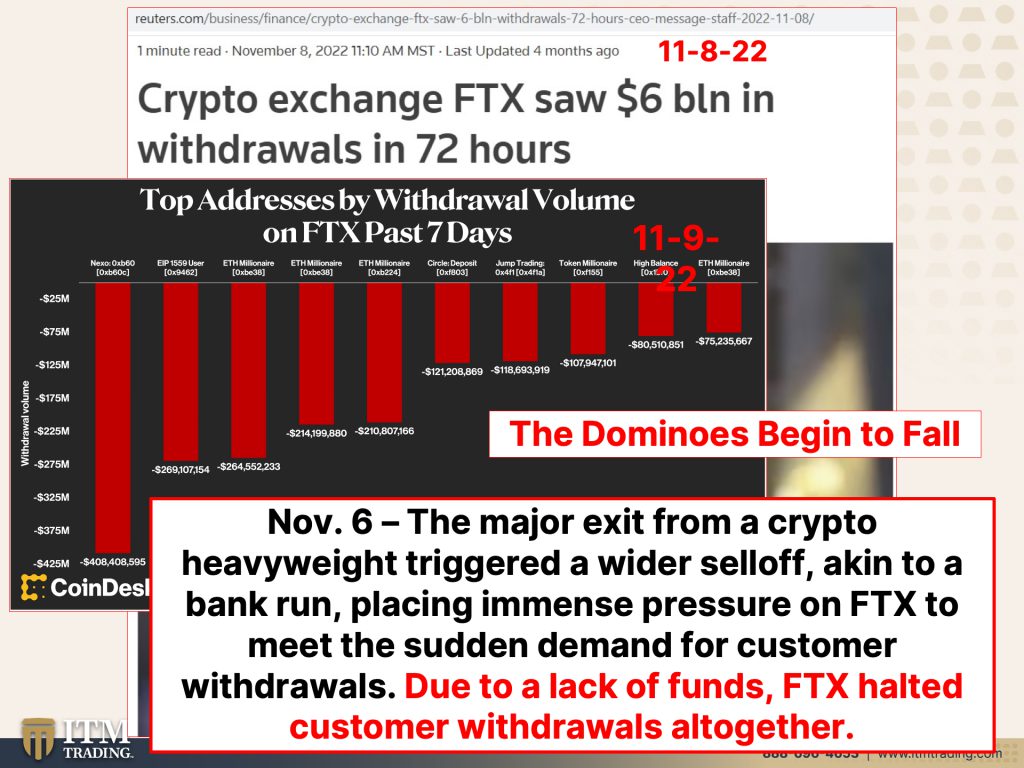

But the dominoes are already falling. This was back in 22, 11-8-22. Crypto Exchange FTX saw 6 billion in withdrawals in 72 hours. That’s a run. We can take a look at what that looked like. Top addresses by withdrawal volume on FDX past seven days. And you can see, you know, ETF there’s all sorts of names in here, but that was an official run. And on November 6th, again, the major exit from a crypto heavyweight triggered a wider selloff akin to a bank run, placing immense pressure on FTX to meet the sudden demand for customer withdrawals due to a lack of funds. FTX halted customer withdrawals altogether. If you don’t hold it, you don’t own it. It is truly just that simple. So whatever it is that you’re holding inside of this Fiat money system, and we saw that the other day. It was stock after stock after stock, the trading was halted. Well, there’s nothing that says that they can’t halt it for a really long period of time. And historically, they indeed have, but they don’t wanna create panic because there is only one level of confidence left. And that is public confidence in the system. But make no mistake, the dominoes are falling.

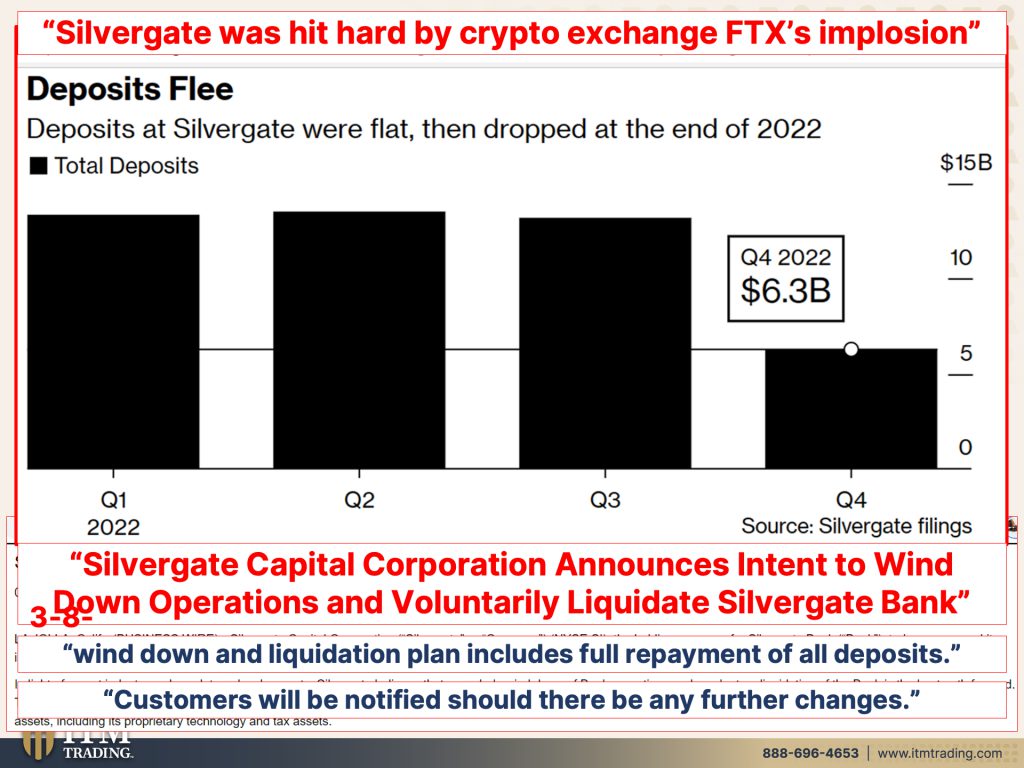

Silvergate also was hit hard by crypto exchange, FTX’s implosion, and we concede the deposits flee. They were flat. And then, and that’s the way things happen. They happen slow and then they happen fast. But this is just one of the dominoes. Announces intent to wind down operations and voluntarily liquidate the bank. You know, that was just on March 8th. So we’re seeing now it going into the banking system. Though this was primarily a cryptocurrency bank. Silvergate Capital Corporation announces intent to wind down operations involuntarily liquidate the bank, wind down and liquidation plan includes full repayment of all deposits. Don’t panic, there’s nothing to see here. Don’t look deeper. You’re gonna get all your deposits back. And now after all, we have the government and we, the treasury, the FDIC, everybody say, don’t worry, we’re gonna backstop all deposits. I’m gonna come to this in just a second. Customers will be notified should there be any further changes. Mm-Hmm. <affirmative>, yeah, they’ll notify you, but it’s too late for you to do anything about it. And then we roll into stock market Miracle collapses on systemic angst spurred by SVB. All right? And end concerns over contagion. That was the biggest concern that the central banks and the government have. We do not want this fear to spread because again, the last vestige of confidence is the public confidence in, in, in this stuff and in the markets and in the banking system. They don’t want a run. We saw what happened in 2020 when the run had begun. And then would you have, you had all these central bankers walk out and say, but don’t worry about it. You can get your money because we will just print all the money that we need to pay you. Yeah, except that all the money that’s already out there loses value every single time the Central Bank does that. So the collapse came days after crypto friendly Silver Gate Capital Corp announced it would liquidate and wind down operations.

What does this mean for your money? Well, I want you to just think about this because I haven’t, I got, I’m gonna explore it more in my mind, yes, they were trying to prevent a run on all banks a hundred percent, but who really got bailed out in that before they even stepped up to the plate for everybody? Were venture capitalists and technology companies, those companies that the government is partnering with and wants to partner with into the future to issue and manage the CBDC’s. So I’m wondering, and I don’t know, this is just a thought, please bear with me and if any of you have any thoughts on this too, share them. But this is just a thought that what they were really bailing out was their ability to issue CBDC’s sooner than later. Maybe I’m wrong, except why would you do that, right? Why if it’s supposed to be bailed in, and we even heard from the resolution committee at the FDIC that everybody’s gonna be bailed in. 97% of the deposits at SVB Bank were uninsured deposits. And now the little poultry amount we have in the FDIC DIF fund is going to cover all that? Interesting.

The failure of our prominent bank for tech startups is inciting fears of a 2008 repeat experts say, don’t panic. So what this means for the future of your money is if you believe them and you buy into this, that you leave your money where it is and it’s easier for them to take. But the second largest back failure of all time and the biggest bank failure since 2008 is stoking fears among everyday investors and savers. This is the last vestige of confidence that they have. They do not want that to happen. The best strategy at the moment is probably do nothing. If retail investors are saving money for a long-term goals and this SVB News is just a minor hiccup, nothing to see here, move on, move on. But frankly, they’re just doing their job. Perception management. If they can manage how you perceive things, then you move forward in a way that supports their plans. I’m not so sure that that’s the best idea in the world. And by the way, the inflation numbers came in today and they’re sticky and core inflation is up more than expected. So we’re gonna see what’s gonna happen with the Federal Reserve. But I’ve been saying for a long time they’re between a rock and a hard place. And so, you know, if they raise rates, you’re gonna see more of this. If they don’t raise rates, then inflation is going to heat up more than it already is. Either one of those, I don’t care which scenario you pick. Either one of those undermines public confidence. And this is a con game. It requires confidence.

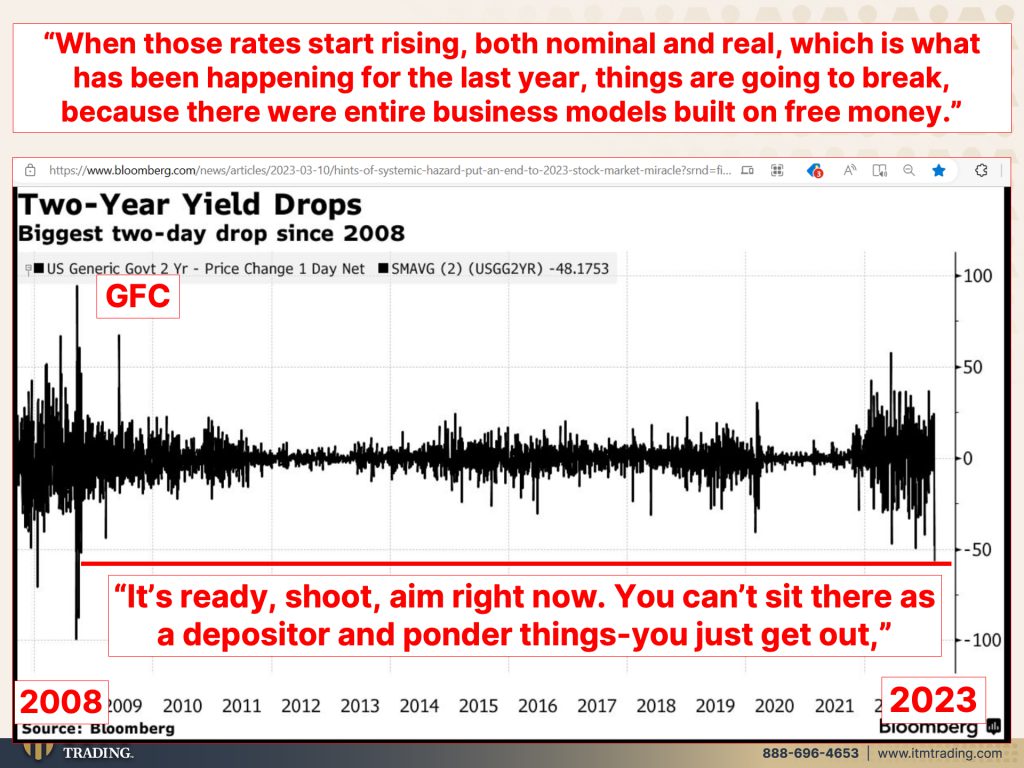

Because when those rates start rising, both nominal and real, which is what has been happening for the last year, yes, the central banks raise rates, things are going to break because there were entire business models built on free money. I said it before, I’ve said it over again, I’m gonna say it again. The system died in 2008 and just went on life support of free money. And now that’s coming home to roost. I think this is interesting because yields were rising, but then in a flight to safety, yes, we saw the graphs. People went to gold and they went to silver. And I know we were busy and we probably are still busy, busy, busy in the physical world, but even in the paper world, out of the frying pan and into the fire, these are two year treasury yields. 2008, here’s the great financial crisis and you can see how much those yields moves from higher to lower. And here we are. This was on the 10th of March. And you can see you gotta go all the way back to 2008 when this system died. And here’s what professionals are really telling themselves to do, which is part of what caused the run. It’s ready, shoot, aim right now. You can’t sit there as a depositor and ponder things. You just get out. But they don’t want you to get out. They want you to think there’s nothing to see here behind the curtain. Everything’s just fine and dandy. No, the same problems that plagued SVB plague every single bank because after 15 years, 14 years of zero interest rate policy, all of those bonds and debt that they bought are all underwater. But don’t worry because you can go to the Fed’s collateral window and you can borrow as if they weren’t underwater, right? We’ll just make you whole. Which isn’t that what they did with AIG when they, when that bet went bad? They made sure that everybody, meaning Goldman Sachs and Citi and all those big guys got paid out a hundred cents on the dollar even though the value of those contracts was more like 40 cents or 60 cents? Yeah, they did the same darn thing. And who did they just bail out? They bailed out venture capitalists. That’s who they bailed out. And tech companies, that’s who they bailed out. Not moms and pops, but we’re supposed to think that they’re doing all of this for save the Children, right? It’s always about the children. Except it’s never really about the children. For you and me it is, but for them it’s just a ploy to pull at your heartstrings and say, ah, nothing to look out here.

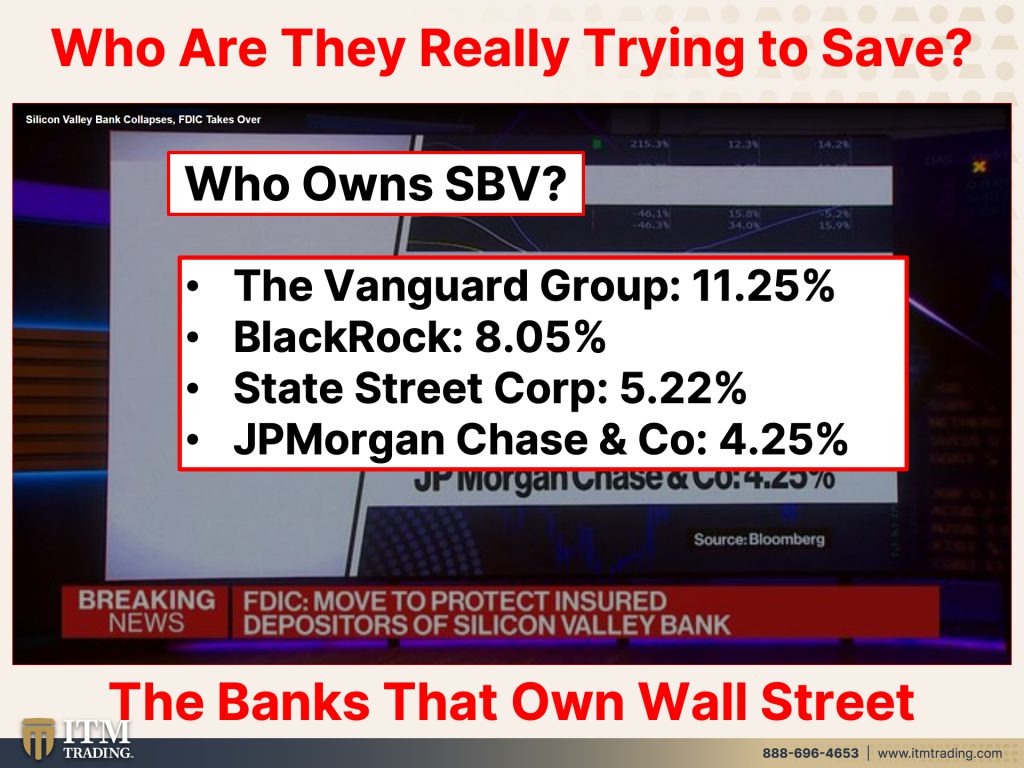

So let’s just take a look at who owns SVB. Hmm? The Vanguard Group, BlackRock State Street and JP Morgan Chase. Hmm. This is the banks that set up all the derivatives and that own DTC and DTCC, which means any asset, any fiat money asset that you hold in an account. Cause if you don’t hold it, you don’t own it. Is actually owned by these guys. It’s just your perception that you own something. But that’s not true. That’s not real and it’s not true. And in a court of law, your perception doesn’t mean a thing. Not a thing. And who else? Oh, look at this. Roku, Roblox and others disclose their exposure to SVB in SEC filings. Now yesterday, I read an email from an ITM customer that tried to to write, write a check into Chase Bank for like 2200 bucks and found out that they wouldn’t have access to those funds until the 23rd of March. She wrote in again, hold on a second. I know I’m live, so bear with me on this one because I printed it out. There it is, but I forgot to grab it before we went on. So let me read this:

Thanks for passing that along. I’m also getting a direct experience of how this thing spreads. A while back I purchased a few shares, less than $50 worth in gold royalties. It was strictly for education purposes. Since I understand so little about the markets except not to invest in it, I figured the $50 was the same amount I’d pay for a textbook if I were taking a course. So it seemed worthwhile. Well guess what? I just got an email from EToro that they used Signature Bank for their customer funds. Hmm? The long arm of what likely could be a slow spread has already knocked on my door twice.

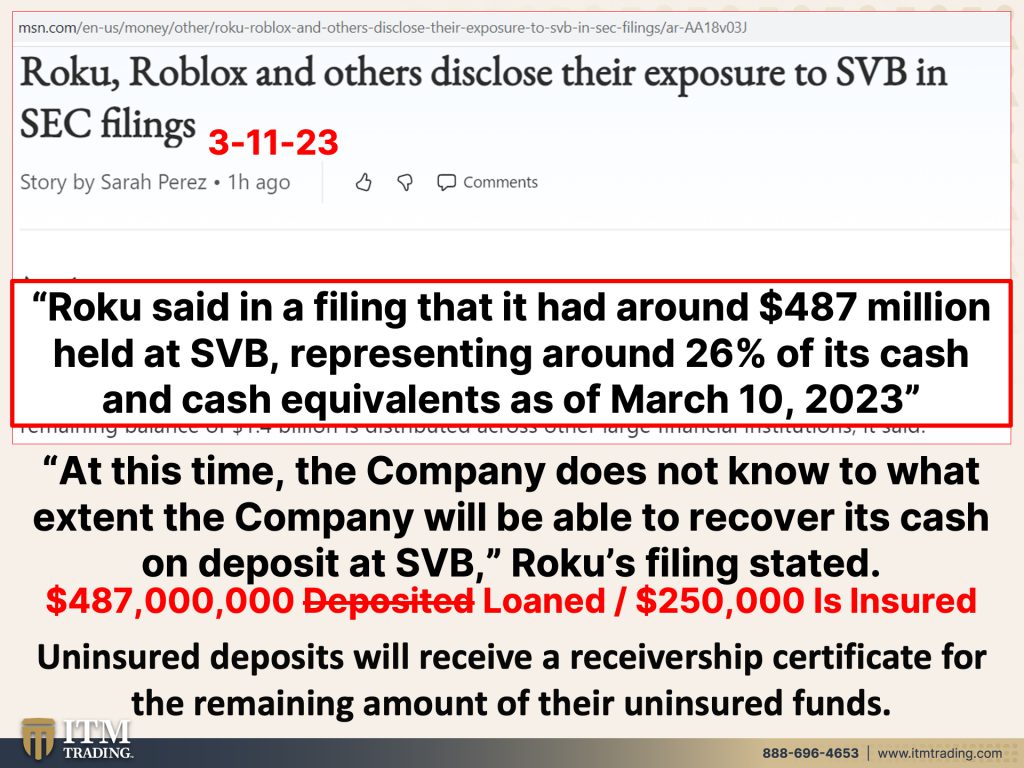

We don’t realize it. You know, Megan does some stuff on Etsy and you know, she got notification that the payments were delayed as well. So, you know, have you heard of SVB bank before this? Probably not. But what a global reach it has. Roku said in a filing that it had around $487 million held at SVB representing around 26% of its cash and cash equivalents as of March 10th, 2022. Well I think that’s a little bit above the $250,000 insurance. So who just got bailed out? Hmm. I’m thinking Roku did and Roblox at this time, the company does not know to what extent the company will be able to recover its cash on deposit at SVB. Well, okay, that question has been answered. Just understand that when you make that deposit, you become an unsecured creditor of that bank. That’s not your money anymore. You have loaned it to the bank. Now I don’t know how long they’re gonna keep that hundred percent. You might remember in 2008 it went from a hundred thousand dollars to 250 and the 250 stuck. Can they do that? Can they actually ensure a hundred percent of the deposits? And what actually ensures that? This! And by the way, while they want you to think that taxpayers funds are not going to do that, who is backstopping the Federal reserves balance sheet? Taxpayers. So one way or another, higher fees, what have you. But we will pay and we will pay dear.

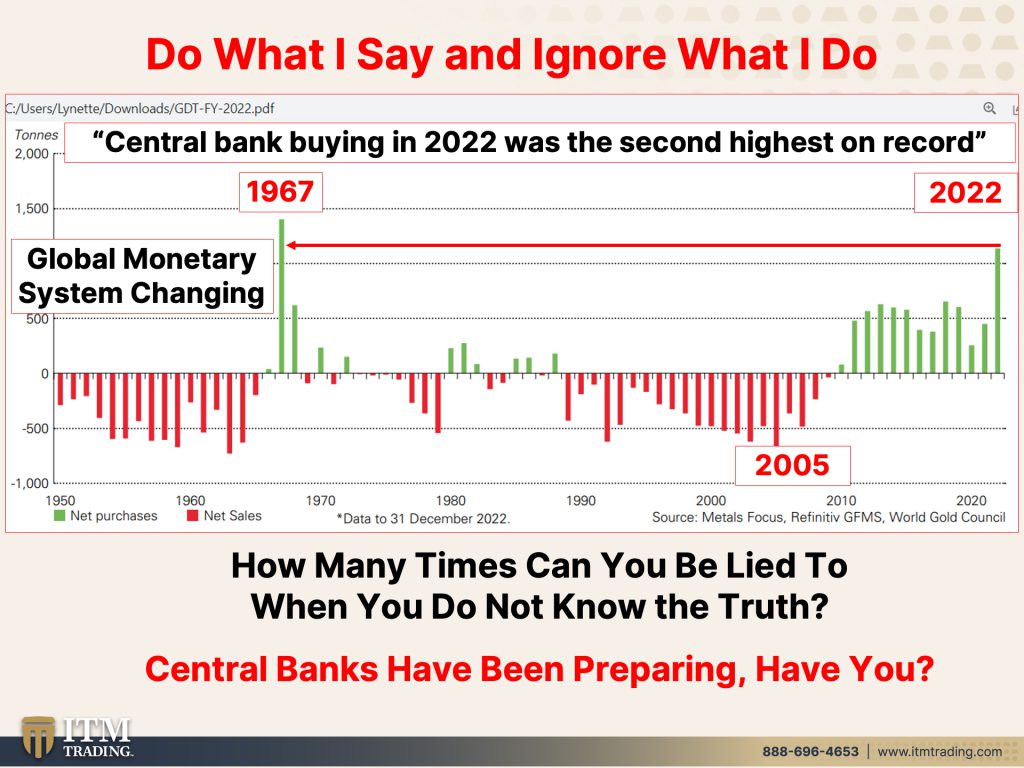

And in the meantime, what do the central banks want you to do? They want you to do what I say, stay in the system. Stay there. Not what they do. So we know that central banks in 2022 bought more gold than they had since 1967, which was the last time that we were shifting into a new monetary regime. Social, economic and financial. My uncle had thousands of these to go into that new regime with. He was in a great position and he was right. Aunt Birdie didn’t have to worry about anything because he had the kind of gold that you could hold no matter what. That’s the kind of gold I like to hold. That’s why I do it because I had that personal experience. I don’t care what anybody says, I don’t know. Are they gonna do an overt confiscation? Are they not gonna do an overt confiscation? They’ve been doing covert confiscation with all this price manipulation forever. But yeah, I can see them going, oh wait, no you have bullion. That’s okay. We’re gonna devalue it. We’re going into hyperinflation. But hey, that’s fine. You can hold your wealth. I don’t think so. That’s not really how they work and they aren’t really doing any of this for your best interest. And so I ask you, how many times can you be lied to and you do not know the truth? Their actions of buying gold? Do not support what they’re telling you to do. Nothing to see here. Keep your money in the system. Do not, I repeat, do not be fooled and be a deer in the headlight cause you don’t know what to do. Cause that’s what’s gonna happen to you. And I don’t want that to happen to you or anybody else. Maybe them, but not you. Not you.

So how many times can you be lied to? Here is the truth. When their actions do not support their words. You know they’re lying. They’re lying, they’re lying. And they’re gonna lie to you some more central banks have been preparing. Have you been preparing? I hope so, because if you click that Calendly link below and you set up a time to talk to one of our Gold and Silver specialists, they can help you develop your own strategy that, oh my goodness, actually puts your best interest first. What a concept. But that’s what you need to do. And you need to be as independent and self-sufficient as possible. I don’t have to worry about food if I couldn’t go off this property. I have plenty to eat. And by the way, plenty to share with my neighbors. Where’s that bill? Oh yeah, <laugh>, let’s get rid of that. And I think it’s critically important. Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter. I can’t tell you whether or not they’re going to keep the public calm. I can’t tell you that, if they can’t, if another bank goes down, then that might just spook them enough. But remember, if the Fed raises interest rates right now, you’re gonna see more of SVB. If they lower or if they don’t raise interest rates, you’re gonna see more inflation. Either way, that erodes confidence of the consumer and it is the public, it is the consumer. That one that’s hanging on by a thread, that’s keeping this whole system afloat right now. Choice is yours and if you haven’t done it yet, well you haven’t done it cause it hasn’t been issued yet. But stay tuned all week for the updates on the collapse. And part two will be coming out on Thursday as well as a really special edition of Coffee with Lynette, with Mario Innecco. So that’s great from his perspective over in Great Britain. And that’s coming out on Friday. We also launched a new Spanish channel and so we’re gonna be doing that live tomorrow. But re or yeah, tomorrow’s Wednesday. Yeah, tomorrow’s, I’m sorry, I’m sorry. Well, the world is a blur right now, but we’re gonna do that live tomorrow. And what’s really good about that, because it’ll be a combination of English and Spanish, but Fernando’s gonna ask me questions and drill down so they’re really short and concise and specific. And that might be good for you to share with other people that you can’t get to watch a 20 or 30 minute video. You know, we try and keep those what, around like 10 minutes or less since something like that, maybe max 15. But as, as short as we can, you might be able to get ’em to watch that. But if you haven’t done it yet, please subscribe. Make sure you give us a thumbs up. If you like this, leave a comment and share, share, share. And remember, wealth shields are made of physical, gold and silver made of metal, not paper and promises. I mean, what is that? That’s garbage. It’s nothing. It’s nothing. And until next we meet. Please be safe out there. Bye-Bye.

SLIDES FROM VIDEO:

SOURCES:

Silvergate (SI) Is in Talks With US FDIC Officials on Ways to Salvage Bank – Bloomberg

Systemic-Risk Fears Put an End to 2023 US Stock Market Miracle – Bloomberg

Is My Bank Going Under? What Silicon Valley Bank Failure Means for Your Money – Bloomberg

Systemic-Risk Fears Put an End to 2023 US Stock Market Miracle – Bloomberg

Silicon Valley Bank (SIVB) Collapse: Yellen Says Bank System Remains Resilient – Bloomberg