The Rise of Zombie Corporations

Those in power would like you to think that the banking crisis is over so that you don’t change behavior or make any different choices than you’ve already made. Frankly,  it has just begun and it’s getting worse and it’s about to get even worse. That’s what we’re going to talk about today. And I’m going to show you how to protect yourself.

CHAPTERS:

0:00 Introduction

1:19 Corporate Crunch

4:29 The Transition is Coming

7:27 Corporate Debt

11:06 Small Business Credit

14:44 Indebted Consumers

15:57 Bankruptcy Filings Up

18:20 Gold Steady

TRANSCRIPT FROM VIDEO:

Those in power would like you to think that the banking crisis is over so that you don’t change behavior or make any different choices than you’ve already made. Frankly, it has just begun and it’s getting worse and it’s about to get even worse. That’s what we’re gonna talk about today and I’m gonna show you how to protect yourself, coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading a full service physical gold and silver dealer specializing in custom strategies. But these strategies are based upon over 4,800 currencies that no longer exist and those repeatable patterns. So I’m seeing all of these repeatable patterns happening. Can you see them? Cause we talk about it a lot. So what just happened with SVB and Signature Bank and and Credit Suisse, etcetera. You know those in power really do want you to think, okay well those were just one off events that’s not having any impact.

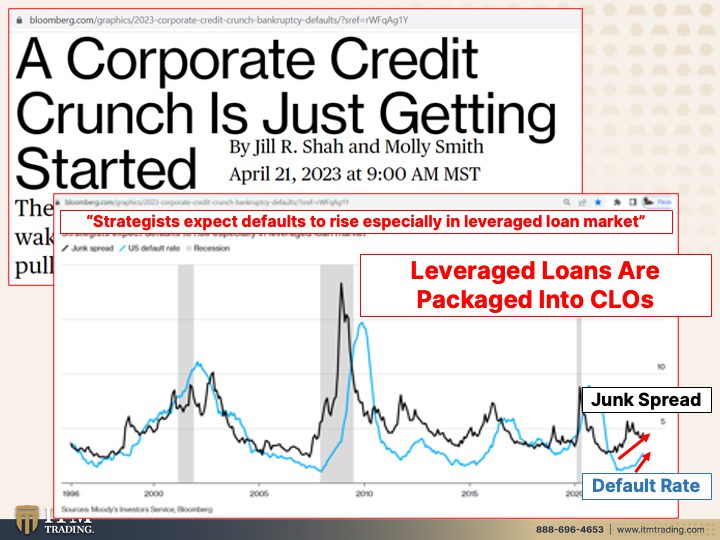

And yet what’s really happening is a corporate credit crunch is just getting started. There are worrisome signs of corporate distress in the wake of the banking crisis raising the specter that a pullback in lending will drag down the economy. Yes, because this system is based on never ending debt and that means it’s not just that you pay that debt off because when you pay debt off that pulls money out of the system. It’s the ability to roll that debt over, roll that debt over, roll that debt over. So we got a big problem and it’s just the tip of the iceberg because it’s also all those derivatives based on that. But we’ll talk about that. Spread signal higher default rate in the loan market strategists expect defaults to rise, especially in the leverage loan market, right? So what’s leverage? It’s like debt upon debt upon debt. So a corporation will have this level of credit but that level of debt based on this itty bitty bit amount of credit, that’s what happened with Shearson when they went out. They were so over leveraged, but that leverage, as I’ve shown you in previous videos, has only gotten worse and there’s just no denying it. So this is the junk spread. Now junk is rated below triple B and that is the difference between the US and sorry about that. That’s the difference. The spread is the difference in interest that they pay on low quality corporations versus what they would pay on treasuries. Which I mean I’m hesitant to say that that’s a high quality bond, but okay. And what we’re seeing that is in both cases, even as the junk spread has come down, the default rate has gone up. You are not getting paid for the risk that you are taking and leverage loans, as we’ve talked about many times in the past. And the bank for international settlements has also discussed that there is a problem brewing because what you need to be aware of is that leverage loans are typically from lower quality corporations and then they’re packaged up into CLOs collateralized loan obligations. And according to the bank for international settlements, they have taken over for the CDOs, which is collateralized debt obligation, which is what imploded in 2008. So this is the same thing, it’s just that those were based on subprime mortgages. These are based on subprime loans and the ability for those corporations to roll that debt over, which could be a challenge.

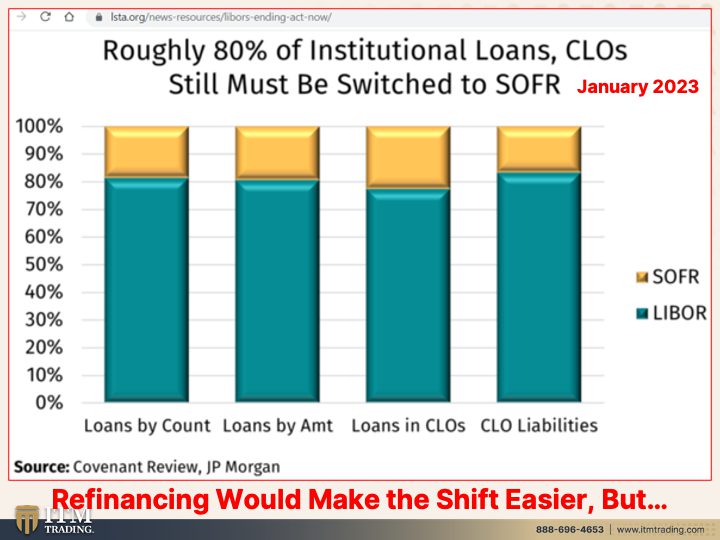

Now we have the LIBOR SOFR transition coming in and they’re saying everything is hunky-dory and maybe it is. I mean this is a grand experience, experiment that they have never ever, ever, ever, ever done before. And certainly all these very smart guys that can create all of these financial innovative products can handle this. Maybe they can, maybe they can’t. But I can see a real danger that’s happening. And what you need to know, this was as of January and here we are in April almost to May. And what you’re looking at is, is less than or more than 80% of the CLOs have transitioned into. SOFR now they put lots of laws in place, they’ve put, they’ve put fallback language in place, they put all of these things in place to make that happen, but they have not been able to make the formulas and even with a fix be exactly like LIBOR. So my concern and what they’re trying to do is, you know, if you just have like a little bit and a little bit and a little bit and there is a change in price cause remember these interest rates impact the principle, right? So when interest rates rise, the principle value, current market value goes down and vice versa. When interest rates fall, then the current market value of those assets go up. But the problem is, is we are in an environment where interest rates have been going up substantially, which means there are a lot of losses in the CLO playbook as well. It would be a lot easier if they could refinance these CLOs, but again, they’re having problems doing that because of the credit crunch, the high interest rates, the banking crisis. And that’s not over yet. So we’ve got a lot of danger and maybe I’m wrong, maybe you know, maybe June 30th, 2023, which is when they said the LIBOR would go away, meaning the Bank of England and the powers that be, it’s going away. Maybe it’ll be a nothing burger and I hope it’s a nothing burger but maybe it’ll be a big crisis, I don’t know. But that’s why you hold gold because then it doesn’t matter. I always like to do what if I’m right and what if I’m wrong? And if I can do something where it really doesn’t matter if I’m right or wrong, rock and roll hoochie coup, that is what I will do hands down every single time. That is a very safe place to be and that’s what gold does for you. Doesn’t matter right or wrong.

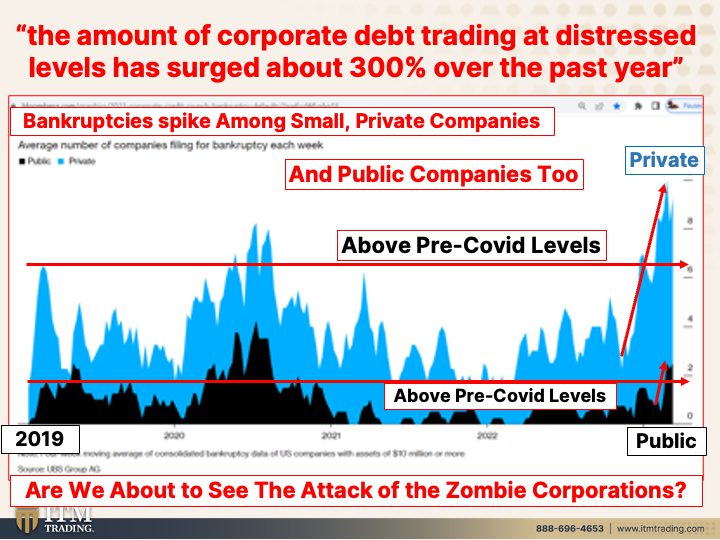

But the amount of corporate debt that is currently trading at distress levels has surged about 300% over the past year. Whoa. The amount of corporate debt trading at distress levels has surged 300% over the past year. Distress levels are meaning they’re having trouble rolling things over, making their their payments. This is not good, going into bankruptcies and that’s what this is showing us. Bankruptcies, spike among small private companies, the average number of companies filing for bankruptcies each week. Now, this graph starts in 2019 so you can see where it was then. And you can see in the private companies it is well above the pre COVID levels 2019. Now here we are in 2020 as the crisis went into play And what’d they do? Of course they pumped a lot of money into the system so it made it calm down, okay? I mean if you give away loans and you print lots of money and give it away for free, it can make things look okay, but does it really solve the problem? No, it just tides it. And that’s what they’ve been doing since 2008. So we have really big problems in there, but it’s also impacting the public companies as well. And those two are above pre COVID levels. So what is that telling you? We got a problem Houston, we got a problem. And are we about to see the rise of the zombie corporations? Now you might recall, cause we’ve talked about it before, that zombie corporations are corporations that do not earn enough income to pay all the interest on the debt. Forget the principle, just even the interest on the debt. And so the banks wanting it to look more like this, right? Like there’s no problem or not much problem here. They would loan these corporations more money so that they could pay the interest on the debt and whatever else came due. But what that did was it gave the, gave the corporations even more debt to deal with. So are the banks everything considered and the credit crunch that we’re talking about here, are we about to see the rise of the zombie corporations? Remember I did an interview, I don’t know, it was a number of months ago and and you know, she was like, oh yeah, we’re gonna have the zombie apocalypse, which, and I said, well yeah, because we’ve got zombie corporations out there. So the fact that they’re represented by like individuals on silly TV shows, but truthfully these zombie corporations could be a very well known name. Remember they stuffed that triple B, which is just at the line of investment quality because a lot of funds can’t invest in junk. And also they have to pay higher interest. Not much as you just saw, the spreads aren’t really that much not getting paid to take that risk. But I think we have a real problem that is about to rear it’s ugly head.

And it is the final decimation of the US small businesses because this has been coming on really since 2000, really since Wall Street and our those in charge decided that Amazon was way more important than the mom and pop shops that were out there. So they didn’t have to make a profit and Wall Street still rewarded them for it as they eliminated the small mom and pops. Well, whoever managed to survive it got through. Maybe they got through COVID, maybe they didn’t, but whoever managed to get through that crisis, well now they’re facing the worst credit in a decade after SVB, it wasn’t that SVB or signature, were loaning to small businesses because they weren’t. But all of the banks are pulling back on their credit. So more businesses had difficulty getting loans last month. That’s going all the way back to 2012, which is when they were, were papering over. Oh, not another one. They do too. They have lots of these. When they were papering over all of the problems from 2008, they did not solve any of those issues. They just papered them over. Those are coming to haunt us now I’m telling you.

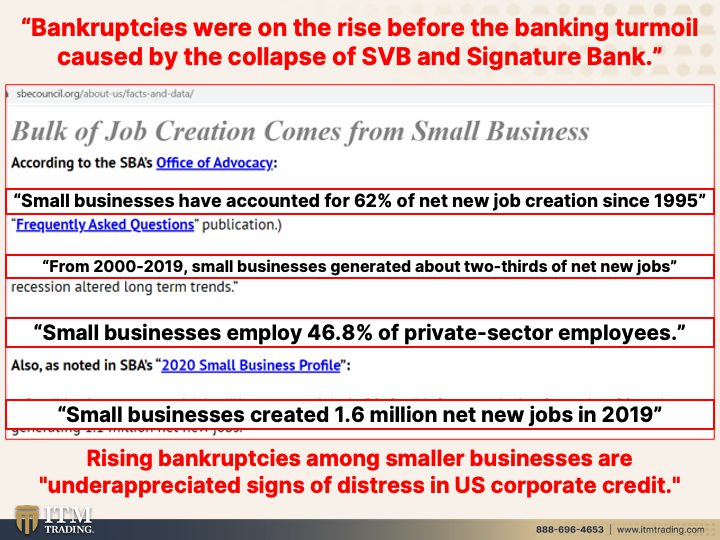

So are large corporations having that same problem? Well we did see that, yeah, there is definitely an uptick in bankruptcies, but frankly they were on the rise before the banking turmoil caused by the collapse of SVB and Signature Bank. And let us not forget Credit Suisse. Here’s the problem though. The bulk of job creations in this country comes from small businesses. Small businesses have accounted for 62% of net new job creation since 1995. From 2000 to 2019, small businesses generated about two thirds of net new jobs. So closer to 75%, no. Yeah, small businesses employ No, that’s about right. 62% small businesses. It’s been a long morning, sorry. Small businesses employ 46.8% of private sector employees. So think about this, small businesses created 1.6 million net new jobs in 2019. So if Fed, well Fed chair Powell has absolutely stated that he wants a pullback in job creation so that people can ask for higher wages because after all the higher wages is what’s causing the inflation, not their money printing, right? But rising bankruptcies among smaller businesses are underappreciated signs of distress in US corporate credit. We got a problem. Houston, what are you doing? And I don’t mean Houston, the place is just we’ve got a problem. So what are you doing to eliminate this impacting you?

Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter, then it doesn’t impact you so much. Nations heavily indebted consumers face a painful margin call. Now this is in Canada, Canadian’s ability to adjust to higher rates could be instructive for other countries. Absolutely. Their debt levels are near a record growth and consumer debt has outpaced income. And this morning the Bank of England were telling us or telling people that live in the UK that you know, they just might have to get used to a different standard of living because what people are trying to do is maintain their current standard of living. And what they’re doing is they’re taking on debt in order to do that. But at some point you either have to service that debt, roll it over or pay it off or default on it. Those are your options. So what we’re seeing is consumers are stressed and insolvency rates are starting to climb up to pre pandemic levels, which is alarming.

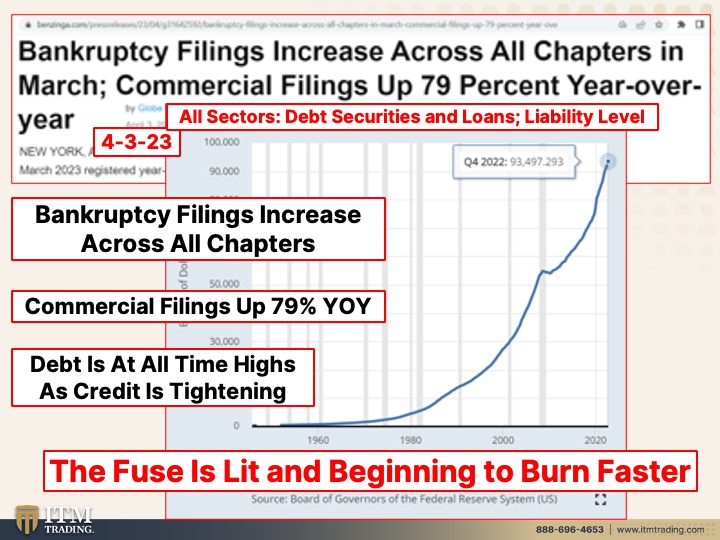

In fact, bankruptcy filings increased across all chapters in March. Commercial filings were up 79% year over year, year over year. And these are all sectors, debt levels and loans. The liability level, this was 2020. No right here. This is 2020, this is 2008. This goes back to 1960. In a debt-based system, in order to grow, in order to see the GDB grow, you’ve got to grow the debt. So what happens when you can’t do that anymore? When you can’t pay it or like service it, roll it over, you’re gonna default on it, you’re gonna default on it. So you can see easily, the answer is more debt, but we are at a wall. We can’t grow more debt. They’re gonna try. But the other thing that I want you to keep in mind, is that debt can give you the semblance of having wealth. Ooh, look at that fancy car, look at that fancy house, look at these fancy trips, look at all the things that they’re doing. But if you’re doing it all on debt, your income better grow faster than your debt or you’re gonna have trouble servicing it. So bankruptcy filings increase across all chapter commercial filings of 79% year-over-year. And debt is at an all time high as credit is tightening. So what that’s really telling you and showing you is that the fuse is lit and it’s beginning to burn faster. That’s why it’s imperative for you if you haven’t done it already. You need to have that strategy in place and you need to be executing it while you still have the opportunity.

And what’s the best way to execute it? Well, it’s really simple for me. It’s this right out of the system. Usable real money anywhere in the world. And what have we seen? We’ve seen gold steady around 2000 as recession fears fuels safe haven demand. Yeah, gold. Physical in your possession is a safe haven asset. The best safe haven asset because of its use globally and its demand globally. Physical gold and silver are also the most liquid assets in the world. I get this question all the time. Who’s gonna buy my gold? Well, if you think back to the depression, even though most of the population was in abject poverty, not everybody was, because wealth never disappears it merely shifts location. So those up at the 1%, they have the tangible assets, they know how to have the wealth shift their way. The powers that be want you to keep your wealth in intangibles because then they can control it a whole lot easier. They’re not coming to your house to bang on the door. Most people these days don’t own much gold. And if they do own it, they own it in IRAs that are easy to sweep and take away from you. And the reality is, is if you don’t hold it, you don’t own it. And it is irrelevant what you perceive in a court of law. So hold it and own it. It’s pretty simple.

But why is it the most liquid asset? I tell tell you this all the time, I probably told you this a dozen times just in this because it has the broadest buyer base. It really is that simple. Therefore it has constant demand. And if you haven’t done so already, we just launched recently our new Thrivers community. And you can find that and download it at on the web at www.thriverscommunity.com. And you can also download “the Thrivers community” on the app store or Google Play. And if you haven’t done this yet, get your strategy in place, click that Calendly link below, set up the time to speak to one of our cons, our strategy consultants, and get your personal strategy lined out and executed. ASAP. We only have as long as we have and and every day that goes by is one less day that you have. So get it done as quickly as you can. And if you haven’t done this yet, make sure you subscribe because we need to keep you in the loop on what’s going on. Leave us a comment, give us a thumbs up and share, share, share. Because ignorance does not make you immune and it doesn’t make your family immune. And they may think you’re crazy. But if you are the one on which the obligation rests, and I know for myself that’s where it rests with me for my family, then you gotta do it. You gotta take that responsibility. Make sure you have your strategy in place, make sure you have it executed because truthfully, financial shields are made of physical gold and silver. Definitely not paper promises, certainly not this garbage. And until next we meet. Please be safe out there. Bye-Bye.

SLIDES FROM VIDEO:

SOURCES:

https://www.bloomberg.com/graphics/2023-corporate-credit-crunch-bankruptcy-defaults/?sref=rWFqAg1Y

https://www.lsta.org/news-resources/libor-transition-clos-you/

https://www.lsta.org/news-resources/libors-ending-act-now/

https://www.bloomberg.com/graphics/2023-corporate-credit-crunch-bankruptcy-defaults/?sref=rWFqAg1Y

https://www.bloomberg.com/graphics/2023-corporate-credit-crunch-bankruptcy-defaults/?sref=rWFqAg1Y

https://sbecouncil.org/about-us/facts-and-data/

https://news.yahoo.com/private-bankruptcy-filings-blowing-past-201500764.html