THE NEXT WEALTH TRAP: Programmable Central Bank Digital Currencies…by LYNETTE ZANG

BITCHUTE: https://www.bitchute.com/video/ZRclukd2Hik/

TRANSCRIPT FROM VIDEO:

The move to total control of the population continues and unfortunately, that’s what we have to talk about today. Coming up.

I’m Lynette Zang, Chief Market Analyst at ITM Trading, a full service physical gold and silver dealer, specializing in custom strategies to help you not just survive, but thrive through the reset that I hope it’s pretty obvious to everybody. We are in the middle of, we’re not even beginning, we’re already in the middle of it. And I’d like to say, you know, this was the first time that we’re doing a full show in the new studio. So that should be an indication of how close I personally think the reset is. So there might be a few bugs to work out, but we’re going to get started on this because the bank for international settlements is escalating the global move towards central bank, digital currencies. And you have to remember, this is programmable money, and that’s why I’m talking about full control. And when we look out at what’s happening in the world right now, I really hope that you can see through all of the hoopla, to the full control and the greater control that governments are really taking on their citizens. So the question is, will your wealth be caught in this trap? Because if it is, you will lose all of your choices.

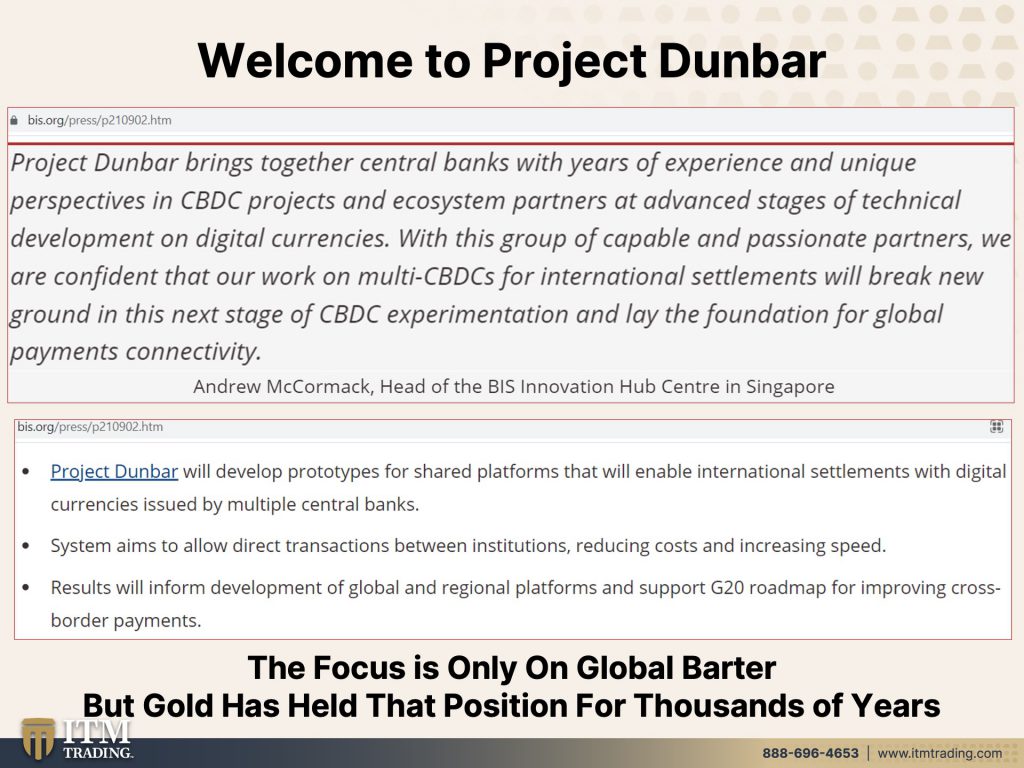

So their innovation hub, this just started. Well, it didn’t just start it, but it just escalated where you have the central banks of Australia, Malaysia, Singapore, and South Africa are going to be testing their central bank, digital currencies for international settlements. I remember, you know, these countries are a bit more advanced than the U.S. Is and its development of the CBDC’s. So they’re testing and they’re learning and they’re sharing all of this knowledge. And it’s really important that we follow what they are doing.

Because this is called Project Dunbar. And I know, you know, in an attempt to make things more easy for everybody to, to look at Project Dunbar brings together central banks with years of experience and unique perspectives on CBDC projects and ecosystem partners at advanced stages of technical development on digital currencies with this group of capable and passionate partners, we are confident that our work on multi CBDC’s for international settlements will break new ground in this next stage of CBDC experimentation. Cause that’s really what it is. A big experiment and lay the foundation for global payment connectivity. And what I want to point out here, there are many attributes of money, right? The only one that the CBDC’s are really focus focusing on at this point is on the barter system, forget the store of value system because they will easily be able to control that with the push of a button. So we’re just looking in the interconnected world. This would also go outside of the current U.S. Swift system, which is the system that’s set up for global trade. And I don’t know that that’s necessarily the thing or a bad thing. We’ve been moving in that direction for quite some time, but that’s where this experiment is. So to get more specific Project Dunbar, will develop prototypes for shared platforms that will develop prototypes for shared platforms that will enable international settlements with digital currencies issued by multiple central banks, system aims to allow direct transactions between institutions reducing costs and increasing speed and eliminating going through the swift system. Results will inform development of global and regional platforms and support G20, that’s the 20 most prominent global economies, support G20 roadmap for improving cross border payments. So again, the focus here is on global barter, but the reality is, is that gold has been used globally. It is a globally accepted medium of exchange, and that’s been used for thousands of years, but they’re trying to figure out a new way to do it, especially with the rise of the crypto space.

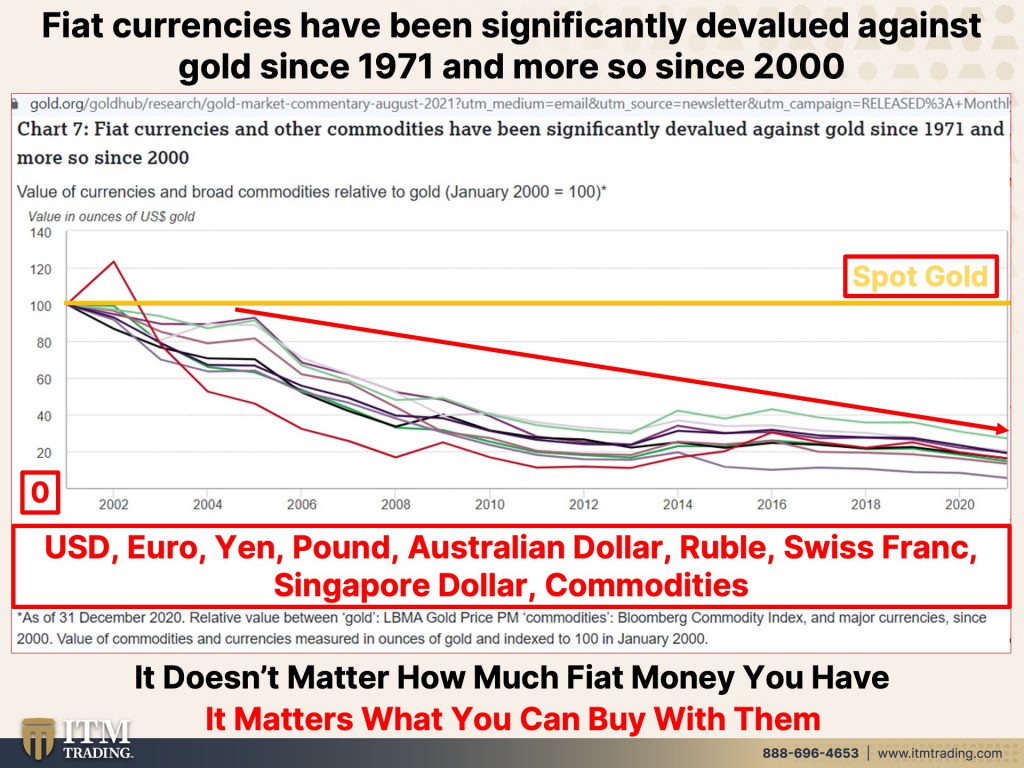

So what you’re looking at here, the reality is is that Fiat currencies. So this CBDC guess what, that’s still a Fiat currency, a government mandated currency, what is going to be on so far is on debt. So they’ve got to get rid of all of this huge mountain of old debt that they’ve created in order to be able to go into this new system. But here, what we see is gold against all of these different things, the dollar, the Euro, the yen, the pound, the Australian dollar, the ruble, the Swiss Frank, the Singapore dollar and commodities. And this line is spot gold, which is a contract. We’ll talk a little bit more about that in a minute. And so if this stays steady, you can see how all of these other currencies and commodities have declined against it. And the reason why you will frequently see gold against other currencies is because gold is the primary currency. Now remember too, that what you’re looking at here is central banks in an indirect way via the rise and fall of interest rates, controlling the rate and speed of the inflation, which inflation is really the loss of purchasing power value. And you know what I’d also like to really point out is it does not matter how many dollars or euros or yen that you have. It matters what you can buy with them, what you can do with them.

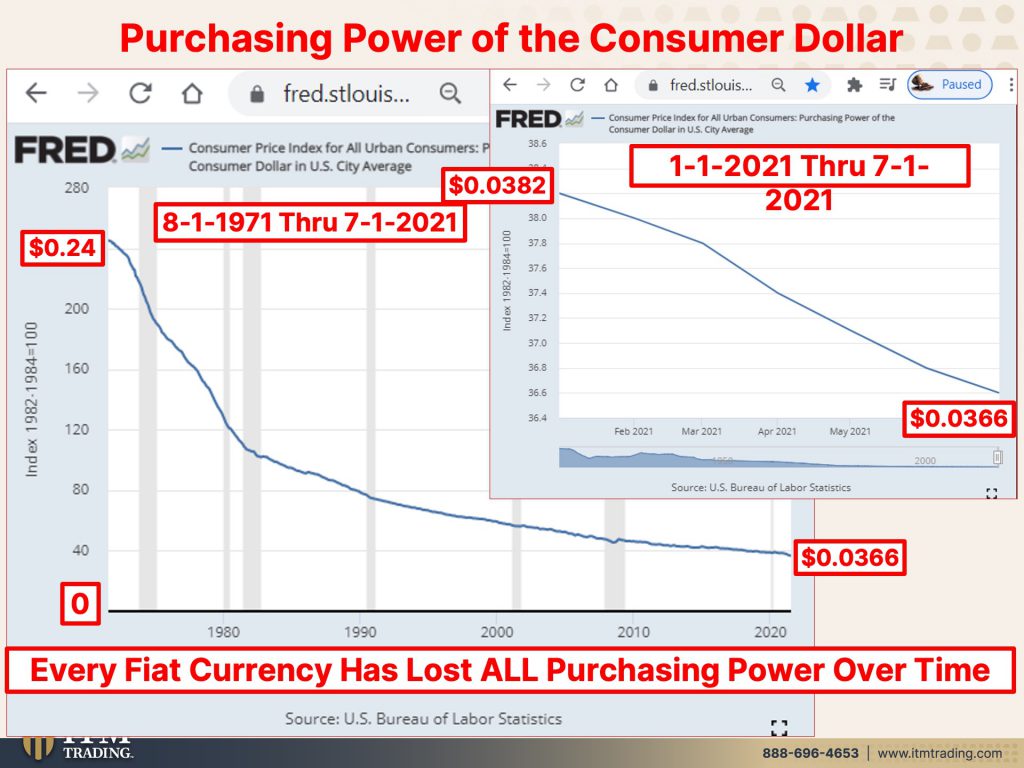

So as a little reminder, since they mentioned 1971; here is from August 1st, 1971 through the most current data, July 1st of 2021…the purchasing power value of the dollar has gone from 24 cents to 3.66 cents. But what I also want to point out to you is this is just what it’s done in the last year, because what I’ve noticed is a speeding up of that loss of purchasing power. And for those that have actually been watching me for a while, they saw when the federal reserve first put zero on the chart, which don’t hold me to this. Cause I’m obviously not looking at it, but I believe it was April two years ago. I could be wrong about that, but it was, it was about that. So, you know, look thousands and thousands and thousands of Fiat currencies no longer exist every single time without exception, their purchasing power value has gone to zero by design.

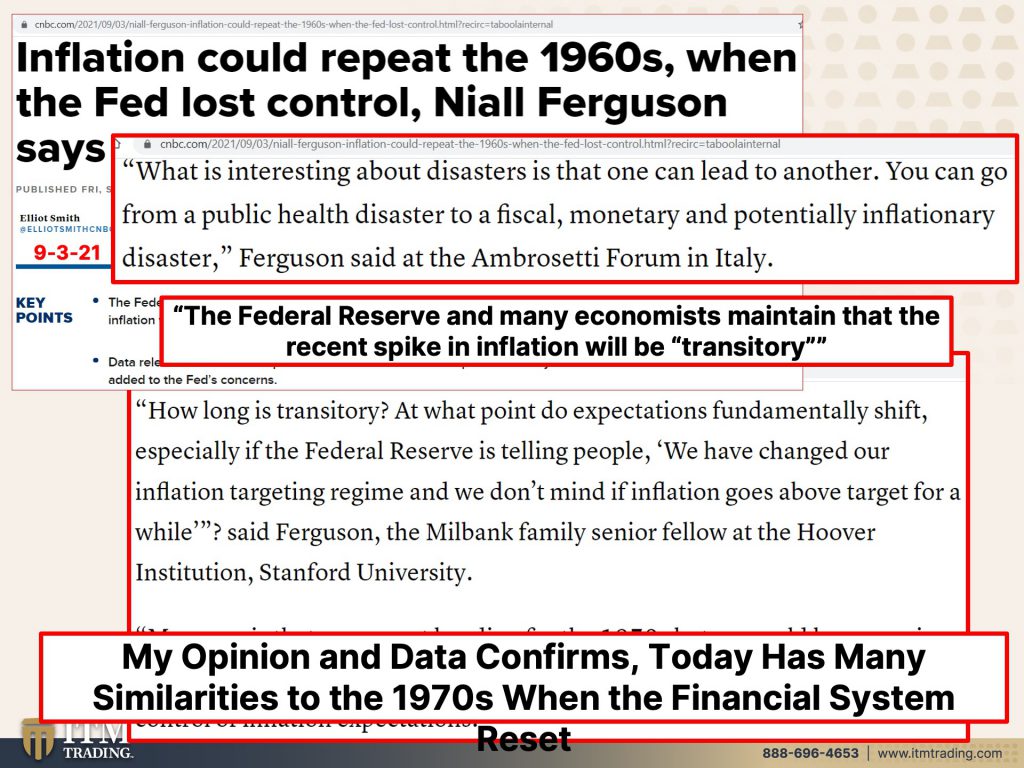

So when they’re talking about inflation repeating the 1960s, when the fed lost control, what I also want you to know is in the 1960s, the U.S. Dollar as the world reserve currency was printing more dollars and exporting inflation globally. All of the currencies were tied to the dollar, but governments could still, at that point, citizens couldn’t anymore since 33, but governments from other countries could convert the dollars that they held in their reserves into gold. So there was a run on the dollar in the 1960s and the fed did indeed lose control. The fed actually went to the IMF and said, here you take back the control of the world reserve currency status. That’s when the SDR was created, which is most likely to be the umbrella currency. And then all these other currencies would be local. But the federal reserve in many economies maintain that the recent spike in inflation will be transitory, but you know, and even wall street is talking about the fact that it is not transitory. It’s not going to be transitory, but what’s interesting about disasters is that one can lead to another. So you can go from a public health disaster to a fiscal monetary and potentially inflationary disaster. Well, haven’t, we just done that. And aren’t, they just blaming all of the inflation on this reason and that reason and the other reason, but really not on the fact that they have intentionally meaning the central banks have intentionally devalued their currency. As we saw in the purchasing power chart, how long is transitory? At what point do expectations fundamentally shift, especially if the federal reserve is telling people, we have changed our inflation targeting regime, and we don’t mind if inflation goes above target for a while. You remember when they did that and they went from a target of 2% to an average of 2%. And that’s when we hadn’t been able to presumably hit that 2% target for 10 years. And I said, at the time, oh man, they’re getting us used to say, well, look, this is all part of the plan because we need that average 2%. Now this is where I disagree with him. My sense is is that we’re not heading for the 1970s, but we could be rerunning the late sixties when then famously the fed chair, then McChesney Martin, lost control of inflation expectations. It’s that expectation piece, right? If the fed can be credible and the public can maintain confidence in them, they remain in power. That’s why all of these expectations of public expectations are so critically important. But I do think that this is very much like the sixties and especially the seventies. When we concluded shifting the monetary system and went to a pure day debt-based system in full control of the federal reserve and other central banks. And look around you. There was always chaos around a currency regime shift. So a lot of what’s happening out of Washington is look over here and blame this and public against public. Go there, while we’re making all of these changes. And pardon me, really setting you up to be…don’t look here. This is a financial system reset. It’s a social, economic and financial system reset. And really what happened in the seventies. It was a social, economic and financial system reset. Here we are again. And what do they want to turn us into? Programmable money. Sounds like a good evolution to me! And I’m being very facetious when I say that. But in the meantime, all of them money printing again, look over here because when the stock markets and the real estate markets go up, that’s what people look at. They look at those numbers, that’s just nominal. It’s nominal confusion. That makes you think you have more. When in reality you have less 1971, $9500, a family of four could live off of with one wage earner today. It takes two wage-earners and maybe they need to work a couple jobs because they’re living paycheck to paycheck. But Hey, we clearly in this system, winners and losers have been chosen.

So global deal making is set to break records. Look at this here’s 99. Here’s 2007 here’s 2021 high profits, cheap credit and lofty share prices have pushed value of deals to almost 4 trillion just since January. And here we are in September, and we’re already above all of the levels that we’ve seen in the previous two crisis, because the reality is in this fiat money system, it takes more and more to get less and less results. And if you’re looking over here, you’re not watching them change your life and your standard of living, it’s despicable. It’s truly, truly despicable.

Then we come up against this, which is all of the breakage in the supply chain. What are we now being told? I mean, I really want you to think about this because I think this is really an indication of how close we are to the end of the system. I can’t tell you it’s Tuesday morning at 8:35, but I’m making sure that I can still broadcast from wherever we have to be. So consumer demand must ease to end supply chain crisis. Only way to end vicious cycle of shortages is for people to buy less. But wait a minute, we are a consumer driven economy and here they’re telling us we need lower consumer demand growth to give the supply chain time to catch up or differently spread out growth over a long period of time. We will need to recover efficiency. Are you kidding me? The only way to end this vicious cycle of shortages is for people to buy less. Now, you tell me how that’s going to help all those profits. So people are buying into this stock market at these lofty levels and the real estate market at these lofty levels. And we have all of these shortages and they’re saying buy less. What do you think that’s going to do? Boost the global economy? Of course, it’s not. They’re giving people money in order to boost spending. And here they’re saying you got to spend less, this is a big problem, a huge problem, an unsolvable problem, but hey, never let a good crisis go to waste. I mean, that is the theory.

This is from the former senior vice president and chief economist of the world bank. You think he has a little bit of influence? You think he might just be saying what everybody else of those other powers that be are thinking, oh, let’s see, there we go. Can you see that we’ve come so far along that the reset has already begun. I mean, I remember a couple years ago when I would say in my intro “to the reset that we have already started walking through” and the feedback that I was getting, oh, you can’t say that because, Hey, we don’t know. I knew and I, because I’ve studied histories and I’ve studied currency life cycles since 1987, I’m telling you this time is not different. This time is not different and you need to be protected and thank goodness you can still buy gold and silver. Thank goodness. You still have a way to protect yourself because they are not letting this good crisis go to waste. For short, he’s optimistic that many existing problems can be tackled simultaneously since they’re all related. Oh yeah. Well, what are those problems? Well, the pandemic has highlighted how the economic system is working. It hasn’t been working since 1913, quite honestly, referencing inequality which the Fiat system enables, climate crisis because the only thing that ever matters, are corporate profits and the lack of resilience in the market economy, because we’re consumer driven. So we need consumers to consume, but it’s creating supply shortages because of globalization and that’s Oliver in the new studio which I guess we’re not going to be able to do anymore, but he looked so cute. I couldn’t say no. He’s warning us about an overnight reset. I mean, you know, many existing problems can be tackled simultaneously. That’s an overnight revaluation and this from, you know, the former senior vice president and chief economist of the world bank. Are you prepared because I’m preparing and I have been working diligently on that for many, many years, food, water, energy security, barterability, wealth preservation, community, shelter, medicine, If you have a chronic illness, get prepared the time to do it now is now. And arguably the most important part to get set up is that wealth preservation and barterability, because that’s the foundation on which you can do everything else.

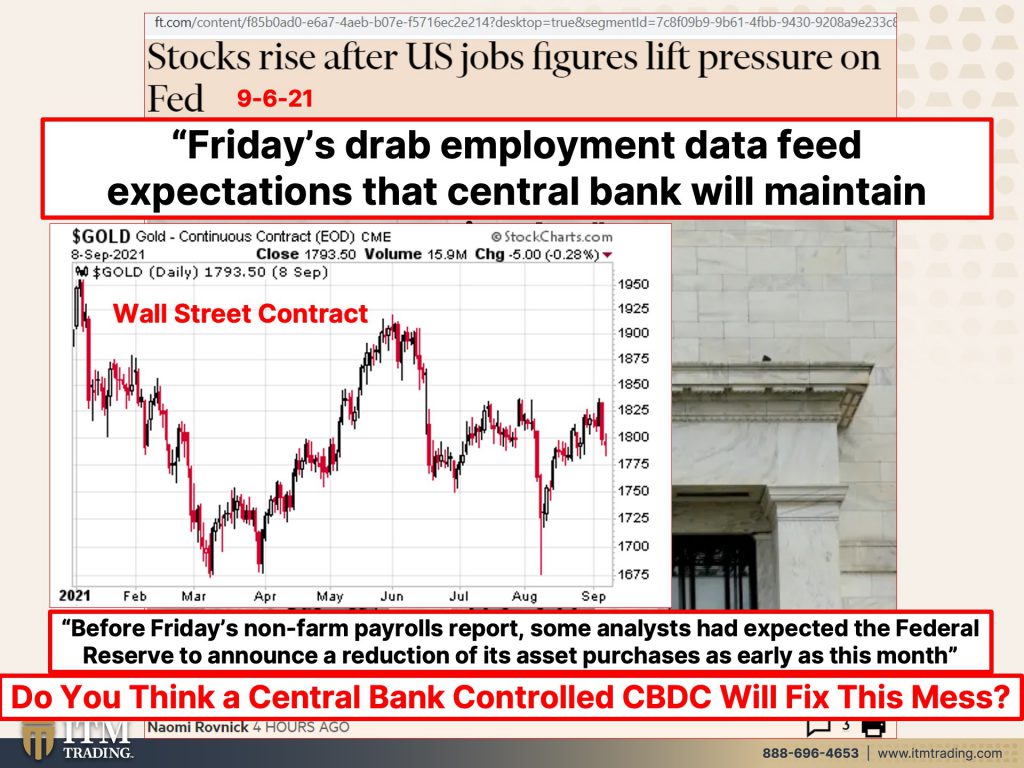

Is it really a surprise that stocks rise after Friday’s U.S. job figures, lift pressure on the fed because they keep talking about tapering buying fewer government bonds and mortgage backed securities. That’s all they’re talking about, but no, they’re not going to do that. They can’t do it anyway, I’m not saying that they won’t make an attempt like they did before, but it’ll fail. There’s no way that they can do it. There’s no, I mean, between a rock and a hard place. No kidding. Before Friday’s non-farm payrolls report. Some analysts had expected the federal reserve to announce a reduction of its asset purchases as early as this month. And they’re not really assets, are they they’re debt instruments. Magically at debt becomes an asset when it’s washed by wall street. So convenient. This is the most current spot contract on gold. It is a spot contract. It is a contract. Do you really think that a central bank, digital currency is going to fix this huge mess that we’re in? It’ll give them a lot more control though. And if you are stuck in the system. They’re going to have full control over you. So they’re warning us. The bank for international settlements is warning us and they’ve told us what we need to do to protect ourselves. And it wasn’t that long ago, July 12th, 2021. First, gold is an asset viewed as many as durable. I’ll just go here because I just summarized it. And you’ve seen this before. These are the big conclusions from the BIS. Gold, physical gold, is free from default risks. The only financial asset with no counter party liability, therefore risk, if kept at home, which the only thing you can keep at home is physical. If kept at home, it is not subject to political manipulation, has been inferiorly proven to be an inflation hedge and its potential value in highly adverse scenarios. Do you think we’re going into an inflationary and a highly adverse scenario? Do you think we’re already there? Because I think we’re already there! Physical gold. You hold it. You own it. Cause baby, I’m telling you right now. If you don’t hold it, you don’t own it. Get prepared, please get prepared. That’s why you see me here. I mean, you know, I saw where the whole in my personal strategy was in March 2020, and then when they had the riots and I said, oh, I need a bug out location. I did not…I knew that what was happening, the cerveza thing that was happening was being used to hide a lot of garbage and justify a lot of garbage. But what I see happening out there really scares the bejebeez out of me. I’m going to say that. And I am ever so grateful that I was able to do and that I am able to do what I’m doing and getting more prepared. But Hey, this is working. So no matter what happens, I’m going to be able to come to you wherever I am. If I’m at the office, if if I’m in my home, down in Phoenix, if I’m up here in my bug out location, I’m going to do my best for you.

So this has been a very interesting week. You’re going to see a lot more about it. I think Edgar may have already been tweeting some things about my getting prepared. So check Instagram. You’ll see what I’m doing in my bug out house. Next week. I’m going to be on with Jay Heck on Being Sons Podcasts. So I’m really excited because that’s somebody brand new to me. And so it’s a little bit, maybe a little bit more of a challenge. You never know what people are going to ask. If you haven’t already, if you’ve already begun your strategy, if you can get her done, if you haven’t call us, we are all here to be service. We have a Calendly link below. You can set up a time to speak with one of our consultants, and I’m sure you’re going to find them to be extremely intelligent and extremely helpful. They have a plan. You need to have a plan. So for more on behind the scenes and trending topics, just follow me on Twitter (@itmtrading_zang) or Instagram (@lynettezang) But if you haven’t already subscribed, do yourself a favor and subscribe and just hit that bell notification. We’ll let you know when we’re going alive. If you liked this, please, please give us a thumbs up, make sure to leave us a comment and to share, share, share, and you know, I absolutely, without any doubt in my mind whatsoever, it is so time to cover your assets. And here at ITM Trading, we use the wealth shield. And again, you want to do your foundation, which is wealth preservation and barterability, but you know, food is the single biggest issue for people going through this. And if you have a chronic illness medicine as well, so food, water, energy, security, barterability, wealth preservation, community shelter and medicine. And until next we speak, please, please be careful out there. Bye-Bye.

SOURCES:

https://www.bis.org/press/p210902.htm

https://www.ft.com/content/4b955a75-55a4-4e13-b785-638b88bbfb0b?segmentId=114a04fe-353d-37db-f705-204c9a0a157b 9-5-21

https://www.ft.com/content/747be2c8-7ee8-4ec3-9725-a2fdbebc937d?desktop=true&segmentId=7c8f09b9-9b61-4fbb-9430-9208a9e233c8#myft:notification:daily-email:content 9-6-21

https://www.ft.com/content/f85b0ad0-e6a7-4aeb-b07e-f5716ec2e214?desktop=true&segmentId=7c8f09b9-9b61-4fbb-9430-9208a9e233c8#myft:notification:daily-email:content 9-6-21