The Fundamental Problem with Money Market Funds

In this video, Lynette Zang, discusses the ongoing transition from the old economic system to a new world order. She talks about the risks of investing in money market funds, which may not be as safe as people think. She also urges you to prepare for a potential economic reset by ensuring you have Food, Water, Energy, Security, Barterability, Wealth Preservation, Community, and Shelter. Join Lynette as she shares the importance of holding physical gold and silver as a means of retaining personal freedoms and choices during times of economic uncertainty.

CHAPTERS:

0:00 Interest Rates

1:41New World Order

3:49 Money Market Funds

10:22 Swing Factor

19:01 Collateral & Financial Plumbing

21:30 Palantir Buys $50 Million in Gold

23:51 The Thrivers Community

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

You know, I wonder if anybody really learned anything from what happened in 2008 because after basically 15 years of zero interest rate policy and people going out on a ledge on that reach for yield, where you really were just jeopardizing your principle for a little teeny bit of pickup and interest. And so now we’re in a different interest rate environment. But make no mistake, we are transitioning from a system that we used to know prior to 2008 to a new world order and people are still making the same mistake on that reach for yield. It’s incredible to me, and we’re gonna talk about that, coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading a full service physical, gold and silver dealer really specializing in custom strategies. And I hope it is apparent to everybody actually, I know it’s apparent to everybody that’s viewing this, that we are entering a completely new phase. But it didn’t just start yesterday, it started back in 2008 when the system died. And I’m gonna show you some of those similarities.

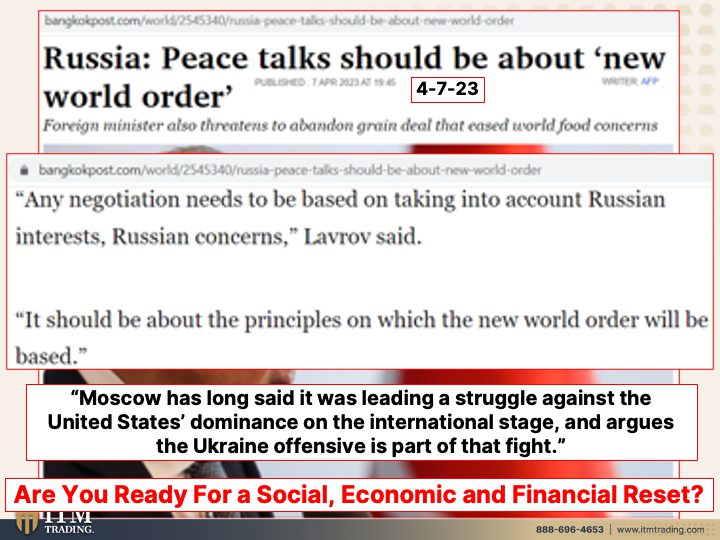

But we gotta talk first about, you know, China brokering a deal for Russia and Ukraine, but Russia’s saying peace talk should be about the new world order. Any negotiation needs to be based on taking into account Russian interest, Russian’s concerns. It should be about the principles on which the new world order will be based. Right now we have a choice and we vote with our wallets and purses. And it is critically important that you take heed because if you don’t hold it, you don’t own it. This is a wealth transfer mechanism. And if the central banks, if everybody can make things appear like they’re calmed down, like from the banking crisis, right? I mean another bank hasn’t blown up in a couple of weeks, Woohoo. It must be that we have resolved that issue. Just be very clear that there is so much lurking beneath the surface. And in this case I’m opening with this because a big crisis is what gets people to comply. But if you are ready with Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter, you will retain your choices and your freedoms. Moscow, has long said, it was leading a struggle against the United States dominance on the international stage and argues the Ukraine offensive is part of that fight. We’ve been talking about the fact that this is a proxy fight between China and the US and it should be obvious that it’s heating up. So are you ready for this reset? And it’s time to get ready. Don’t believe the lies.

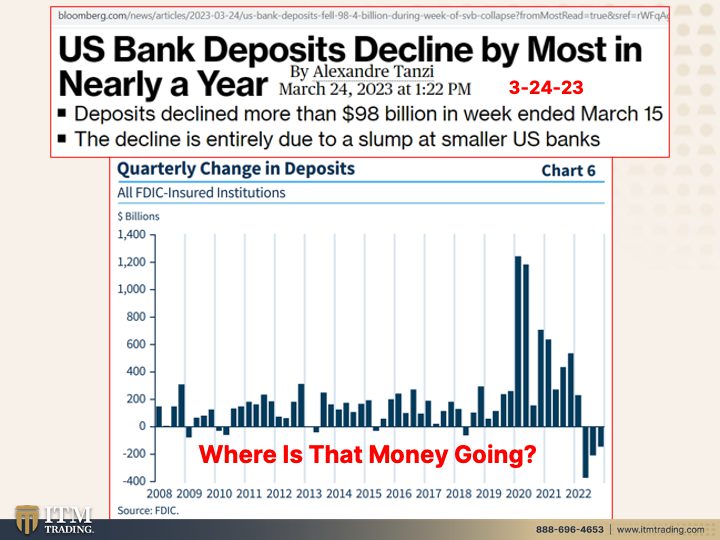

Now I wanna talk more about really briefly what’s happening in the banking sector, okay? Because deposits have declined by the most in nearly a year. So for a minute we had SVB and the other banks and credit suisse, etcetera, that made people nervous. But in a couple weeks there hasn’t been very much and people are flying to safety now. They think that the safety is in the fiat money products, right? So money markets we’re gonna talk about specifically, and we need to because people’s perception is that they’re like a savings account and they’re safe, but they’re not really safe. So if those deposits are leaving the banks, so we know a lot of it’s going to the large banks from the smaller banks. Where is that money going?

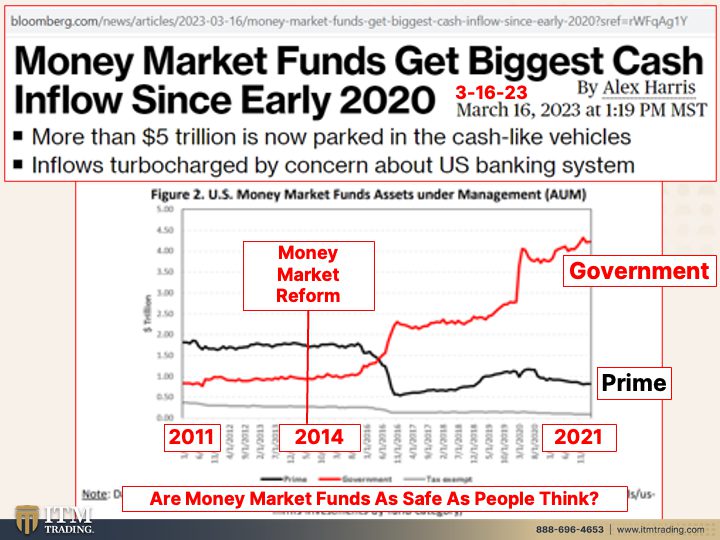

And it’s going into money market funds. Biggest cash inflow since early 2020. What else was happening then? Well, you know, they’re, they’re parked in cash-like vehicles. Are they really like? I don’t think so. We’re gonna talk more about it, but in 2008 we had the prime money market fund that froze. So again, the perception is that hey, this is just like a savings account. Except, and this is true for savings account too. When liquidity drives up, what do they do? They go, Nope, you can’t have it. And so they changed the rules back in 2000 and 14. And you can see this black line, here’s 2011, there’s 14 when the morning market reform occurred and there and this graph goes to 2021. So you can see this is the prime fund that went down. This is the government fund. So people feel more comfortable in government treasury money markets. Except aren’t we hearing a lot about the lack of liquidity in the treasury markets? So in my opinion, it’s going from out of the frying pan into the fire. And I’m gonna show you more about what I mean exactly by that. But you gotta ask yourself that question. Are money markets as safe as people think? Flight to safety. Oh, oh, let’s put it in the Japanese yen or the US dollar. Are they really safe when you see global central banks buying more gold than they have since 1967 when we were transitioning into a new system? They refer back to 1967, they just never take it to that next step, which is that’s when the system was converting and whoever holds on to the gold, holds on to their choices and their freedoms.

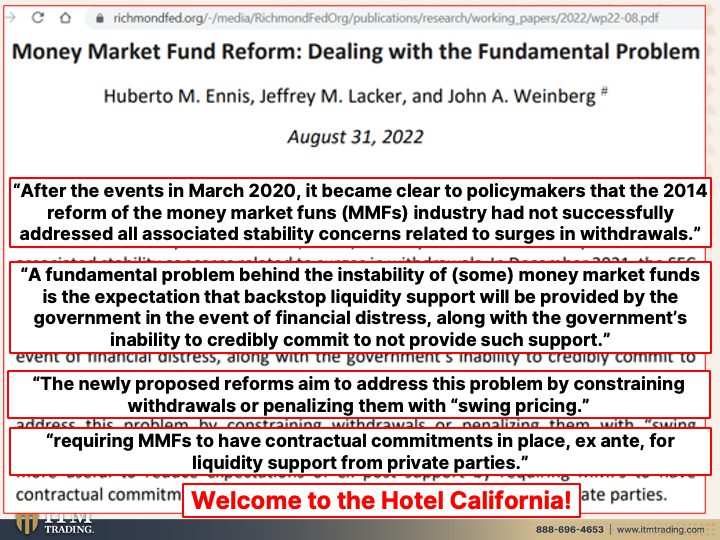

But we need to take a look at this because 2020 was really a big test and so they’ve gone back to money market reform yet again dealing with the fundamental problem. Yeah, <laugh> the fundamental problem. After the events in March of 2020, it became clear to policy makers that the 2014 reform of the money market funds industry had not successfully addressed all associated stability concerns related to surges and withdrawals. Interesting. A fundamental problem behind the instability of some money market funds is the expectation that backstop liquidity support will be provided by the government in the event of financial distress, along with the government’s inability, inability to credibly commit to provide such support. So I wanna take you back a little bit because what they’re saying that the government will scoop in. Now they may deny this, but isn’t that what they just did with SVB? I mean in 2008 they bailed out the banks with svb. So 2023 they bailed out the venture capitalists and the tech companies, those entities that will help them bring the CBDC force. So while this really goes to their credibility and since this is a huge con game and it’s based upon trust, therefore it’s also based upon that credibility which is declining. And let me tell you, once the public loses that confidence, it’s it’s game over. But they already know that. So they’re putting things in place to give you no choices. The newly proposed reforms aim to address this problem by constraining withdrawals or penalizing them with swing pricing. So in other words, you’re not gonna be able to get your money out. This gets more and more interesting as we go along requiring money market funds to have contractual commitments in place. Ex-ante for liquidity support from private parties. Who are those private parties? Well they could be a bank, but how about your deposits? How about that you’re the private party? Because when you make that deposit, you’re actually loaning them money. Whether you realize it or not, your perception does not matter in a court of law. So all I can say is welcome to the Hotel California. You can get in but you can never check out. So as we’ve been talking about bank bail ins, do not ignore money market funds because yes, money market funds will pay you more than what you’re getting at the banks though the banks are gonna have to step up because that is a significant source of funding for them. But essentially you are no safer actually you could even be more at risk in the money market funds. Those are money market mutual funds. But it gets more interesting than that. Let me continue on.

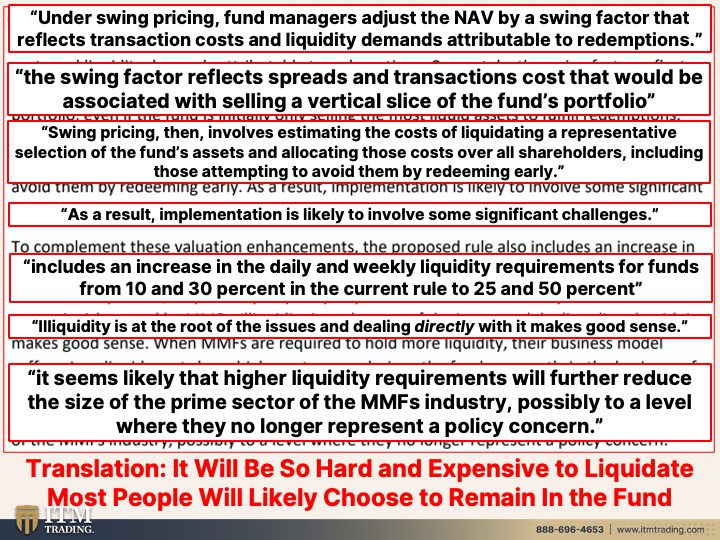

Okay, under swing pricing, which is what they were talking about, fund managers adjust the NAV, the Net Asset Value. So what you would get paid by a swing factor that reflects transaction costs and liquidity demands attributable to redemptions. So if you’re the first out, right? Well you’re still gonna have to eat this. The swing factor reflects spreads in transaction costs that would be associated with selling of vertical slice of the fund’s portfolio. Let me explain that a little bit more. Okay, so the fund, it’s a mutual fund, right? So they hold different assets, commercial paper which could be debt on on other corporations or venture or venture capitalists or private equity, etcetera. These may as we go through that, those layers, some of them are highly liquid, like maybe short term treasuries, but others would be a whole lot less liquid, in fact might not be liquid at all. So they get to use their judgment on what those costs would be. So you think you’ve got it at a dollar, but when you go to liquidate, maybe they give you 60 cents and you go wait a minute and you watch, they’re gonna tell you before you make that final choice, this is what we’re gonna pay you. Do you still wanna do it? So remember in their documentations when they’re creating any of this stuff, they want to charge fees high enough for you to go, oh, forget about it, I’ll leave it in there. But that is just a ruse. So maybe the time to get it out is now before all of this goes into effect and before the next run happens. Swing pricing then evolve involves estimating the costs of liquidating a representative selection of the fund’s assets and allocating those costs over all shareholders including those attempting to avoid them by redeeming early. So you get nervous and you wanna leave and they go, well okay you can but we’re only gonna pay you whatever, 50 cents, 60 cents, 70 cents on the dollar, whatever they think is steep enough, a high enough cost, kind of like the IRAs, I don’t wanna pay those taxes. Well guess what? You’re paying fees no matter what choices you’re making. Even if that fee is in the decline of the purchasing power value of the currency that you’re holding there. Plus you’re running a whole lot more risk even though your perception may be that it’s not a risk. As a result, implementation is likely to involve some significant challenges. Heck yes, because all of a sudden you’re not getting nearly what you thought you would get from redeeming and you’re gonna have a problem and there are going to be lawsuits and people are going to be up in arms. So yeah, <laugh>, I think they’re right. I think there will be some very significant challenges. Includes, now these new reforms includes an increase in the daily and weekly liquidity requirements for funds that go right now they’re 10 to 30%. Now they’re more than doubling 25 to 50%, which means that they know there is a problem coming up and they wanna nip it in the bud bite by not enabling you or they can’t say no you can’t have your money back. They can just put those fees in high enough that you go Whoa, whoa, whoa, whoa, wait, wait, wait, I don’t wanna do that. Do not be penny wise and pound foolish. You are not getting paid enough for the risk that you are taking. And it really is that simple and it’s always been that simple. Why do you think risky bonds have to pay more and they’re still not paying you enough for the risk that you are taking?

Okay. Illiquidity is at the root of the issues and dealing directly with it makes good sense. So in other words, what they’re holding in those money market funds, some of it is liquid, it absolutely is, but a lot of it is not instantly liquid without substantially moving the market. And you are gonna be the one if you’re holding that, you are gonna be the one to pay this. It seems likely that higher liquidity requirements will further reduce the size of the prime sector. Now they’re talking about the prime sector again, which they basically decimated in 2014 as I showed you on that one graph prime sector of money market funds industry possibly to a level where they are no longer, where they no longer represent a policy concern. Let’s think about, I’m gonna read that again because I want you to think about what they’re saying. It seems likely that higher liquidity requirements will further reduce the size of the prime sector of the money market fund industry possibly to a level where they are no longer represent a policy concern. So it’s minuscule. Let me show you what that looks like again.

Okay, so this is the prime fund. So that’s actually a bit more of a free market. This is the government fund. So what the government did was redirect your deposits for them, but how safe are they really? Because they could tax you to get the money to pay you. But we’ve already seen, and that started back in 2015, the problem in the treasury markets cause they handed that market over to traders in 2013. I’ve shown you those graphs before. So make no mistake, it’s like they are attempting to get rid of the free market entirely and take over everything. And once they have you on CBDC’s and they can dictate what you can spend, where you can spend it, etcetera. Mm well you know we’ve got some issues there. Okay? So let’s just finish that up.

It will be so hard and expensive to liquidate. Most people will likely choose to remain in the fund. And for those of you out there when you’ve gone to liquidate something, when I was a stockbroker back in the eighties and nineties, if you called up and I wasn’t available for some reason, you could talk to my assistant to liquidate, you could talk to the manager. There was always somebody cause when you said liquidate, boom, our job was to get that liquidated instantaneously. Tell me, has anybody had the issue where you’ve wanted to liquidate something and what you get is, oh, they’re on vacation or oh, this and that and they postpone it and there’s nobody else for you to talk to. What kind of garbage is that? That is garbage. But that is where they’re headed so that you make choices not to liquidate. And by the way, if you think this can’t happen or isn’t also happening in the government money market funds think again because when the liquidity continues to, continues to dry up in that area, we’ve done recent videos on that, Edgar, maybe you can put put that some of those links in there. Then you’re gonna get the same thing. You know they take an inch and then they take a mile. So you just have to be aware that any wealth that you choose to hold in this fiat money system, you are loaning to all of them and it’s not really yours. And the likelihood of you getting it back when the poopy hits the fan is pretty darn slim.

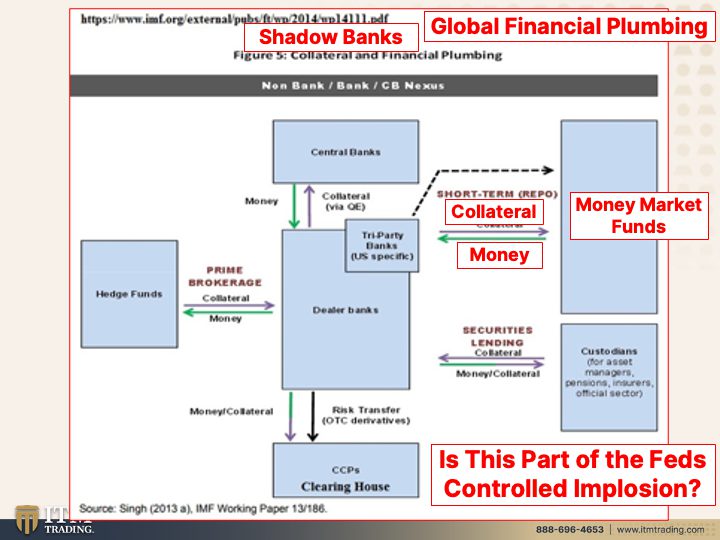

And as a reminder, I’ve shown you guys this before. This is the collateral and financing plumbing, this is the plumbing, the global financial plumbing to the world. And here are your money markets, okay? Right here. Look at that huge funding vehicle. So people put money in the money markets it goes to, there’s your money going into all of this other stuff and you get the collateral. Well guess what? That’s counterparty risk. And any contract is only as good as the counterparty to that. So when liquidity dries up, and I don’t care if it’s in the prime fund or it’s in the government fund because we’re seeing a lot of liquidity issue in the government funds as well. You’re not getting your money back and who are you gonna go to? Too bad. So sad. Look at how hard it’s been for you to liquidate right now. Look at how hard it’s been for many of you to send a bank wire, right? I get reports on that all the time. I went to my bank and they said they were going to do it and three days later they hadn’t done it yet or they said I couldn’t do it or they’re questioning me, blah blah blah. Can you, are you already seeing and maybe maybe you can share your experiences with other viewers on how challenging it’s been for you to get your money from any entity, whether it’s a brokerage account or a bank account. You know my question and I’ve been asking this, is this a controlled implosion? It’s not supposed to be a controlled, I mean it’s not supposed to be implosion If they, if you listen to the Fed and the policy makers, they want you to think that they’re doing everything to keep everything together except we’re at the end of this currency’s life cycle. And if that’s the case and they know that it’s time to transition, what they’re trying to do is control it so that at the end of the day they stay in power and they stay in control. But what we know is global central banks are loading up on gold. Why? Because they know this. And I think this is all part of the controlled implosion.

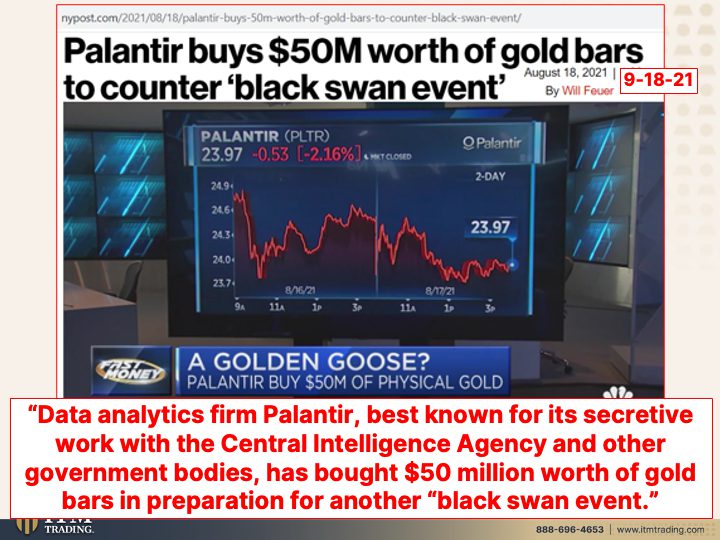

Even corporations are becoming more aware. Palantir buys 50 million worth of gold bars to counter a black swan event that was in 2021. We’ve had so many black swan events, it’s been incredible. And we see the wars globally heating up between China and the US, not just the Ukraine and Russia and in which is really just a proxy war. But in many other places we’re seeing more and more conflicts heating up. In fact, what’s interesting particularly about Palantir is that Palantir best known for its secretive work with the CIA and other government bodies has bought 50 million worth of gold bars in preparation for another black swan event. Do you think they might know something that you don’t? You think you might follow suit? Personally, I always think you should do what the smartest guys in the room on any given topic are doing for themselves and they’re buying physical gold. Now, gold bars is not what I would buy as an individual because I don’t have those kind of connections. That’s why I personally prefer the collectible coins. And I do that because I wanna make sure that it doesn’t matter whether or not there’s gonna be an overt confiscation, they have been doing a covert form of confiscation through inflation since the day you were born and you don’t even realize it. And it’s hard for me to imagine at the very end they’re gonna go, oh wait, no. We’re gonna let you hold that wealth. So I do this and I do it while it’s still well below it’s true fundamental value because one thing I’m quite clear on is this has almost no value left. The only value it has is because people trust it still. I don’t know why inflation shows you it has no value officially. There’s only 3 cents out of the original dollar. In gold and silver I trust, physical, in my possession. Cause if you don’t hold it, you don’t own it, period. End of discussion.

But I am really excited to tell you about our new community that we just launch launched the Thrivers community. So make sure to download it on the web at ww www.thriverscommunity.com or on Google Play or the App store, “The Thrivers Community.” Now next week we’re gonna do something a little bit different for those Thrivers. We’re doing a live Q&A portion through Zoom because I want everybody to be able to communicate with everybody. This is a Community. It’s not all about me, it’s about all of you frankly. So I wanna be able to see everyone and for us to help each other, but also make absolutely certain that you subscribe to our Beyond Gold and Silver channel because that’s where you’re gonna learn wherever you’re at, that’s where you’re gonna learn about Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter. So it’s a great, it’s a great channel and I hope you join us there as well as our reasonably new ITM Spanish speaking channel, which is frankly in both English and Spanish. And what I like about it particularly is that Fernando asks me questions from it and condenses the whole piece down to maybe seven to 10 minutes. So for those that have been asking, how can I get my family members engaged? Might be hard to get them to sit down for 20 minutes, but it might be easy for you to get them to sit down for seven and that might inspire something. So if you haven’t already, make sure you click the calendly link below and start your own gold and silver strategy. Because financial shields are made of physical gold, physical, silver, not paper and promises. So if you haven’t, make sure to subscribe. Leave us a comment, give us a thumbs up and share, share, share. And until next we meet, please be safe out there. Bye-Bye.

SOURCES:

https://www.bangkokpost.com/world/2545340/russia-peace-talks-should-be-about-new-world-order

https://nypost.com/2021/08/18/palantir-buys-50m-worth-of-gold-bars-to-counter-black-swan-event/