The End of Libor: Are You Prepared for the Coming Storm?

An interesting thing is happening on the progress toward the transition between the LIBOR and the SOFR and it’s happening in the CLO market. We have about six months to go in this transition, and when it’s super quiet, it always makes me wonder what are they trying to hide? Because that could indeed create a huge surprise and you don’t wanna be surprised in a negative way.

CHAPTERS:

0:00 LIBOR and SOFR Transition

1:56 Collateralized Loan Obligations

4:16 Debt Investors Fight Back

9:36 Strains in Credit Market

12:50 Distressed Debt

15:13 Central Banks Buy Most Gold in History

18:28 Protecting Your Wealth

SLIDES FROM VIDEO:

Well, an interesting thing is happening on the progress toward the transition between the LIBOR and the SOFR and it’s happening in the CLO market. These are all things that we’ve talked about in the past, but you need to have an update because we now have less, well, we have about six months to go in this transition, and when it’s super quiet, it always makes me wonder what are they trying to hide? Because that could indeed create a huge surprise and you don’t wanna be surprised in a negative way. Coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading a full service physical gold and silver dealer, but really specializing in custom strategies. The powers that be have a strategy. And quite honestly, so should you. So if you haven’t done this, there’s so many things that are going on. If you haven’t subscribed yet, make sure that you hit that button and click on that bell. We’ll let you know when we’re going on. But you need to know what’s going on, almost moment by moment now that we’re in 2023. And if you don’t have a plan already, click that Calendly link below and set up a time to talk to one of our consultants because you really need to have a plan and you really need to have it in place now and you need to execute it. It’s not just the plan, you need to execute it. So I wanted to give you an update on what’s happening.

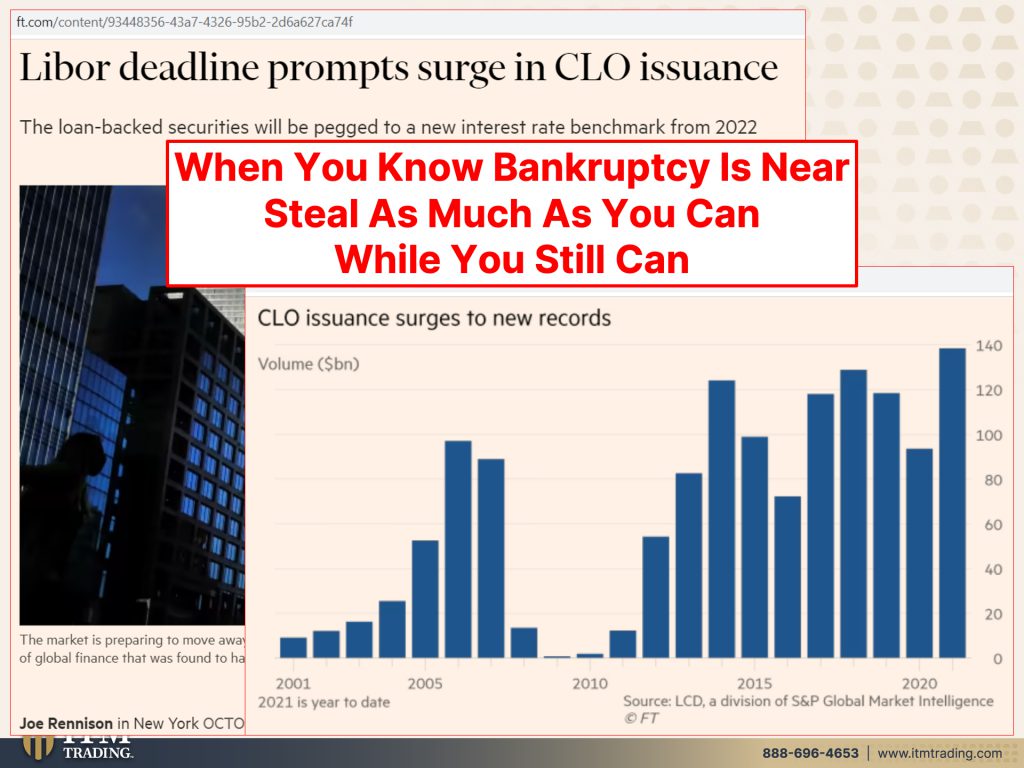

Now, let me just redefine CLOD, which is collateralized loan obligations. These typically go to below investment grade and even well below in these loans for investment grade corporations. So these corporations are already dicey and a CLO takes these, all these different loans and packages them up into one big loan that they can then sell to investors. Are you sitting on some CLOs that you don’t even know about? You might wanna double check if you’re sitting in the fiat markets and somebody else is managing this for you because we know that over 610 trillion in notional value contracts have to shift before, or by, I should say, June 30th, 2023. And you know, in that runup so many new contracts, not just with CLOs, but so many new contracts up until January of 2022 already had LIBOR embedded in them. And they’re going to have to shift. But let’s just focus in this one little area right now because some really interesting things are happening that you need to know about. And the reality is, is when you know that there’s a bankruptcy near, well gosh, if somebody sends you a credit card when you know you’re gonna be declaring bankruptcy, what are you most likely to do? Unfortunately, not ethically, but unfortunately you are likely to go out and load that credit card up. So in the lead-up to this transition, that is exactly what CLO’s did. By the way, this is 2008, 2009 and 2010. So it’s pretty clear that in 2021, didn’t mean to do that, but I’m sorry about that. But in 2021 we had new highs of issuance in the CLO market. Something similar is happening now. But let’s just stay on this for now.

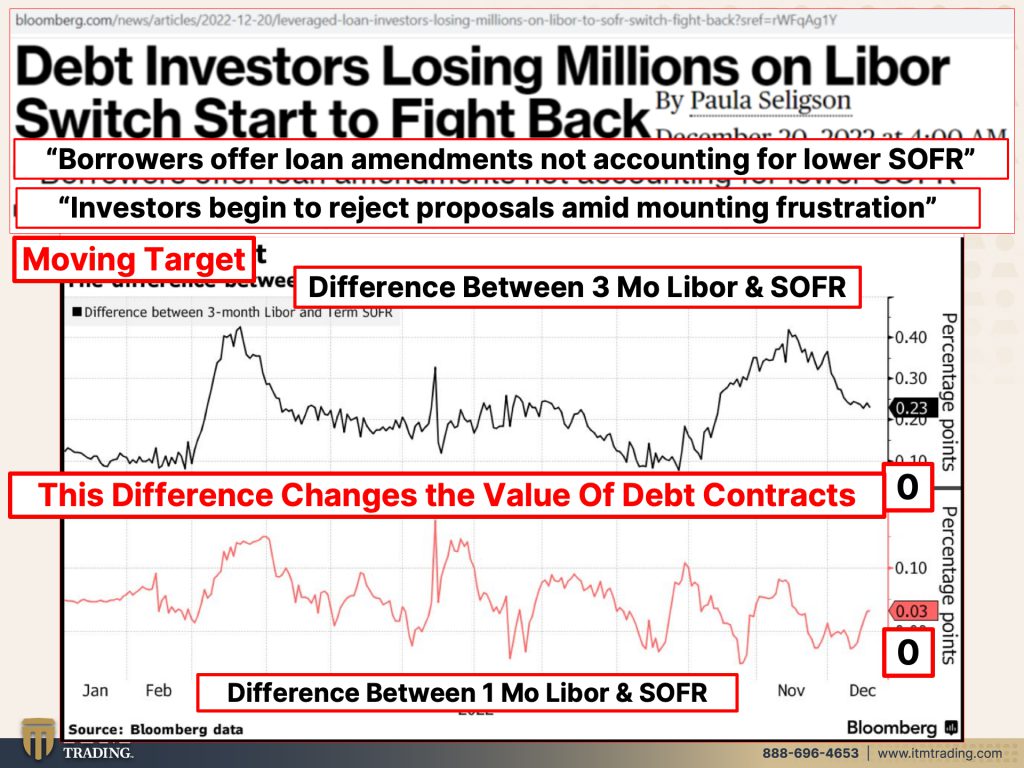

Debt investors losing millions on LIBOR switch, because of that revaluation, start to fight back. Goodness gracious borrowers offer loan amendments not accounting for lower SOFR. So what borrowers are attempting to do is have to pay the lenders less money. You and I, by the way, are the lenders, okay? But investors, us lenders, begin to reject proposals about mounting frustration because when you signed that contract, when you bought that mutual fund, etcetera, I mean you as an individual aren’t gonna know this, but the institutional investors will, it made a difference in the valuations in how much interest they’re gonna pay and also in the value of the contracts. And, and while you know, I mean when I did it, it didn’t seem like that much. You’re looking at pennies. But the reality is, is when you’re looking at pennies on trillions of dollars worth of contracts, it adds up and it’s a moving target because SOFR is not identical to LIBOR, against which all these contracts are written. Now there’s your zero. So what you’re looking at on this top graph is the difference between three month LIBOR and the SOFR. And you can see it should be here. If there’s no difference, it should be at zero and it’s well above zero. You see what I’m saying? I know this is complicated, but you can see here’s zero. That’s where it should be at. At any point in this, is it at zero? No, it’s not. That’s your difference. This bottom piece here is the difference between one month LIBOR and SOFR. And so if zero is here, do you see it at zero? No, you do not. So this proves absolutely what I’ve been trying to tell you all along. When this shift occurs, it changes the valuation of the interest payments as well as the value of the underlying contracts that could potentially really devastate the markets and bring everything down. I expect that this is going to, we’re gonna run into a lot more volatility in the first half of the year leading to this transition that’s supposed to happen on June 30th. Now look, I could be completely wrong. It could be a big boop, nothing, except that it’s never been done before. It’s a huge experiment involving, well they’ll, they’ll admit to 610 trillion. But we’re really looking at quadrillions. This could well take down the global financial system. I believe it will.

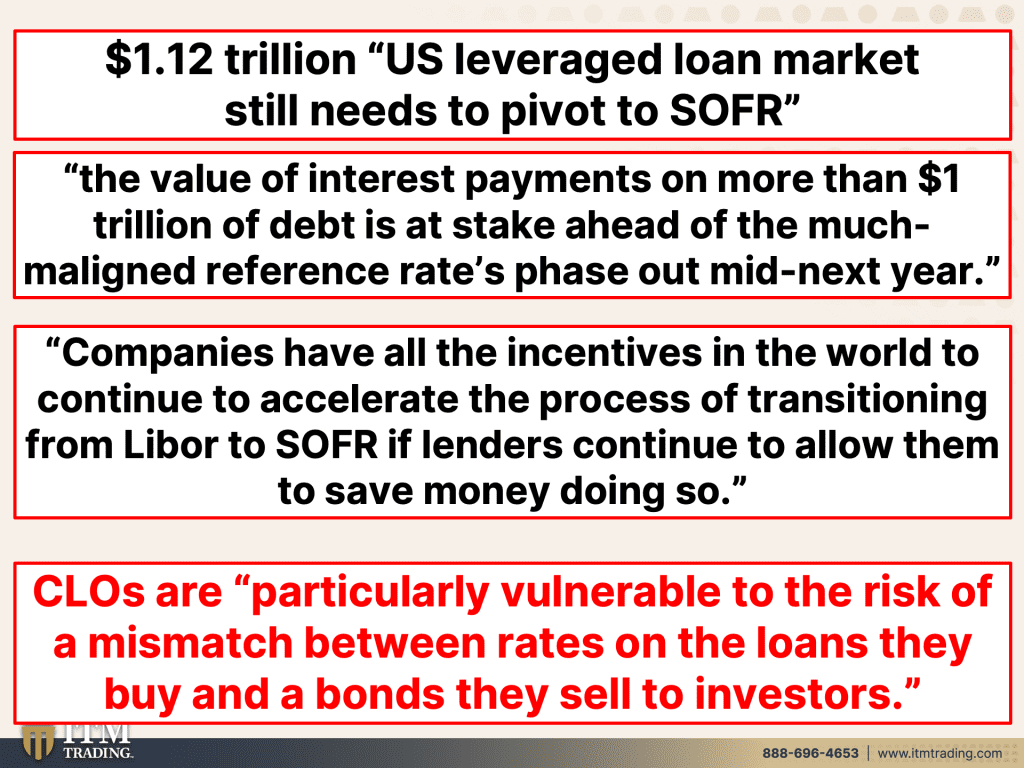

In fact, there are just in the leverage loan market, that is what is inside of those CLO’s. Okay? So just this one little area, 112 trillion that still needs to pivot to SOFR and we are running out of time in which to do that and everybody’s gotta agree. Now they’re getting some pushback and people don’t wanna agree. The value of interest payments on more than a trillion of debt is at stake ahead of the much maligned. And I’d be one of those, reference rates phase out mid next year. Cause this article was in 2022. Companies have all the incentives in the world to continue to accelerate the process of transitioning from LIBOR to SOFR if lenders continue to allow them to save money doing so, right? So because SOFR always tracks lower than LIBOR, they save money, but now they’re getting pushback when people see that, when entities see that because valuations are based on X and if X changes, so do the valuations. It’s that simple, honest to goodness. But CLO’s are particularly vulnerable to the risk of a mismatch between rates on the loans they buy and bonds they sell to investors. Yes they are because the CLO is actually that that new mishmash of bonds, much like the CDO (collateralized debt obligation) was a mismatch in mortgages. And that’s what what took the system down in 2007, 2008. This has replaced it. I’ve done pieces on it. Go back and look, I know it’s complicated, but this is critical. This is probably the single most important thing that I talked to you and I guess I will have egg on my face if June 30th comes and there’s no crisis or if there’s no volatility and everything is hunky dory and oh, maybe we’ll have a soft landing. We’re not gonna have a soft landing into a recession, it’s not gonna happen. That’s my opinion, I can’t prove it. But we’ll find out. Historically it’s never happened before, but hey, this time is different.

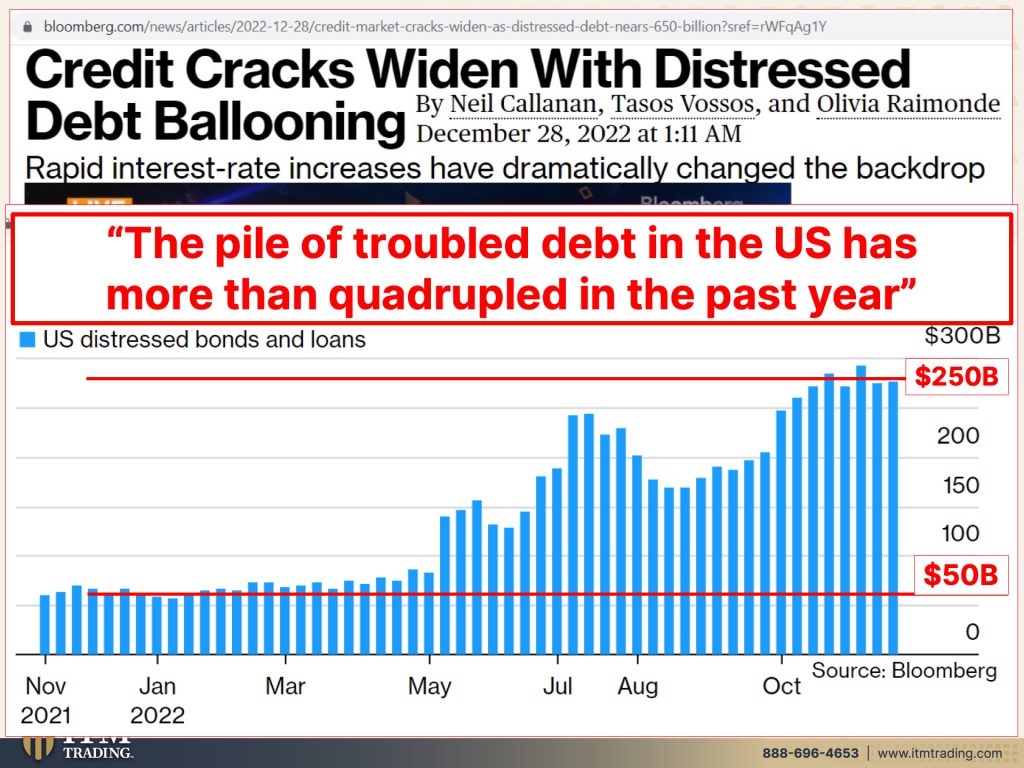

At any rate, credit cracks widen with distressed debt ballooning. Now why do you care about credit cracks widening with distressed debt? Because that’s what goes into the CLO’s. This is really, you know, when when the central bank lowered rates to zero and made, created all of this cheap money, right? Corporations that that should have, could have used that to reduce their debt burden just loaded up on more debt because their payments were the same. Oh great. But now guess what’s happening with interest rates and they’re committed to it. But these strains are showing in the credit markets, this is where the strain was in distress debt was, which is, which is bad enough in November, 2021, right? Look at where it is now. And this goes to December 28th, right? It’s huge. So you can see that distress is happening in the credit markets that make up those CLOs. You may not realize it, but ignorance does not make you immune, it just leaves you vulnerable. The pile of troubled debt in the US has more than quadrupled really since May of last year. Not even a year. Not even a year. Do you think that’s going to get better? Particularly with the Fed raising, continuing to raise rates And much as the market doesn’t believe the Fed, the Fed keeps telling us they’re gonna keep going, that means that there’s gonna be more and more and more distressed debt. Are they gonna have the ability to roll that debt over because credit is tightening? So you know, this could take down the whole system. I’m not kidding.

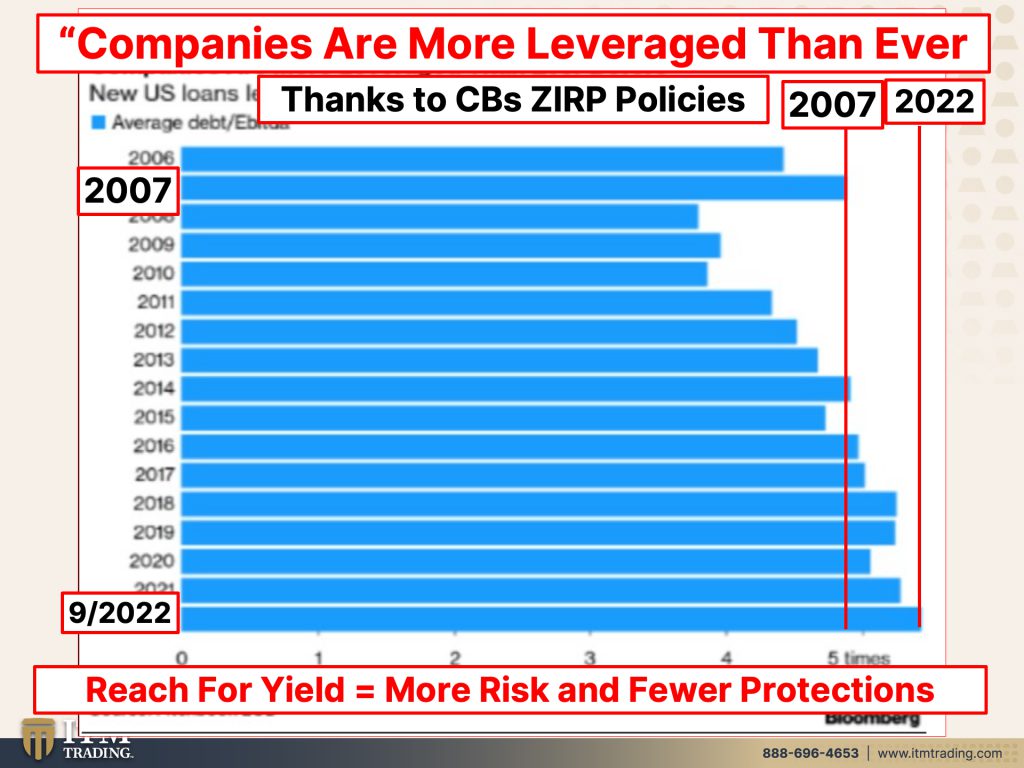

Companies are more leverage than ever before and a lot of funny accounting tricks can hide that leverage. But this is simply the fact, thanks to central banks, free money and and zero interest rate policies, ZIRP, zero interest rate policies, corporations level levered up there we were with the leverage in 2007 that toppled the system and here we are through September of 2022. What do you think? You think this is not gonna be a big deal, it’s gonna be a very big deal that reach for yield, these are what, this is the unintended consequences because these guys couldn’t figure out that this was what was going to happen Or did they want it to happen? Because we’re at the end of this currency’s life cycle. We’ve gotta transition into a new system, but we gotta do it with a big huge crisis. So much as people think that they wanna kick the can down, kick, kick, kick, kick, kick. Maybe they don’t, maybe they’re ready for this to be over, I don’t know, CBDC’s? I don’t know.

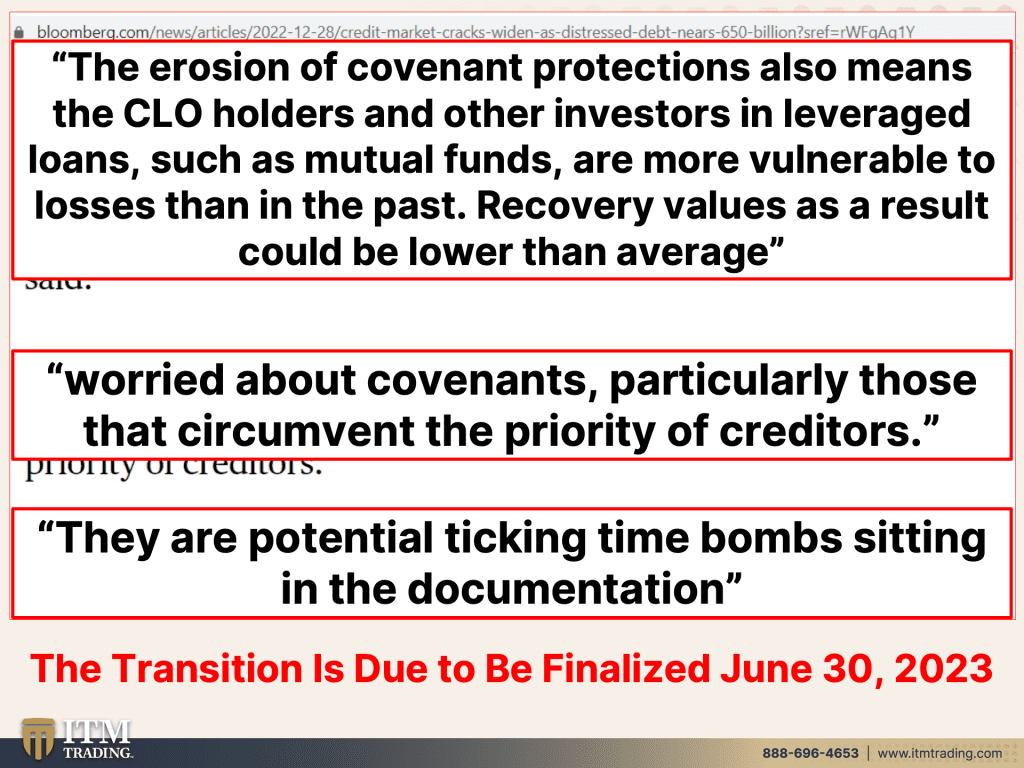

But the erosion of covenant protections, which means investor protections also means the CLO holders and other investors in leverage loans such as mutual funds are more vulnerable to losses than they were in the past. And recovery values as a result could be lower than average. And so what they’re really telling you here is that when this shift occurs, valuations change. So not only are you dealing with distressed debt, but the value of the contracts are lower too. Who’s going to eat it in the shorts? The little guys, we will people that just give their money to these institutional investors and expect them to truly have your best interest at heart when all they can invest in is a dying currency, Fiat money, dying currency. Worried about covenants, particularly those that circumvent the priority of creditors. Well you would be a creditor if you own that CLO, but as people were more concerned about yield than they were about safety and protection, they accepted less and less and less protection. We’ve talked about this too, you can see it in other videos. So make sure that you go back. I would, I would make sure that I’d go back in and look at all of the videos and maybe we can put all of them cause I’ve been talking about this for quite some time videos in there so you can follow this evolution because we are now at the end. Could they kick the can down the road again? Well, if they were going to, I think they missed that opportunity. But once they disallowed any new contracts being written against LIBOR, I think it kind of sealed it that we’re coming to an end. And these covenants, or the lack thereof, these loss of covenant protections are potential ticking time bombs sitting in the documentation. And guess what? In a court of law, they don’t care what your perception is, they care about what you agreed to. And if you didn’t read the contract, guess who’s gonna be impacted the most?

What’s the result? Well, gold buyers, yes indeed. Gold buyers binge on biggest volume for 55 years and a bunch of those gold buyers are, guess what? Central banks who’ve been buying the most in history or since they started tracking everything, central banks binge on gold. Would you please look at the difference since we hit 2022 of how much gold they’ve been buying? And remember we just went net positive in 2010 even though the gold buying from the central banks really started in 2005. So who knows more about what’s coming than central banks that are creating this mess? Seriously, this last time, the last time this level of gold buying was seen was, what year was that? 1967 marked a historical turning point for the global monetary system. Do you know I never see those words. Thank you. Financial times, thank you because they’ll refer back to those dates, but they never talk about what was happening during that period of time. In the sixties, the US was definitely exporting inflation to the globe and there was a run on the dollar. Foreign governments converting their dollars into gold, pulling the gold out of our system. Nixon closed the gold window giving power to the central banks for inflation in 1971. This is not a shocker because we are already at a historical turning point for the global monetary system. Thank you Financial times. Thank you for putting that in print. It’s nice when somebody verifies what I’m talking about.

So here you go. This is the purchasing power of the consumer dollar since 1971. Look at this pretty little zero, right? And even though it looks like it’s flattening out, it’s not. We’ve got inflation that tells you what’s really happening with the currency. Spot gold, which is a contract, doesn’t reflect its true fundamental value. 1968, it was at 35 bucks an ounce on as far as nine 1-6-2023. It was $1865.80 gold protects your purchasing power over time period. End of discussion. It’s what it’s done for 6,000 years. It’s what it will continue to do in the future. There is no other alternative and certainly no proven alternative. Well, I’ll have to fix that piece because I am realized that was the end of it. Okay?

No proven alternative exists for protecting you from what we’re facing geopolitical risk. I mean, there’s a lot of that going around monetary risk. We are in a reset. This is not something I’m waiting for, it’s something we’re already in the middle of. What do you want to protect you? That’s what I have protecting me. Plus Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter. So if you haven’t already, please do yourself a favor, make sure you subscribe. Hit that button so you know when we post something new. And if you haven’t already, go ahead and watch last week’s video on exposing the scheme that Wall Street is trying to pull. I mean, just go watch it and then tell me what you think. We love questions and we also love comments. Leave us a review on Apple or Spotify and listen to us anywhere, anytime on all major podcast platforms. And if you haven’t, again, if you haven’t already done it, click that Calendly link today. Get your strategy in place, get it executed as quickly as you can. Do yourself a favor. I would always rather be, I don’t care if I’m 10 years too early than one second too late because that one second is the difference between your ability to make a choice. So if you haven’t already, make sure you subscribe. Leave us a comment, give us a thumbs up, help us spread this message and share, share, share. And until next we meet. Please be safe out there. Bye-Bye.

SOURCES:

https://www.ft.com/content/93448356-43a7-4326-95b2-2d6a627ca74f

https://www.ft.com/content/e0983ebb-bbe0-4d33-8517-e19fa06e1a77