The 3 Trillion Dollar Black Swan Event Unfolding

Japan showed the entire world how to manipulate the markets and interest rates, and now they are failing in a catastrophic way. It’s what I’ve been explaining for years, coming to fruition in real-time, and I’ll show you why this is a major indicator of where the global markets and therefore the United States is heading. Coming up!

CHAPTERS:

0:00 Global Markets

1:31 Bank of Japan Yields

5:12 Japanese Investors

8:33 Carry Trade & $3 Trillion Threat

12:44 Buying of Japanese Govt. Bonds

18:05 Spot Gold Market

20:40 Self-Sufficiency & Independence

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

Japan, since the early nineties has showed the entire world how to manipulate the markets, the bond markets and interest rates. And now they’re failing in a catastrophic way. It’s what I’ve been explaining to you for years and that is coming to fruition now in real time. And I’ll show you why. This is a major indicator of where the global markets and therefore the United States is heading. Coming up.

I am Lynette Zang, Chief Market Analyst here at ITM Trading a full service physical, gold and silver dealer specializing in strategies. And what I’ve been watching and warning you guys about for a very long time is unfolding right now as we speak over at the Bank of Japan. I mean they were after all the ones that introduced us to yield curve control. And I mean they had so many alphabet soups, it’s ridiculous. And they’ve also introduced the zombie corporations to us, which is now global, used to just be in Japan, now global. So these are really not good things, but they’re losing control. Let me talk about this for a minute.

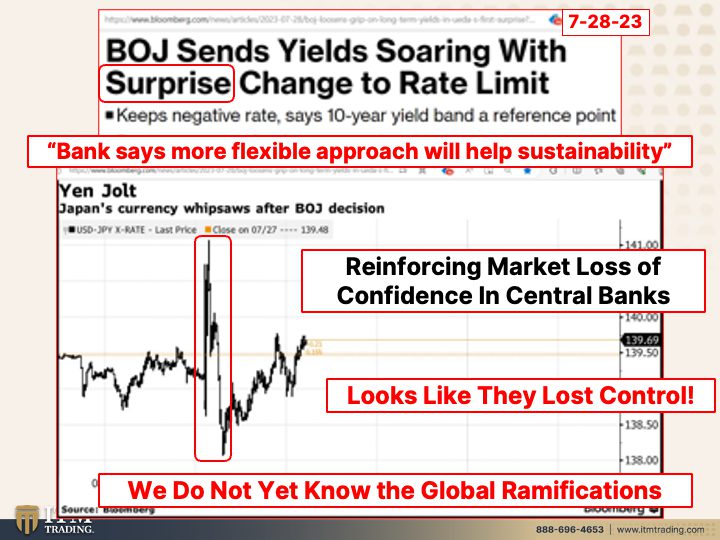

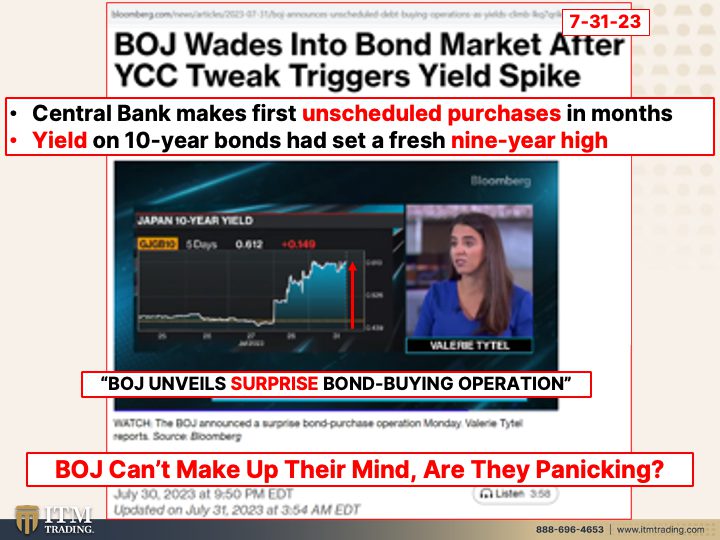

Okay, number one, lemme grab my little laser pointer. Okay, so on Friday, I mean this is so interesting, really, on Friday the Bank of Japan sent yield soaring with a surprise change to the rate limit. You get that? A surprise change something that nobody was expecting. Look at this bank, they’re now look, are they saying, well we lost control? But they were losing control. That’s why they had to change the rate change the rate. Oh, I am losing it today. They had to change the range of the rates and allow the rates to go up even higher. The bank says more flexible approach will help sustainability. Yeah, will help them stay in power because they are losing that control. You could see what happened when they announced that surprise change to the rate limit, it went ballistic. Well, alright, big deal. That’s over in Japan. This is here. But what it really does is it reinforces the market’s loss of confidence in the central banks. And that confidence, especially when you’re a con game, that confidence is everything. It’s required. So what I’m, what I’m hoping that you can see is that they are losing control. This is an indication of how close we are. What is this gonna look like as it unfolds? I got news for you. We do not yet know the global ramifications. Those are gonna come over just a little bit of time. But what happened on Monday? That’s yesterday. They, it says listen to how they make it so nice. Bank of Japan wades into bond market after YCC. That’s yield curve control, tweak triggers, yield spike. Well they had to have known that that was gonna be a bit of a problem and you could certainly see how the yield has gone up from there. But the central bank makes their first unscheduled. Thus another surprise ’cause they didn’t like the way they got the reaction from Friday. But unscheduled purchases in months. Yield on the 10 year bonds had set a fresh nine year high. Now look, everything is always going to go to its easiest place. So with the Bank of Japan saying we are going to, we’re gonna widen that interest rate banned, that’s where interest rates are gonna go. Like duh. Why was this such a surprise for them? Because I think honestly they’re just losing control. Bank of Japan unveils surprise bond buying operation. So they don’t know what they’re doing because by releasing that yield and allowing that to go higher, that says that they’re tightening. But by going in and buying bonds that says that they’re loosening. So you tell me, they don’t know what they’re doing, they’re throwing stuff up on the wall and hoping that something sticks. But to me it looks like panic. What’s it look like to you? To me it looks like panic.

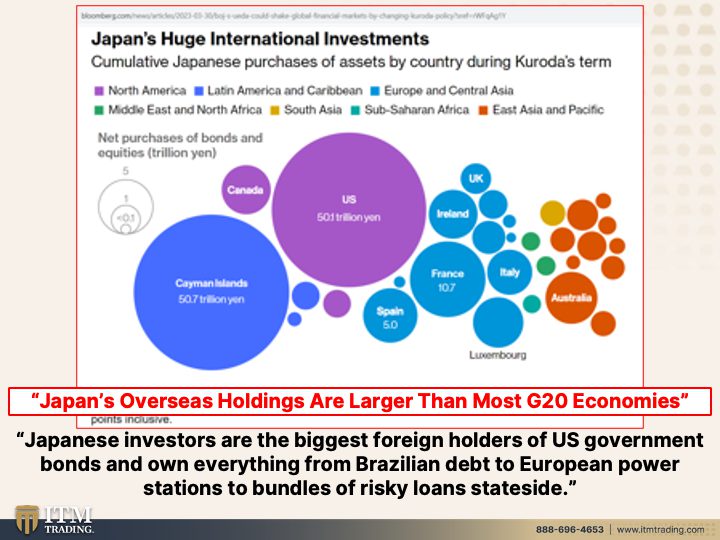

And here’s where I’m saying we don’t know yet what those global ramifications are because as they have kept, as the Bank of Japan has kept interest rates super low, well a lot of the money the investors in Japanese investors have gone elsewhere. Here’s the US 50.1 trillion Yen Cayman Islands, 50.7 trillion. Spain, France, Italy, Ireland, UK, Australia and everywhere else. So if the yields go up in Japan, the most likely outcome is that Japanese investors will sell what they’re holding globally and potentially bring that money home. Japanese investors are the biggest foreign holders of US government bonds and own everything from Brazilian debt to European power stations to bundles of risky loan stateside. So what happens if these Japanese investors start to liquidate those positions? Well, if they start to liquidate US treasuries, I mean that’s kind of a problem. Pushes interest rates up maybe even further. Then the Fed wants them. And especially at a time when the Fed is trying to liquidate their bonds into the market and the treasury is issuing trillions of dollars worth of new debt into the market. This is a big problem ’cause the Japanese investors have been the biggest foreign holders. So this is gonna have repercussions that we aren’t seeing yet. This was the ignition. We’re gonna see what the outcome is. Japanese overseas holdings are larger than most G20. So that’s the top global, the economies in the world, their holdings are larger than most of those economies.

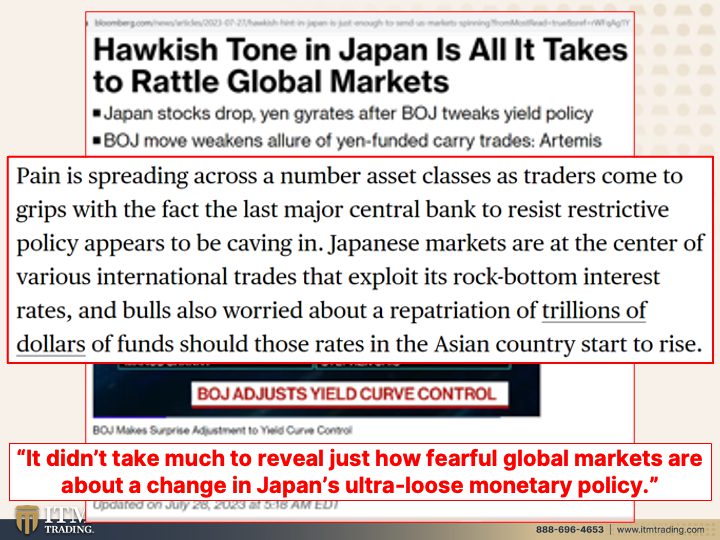

Hawkish tone in Japan is all it takes to rattle global markets. Well yeah because the Japanese stocks drop the yen gyrates after Bank of Japan tweaks yield policy and they move to weaken allure of yen funded carry trades. Wow. We’re gonna talk more about carry trades in just a minute. But pain is spreading across a number of asset classes as traders come to grips with the fact that the last major central bank to resist restrictive policies appears to be caving in. Japanese markets are at the center of various international trades that exploit its rock bottom interest rates and bulls also worried about the repatriation so the bringing home of trillions of dollars of funds should those rates in the Asian country start to rise. It didn’t take much to reveal just how fearful global markets are about a change in Japan’s ultra loose monetary policy.

So let’s talk about the carry trade because this is significant. First of all, what is a carry trade? That is when you go in, traders borrow in countries with low interest rates like Japan, who’s at negative interest rates to invest in higher yielding assets. So that’s why frankly a lot of the Japanese investors went overseas because they really couldn’t get it in Japan. But they’re not the only ones. This is a global thing where Wall Street globally will borrow in cheaper with lower interest rates and then invest that money in higher yielding assets. But we don’t know if the liquidity is the same on both sides. And remember, there’s also all of these derivative betts that are written against this. The surprise loosening by the Bank of Japan of its grip on bond yields Friday holds particular significance for emerging market currencies. As Japanese investors are at the center of the carry trade borrowing in countries with low interest rates to invest in higher yielding assets. Yen funded carry trade strategies have outperformed those borrowed in dollars in all developing markets this year. Shocker. But understand that this is a surprise. So when they’re saying the surprise loosening by the Bank of Japan of its grip on bond yields tells me they lost control. Hey, maybe I’m wrong. Maybe I don’t know what in the world I’m talking about or maybe I do since I was groomed for this moment in time. We have not felt this yet. But this is a tectonic shift. Remember Japan has been absolutely instrumental in creating all of these other products that the central banks use to make things look okay, but they’re also the owners of most of the debt and the stock market in Japan.

And in the meantime a $3 trillion threat to global financial markets looms in Japan. 3 trillion. That would be a flipping gift. It’s the derivatives, those big betts that are based upon all of this that are the real problem and we can’t see it. It’s buried underneath until it’s too late. Tell it’s too late. I do not want you to be a deer caught in the headlights. I want you to know what’s happening when you control a price and loosen the grip. It can be challenging and messy. We think it’s a big deal. What happens next? Yeah, yeah. But I’m gonna read this guy’s credentials ’cause I love him so much. Head of BlackRock Investment Institute now and former deputy governor of the Bank of Canada. It’s a revolving door between Wall Street and the central banks and the governments. It’s just a revolving door. But we can’t see the real risks that are happening. But I want you to pay attention to what they say. Say when you control a price and loosen the grip, it can be challenging and messy. So what have they been doing with gold? Spot gold? ‘Cause We know a rising gold price is an indication of a failing currency. So what they’ve been doing is holding it down and it’s like a spring, right? You hold it down, you hold it down, you hold it down. When you remove that, that pressure, then whatever it is, shoots in a direction. So we saw the interest rates. They were artificially held down, held down, held down. Now they shot up scared the crap out of the Bank of Japan. I don’t know why. I don’t know what in the world they were expecting. But the same thing is gonna happen with spot gold in the meantime in the physical market that’s already happening. But in the spot market, it’s just kind of flat mushed down a little bit.

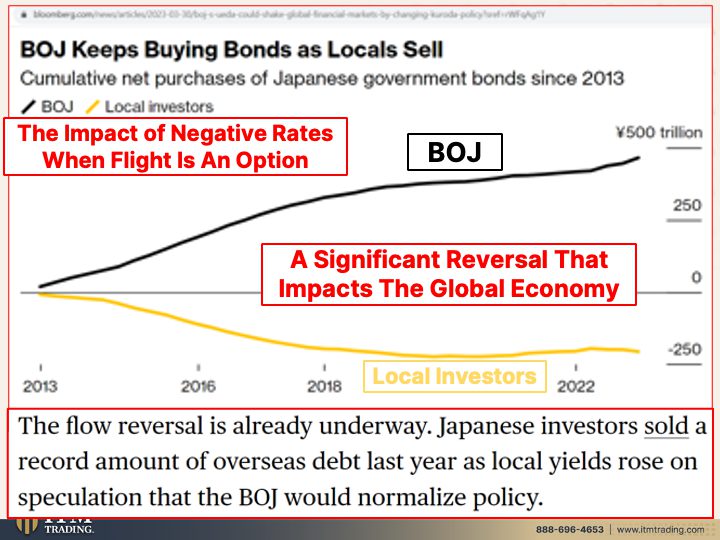

But let me show you how all of this built up. ’cause This goes back to 2013 and this is the bank of Japan’s buying of Japanese government bonds. This is the local investor. So as the local investor was taking their money out and putting it elsewhere globally, bank of Japan was buying it to suppress the interest rates, the impact of negative rates when flight is an option. So they were allowing their investors to go elsewhere. But I mean they say, I mean this is incredible to me and it makes no sense at all that negative rates are a choice, right? ’cause I’m gonna bust my butt, I’m going to give you money and expect to get back less than what I loaned you. Yeah, that makes a lot of sense for everybody. The only person I would do that for, the only people I would do that for are my children. How about you? I mean come on. So this is what happens. But now we are having a significant reversal. That’s what just happened. They lost control. They’re never gonna admit that they lost control. But these two surprises shows me that they lost control and they’re scared. The flow reversal is already underway. Japanese investors sold a record amount of overseas debt last year as local yields rose on speculation that the Bank of Japan would normalize policy. Can anybody please tell me what a normal policy is anymore? Because all we’ve been living under has been extraordinary policy. But at what point does all of this on extraordinary policy become normal? Well, it did look at QE that’s been going on. It started in Bank of Japan first, not in the crisis but in the early nineties. So I don’t know. This to me definitely looks like Bank of Japan lost control.

But this is also a kind of has me troubled. Bank of Japan’s real surprise was the dovish inflation forecast because inflation is part of the fiat money system. Yen fell 1% against the dollar on Friday after the rates meeting. Well first of all, that’s one currency against another currency. All the while, whether you’re talking about yen or you’re talking about the dollar or you’re talking about any other fiat currency for that matter, the purchasing power value continues to decline. But that’s what the inflation is. So they want inflation to go up. But there’s only one way. It’s not like you got a whole bunch of choices. There’s only one way to fight inflation. And that’s with deflation and vice versa. There’s only one way to fight deflation. And that’s with inflation. Do you think they might overshoot it? Do you think they already did overshoot it? The inflation forecast change was the big news. On the one hand, they introduced this tweak, obviously just a step towards some further flexibility. Yeah, they need further flexibility so that they can at least look like they’re maintaining control. But on the other hand, which I think was the biggest surprise to me, they downgraded the inflation forecast well because in theory when interest rates rise, fewer people are borrowing their spending. And that’s what curtails the inflation. We haven’t seen the end of any of this yet and I hope you’re ready for it. That’s all I can say. And if you haven’t done it yet, you need to click that Calendly link and get your own strategy in place. Clearly the programs that were in place are not being very effective. And I’m not talking about the ones they just put in place. They’ve been battling this sincerely nineties. So you might say to me, well Annette, if they’ve been battling it sincere, early nineties, how is it that they’re still surviving even to be able to do this? Because as one of the world’s largest economies, the whole world agreed to allow them to. That’s what’s changing and that’s what’s different in the US is that we have ticked off a lot of countries a lot. We’re not gonna have as much leeway as the Bank of Japan has had. And I would say absolutely a hundred percent we are in the danger zone. And what do you wanna do? Do you wanna fight it with this? That’s losing value? And I don’t care if you put it in stocks and they go to the flipping moon. A trillion times zero is still zero. This isn’t even a little pen knife. This, this, these are bazookas. What do you wanna go into this fight with? I want a bazooka.

And we can see what’s happening in Japan against the spot gold market. This is spot gold to the Japanese yen. And don’t we see a cup formation and don’t we see a breakout? But even this is still being controlled because a rising gold price is an indication of a failing currency. Do they want you to know that this is going away a hundred percent? No, they do not. Because then you make different choices and you cover your assets. You wanna cover your assets. This is how you do it. Plus Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter. Get it done. I cannot urge you enough. I am seeing so many things. It is so easy for me to pick a topic because there are so many things that are going on. When do you wanna be ready? Because if you don’t do it before the big surprise and the big shocker occurs, you will not have the time to do it later. I hear too many people say, well I want to move or I want to do this, or I want to do. I a hundred percent knew that the system died in 2008, a hundred percent. I was getting ready to retire. I had a little two bedroom condo. I could lock the door and off I could go and have a great time and not have to worry about anything. Instead, I turned around and bought this property in central Phoenix. ’cause I knew my daughters wouldn’t leave. And so this is where I was going to make my last stand. And I became an urban farmer. Why? Because I believe my research, because I know what happens a hundred percent of the time as we transition from one currency system to another currency system. And for the most part, for most people it’s ugly. It’s nasty. What 90% of you know, you’re talking about the middle class. Have you not watched the erosion in the middle class? That really started back in the, well, it really actually started when we went off the gold standard completely. But it really started with the fiat money system and then it sped up in 2000. I mean, that’s it.

And we are slowing. What are you gonna do about it? That’s what I wanna know. What are you doing to make sure that you are self-sufficient and independent as possible Going when it becomes apparent to everybody? ’cause We’re already going through it. So again, if you have not done so, click that Calendly link below. Set up a time with one of our specialists to put your own strategy together and get it executed. Because you’ve got to make sure that you are as independent and self-sufficient as possible. And physical gold, physical, silver in your possession, that is your, that is your wealth shield. And that will be the best foundation that you can give yourself. But you also wanna give yourself Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter. So if you haven’t already, you wanna make sure to look at the retirement crisis looms because they haven’t really been talking too much about it, but it is on top of us. And hey, if everything collapses and we go into crisis, isn’t that a great way to take care of that retirement crisis? And also make sure you watch Taylor Kenny’s piece on the “Fednow and can change everything.” Yes it can and will change everything. And until next we meet. Please be safe out there. Bye-Bye.

SOURCES:

BOJ Shocks Financial Markets by Adjusting Yield Curve Control (YCC) – Bloomberg