Shifting Your Bank Accounts to FedNow Without Your Knowledge – by Lynette Zang

CHAPTERS:

0:00 Fednow Payment System

2:17 Webster Bank

5:25 What Will Change

10:18 Money Pass & Fiserv

17:47 Gold ETF Flows

20:11 Building Your Foundation

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

The Fednow payment system launched four days ago, and there are major concerns about how this infrastructure could lead to Central Bank Digital Currencies and the reset of the US dollar. Your money is becoming less and less safe by the day. One of our clients received a suspicious letter from their bank telling them that there were some exciting changes coming. The letter said most of their account information would stay the same, and their online experience would be changing and some account features. I asked to see the prospectus, and after days of digging, I just confirmed that Fednow was behind these changes. And I’ll show you how they’re doing it without you knowing it. ’cause I’ve been saying for years that the shift is going to happen without you knowing. And by the time you know, it’ll be too late to do anything about it. This is about how to do your own digging, how to read between the lines, and how to protect your assets from financial manipulation and control, coming up.

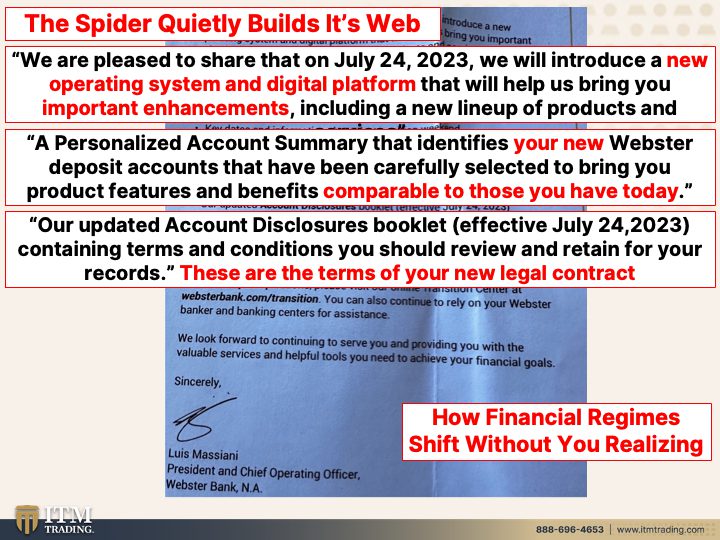

I’m Lynette Zang, Chief Market Analyst here at ITM Trading a full service physical, gold and silver dealer, but specializing in custom strategies. And let me tell you, you guys, you need to have one because they have one, they have a plan, and they’re executing it, and it involves converting you into their slaves. So fortunately, we had a wonderful client that sent in a letter that he got from its bank, Webster Bank, and it said, Okey-doke. ’cause Really what this says, is the spider quietly building its web. And let me tell you before I go, before I start this, why this is so important is because this is an absolutely perfect, perfect, perfect example of how they get you into compliance without you even knowing it. It is perception management at its flippin’, finest. And I am so ticked off, I can’t even stand it.

Let me show you what I found. I mean, I was totally. I’m just, I’m just gonna go on okay. ’cause This impacts everybody. It isn’t just Webster Bank that this is happening with. It’s everybody as the Central Bank, spiders build their web, quietly. So what do they say in this wonderful letter? We are pleased to share that on July 24th, 2023, we will introduce a new operating system and digital platform that will help us bring you important enhancements. Yeah. For who, including a new lineup of products and services. Isn’t that great? Isn’t that just great? So, hey, this is great. We’re doing all sorts of new stuff for your benefit. Don’t worry. Because a personalized account summary that identifies your new Webster deposit accounts that have been carefully selected to bring you product features and benefits comparable to those you already have. They have to keep things as close to what you’re used to as possible so that you do not notice that anything has really changed. When in reality, everything has changed. For those of us that are my age, you remember back to August of 1971, and what were we told? Just by American, nothing has changed. You’re not gonna get inflation. It’s not a problem. But the reality is, is after August 1971, everything had changed. Everything. Our updated account disclosures booklet, this is your contract. This is your contract, effective July 24th, 2023, containing terms and conditions you should review and retain for your records. This is your legally binding contract. If you continue to use the account, you have agreed to these terms. Now, I gotta tell you, I went into this and I wanted to know, okay, what’s changed? And when I’m reading this, I can’t see anything that has changed because they don’t want you to understand what has changed. So I went in and being the little ferret that I am, I started to dig because I realized just reading this was a waste of my time, right? I mean, you are legally bound by this, but it was a waste of my time. I can’t wait to show you what I found. Thank you. Thank you so much for that wonderful client that sent this in and brought this to my attention and, and had me focus on it. I want you to know right now, I really, really appreciate it. Absolutely. And I’m sure everybody watching really appreciates it too.

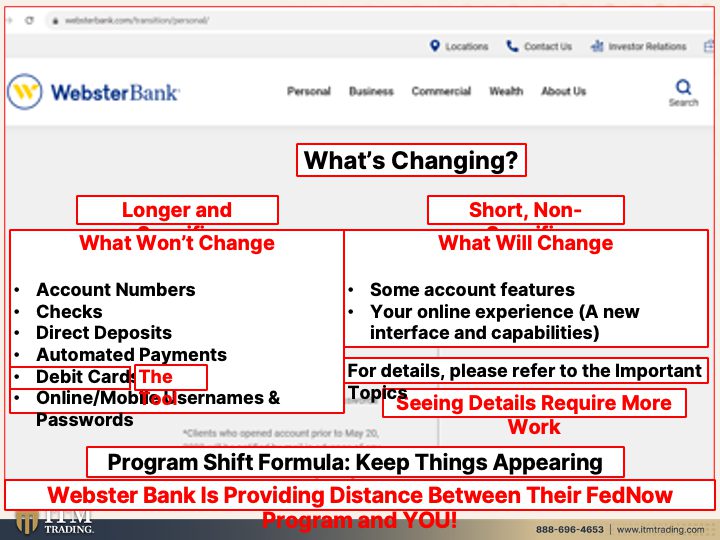

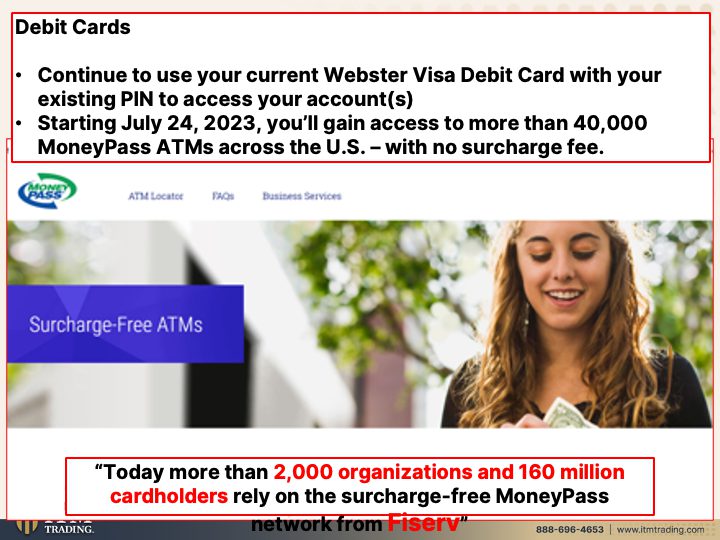

Because what I’m about to show you in black and white with all the links is how central banks and governments change financial regimes without you realizing it. How they get you suckered in and then it’s too late. So let me show you now, going on their website, what does it say? What’s changing? All right, that’s what I wanted to know. I’m sure that’s what you, you wanted to know, but they’re gonna start with what won’t change. So account numbers, check, direct deposit, automated, automated payment, Deb’s card, online, mobile, nothing really. These are all the services that you’re using. Nothing’s changing. Notice how nice and long and specific this list of what is not changing is, specific, right? Let’s look at what will change. Ah, two things will change. No big deal, right? Some account features though, they don’t say what those are, and your online experience, and again, they don’t say what those things are, but what they do is you’ll notice two things. So it’s much shorter and they’re completely non-specific. And if you wanna know more details, please refer to the important topics. So now you’ve gotta do more work. Most people are busy. Most people are going, well, the things that matter to me, those aren’t changing. And there’s only, you know, some little things that are no big deal. And so you agree to it because you don’t know what’s going on. Plus, if you wanna use your account, I don’t know that there’s any place you’re gonna be able to get away from it. I mean, not everybody is adopted, but they will. And I’ll get into more about that in just a second. So again, the formula, and they have done this in 1913. They’ve done it many, many times, but they certainly did it in 1913. They did it in the 1940’s in Bretton Woods. They did it in 1971. And I am here to sit here and tell you, and I’ve been saying this since 2008, no doubt in my mind, the old system died and was put on life support to get all these new things in place. And by the way, things that you used to be able to do with your bank account, like give your kids cash. I mean, when my girls were in college, I would deposit cash into their accounts. Boom, can’t do it. That’s one little minor thing. And you say, ah, well that’s not a big deal. Nothing in and of itself ever seems to be that big of a deal. But when you step back and you look at this whole spider web, you know you’re getting caught. Let’s move forward. Okay? Webster Bank is provi. Oh, okay. This was the point that I wanted to make too. Okay? Remember, I’ve told you over and over and over again because they’ve told me in their big documents that the IMF and the BIS and all those guys do, what do they want? They want distance between policy. So they wanna institute the Fednow, now accounts and how it’s introduced to you, this is how they’re introducing it. So just keep these things in mind. So kind of obscure, look at this. You are going to have access through your debit cards, which people use the debit cards, the credit cards, a surcharge free ATM through Money Pass. So they’re telling you, continue to use your current Webster Visa debit card with your existing PIN to access your account. See, nothing has changed. And starting today or yesterday, you’ll gain access to more than 40,000 money past ATMs across the US with no surcharge fee. See what’s changing? That’s what’s changing. Now you’re gonna look at that and go, well, great. Now that just means that I’ll be able to access my cash in 40,000 more places if I need it. Isn’t that grand? Well, yes. And many people think so. Today, more than 2000 organizations and 160 million card holders rely on the surcharge Free Money Pass Network from Fiserv.

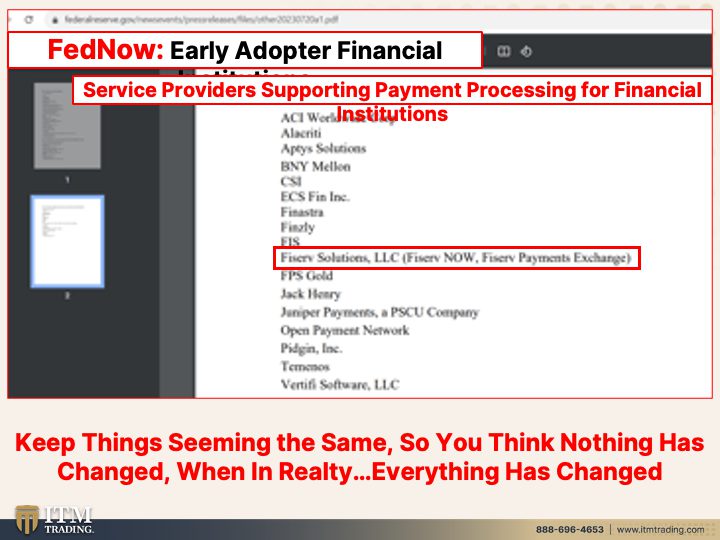

Hmm, Fiserv. Hmm, Money Pass, Fiserv. Okay, who are they? Who’s Fiserv? Well, I went online and Fiserv has been around for a while. And I thought, well, you know, I mean, I think I even made mention that I somehow felt that this change with the timing and everything was about the Fednow. So look at what you’re watching. This is from Fednow the links are below. It’s two pages long. You wanna know if you’ve got if, if they’re participating in the Fednow program, click that link below and check out and see if your bank is on there, because these are early adopter financial institutions, okay? And there’s a whole nother page of ’em with all of the banks that are, that are participating already and in this rollout. Now, clearly that means that not every bank is, but guess who really are? Oh my goodness. Who is that? Fiserv Solutions, LLC. is now Fiserv Payments Exchange. Voila. Okay. There is the connection. Buried so that you don’t see it. I couldn’t find it in here. I mean, Fiserv. Yeah, but I couldn’t find this connection in there. So now all of those people are connected to the Fednow service through Fiserv, not, not obviously directly through your bank though, there’s a whole list of banks. And again, I’m gonna encourage you to click that link and go check it out and see if your bank isn’t one of those that are participating as an early adopter. So the reason why you and I, it’s not more blatant. I mean, they came out with the bed now, announced it in 2019. Why did they announce it in 2019 when they’re only bringing it out in 2023? And what did they say then? Everybody’s gonna have an account, but they’re not gonna, you’re not gonna know it until this next crisis when they dump CBDC’s digital dollars in there, go shopping, go spending. Don’t worry, we’re stimulating. And if you’re desperate, if you have not become your own central bank, what are you likely to do? And even if you have, if somebody gives you free money, what are you gonna do with it? You’re probably gonna spend it. The question is, and this is the challenge that a lot of the central banks have been having, is whether or not you continue to make deposits in there. So convert your current savings and checking account into this Fednow account after they’ve tried to get you used to using it. That’s where we can have pushback. But I’m telling you right now, you need to become your own central bank so that you are as independent and self-sufficient as possible. I mean, it really is that simple. Just keep things seeming the same so that you think nothing has changed, when everything has changed. So for all these guys at Webster Bank or all these other entities that are there, and on page one, which I didn’t put up here, but you can go and see everything has changed. Does it mean we don’t have a choice? No, that’s not what it means. It means that we do have a choice because you vote with your wallet and you vote with your purse. This is my vote. Sound money and Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter. That is my vote. That’s where I spend my dollars. And obviously all of this is just funny money. But then again, even the, the, I, I can’t call ’em legitimate because they’re a derivative of this. They were designed as a derivative of this so that we did not know that anything had changed when they took us off the gold standard, when in reality everything had changed. What are you going to do about it? Is this okay with, I mean, gold and silver, okay, with you. But is this okay with you? Because I gotta tell you, it’s not okay with me. Can you live without a bank account? Probably not. I mean, a lot of people, you have automatic deposits, automatic withdrawals, blah, blah, blah. This is still our tool of, this is still our tool of barter. See, I was a little nicer to you this time. So we do have to use it because it’s what’s recognized. But let me tell you, the confidence is at its lowest level. And when it gets to loss of confidence, a big fat goose egg in confidence, this will mean nothing. They’re gonna say, don’t worry about the cbdc because there won’t be inflation. No, there’ll be deflation. We’ll be able to control everything. You’re gonna be just great. Don’t believe them. Why would they magically suddenly be doing things in your best interest when they haven’t done that since the day you were flipping born? Central bank’s job is not to take care of the public. It’s to make sure that they exist. Same reason that governments, that’s the same reason for governments. Government’s job. Look at the job that they’ve done, is not about you. It is purely about making sure that they remain in control. But we have a choice. There is a revolution that’s brewing. No doubt about it. Look at what’s happening with the unions coming back. I mean, there are so many parallels between every single monetary shift that makes it easy to understand what’s happening. They’re out there on the campaign. Ah, no recession. Oh, you know, soft landing. I’m sitting here telling you garbage, garbage, garbage. Oh, and did I mention this? Garbage? Absolute garbage. Don’t believe them. Protect yourself. Protect yourself. Protect your wealth. Keep an account there, but don’t keep more in there than you really need. You deposit, you take out cash right now. That’s cash in the wild before they put the chip in it. But just remember, we vote with our wallets. We vote with our purses. This is my vote. And quite honestly, in my opinion, it should be everybody’s vote. And if it was everybody’s vote, guess what would happen? They would lose control and we’d have a shot at a much more fair system.

But what do they prefer to give you? More garbage. Garbage, garbage. Gold ETF flows. I mean, really. You don’t own gold. If you own an ETF, you own a share in a trust of a diminishing asset that was purely designed to mimic the manipulated spot market that won’t protect you. It will not protect you. Wall street’s gold is fool’s gold. Don’t believe their garbage. Yeah, look at the stock markets because that’s what most people pay attention to. You open your 401k statement, as long as it hasn’t dump a roo skied. You’re like, oh, all right. Well, everything must be okay. ’cause Most people aren’t paying attention. They are too busy trying to keep everything together, trying to feed their families and save for retirement. You can’t save for retirement in this system. When I first became a stockbroker, nobody ever talked about people outliving their retirement funds because you could get treasury bonds at like 8-9%. So you’d live off the interest and preserve your principal. You couldn’t outlive it. Well, guess what? Today they’ll tell you, well, all right, you’re gonna live you’re gonna outlive this if you live past 86 or 72 or 93, or whatever that number that they miscalculate is. But here’s the reality, because of what they are doing to this currency with all of this, just trying to stay in power. That’s what this is about. Staying in power. I don’t want them to stay in power, do you? Because they aren’t doing what is in your best interest. What is in the public’s best interest? They are picking and choosing winners, as George Carlin used to say, this is a big club and you ain’t in it. Let’s create our own club. Let’s create our own community. This is my vote. I hold it and I own it outright. That’s why what the Bank of International Settlements, what, what gold in reserves?

This is real money. This protects you from inflation. Gold held at home does not run geopolitical risk. I’m telling you guys, this is so simple. You vote with your purse and make sure that you are secure in Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter. We are close to the end. They are setting up everything. Stop. If you’ve been waiting, stop. I mean, it’s just so simple. Just stop. Just do something different. If you’re holding silver and gold, what’s the worst thing that happens? You know, I always like to go, what if you’re right? What if you’re wrong? What’s the worst thing that happens? What if you’re wrong? It’s used in every single sector of the global economy. When I travel, I always make sure that I have gold with me and some silver. So if you haven’t subscribed yet, click that button and subscribe. Start your gold and silver strategy by clicking that Calendly link below and setting up a time, putting your best interest first.

That’s it, period. This is not rocket science. They’re taking you down. If you believe them, there’s 3 cents worth of purchasing power left. But in reality, they’re gonna take all of it because they are greedy. s.o whatevers, I’ll let you fill in the blanks with that. But seriously, I mean, I did a happy dance when I found that connection. Obscure, obscure, unless you’re a little ferret, it’s there. It’s there. You agreed to it, it’s there. Your perception means nothing in a court of law. Don’t you remember 2008 who went to jail? Nobody. Why? Because what they did was disgusting. Just like what they’re doing now. Disgusting, evil, vile, but not illegal because who writes all these contracts? That’s what Wall Street is about contracts. I’m about real money and community. And community, please get it done. Because the reality is, it’s not just your financial shield, your freedom, your family’s freedom. And you guys know I’m fighting for my grandchildren and my great-great-grandchildren that are not even born yet. Because if we don’t make a stand, it’s only gonna get worse. For most people, it’s not gonna get better. But we have choices and it’s not all doom and gloom. If you make those choices, then you can build a fantastic foundation for you and your family that you cannot outlive. Until next we meet. Please become your own central banker and be safe out there. Bye-Bye.

SOURCES:

https://www.websterbank.com/transition/personal/

https://www.moneypass.com/business-services/surcharge-free-atms.html

https://www.federalreserve.gov/newsevents/pressreleases/files/other20230720a1.pdf

https://www.gold.org/goldhub/data/gold-etfs-holdings-and-flows