SETUP TO BLACK SWAN EVENT: Are Central Banks Setting Up the Next Crisis?

In a current BIS report, they show us the tip of the iceberg, which is all they can see on this particular foreign exchange derivative transactions. But what they’re concerned about is everything that’s underneath the ice. I have to be honest with you, you need to be concerned about it too. Warren Buffet called these weapons of mass financial destruction, coming to a theater near you

CHAPTERS:

0:00 Weapons of Mass Financial Destruction

1:10 Derivatives Bets at All-Time High

2:27 Emerging Market Currency Trading

4:49 Foreign Exchange Swaps

8:12 BIS Quarterly Review, December 2022

18:24 China Boosts Gold Reserves

20:20 Inverted Yield Curve

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

In a current BIS report, they show us the tip of the iceberg, which is all they can see on this particular foreign exchange derivative transactions. But what they’re concerned about is everything that’s underneath the ice. And I gotta be honest with you, you need to be concerned about it too. Warren Buffet called these weapons of mass financial destruction coming to a theater near you. And coming up here today.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading a full service physical gold and silver dealer specializing in custom strategies based upon putting your best interest first. What a concept.

So today I need to talk about derivatives. And this is, honestly, I’ve been saying this right along. The derivative problem is going to sink it. It’s so huge in the many quadrillions that we don’t even know. But I think what’s interesting is that the Bank for International Settlements, which is the central banker, central Bank in this current December report, is talking about that which we cannot see. Everybody admits, nobody really knows the true value at risk, whether it’s the Bank for international settlements, the IMF, the Federal Reserve, the FDIC, the World Bank. Nobody really knows because these are very, very complicated. But I love this. We’ve talked about this before. Excuse me. Accounting conventions have hidden immense amount of foreign exchange liabilities. Let me tell you, they’ve hidden a lot of other liabilities too. We might not know where they are until the next crisis. And guess what? That’s because they’re causing the next crisis.

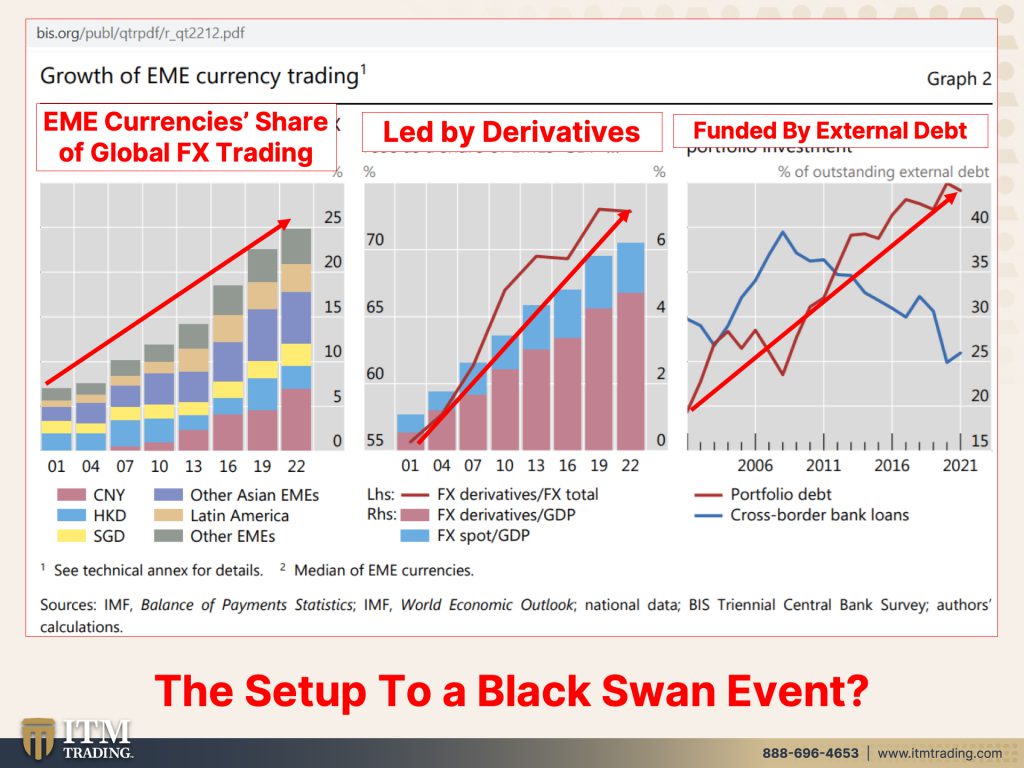

So these can come from any place. But let’s just start by looking at the Emerging Market Currency Trading. And you can see how much that has grown since just 2000, right? That’s 2001 in the last 20 years. This is led by derivatives, right? So we didn’t learn anything in long-term capital management in 98, which was when the first derivative, implosion happened and almost took down the global financial markets. You probably didn’t even know about it because the Fed and Wall Street rushed in to bail them out. So you didn’t know anything about it. Well, did that make them smaller? No, no, no. They’ve just grown exponentially larger. The second implosion was 2008 with the CDOs based on mortgages. Now is it gonna be foreign exchange or any other massive derivative? Which is just a leveraged bet. And that’s what you have to understand or what’s leverage it’s debt upon debt, upon debt, upon debt upon debt. It’s leverage. So it’s stacked and it makes everything that much more powerful, great on the way up. Horrendous on the way down, can take the entire system down. And this is funded by external debt, which means that if you’re in this country, you’re borrowing from another country. We’re gonna talk more about that as we go through. But, so they’re, they’re using debt and buying these leveraged instruments tied to foreign exchange, which are currencies. The dollar against the Euro or the dollar against the yen, etcetera. This is totally a setup for a potential black swan event. And a black swan event is typically not something you can see coming. But the point is, is this is so hidden that we can’t see it. We can’t see it until it’s too late. And you need to be aware of it.

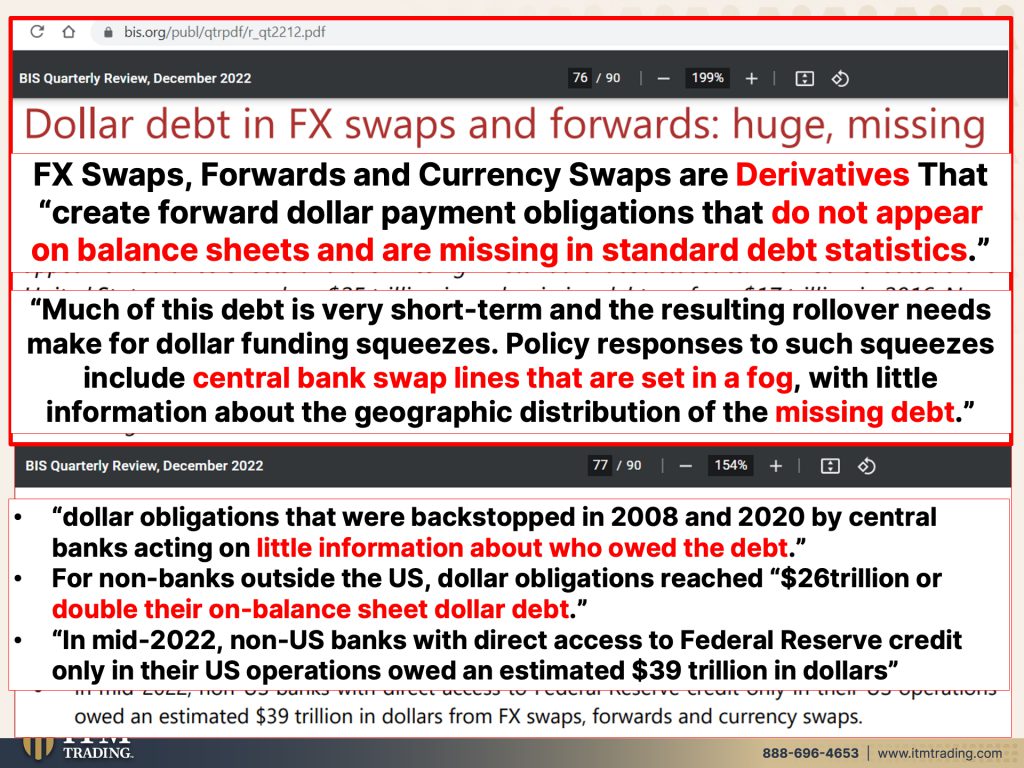

Dollar debt in foreign exchange swaps and forwards, huge missing and growing foreign FX swaps, foreign exchange swaps forwards and currency swaps are all derivatives that create forward dollar payment obligations. In other words, they’re gonna have to come up with dollars. Now if you’re in the US and you work and you earn dollars, maybe not as much of a problem, although you gotta earn enough. But we’re talking about other countries that are doing these dollar obligations that they’re gonna have to come up with down the road. They do not appear on balance sheets and are missing in standard debt statistics. So we really don’t have any way of knowing what the true value at risk is. Much of this debt is very short term and the resulting rollover needs, right? It matures. And then you either have to, when you have debt, you have to either roll it over, pay it off, right? And the resulting rollover needs make for dollar funding squeezes, they gotta come up with dollars. That’s a dollar funding squeeze. Policy responses to such squeezes like the Fed creating all of these swap lines that provide dollars so that this market does not implode, but they are set in a fog because they don’t really know where or what is needed with little information about the geographic distribution of the missing debt. And should make you feel really comfy because dollar obligations that were back stopped in 2008 and 2020 by central banks acting on little information about who owned the debts. So they’re just working blind here, just take this, take dollars. We’ll create as many of these as you need because we do not want this market to implode. Well, they’re in a tightening cycle. So you tell me how easy that’s gonna be. There’s your pivot. You wanna know when the pivot is? There’s your pivot for non-bank outside the US dollar obligations, reach 26 trillion or double their on balance sheet dollar debt so they can see. And that’s a guess. I’ll show you that in a minute. That’s just a guess. So these are non-bank. So corporations, insurance companies, hedge funds, pension plans, that’s who the non-banks are, are double their on-balance sheet debt as a guess in mid 2022, non-US banks with direct access to federal reserve credit only in their US operations owed an estimated 39 trillion in dollars. That’s an estimated they don’t really know how much. That’s what I’m talking about. There’s, it’s like an iceberg. You see the tip which you don’t see and that’s where the danger is, is underneath.

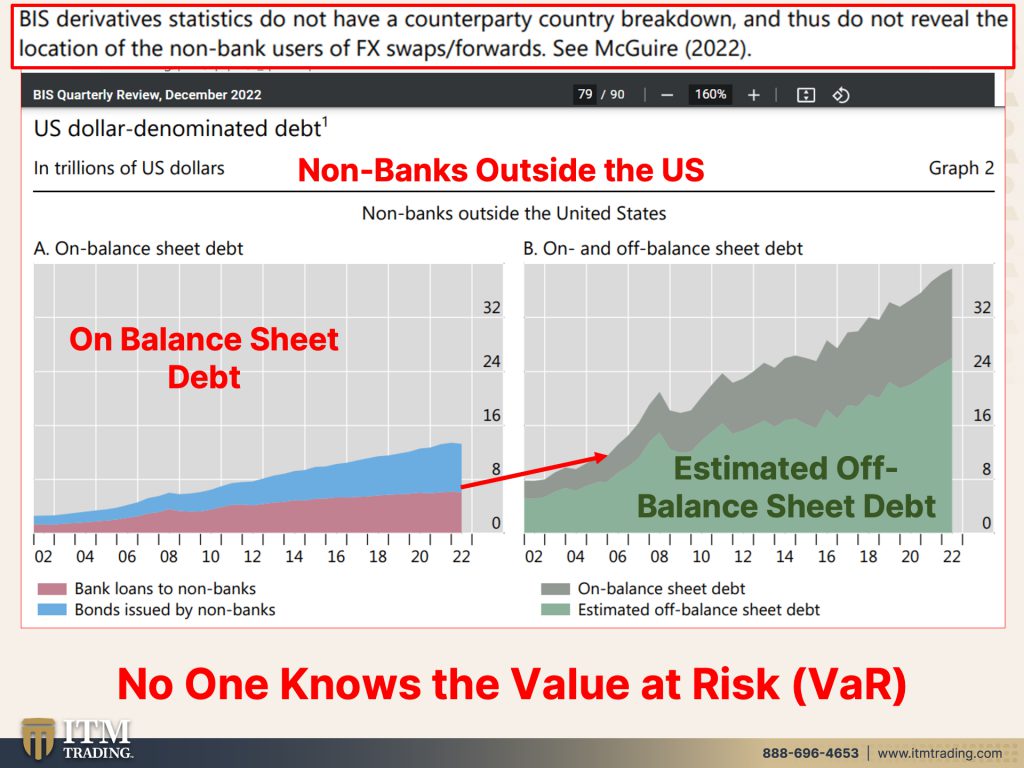

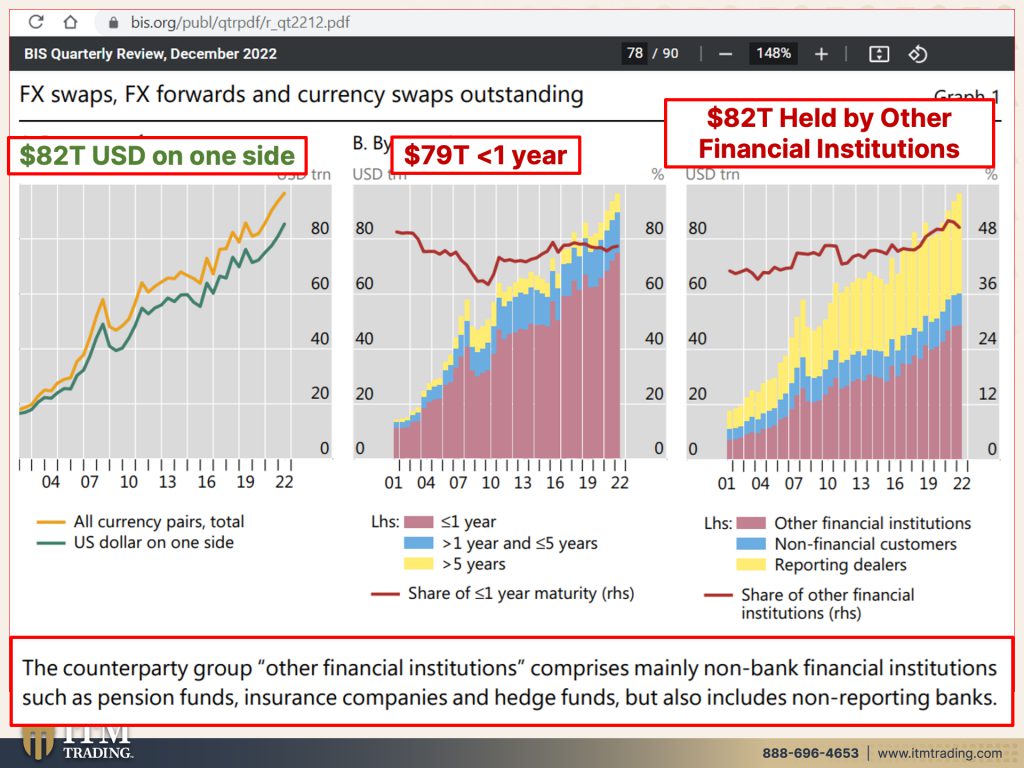

BIS derivatives statistics do not have a counterparty country breakdown and thus do not reveal the location of the non-bank users of FX swaps/forwards. So, in other words, they don’t know. That’s why I said this could be a potential black swan because they don’t know where this is gonna be triggered from and they can’t see it. There’s no way to see it. But lets you and I take a look at that because these are non-banks outside the US of the US. This is what they show as their on-balance sheet debt. This is loans to non-banks and this is bonds issued by non-bank, but this is what they estimate. So this darker green, represents this. This is an estimated off balance sheet debt. It could be so much bigger than this because of all of that leverage that’s built into the into the derivative contracts. That’s what derivatives are all about. Nobody knows. Does this help you sleep better? I’m sorry to be bringing this up around the holiday season, but this report just came out from the BIS and you need to know about it cause ignorance doesn’t make you immune, it just leaves you vulnerable. And I don’t want you to be vulnerable at any time. 82 trillion are based on US dollar against another currency. So again, the euro, the yen, the pound, whatever, but by a wide mile it’s this green line and you just go up, the gold line is all currency pairs. So you can see that the US dollar is on one side of the trade more than any other currency by a mile. Now here’s the problem too. And you can see this, this is under a year, right? So when they’re talking about short term and they’re talking about this in a rising interest rate environment with a lot of uncertainty, this could easily trigger a crisis. If they can’t, right? They have to roll this debt over all of this. They have to roll it over. If they can’t get funding in terms of dollars, cause remember they don’t earn dollars, they have to go out and get those dollars. There’s your problem. You can see it right there. And 82 trillion are held by other financial institutions. And what they’re talking about there, the counterparty group, right? So people say, well what’s counterparty? Okay, you and I signed a contract. What we’re both counting on, is that both parties will live up to the letter of that contract. If they don’t, you got a problem. So that’s a counterparty risk. But the counterparty group of other financial institutions comprises mainly non-bank financial institutions such as pension funds, insurance companies and hedge funds, and also non-reporting banks. Not all banks have to report.

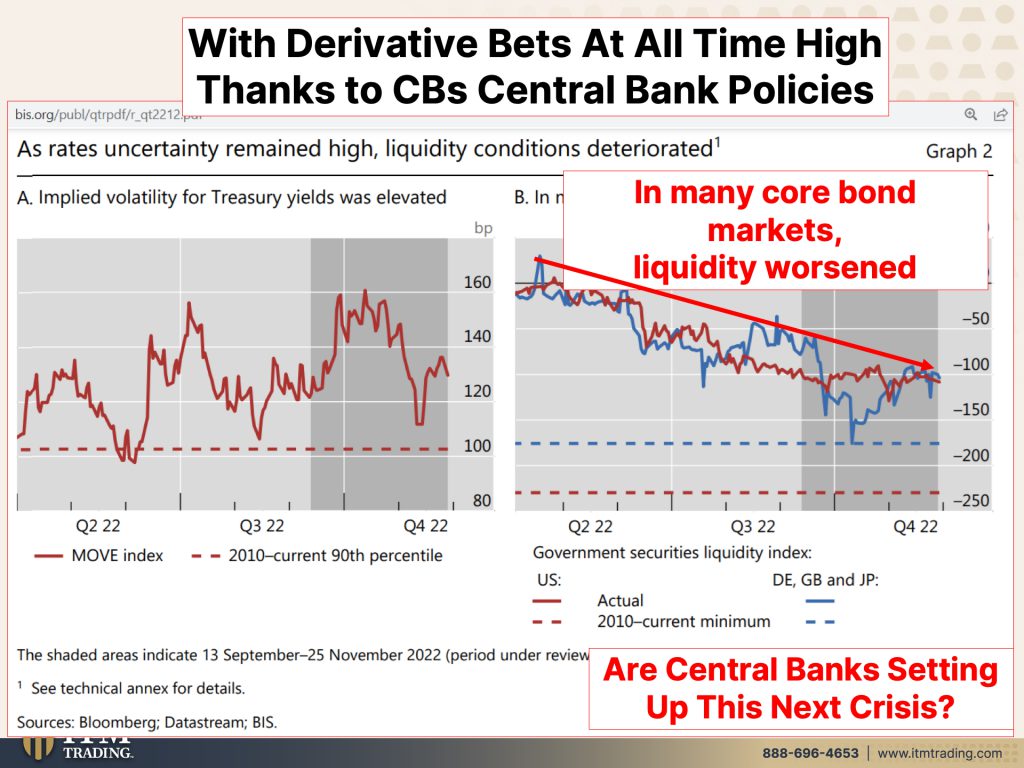

With derivative bets at all time. High thanks to Central Bank, cheap money, right? Just like all of these other bubbles that are now popping because this central bank is raising rates, this bubble may pop too. That’s the scary part of it. Let me show you what I’m talking about because it’s now happening when liquidity is drying up and what they mean by core bond markets. The treasury market, the British guilt market. So these sovereign bond markets that were sold as the safest thing you can do. Because after all, governments can print the money that they need to pay you back. Well, they’re not so safe anymore. And I’ve already been talking many times about the liquidity problems getting worse. So is that gonna, that’s why I said this is gonna be where they’re gonna basically be forced to pivot when this bubble pops. But they won’t be able to pivot enough. They won’t be able to print enough because nobody knows how big this is. I can tell you that when before they change the accounting, like they talked about, I personally saw that there were 1.42 quadrillion in derivative contracts at that point. I didn’t know how to push print screen. And were now at like all time highs. So how much is really there? How many quadrillions? Well, the global GDP isn’t in the quadrillions, it’s still in the trillions. They won’t be able to print enough to bail this out. This is it. This is gonna mark the end. It’s gonna create a crisis that’s gonna justify the CBDC’s. And it’s going to be, nobody’s gonna be immune. And remember what we’ve got coming up too in 2023, the shift from LIBOR to SOFR.

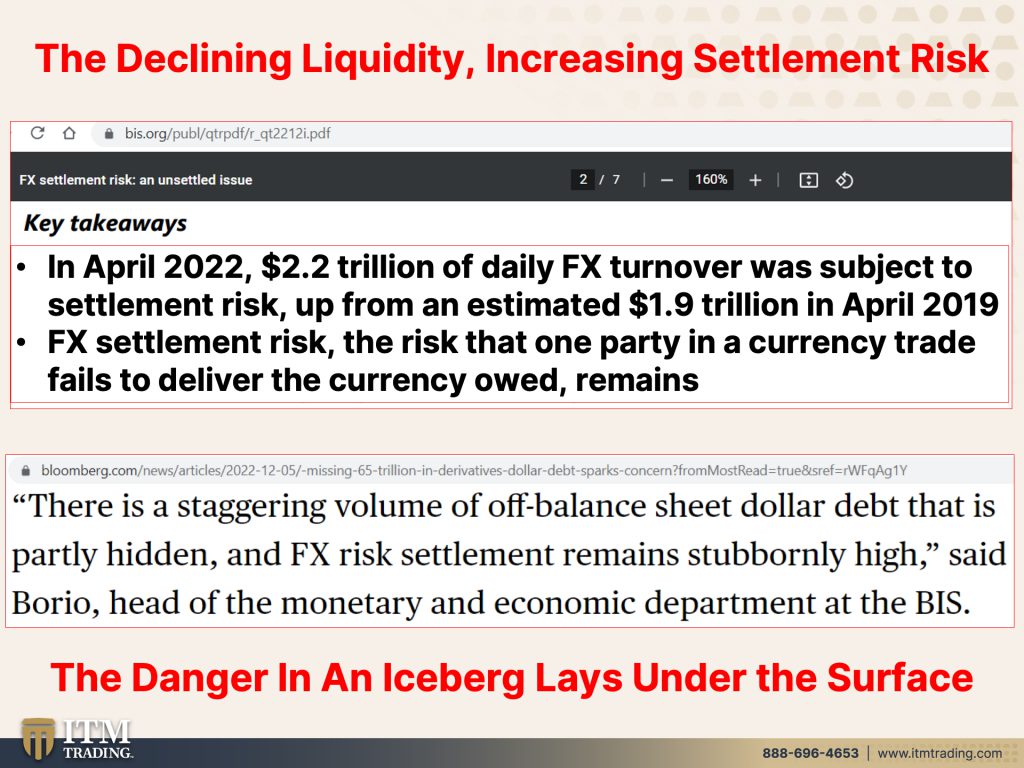

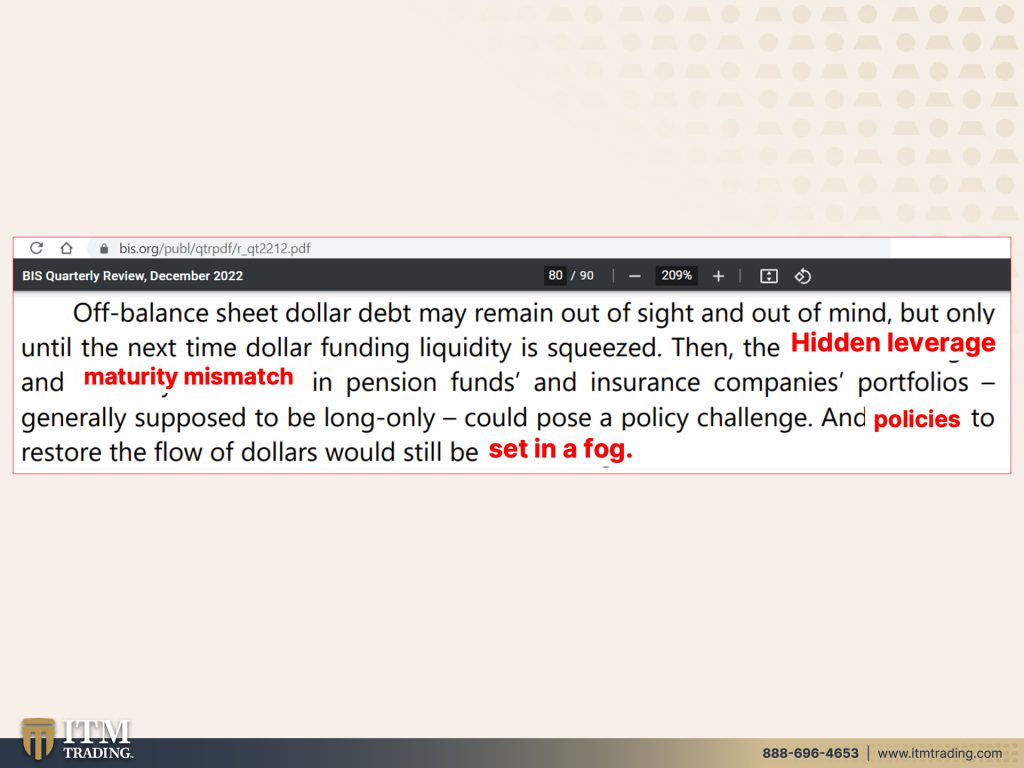

Declining liquidity, increasing settlement risks. So this is what they’re talking about in another report. They didn’t talk about it in the key report that I’m talking about. And I have all those links below follow read the reports. But in April, 2022, in April 2022, 2.2 trillion of daily, daily foreign exchange turnover was subject to settlement risk. In other words, that the counterparty would not be able to pay. Okay? Settlement risk. That’s up from an estimated 1.9 trillion as of April 2019. So that’s up pretty substantially in a very short period of time. Foreign exchange settlement risk is the risk that one party in a currency trade fails to deliver the currency owed. Hmm, I don’t know what I said by remains, but fails to deliver what they owe. That’s a big problem, especially if half of that or more than half 82 trillion, most of it on one side are dollars. The dollar had to get weaker in here because it was creating a bigger problem. When it got stronger against these other currencies, then it would cost them more to settle this trade. But you know, daily, 2.2 trillion at risk of not being able to settle, there is a staggering volume of off balance sheet dollar debt that is partly hidden. And foreign exchange risk settlement remains stubbornly high. Shocker. I don’t know if these guys ever look in the mirror and see the consequences of their behavior or they just like to point fingers. But the danger in any iceberg lays under the surface. It’s not what you can see. That’s not gonna be a black swan event. If you can see it coming, then you can prepare for it. You can prepare for even what you can’t see if you hold and owned gold and silver because physical in your possession runs no counterparty risk. And that is also according to the Bank for International Settlements. Okay. Off-balance sheet dollar debt may remain out of sight and out of mind, but only until the next time the funding liquidity is squeezed. Then the hidden leverage and maturity mismatch in pension funds and insurance company portfolios generally supposed to be long only could pose a policy challenge. Now what I mean by maturity mismatch is if you’ve gone and you’ve bought an annuity as an example, and you’re not planning on retiring for 20 years, okay. So they need 20 year paper to make sure they have whatever they agree to pay you out in 20 years. That’s a long term. But here they’re going into shorter and shorter and shorter terms. So that’s why you’ve got short-term debt that’s rolling over. But you’ve got a long-term obligation. So if you’re counting on that for your income, there could be a problem. And if you don’t understand this, let me know, send into services@itmtrading.com, Ask that question so that we can talk about it. Because I’m sure if one person has a question, at least a hundred people have that same question. Okay? And this is really critical because the policies that the central banks exhibit, well remember, they are set in a fog. They can’t see, they don’t know who actually owes this obligation, but they’re, it’s happening inside of a liquidity crunch. Now, why should there be a liquidity crunch when they created trillions and trillions of new currencies out there? Cause that money went to buy hard goods, real stuff.

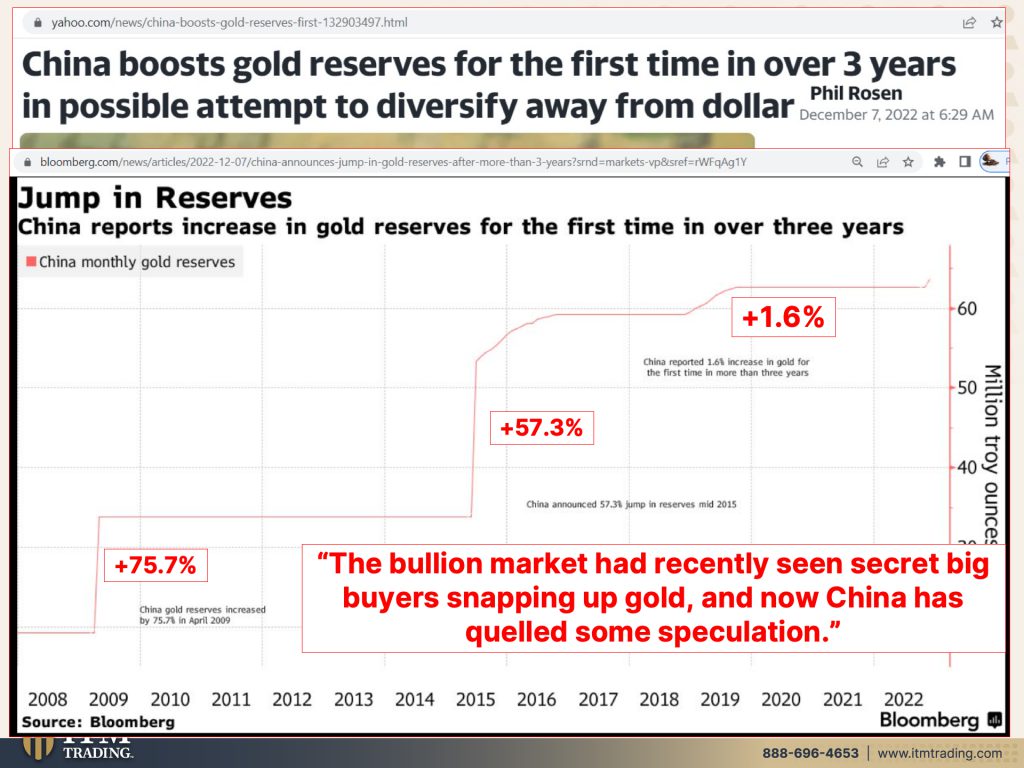

But what about China? So how do you protect yourself? Well, China boosts gold reserves for the first time in over three years. The truth of the matter is, is we don’t really know how much gold China owns. We know that they don’t let any gold out of their country. So if you go to visit China and you’re wearing gold, you better declare it on the way in or you’re not taking it on the way out. So it is really hidden. But what they are willing to show us is back in 2009, they increased their reserves by 75.7%. And then in 2015, they increased their reserves. Another 57.3%. The most current one that they’re talking about is 1.6%. But in 2006, China allowed their citizens to buy gold again and hold it in the banking system. So there’s lots of access to physical gold in China and they’re getting ready for this black swan event. I think you should too. I know I am. Between the gold, silver plus Food, Water, Energy, etcetera, I’m getting ready for that so that I know with a lot of confidence that I can take care of my family and families expanded. It’s not just immediate family, but cause you have to have a lot of different talents to build a community. But the bullion market had recently seen secret big buyers snapping up gold. And now China has quelled some speculation. And why would they do that? Because they wanna stay in power, they wanna expand their global reach. And whoever holds gold is going to have a whole lot more choice than those that do not.

So if you haven’t done this already, you need to make sure to subscribe because there’s a lot of information that’s coming out very rapidly these days. So please also make sure to watch last week’s video on the Hidden Lies of Inflation in the stock market. And tomorrow’s video or Thursday’s video on the inverted yield curve has gone global for the first time in history. This is a big deal, a very big deal. You need to know about it. So make sure, if you like this, give us a thumbs up, make sure you subscribe, make sure you leave a comment and share. That’s probably the single most important thing. Share, share, share cause we’re going into 2023 and 2023 promises to have some nasty surprises. So make sure that even though you’ll be surprised, it won’t hurt you. And until next we meet, please be safe out there. Bye-Bye.

https://www.bis.org/publ/qtrpdf/r_qt2212.pdf

https://www.yahoo.com/news/china-boosts-gold-reserves-first-132903497.html