Regime Shift & Changing World Order

The big questions are, when will the economy completely collapse? And how can I protect my family and my wealth before it does? I will answer both questions by showing you historic cycle indicators and the current actions of those who are in control of your money. Because we are at the end stage of both the regime and currency shift, otherwise known as the changing world order. There are six stages to the shift, and Ray Dalio just wrote this month that we’re approaching the final stage, the breakdowns are escalating. If you understand history, you know there are always winners and losers in every crisis. I’m going to show you exactly where we are, what’s coming, and how you can position yourself to win.

CHAPTERS:

0:00 End of Fiat Money Regime

3:15 Central Banks Purchase Record Gold

7:37 Internal Order-Disorder Cycle

11:49 Stage 6 = War

16:14 Dollar’s Purchasing Power

20:20 Example of Gold’s Purchasing Power

TRANSCRIPT FROM VIDEO:

The big questions are, when will the economy completely collapse? And how can I protect my family and my wealth before it does? I will answer both questions by showing you historic cycle indicators and the current actions of those who are in control of your money. Because we are at the end stage of both the regime and currency shift, otherwise known as the changing world order. There are six stages to the shift, and Ray Dalio just wrote this month that we’re approaching the final stage, the breakdowns are escalating. If you understand history, you know there are always winners and losers in every crisis. I’m going to show you exactly where we are, what’s coming, and how you can position yourself to win coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading a full service physical, gold, silver dealer specializing in custom strategies. And war is all about strategy, isn’t it? And we are definitely in a financial war and unfortunately fast approaching a physical war, and Ray and I are definitely on the same page. We’re just looking at it. A teeny weenie bit different. But make no mistake about it, this is the end of the fiat money regime. That’s why I came to ITM trading in two, 2002. I already knew it was the change and we’re already seeing some shifts away from fiat. But according to Ray, the good thing is that the scary realities are now much more broadly recognized. And what that really means is that the public is starting to recognize that there is definitely something wrong. That’s what that high inflation does, because it’s noticeable to the public. And remember, this is a con game. This whole fiat money structure, this whole fiat money system is a con game and it requires confidence.

The bad things are that conditions are deteriorating even faster than Ray expected. And the cause effect relationships and how they progress are not well understood <laugh>. So there are many unintended consequences that can come from the actions as we’ve been seeing of the central banks, the central planners, the and actually the different governments. Nothing much is being done to halt their progressions. Of course not because we’re at the end of this system, but what you’re looking at in here is that physical gold demand is growing because it is more recognized that there are crazy things a foot.

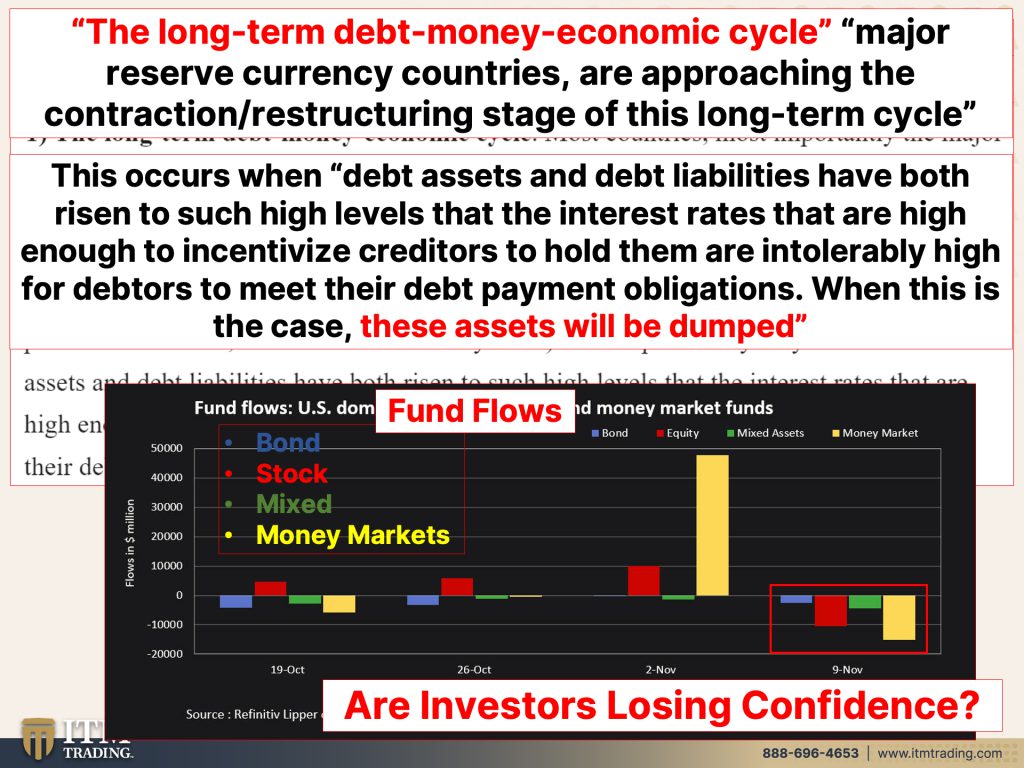

Central banks have purchased in the second, in the third quarter, just the third quarter, a record amount of gold. And who knows more about the monetary and the financial system than the central banks? So if they’re buying a lot of gold than you should also 36% growth in bar and coin investment. And what you have to understand that’s people like you and me, that is the retail investor. 36% growth. That is a very, very good thing. That is indication of a flight to safety, to real safety, not wall street’s made up safety. We do know that other consumption has grown in terms of gold, but let’s look at where we are in the three cycles that make up the big cycle. I said six stages, but there are three cycles. So where are we? Well, the long term debt money cycle with major reserve currency countries are approaching the contraction restructuring stage of this long term cycle. And we’ve seen that, haven’t we? I’ve been showing you the liquidity issues that are happening in the government bond markets in Great Britain in the US with the treasury concerned about liquidity. Everybody’s concerned about liquidity even as they have printed massive, massive amounts of money. That’s all of this liquidity. Where did all those trillions and trillions and trillions go? Evaporated into the ecosphere or converted into hard assets. Additionally, this occurs when debt assets and debt liabilities have both risen to such high levels that the interest rates that are high enough to incentivize creditors to hold them are intolerably high for debtors to meet their debt payment obligations. So what they’re saying is with the Federal Reserve and the global central banks raising interest rates to attract buyers of this debt, those that are borrowing from, you can’t afford to pay it. And that means that we are going to have frankly, a lot of defaults. So when this happens as it is now, these assets will be dumped. Now what you’re looking at here are fund flows. That is the money that goes into stocks, bonds let’s see, bonds mixed, which means a combination of both stocks and bonds as well as money markets, which we’ve been taught to think of as safe. But it looks like I’m pretty happy that people are realizing they are a mutual fund and they have frozen, they froze in September, 2019 and again recently, and they just needed to do a whole bunch of this so that you didn’t realize it. But every time they do that, it’s less and less effective. This is the first time in this cycle where stocks, bonds and stocks and bonds as well as money market funds have been sold. Sold. So what does that tell you? That could tell you that the flight from fiat money products has begun into the tangibles as we saw in the levels, especially of the bar and coin demand for the retail public. But it also could tell you that investors are losing confidence in the system. And once that confidence is lost, I’ve been telling you this for years and years, once that confidence is lost, that’s when we will see the hyperinflation. And that’s also when we will see gold expressed to its true fundamental value.

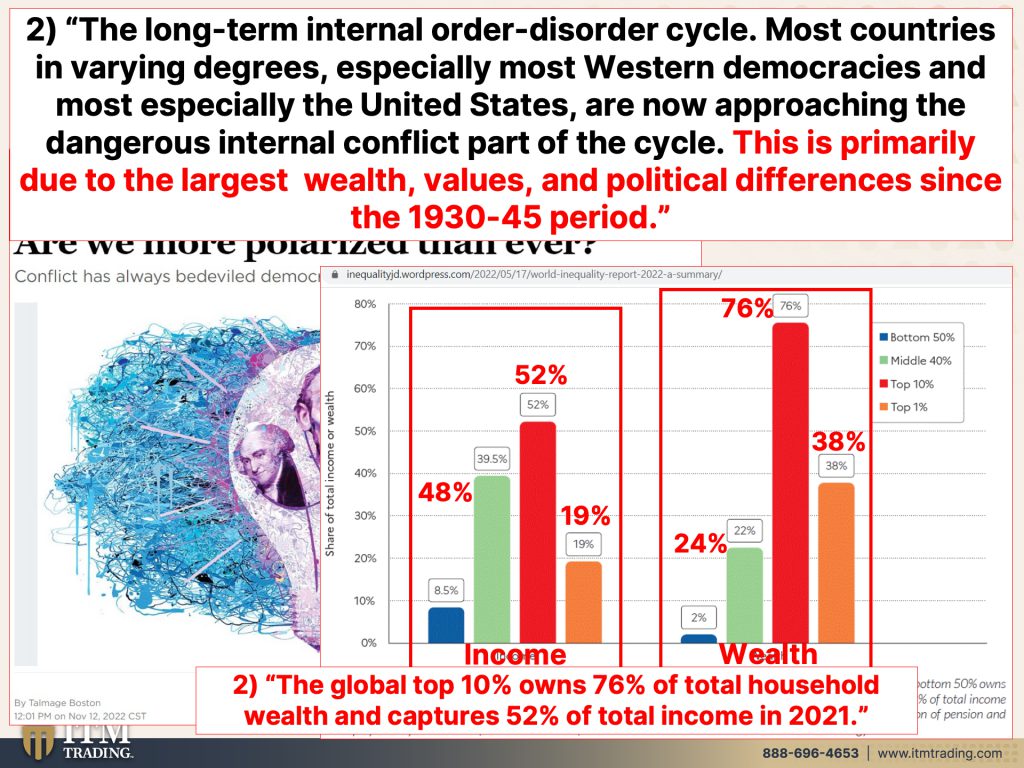

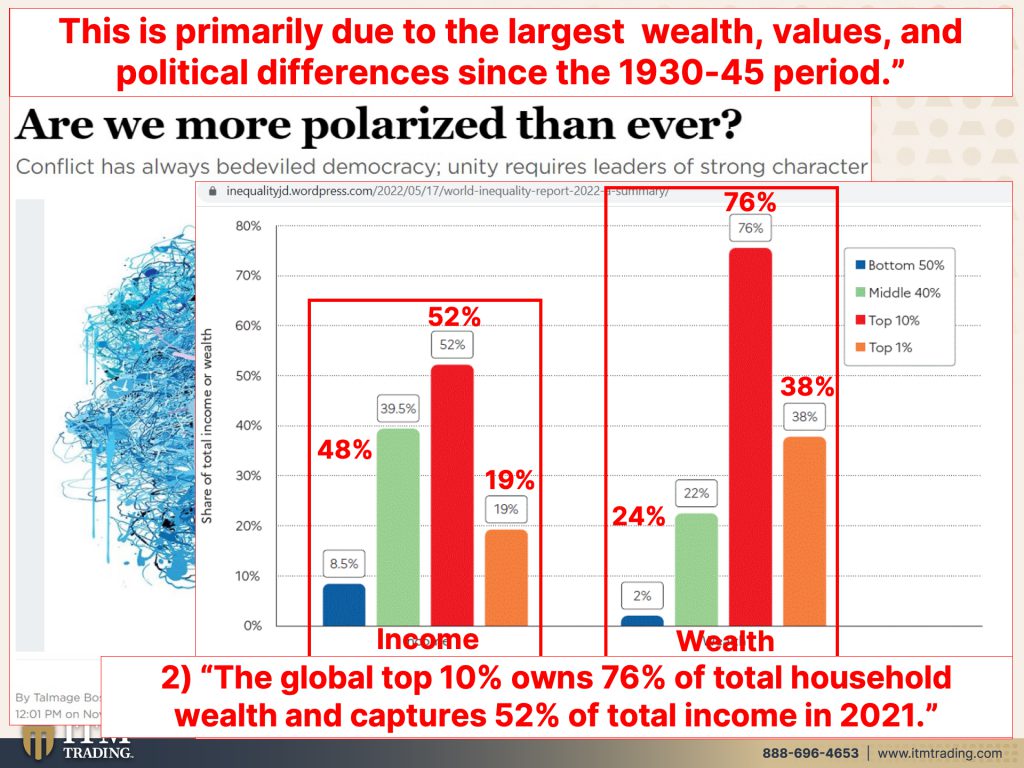

So additionally, the long-term internal disorder cycle, most countries and varying degrees, especially most western democracies and most especially the United States, are now approaching the dangerous internal conflict part of the cycle. How do you know that? Well, it’s primarily due to the largest wealth values and political differences since 1930 to 1945 period. Isn’t that interesting? We do know that values have been shifting really greatly. However, we also see it in the wealth, the greatest level of income and wealth and equality. And we also see it in our government. So going back and taking a look at that, here we are in 1929. Does that date bring anything up for you? Because that’s when the punch bowl was taken away after you had the public that got to join the party from the roaring twenties, right? But you can see at that point we had the highest level of income and wealth and equality. And of course we went into World War II. And this is the other point that I wanna make. And why you see, can we go to full screen for a second? Why you see these props on my desk? Because war always, always, always accompanies a currency regime shift. So if we stop and we think about it, and we’ll talk a little bit more about this, but if we stop and we think about it, World War I was 1914, what happened in 1913? Oh my, they instituted the Federal Reserve System and we started the transition to the monetary, into a fiat money system right off of a gold standard, off of a pure gold and silver standard. And what happened in the forties? Well, World War II happened in the forties, but then you also had the Brenton Woods Accord where the whole world was now attached to the US dollar. And the US dollar was supposed to remain at $35 for an ounce of gold. 1971, we have Vietnam. And what happened then? We went off any kind of semblance of a gold standard into a pure debt based standard. So understand war, always, always, always a accompanies a fiat money regime shift. And what are we being told in this reset? It is social, economic and financial, right? So we can see there we were in, oops, sorry about that, in 1929, and here we are in 1971. And between 1929 and 1971, the masses participated in the growth that was around them in the economy. But there was a shift in 1971 when we went completely off the gold standard. And then finally, let’s look at where we are because the inequality shifted and the trend began in the mid 1980s. This is not a coincidence. None of this is a coincidence. And then finally, of course, 2008 in the great financial crisis, well, we had a lot of protests. We had occupy Wall Street. They didn’t understand what they were fighting for. What they’re fighting for is to be fairly paid. It’s the monetary system, the financial, the underlying financial system. And what about this most recent K-shaped recovery? Because what that did was that made inequality even worse.

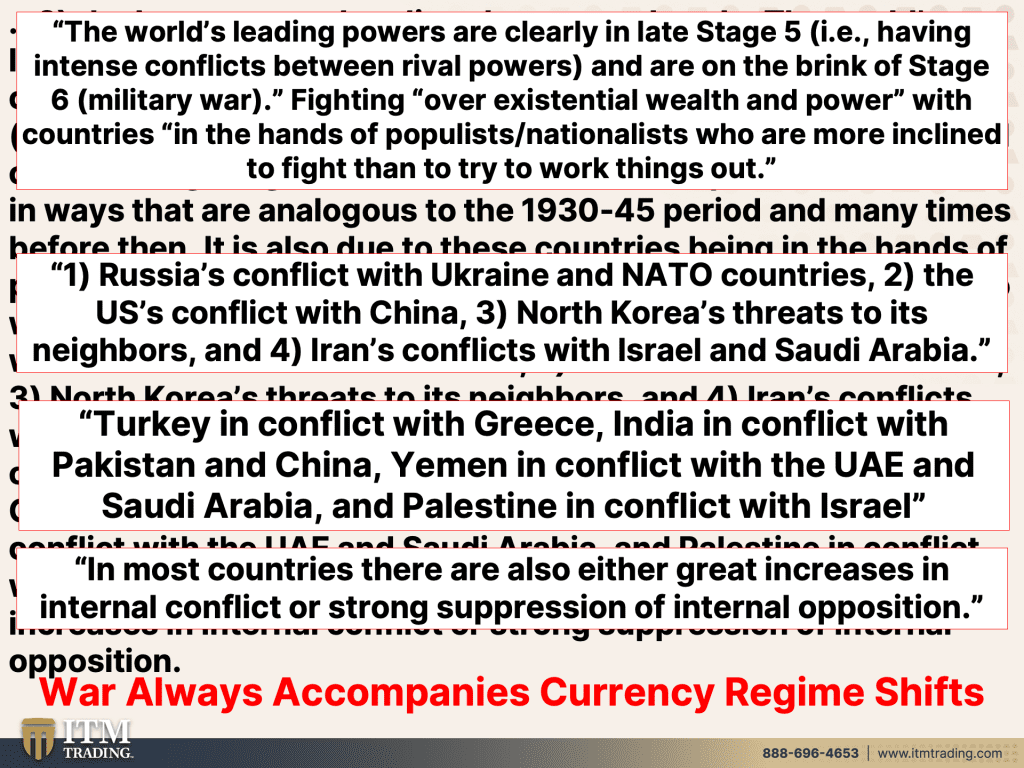

So let’s take a look at that because truthfully we know that that in our government, we are more polarized than ever and it’s hard to get too many things done because this is about because people wanna stand their ground. But what’s happened to that income and wealth and equality? Wow, let’s look at income first. Basically, you know, you have those that are on the top, the top 10% that earn the lion’s share of income, but even worse than that, they also have 90% of the wealth. So we know in this inflationary environment, that just gets exacerbated, the global top 10% owns 76% of the total household wealth and 52% of the total income captured just this goes through 2021. So it’s gotten even worse. And we also know that when people are hungry and hopeless, they make choices they would not otherwise make. And those choices could topple governments could topple central banks. And I gotta tell you, that’s my hope. But the world’s leading powers are clearly in late stage five, having intense conflicts between rival powers that are on the brink of stage six, which is an actual military war fighting over existential wealth and power with countries in the hands of populous nationalists who are more inclined to fight than to try to work things out, which we’re seeing between the Democrats and the Republicans in this country. But we’re also seeing it in many other places like the conflict between Russia and Ukraine and other NATO countries. The US’ conflict with China, which maybe that was walked back a bit, but we’ll see because Taiwan is a huge hotbed issue that we kind of poked the bear on that when Nancy Pelosi went over to Taiwan last summer. And then North Korea’s threats to its neighbors and Irans conflicts with Israel and Saudi Arabia. And how about Turkey and conflict with Greece? Indian conflict with Pakistan and China Yemen and conflict with the UAE and Saudi Arabia and Palestine and conflict with Israel. There’s a lot of conflict and that’s why Ray is saying that we are clearly in late stage five, but in most countries there’s also either great increases in internal conflict, like I said, Democrats, Republicans and also you and them, right? We are are being very divided. It’s divide and conquer. You might remember all of the conflict during the, during the covid whole covid thing between vax and un-vaxxed and many other things and a lot of, a lot of freedoms that we’ve had being taken away. So there’s either great increases in internal conflict or strong suppression of internal opposition. And I personally can attest to how I feel about certain things that I can and cannot say on air. So I self censor and a lot of other people do too because of that strong suppression. They don’t like what I’m saying, they just take me off air and then I do nobody any good. But as long as you understand that war always, always, always a company’s currency regime shift because it’s a bait and switch. Look over here while we’re doing this over there. Oh, the war is causing the inflation, not all the money printing that we did, that’s not causing any inflation. Of course not. It’s the war that’s doing it. So they use that to justify the inflation and also to distract you from what’s really really happening.

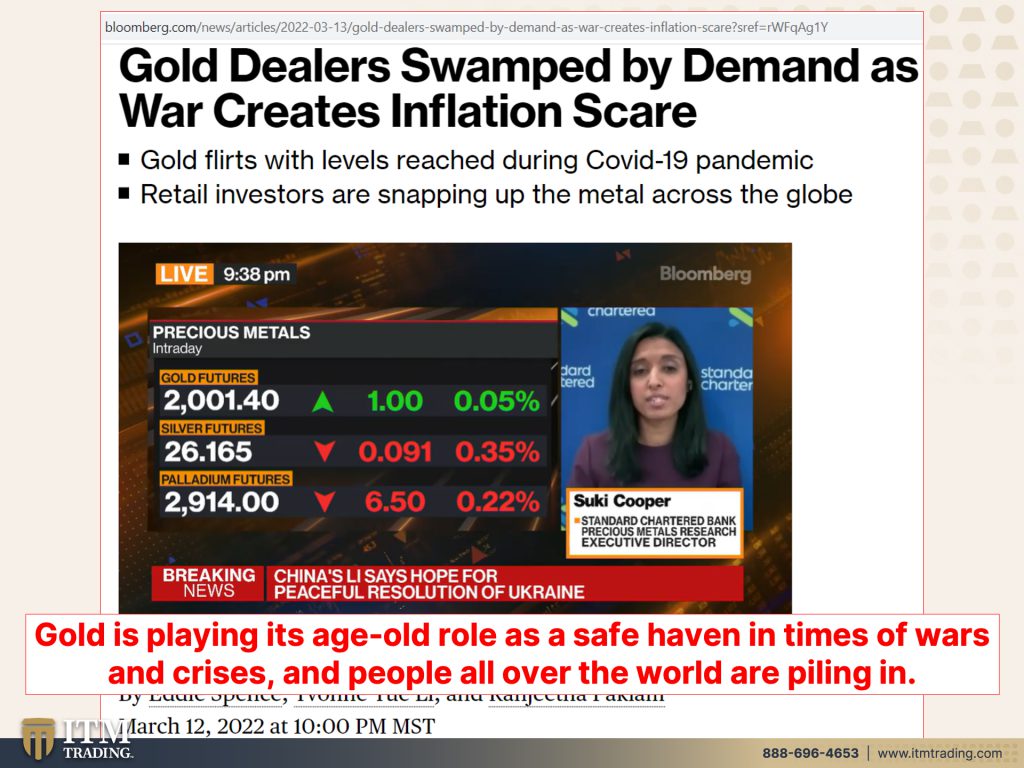

But then what happens to gold during these periods of time? Well, we know that when people are uncomfortable and nervous, they go to a flight to safety. And gold dealers swamp by demand as war creates inflation scare. Well, what do you think? Because gold protects you from inflation. And we’re gonna talk more about that in just a minute. But frankly, gold is playing its age old role as safe haven in times of war and crisis. And people all over the world are piling in and they are. So we’re seeing them starting to really flee from the fiat money intangible side into real money gold because that’s what protects you. Even according to the BIS bank for international settlements, gold held at home is not subject to political policies. Mm. Yeah, hold it, own it. If you don’t hold it, you don’t own it.

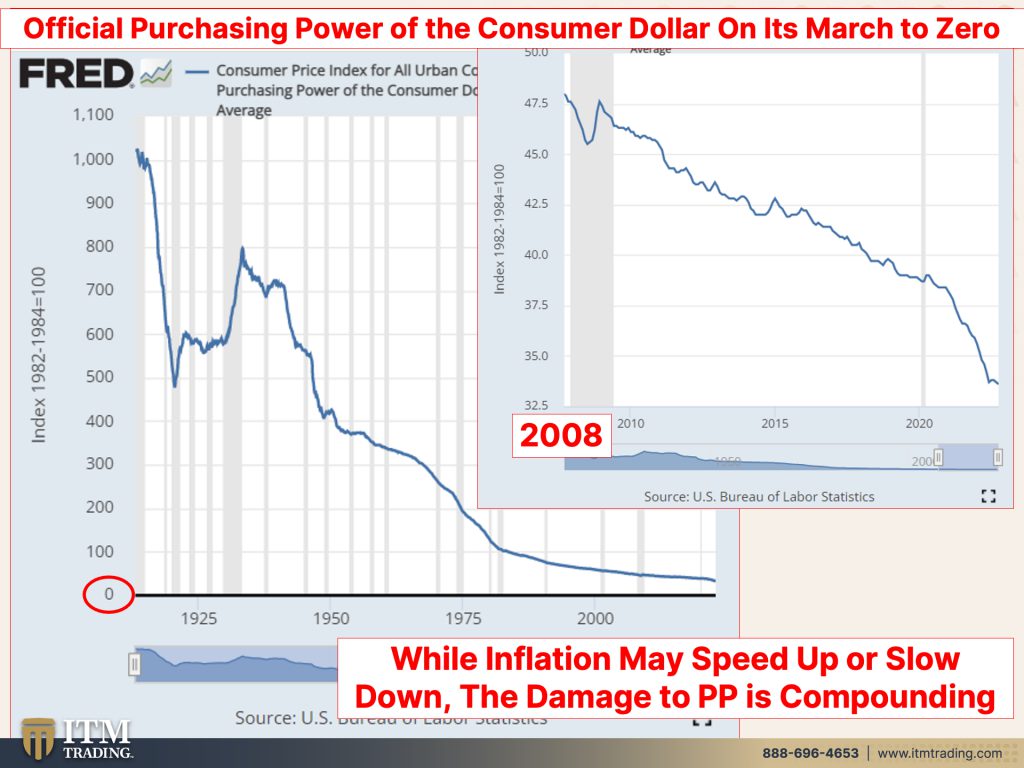

But let’s just, let me show you what this really looks like because this goes back to 1913 when the Federal Reserve was installed. And if you just take this one little zero away, what do you got? You got your buck, you’ve got your dollar, and this huge drop off, 50% drop off was because, and I’ll show you this in real time, but it was because a 20th of an ounce of gold, right? So let me just show you the difference in the sizes. This is an ounce of gold. You can see it pretty good. This is a 20th of an ounce of gold, right? So it used to be that a 20th ounce of gold backed $1, but when they installed the Federal Reserve, now this little 20th of an ounce of gold backed $2 and 40 cents, that’s why you see this major runoff. But I’d like to also bring your attention down to zero, right? So we can see. Now look, it said that the dollar gain purchasing power in 1933 during the the depression in the thirties. Let me ask a question. In all of your studies on school and everything, have you ever heard anybody being better off because they could buy more stuff during the depression? And I believe that what we are entering is a hyperinflationary depression. However, having said that, I’d like you to notice that it kind of looks like it’s trailing off. But let’s take a look at where we are right now, because that’s from 2008 and clearly it’s continuing to go down. And what the rapid inflation really does is it erodes your purchasing power even more quickly. They can do anything they want with paper, right? They can make spot gold go up, down, sideways. But the reality is they can even make change things and make the inflation numbers look however they want. So, ooh, whoops to do. We’re down at 7.7 which is still extraordinarily high according to the central bank’s calculations and how they jury rig things. But it doesn’t matter when you look at the CPI because do you see this purchasing power going up? And besides whether or not you see it, are you experiencing an ability to buy more stuff with the same number of dollars? That would be a no, because this is by design and it should be really obvious from my purchasing power graphs. And for those of you that look to, you know, who can we talk to about them? This would be it.

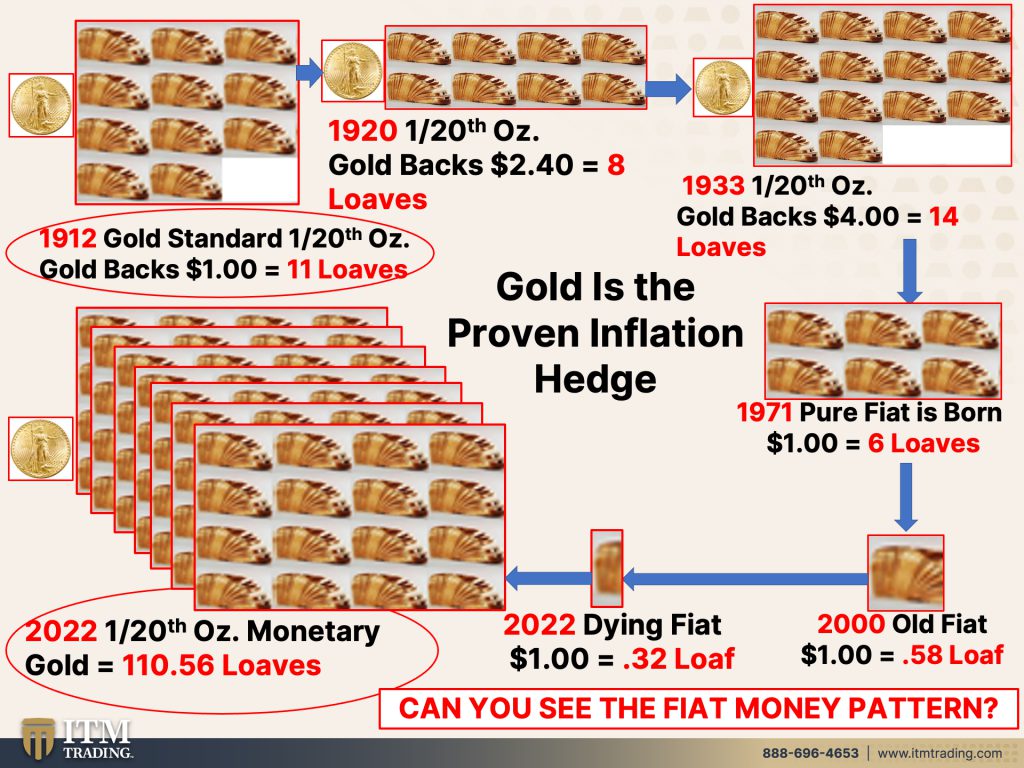

Now let me show you in more reality, I’m gonna show you this presentation that I did on your ability to purchase using this little, any bitty teeny weeny 20th of an ounce of gold. Can you guys see that? You can barely see it. Okay. And here we go. This, which you can barely see, but you’ve seen a picture of it, right? Is a $1 gold coin. It is 0.0484 ounces of gold. So roughly, roughly a 20th of an ounce of gold. And back in 1913, this would buy nine loaves of bread because back then a loaf of bread was 11 cents. Okay? So you could have bought it with this little gold coin or this silver dollar or this silver certificate, and what does it say on that payable to the bearer on demand one silver dollar, right? So you can see what this all looks like. But then they started the transition. So what did the fed do? Well, they just started printing and printing and printing kind of slowly because they had to go through Congress. And what does it say on these? Well, they’re no longer gold certificates or even silver certificates, but now they are federal reserve notes, and a note is a debt instrument. So what I’d really like you to see is how they make this transition. And you see the coins, there’s a half dollar and you see it’s all silver. You can see that line. Then you can see the transition where no longer is it a full half ounce or roughly a half ounce of silver. It has copper in it with just a little bit 40% silver. So we went from 90% silver down to 40% silver, but my goodness kind of looks the same as you can see. So they could make that transition. And the public didn’t realize that anything had changed. When in reality in 1971 everything had changed because then everything went to this. Now you can see how closely the dollar bills, the $10 bills that from the gold certificate to the fiat money certificates, you can see how closely they look because what they know is that people marry the legal money of the state. So people got used to seeing this gold certificate and this silver certificate so that when it transitioned into a fiat certificate, nothing changed. And after all, we were told that if we buy America made products, nothing will change. Of course, they shipped all the jobs overseas for the manufacturing jobs. So everything has changed. And after 1971, it’s been constant with that. So this little $1 gold coin where this silver dollar where these 10 silver dimes, now you know how many loaves of bread this buys? Well if we do the math right, so 0.0484 ounces of gold in one and a $1 gold coin. Then at a dollar 53 a loaf, which is what the BLS says, the average price of a loaf of bread is would buy you 56 loafs. So hold on a second, let me get ’em. Okay, so we’ve got 9, 10, 14, 25. I am gonna donate all these loafs of bread when we’re done with this experiment. 28. I mean, do you get the point? It’s not that this bread is worth that much more money, it’s that the dollars are worth less and less and less. So when you see the price of a stock market going up or real estate going up, is it really that that is worth that much more money? No, it’s that because of all of the printing and all of the debt, it’s worth that much less. The function of the money today is to get you to volunteer your labor and your work and transfer that their way. So what we’re gonna talk about is to how to protect your purchasing power, how to protect your real estate values and keep them.

And frankly, with all the high inflation, you could now even get more loaves of bread than what I showed you in that video. But I think it makes the point. You’ve got to make sure that you are protected. We are at the end stage. When?

I can’t tell you the exact moment, but I can tell you we are closer and closer and closer every single day. Now, if you have not already done so, make sure you watch my Coffee with Lynette, interview with Wolf Richter. He is brilliant. And last week’s treasury liquidity video, which is critically important that you understand. I mean, I’ve been talking about liquidity for a while, but you need to understand that this is the foundation. So make sure you do that. And also visit Beyond Gold and Silver, where we talk about the rest of the mantra, Food, Water, Energy, Security, as well as some Barterability, Community, Shelter, and a little bit of Wealth Preservation. So the Calendly link is below. If you have not yet, set your strategy up. This is not the time to procrastinate or delay. Get it done and get it executed as quickly as you possibly can. And if you like this, please give us a thumbs up. Make sure that you subscribe. Hit that bell. We’ll let you know when we’re going live. Leave us a comment and share, share, share. And until next we meet please. Please be safe out there. Bye-bye.

SLIDES FROM VIDEO:

SOURCES:

https://www.linkedin.com/pulse/changing-world-order-approaching-stage-6-war-ray-dalio/

https://inequalityjd.wordpress.com/2022/05/17/world-inequality-report-2022-a-summary/

https://www.dallasnews.com/opinion/commentary/2022/11/13/are-we-more-polarized-than-ever/